[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

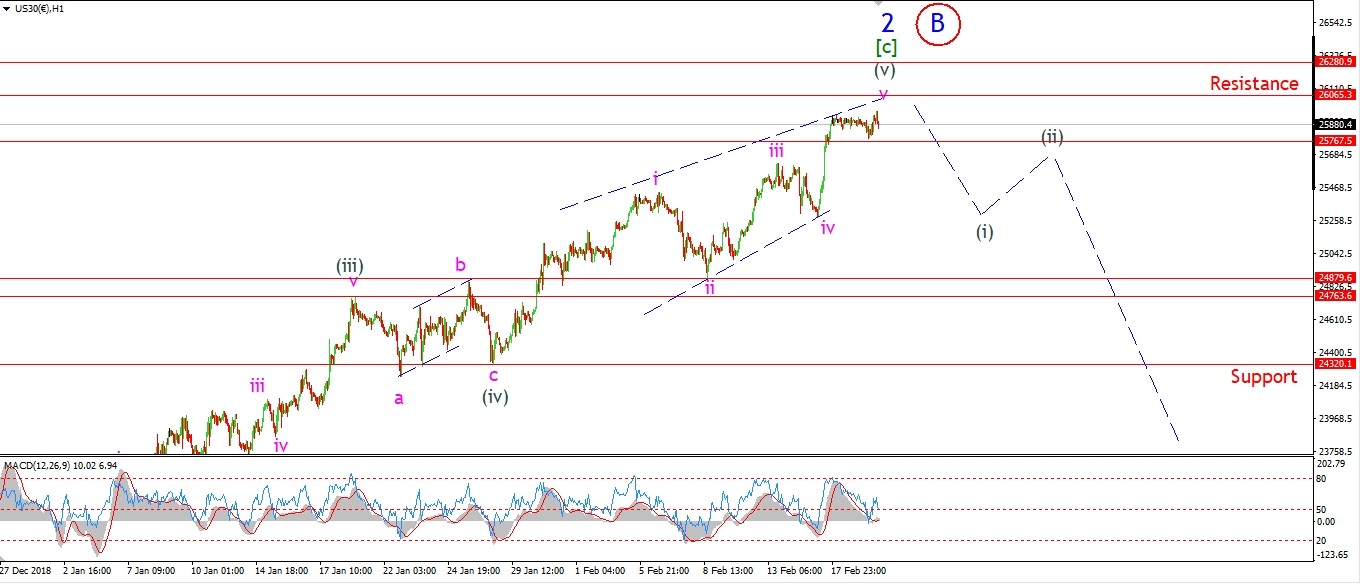

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row][vc_row][vc_column width="2/3"][vc_custom_heading text="1 hr" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/3"][vc_custom_heading text="4 Hours" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text]

[/vc_column_text][vc_custom_heading text="Daily" use_theme_fonts="yes"][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

We are almost back at the resistance line of 26065 today after a subdued open to the week.

I have shown the alternate count on all three time frames.

It shows this evenings highs as wave 'B' of (4).

This alternate wave count allows for a new high to occur above 26065,

but this will be fully retraced in wave 'C' of (4),

And the target for wave 'C' of (4) lies at the lower trendline at 20500.

Wave 'C' may well overshoot to the downside also.

So we are now facing at least a drop in wave 'C'

which should be in the region of a 5000 point decline.

If the wave '3' of (3) scenario plays out,

We are facing a larger decline than that.

Tomorrow;

I am still open to the idea of 26065 holding and a drop in wave '3' of (3) to begin.

But the alternate count is still a significant risk.

Watch for wave (i) down to begin for either interpretation

over the coming few days.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width="5"][/vc_column][/vc_row]