[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Hello everyone.

The video is up so grab a beer and enjoy, if thats possible!

Ok,

It’s Friday so lets gets into it.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Another days trade without the move lower into wave ‘iii’.

So I am considering some alternates for wave (ii) this evening.

The action today could suggest a triangle developing as a minor fourth wave within wave (ii),

If this plays out

then we will see a move above 1.1420 again to finish an expanded flat wave (ii) as shown in tonights video.

Monday;

The market is moving lower again off the highs labelled wave ‘c’,

If the market moves lower on Monday to break initial support at 1.1221,

that will rule out the alternate count and we can expect wave ‘iii’ of (iii) to take over.

Watch for a break of 1.1221 on Monday to confirm wave ‘iii’ down.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The action in cable is equally frustrating today!

The market is down off the highs,

but so far we have not seen an impulsive move lower.

It is possible that wave ‘c’ of (v) is still unfolding,

but if we see a break of 1.3140 on Monday that will signal wave (i) has begun.

Monday;

We are at the end of a corrective move higher now.

The major risk is to the downside in wave ‘3’.

The job is to identify an impulse wave lower off the highs as shown to signal the larger shift in trend.

Watch for wave (i) down to begin next week.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

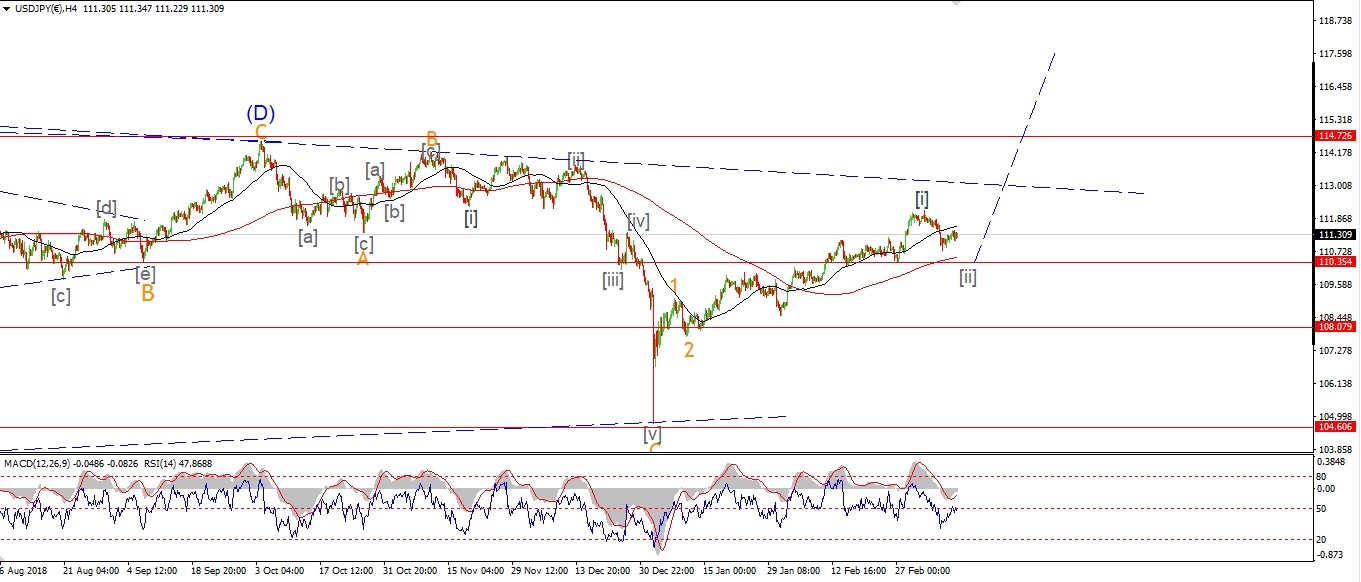

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY is moving ower again off a possible wave (b) high.

Wave (c) is taking its time in getting started,

but I think we should see wave (c) come in early next week

and finally close out this three wave pattern lower in wave [ii].

A break of 111.00 again will confirm wave (c) is underway.

Monday;

This correction should be completed next week.

At that point we can concentrate on wave [iii] up to begin off support at 110.35.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The DOW opened lower by 200 points,

and then rushed higher this afternoon by another 300 points off the lows.

I think this rally is an ending diagonal wave ‘c’ of (ii) over the last few days.

We have reached the 62% retracement level of wave (i) now.

So if this market is going to turn,

now is the time to do it!

A break of that internal wave ‘b’ low at 25460 will signal that wave ‘i’ of (iii) has begun.

So that is the main focus early next week.

Monday;

Watch for wave (ii) to complete below the highs at 26240.

we should see the initial turn lower into wave (iii) by Monday evening.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

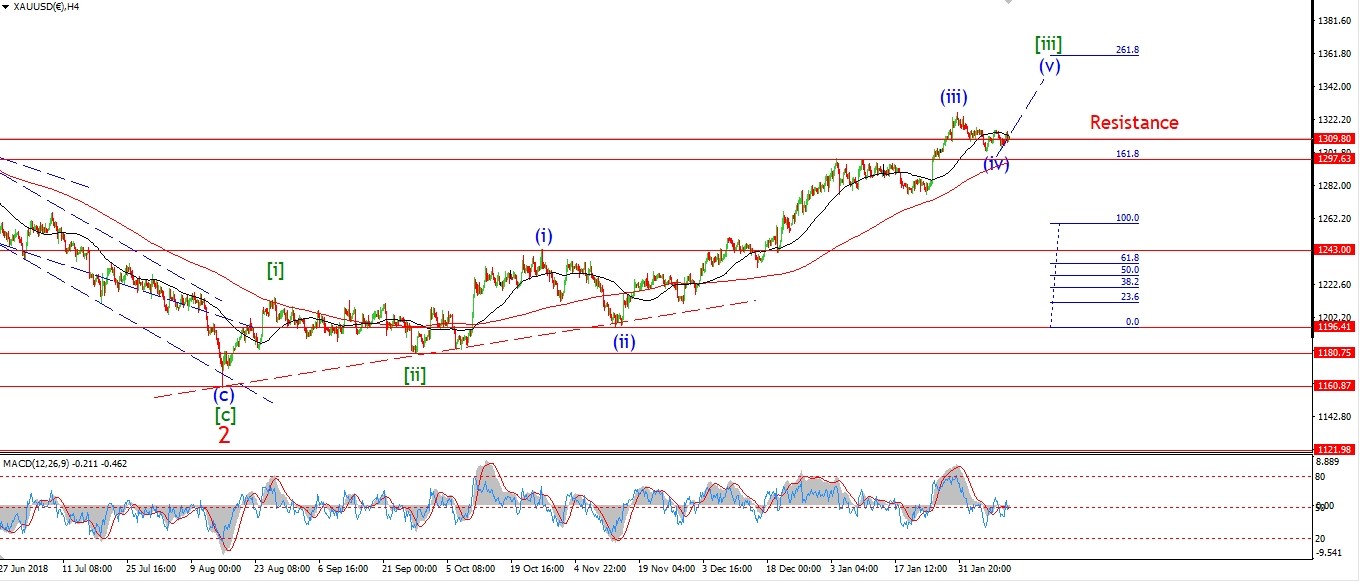

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

GOLD rose today to a slight lower high below wave ‘i’.

I have labelled this as wave ‘b’ of ‘ii’.

Wave ‘c’ down should follow on Monday

to complete a three wave pattern in wave ‘ii’.

The minimum target for wave ‘c’ lies at the low of wave ‘a’ at 1293.

The margin is tight at that point for wave ‘ii’,

as wave ‘ii’ must hold above the 1280 lows to remain valid as an impulse wave.

Monday;

Watch for wave ‘c’ of ‘ii’ to complete above 1280 and wave ‘iii’ up to begin with a break of 1311 again.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

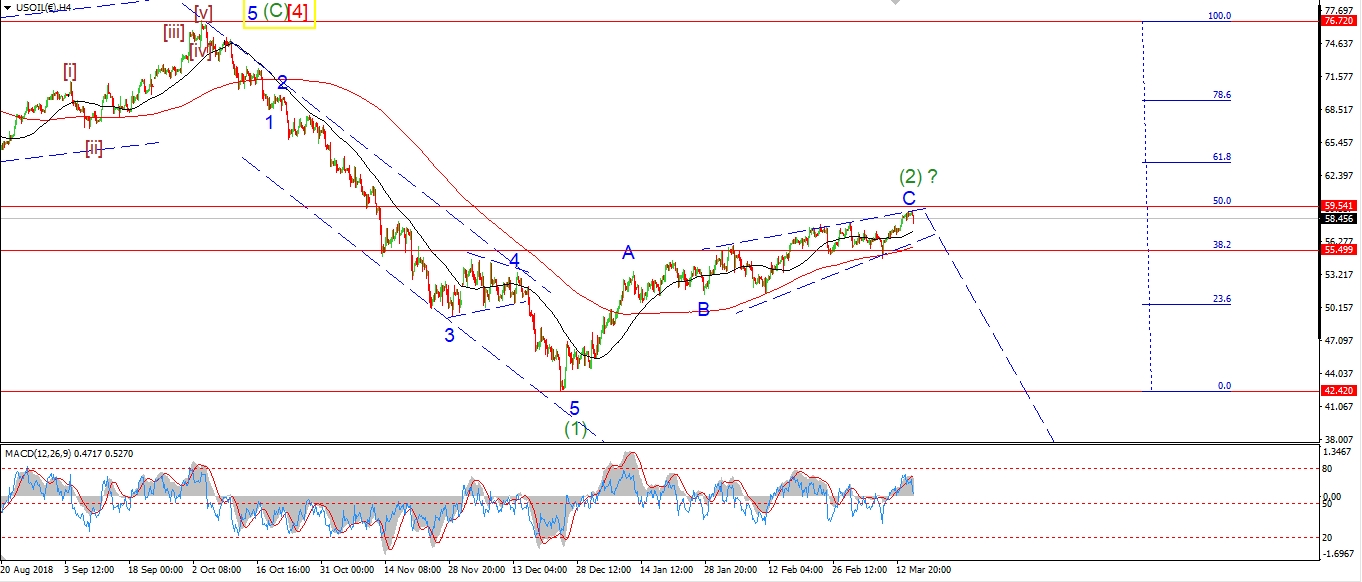

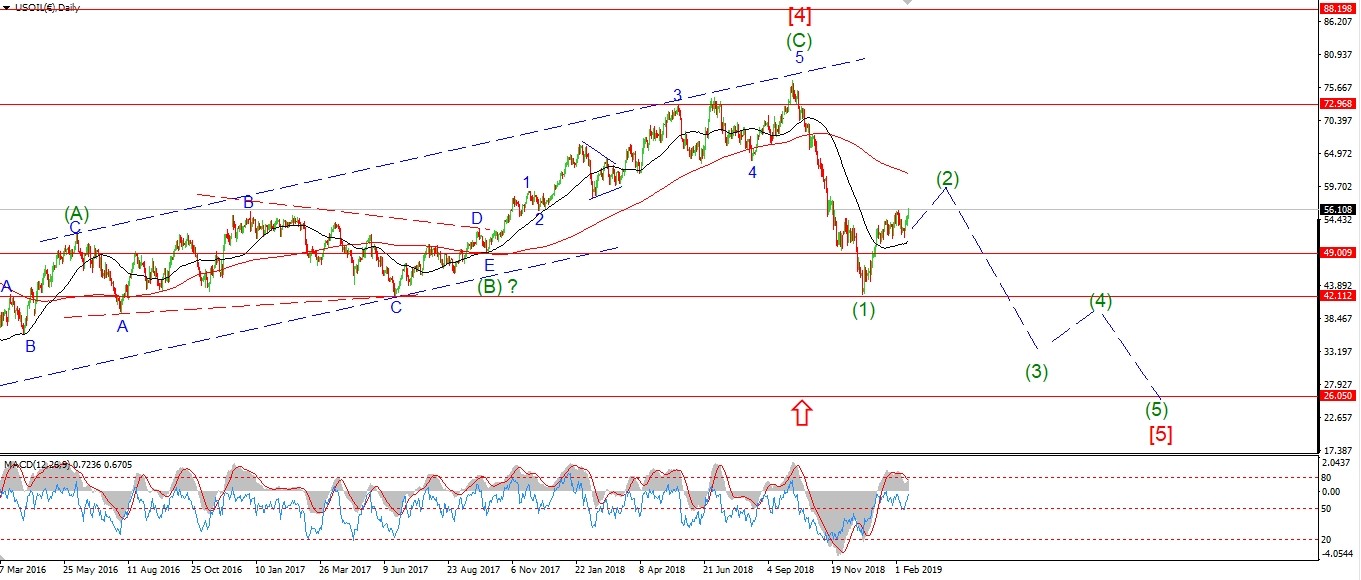

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The burning question I have right now is this;

Will crude lead the way lower again for stocks and the economy the same way it did in 2008?

And as it also did to a lower degree back in October last.

If wave (2) is now complete,

then the answer is yes.

And we should see a crash in wave (3) for oil price

which would then lead the way for a crash in stocks also.

Crude sold off with stocks this morning,

but as yet we have not seen a recovery to a new high as we did in the DOW.

The price is now in the territory to complete wave ‘C’ of (2).

Wave ‘C’ has traced out five waves higher in an ending diagonal.

So all we need is an impulse wave lower off wave (2) to confirm wave (3) has begun.

Monday;

I will be looking for that turn to occur soon.

If price pushes back below 57.00 again.

That will signal wave [i] down is in play.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

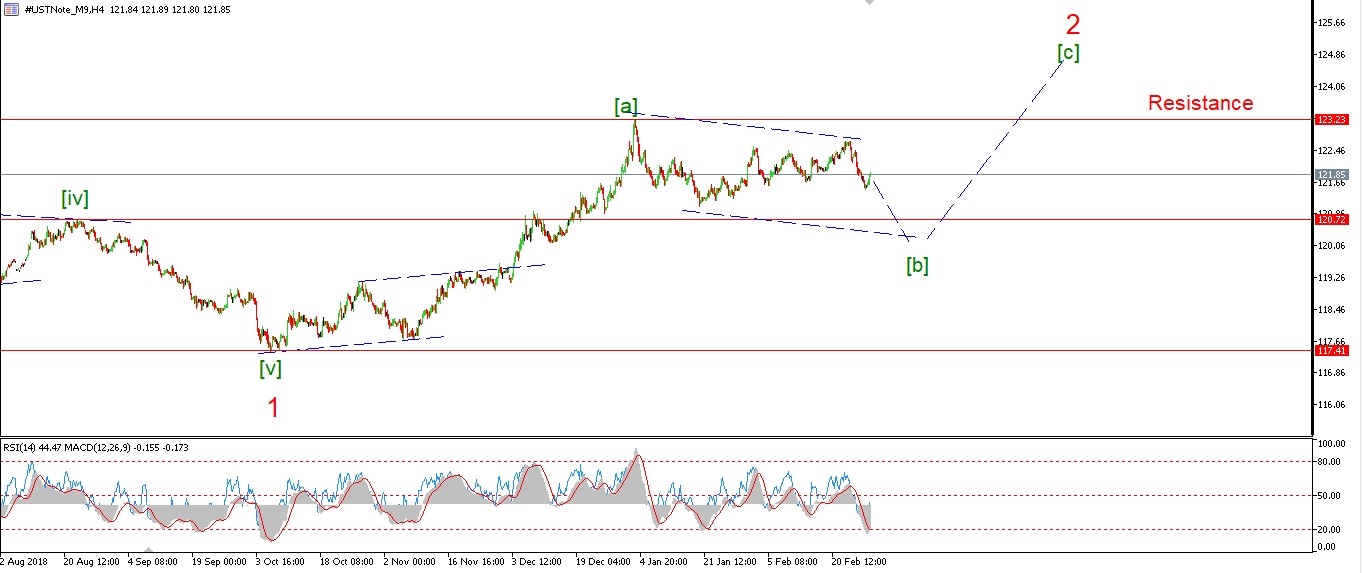

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The treasury market is holding onto the price highs this week.

But this will not last long as wave (c) down is now overdue

and we should see a push back into 120.80 again.

this will complete the larger correction in wave [b].

The price hit the upper trend line again today,

And again we have moved lower off that high.

122.35 is the trigger point for wave (c) down.

Monday;

Watch for wave (c) down to take over next week.

WE should see a minor impulse wave develop off the highs by Tuesday evening.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver has moved higher again today in what could be the beginning of wave ‘3’ of ‘i’.

A break of 15.53 again on Monday will signal that wave ‘3’ is underway.

The recent low must now hold at 14.97 labelled wave (ii).

while wave (iii) up will be confirmed with a break of 16.20 again.

Silver is long overdue an impulsive rally in a third wave

A move higher to carry us up out of the corrective doldrums we have been in for well over 2yrs now!

Wave (iii) up should do that.

Monday;

Watch for 14.97 to hold,

and wave ‘3’ of ‘i’ to break above 15.53 again.

Wave ‘i’ should complete next week.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P has pushed higher in a minor fifth wave today.

This is labelled wave ‘5’ of ‘v’ of (v) of [c] of ‘B’.

So you can see from the labeling,

this market is putting in a very large degree top now.

And the downside potential is massive.

That is the reason why I am so focused on catching that turning point into at least wave ‘C’ down.

If we get a touch of that upper trend channel line at about 2850,

and the a sharp move lower off that high.

That will be another good sign that this rally is over.

And we can work on building a five wave structure off the high into wave (i) down.

Monday;

Wave ‘v’ should complete Monday, if it has not already done so.

Watch for a drop back below 2780 again to begin wave (i) down.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

Have a great weekend.

It’s going to be an interesting one for me,

as I will be doing a bit of demolition and construction on the house!

I have to fit a new patio door at the back of my house.

I have been threatening to do it for years!

So I gotta dust off the old construction skills again.

God’s speed,

Enda.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]