Good evening folks and the Lord’s blessings to you.

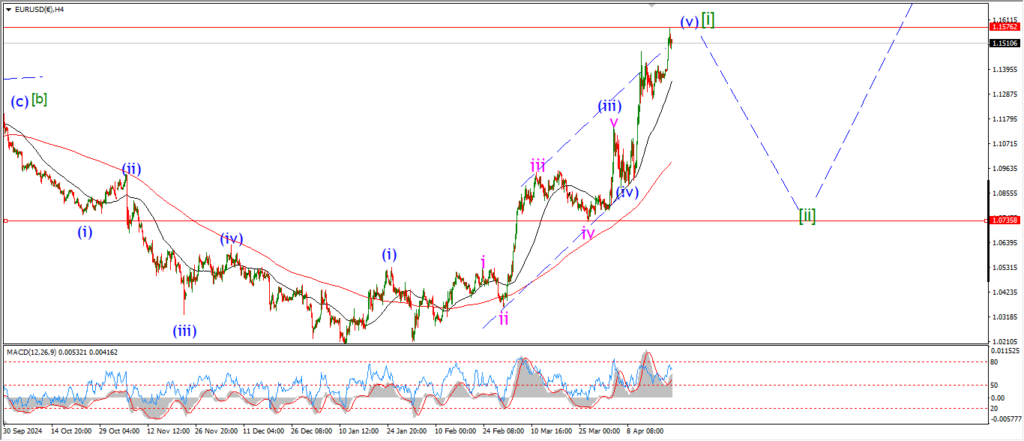

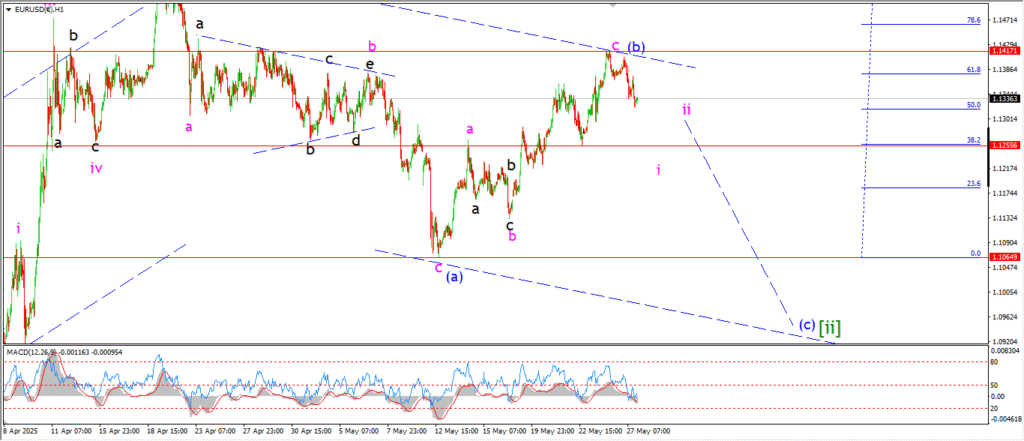

EURUSD

EURUSD 1hr.

Well that is a start at least!

EURUSD came back off the high at wave (b) finally today with a retracement of Fridays rally.

I am looking for wave ‘i’ of (c) to take over from here.

And that initial drop into wave ‘i’ should fall into 1.1255 at the previous pivot low.

That level also marks the area of the previous wave ‘a’ high.

So a break of that level wil be a strong indication that wave (b) has topped out and wave (c) is underway.

Tomorrow;

Watch for wave ‘i’ of (c) to fall below 1.1255 to confirm we are on the right path here.

Wave (c) should fall below 1.1065 at a minimum.

And a tag of the lower trend channel line will occur near the 1.09 area.

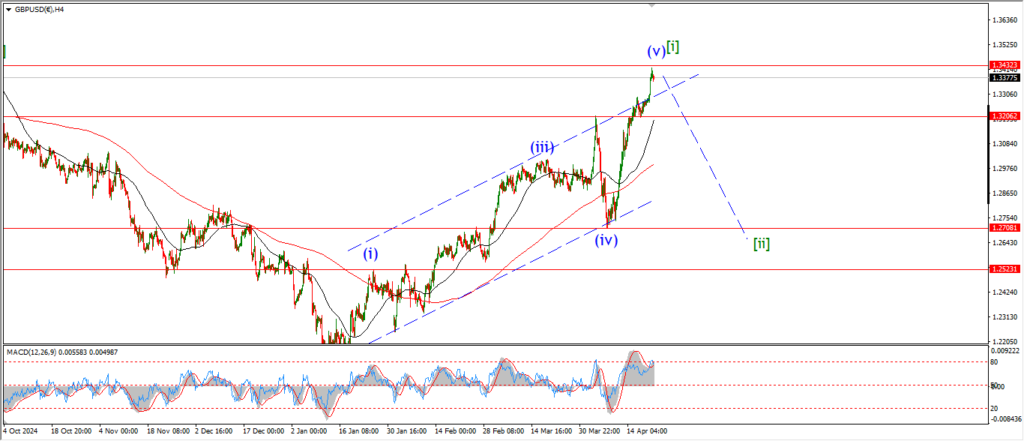

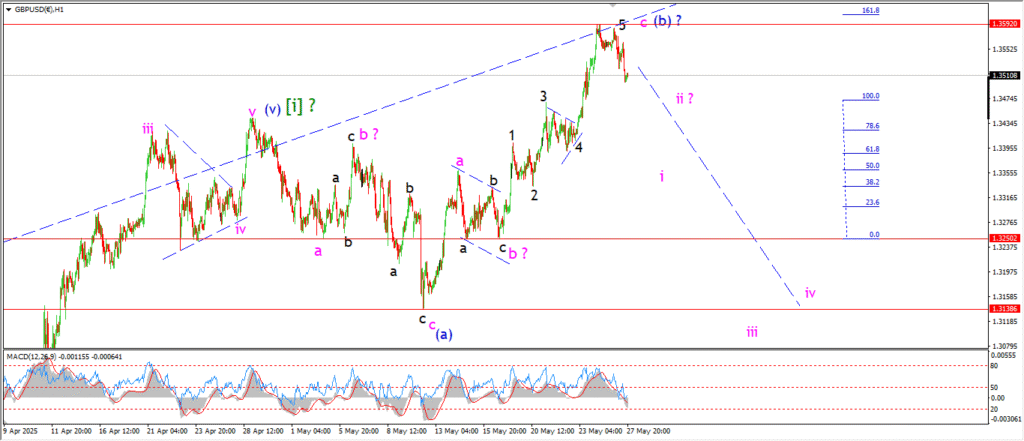

GBPUSD

GBPUSD 1hr.

Cable has made an attempt to turn lower also today with a drop back into 1.35 again.

I am looking for wave ‘i’ of (c) to break back below 1.3400 at a minimum.

And if that happens I will happier with the overall count for wave (c) of [ii].

The minimum target for wave (c) comes in at 1.3186.

So there is a ways to go here.

Tomorrow;

Watch for wave ‘i’ of (c) to continue lower with a break below 1.3400 the main target for wave ‘i’.

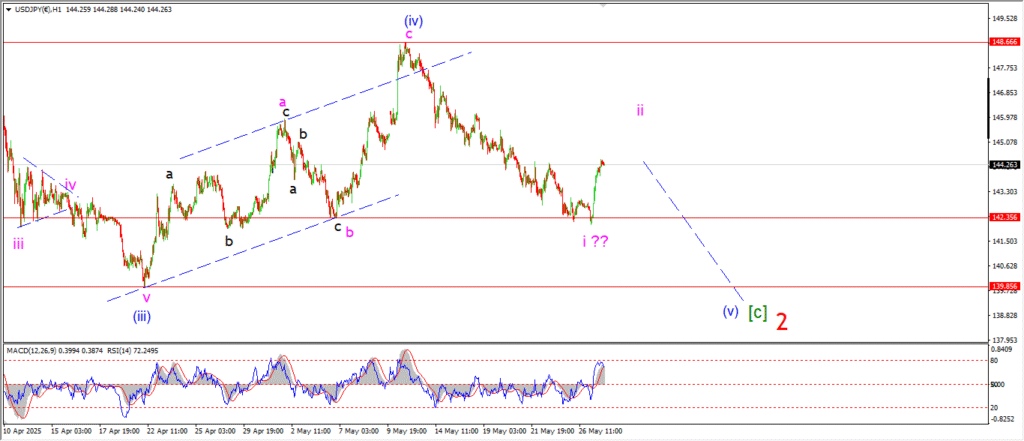

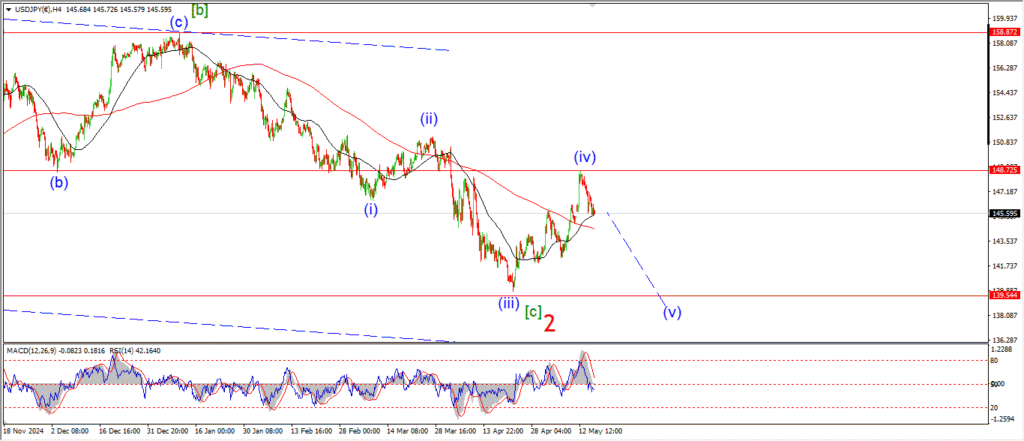

USDJPY.

USDJPY 1hr.

USDJPY 4hr.

USDJPY daily.

The action in wave (v) so far has been a mystery to me.

And todays turn up higher is adding to that mystery!

The target for wave (v) is simple,

a break of the wave (iii) low at 13986.

And from there I can begin to turn my attention higher again.

But so far,

the internal pattern for wave (v) is a jumbled mess.

But the main direction is not in doubt,

with a solid lower trajectory all last week.

It is still possible that we have a ‘i’ ‘ii’ pattern in play here to begin wave (v).

And that will allow for a correction higher towards 146.00 again in wave ‘ii’.

So,

I will allow for that scenario over the coming days.

Tomorrow;

Watch for wave ‘ii’ to trace out three waves up towards 146.00 as shown.

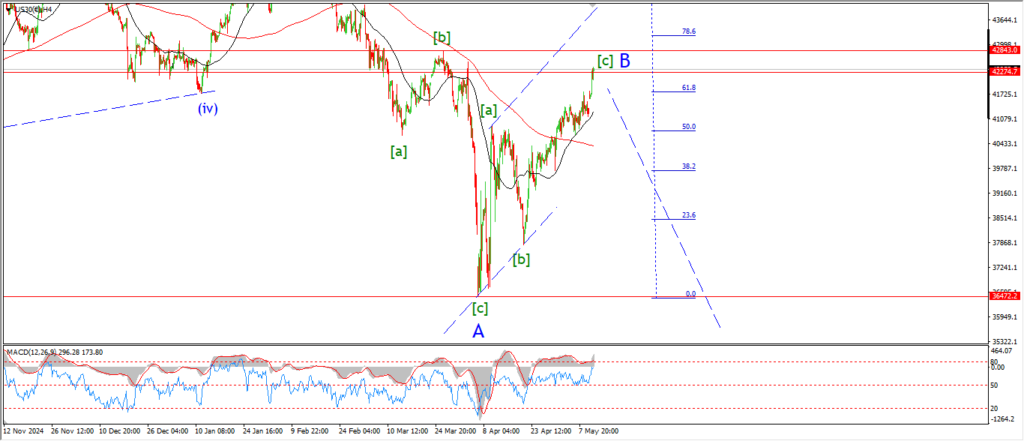

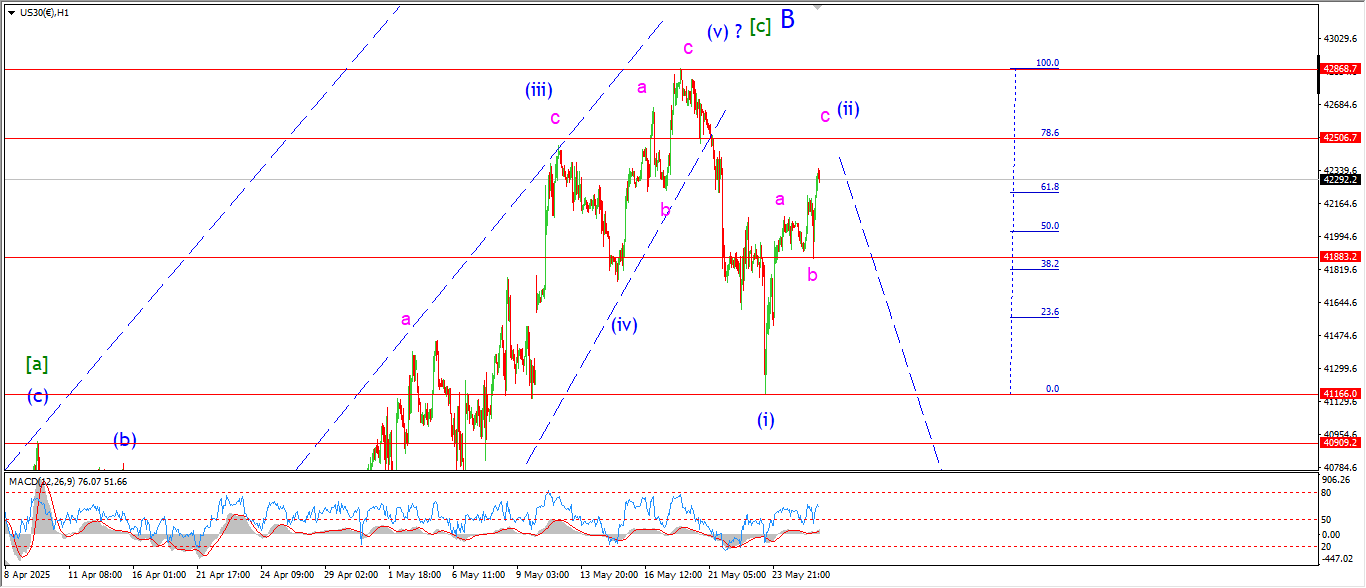

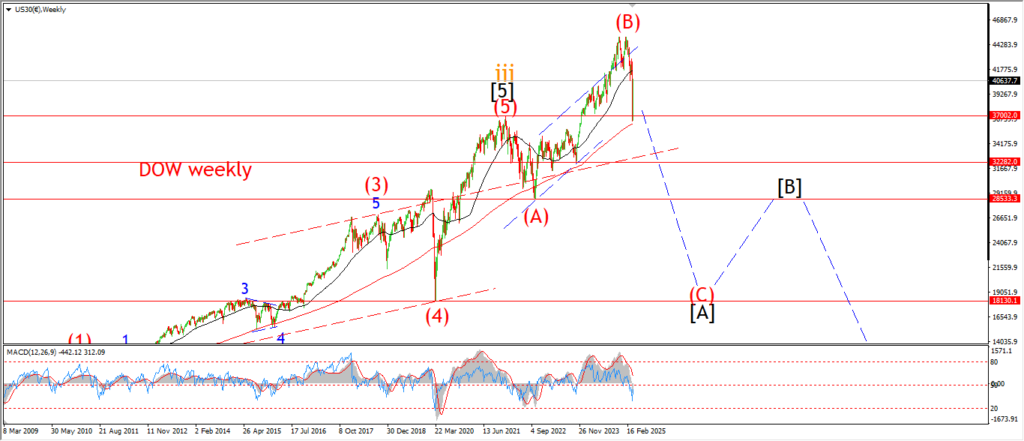

DOW JONES.

DOW 1hr.

The DOW has started the week with a strong pop out of Fridays lows.

This changes up the short term pattern again.

the rally into todays high is still in three waves overall.

so I am counting this as a larger wave (ii).

with todays top getting close to the top in wave ‘c’ of (ii).

The 78.6% retracement of wave (i) lies at 42500,

that level now becomes the most obvious target for wave (ii) but we will see if the early week optimism stays soon enough.

Tomorrow;

Watch for wave ‘c’ of (ii) to hold the lower high below 42860 at the wave ‘B’ high.

This week is very important as we need to see a turn down into wave (iii) begin before the end of the week.

So it is important that the market hold this lower high in wave (ii).

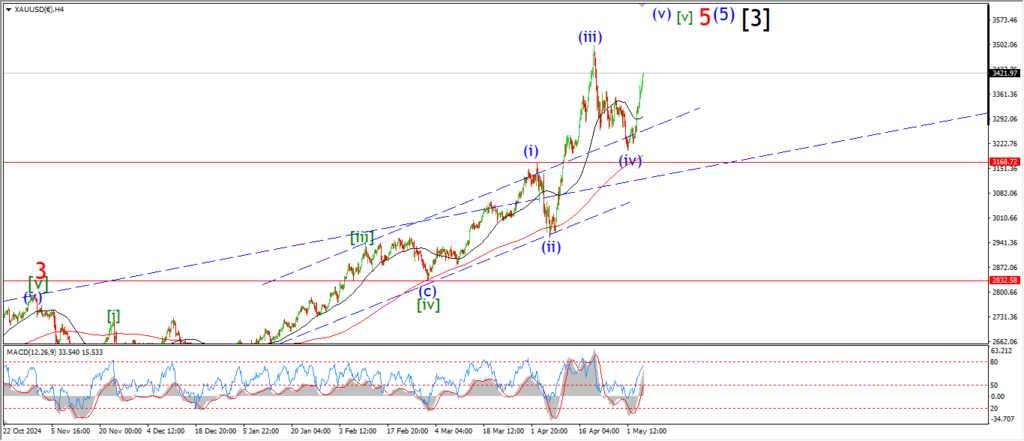

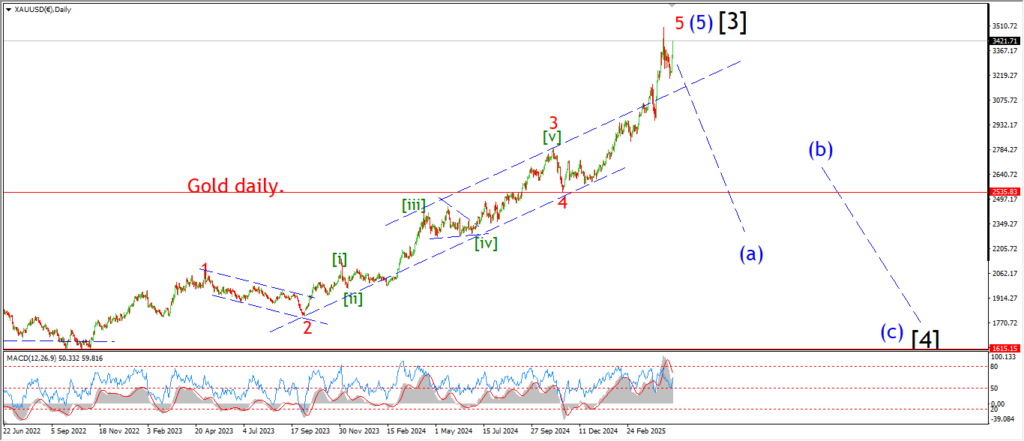

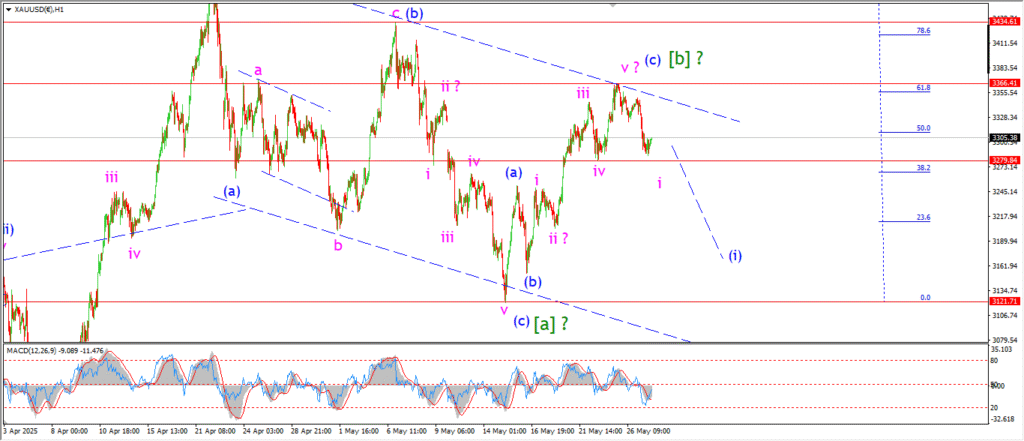

GOLD

GOLD 1hr.

Gold has dropped off the wave [b] high again today but the price is still holding above that wave ‘iv’ low tonight.

I want to see a break of that level in wave ‘i’ of (i).

so I am hopeful,

but not convinced that wave (C) is underway here.

Tomorrow;

watch for a break of 3280 in wave ‘i’ of (i).

and then we should see a full five wave pattern lower this week in wave (i) blue.

wave (i) will likely hit a low near 3160 to complete.

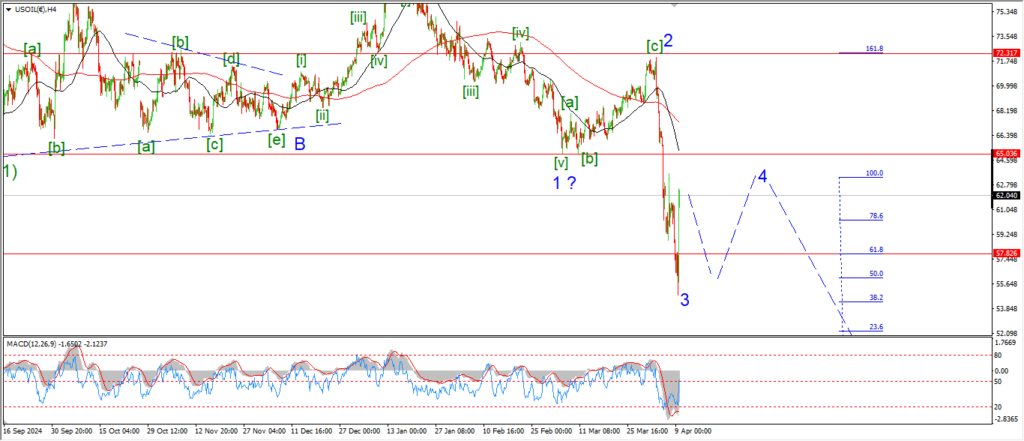

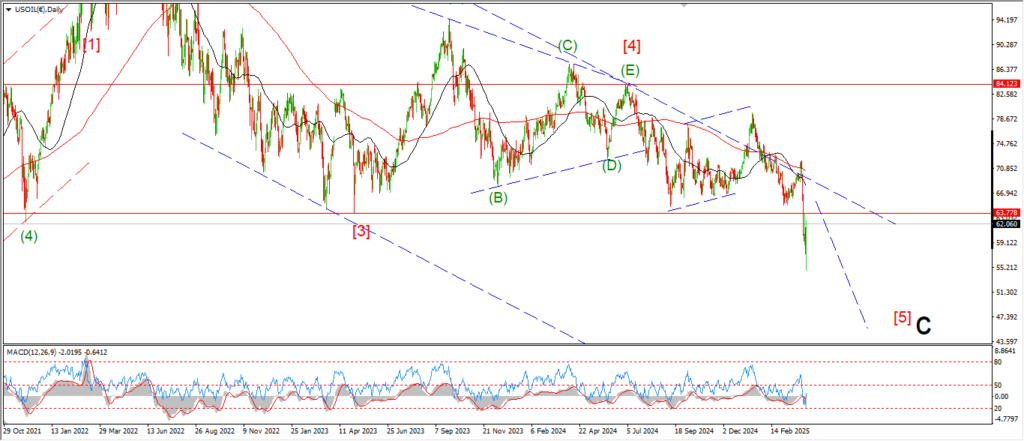

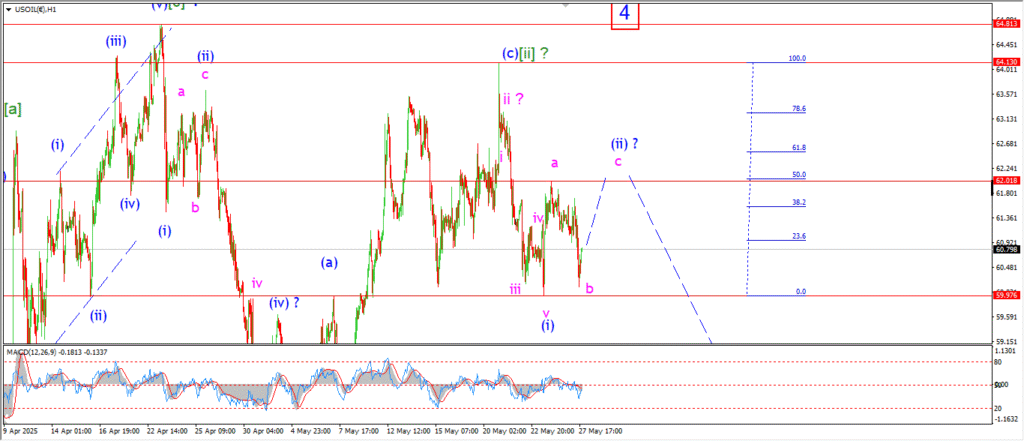

CRUDE OIL.

CRUDE OIL 1hr.

The action today in crude oil suggests that wave (ii) is still in play here.

The price fell back again today,

but the pattern off that 62.00 high is in three waves.

So I think this fits wave ‘b’ of (ii) now.

And the rally this evening is labelled wave ‘c’ of (ii) now.

Tomorrow;

watch for wave ‘c’ of (ii) to complete the correction with a rally into the wave ‘a’ high again at 62.00.

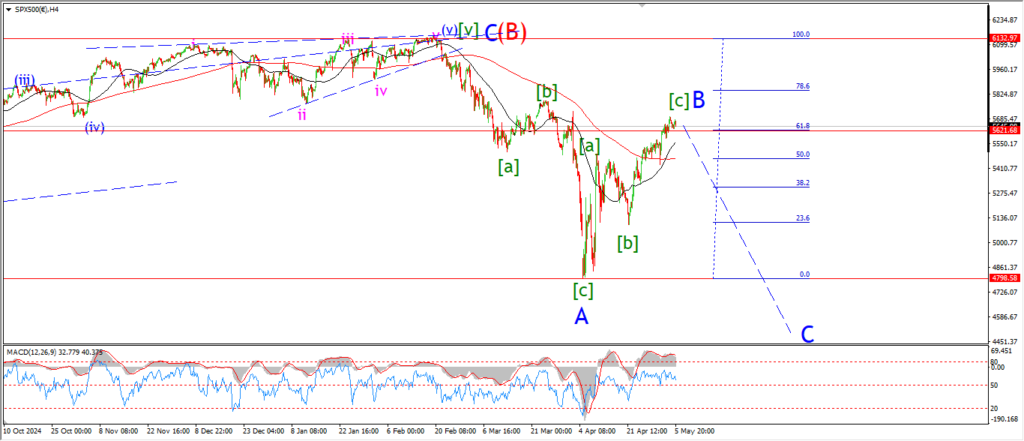

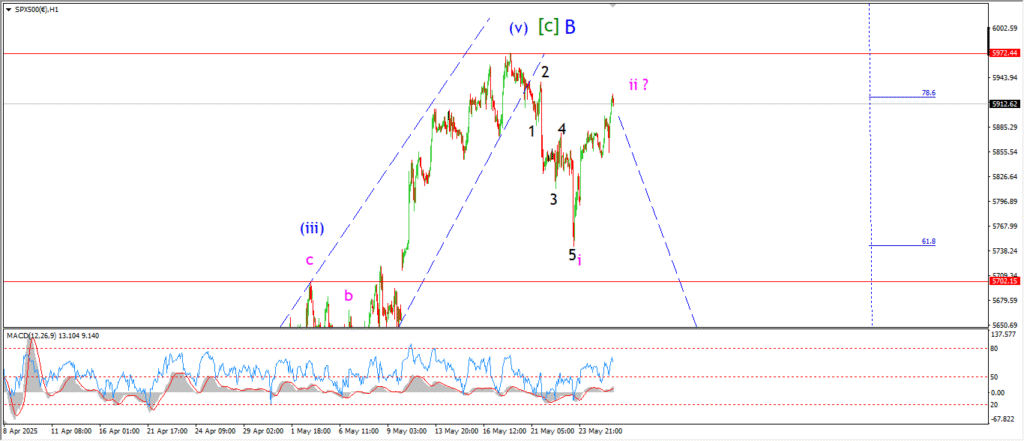

S&P 500.

S&P 500 1hr

The S&P has rallied back towards the highs at wave ‘B’ again tonight.

this action puts the pattern in danger of invalidation again as we approach that high again.

and I am worried now for sure.

If we get a solid rejection below the wave ‘B’ high this week,

that will favor the wave ‘i’ and ‘ii’ idea.

Tomorrow;

Watch for the wave ‘b’ high to hold and wave ‘iii’ of (i) to turn lower again with force.

SILVER.

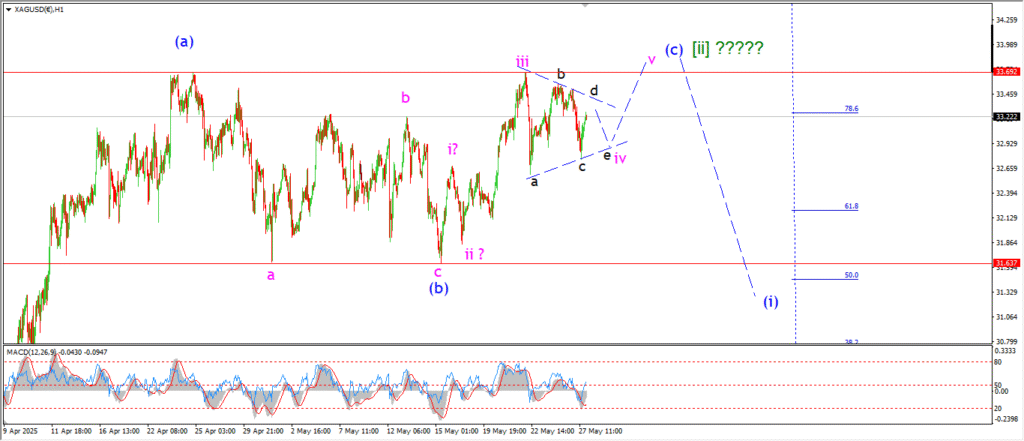

SILVER 1hr

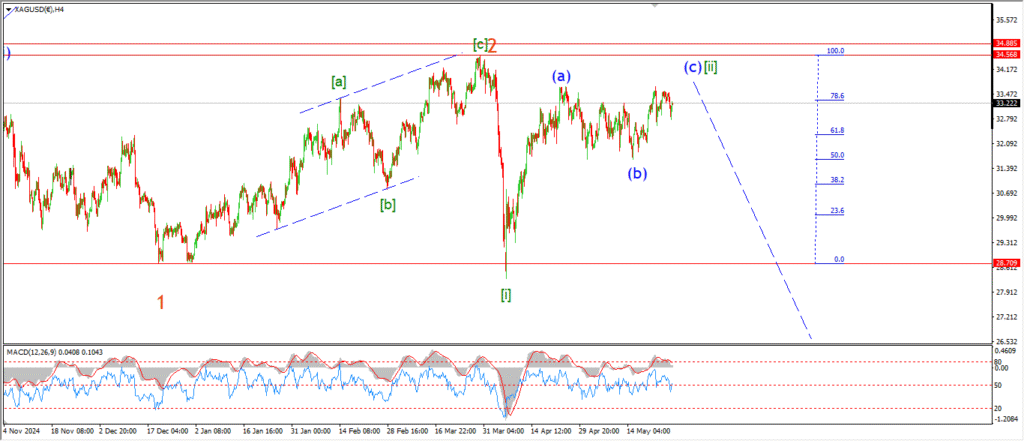

SILVER 4hr.

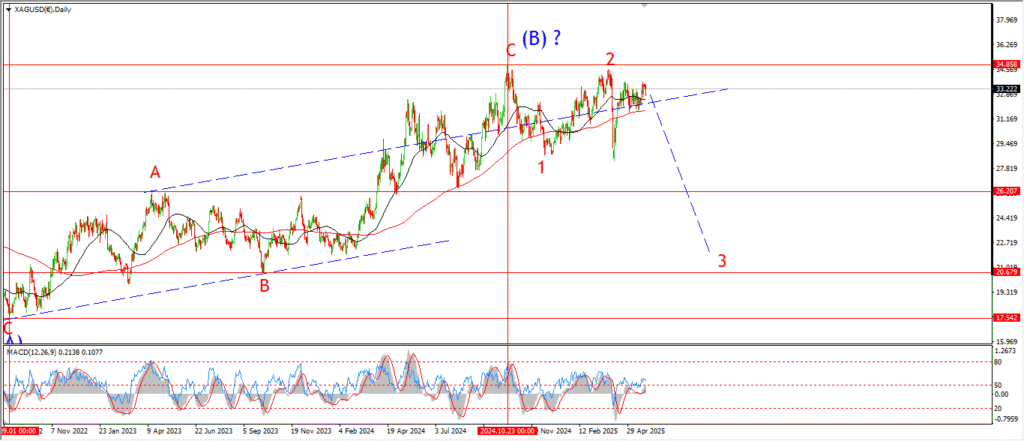

SILVER daily.

Well I am giving this count a revamp tonight but I am sticking in the vein of the previous idea.

If you look at the daily chart you can see a large ‘1’ ‘2’ pattern off the high.

With a lower degree impulse wave to begin wave ‘3’ now in play here.

The 4hr chart shows wave [ii] of ‘3’ in more detail.

the pattern is labelled as three waves up in wave [ii],

with wave (c) of [ii] now close to complete.

The hourly chart shows wave (c) in detail.

the action in wave (c) has gone sideways for the last week.

Wave ‘iv’ of (c) is tracing out a triangle,

with wave ‘v’ of (c) now left to complete five waves up in wave (c).

When that happens,

I will then look for a turn lower to begin wave (i) of [iii] of ‘3’.

Tomorrow;

Watch for wave ‘v’ of (c) to close out with a pop above 33.70 by midweek.

And then wave (i) down should begin before Friday.

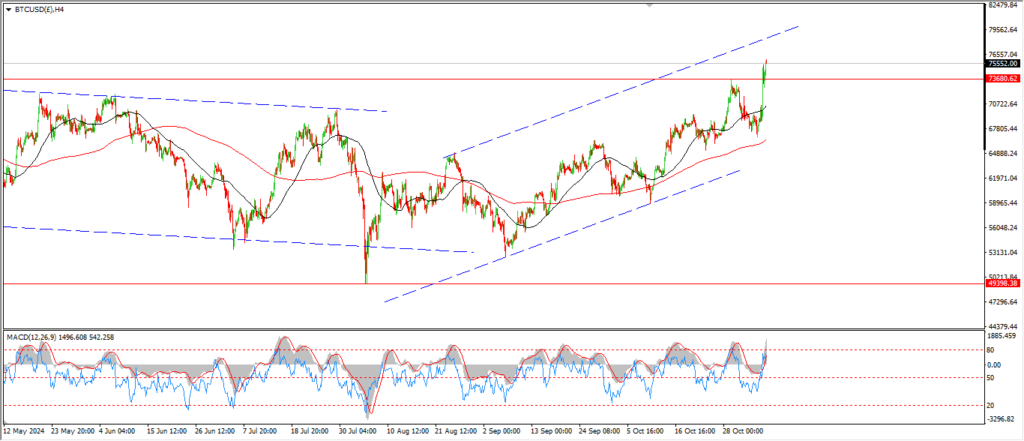

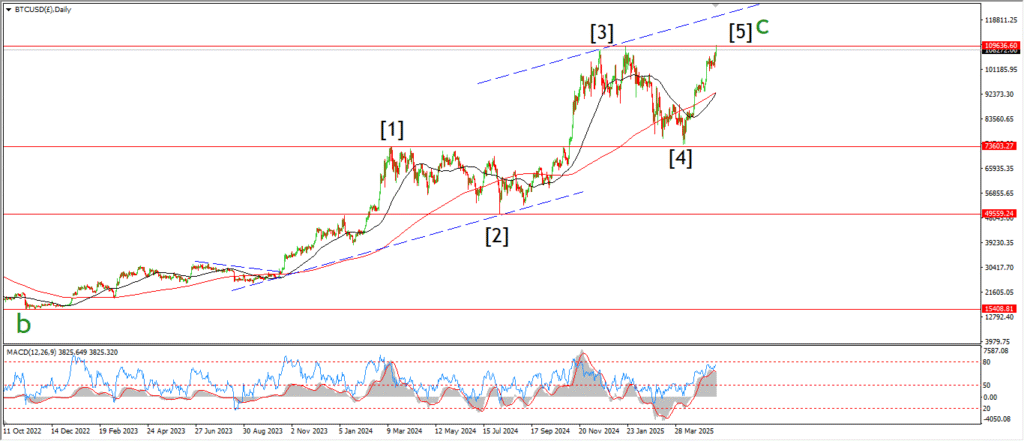

BITCOIN

BITCOIN 1hr.

….

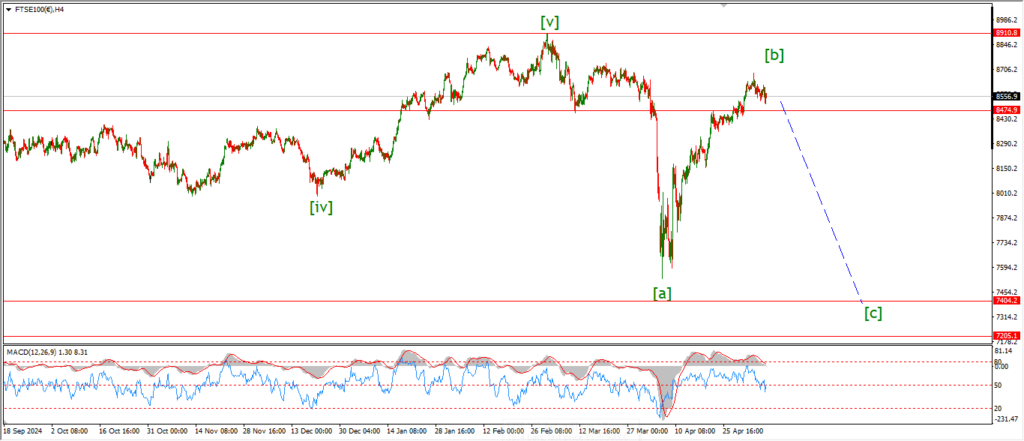

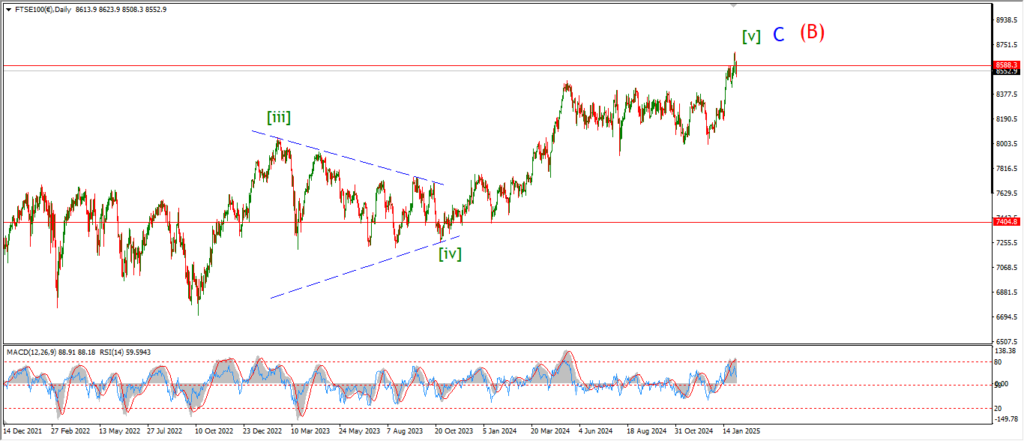

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

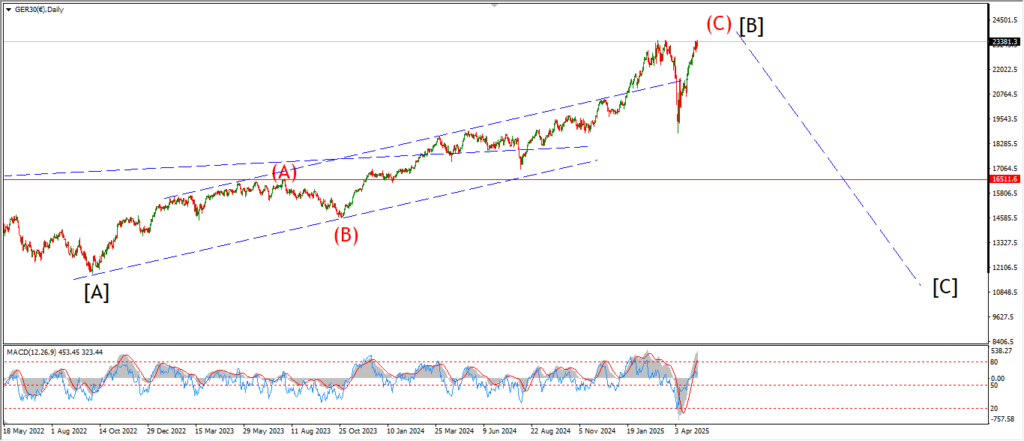

DAX.

DAX 1hr

….

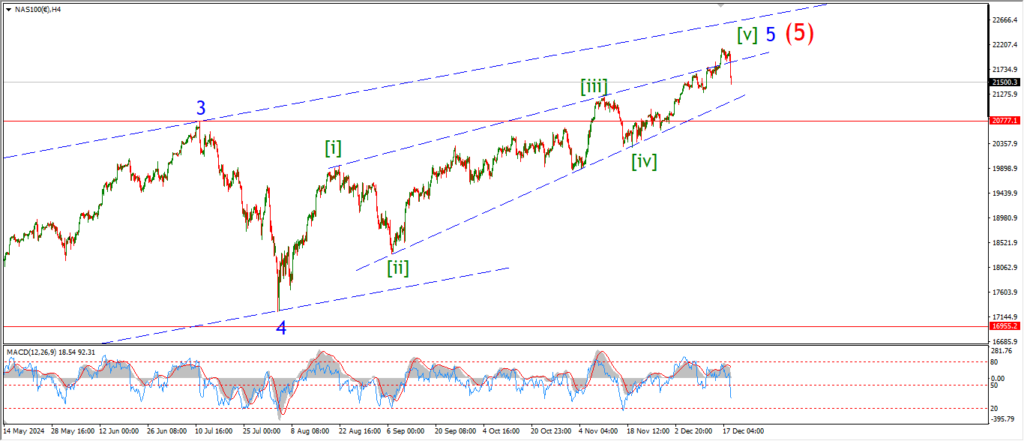

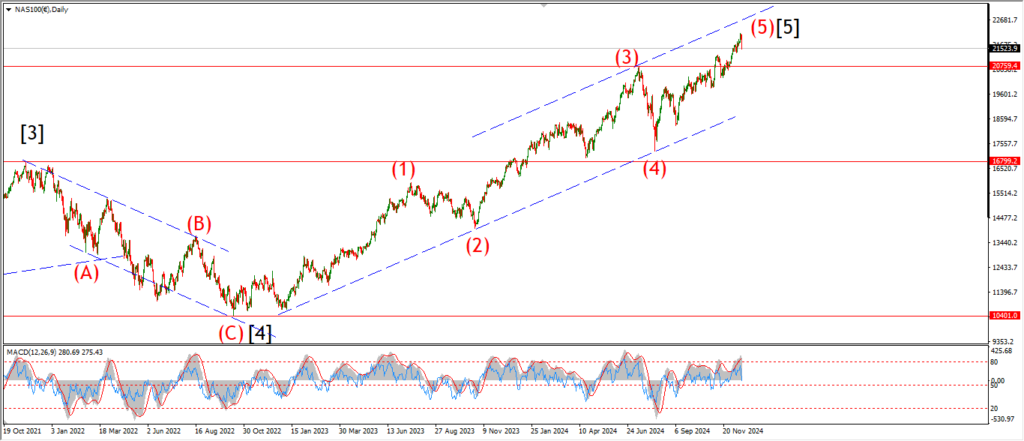

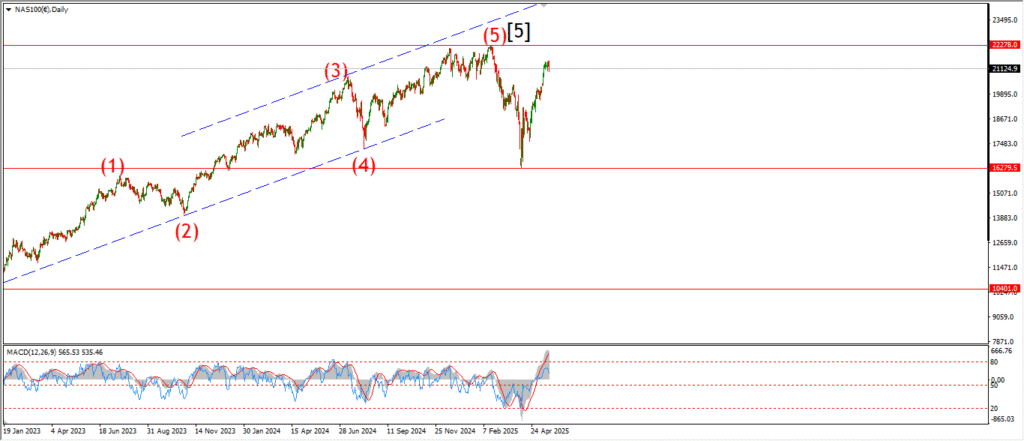

NASDAQ 100.

NASDAQ 1hr

….