[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Hi there everyone.

This is possibly the most dovish FED in history.

Each new day brings a statement or interview where they postulate how patient they are willing to be towards the market.

It’s a real case of ‘Kids Gloves’ for the market,

when the verys same market is at the all time highs!

As far as I can see, they know full well that they are holding a ticking time bomb.

And Jerome powell daren’t be the one to set it off!

Government, corporate and household indebtedness is now so bad

that the FED cannot possibly shrink it’s balance sheet,

or move in any way reasonably higher in its base rate.

If they did,

they would render insolvent the U.S government,

half of the S&P500 companies,

and wipe out the corporate credit markets completely.

The game of leveraging up and rolling over the debt load would be up, immediately!

Powell is on a tightrope, 30 floors up, and the wind is picking up!

They have shot their wad now!

And when the decline comes in wave ‘C’ or wave (1),

they will not have anything dovish left to say to prop up a collapsing market.

Good luck then Mr Powell.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

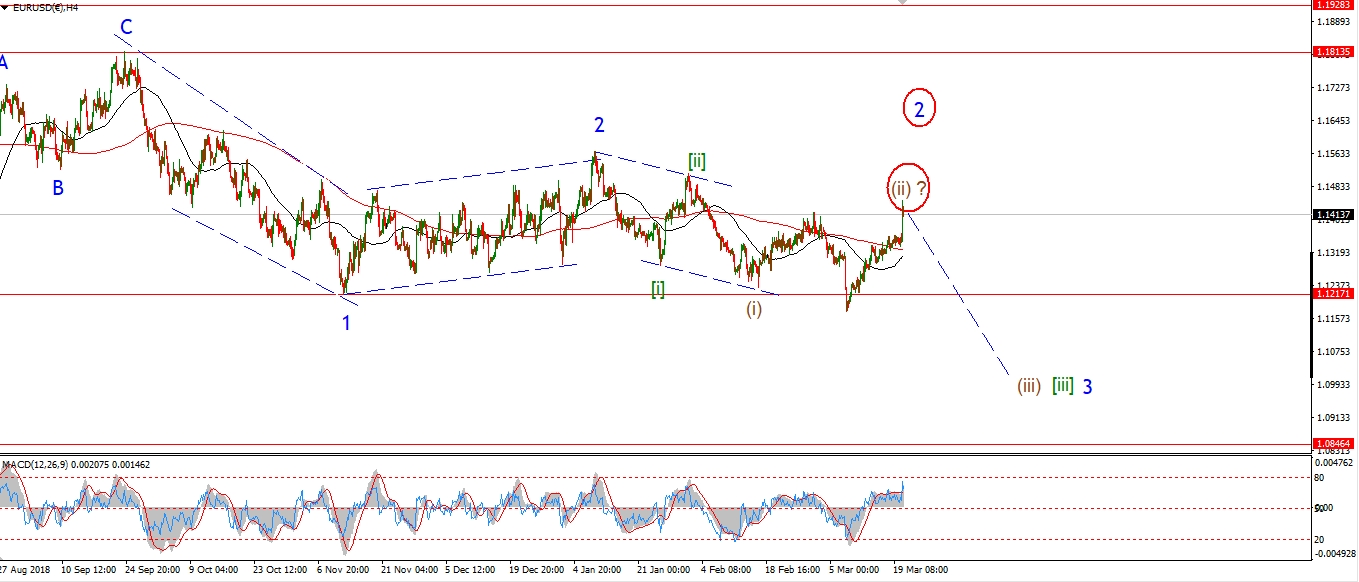

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD has given up most of the gains of yesterdays vertical move.

The action today can be viewed as an unfolding five wave move lower in wave ‘i’.

Possibly wave ‘1’ of ‘i’ of (iii),

We will need to see more downside tomorrow and a break of 1.1234 to be more sure.

Tomorrow;

The wave (ii) high at 1.1448 forms the invalidation line for this count.

This level must hold and wave ‘i’ down should continue towards support.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Cable dropped fairly sharply off yesterdays three wave rally labelled wave ‘2’.

The decline today is viewed as wave ‘3’ of ‘iii’ with more downside expected.

Wave ‘iii’ itself should complete below 1.2960 before any rebound in wave ‘iv’ begins.

If this count is correct,

then the low of wave ‘i’ at 1.3204 should hold from here on out.

As wave ‘iv’ must not break the low of wave ‘i’.

Tomorrow;

watch for ‘iii’ to continue lower and break 1.2960.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY found support early this morning at the previous wave (iv) low of 110.35.

the price has rebounded higher today in a possible wave ‘i’ of (i) again.

Wave (i) should now hold above that support level again

and head higher in five waves to break the previous high at 112.36.

We may now be heading into wave [iii] up,

and this wave has the potential to bring us significantly higher over the coming months.

Wave [iii] will reach equality with wave [i] at 114.70,

and this is the minimum expected target.

Tomorrow;

Watch for 110.35 to hold as wave ‘ii’ completes.

Wave ‘iii’ of (i) should head higher before the end of the session.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

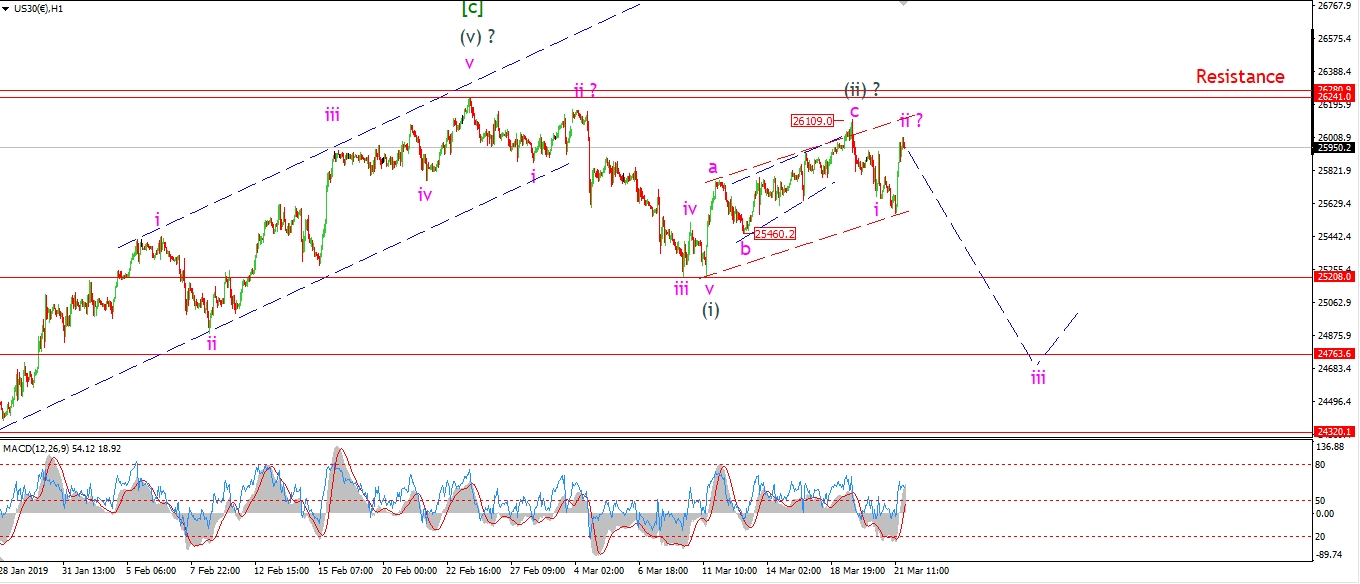

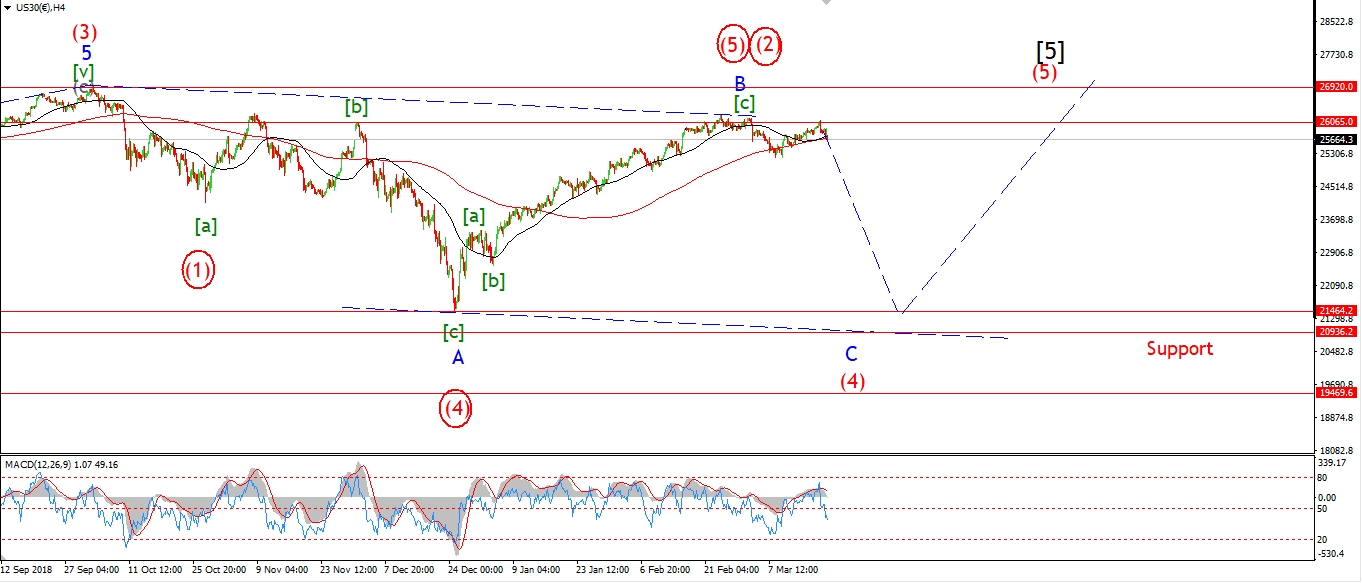

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The DOW is sitting 3.5% below its all time highs at 26920 this evening.

Will someone please tell the FED this fact.

They seem to believe that some financial Armageddon is threatening stability right now,

And this evil, is forcing them to leap to the rescue the non-collapsing market!

The market gaped lower this morning,

and then rallied 350 points to end the session just shy of 26000 again.

We are still off the highs labelled wave (ii) for now,

So the bearish count still holds.

Tomorrow;

It is possible todays rally was wave ‘c’ of an expanded flat wave ‘ii’.

If so,

the high at 26109 must hold.

And tomorrows action must be a full on selloff in wave ‘iii’ of (iii).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

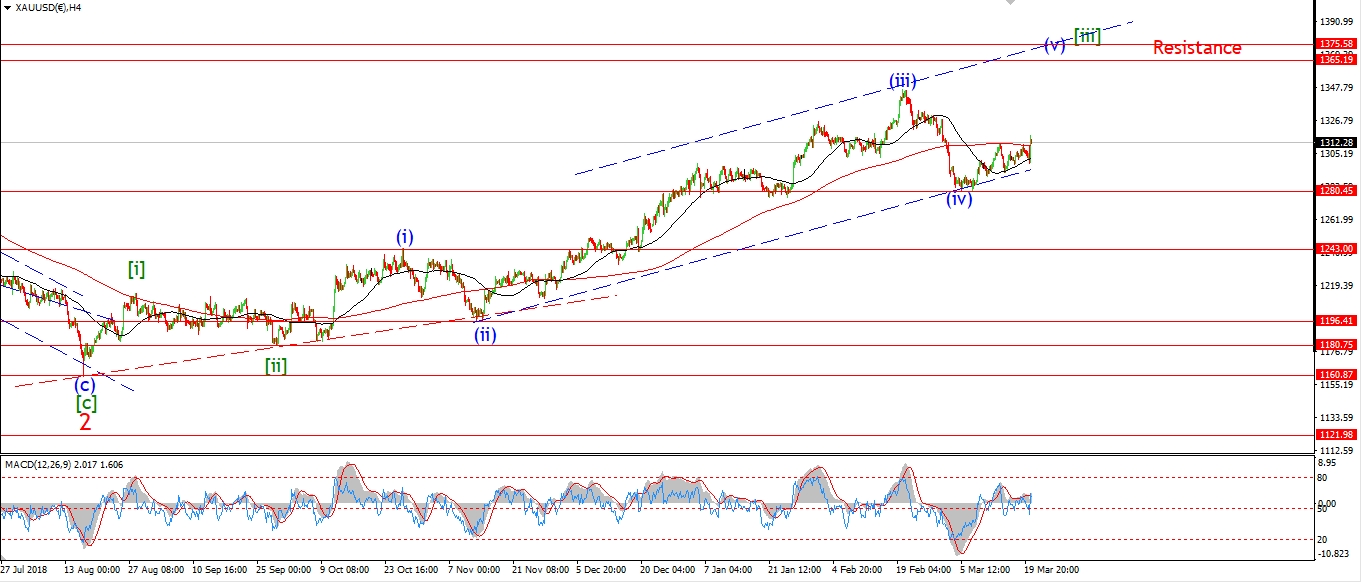

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The price of GOLD took another hit today and fell sharply off the 1320 high registered yesterday.

We did not see a new low though,

so for now this can be viewed as a possible wave ‘1’ and ‘2’ of ‘iii’.

If price breaks 1320 again tomorrow,

that will confirm the bullish count.

And then we can expect a continuation higher in wave ‘3’ of ‘iii’ again.

Tomorrow;

Wave ‘ii’ lies at 1298.

This low must hold and wave ‘iii’ continue to rally.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

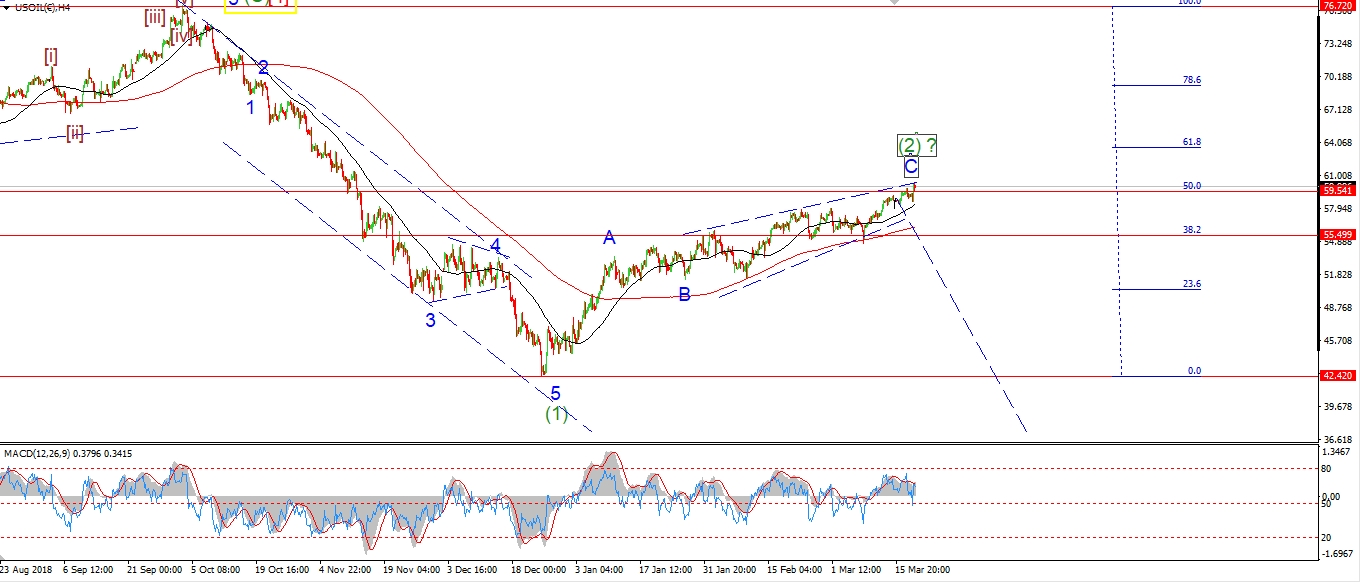

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Crude seems stuck below the upper trendline today as wave ‘v’ completes.

The rally in stocks was not confirmed by crude today

as has been the case over the last 10 weeks.

But if stocks fall hard tomorrow,

crude will fall also.

And we should begin to build a five wave pattern lower in wave [i] as shown.

Tomorrow;

For now the crude market is a waiting game.

The impulse wave lower that I have been waiting for has not materialized yet.

I do believe we will see it soon enough though.

Wave [i] beckons,

lets see if tomorrow heralds it in.

watch for a break of 58.55 again to signal a turn.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

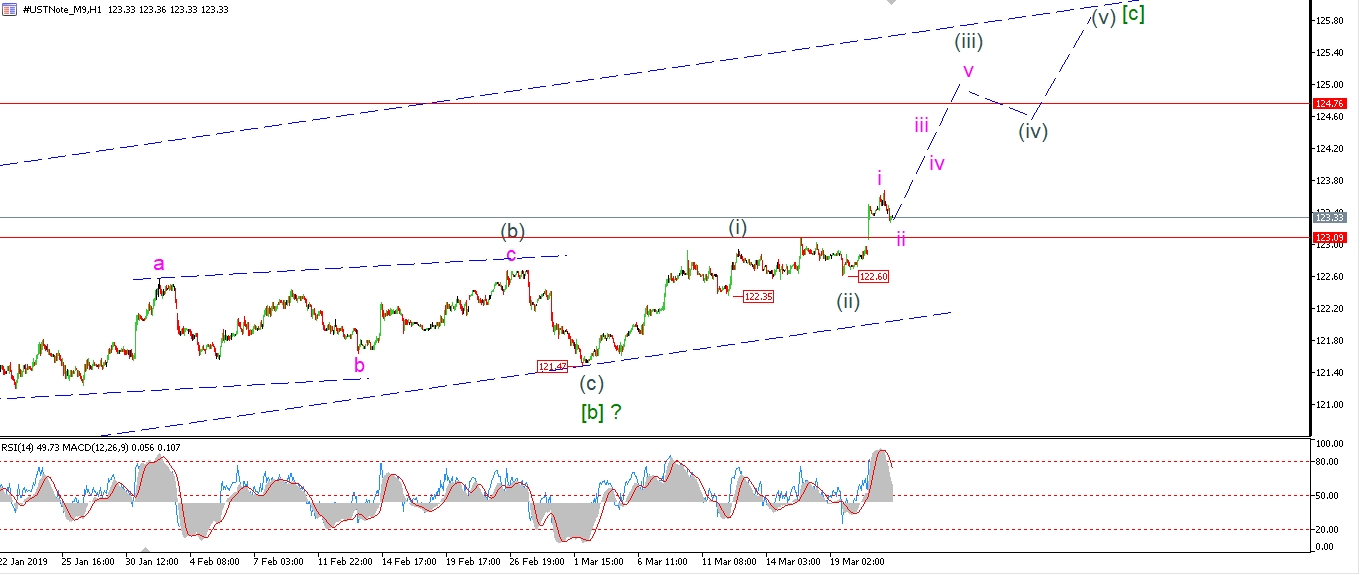

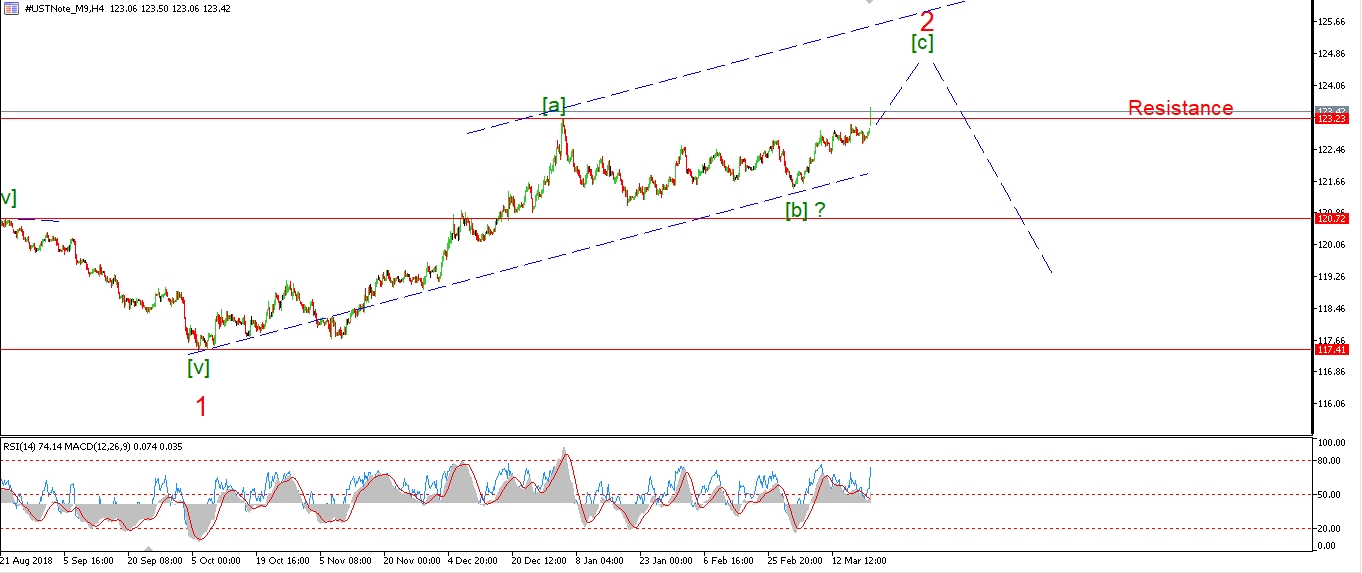

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The 10YR fell slightly today in a possible wave ‘ii’ of (iii).

The decline in wave ‘ii’ is not quite three waves just yet.

So tomorrow we should see an undecided trade

with a low in wave ‘ii’ at the recent shoulder of support at about 123.00 again.

Wave ‘ii’ must hold above 122.60 and then turn higher into wave ‘iii’ of (iii).

Tomorrow;

Watch for wave ‘ii’ to complete with a drop to 123.00 again.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver is dropping today off the upper trendline of the three wave rally today.

This is likely wave ‘c’ of ‘2’ now underway.

Wave ‘2’ must complete above 14.97.

So I realize that we are running quite a tight margin for wave ‘2’.

Tomorrow;

The recent low lies at 15.12,

So wave ‘2’ will find support at that level and should then turn higher into wave ‘3’.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

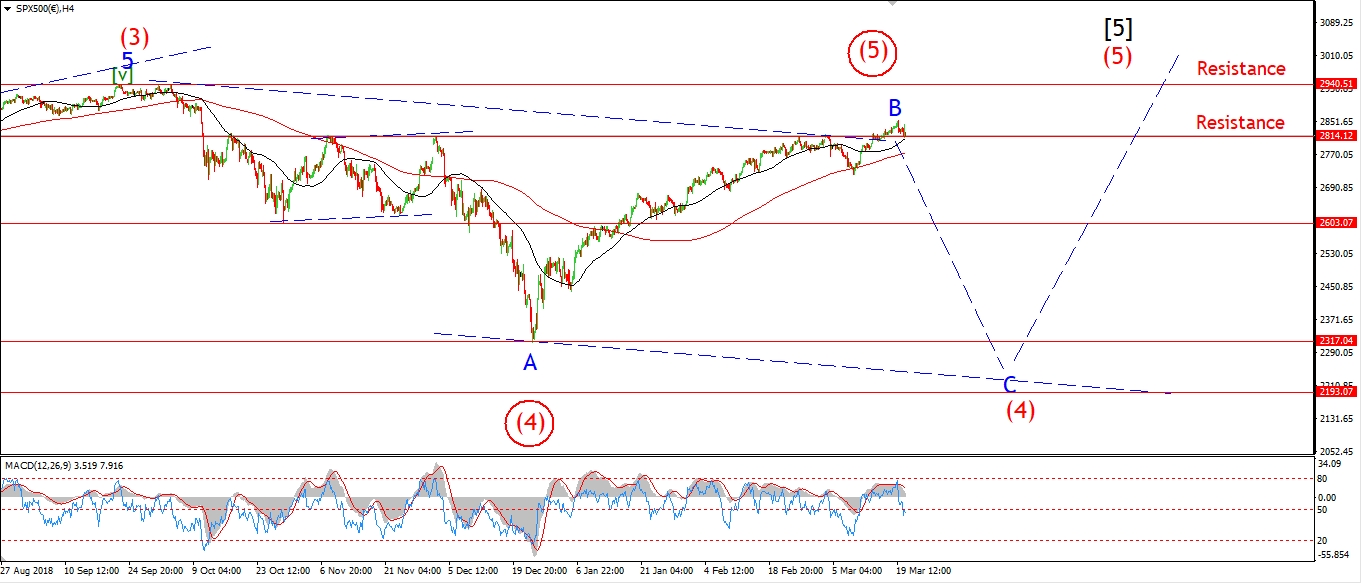

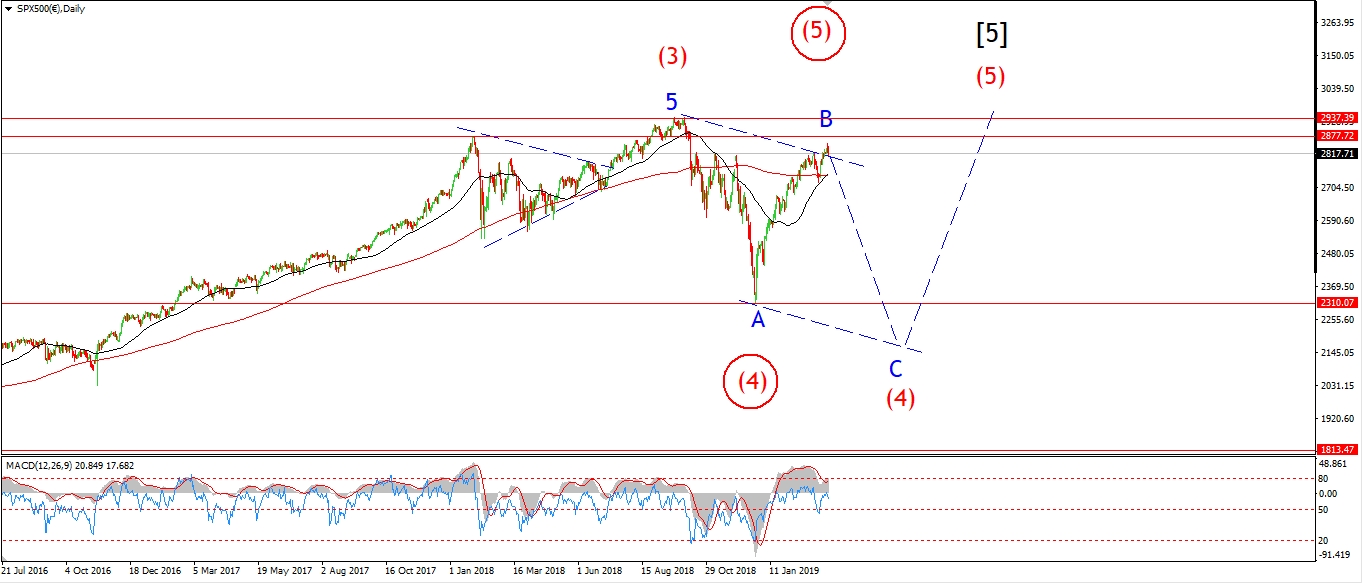

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P rallied stronger than the DOW today

and hit a new high for the whole rally off the December lows.

The price is back at the upper trend channel line in wave ‘v’ again.

This new high has occurred in the Nasdaq also,

but not been confirmed by the DOW or the NYSE composite though.

So we have a split market right now.

With the NYA and the DOW showing five waves down off the recent highs.

The longer term momentum setup alone points to a sharp sell-off dead ahead.

So the wave count in the S&P will signal a turn soon enough.

Tomorrow;

Watch for the upper trendline to halt this latest rally again.

A push below the 2800 level again will be the first sign that this market is rolling over.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]