[_s2If current_user_can(access_s2member_ccap_currencies)]

[vc_row][vc_column][vc_column_text][_s2If current_user_can(access_s2member_ccap_currencies)]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Bullish action in USDJPY, GOLD slammed!

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

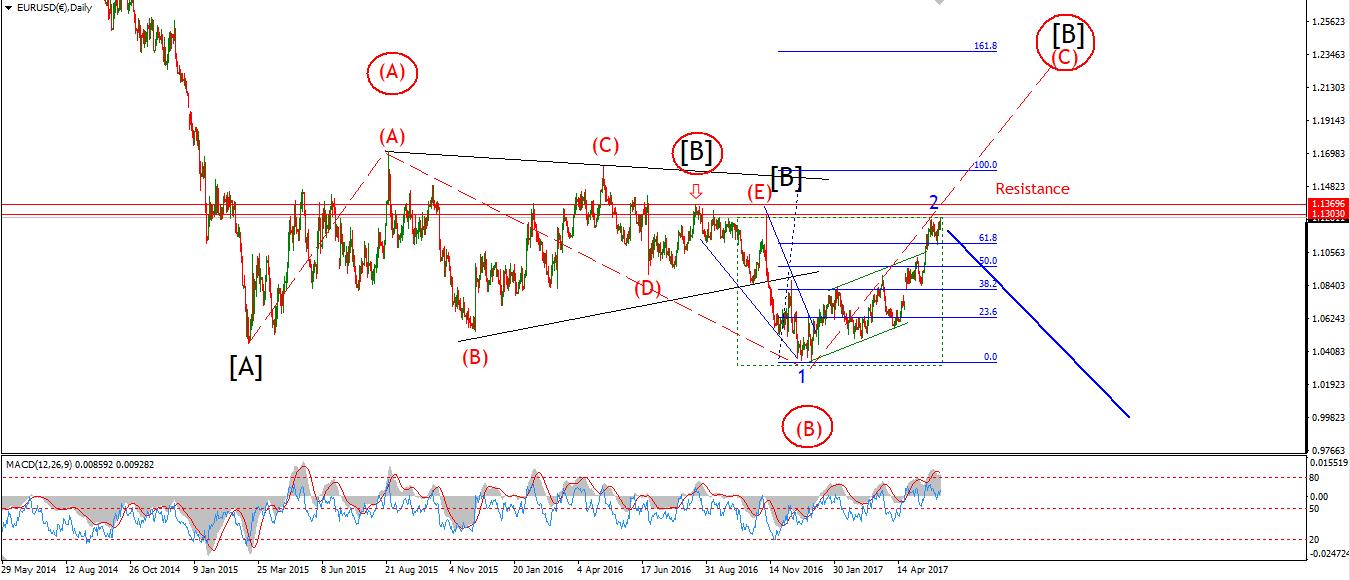

EURUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short in wave 3 blue.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short in wave 3 blue.

Wave Structure: downward impulse wave 1, 2 blue

Long term wave count: lower in wave 3 blue

Important risk events: EUR: ECB President Draghi Speaks. USD: CB Consumer Confidence, Fed Chair Yellen Speaks. USD: CB Consumer Confidence, Fed Chair Yellen Speaks.

Bon soir mes amis.

Another day another Dollar wave count!

EURUSD reached resistance at 1.1213 again as suggested,

The price has dropped away sharply from that point.

This action suggests wave ‘ii’ pink is complete at todays highs.

The first key level form here is the low labelled wave ‘i’ pink at 1.1131.

A drop below that point will indicate wave ‘iii’ has begun.

And again the support at 1.1109 is the conformation point for wave ‘iii’ pink.

For tomorrow;

watch for the formation of a lower high below 1.1219, todays high.

The declining trendine should hold the price down.

A further decline from that point will be the first hint that wave ‘iii’ pink has begun.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: short below parity in wave (5).

Wave Structure: continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

Important risk events: GBP: BOE Financial Stability Report, BOE Gov Carney Speaks. USD: CB Consumer Confidence, Fed Chair Yellen Speaks. USD: CB Consumer Confidence, Fed Chair Yellen Speaks.

The high of the day in cable lies at 1.2759.

This high now takes the wave ‘ii’ pink label.

The rise off the low at wave’i’ pink is in a clear three wave form.

This suggests a corrective rally rather than the start of a recovery to new highs.

Form her we need the see the price fall off again the get wave ‘iii’ pink underway.

A decline below 1.2634 will be the initial indication sign that wave ‘iii’ pink has started.

1.2588 is the confirmation point.

On the daily chart you will notice that wave (4) blue has taken the guts of a year to play out.

The next decline phase in wave (v) blue should take a similar length of time.

For tomorrow keep an eye on todays high,

The price has already shown signs of turning down in wave ‘1’ grey,

So that high needs to hold.

The invalidation line for this bearish count is at 1.2818.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

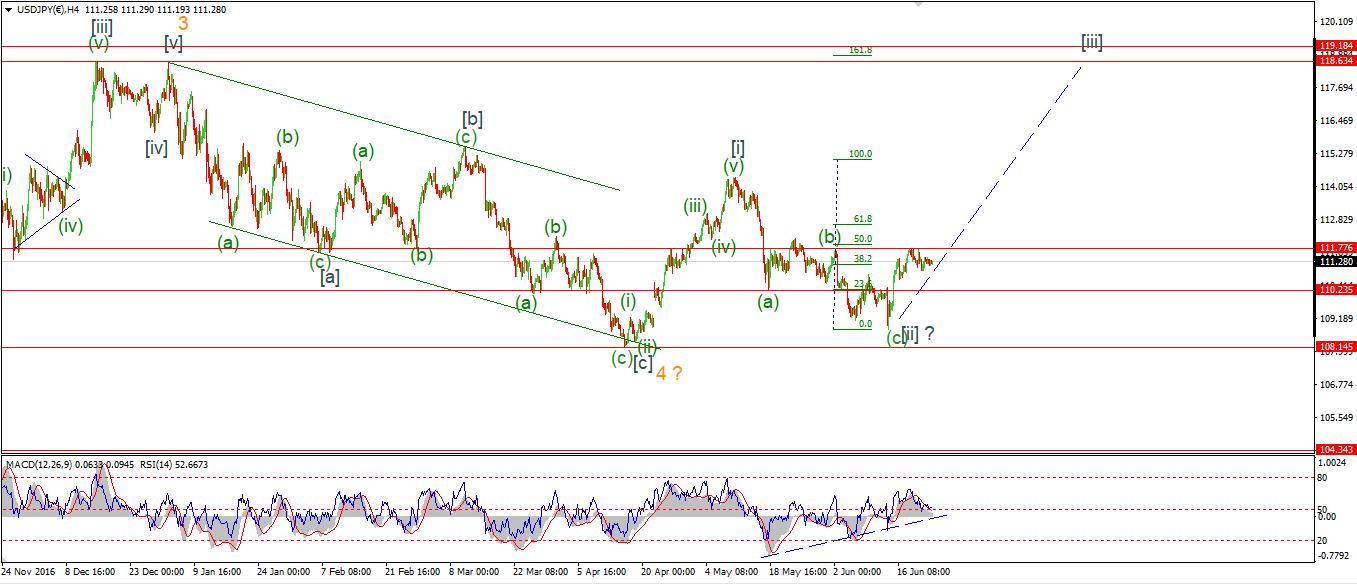

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: LONG

Wave Structure: rally in wave [C]

Long term wave count: wave [C] is underway, upside to above 136.00

Important risk events: JPY: N/A. USD: CB Consumer Confidence, Fed Chair Yellen Speaks.

USDJPY rose today and broke Fridays high at 111.44 which has again shifted the focus higher in a possible wave ‘iii’ brown.

I have shown an idealised wave ‘1’ pink which should break the upper trend line of that rising trend channel.

Another small corrective decline off wave ‘1’ pink would be another elliott wave bullish signal.

The price could be rising in wave ‘iii’ brown now,

So the possibility for a an acceleration higher is quite high.

The only other interpretation for todays rise is that wave ‘b’ pink is extending in a three wave form.

So the action near that upper trend line is critical.

A clean break higher above that trend line is needed from here.

For tomorrow watch for the resistance at 111.78 to become support in wave ‘2’ pink.[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_gold)]

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

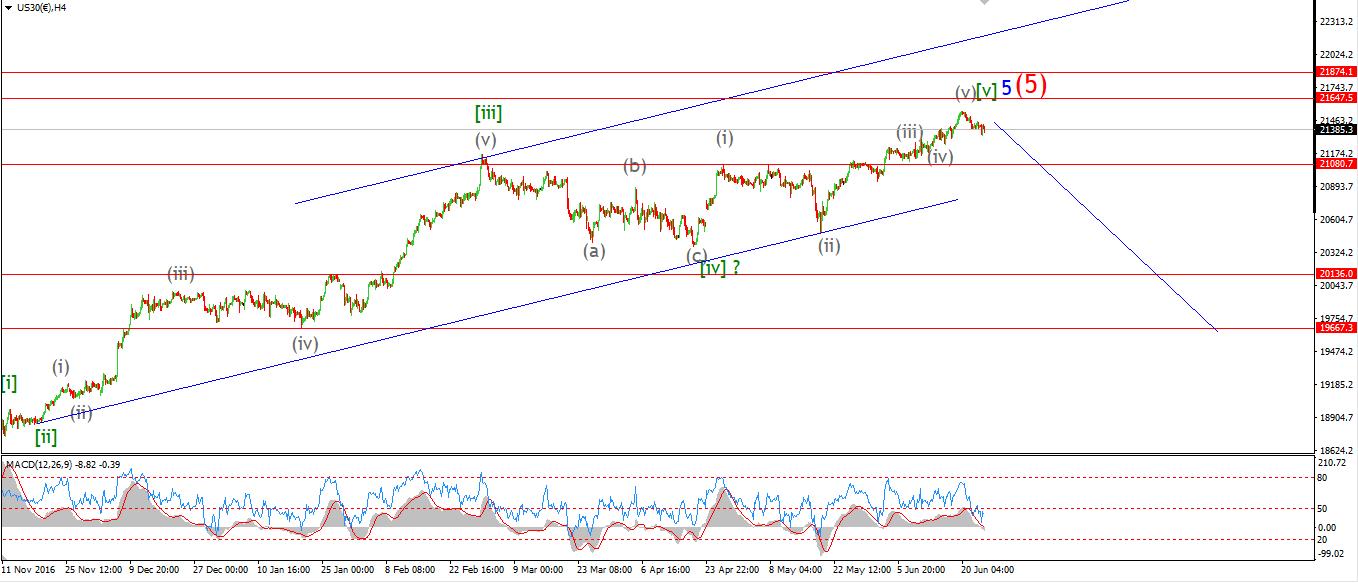

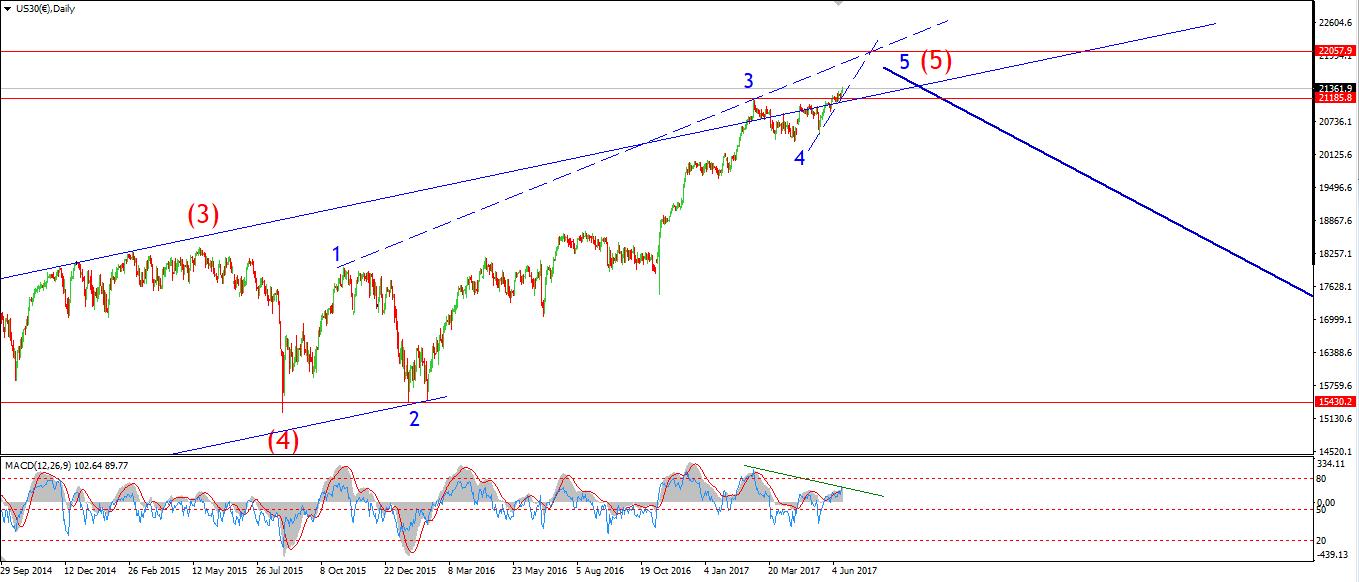

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Topping in wave (5)

Important risk events: USD: CB Consumer Confidence, Fed Chair Yellen Speaks.

This evenings sharp declines have raised the possibility of an Elliott wave signal off the all time high.

It is a bit of a long shot, but the structure is best counted that way.

And the sharp decline is a hit that the market is rejecting the all time high.

It will be very interesting to see how this develops.

A break below 21329 will add significant weight to this outlook.

Of course the immediately bearish view suggests the recent all time high is the final high of the bull market.

From here on out it will be wise to keep that in mind.

Any impulsive decline will be taken as the beginning of the bear market.

Watch the low at 21329 tomorrow.

wave ‘iii’ pink should carry the price down below support at 21200.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

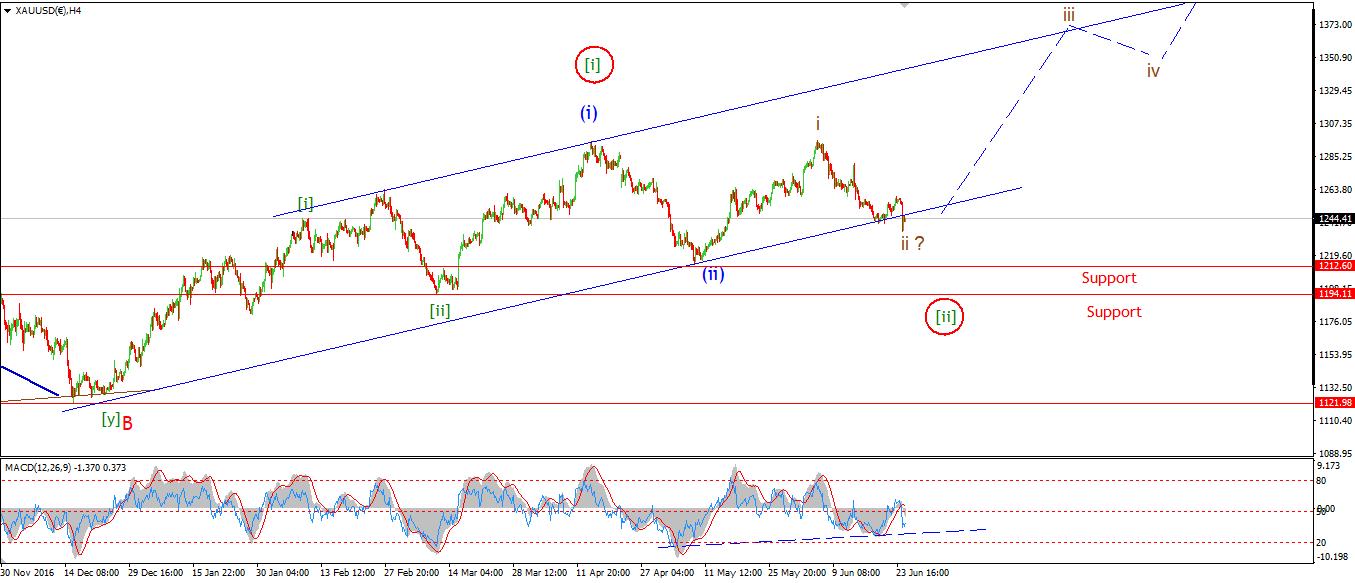

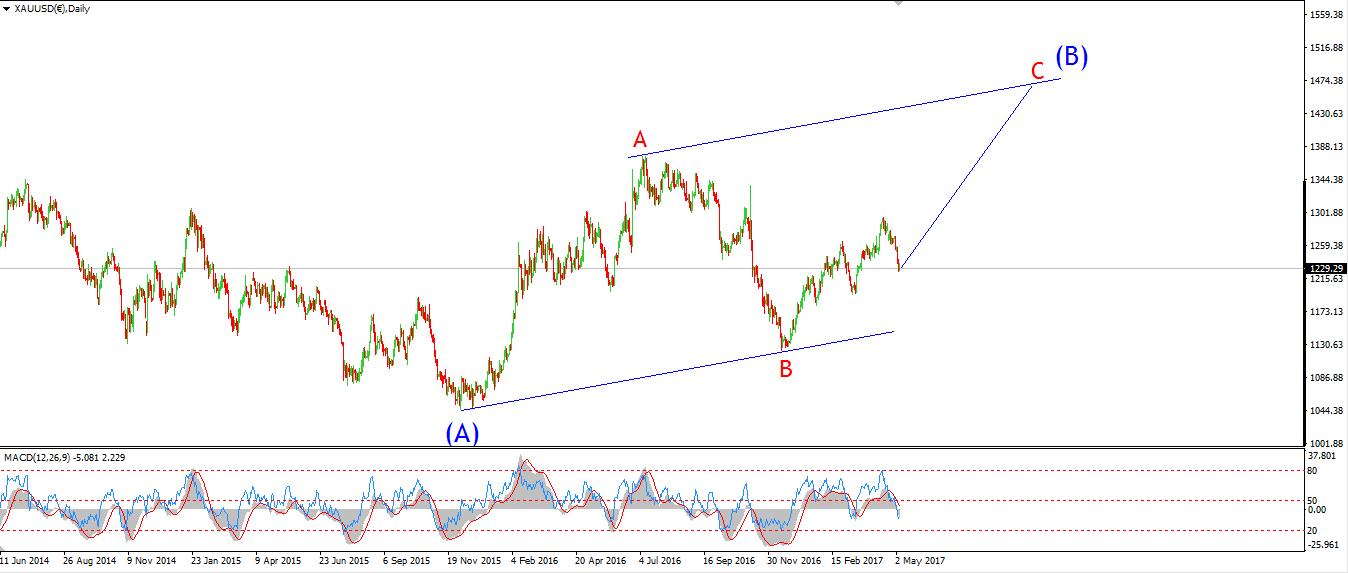

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”30 min” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_column][/vc_column]

[/vc_column_text][/vc_column][/vc_row][vc_column][/vc_column]

[/_s2If]