Good evening folks and the Lord’s blessings to you.

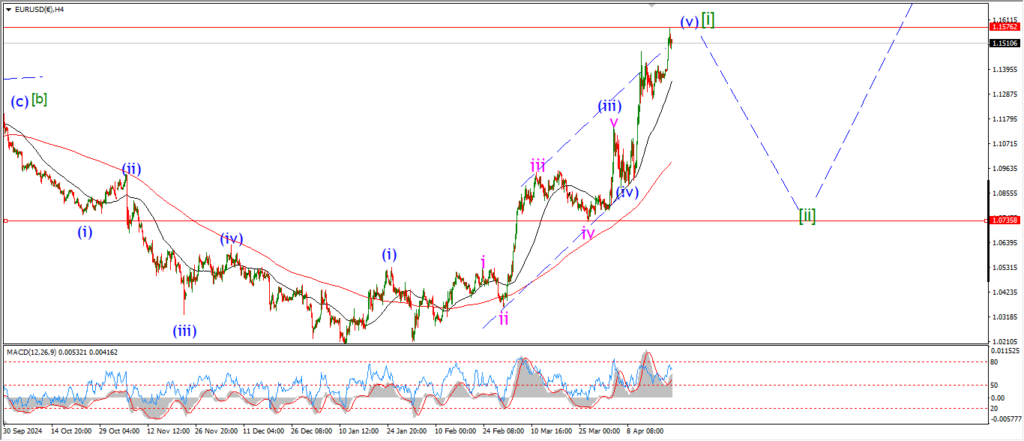

EURUSD

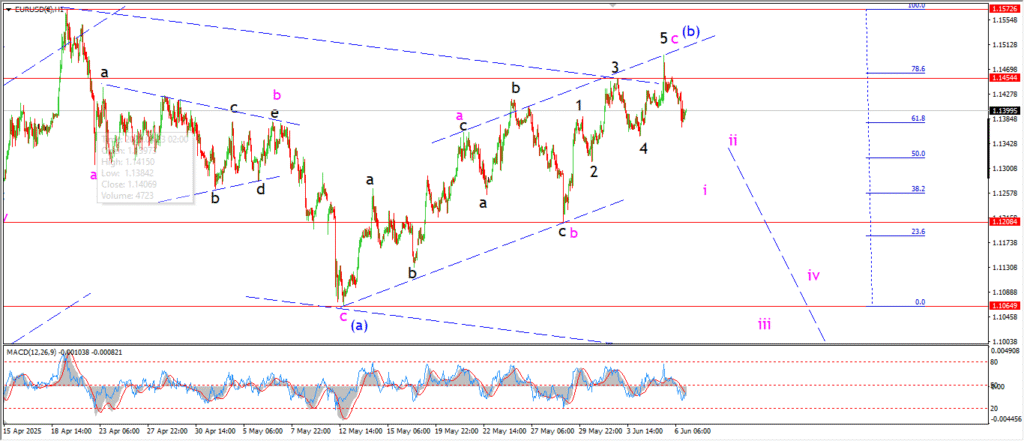

EURUSD 1hr.

EURUSD has moved lower off the upper trend line today with another chance building that wave (b) is finally in the bag.

the price action has chopped its way higher this week,

with multiple false tops and false reversals.

I am hopeful that the current high for wave ‘c’ of (b) is done.

And wave ‘i’ down can now turn lower to begin wave (c).

Monday;

Watch for wave ‘i’ of (c) to fall in five waves towards the support at 1.1204 early in the week.

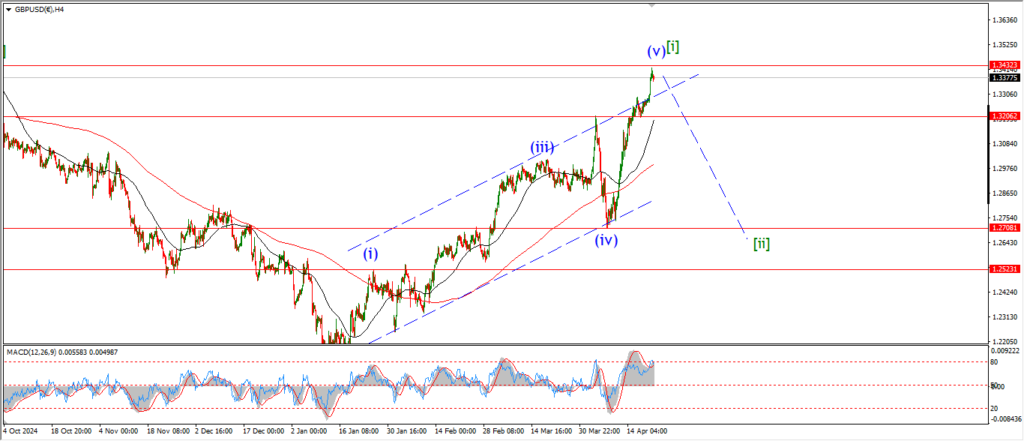

GBPUSD

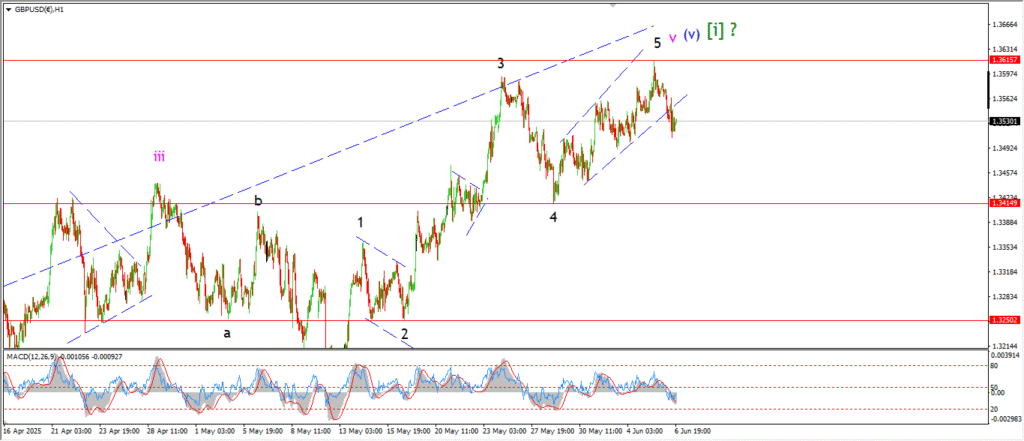

GBPUSD 1hr.

cable is holding below this weeks high tonight and the idea of a top in wave [i] remains.

The fact that wave [i] has taken so long to be corrected only leads me to think that the inevitable correction in wave [ii] will be protracted and quite deep.

I am going to wait for confirmation on that wave [i] top before jumping with both feet into wave [ii] again.

So the target is for a break of 1.3415 again.

Monday;

Watch for wave [i] to hold and for an impulsive drop to break 1.3415 again.

USDJPY.

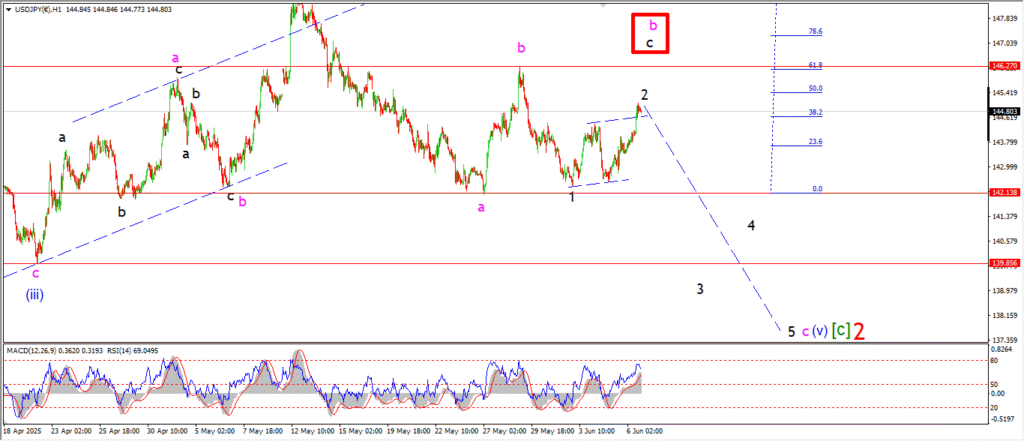

USDJPY 1hr.

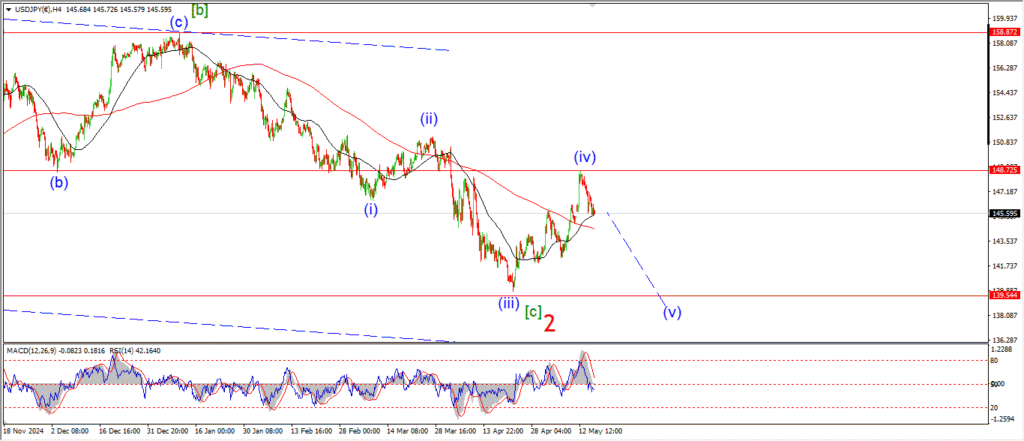

USDJPY 4hr.

USDJPY daily.

Three waves up in wave ‘2’ has completed today.

the price has broken above the upper trend channel line this evening.

Wave ‘3’ of ‘c’ must turn lower on Monday,

And if that does not happen,

then I will focus on that alternate count for wave ‘c’ of ‘b’ at 146.27.

Monday;

Watch for wave ‘3’ of ‘c’ to fall back below 142.00 again to confirm this pattern.

A break of 146.27 will trigger the alternate count.

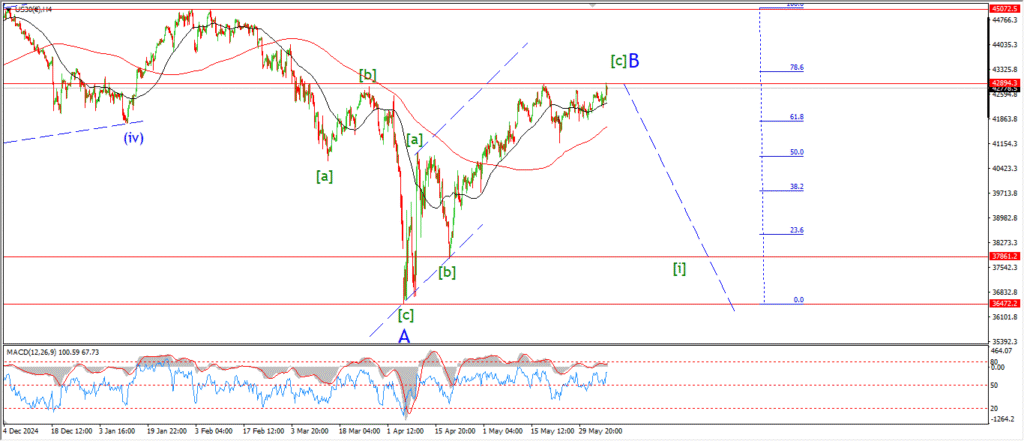

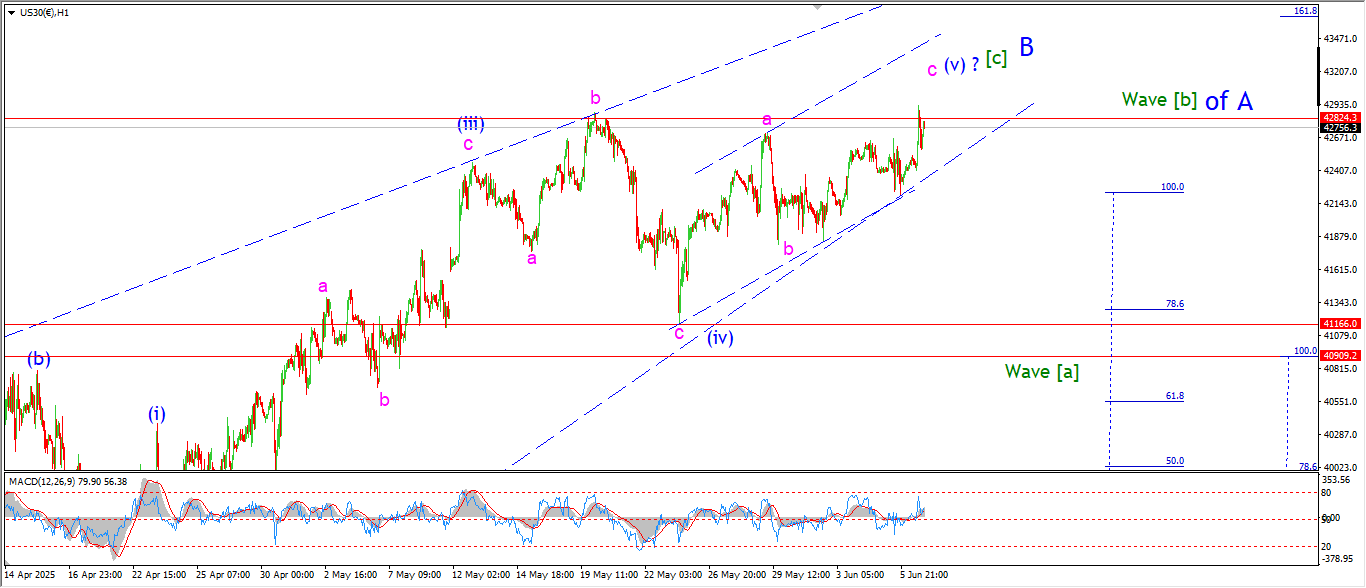

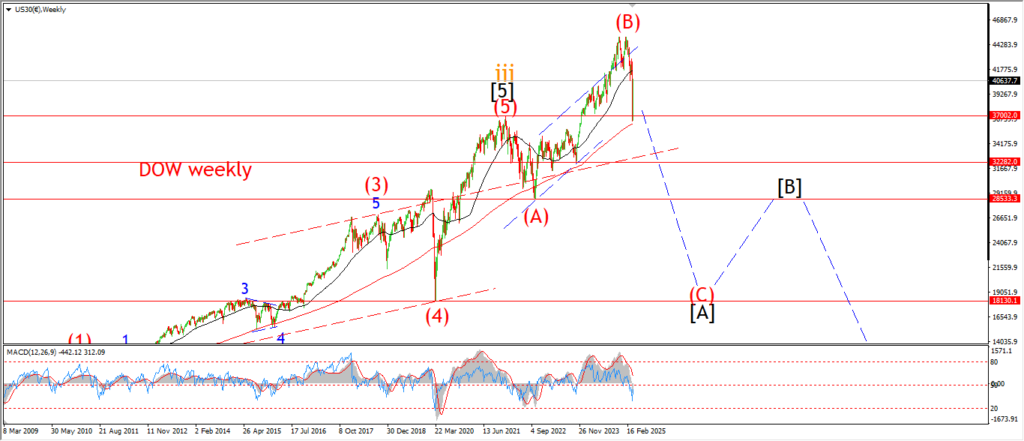

DOW JONES.

DOW 1hr.

I am overly emotional in my reactions to daily price action.

But,

There comes a point in every retracement when I find these squeaking new highs as stomach churning.

Todays one is particularly nauseating!

How and ever, here we are.

I can’t seem to abandon the idea that wave [c] of ‘B’ is an ending diagonal pattern overall despite todays new high.

The internal action of wave (iii) in particular is too messy to be considered a standard five wave pattern.

I will not that the last high in this rally was on may 19th,

and we here are closing lower than that level again tonight.

I have marked the previous wave [b] of ‘A’ at 42824.

The market is failing below that level for almost a month now.

So the retracement in wave ‘B’ has made no progress beyond the standard target level for a retracement.

that is interesting.

Monday;

Watch for that top at wave [c] of ‘B’ to form eventually.

This week was a wash out.

Next week beckons.

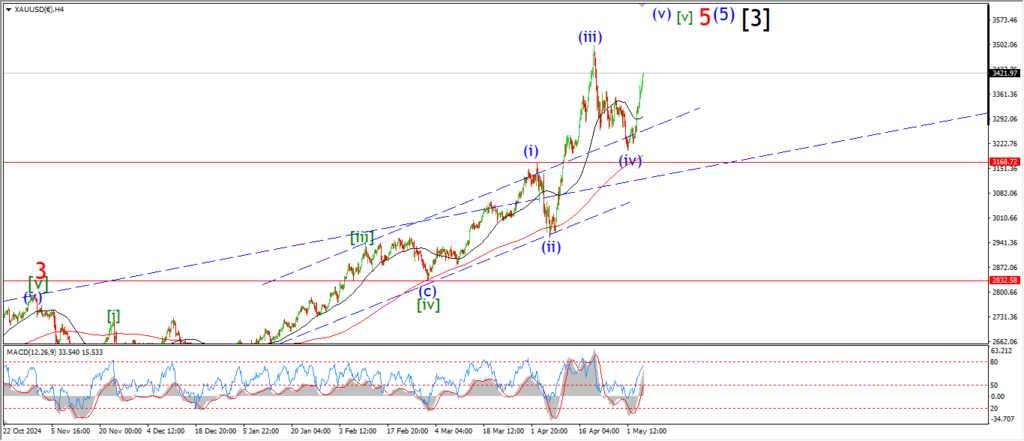

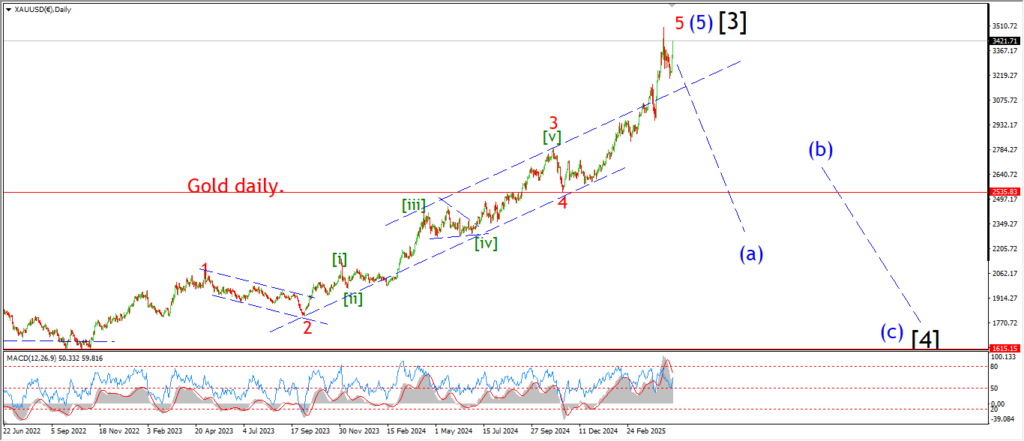

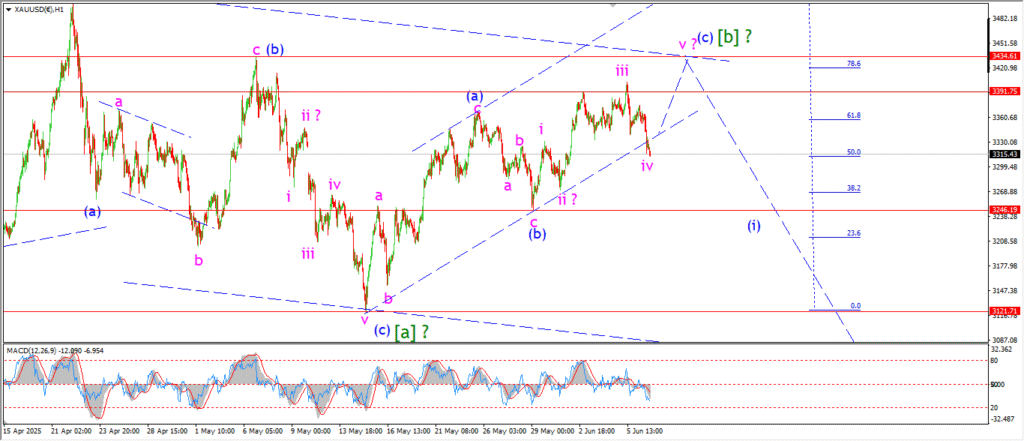

GOLD

GOLD 1hr.

Gold took another step lower today and I am begin generous here by sticking to the main wave count for wave (c).

the decline has only traced out three waves down.

And this can still be viewed as a correction at the moment.

If the price falls back below 3246 again that will be a better argument for a wave [c] decline getting started.

Tomorrow;

Watch for wave (c) of [b] to top out with a pop in wave ‘v’ towards 3434 again.

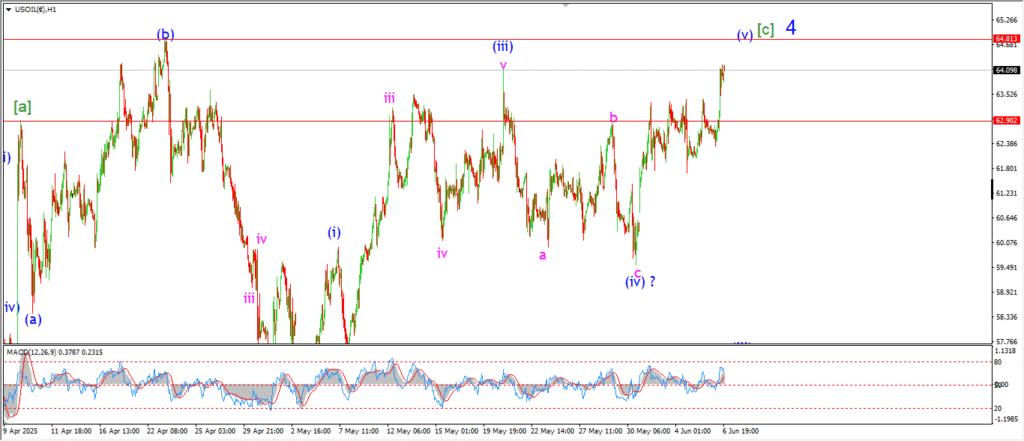

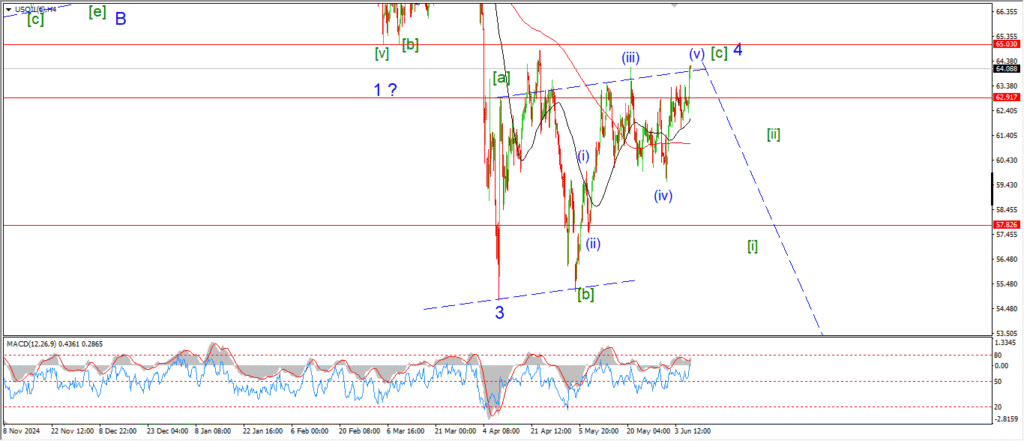

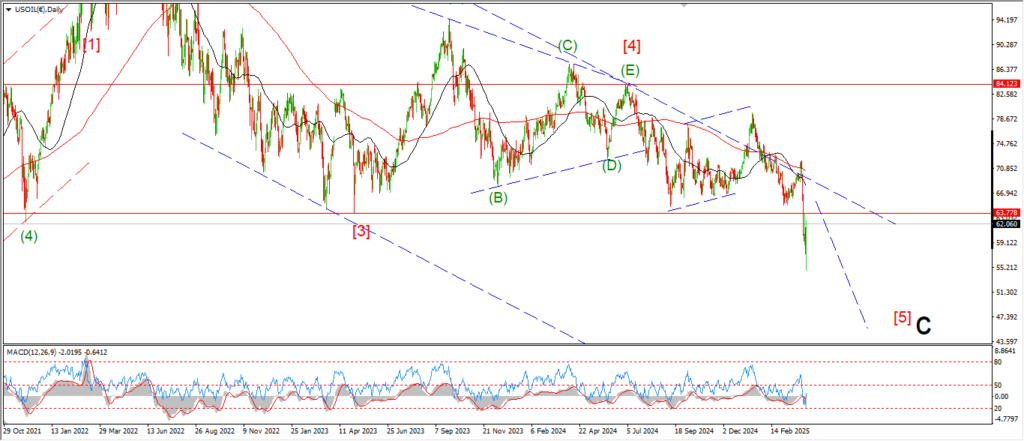

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Starting on the 4hr chart tonight.

You can see that the action today has triggered the alternate count for wave ‘4’ blue.

the price has pipped above the previous high at 64.00.

And now the pattern is thrown back by 2 degrees into the wave ‘4’ correction.

The price is touching the upper trend channel line of wave ‘4’ again tonight.

And the market has failed at this line twice before.

Wave (v) must be at the end of its run now,

and from there wave [i] of ‘5’ can begin.

Monday;

watch for wave (v) of [c] of ‘4’ to top out next week.

That reversal has failed this week,

but the pattern still calls for another turn down into wave [i] of ‘5’.

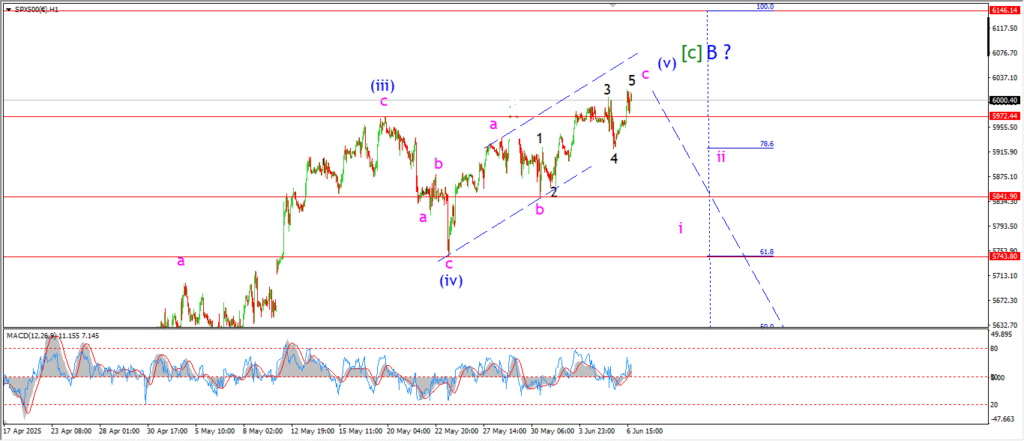

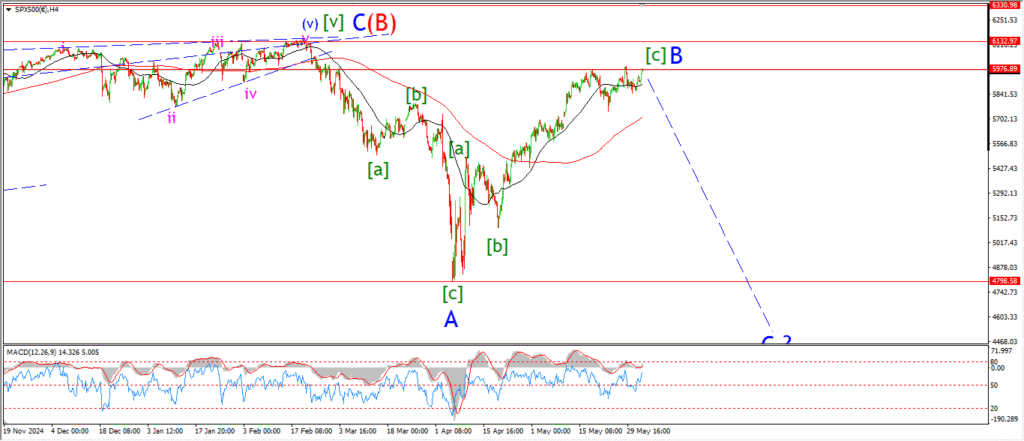

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

Disgust is the over riding sentiment for the S&P500 also tonight!

The market has managed to push higher today into a possible wave ‘5’ of ‘c’,

this completes three waves up in wave (v).

and that completes five waves up as part of the ending diagonal pattern in wave [c].

I am at the end of the road for this pattern now,

so there is nothing much left to allow for any more stretch into wave [c].

It is the end of the line.

Next week.

The coming few days are crucial for obvious reasons.

Wave ‘B’ must top and turn finally.

SILVER.

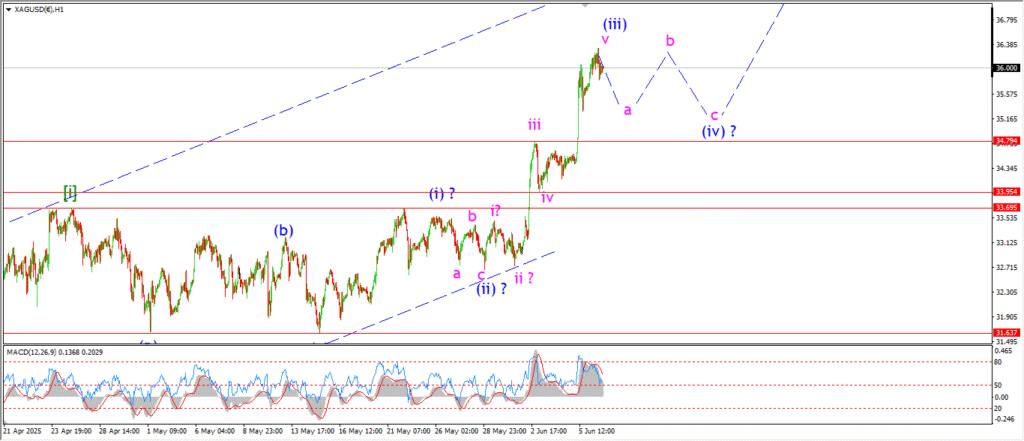

SILVER 1hr

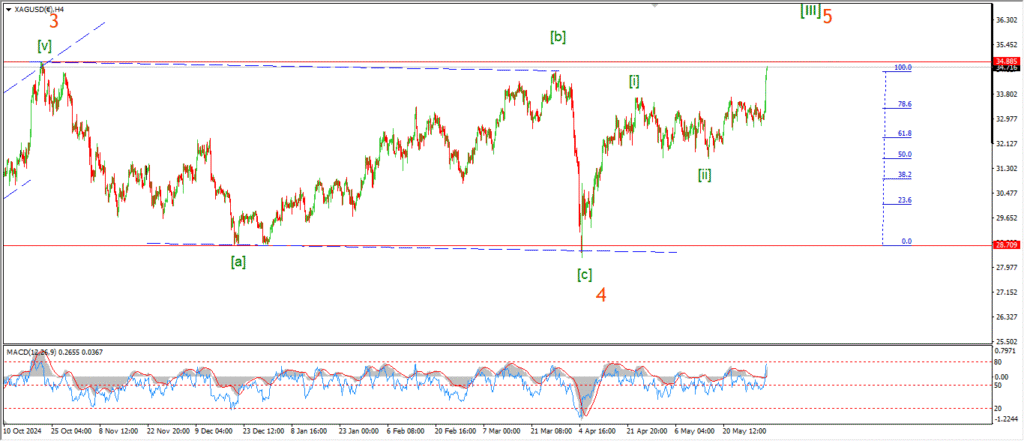

SILVER 4hr.

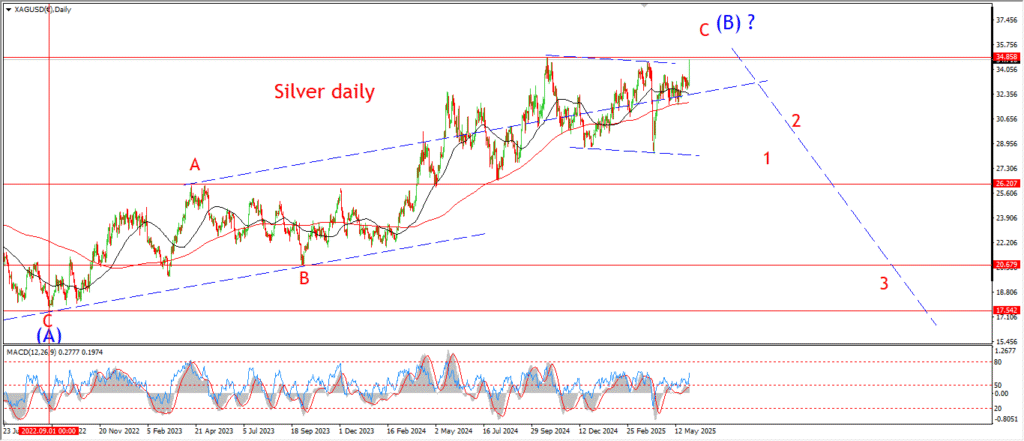

SILVER daily.

Silver has completed a five wave pattern internally in wave ‘v’ of (iii) now.

And this pattern now calls for a correction into wave (iv) as shown.

Wave (iv) should begin early next week,

and The correction will likely hold above the recent interim high at 34.75.

A triangle pattern will achieve that,

but we will see how it develops over the next few days.

Monday;

watch for wave (iii) to hold at the current highs.

Wave ‘a’ of (iv) should fall back towards 35.00 again in this scenario.

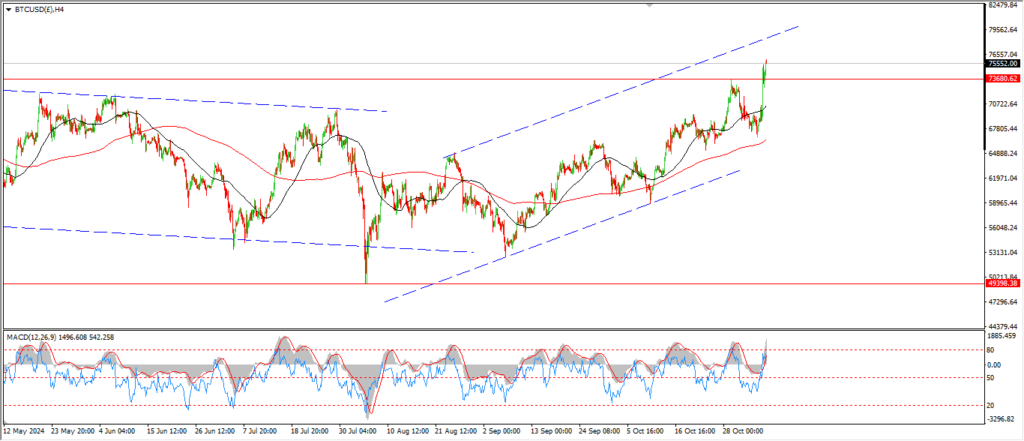

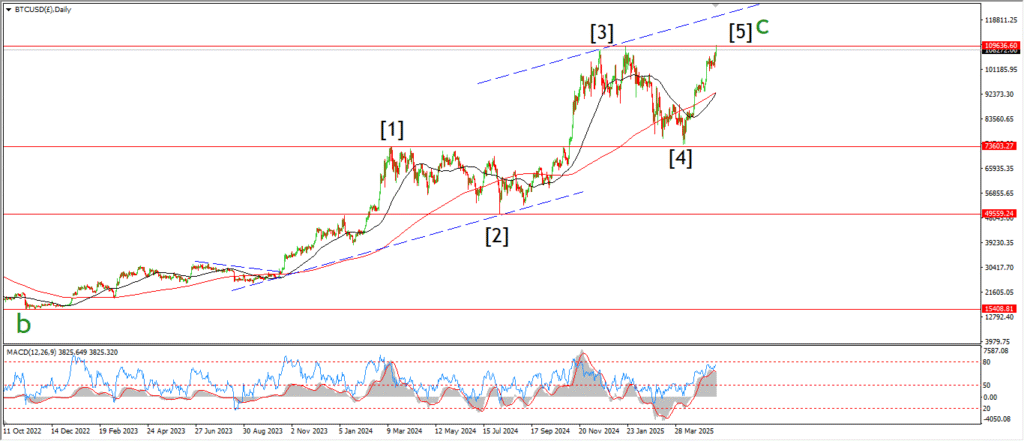

BITCOIN

BITCOIN 1hr.

….

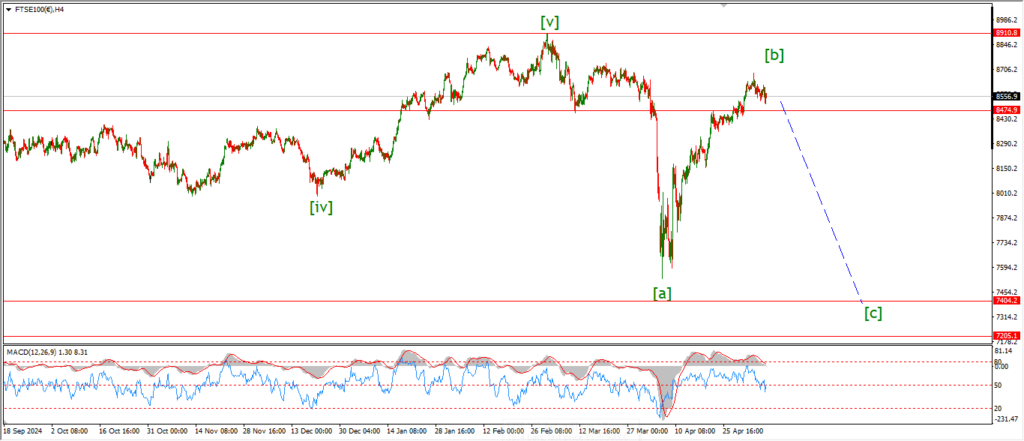

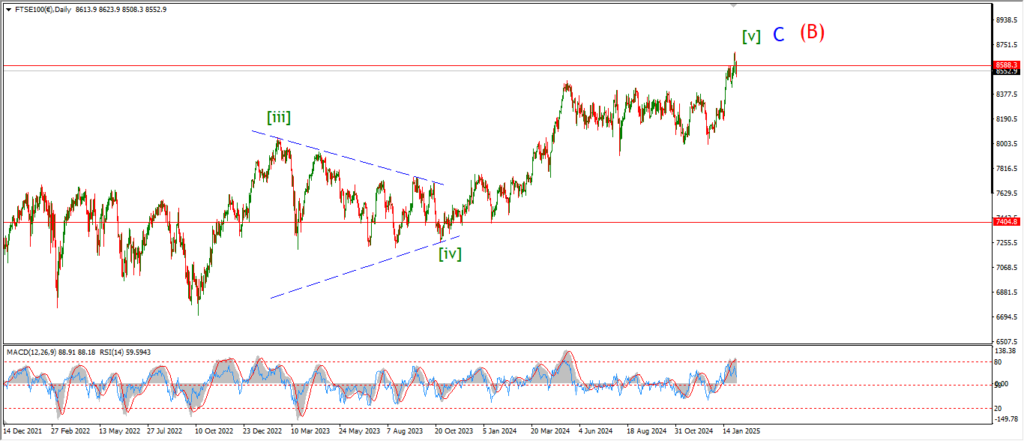

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

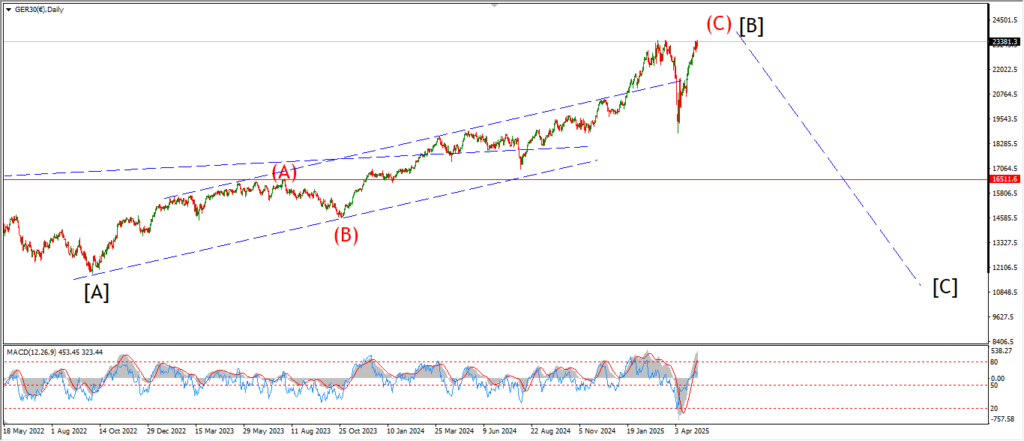

DAX.

DAX 1hr

….

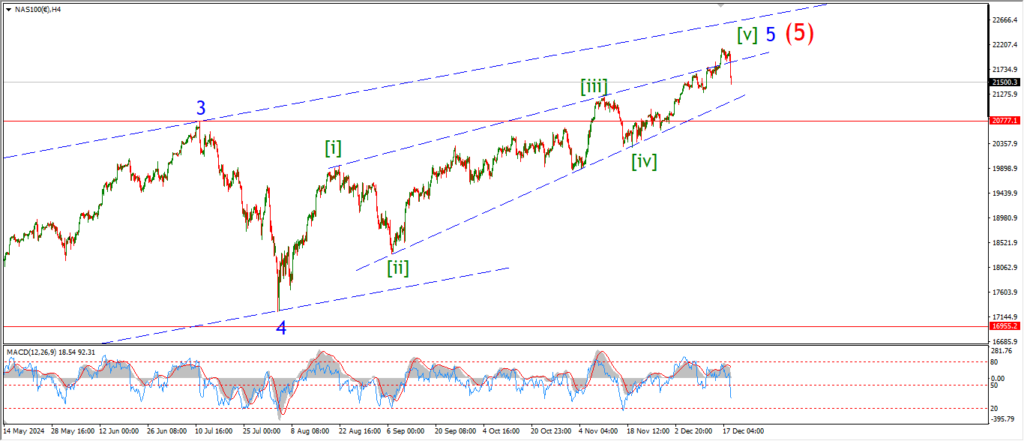

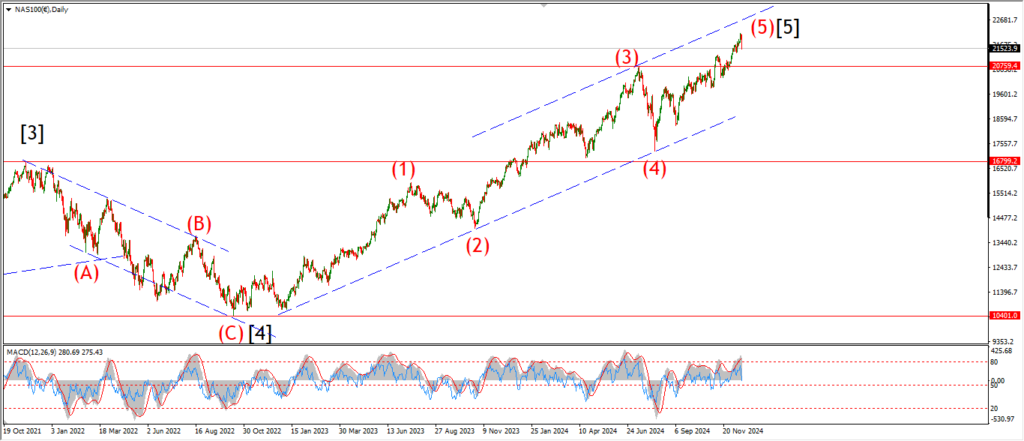

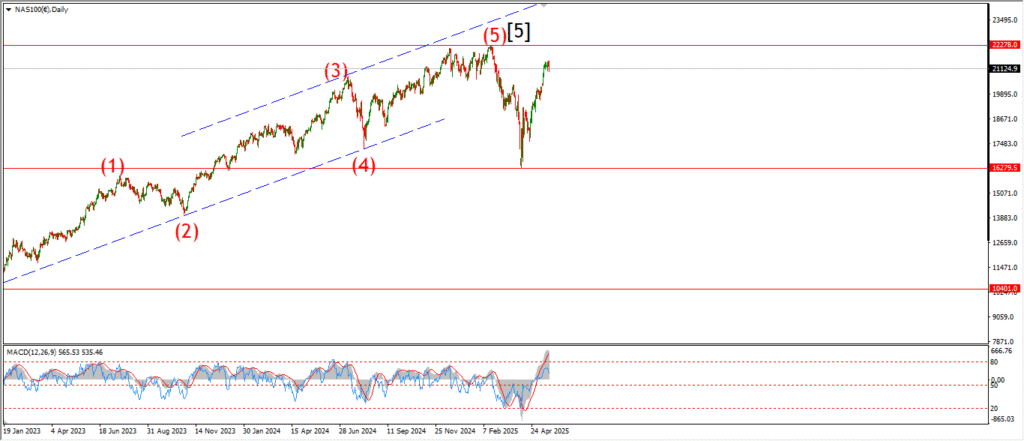

NASDAQ 100.

NASDAQ 1hr

….