[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Hi everyone.

Straight down to business tonight.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

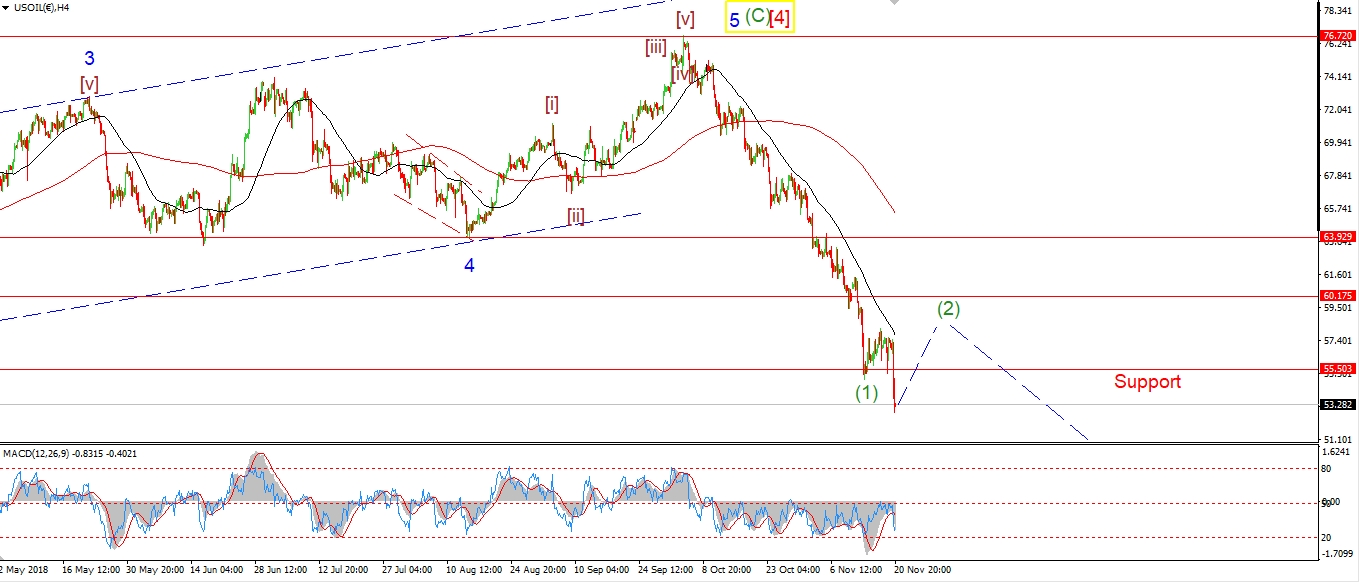

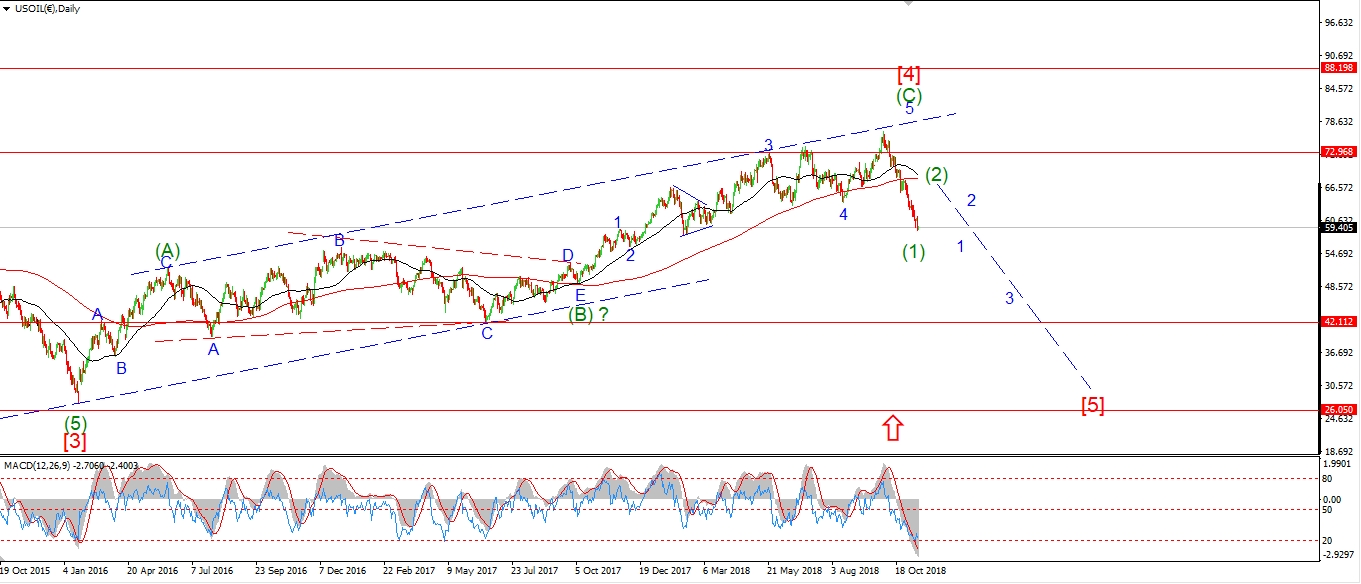

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

All the way up the recent rally,

the financial media spewed out how prices were rising on the back of 'global demand'.

And global demand was predicted to continue to grow to the sky!

So prices should follow.

Well, going by that logic:

Seen as the price is collapsing, does that mean that no-one wants oil anymore??

This is the critical failure of the supply/demand framework when applied to financial markets.

It is hopeless as a tool to expalin market action,

never mind predicting prices!

The price again moved sharply lower today to create a new low for the year.

I have labelled this decline as a possible wave 'B' flat correction.

waves [a] [b] and [c] follow the 3,3,5 pattern.

So;

I still think we will see a rally in wave 'C' to about 60.00 to complete wave (2).

If the declines continue tomorrow,

I will have to rethink the short term count.

Tomorrow;

Watch for wave 'B' to find a low soon, and wave [i] of 'C' should begin tomorrow.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Treasuries are holding on at the highs of wave (ii) today,

as the market caught a bid off the back of the decline in Crude and stocks.

The price has hit the upper trendline and bounced back off it three times today.

So the trend channel is proving a difficult obstacle to overcome so far,

even though stocks are under pressure.

Todays highs also markets the 62% retracement level of the wave (i) decline.

So we are right in the territory for a reversal into wave (iii).

Tomorrow;

Watch for an initial decline back below 119.00 to begin wave 'i' of (iii).

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]