Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

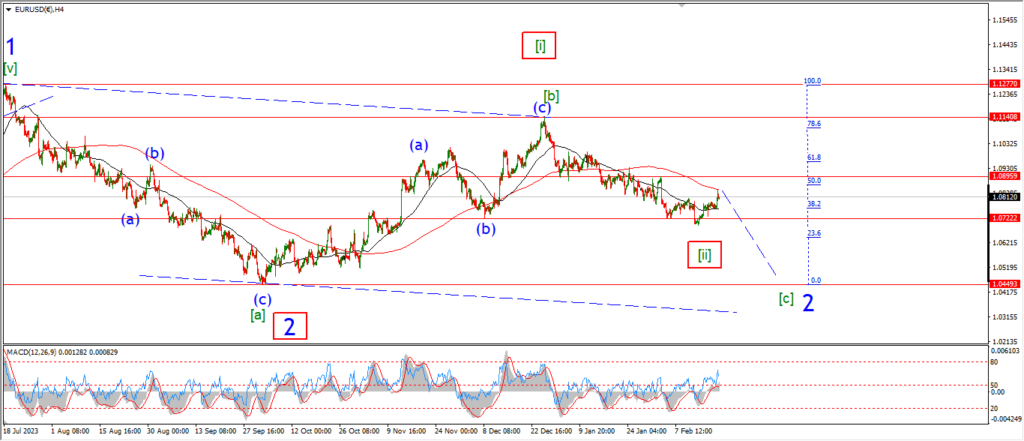

EURUSD.

EURUSD 1hr.

Take a look at the 4hr char first tonight.

I want to draw attention to a possible alternate count for the current action.

the decline into wave [c] of ‘2’ has been a little subdued to be honest,

so I must consider the possibility that there is something else going on here.

The action has created a higher low as it stands this week.

We could call this wave [i] and [ii] to begin wave ‘3’ up.

If the price continues to push higher and break the 1.09 level over the coming days,

then I will be looking at this bullish count again.

so just keep one eye on this idea here.

Tomorrow;

Back to the main count for wave [c] of ‘2’.

The spike higher today did come close to breaking the invalidation level at 1.0846 at wave ‘i’.

but this evening we have a reversal off the highs.

I am going to give wave ‘v’ another day to begin.

If we see a break of the wave ‘b’ lows again that should be enough to confirm this count.

GBPUSD

GBPUSD 1hr.

Last nights count is still valid,

but;

I actually switched counts earlier today to show a larger wave ‘ii’ correction.

and the count is still in place on the main chart above.

This scenario allows for a rally in wave ‘c’ of ‘ii’ into the upper trend channel line near 1.2700 again,

before turning down into wave ‘iii’ as shown.

The price has actually dropped off the session highs again this evening,

so we may be turning into wave ‘iii’ quicker than this count allows.

We will see how it goes.

Tomorrow;

A break of the wave ‘i’ low at 1.2517 again will signal wave ‘iii’ of (iii) is underway.

Watch for wave ‘c’ of ‘ii’ to complete with a break of the wave ‘a’ high at 1.2686.

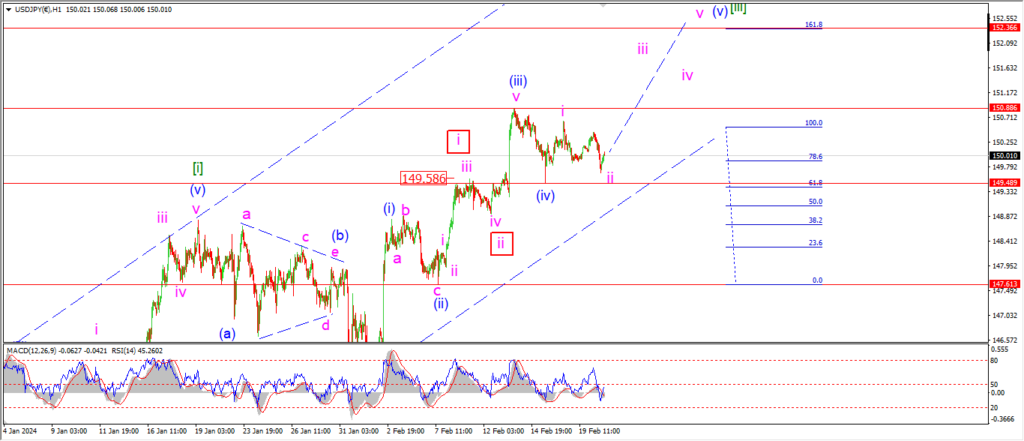

USDJPY.

USDJPY 1hr.

USDJPY has spent another day stuck in the corrective mud!

But the price may well be turning up out of the hole this evening again.

A clear three wave correction has completed at todays lows.

and now we the price is set for a rally into wave ‘iii’ of (v) of [iii].

A break back above the wave (iii) blue high at 150.88 will confirm this count.

And the target for wave (v) remains at the 162% extension of wave (i) at 152.36.

Tomorrow;

Watch for wave (iv) to hold at 140.49.

Wave (v) must continue higher in a five wave pattern from here.

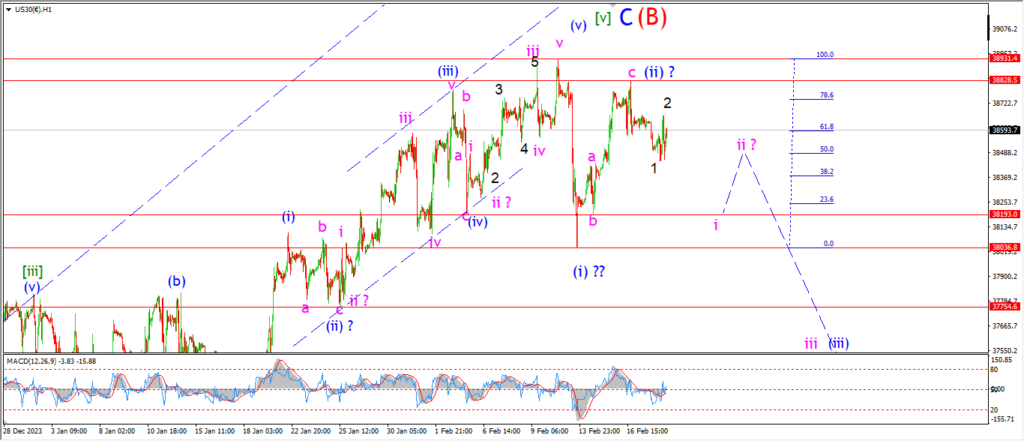

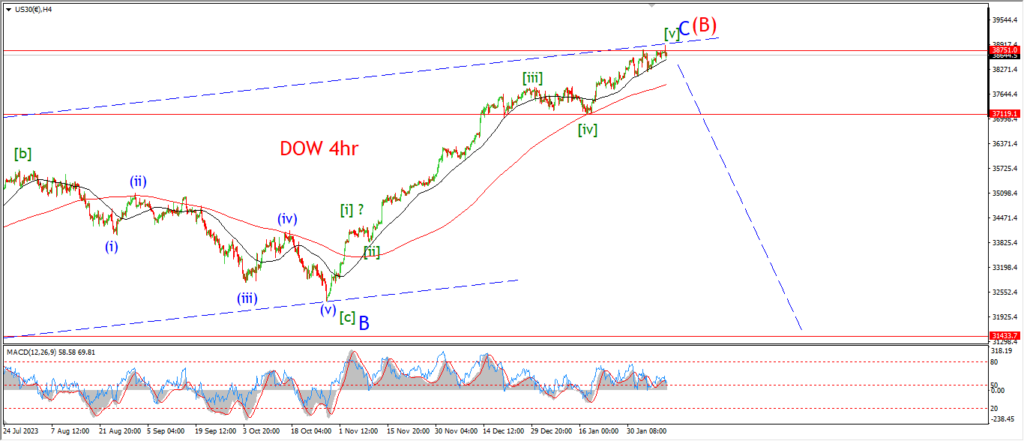

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The DOW is lower today which puts some distance between us and the invalidation line.

but there is very little new here to confirm the bearish count at the moment.

We do have a small lower high built off that wave (ii) top.

This move is not big enough to label as wave ‘i’ and ‘ii’ yet,

so I have suggested that this is only a first step into wave ‘i’ pink.

We need to see five waves down and a low near 38200 to call wave ‘i’ of (iii).

A move back below 38000 again will signal wave (iii) is in play.

Tomorrow;

Watch for wave ‘i’ of (iii) to retrace the full wave ‘c’ advance at 38200.

The wave (ii) high must hold.

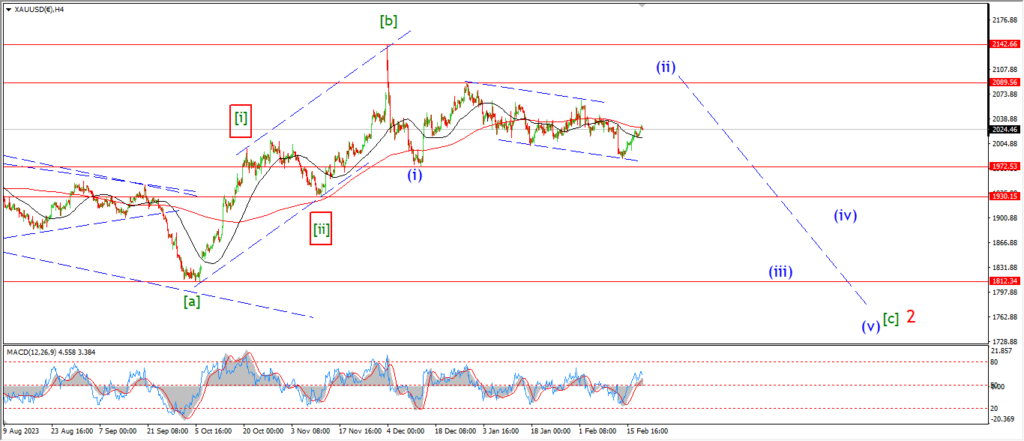

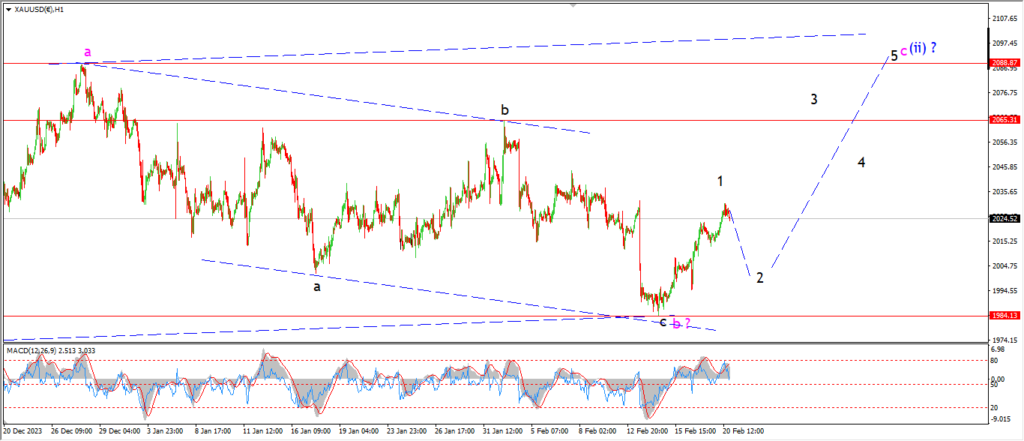

GOLD

GOLD 1hr.

Take a look at the 4hr chart first tonight.

I have changed the wave count for wave (ii) of [c] to the alternate pattern tonight

the price has risen enough today to suggest that wave (ii) is still in play here.

The price has fallen in a corrective fashion over the last few weeks even

and there has not been any acceleration lower into wave (iii).

I am now suggesting that the recent decline happened in wave ‘b’ of (ii).

and the rally this week is the beginning of wave ‘c’ of (ii).

Wave ‘c’ of (ii) will break above the 2090 level to complete a three wave correction higher.

and then I can look for a turn lower into wave [c] again.

Tomorrow;

If this new interpretation is correct,

then we will see five waves up into wave ‘c’ of (ii) over the coming days.

Wave ‘1’ and ‘2’ should complete a higher low above 1984.

Wave ‘3’ of ‘c’ should break above the 2065 level at wave ‘b’.

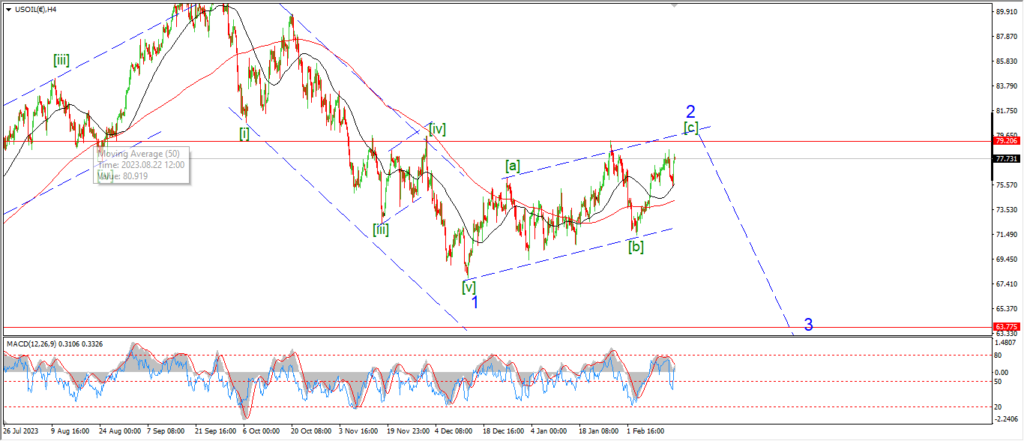

CRUDE OIL.

CRUDE OIL 1hr.

I am going to give the benefit of the doubt the crude oil tonight.

The price has failed to advance in wave (v) of [c] today,

but there is still a chance that we are witnessing the initial step higher into wave (v) even today.

The price is holding above the wave (iv) lows at 75.48 at the moment,

so I am suggesting that wave ‘ii’ is only now completing.

And we should see a rally in wave ‘iii’ of (v) back above 79.22 at the recent highs.

Wave (v) is expected to close out the larger pattern in wave [c] of ‘2’ back at the upper trend channel line at near 81.00 later this week.

So lets see how that goes.

Tomorrow;

If this rally in wave (v) fails to materialize,

then I will look lower again into wave [i] of ‘3’.

Watch for wave ‘iii’ to turn up again tomorrow and this that resistance at 79.22.

S&P 500.

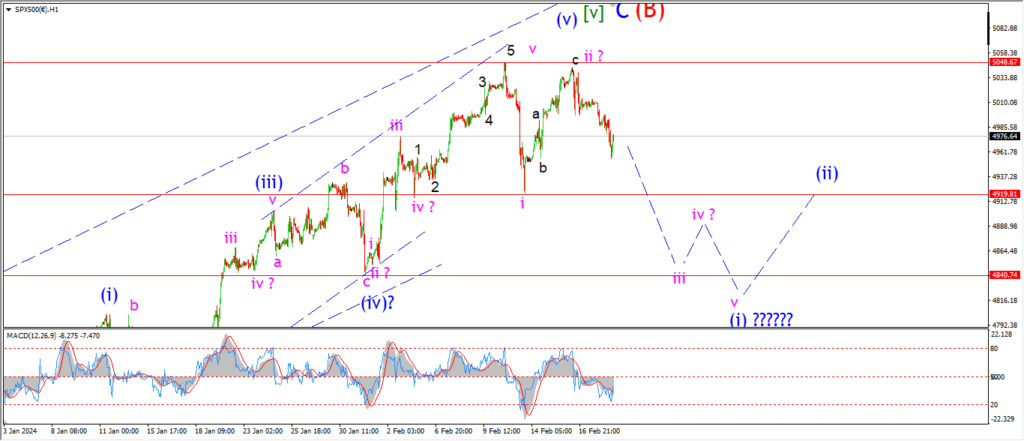

S&P 500 1hr

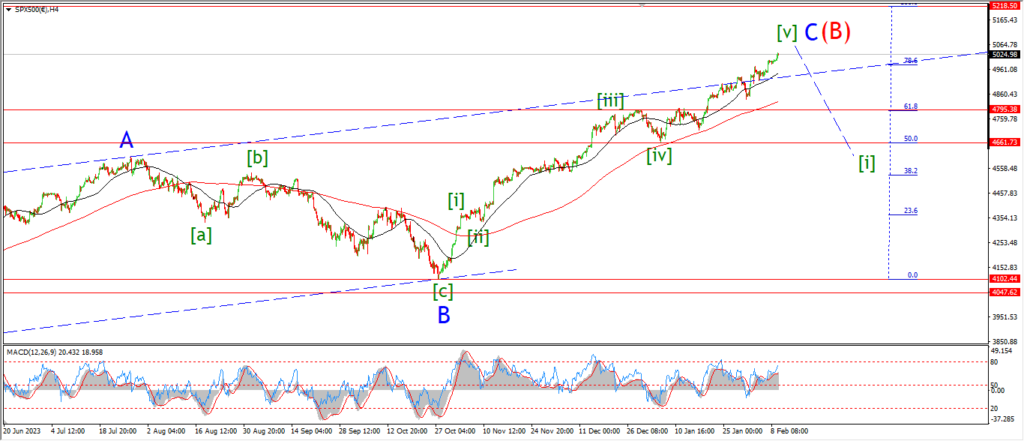

S&P 500 4hr

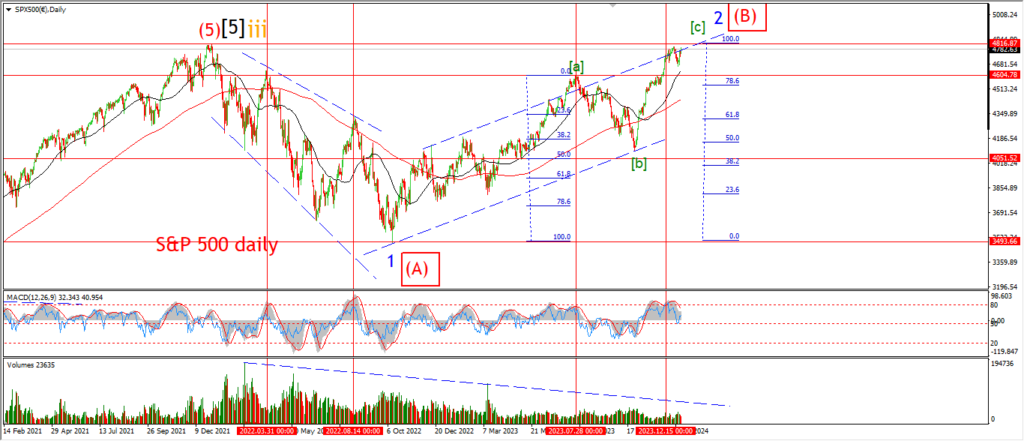

S&P 500 daily.

An decline in the S&P today gives me some breathing room between here and invalidation again.

But,

this move lower is not enough to confirm wave ‘iii’ at all yet.

So we still have work to do here.

The initial target here is for wave ‘iii’ to break below the wave ‘i’ low at 4919.

And then we will see if some momentum can build into wave ‘iii’ down to target the next support at 4840.

The highs at wave (ii) must hold from here.

Tomorrow;

Watch for wave ‘iii’ down to continue and break the minimum target at 4919 again.

SILVER.

SILVER 1hr

I must start by saying,

if this wave count is correct in silver,

then we are very close to a solid buying opportunity for the long term.

Wave ‘2’ should be followed in quick succession by a large rally in wave ‘3’.

And I would suggest an initial target for wave ‘3’ of (3) back up near 30.00 again quite easily.

Just keep that in mind,

especially if you are a physical buyer,

and you prepared to buy in steps around the lows.

Just a thought.

In the short term I am tracking the completion of wave [c] of ‘2’ as an ending diagonal.

Wave (iv) topped out and turned lower this week.

And now we seems to be looking at wave ‘a’ of (v) now underway.

Ideally,

wave ‘a’ should retrace most of the previous wave ‘c’ rally.

That suggests a low near 22.00 in the coming days.

Tomorrow;

Watch for wave ‘a’ to trace out five waves down and complete near 22.00 again.

The high at wave (iv) must hold.

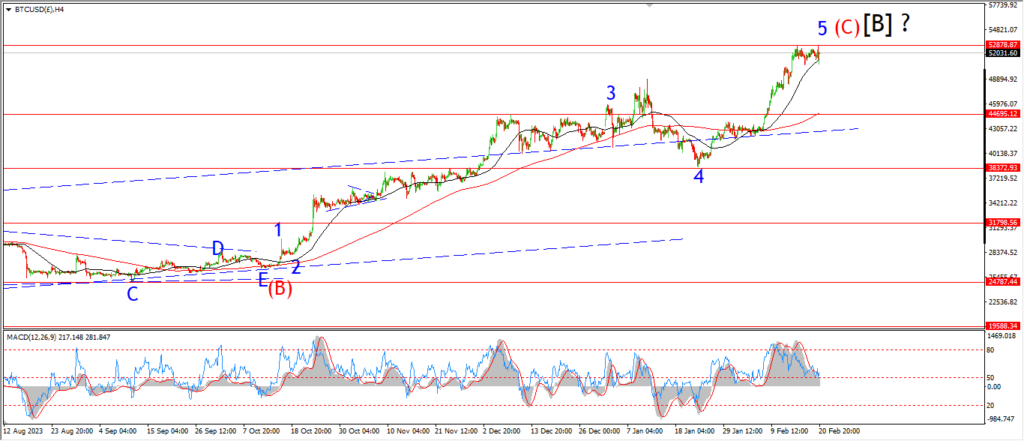

BITCOIN

BITCOIN 1hr.

….

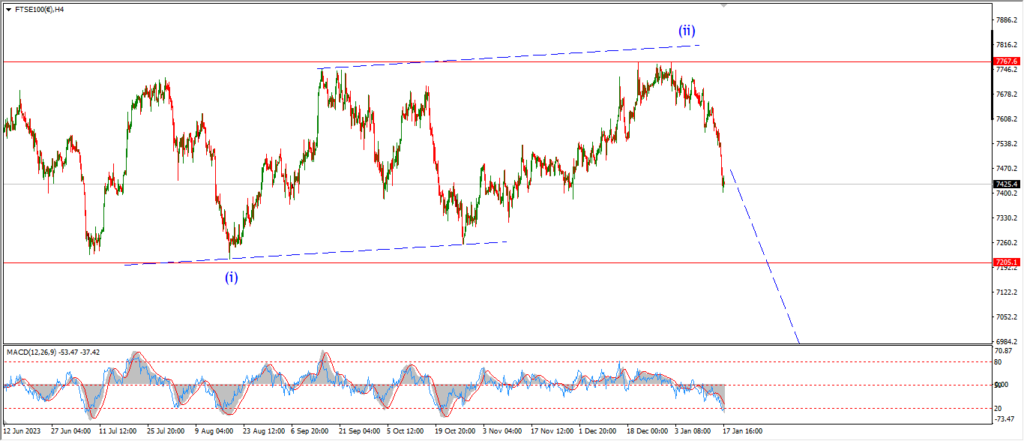

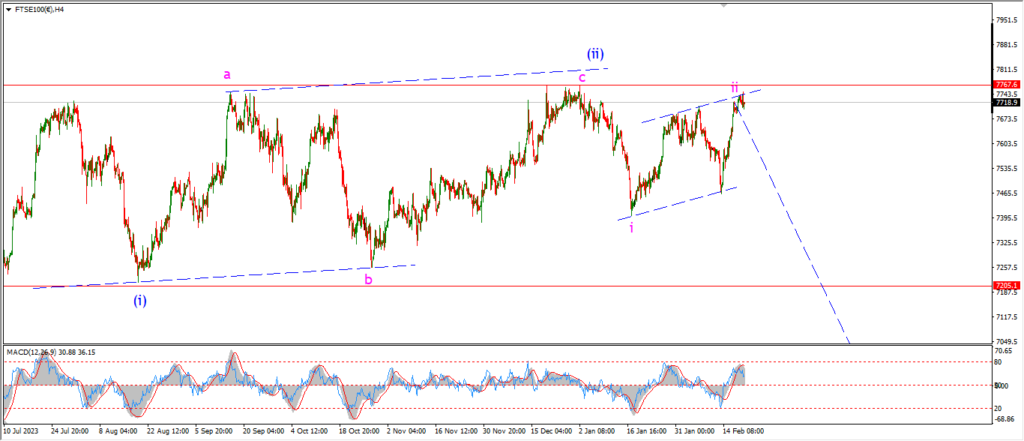

FTSE 100.

FTSE 100 1hr.

….

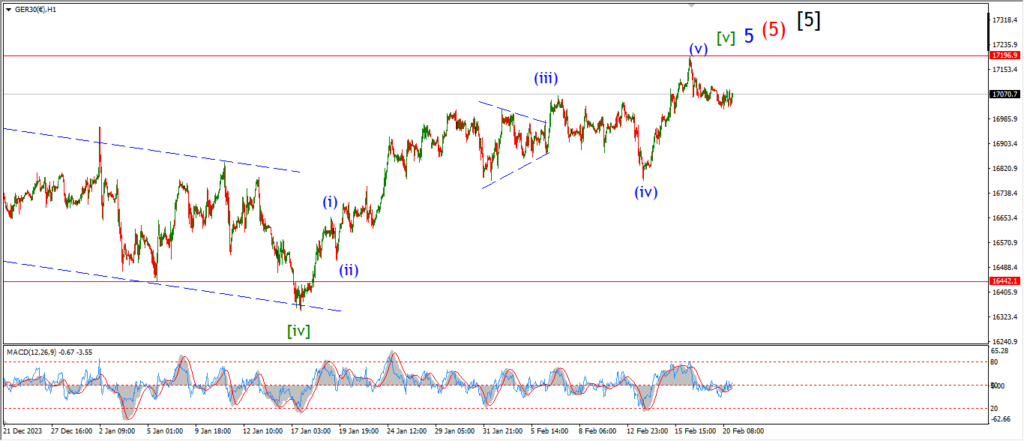

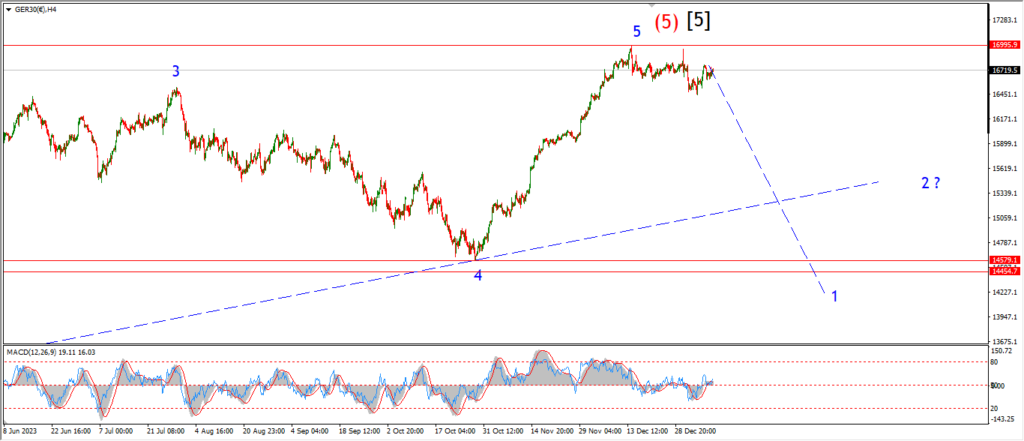

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

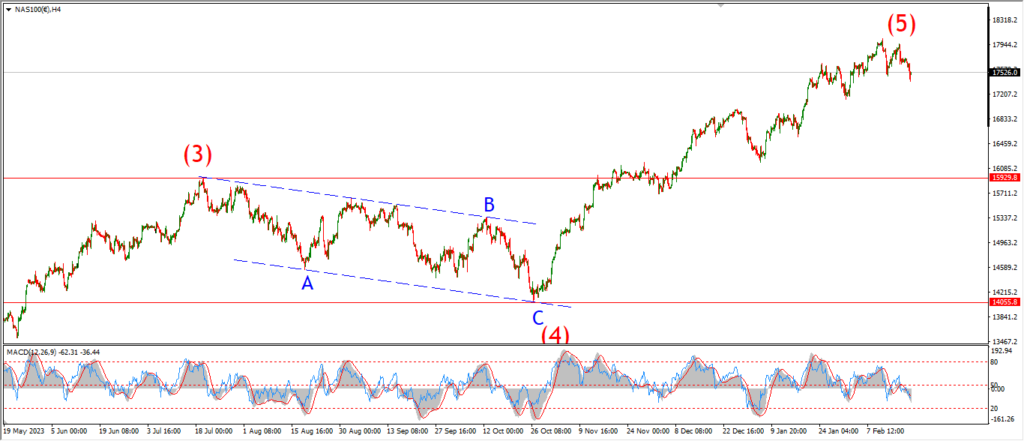

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….