Good evening folks, the Lord’s Blessings to you all.

I was not aware of the public holiday in the U.S today,

and as a result,

the markets are dead quiet across the board.

I will do a run down on the outlook for the week anyway to get us off on the right foot.

https://twitter.com/bullwavesreal

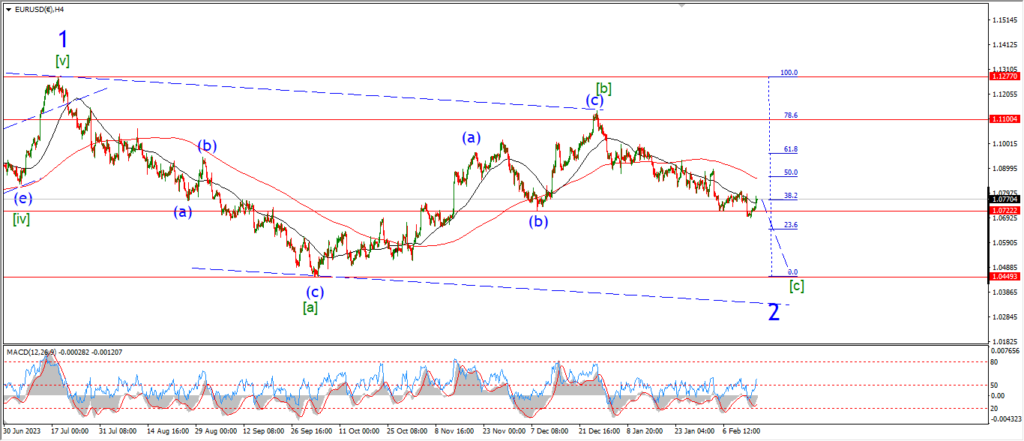

EURUSD.

EURUSD 1hr.

The Action over the last few days in EURUSD is still corrective looking and in three waves.

The price is close to hitting the initial target area for wave ‘iv’ at 1.0805.

this pattern requires one more pop to break above the target level,

and then we can look lower again into wave ‘v’ of (iii).

Tomorrow;

Wave ‘iv’ must complete below 1.0846 at the wave ‘i’ low.

Then we should see a drop back into wave ‘v’ of (iii) close to the lower trend channel line by the end of the week.

GBPUSD

GBPUSD 1hr.

There is a small corrective pattern complete at the session high today.

And so far cable has dropped back off that high again.

the action has not proven wave ‘3’ of ‘iii’ is underway yet.

I want to see a break of 1.2517 to confirm the next wave down.

And I am looking for a break of 1.2431 as a minimum target for wave ‘3’ of ‘iii’.

Tomorrow;

Watch for wave ‘2’ to hold that lower high below wave ‘ii’ pink.

Wave ‘3’ of ‘iii’ will be confirmed with a break of 1.2517.

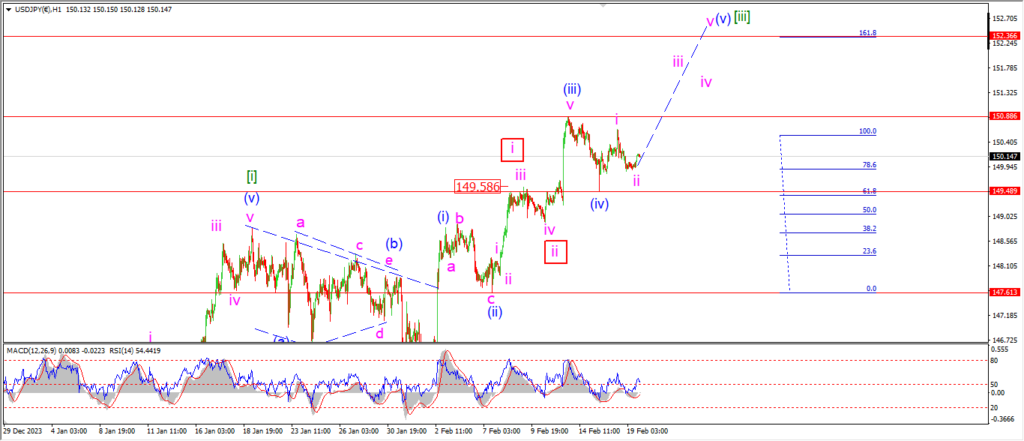

USDJPY.

USDJPY 1hr.

I need some clarity on the main count for USDJPY this week.

The size of wave (iii) blue was a little disappointing to be honest.

So I am keeping one eye on the alternate count for wave [i] and [ii] this week to see if that count can describe the action a little better.

It is not time to change counts yet,

but if we see a break down below 147.60 again that will require some rethinking here.

that is the main issue in the count really.

I will stick with the main idea until that support breaks.

Tomorrow;

Watch for wave (iv) to hold at 149.49.

Wave ‘iii’ of (v) should continue higher.

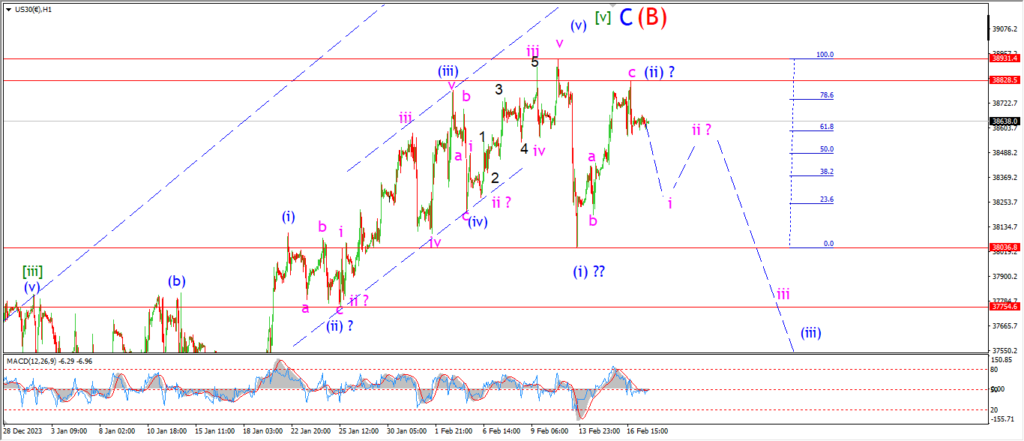

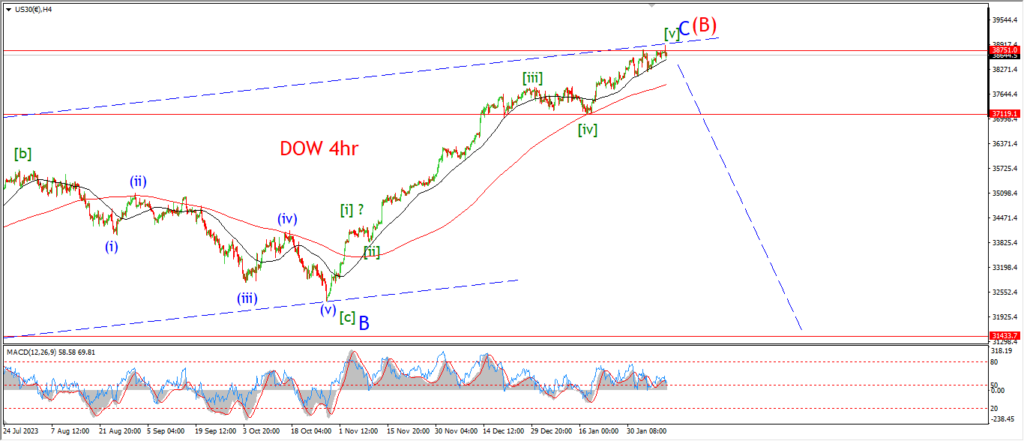

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The market made a good start to a reversal pattern early last week,

but then we had a rapid rally to retrace most of the decline.

The wave (i) decline is still valid at the moment as the market is holding below the all time high.

So the next few days will be testing to see if the market can reverse and drop back again into a third wave down.

We will know soon enough I suppose.

Tomorrow;

Watch for that all time high to hold at wave (B).

Lets see if last weeks rally was just a knee jerk reaction and if the turn down can continue into wave (iii).

GOLD

GOLD 1hr.

Gold is basically flat since November last year.

And that is a problem for my main interpretation of wave ‘2’ red.

I am looking for a five wave decline in wave [c] of ‘2’,

and gold is holding on above the 2000 level for an age now.

I am not oblivious to this fact.

And I am watching the action to see if a viable bullish alternate arises here.

Until that happens I will stick with the wave [c] of ‘2’ count.

And if we get a break of the next support at 1972 again that will seal the deal for this count.

That remains a real possibility at the moment.

Tomorrow;

Watch for a drop back into the trend channel to continue the five wave decline in wave [c].

A break above 2044 will rule out this count.

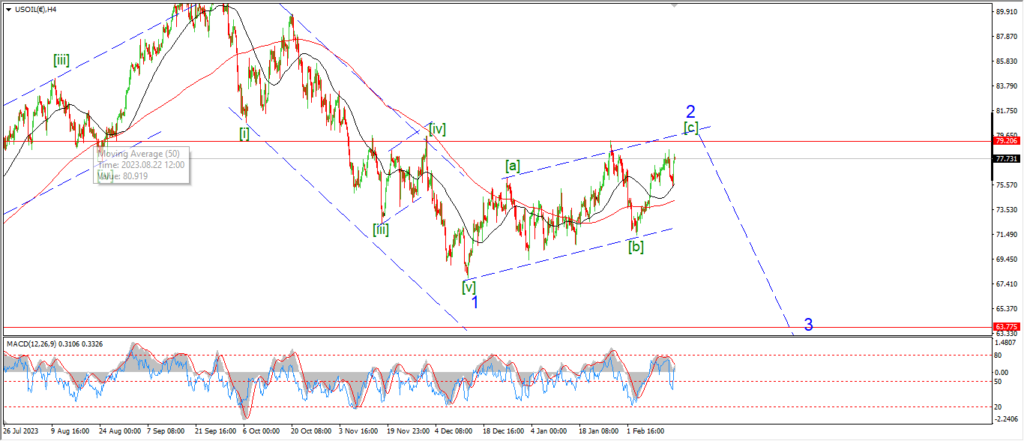

CRUDE OIL.

CRUDE OIL 1hr.

Crude seems to have given up on breaking to a new high for wave [c] as the price action remains below the previous highs at wave (b).

The rally in wave [c] should hit the 80.00 handle again before topping out wave [c] of ‘2’.

And once that happens I will turn my attention lower again into wave [i] of ‘3’.

Tomorrow;

Watch for wave (v) of [c] of ‘2’ to top out with a break of 80.00 again.

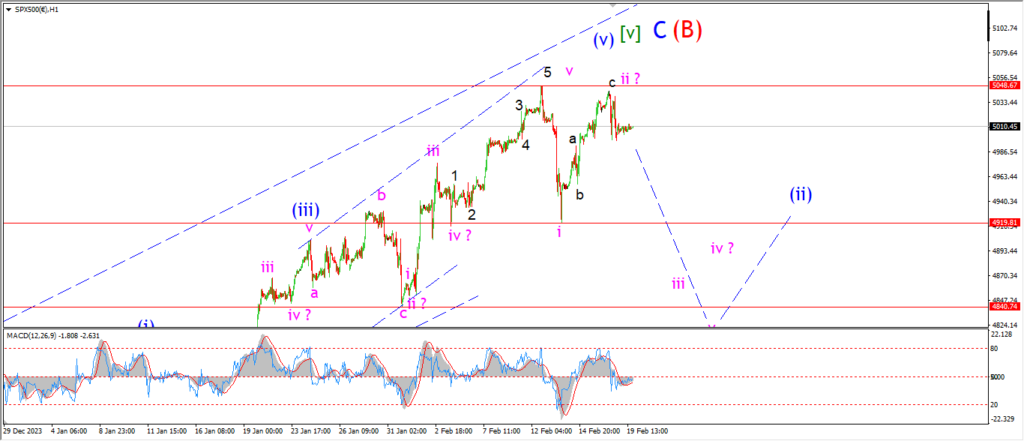

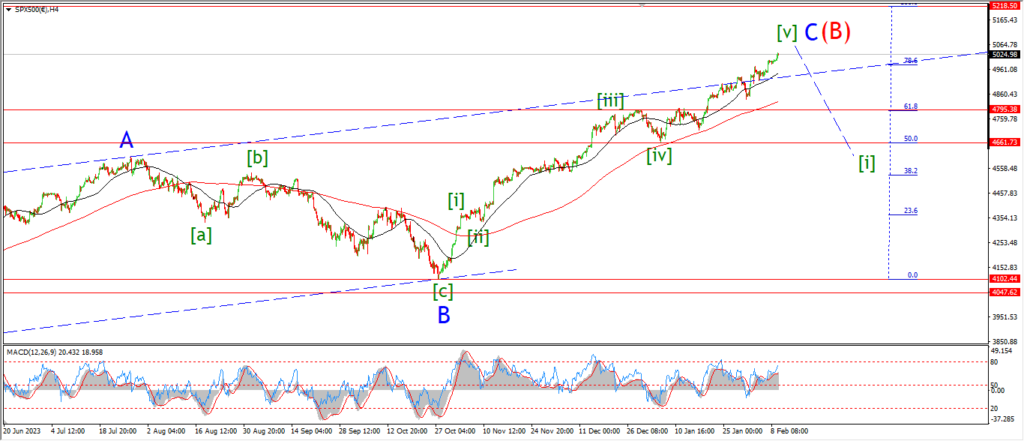

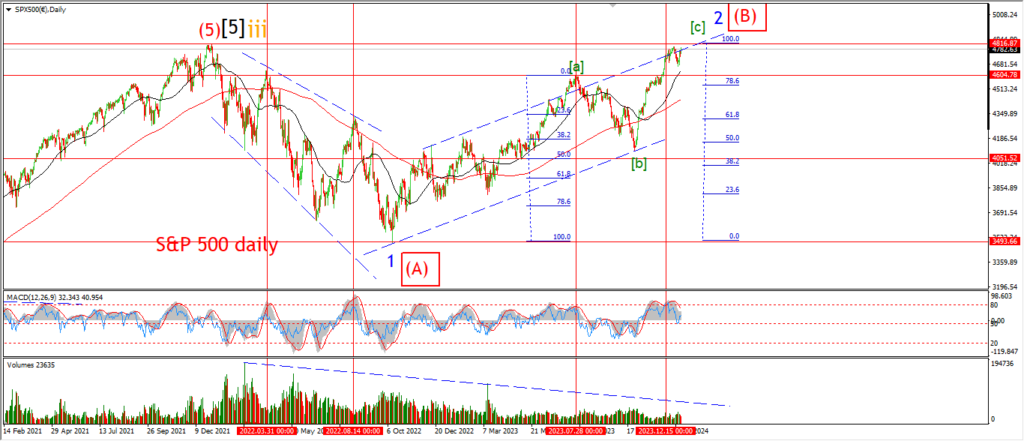

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The market is playing see-saw at the top over the last week.

A solid five wave decline was followed by an almost full retracement late last week.

And now we are sitting just below the all time highs again in a possible wave ‘ii’.

this market will prove this count wrong very quickly tomorrow with a very small pop into the 5050 area.

So at the moment I will call this idea just a test on the possibility of a reversal into wave ‘iii’ of (i).

Tomorrow;

Let’s see if the highs can hold.

the market has a large drop dead ahead if wave ‘iii’ of (i) is coming.

SILVER.

SILVER 1hr

Now that we have a three wave flat correction in place at last weeks highs,

that opens the door for a drop into wave (v) of [c].

If the ending diagonal wave [c] is correct,

then we should see a three wave drop in wave (v) to hit a low near 21.20 level by the end of this week.

Tomorrow;

WAtch for wave (iv) to hold at the recent highs.

Wave (v) should begin with a drop into the 22.00 level again to retrace all of the wave ‘c’ rally last week.

BITCOIN

BITCOIN 1hr.

….

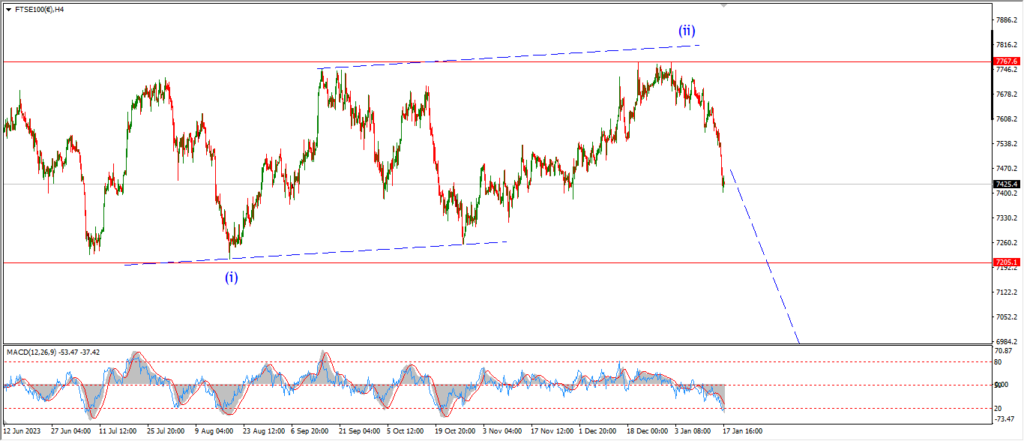

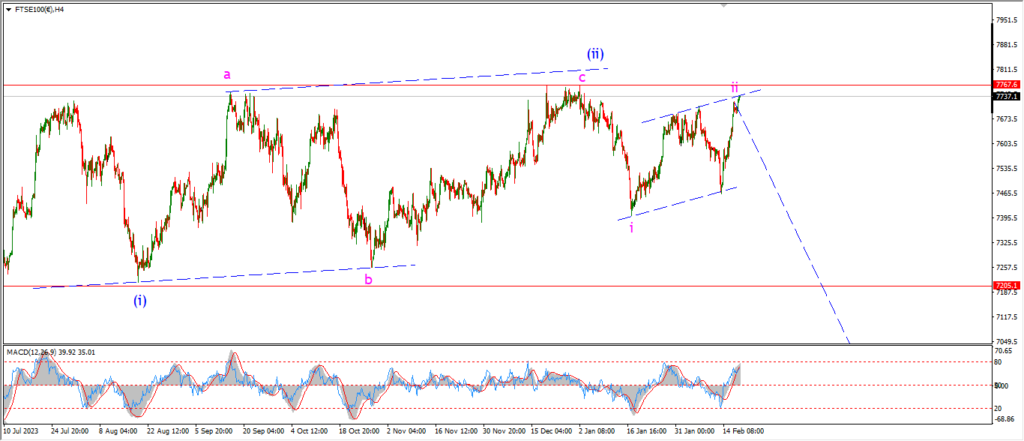

FTSE 100.

FTSE 100 1hr.

….

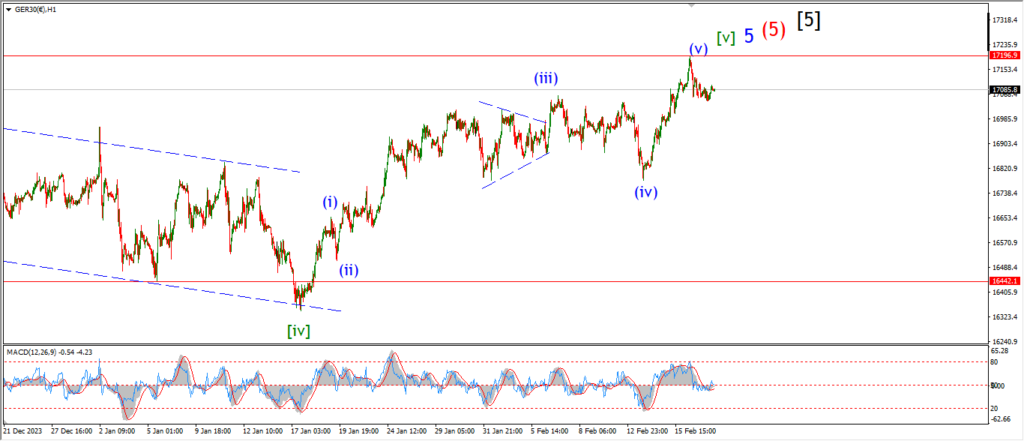

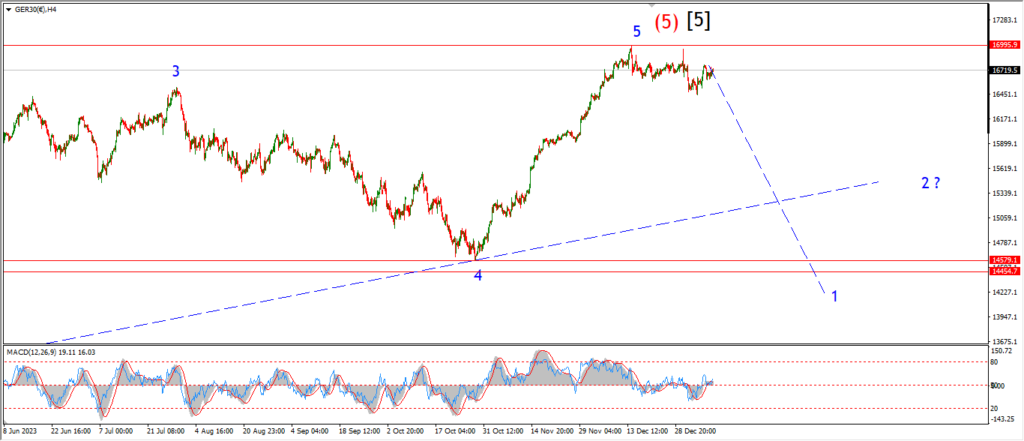

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….