Good evening folks, the Lord’s Blessings to you all.

S&P 500 is the most concentrated it’s been in 50 years and is approaching an all-time high. This is fine right?

WARNING: M2 money supply is contracting at levels last seen during the Great Depression

https://twitter.com/bullwavesreal

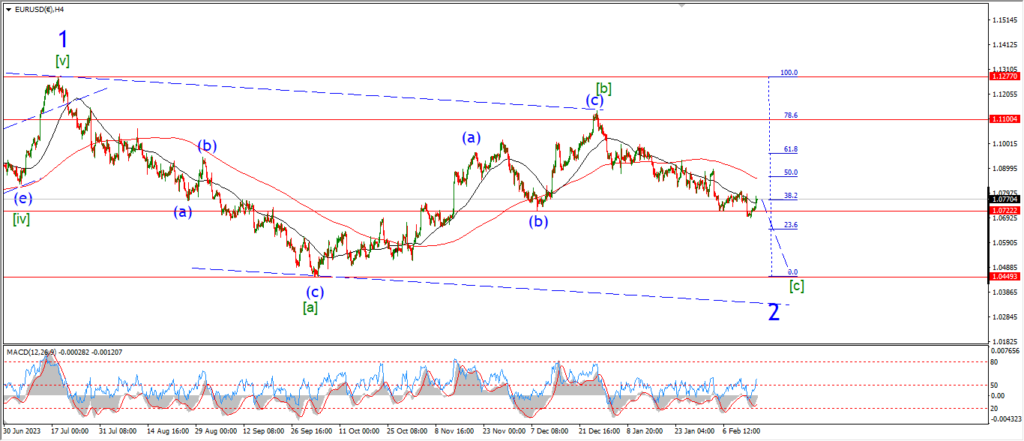

EURUSD.

EURUSD 1hr.

EURUSD dropped in three waves to form a higher low today.

The pattern suggests wave ‘b’ of ‘iv’ is now in place.

the price then rallied off the session lows again which suggests wave ‘c’ is now underway.

The initial target for wave ‘iv’ lies at 1.0805 at the previous wave ‘4’ high.

That will also fill the trend channel again.

Once the correction completes,

then we can look for wave ‘v’ of (iii) to turn lower again.

Monday;

Wave ‘iv’ must complete below the wave ‘i’ low at 1.0846.

And then wave ‘v’ should turn lower again early next week.

GBPUSD

GBPUSD 1hr.

Cable has been stuck in the mud over the last few days but the action is pretty corrective looking so far.

I am going to stay with the idea that this sideways move is wave ‘2’ of ‘iii’ as shown.

The internal structure of wave ‘2’ is a flat correction.

And the price has done enough to complete the pattern now.

So,

I am looking for a pretty sharp turn lower on Monday to begin wave ‘3’ of ‘iii’.

Monday;

Watch for wave ‘2’ to hold below the wave ‘ii’ pink level at 1.2686.

Wave ‘3’ of ‘iii’ will be confirmed with a break below 1.2517 again.

Wave ‘iii’ pink has a minimum target at 1.2431.

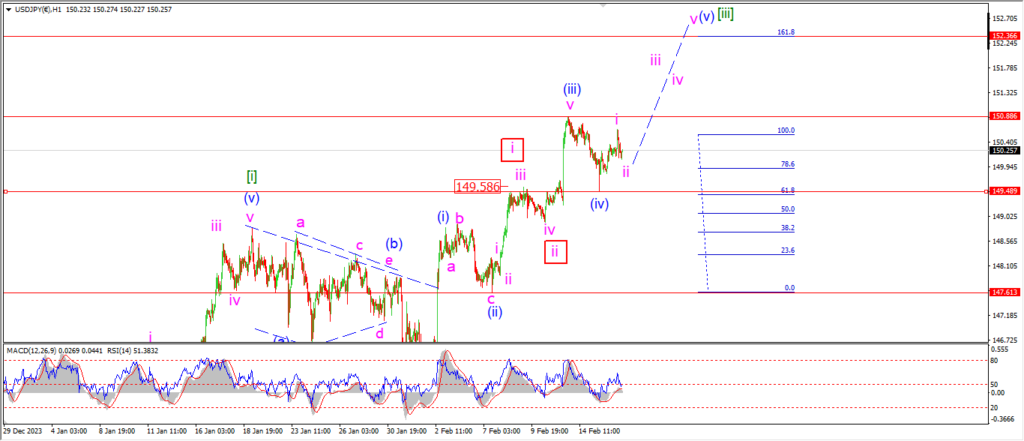

USDJPY.

USDJPY 1hr.

The pattern in USDJPY is getting a bit tight a bigger than expected correction this week.

The larger wave [iii] idea is still valid here.

But I am going to follow the alternate idea closer over the coming days just to see if that fits the action better.

You can see that pattern on the 4hr chart.

The price has completed another higher low above wave (iv) today.

And that action can be counted as wave ‘i’ and ‘ii’ to begin wave (v).

The price must turn higher on Monday to break above 150.88 to confirm this pattern.

Monday;

Watch for wave (iv) to hold at 149.48.

Wave ‘iii’ of (v) must turn higher again.

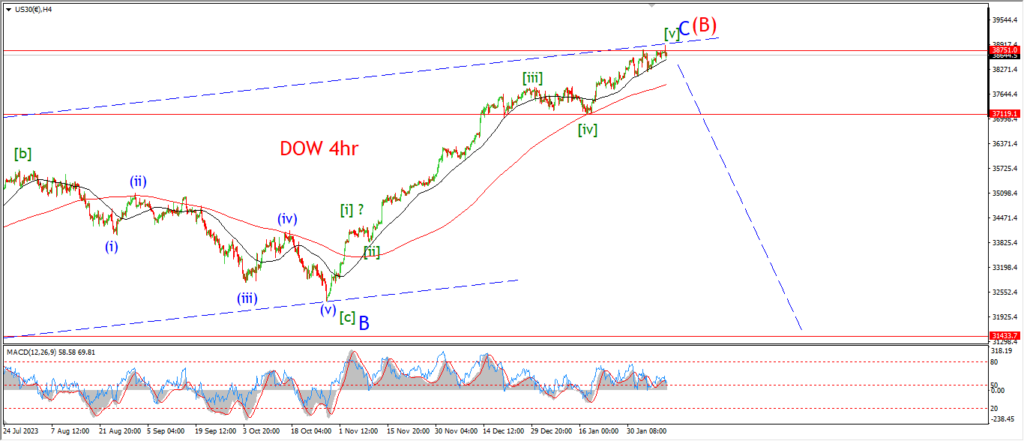

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

You can definitely take the opposing point of view on this weeks action.

The decline is impulsive in nature,

and that decline traced out five waves down.

But now we have a solid retracement higher off that wave (i) decline.

So the count hangs in the balance again.

I will be looking at a viable alternative again on Monday if the price manages to break out to a new high.

So we will see how this pattern develops.

Even if the market holds at a lower higher in wave (ii) on Monday.

It is still too early to get excited about the prospects here.

Wave (iii) down has a lot of work to do before we get serious about reversals.

the key support to the DOW lies at 37000 at the previous wave [iv] lows.

A break of that low will be the main target for a bearish reversal to become dominant.

Monday;

Again we will have to wait and see if the high at wave (B) can hold.

Wave (iii) down must get started on Monday to stick with this count.

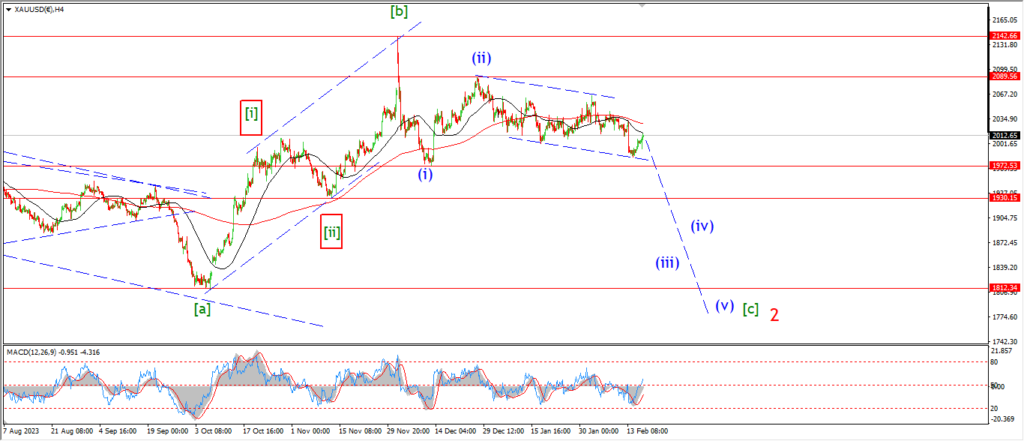

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

I am watching gold today with interest again,

because now I am asking myself if we are getting close to a bullish reversal sooner than I thought.

I have shown the latest action as a corrective rise within wave ‘3’ of ‘iii’.

And so far the price action is staying in the trend channel

and I can still view the internal pattern of wave ‘3’ black as a developing five waves down.

So,

the main count can hold for now.

this pattern calls for a continued decline in wave ‘iii’ pink towards that 1970 area.

This bearish pattern will get very weak if we see a rally back above the wave ‘2’ high at 2044 next week.

In fact,

if we see a break out of this downward trend channel,

that will raise questions about the main count.

Monday;

for the moment this count stands.

I want to see wave ‘3’ turn lower again and hit that support at 1972 again.

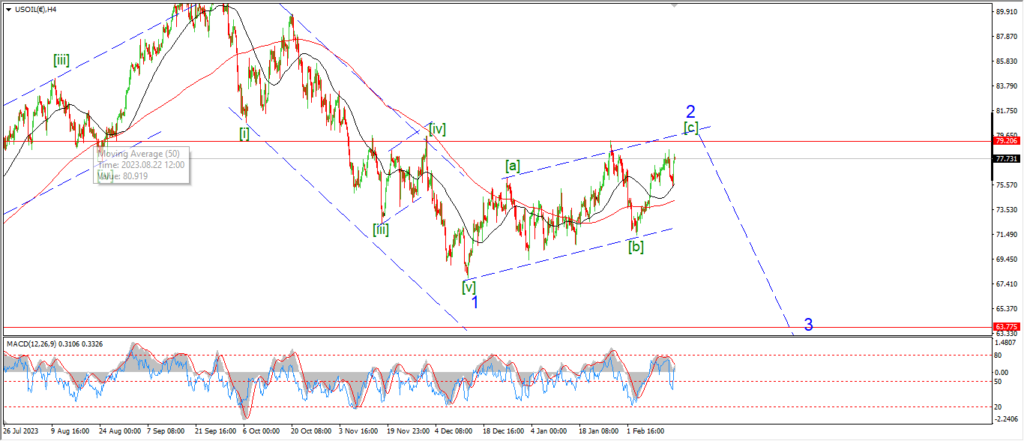

CRUDE OIL.

CRUDE OIL 1hr.

Ok,

The price action in crude is moving in line with the new count for wave ‘2’ again.

the price has slowed the upside momentum by a large degree this week,

but we are very close to hitting that upper trend channel line again and that seems like a reasonable target here.

After that point it is likely that we will see a reversal pattern build again.

Monday;

Watch for wave (v) of [c] to hit the upper trend channel again to close out this new pattern for wave ‘2’ of (5).

Later next week we should see an initial turn lower to begin the next big move down.

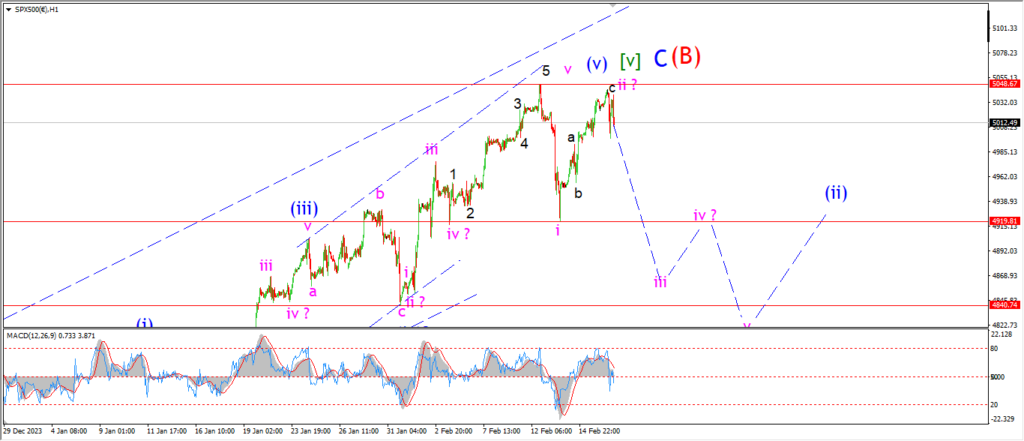

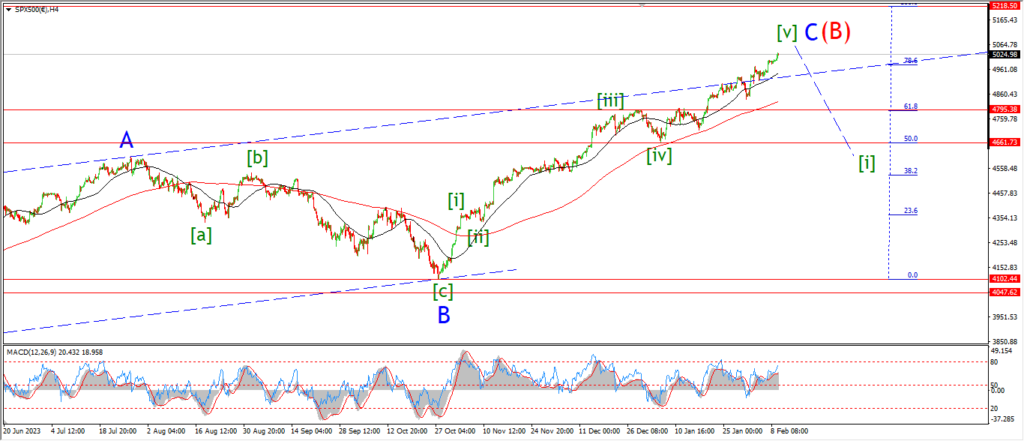

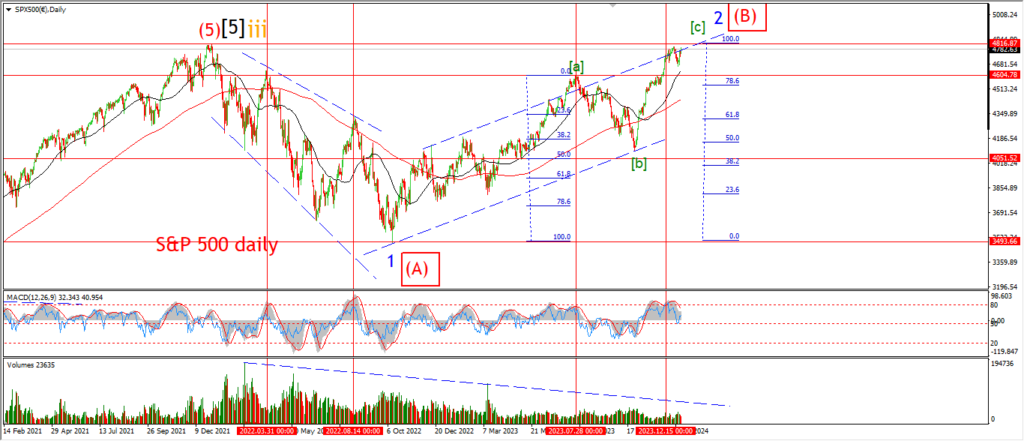

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P got close to hitting the highs again,

but the last hour has halted the rally again.

The market is ending the session slightly in the red but I need to see much more than that to favor the bearish count.

At the moment I can allow this bearish idea another day to see if wave ‘iii’ of (i) can take the market lower again.

the level to watch in the short term lies at the wave ‘i’ low at 4919.

Below that we have the wave (iv) low at 4840.

I may be asking a lot here,

but we will know pretty soon on Monday if there is the potential to turn lower again or not.

Monday;

Watch for wave ‘iii’ down to drop back into the wave ‘iii’ lows at 4919 again.

SILVER.

SILVER 1hr

Silver has broken above the wave ‘a’ high again this evening,

and the rally has traced out a five wave pattern higher as shown.

The action now suggests wave ‘c’ is now in place,

This correction in wave (iv) is complete,

and we should see a drop back into wave (v) of [c] next week.

Wave (v) is expected to drop into the lower trend line again near 21.20.

Monday;

Watch for wave (iv) to top out and reverse into wave (v) of [c] over the coming days.

If the ending diagonal pattern for wave [c] is correct,

then wave (v) will trace out three waves down into the target area.

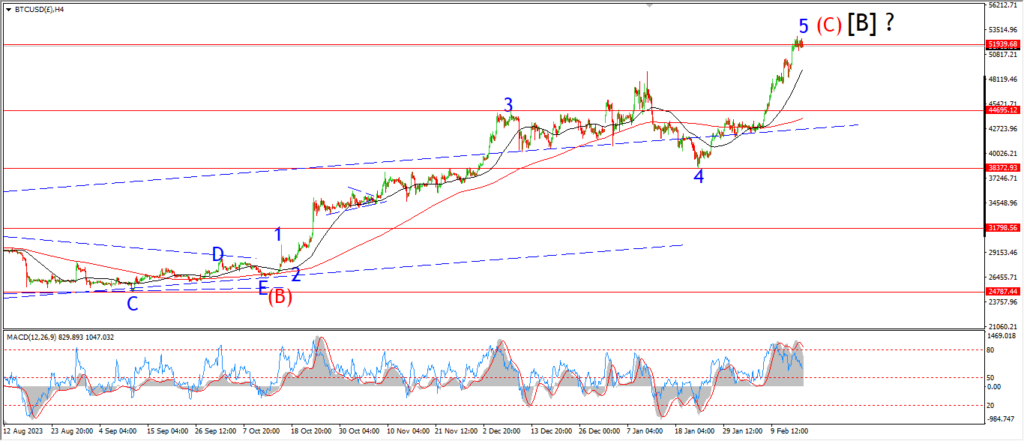

BITCOIN

BITCOIN 1hr.

….

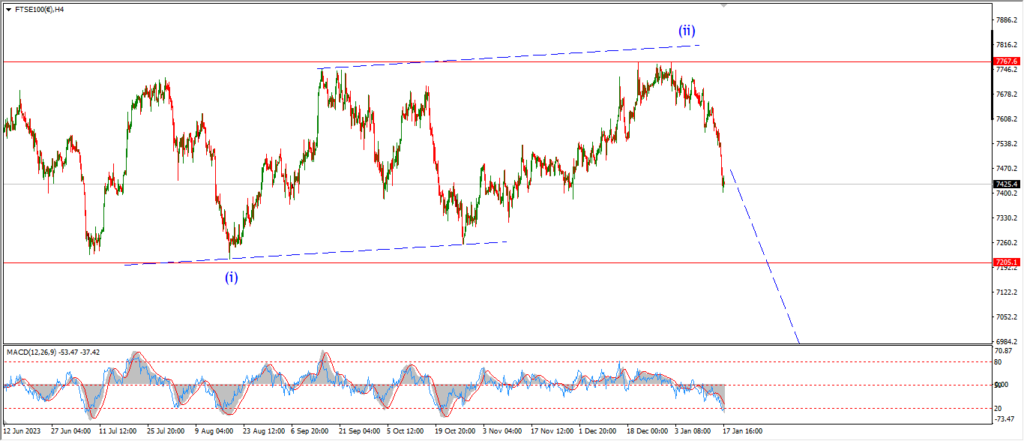

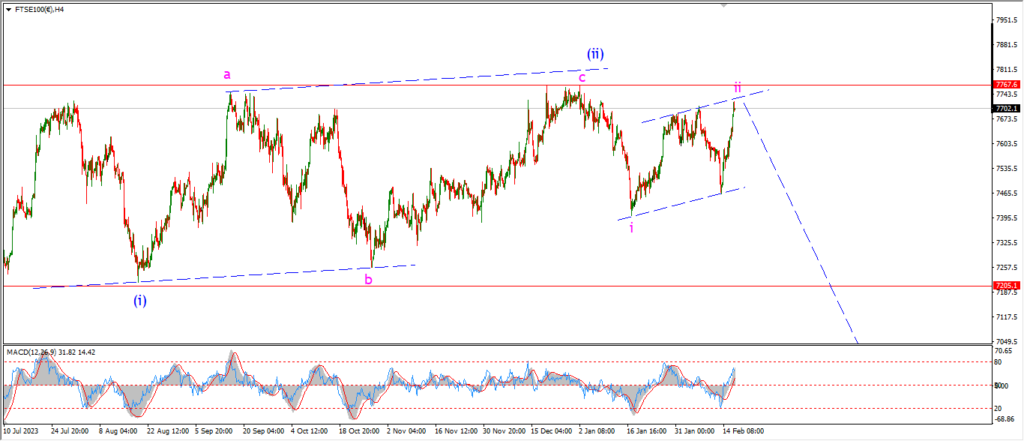

FTSE 100.

FTSE 100 1hr.

….

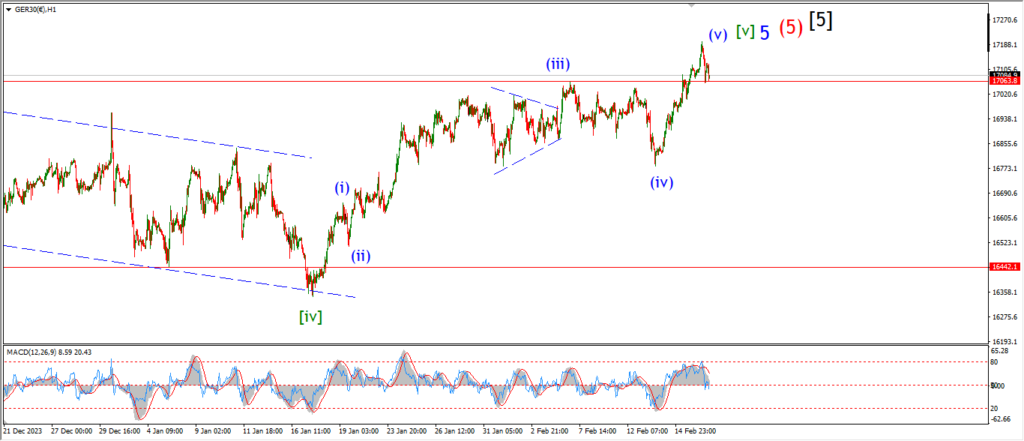

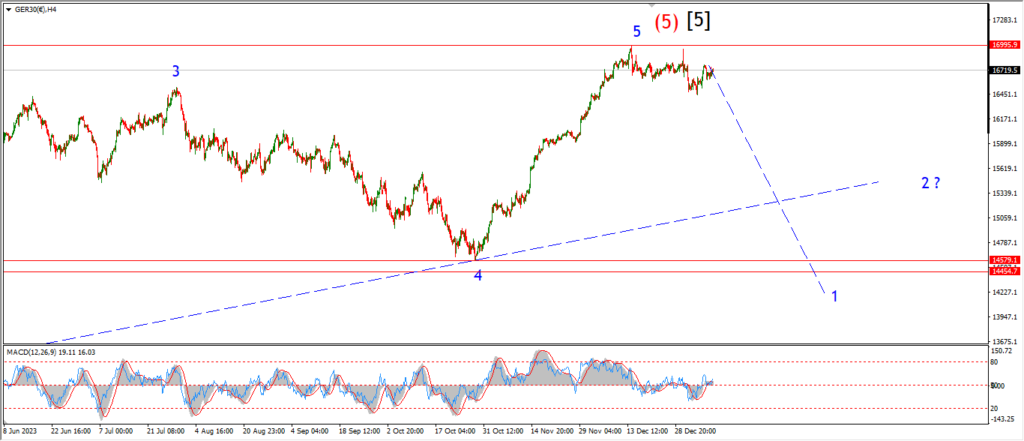

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

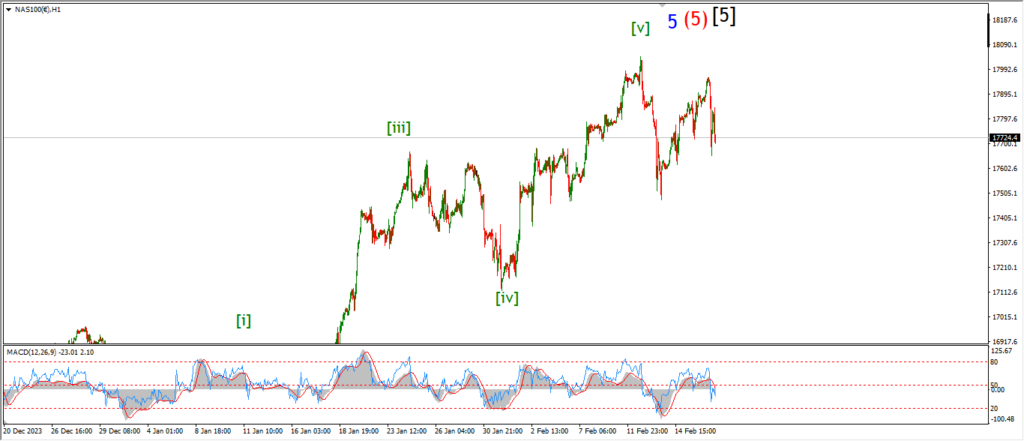

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….