Good evening folks and the Lord’s blessings to you.

EURUSD

EURUSD 1hr.

EURUSD is holding above the recent lows at 1.0733 again today but the rally does not look impulsive just yet.

There is a three wave pattern in place off that wave ‘iv’ low at the moment.

this does not fit the impulsive idea as you well know.

So I am aware that the rally in wave ‘v’ is still on shaky ground.

The only real confirmation comes when we see a break above the wave ‘iii’ high at 1.0954.

That is the minimum target for wave ‘v’.

Monday;

Watch for wave ‘iv’ to hold at 1.0733 and wave ‘iv’ should continue higher to break 1.0954 at a minimum.

GBPUSD

GBPUSD 1hr.

Cable is definitely moving in a corrective pattern this week,

that much I am sure of!

The action is basically flat on the session,

and the overall wave (iv) correction remains the best bet at the moment.

Wave ‘c’ down should fall into above 1.2840 to complete,

and then I will look for a rally again in wave (v) as shown.

Monday;

Watch for wave ‘b’ to hold at 1.2990.

Wave ‘c’ should continue lower to hit 1.2886.

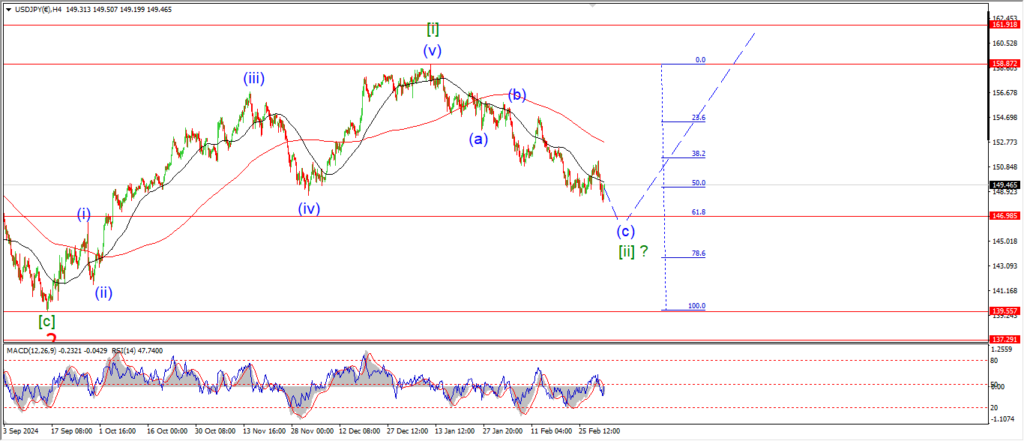

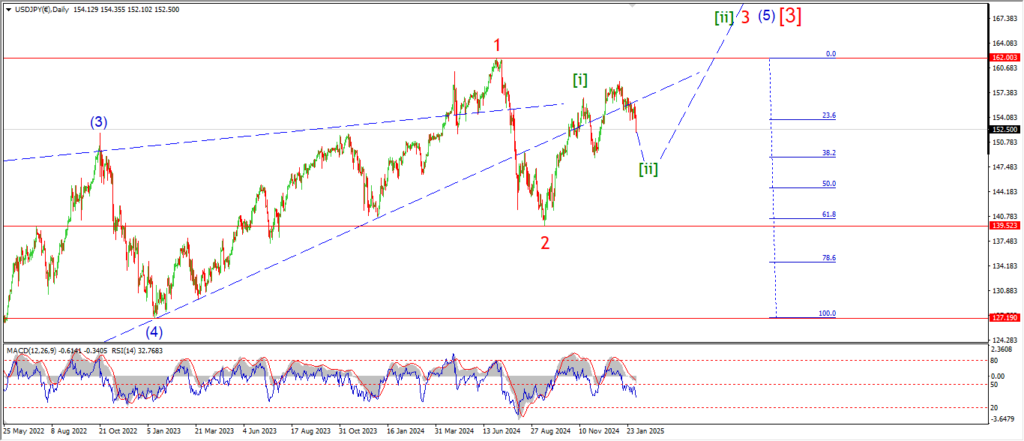

USDJPY.

USDJPY 1hr.

USDJPY turned lower off the wave ‘b’ high today which is in line with the wave ‘ii’ count again.

Wave ‘c’ of ‘ii’ is well underway now,

and the minimum target for wave ‘c’ lies at 149.55.

The 50% retracement lies at 148.76.

Wave ‘ii’ should complete in that range somewhere.

That should complete an expanded flat correction in wave ‘ii’.

And then wave ‘iii’ up needs to begin.

Monday;

Watch for wave ‘c’ of ‘ii’ to complete with a break of 149.50.

And then I will look for a turn higher into wave ‘iii’ up.

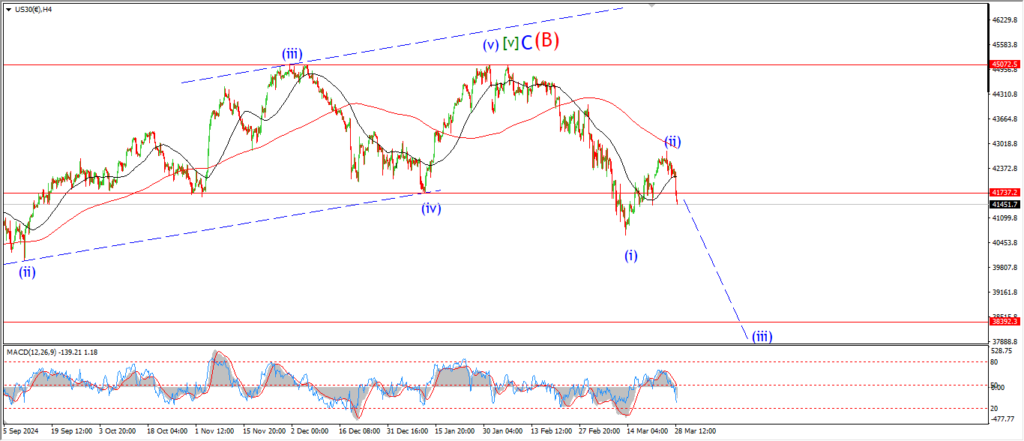

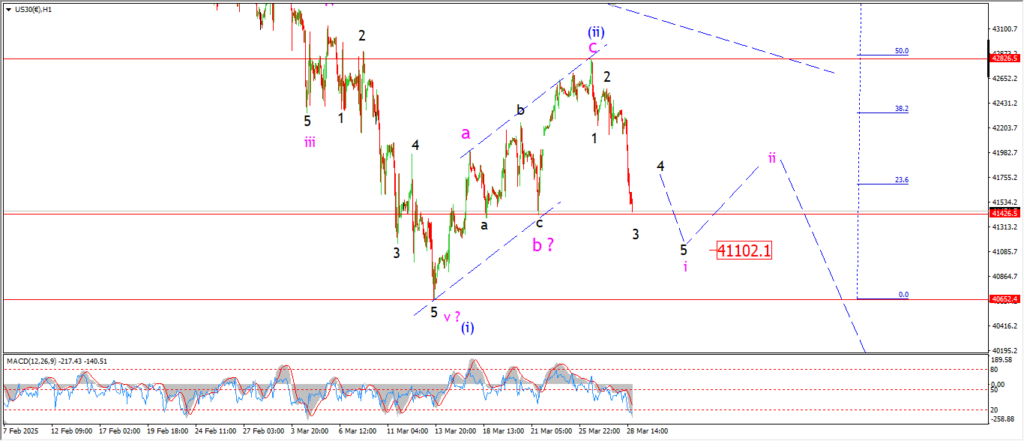

DOW JONES.

DOW 1hr.

Todays action is a solid vote in favor of the main wave count for wave (ii).

This weeks action in general has been in lockstep with the pattern.

So something is brewing here!

The market retraced in three waves this week to hit the 50% retracement level of wave (i).

The DOW has dropped sharply off that wave (ii) high.

And we are close to hitting the wave ‘b’ target level at 41420 now.

This looks very must like an impulsive decline in wave ‘i’ of (iii).

and that is how I am labelling this action now.

If this pattern is correct,

then we can expect the market to move into another acceleration phase lower over the coming weeks.

Wave ‘iii’ of (iii) will be the point where people will start to panic a little,

and that wave can easily hit a low near 38000 again before taking a break.

So things are about to get bumpy in this scenario.

Monday;

Watch for wave ‘i’ of (iii) to complete with a break of the wave ‘b’ low at 41420.

Wave ‘ii’ should correct higher for the following few sessions.

and then its down down down we go – if I am right!

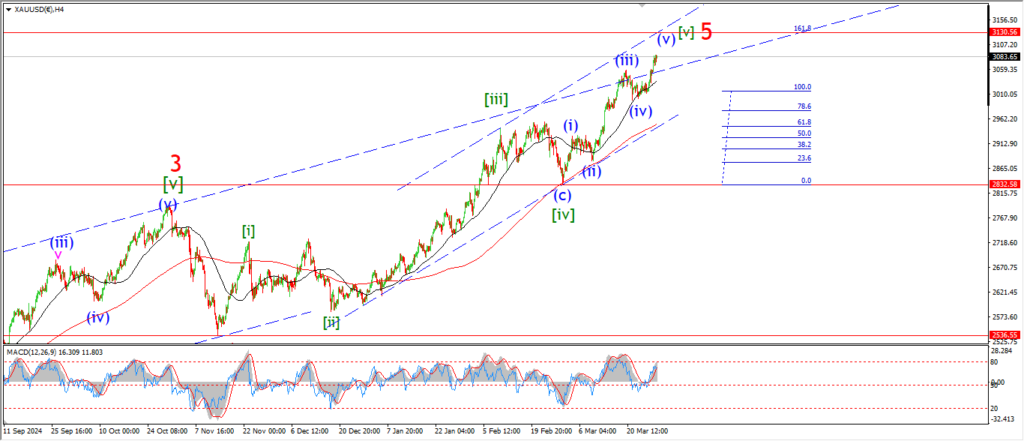

GOLD

GOLD 1hr.

Ok,

I think gold has pulled forward the timeline of this pattern drastically this week.

I was looking for a more relaxed wave (iv) correction,

and then maybe next week we get started in wave (v).

But this market is moving at break neck speed here.

Wave (iv) seems to be complete now,

and wave (v) has burst higher again.

The internal pattern of wave [v] green is shown on the 4hr chart.

And the price is very close to hitting the upper channel line in wave (v) of [v] even now.

If wave [v] green reaches the 162% extension of wave [i],

that gives a target at 3130 for the overall pattern.

Lets take note here.

this rally in wave (v) blue is about to top out a rally at five degrees of trend.

We are looking at a top forming in wave (v) of [v] of ‘5’ of (5) of [3].

And There is every chance that the correction into wave [4] will take the price down to the previous fourth wave low at 1615 over the coming year.

All I am saying here is to exercise some caution here.

that’s all.

Monday;

Watch for wave (v) to make its way to 3113.

this is where wave (v) reaches equality with wave (i) blue.

The higher target lies at 3130.

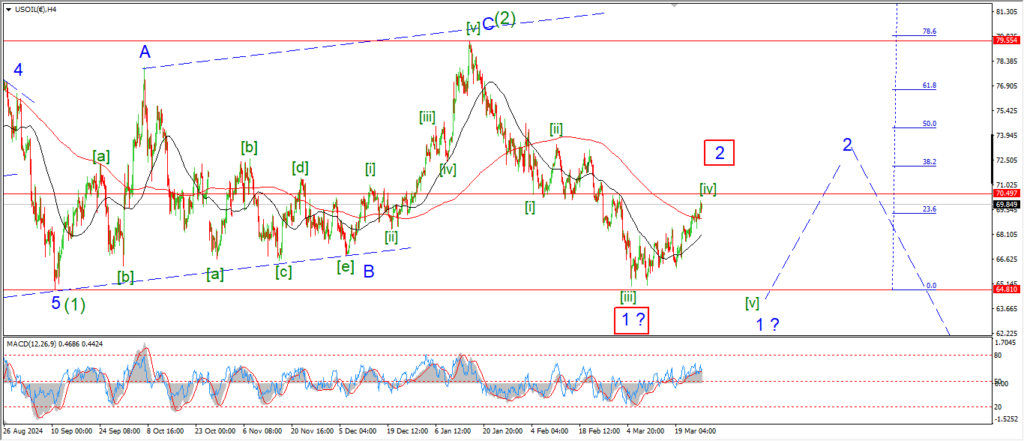

CRUDE OIL.

CRUDE OIL 1hr.

Crude has turned lower today but the price ahs only traced out a three wave decline off the top so far.

So this count for wave [iv] is still a little vulnerable.

The alternate count in wave ‘2’ blue is shown on the 4hr chart.

if the price turns higher to break 70.46 that will trigger the alternate count.

In both cases,

then next big move will be down in either wave (v) or wave ‘3’.

And both patterns can bring the price back below 65.00 pretty quickly.

Tomorrow;

Watch for wave (i) of [v] to continue lower in five waves to break 68.00 at a minimum.

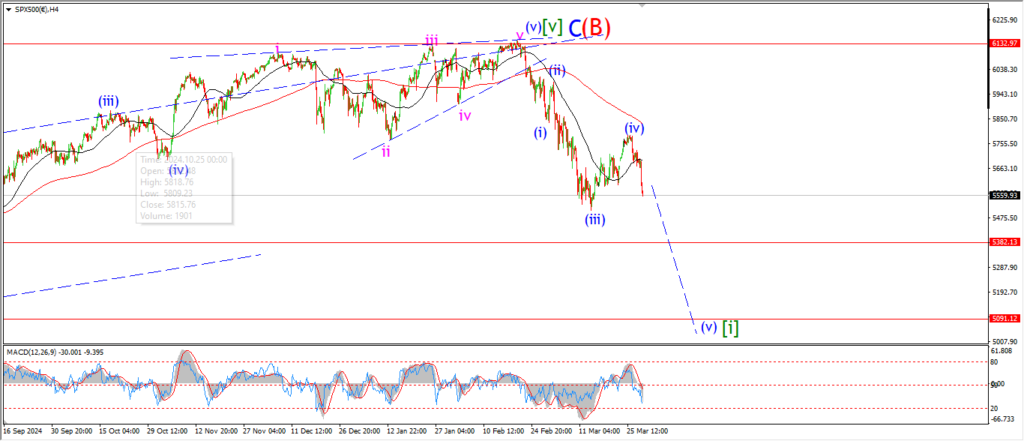

S&P 500.

S&P 500 1hr

The S&P took a sharp step lower today and the price is close to hitting the minimum target for wave (v) as I write.

I am suggesting that todays drop is part of wave ‘i’ of (v),

and in this scenario,

wave (v) has much further to go next week.

I am beginning to think that this pattern is operating at one degree higher after this weeks action,

but I will deal with that more in depth next week if the need arises.

for the moment,

we have a fifth wave decline now underway and this should take up most of next weeks action.

Monday;

Watch for wave ‘i’ to complete near 5500 as shown.

wave ‘ii’ should then correct higher in three waves towards 5650 again.

If the price accelerates lower after breaking the wave (iii) low that will signal something different is going on here,

possibly a larger third wave is beginning in that case.

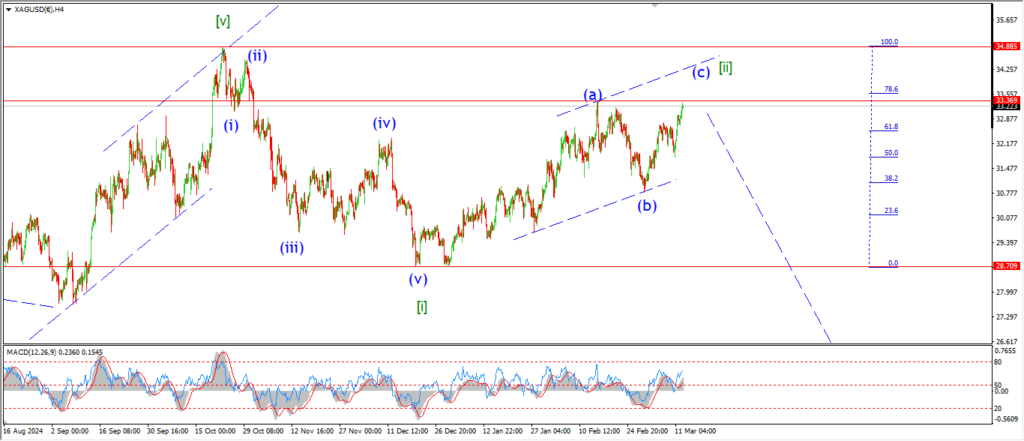

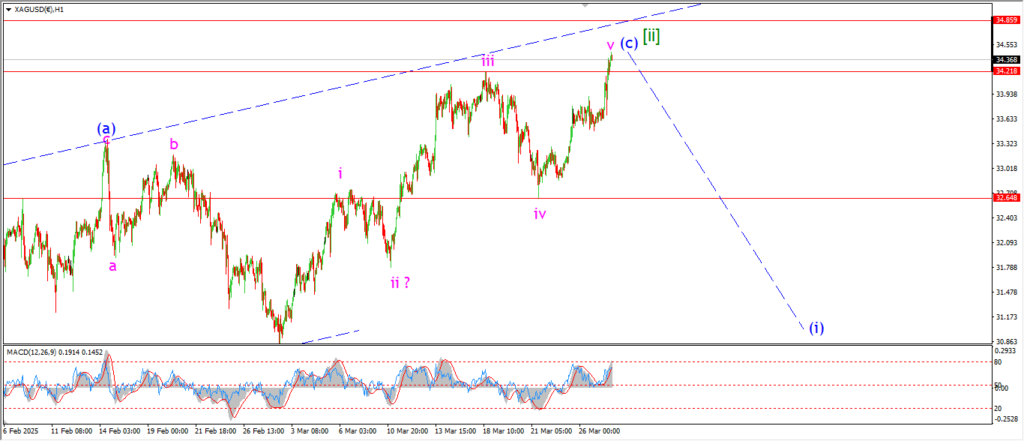

SILVER.

SILVER 1hr

The count in silver has been saved by the bell tonight!

The price came close to breaking that invalidation line at 34.85 this week,

but right now we have a failure below that level.

I am not going to get comfortable here because this move has not proved the main count at all.

But at least it helps it live to fight another day.

Monday;

Watch for wave ‘i’ of (i) to fall into the wave ‘iv’ low at 32.64 in five waves.

If that happens,

then I will be a little more confident that wave [iii] is getting going.

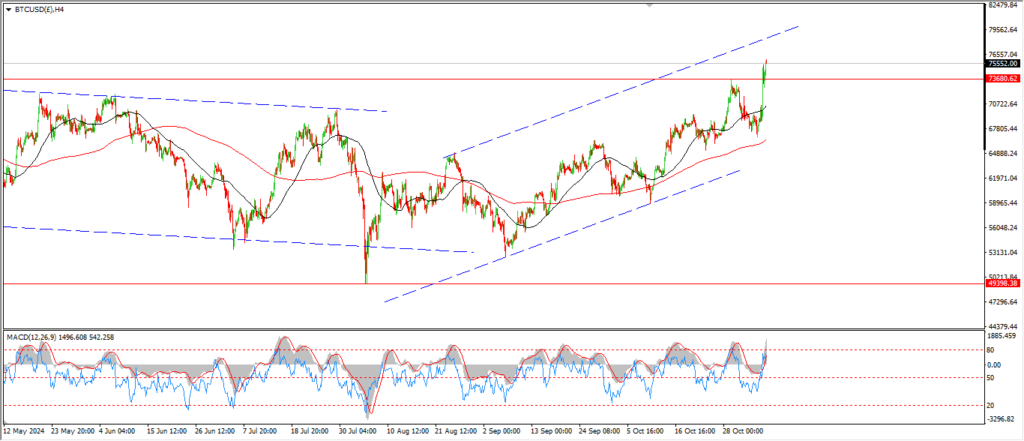

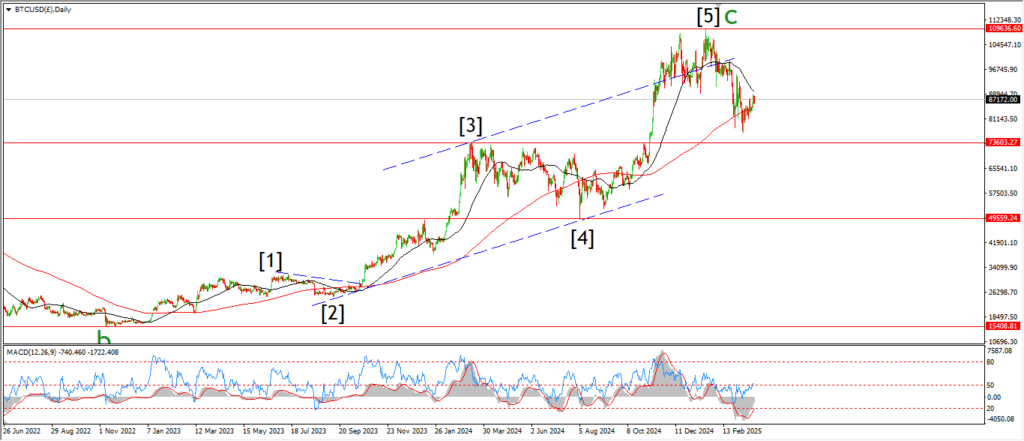

BITCOIN

BITCOIN 1hr.

….

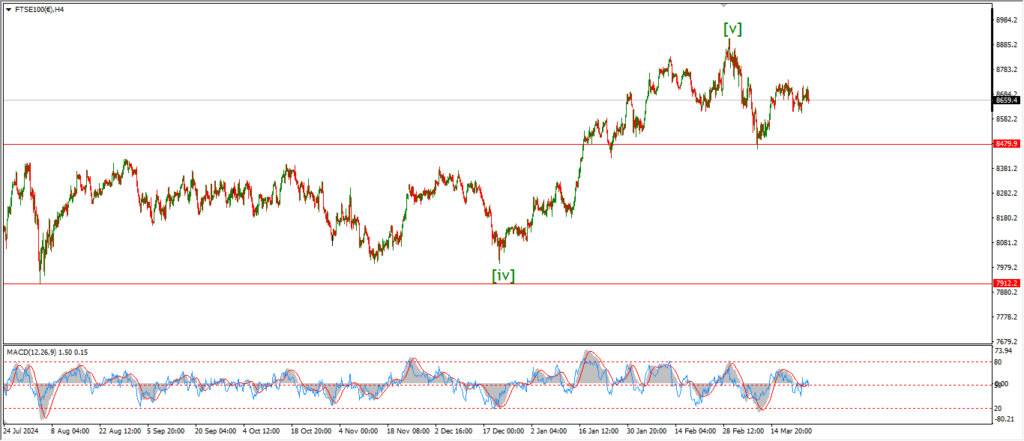

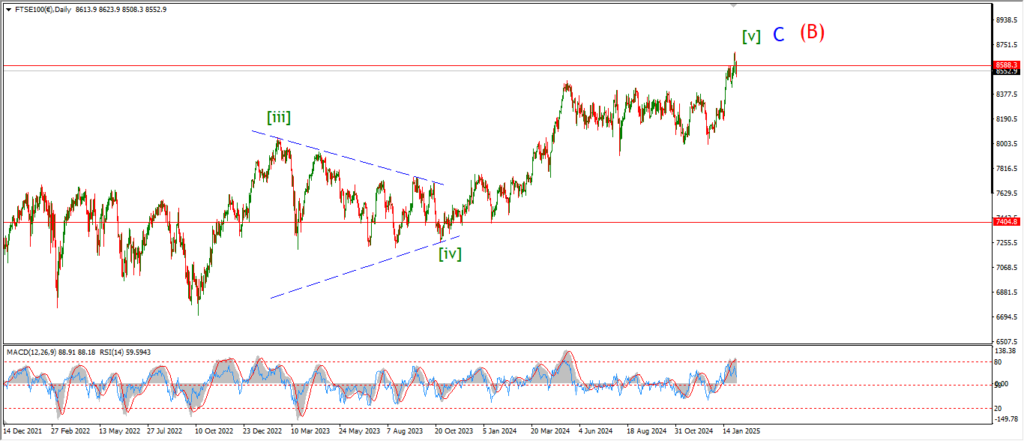

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

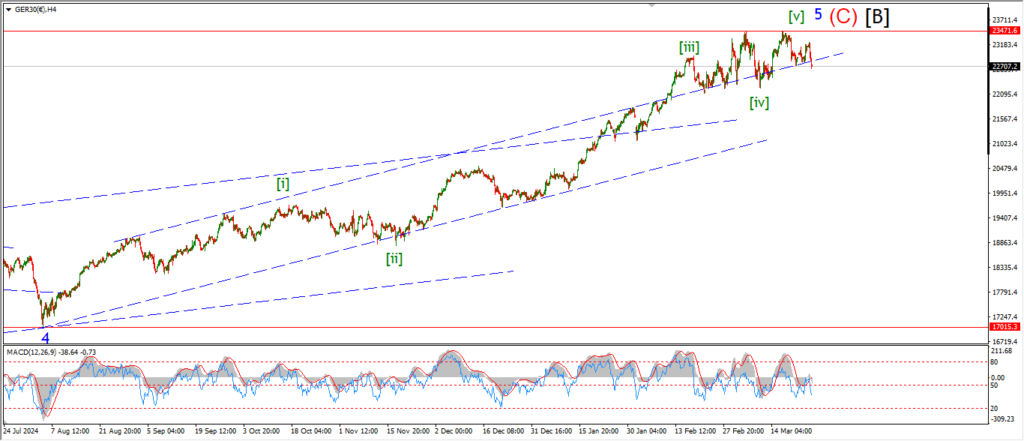

DAX.

DAX 1hr

….

NASDAQ 100.

NASDAQ 1hr

….