Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

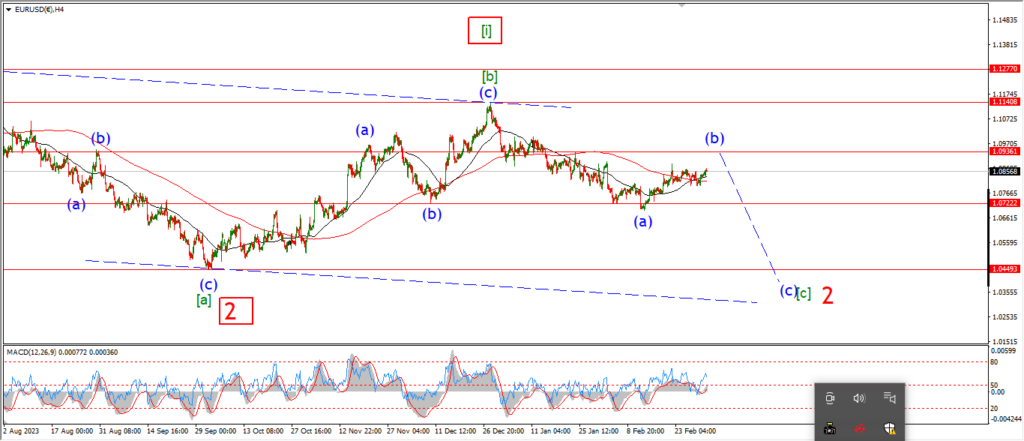

EURUSD.

EURUSD 1hr.

Wave ‘c’ is still in play today after a flat trade in EURUSD.

I am looking at the 652% retracement level at 1.0968 as the main target level for wave ‘c’.

And when we have three waves up complete,

then I will look lower into wave (c) down.

Tomorrow;

As long as wave ‘b’ holds at 1.0795 then this count holds.

Watch for wave ‘c’ of (b) to complete three waves up as shown possibly by late Thursday if this pattern works out.

GBPUSD

GBPUSD 1hr.

Cable ran up to the upper trend channel line again today and then reversed off the highs again.

We have a possible high for wave ‘ii’ now in place today,

and now the test begins for wave ‘iii’ down.

Wave ‘1’ of ‘iii’ must fall pretty quickly to break 1.2600 again.

And the rest of this week should be dominated by the downside as wave ‘iii’ picks up the pace.

Tomorrow;

Watch for wave ‘ii’ to hold at todays highs.

Wave ‘1’ of ‘iii’ must fall in an impulsive manner to break initial support at 1.2600.

USDJPY.

USDJPY 1hr.

USDJPY has traced out three waves down into todays lows at 149.70.

That should complete wave ‘ii’ pink,

and the price should now turn higher again into wave ‘iii’ of (v).

The minimum target for wave (v) lies at 151.00 with a break of the wave (iii) high.

But I am looking for an extended rally in wave (v) to bring the larger pattern back into proportion again.

Tomorrow;

we are in a crucial moment for this wave count now.

Wave ‘iii’ of (v) must now take the price higher to confirm the pattern.

Watch for wave (iv) to hold at 149.21.

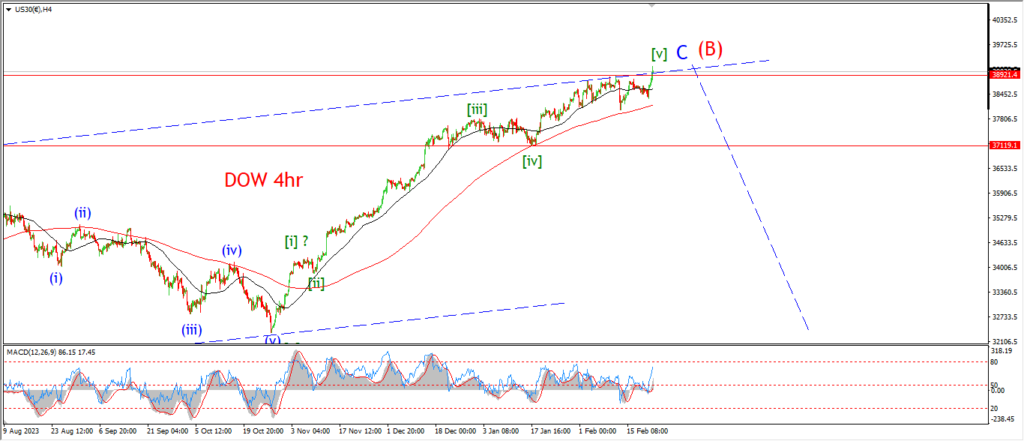

DOW JONES.

DOW 1hr.

I have shown a variation of the ending diagonal tonight after todays selloff.

I know that it is tempting as always to jump on the doom train,

but I will let this pattern play out first before doing that!

Wave (iv) can still be in play tonight with this larger three wave pattern.

And wave (v) can still turn higher in three waves to complete the larger pattern at wave [v] green.

A break of the wave (ii) low at 38036 again will cause me to think again on this one,

maybe then I can favor the alternate count.

Tomorrow;

Watch for wave (ii) to hold at 38036.

Wave (v) should turn higher in three waves as shown.

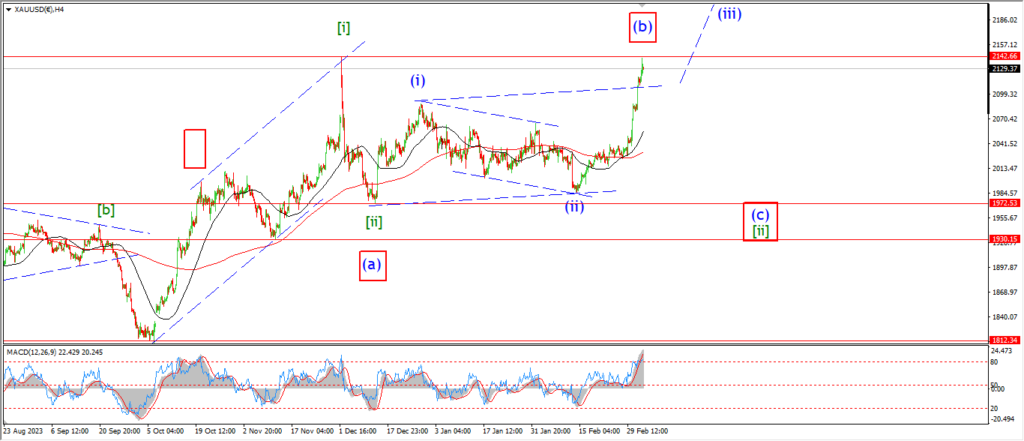

GOLD

GOLD 1hr.

Lets start at the 4hr chart.

I have switched to the bullish alternate count this evening after the price hit a double top this afternoon.

The rally today has ruled out last nights count,

and brought forward the bullish potential.

This may be wave (iii) of [iii] up now underway,

but there are some severe headwinds to that possibility.

The 4hr chart shows a possible alternate count for wave [ii] green.

in this scenario,

the current top is a (b) wave of an expanded flat.

Wave (c) can take the price down to 1970 again in five waves.

Jeut keep one eye on that pattern in case this is a false break out.

Tomorrow;

If wave (iii) of [iii] is now underway,

then we will see a clear five wave pattern trace out over the next week as shown on the hourly chart.

This is pretty close to the recent wave count,

only we will see wave (iii) blue break out to a new high and hold near the highs for an extended period as wave (iii) and (iv) complete.

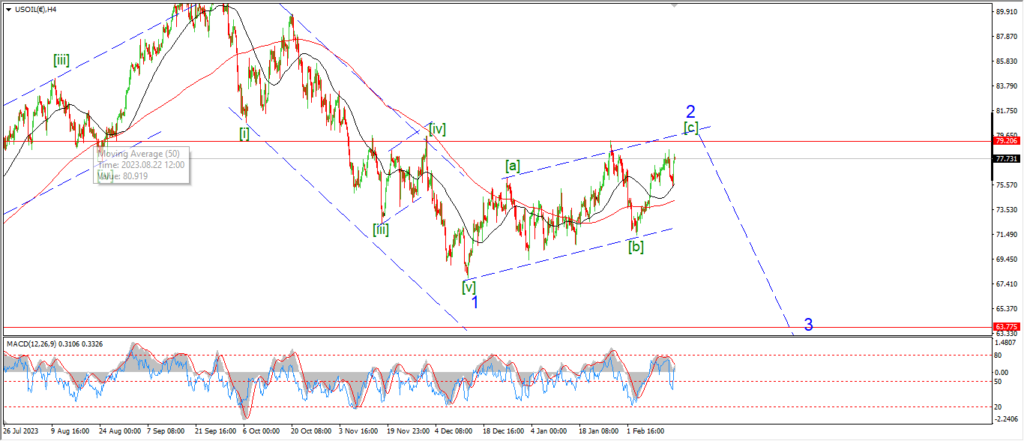

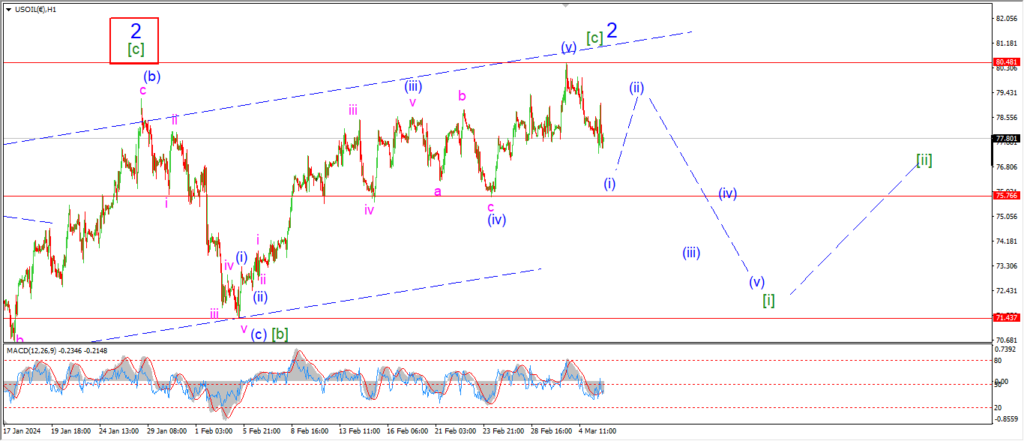

CRUDE OIL.

CRUDE OIL 1hr.

Crude has fallen enough today to rule out last nights count and to now consider the possibility that wave [c] and wave ‘2’ are now complete at this weeks highs at 80.48.

If that is correct.

Then we are in for a serious decline into wave ‘3’ over the coming months.

If this count is correct,

then wave [i] of ‘3’ will fall in five waves in the coming few weeks as shown.

And wave [i] is likely to fall into the wave [b] lows at 71.40.

Tomorrow;

Watch for wave (i) and (ii) to form a lower high below the wave ‘2’ high as shown.

Wave (iv) marks initial support here at 75.76.

And wave [i] down will be confirmed with a break of that level.

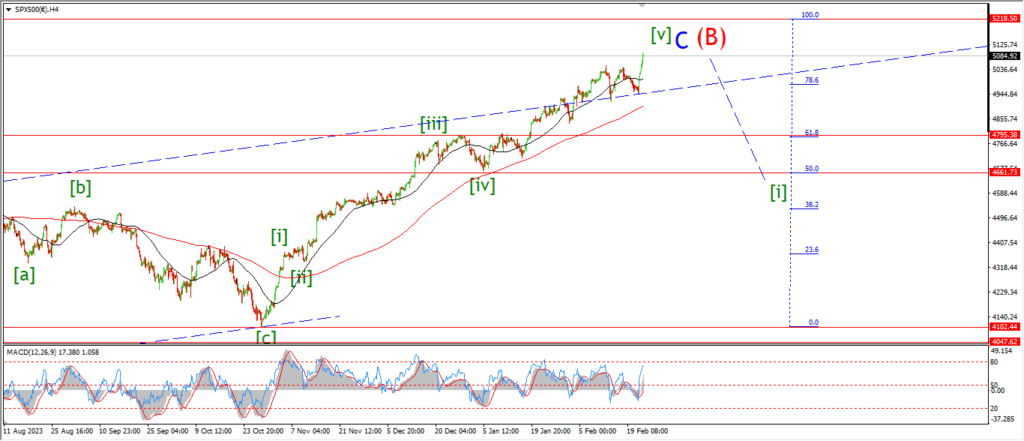

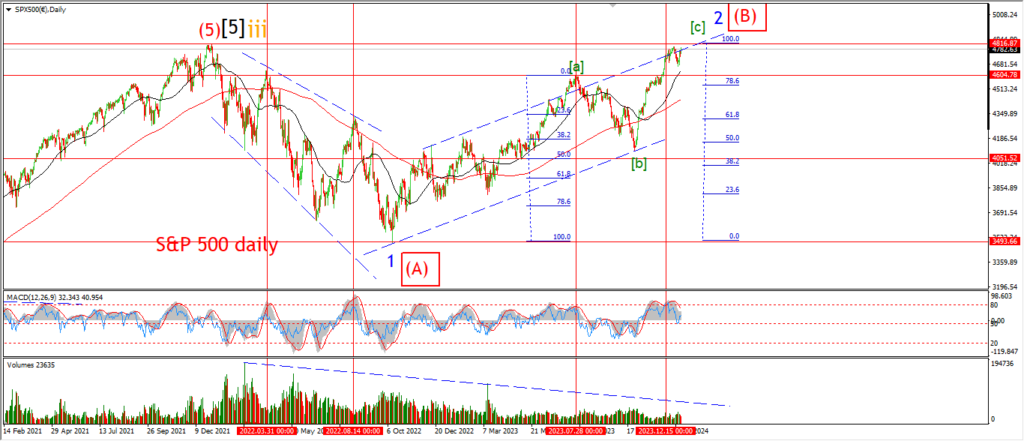

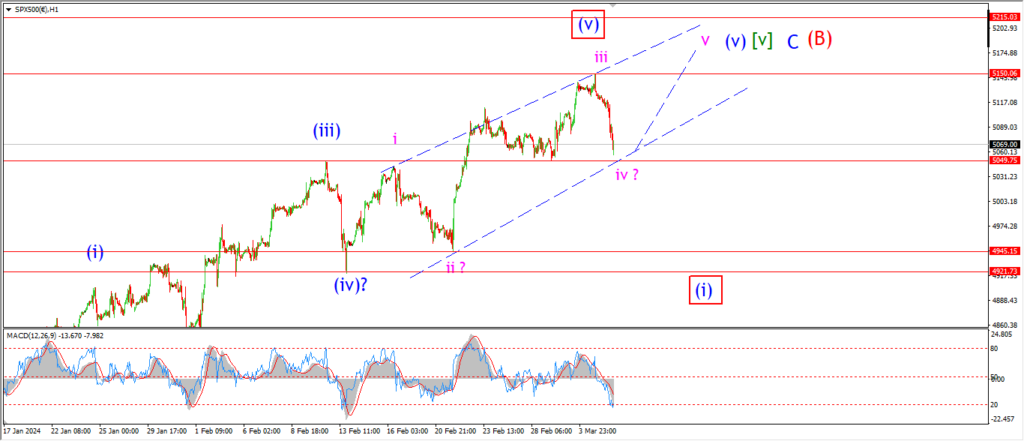

S&P 500.

S&P 500 1hr

Well,

the possibility for a bearish reversal is on the cards tonight as this decline develops.

I will leave that for a few days unless and until we see a sustained decline that breaks below 4920 at the wave (iv) lows.

I am going to allow for another run higher in wave ‘v’ of (v) as part of the ending diagonal pattern for wave (v) blue.

This pattern will only be ruled out if we get a break of the wave ‘ii’ low at 4945,

but I gotta say,

if the market actually falls into that wave ‘ii’ support,

then the ending diagonal pattern will be untenable anyway!

So,

the market is at a very interesting inflection point here.

Further declines will break the main pattern for wave (v) and open up a possible wave (i) down.

Lets see how the next few sessions go.

the market will make a decision soon enough.

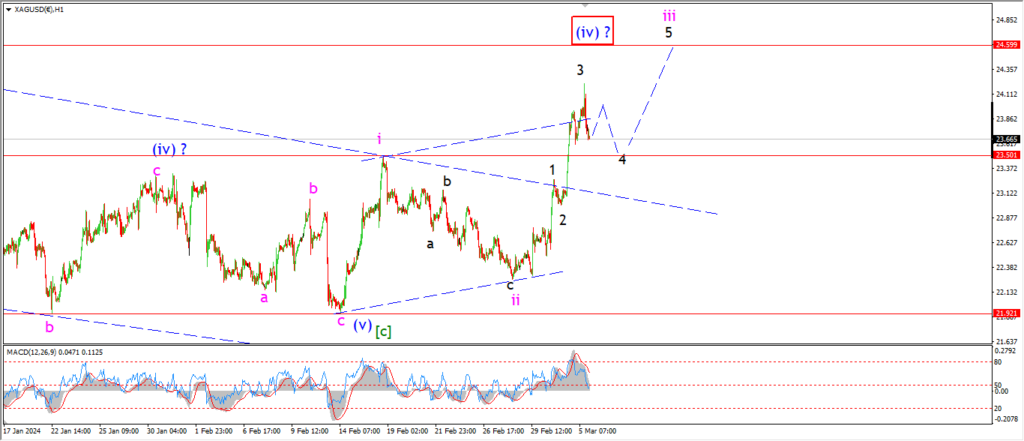

SILVER.

SILVER 1hr

Ok,

I know there is an endless amount of hype being printed today about the run higher in gold,

but then you look at the action in silver and we get a reversal off the top??

The main count is calling for a three wave decline in wave ‘4’ of ‘iii’.

This wave should find support at the previous wave ‘i’ high at 23.50,

and then turn higher again into wave ‘5’ of ‘iii’.

So the main count is still looking higher into next week as wave ‘iii’ completes.

the alternate count is still in play also today,

we have three waves up into this weeks highs,

and I know this is annoying,

but this is a valid wave (iv) correction higher also.

The action over the next few days is crucial to decide between both counts.

Tomorrow;

Watch for wave ‘i’ to hold at 23.50.

Wave ‘4’ will fall in three waves and that correction should be complete by the end of the week.

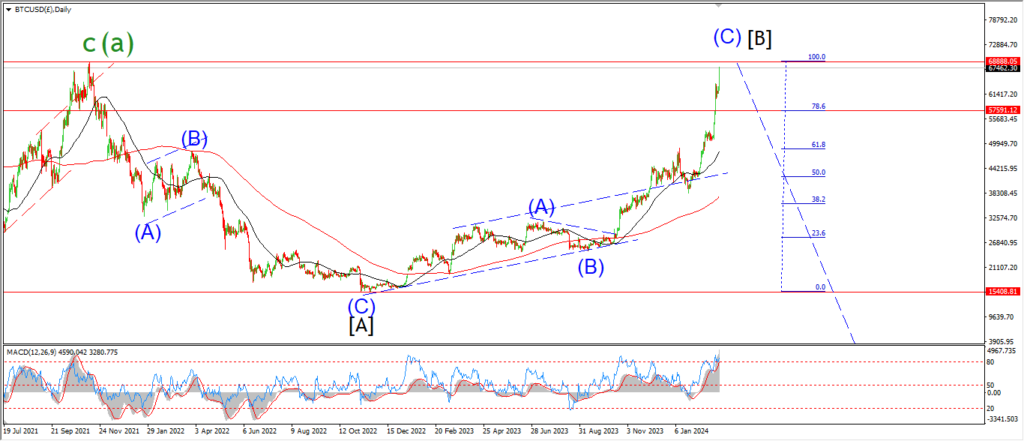

BITCOIN

BITCOIN 1hr.

….

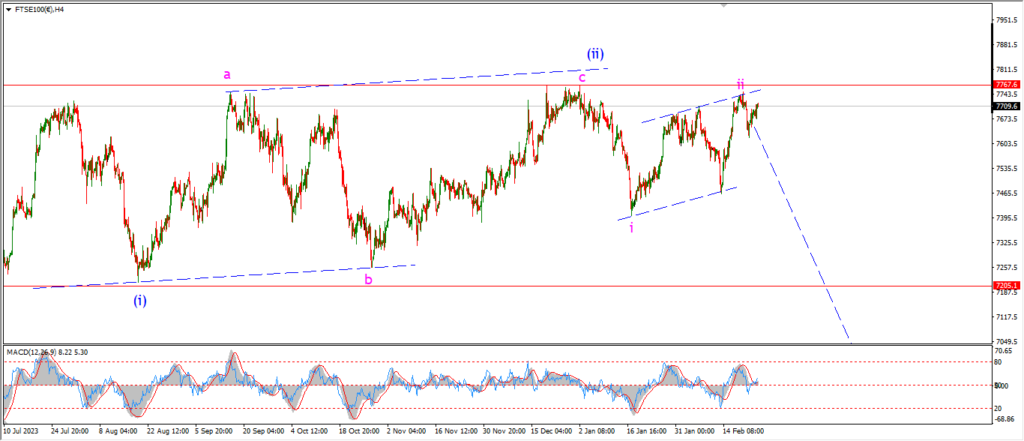

FTSE 100.

FTSE 100 1hr.

….

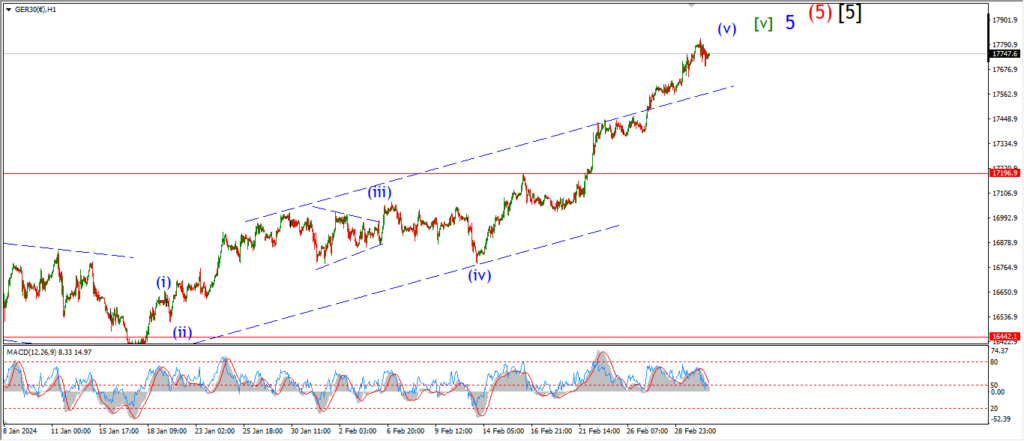

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

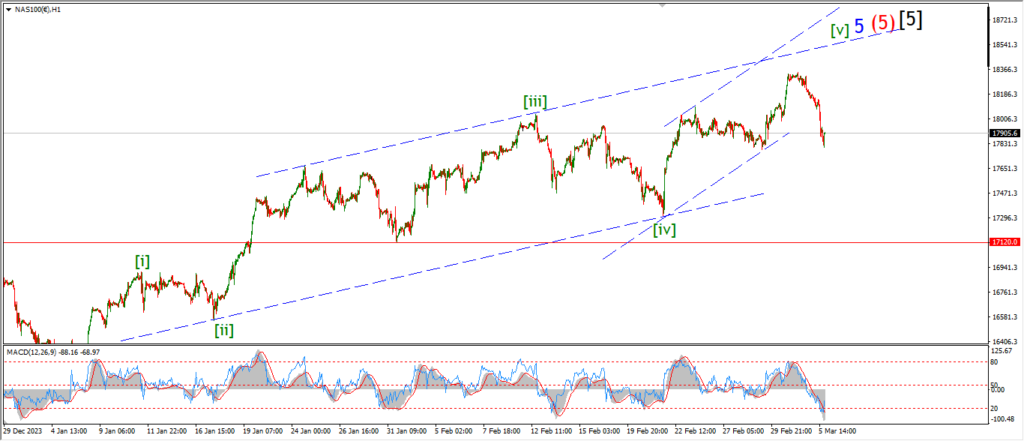

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….