Good evening folks and the Lord’s blessings to you.

Just as a reminder, this week is a short trading week as the market will be closed on Friday for good Friday.

EURUSD

EURUSD 1hr.

EURUSD is dropping slowly today but at least the action is in line with the main count.

I am suggesting that wave ‘a’ pink is tracing out three waves down towards 1.1200 now.

wave ‘b’ of ‘a’ completed a contracting triangle today,

and now wave ‘c’ of ‘a’ is heading towards the target area.

Tomorrow;

Watch for three waves down to complete in wave ‘a’ of (a).

And from there wave ‘b’ will move sideways again in a corrective manner.

If the price drops below 1.1100 tomorrow then I will consider that wave (a) is closer to completing than currently suggested.

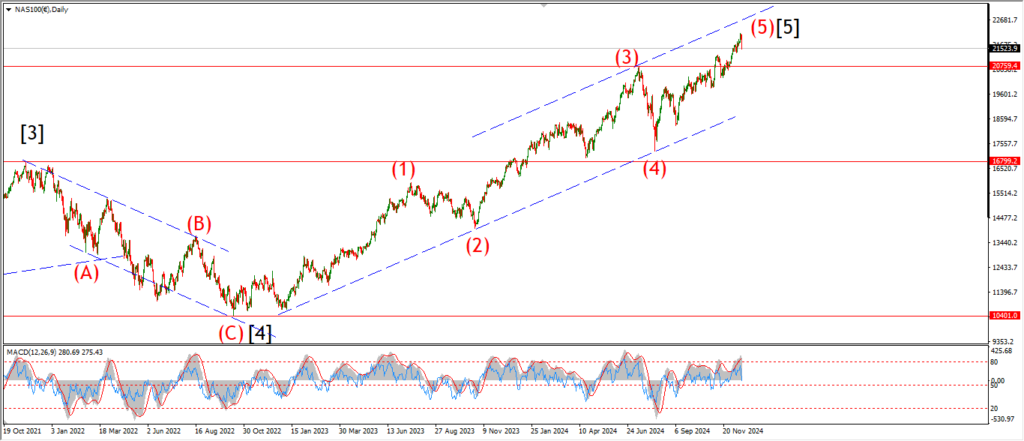

GBPUSD

GBPUSD 1hr.

Cable actually reached the upper trend channel line in and the choppy action continues.

I am sticking with the wave [ii] idea overall here.

And this new high is still wave (b) of [ii].

But the pattern is now confirmed as an expanded flat correction.

five waves down in wave (c) of [ii] will start before the end of this weeks trade.

And I am now thinking that wave (c) will drop closer to 1.2500 to complete wave [ii].

Tomorrow;

Watch for wave (b) to finally put a top in and then price should turn impulsively lower into wave (c) of [ii].

A break of 1.3000 again will signal wave (c) is underway.

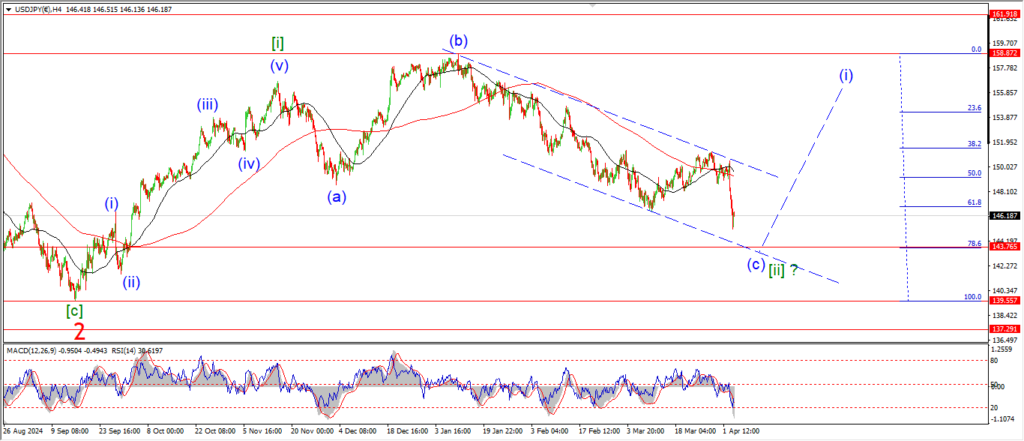

USDJPY.

USDJPY 1hr.

Take a look at the daily chart to start.

The overall idea here is that wave ‘3’ of (5) of [iii] up should rally significantly over the coming months once it actually does take over.

The current indecision here revolves around this wave [ii] low,

this count remains valid as long as the price holds above 139.55.

There is an alternate count on the daily chart involving a possible larger wave ‘2’ in red.

In this scenario wave ‘2’ will complete with a break below 139.52,

hit the lower channel line near 135.00 and then rally into wave ‘3’ will begin.

Tomorrow;

Watch for wave ‘i’ of (i) of [iii] to turn higher in an impulsive pattern.

A break of 146.00 again will be a solid vote in favor of this pattern.

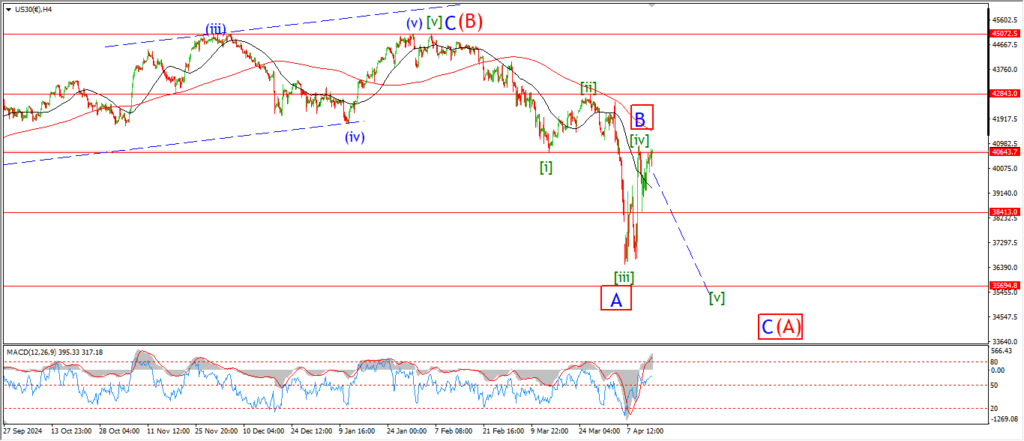

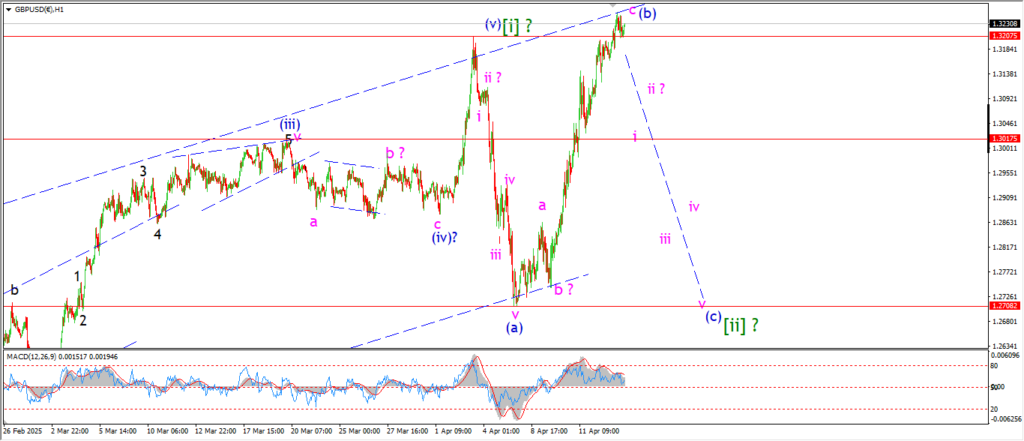

DOW JONES.

DOW 1hr.

The Dow is holding just below last weeks highs again today.

I am stuck between a rock and a hard place here regarding both counts.

I am tempted to just go with the alternate idea for wave ‘B’,

but as long as that high holds at wave [iv],

I can still regard this count as valid for wave [iv] stick with this wave count.

There is no major sigs of a roll over today although the market is turning lower this evening.

The market is rejecting that wave [iv] level again,

and the door remains open for a drop into wave (iii) of [v] again tonight.

Tomorrow;

If that wave [iv] high holds again tomorrow the action will really favor a sharp drop into wave (iii).

A break of the wave (i) low at 38440 will confirm the count.

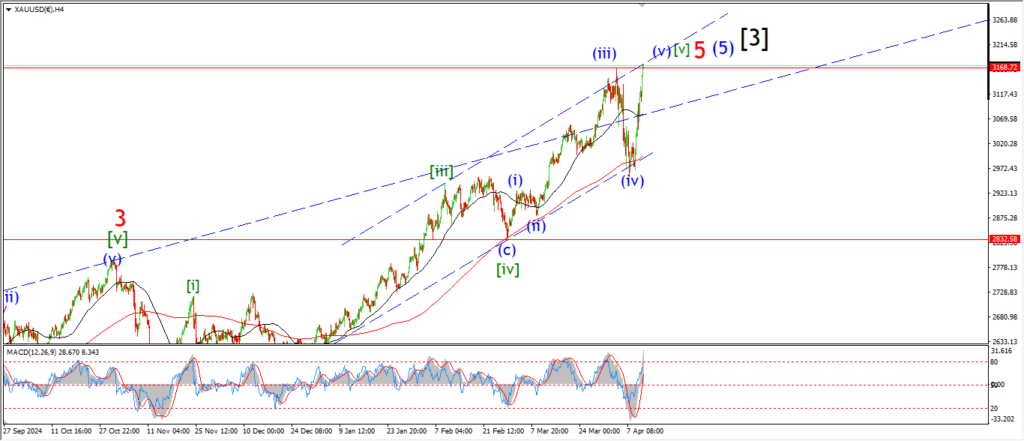

GOLD

GOLD 1hr.

Gold is holding just above the upper channel line tonight after a very tight and choppy trade today.

The decline into wave (i) has not been confirmed yet,

but a break of that wave (iii) high again at 3167 will favor the wave (i) idea.

And I would like to see a break of the 3100 again to complete wave (i).

It is a wait and see moment here as in many of the markets tonight.

the market depth is quite thin this week so far,

and that may be a hint at the possibility of another reversal.

Tomorrow;

Watch for wave (i) of [i] to begin before the end of this week.

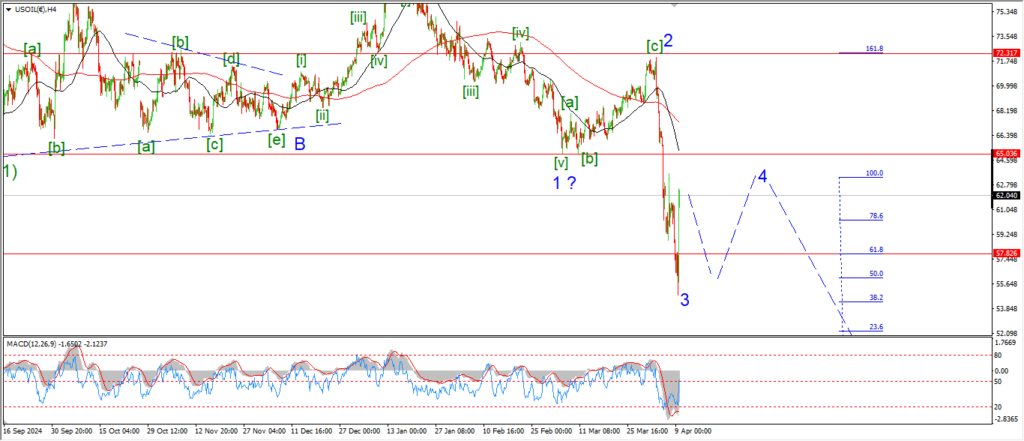

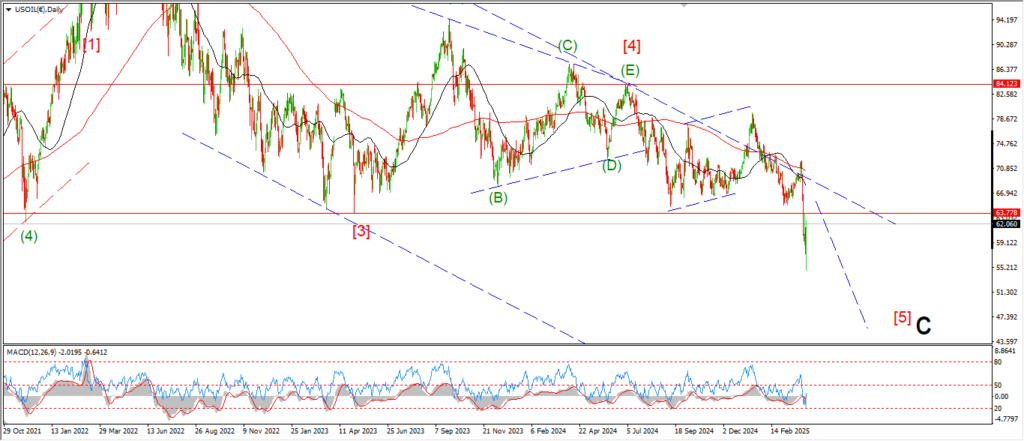

CRUDE OIL.

CRUDE OIL 1hr.

The drop into wave (c) is still in play today although wave (c) is not yet confirmed.

There is a lower high in place for wave ‘ii’,

and the price did turn lower off that level again this morning.

So wave ‘iii’ of (c) should continue lower towards 58.00 again in this scenario.

If the price hits the lower channel line again in wave (c) that will bring us close to 57.00 to complete wave [b].

Tomorrow;

Watch for wave (c) to continue into the minimum target at 58.42.

S&P 500.

S&P 500 1hr

I am stepping up the wave count by one degree tonight.

So the recent high takes the wave [iv] label now,

and wave [v] should get underway from here.

Wave (ii) of [v] is holding below that wave [iv] high.

So that leaves wave (iii) of [v] to pull the price lower over the coming few days.

If this idea is correct,

then wave (iii) will do most of the work to reach down into support at 4800.

Tomorrow;

Lets just see if the market complies tomorrow and wave (iii) of [v] takes us lower.

the wave [iv] high must hold in this scenario.

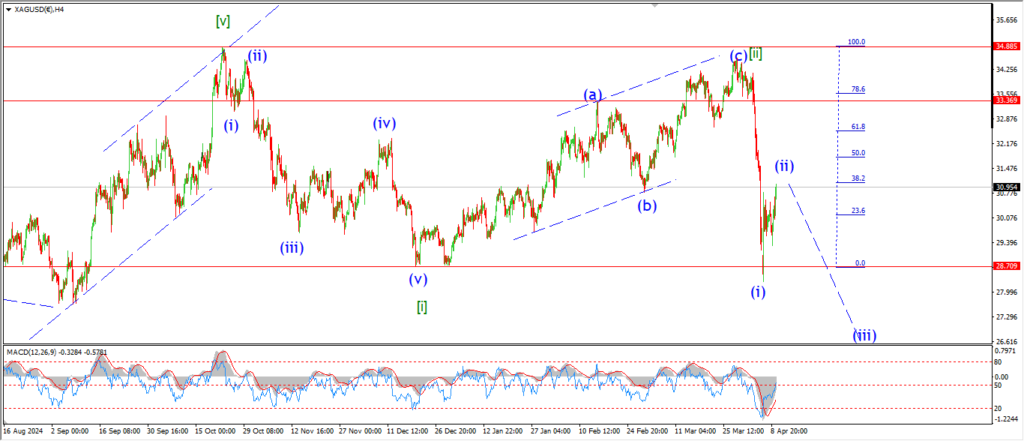

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

The silver rally has stalled completely this week.

The price is nailed to the 62% retracement level all day today,

and this comes after an extreme high and reversal in momentum late last week.

I want to see wave ‘i’ of (iii) take over from here.

There is two trading days left this week,

that is enough time to establish a reversal into wave (iii).

Tomorrow;

Lets see if the narrow range a momentum reversal results in a price reversal as the wave count suggests.

Wave ‘i’ down should break 30.00 again.

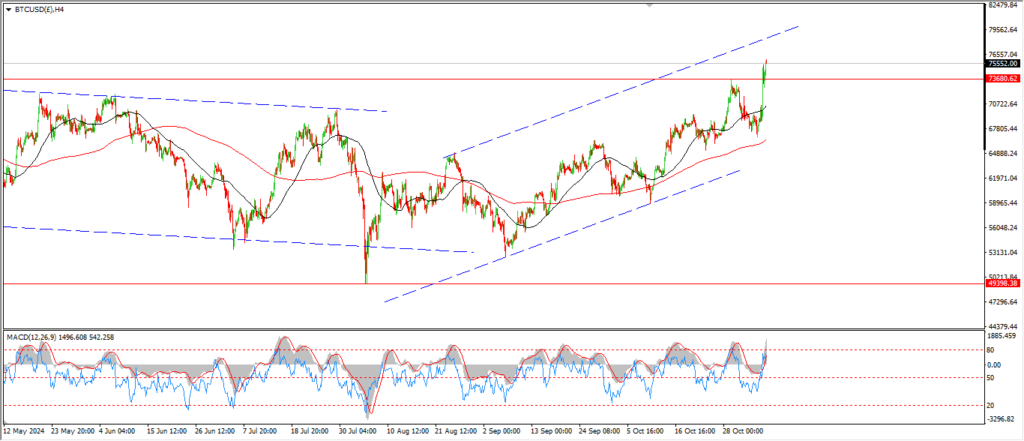

BITCOIN

BITCOIN 1hr.

….

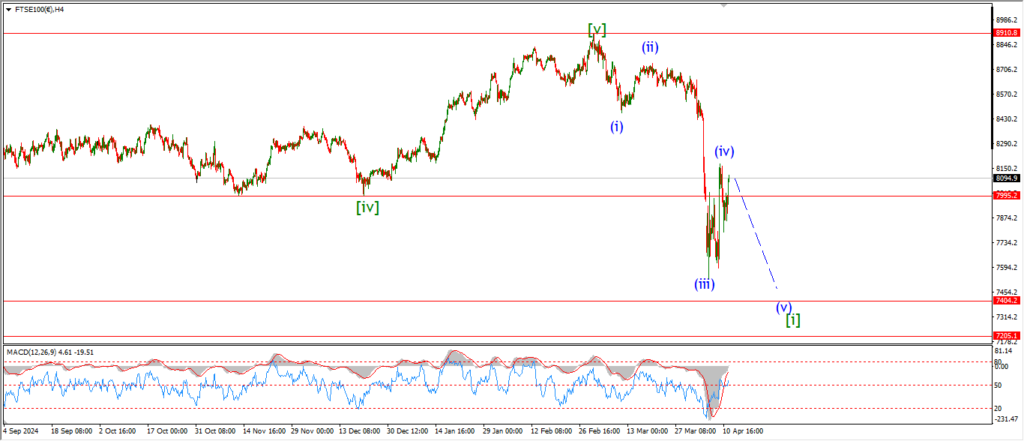

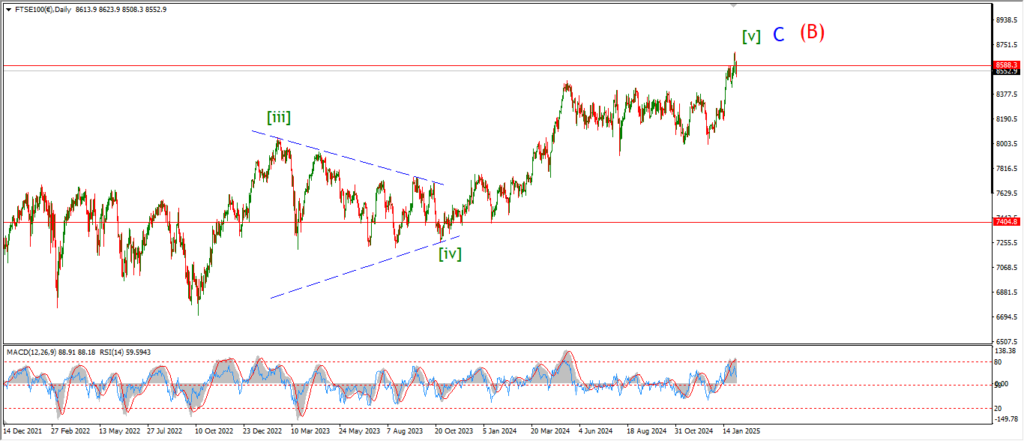

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

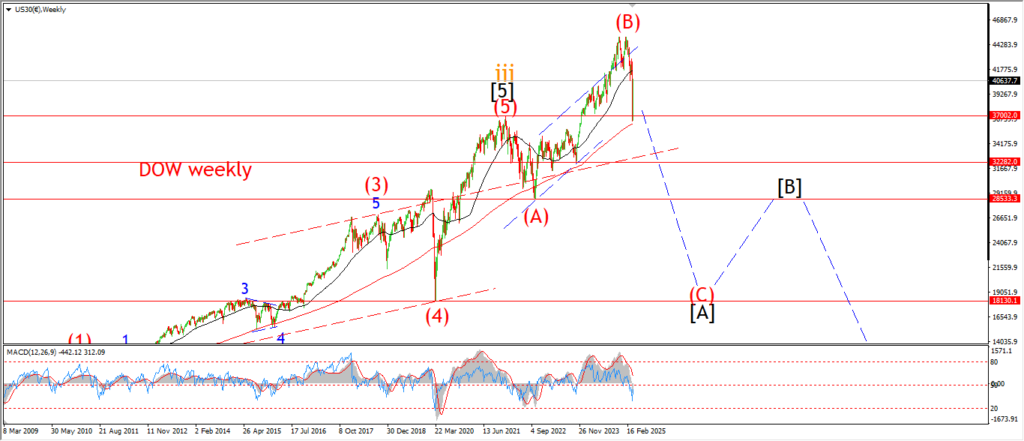

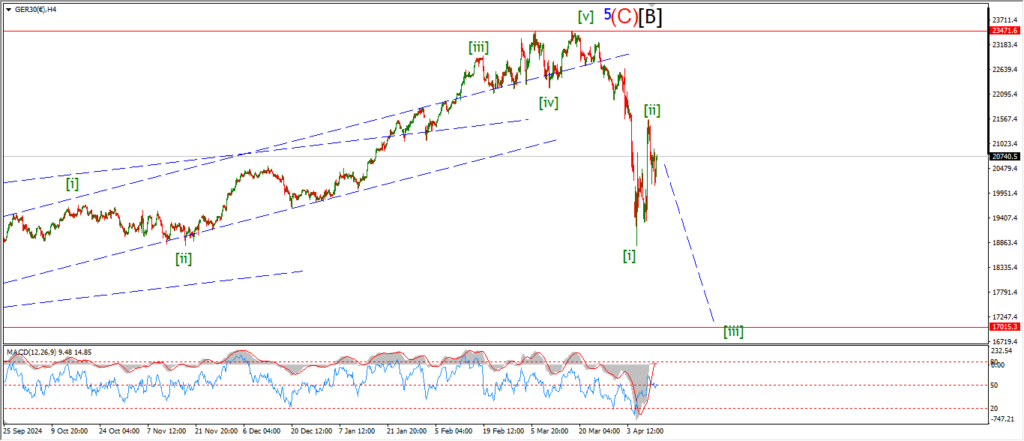

DAX.

DAX 1hr

….

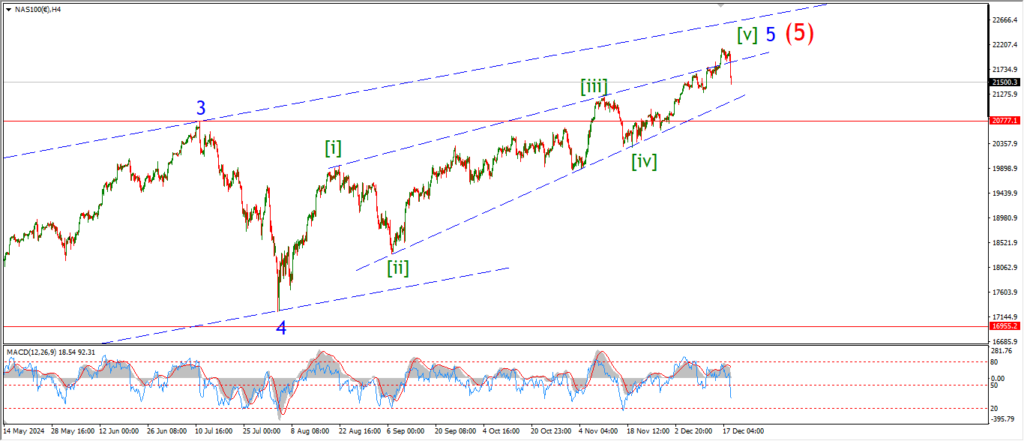

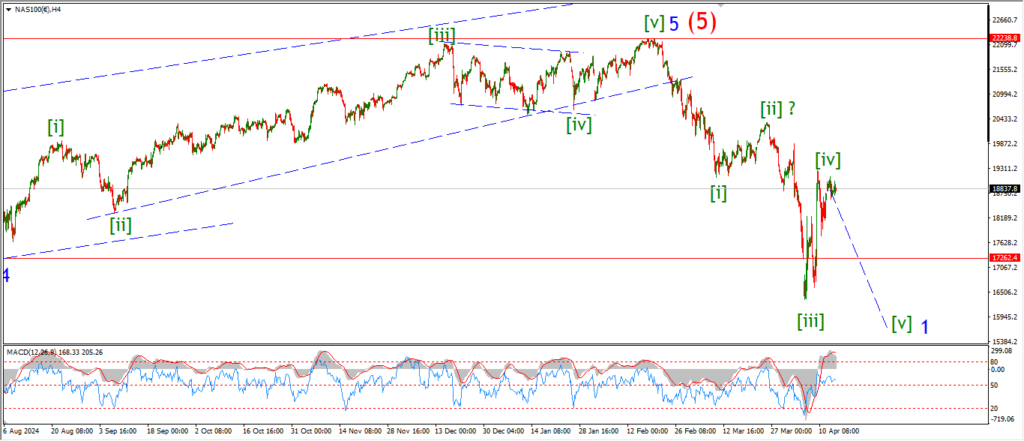

NASDAQ 100.

NASDAQ 1hr

….