[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Good evening everyone.

I know you guys and gals don't need to be told that the underlying foundation of the economy has fully rotted out.

But, as a grounding mechanism for myself,

I like to take a wide angle view now and again to see the lay of the land.

So here it goes.

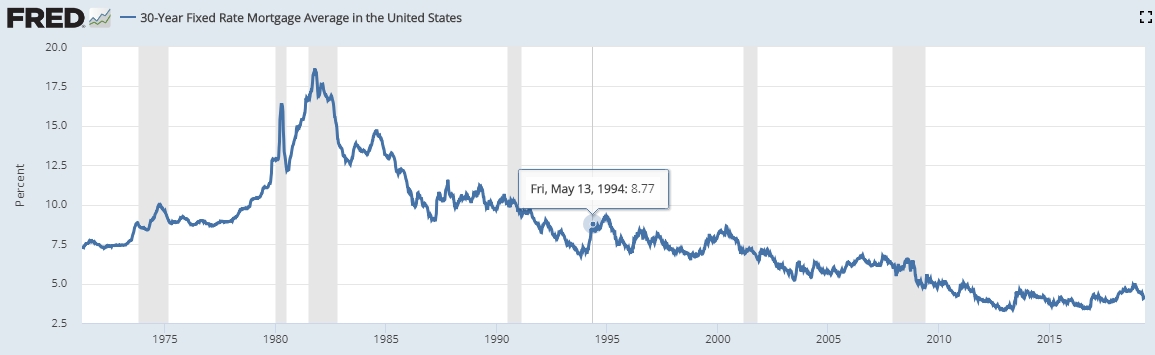

Mortgages:

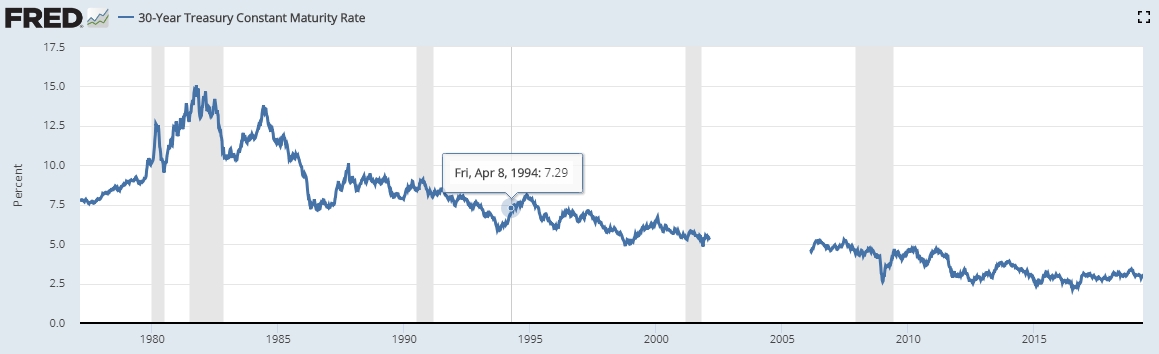

The housing market today, is built on a declining cycle of rates on long term debt securities.

A bull market in the treasuries has been ongoing for 30 years.

As the credit worthiness of the govt went up,

so rates began a long slide into the recent lows in 2016.

This half cycle has ended,

And so has the half cycle of declining mortgage rates.

Therefore, the corresponding continuation of higher priced real estate has ended.

The next big cycle is the one that nobody is prepared for.

And that is a new bear market in long term treasuries and a rising rate cycle that will likely last a good ten years at least.

Wave good bye to a thirty YR mortgage at 4%,

but say hello to a housing crash that will dwarf the 2008 debacle.

In twenty years, people will buy their first home for about 1X of the income!

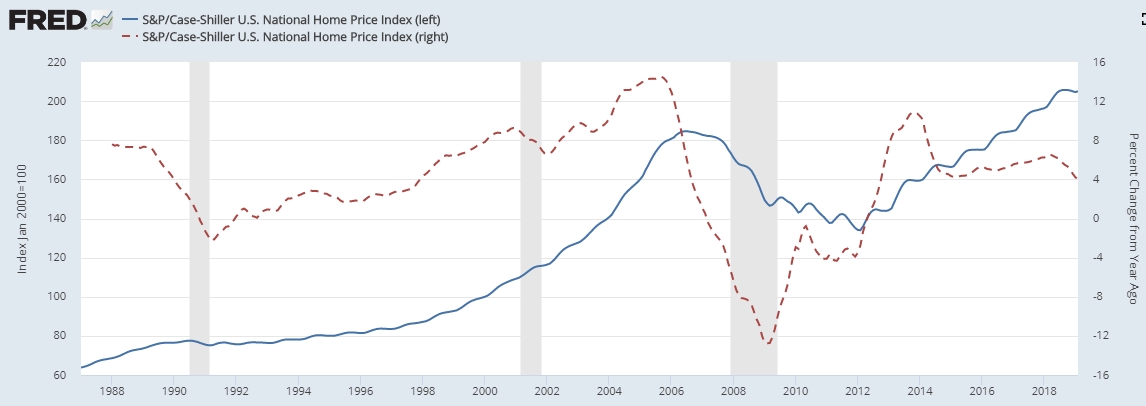

House prices:

The housing market is already beginning to show signs of stress.

The rate of change of prices has been slowing down since 2014.

When the red line goes negative again you will know that the gig is up for housing.

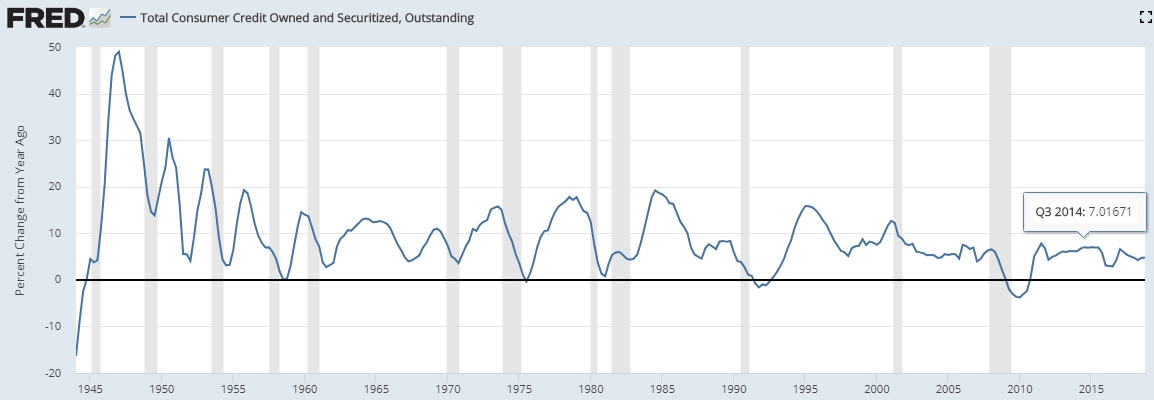

Credit;

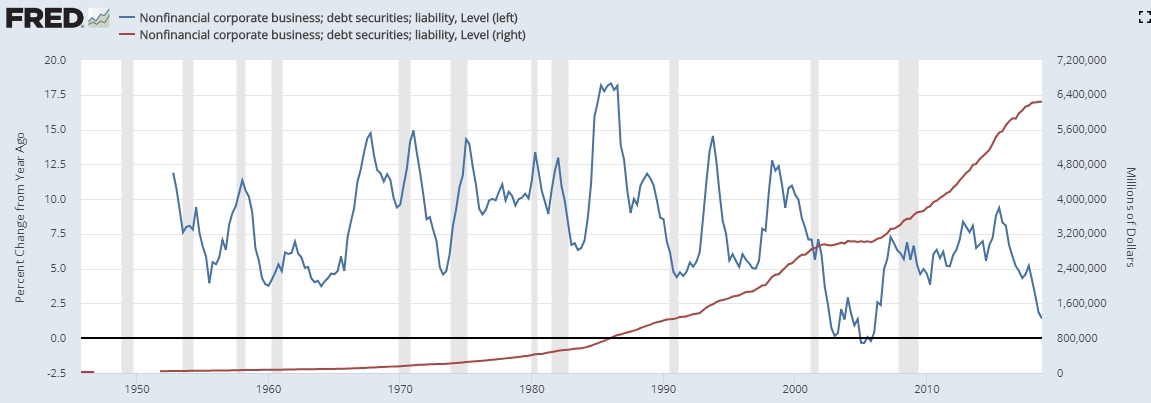

The chart below shows the cycle of consumer credit since the 1940's.

And you can see that we are in the late stages of the credit expansion cycle since that time.

Each shorter term cycle high has been on a decline since the mid nineties!

And every mania htat has occurred since then has been at lower and lower expansion rates.

The current minor cycle since the 2009 lows is anemic at best when compared to all previous cycles.

And the next time we go negative, I expect it to say that way for a while.

Corporate debt crash underway;

Corporations have been on a debt binge this last 10 years.

Corporations took 50 years to amass 3 trillion in debt.

And they have doubled that amount in the last 10 years!

And what has been achieved?

have the number of jobs doubled in the last 10 years?

Or have they simply pumped their own stock price on the credit card?

Take note,

the corporate debt bubble has popped!!!

And debt load will have to be paid, or it will crash the banking system, again!

And oh by the way,

When the buybacks stop, who's going to buy?

[/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

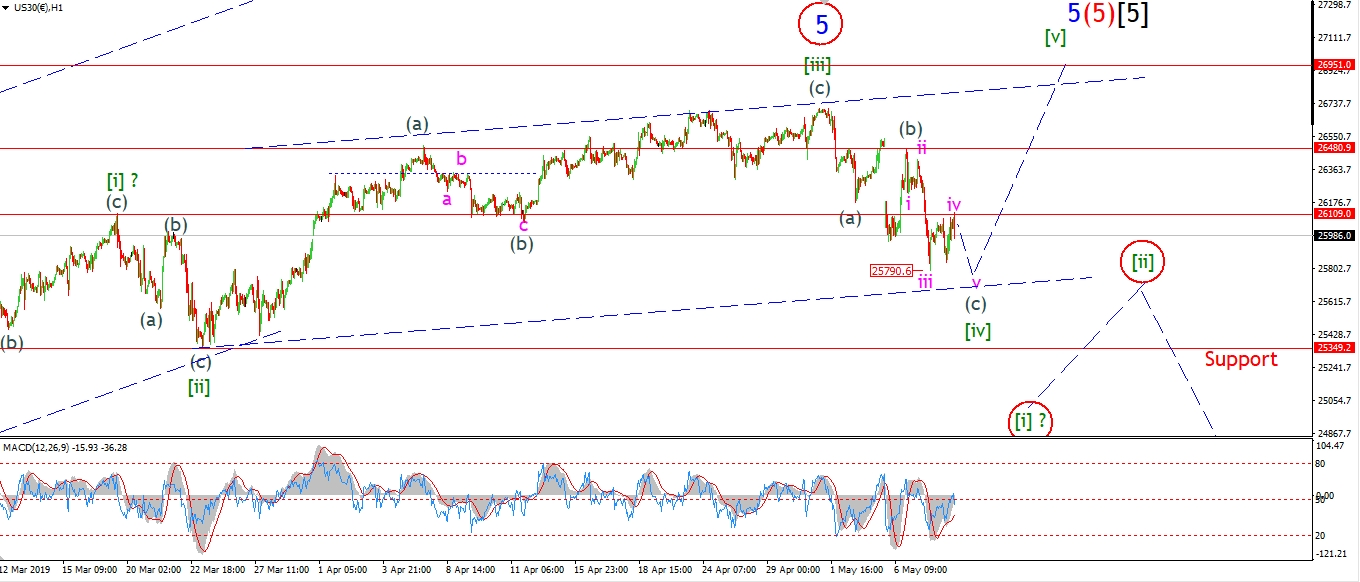

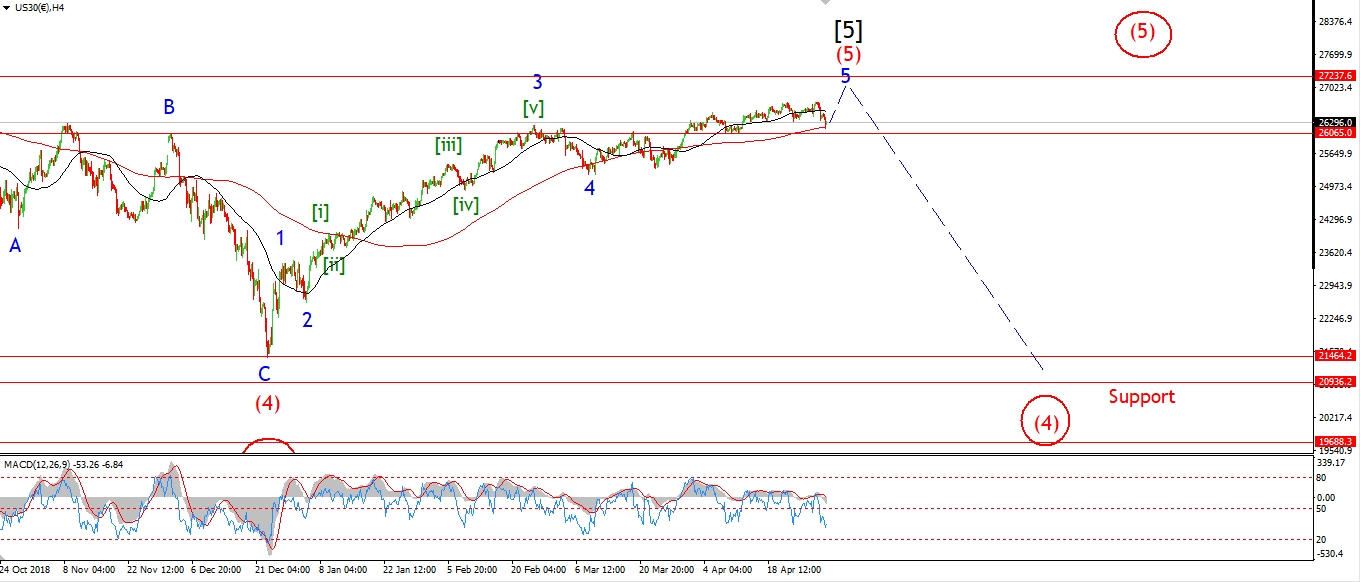

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Todays rise in the DOW looks like a three wave correction higher.

I have labelled it as wave 'iv' of (c).

One more dip below 25790 tomorrow will complete a five wave decline in wave (c).

And that should complete this wave [iv] correction.

If the market is only correcting in a fourth wave within an ending diagonal,

then the previous wave [ii] should offer significant support at 25349.

A break through this level however, will trigger the alternate count shown.

And then we can work on identifying a full five wave structure lower off the high.

This will signal the market is turning down in a possible large degree trend change.

And the bear market will be on the cards once again.

Tomorrow;

Watch for a final drop in wave 'v' of (c),

and then a turn higher to begin a three wave rally in wave [v] to complete this ending diagonal.

A break of the wave (b) high at 26480 will confirm that wave [v] has begun.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

IF You want to Know what happens next?

Check out Bullwaves Membership.

And stay ahead of the next BIG market move!

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]