Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

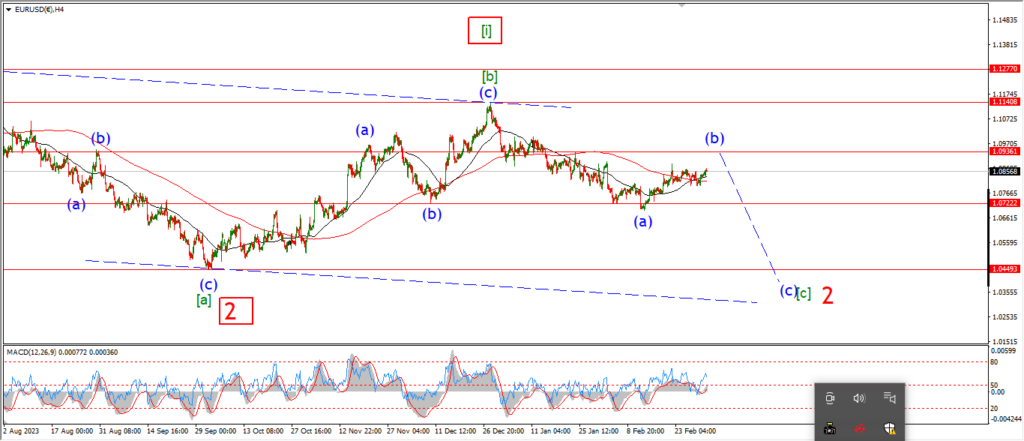

EURUSD.

EURUSD 1hr.

I am not enjoying the slow turnover into wave (c) here that’s for sure!

The price continues to trade slightly lower each day this week,

but without a decisive blow that will confirm the pattern yet at least.

Wave ‘i’ of (c) would hit the 1.0800 level in an ideal world,

but the action off the top so far is not giving me much confidence now.

So,

I think tomorrow will be crucial for this count.

A break below the wave ‘a’ high at 1.0888 will signal wave ‘i’ of (c) is underway.

The high at wave (b) must hold.

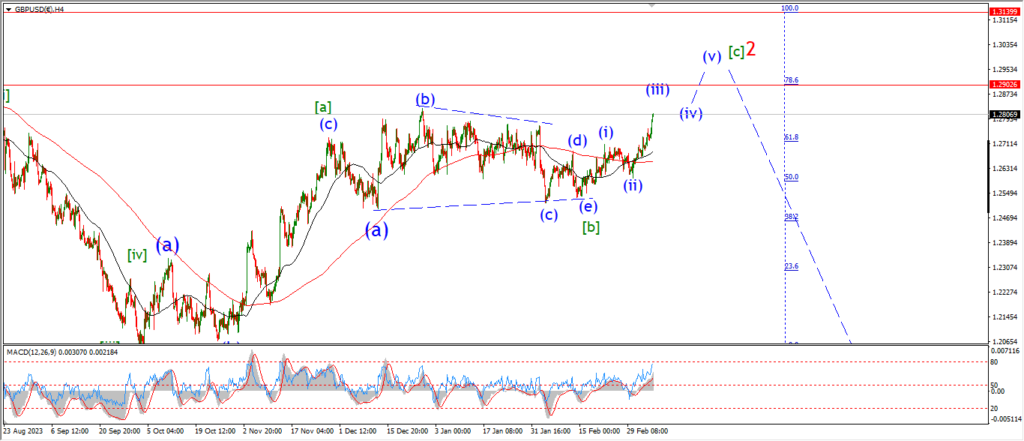

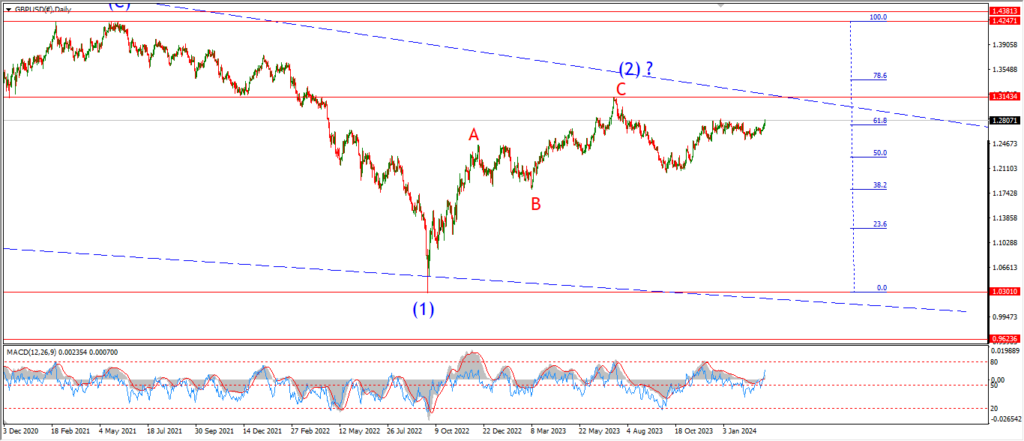

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

Cable has dropped off in five waves into todays lows,

that action suggests wave (iv) is a simple zigzag pattern,

that will trace out a 5,3,5, pattern lower into the wave (iv) low later this week.

Also,

the low of wave (iv) will get very close to the wave (i) level at 1.2708,

so I will be watching for a possible violation of that level which will mean a possible turn lower into wave ‘3’ much quicker than expected.

Tomorrow;

Watch for wave ‘b’ to trace out three waves up to a lower high,

and wave ‘c’ should begin by tomorrow evening.

USDJPY.

USDJPY 1hr.

Wave [ii] may now be complete at the recent low after todays small rally.

If this is true,

then wave (i) of [iii] will rise into the corrective low of wave (a) at 149.25,

and then wave (ii) will create a bullish higher low above wave [ii] most likely next week.

The decline in wave [ii] never reached the previous wave (iv) low at 145.90 as suggested,

so I am aware that this bullish pattern is a little bit speculative at the moment,

but as long as wave [ii] holds,

then we should see a new run higher into wave [iii] build from here.

Tomorrow;

Watch for wave (i) and (ii) to continue to build a bullish higher low over the next few days.

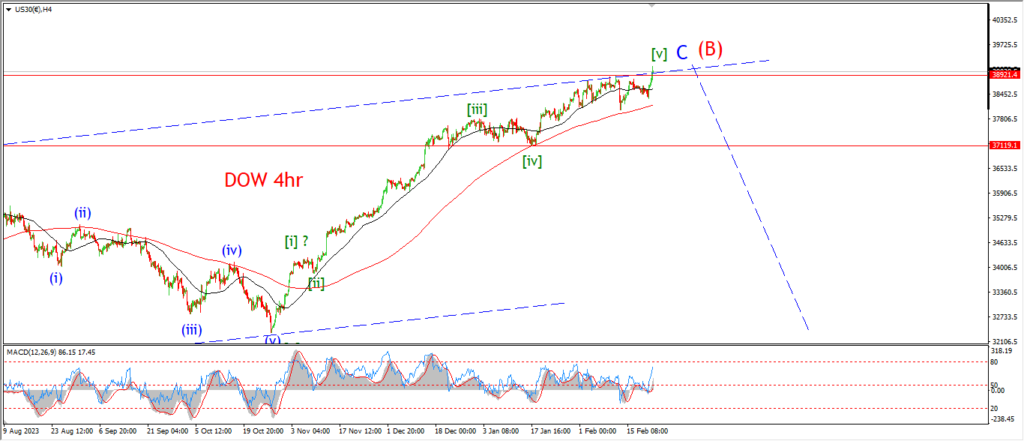

DOW JONES.

DOW 1hr.

The rise into wave ‘c’ got underway today,

and so far the action in wave ‘c’ is in keeping with the overall theme for wave (v).

That is;

very choppy and overlapping so far!

We should see this final rally break to a new high this week in this scenario.

And if the guidelines for an ending diagonal are followed here,

then wave (v) will not exceed the length of wave (iii),

That gives a minimum target at 39288,

and an upper end target for wave (v) at 39700,

where wave (iii) and (v) reach equality.

Tomorrow;

watch for wave ‘c’ of (v) to continue to break to that minimum target and create a new high for the market.

We may not even see much more than that to top this one out.

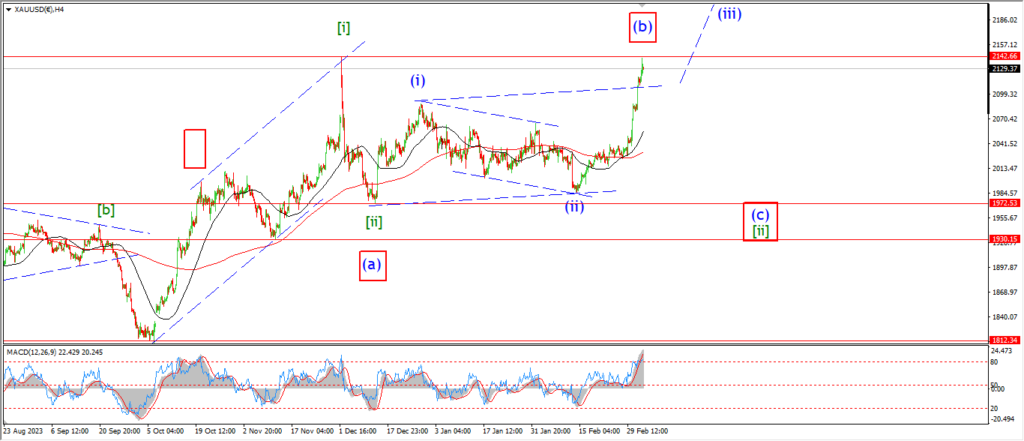

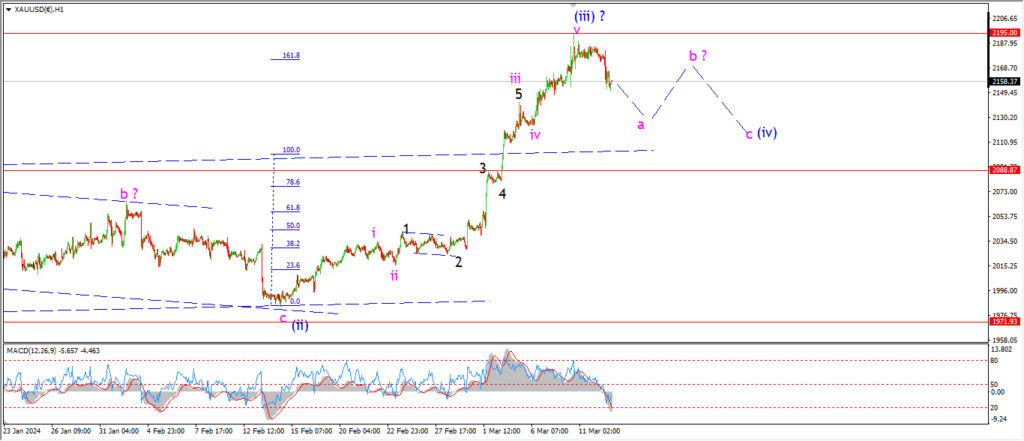

GOLD

GOLD 1hr.

Wave ‘a’ of (iv) has turned the corner today and now the test of the rally begins.

Wave (iv) should cool off this rally substantially over the coming days.

and I expect to see a the price go sideways long enough to see 4hr momentum create a cycle low again.

That will create the conditions for a resumed rally into wave (v) over the coming weeks.

The wave (iv) low must hold above the wave (i) high at 2088,

and as long as that level holds,

then the bullish stance here holds.

Tomorrow;

Watch for wave (iv) to continue sideways and trace out a three wave internal pattern as shown.

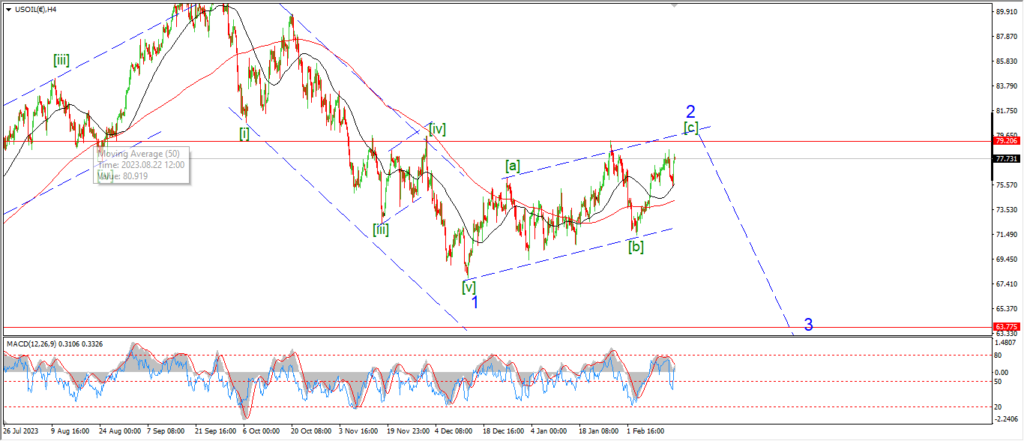

CRUDE OIL.

CRUDE OIL 1hr.

I can’t add much to last nights thoughts on crude simply because nothing has happened here yet.

Wave (iii) has not been confirmed yet by breaking the support at 75.76.

And the price is holding in a trend channel off the highs,

So as it stands,

we are in a limbo here until the market confirms or denies this pattern.

Wave (iii) must begin soon if this main count is to hold,

so I will be looking for a turn lower to break support tomorrow.

Tomorrow;

watch for wave (ii) to hold at 80.10,

wave (iii) down must continue to trace out five waves down and break support.

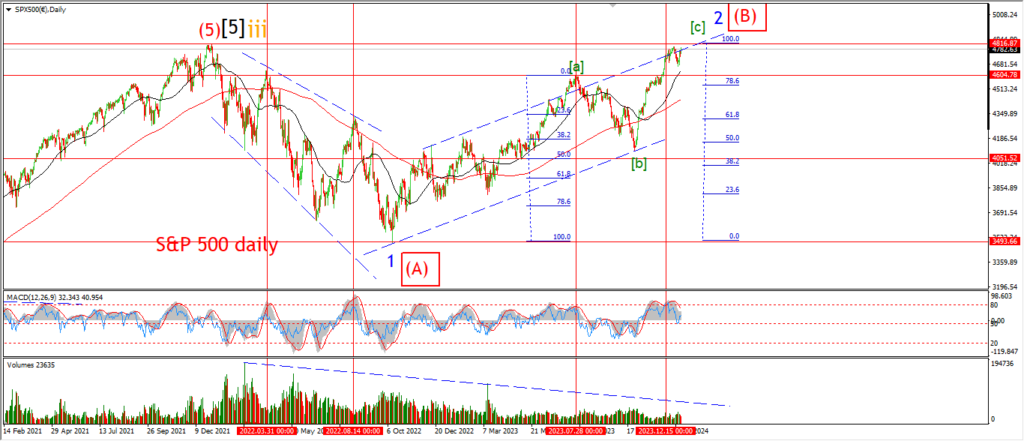

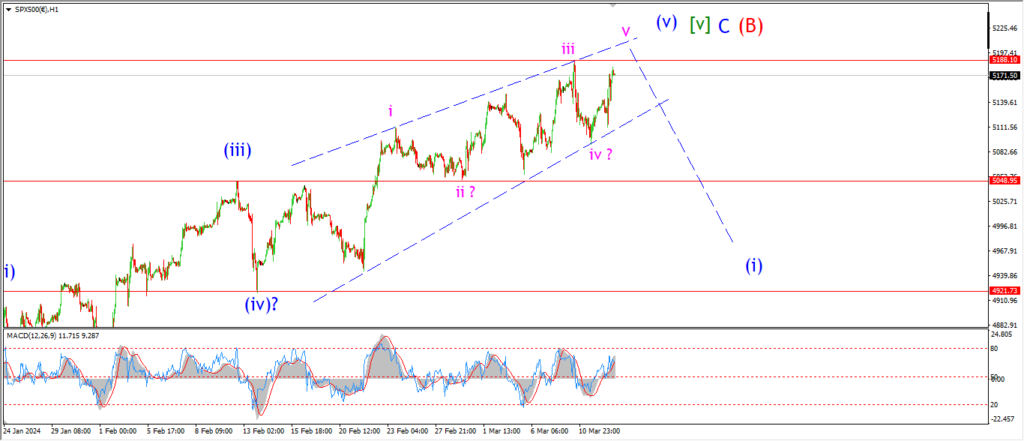

S&P 500.

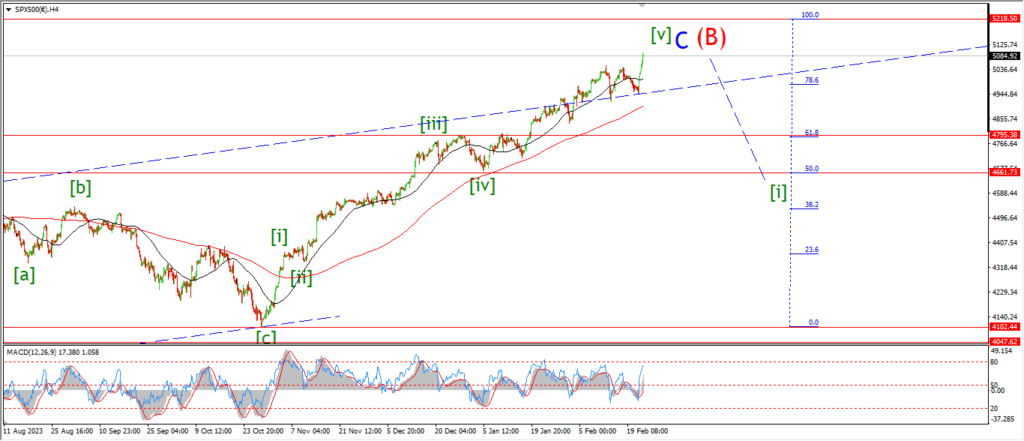

S&P 500 1hr

The S&P has ruled out last nights idea with the rally today.

The market is back at the highs again this evening,

and I am showing another possible wave formation for the current pattern.

this involves the ending diagonal idea that is operating in the DOW.

The price action in the S&P is forming a wedge into the highs that much is true.

It remains to be seen how wave ‘iv’ and ‘v’ actually develop.

As the market can easily go sideways from here to complete a larger wave ‘iv’ before turning higher into wave ‘v’ later next week.

Last night pattern can be triggered again if the market takes a rapid turn lower to break 5048 again,

and in that case,

we could see a solid five waves down by the end of this week.

Tomorrow;

Watch for wave ‘iv’ to hold at Fridays low,

and wave ‘v’ up to close out the wedge pattern at the upper trend line.

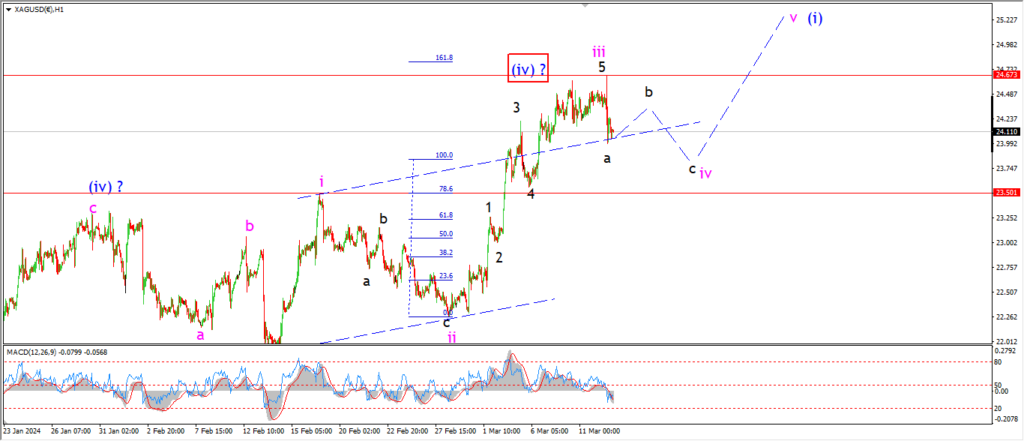

SILVER.

SILVER 1hr

Wave ‘a’ of ‘iv’ is closing out this evening as I write,

and that is the first step into wave ‘iv’ of wave (i).

Wave ‘iv’ should dominate the next few sessions as the price corrects the recent rally.

Three waves down in wave ‘iv’ must complete above 23.50 at the wave ‘i’ high.

and as long as wave ‘i’ holds at 23.50,

then this bullish count is valid.

If that level breaks,

I will be forced to rethink the short term count at least.

Tomorrow;

Watch for wave ‘b’ of ‘iv’ to complete a lower high below 24.67.

and then wave ‘c’ down will turn lower again as shown.

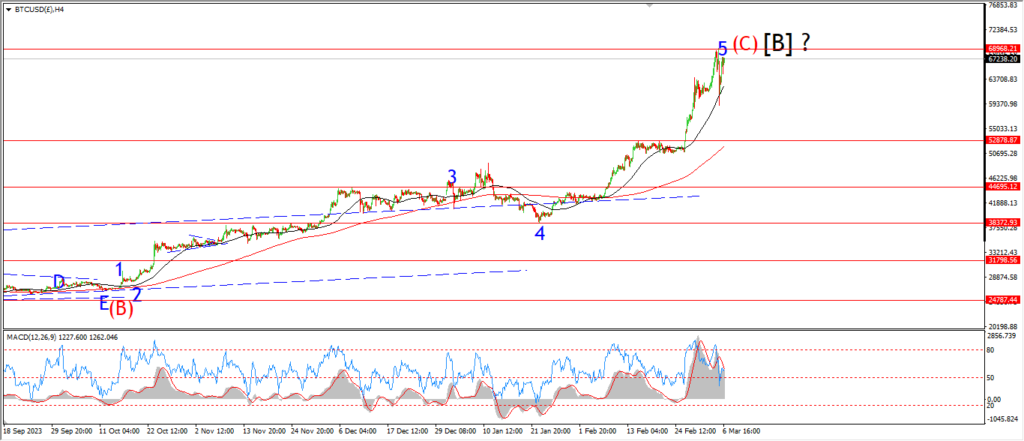

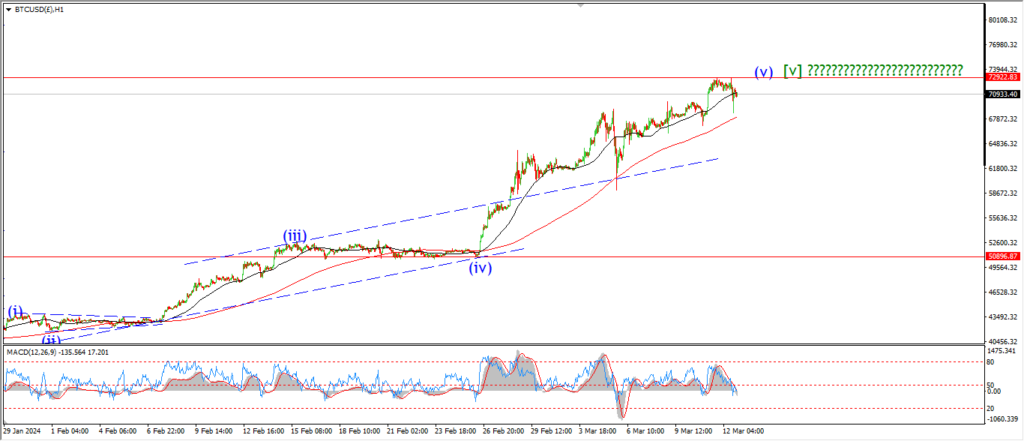

BITCOIN

BITCOIN 1hr.

….

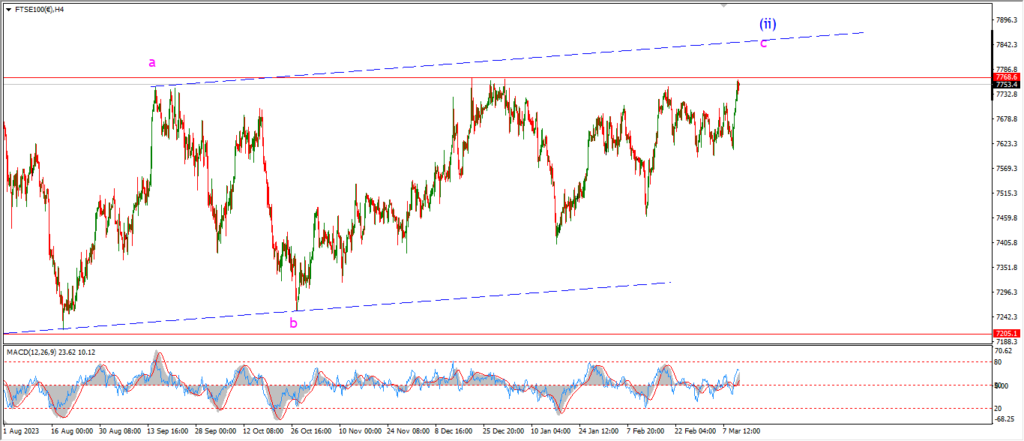

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

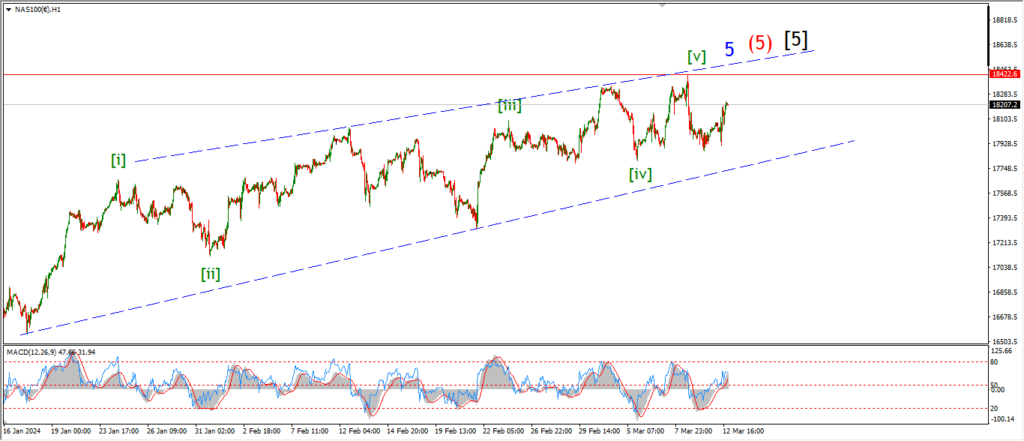

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….