Here is my updated Elliott wave Analysis Trading Strategy PDF.

I have used the Elliott wave principle for as long as I have been trading and analyzing the financial markets.

In this Elliott wave principle PDF,

I want to to show people how useful Elliott can be to spot high probability turning points,

market tops and bottoms and possible entry points in the market.

This is the trading strategy that I have used and I want you to benefit from it also!

This Elliott wave basics PDF covers;

- General Elliott wave theory, rules and guidelines,

- Elliott wave patterns,

- Advanced Elliott wave analysis,

- Mastering Elliott wave,

- Elliott wave trading strategies,

In this Elliott wave principle PDF, I have done my best to simplify Elliott wave techniques, which should make this Elliott wave PDF valuable to both beginner and more advanced practitioners.

Download this Elliott wave PDF Guide

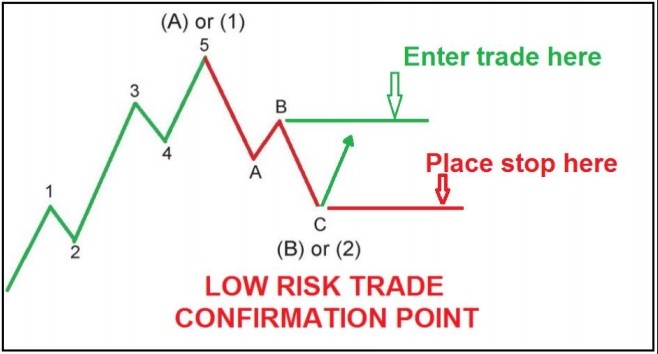

3 step guide to low risk trading using Elliott Wave.

3 step guide to identify, confirm, and place a low risk position using Elliott Wave Theory.

Placing a trade is a risky business.

But, even worse than that;

Placing a trade on a hunch, without having an overall view on the market trend, and then using that

standard 50-point stop loss, is;

- at best – a hit and hope strategy, and,

- at worst – it will destroy your account balance in short order.

Through an unending series of stop loss strikes!

Identifying where key turning points may lie in a trend, and even more importantly;

Knowing at what point you are wrong in your thesis, is priceless information when trading.

In the long run, this approach will save your account balance,

and your sanity!

Catching the turning point of any change in trend is like trying to catch a falling knife,

It is dangerous and often bloody!

In this guide I will show you the three steps I use,to identify turning points in the price structure, and how to place low risk trades, using Elliott Wave

analysis as your guide.

An Elliott Wave trader, begins from a ‘wide angle’ view on the overall trend of the market.

This helps to identify potential turning points in the price structure in advance, and helps the trader to prepare a strategy to enter the

market when the opportunity presents itself.

In order to identify the dominant trend and reveal those low risk opportunities,the Elliott Wave trader first performs a top down analysis on

the price structure.

Here’s how that top down analysis works if you are to start from a blank chart:

First you Identify the long-term price pattern, or trend – ie: on a daily chart.

Figure out the most likely wave structure of that trend pattern – ie: is it a developing five wave form, impulse wave? Or a three-wave form,

corrective wave?

What does the larger wave pattern call for next? – ie: if the price has just completed a corrective structure in a 2nd wave,then we can expect the

price to explode back into trend soon in wave 3.

Once you have orientated yourself, to the larger operating trend, and you know what to expect next.

Then you can then move down and try to understand the short-term price structure on a 2-hour chart.

You need to figure out how far advanced that 2nd wave correction is.

First you identify what type of corrective structure best fits the short-term action.

Is it a ZIGZAG, a FLAT, EXPANDED FLAT or maybe even a TRIANGLE?

Has that structure completed according to the guidelines – ie: does it contain three waves, and does it fit in a trend channel

And then finally:

look for ‘confirming price action’ on a short-term chart, ie: 30min bars.

This confirming price action is the signal that a change in trend is at hand.

And the time has arrived to start testing the market with a low risk trade.

Read on to find out how to do exactly that!

Step 1: Identify the short term price pattern.

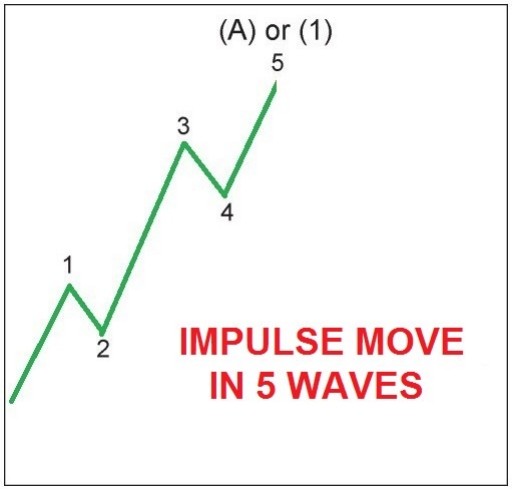

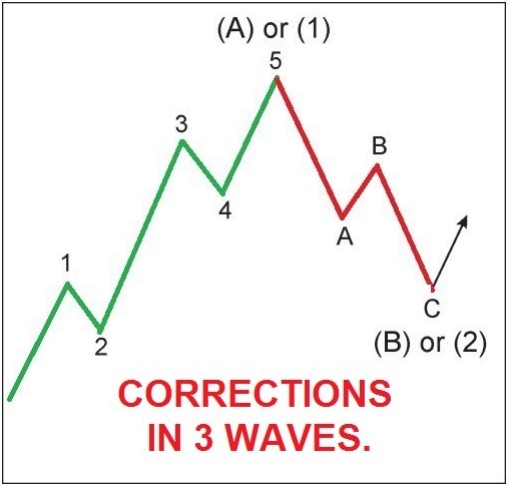

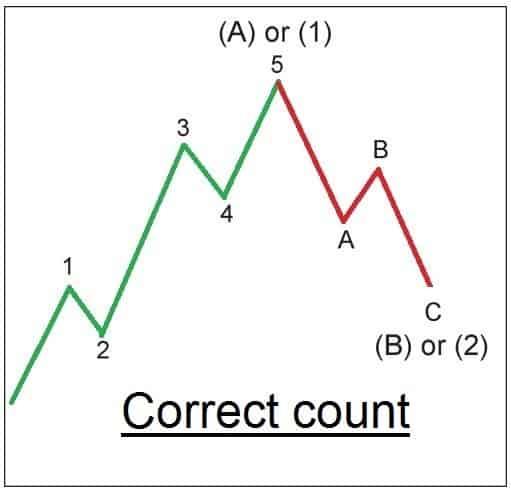

Elliott wave patterns happen in 5 waves structures labelled ‘1,2,3,4,5’ or 3 wave structures labelled ‘a,b,c’.

Now that You know a turning point has arrived, you look for confirming price action.

Ask yourself this question:

Can I count 5 waves in the direction of the trend and three waves against the trend?

The first 5 wave movement is labelled wave (1).

When 5 waves are complete, the market will correct itself in a counter trend correction and will occur in 3 waves and is labelled wave (2).

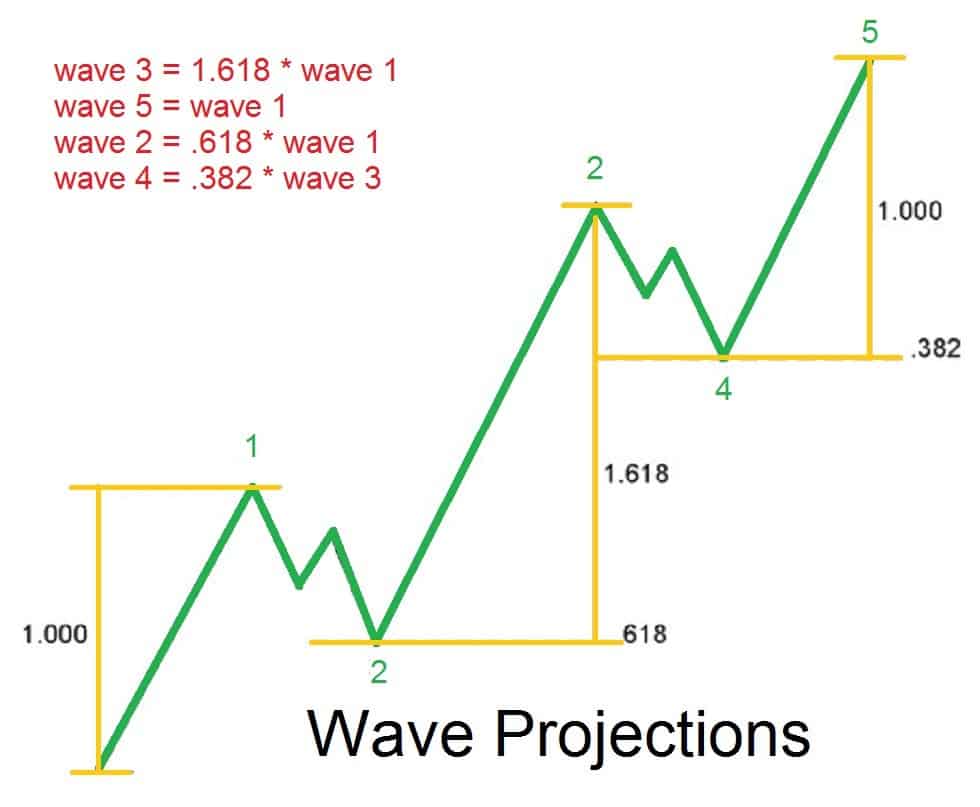

Once the price has reached the end of its wave (2) correction, we can look for the price to move quickly in wave (3).

This is where our opportunity lies!

Step 2: Look for confirming price action.

Now you have identified a 5-wave structure in the direction of the trend, It is time to look for the inevitable correction in 3 waves.

Corrections are labelled ‘a,b and c’ and usually retrace about 50% of the previous impulse wave.

When the correction is complete, we begin to look for the market to turn back in the direction of the trend.

This action will signal a turn back into the direction of the trend.

But we don’t enter a trade just yet!

Step 3: Identify the low risk entry point.

Now that we have confirming price action in place, we know that wave (3) has begun, It is now time to place your trade.

• A low risk trade can be placed at the end of wave ‘B’ in the previous correction.

– When wave 3 begins, it will trigger that trade and should accelerate away from that point with ease.

• And a stop loss can be set at the ‘C’ wave low of the correction, – placing a stop at this low means you have minimized the risk in the trade.

The above trading method, results in a trade with the lowest possible risk and the highest probability for reward when the price resumes its trending move.

Using this method to identify trading opportunities means you raise the bar for qualifying trades, and your trading risk is reduced to very manageable

levels.

All of this means, you will reduce losing trades and increase the odds for placing successful trades.

Lets check out how to apply this method in real time!

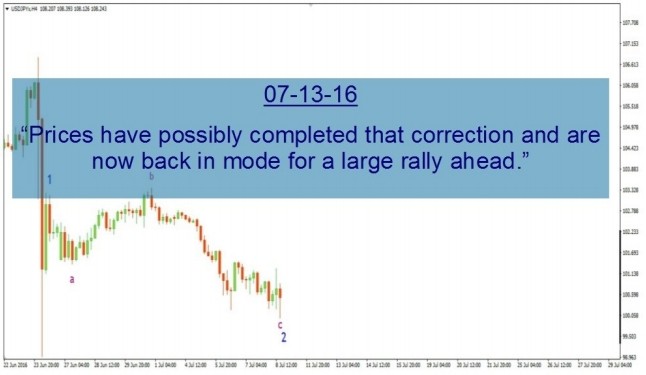

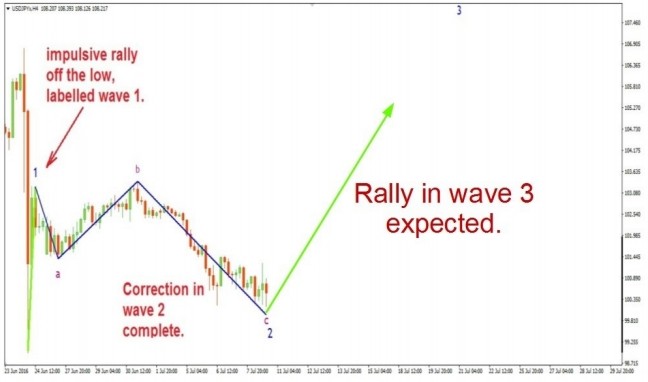

Here is a chart of USDJPY taken from my own analysis at the time.

USDJPY rallied off the June 2016 low in a 5 wave form to complete wave ‘1’ blue.

Then came a correction in 3 waves, to complete wave ‘2’, labelled in blue on the chart above.

Once this correction was complete, I was expecting the market to turn back into the trend in wave ‘3’.

The above wave count called for a rally in wave ‘3’ labelled in blue, the next leg up of the larger wave form.

Lets take a look at the short term chart to see the setup:

The correction looked complete and USDJPY rallied off the ‘c’ wave low in a possible 5 wave form on a short term chart.

This was then followed by a 3 wave correction, labelled a,b,c.

The bullish interpretation of the wave count called for a rally off the wave ‘c’ low labelled in blue.

This presented a bullish opportunity to enter a trade at the wave ‘b’ high at 100.68 labelled as shown on the chart.

The stop loss was placed at the wave ‘c’ low which 30 points below the trigger point.

What followed this bullish setup, was a rally over the next 2 weeks which carried the price 700 points higher!

This is first hand evidence of the value of trading using the Elliott Wave principle as your guide.

You will easily find the trend in any market, and you will be able to place low risk trades to ride that trend to its conclusion.

And that is the essence of a good trade!

Download this Elliott wave PDF Guide!

Elliott wave theory proposes a model for the advancement and pattern of financial market prices.

The Elliott wave model suggests that a price will move in a patterned manner, with 5 waves in the direction of the trend. and the price will correct in 3 waves against the trend.

There are many different wave patterns, but the main framework of the model suggests a total of 8 internal waves to construct the larger cycle.

Elliott wave theory is based on a fractal model for the movement of prices in financial markets.

This model can be used to gauge the position of a market pattern according to that model, and then suggest a path for prices into the future.

Like any form of technical analysis, the Elliott wave model is more of an art than a science, so the key to using the model is in the interpretation of the price movements.

Elliott wave is very useful to get an overall picture of where the market cycle is at any time.

and it can suggest where the price is likely to go next.

Step 1: Identify the short term price pattern.

Elliott wave patterns happen in 5 waves structures labelled ‘1,2,3,4,5’ or 3 wave corrective structures labelled ‘a,b,c’.

Ask yourself this question: Can I count 5 waves in the direction of the trend and three waves against the trend?

Step 2: Look for confirming price action.

Now you have identified a 5-wave structure in the direction of the trend, It is time to look for the inevitable correction in 3 waves.

When the correction is complete, we begin to look for the market to turn back in the direction of the trend.

This action will signal a turn back into the direction of the trend.

But we don’t enter a trade just yet!

Step 3: Identify the low risk entry point.

Now that we have confirming price action in place, we know that wave (3) has begun, It is now time to place your trade.

• A low risk trade can be placed at the end of wave ‘B’ in the previous correction.

– When wave 3 begins, it will trigger that trade and should accelerate away from that point with ease.

• And a stop loss can be set at the ‘C’ wave low of the correction, – placing a stop at this low means you have minimized the risk in the trade.