Good evening folks and the Lord’s blessings to you.

EURUSD

EURUSD 1hr.

EURUSD is retreating off the weekly high today but I have switched to that alternate count anyway.

The correction in wave (iv) is now viewed as a complex three wave pattern.

Wave ‘c’ of (iv) is tracing out an ending diagonal in five waves.

and WE should see a top in wave ‘c’ of (iv) near 1.0600 in this scenario.

Monday;

Watch for wave ‘5’ of ‘c’ of (iv) to complete this correction and then turn down into wave (v) again.

GBPUSD

GBPUSD 1hr.

Cable dropped off the top in a corrective manner today.

Wave ‘iii’ really has not achieved the extension I would prefer.

But wave ‘iii’ has high a new high above the equality level with wave ‘i’.

I would prefer to see another move higher to complete wave ‘iii’ near 1.2800.

And then a correction in wave ‘iv’ can begin.

So I am hoping that will happen on Monday to simplify this pattern.

Monday;

Watch for wave ‘5’ of ‘iii’ to push up to the 1.2800 area to complete this rally.

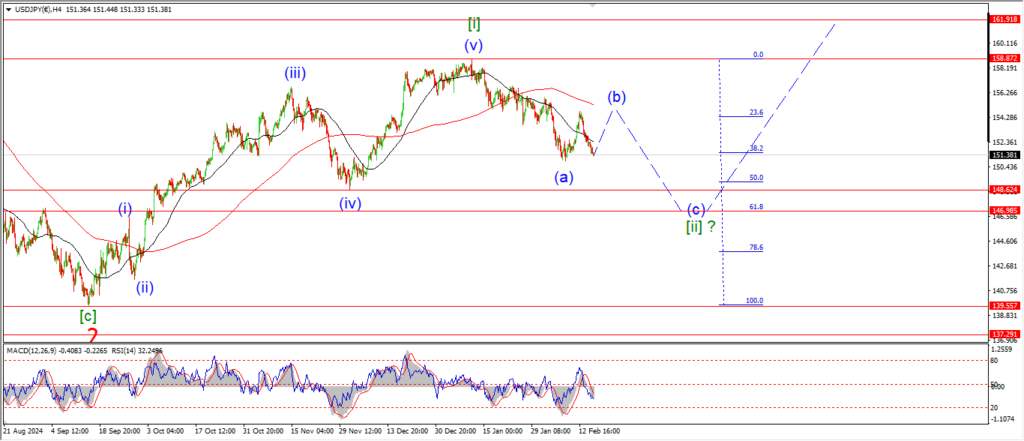

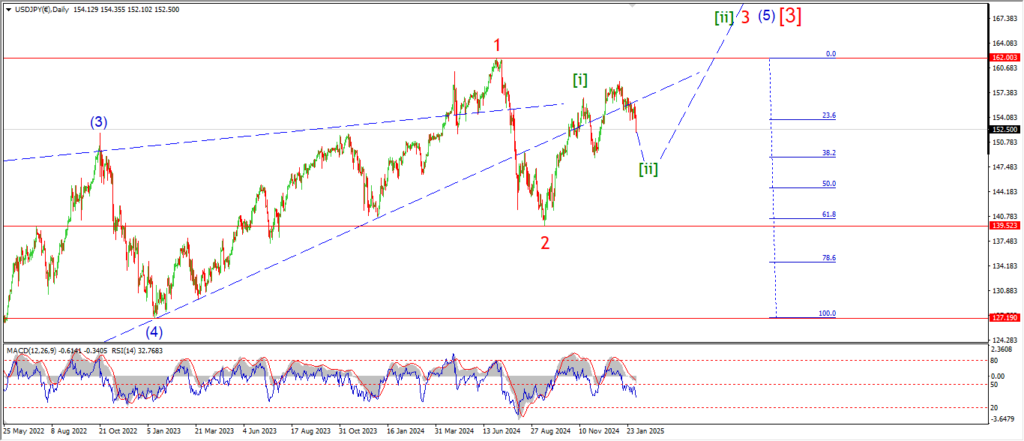

USDJPY.

USDJPY 1hr.

USDJPY has turned lower today and this looks like a drop in wave ‘v’ of (c) now.

Wave [ii] is expected to hit the 147.00 area to complete.

that will bring wave [ii] to the 62% retracement level of wave [i].

And from there I will look for a turn higher into wave (i) of [iii] again.

If the turn fails to happen,

then I will look at possible alternates.

Although I do favor the bullish side on the USD now with the pattern being a little clearer in favor of the USD.

Monday;

Watch for wave (c) of [ii] to complete five waves down near 147.00 over the coming few days.

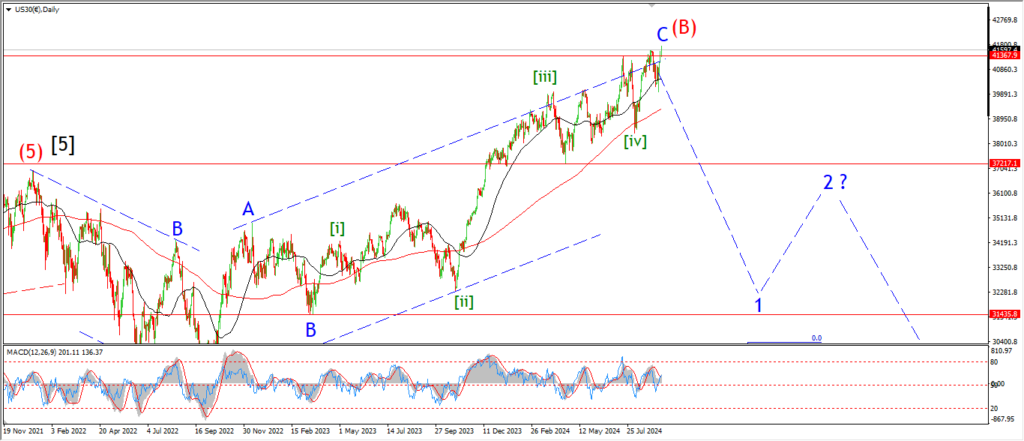

DOW JONES.

DOW 1hr.

Well,

The main count has been holding on by the skin of its teeth over the last few weeks,

but the action today is leaning back in favor of the main count.

On the 4hr chart the price has sliced down through the 200MA with ease.

And now we will see if that level becomes resistance to any further action.

Obviously next week I will be looking for a drop into the first support at the previous wave (iv) low.

This level lies at 41700.

And now after todays momentum switch,

that level looks achievable to be honest!

Monday;

Watch for a continued decline into support at 41700 in five waves to signal another chance at a major reversal.

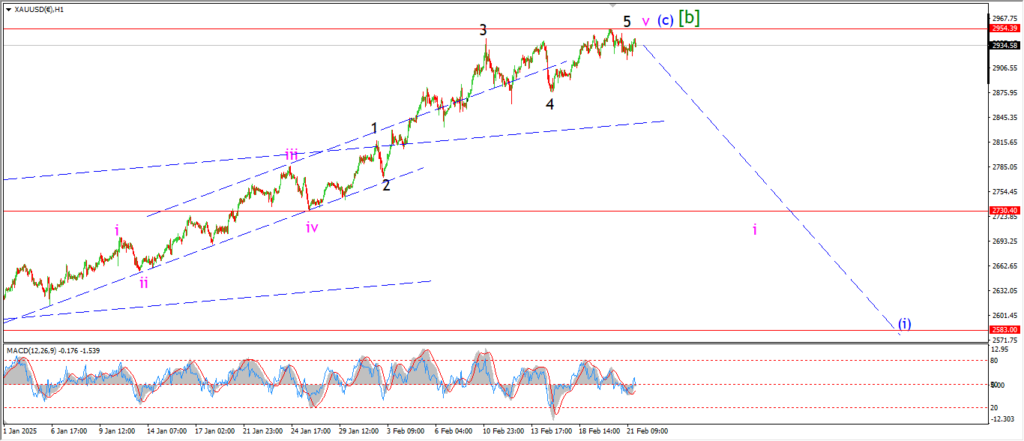

GOLD

GOLD 1hr.

Gold has gone completely quiet this week after completing a triple top.

On the 4hr chart I am looking at a momentum burnout after an extreme high on the 4hr chart.

This is not a certainty,

but it is the type of setup you might expect at a turning point.

the pattern in gold in flux at the moment.

Wave ‘v’ of (c) is not ideal.

The pattern is extended for sure,

But I am not convinced by that wave ‘4’ running flat traced out this week.

A sharp drop in five waves will clear things up in my mind.

And 2730 is the level to watch in that regard.

Monday;

Watch for a top to hold at wave ‘v’ of (c) of [b].

and a drop in five waves to form wave ‘i’ down.

CRUDE OIL.

CRUDE OIL 1hr.

Crude has turned lower with a nice impulsive looking move today.

this action suggests wave [ii] is complete at yesterdays highs.

the pattern for wave [ii] is different,

but the result is the same,

wave (i) of [iii] has dropped into support again with a nice internal pattern.

Tomorrow;

Watch for wave (i) down to complete below 70.28.

Wave (ii) should form a lower high in the second half of next week.

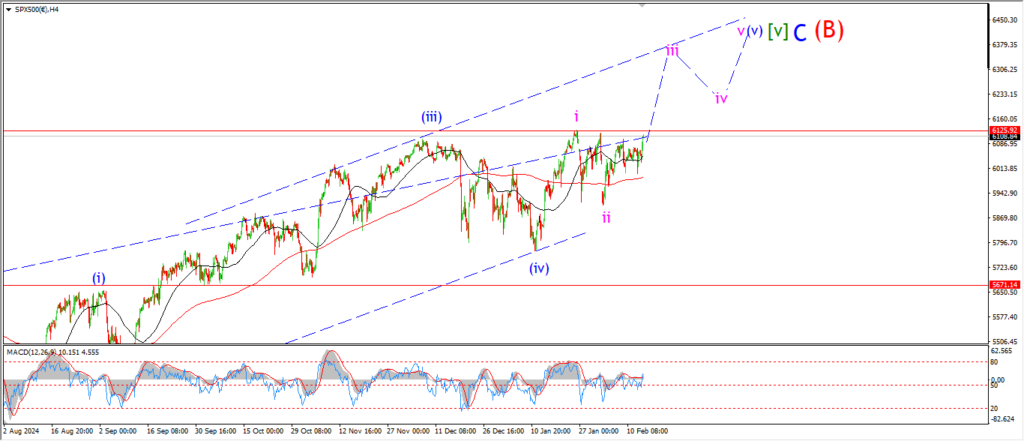

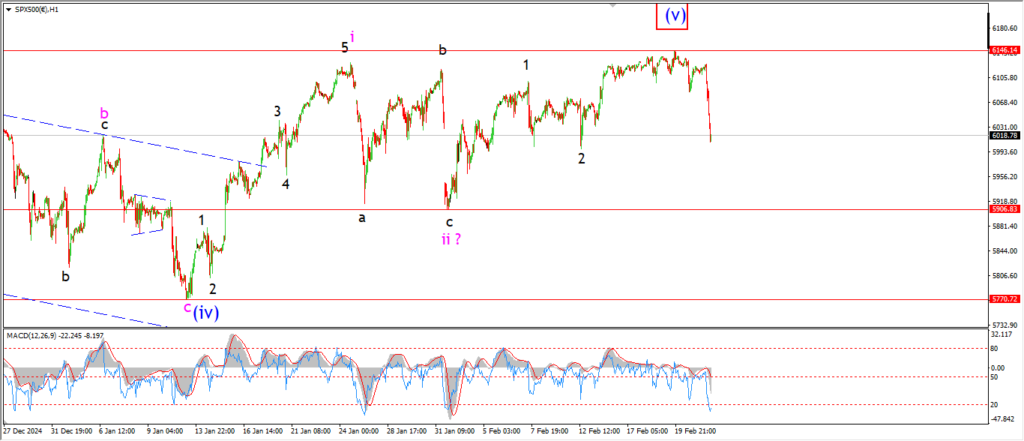

S&P 500.

S&P 500 1hr

The market is again showing signs of cracking off that new high formed this week.

I am not nailing my colors to the mast after one solid down day.

But I will be looking for an impulsive follow through next week to break support at 5770.

If that happens,

then we are on course for a major top again.

The main count showing wave ‘i’ and ‘ii’ is still valid until we see a break of 5900,

so that is the first level of interest next week.

Monday;

Let’s see if the follow through to the downside does come.

5770 is the first support.

And a break of that level will increase the odd’s of a topping pattern forming again.

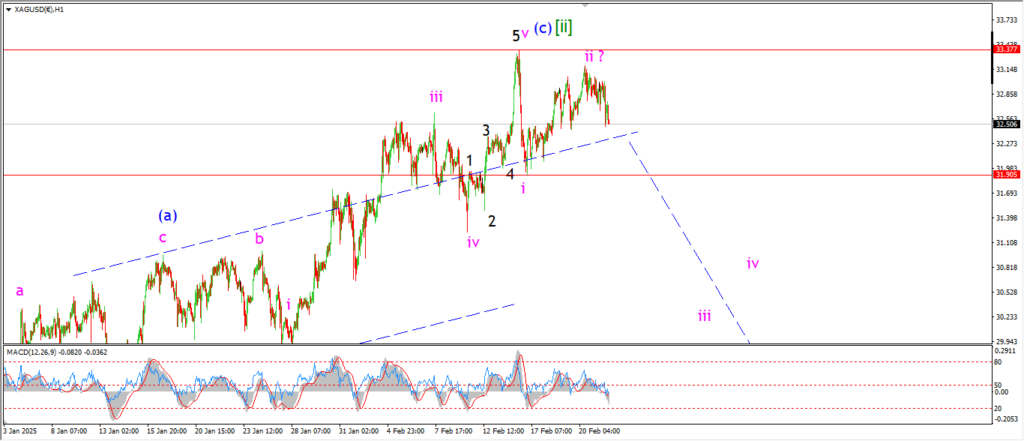

SILVER.

SILVER 1hr

I am not happy with the form of the decline today.

It looks very choppy to be honest.

And I would expect an impulsive decline would drop below 31.90 again with ease.

That said,

the price has stopped short of breaking to a new high.

And that wave ‘i’ decline has the perfect form.

So the idea of a top is still in play here.

Monday;

If we see a follow through again to break 31.90 that will signal wave ‘iii’ is underway.

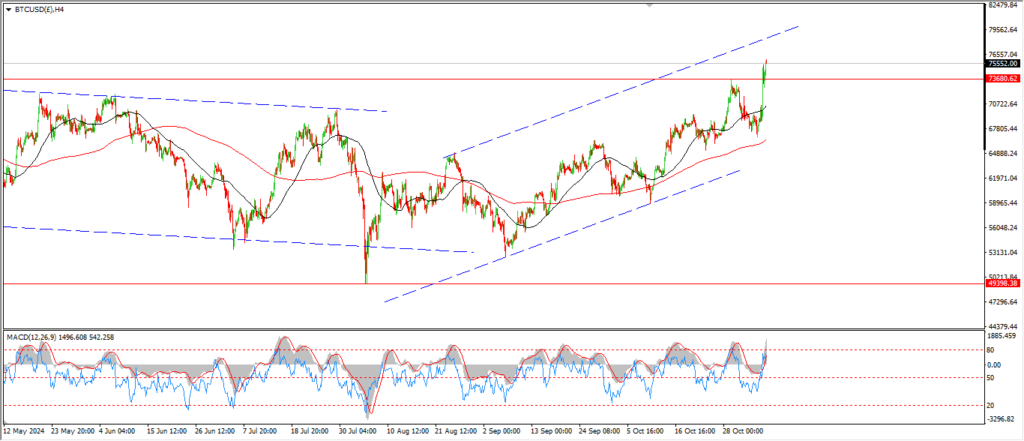

BITCOIN

BITCOIN 1hr.

….

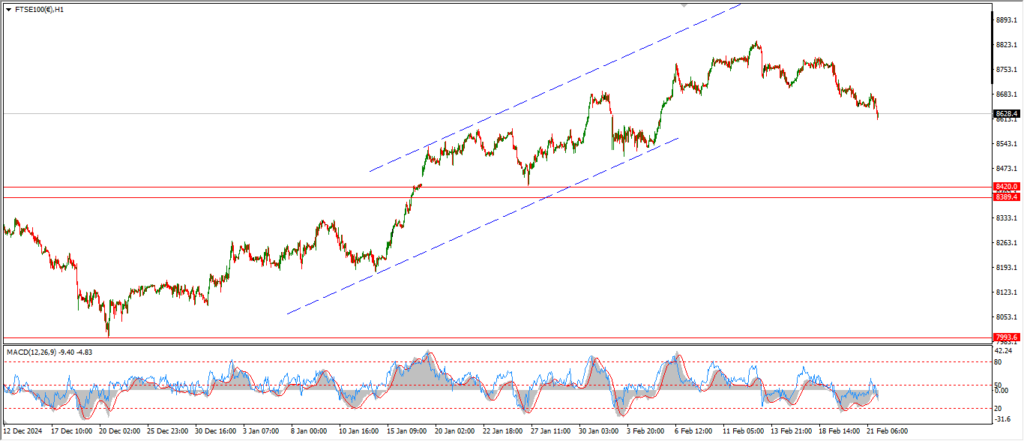

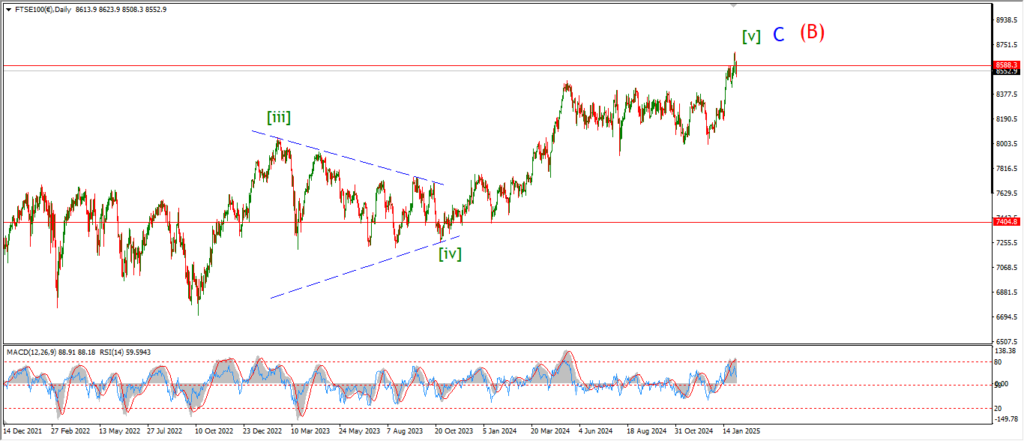

FTSE 100.

FTSE 100 1hr.

FTSE 100 4hr.

FTSE 100 daily.

….

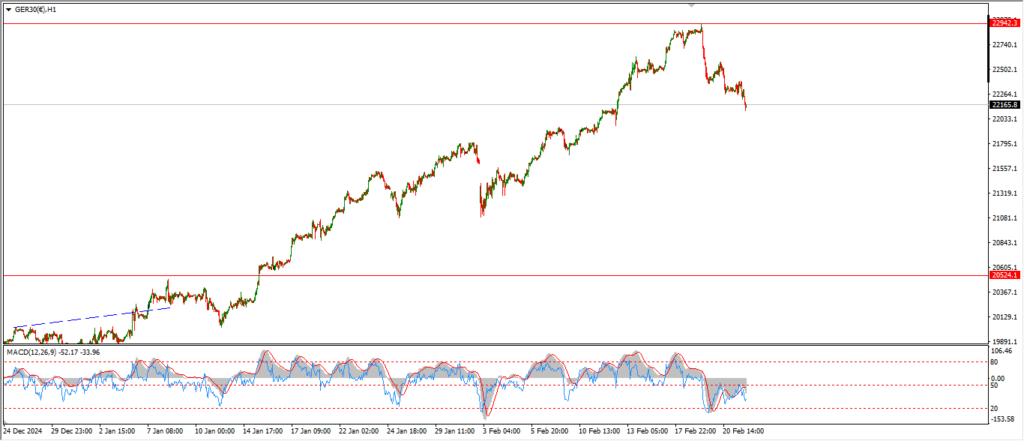

DAX.

DAX 1hr

….

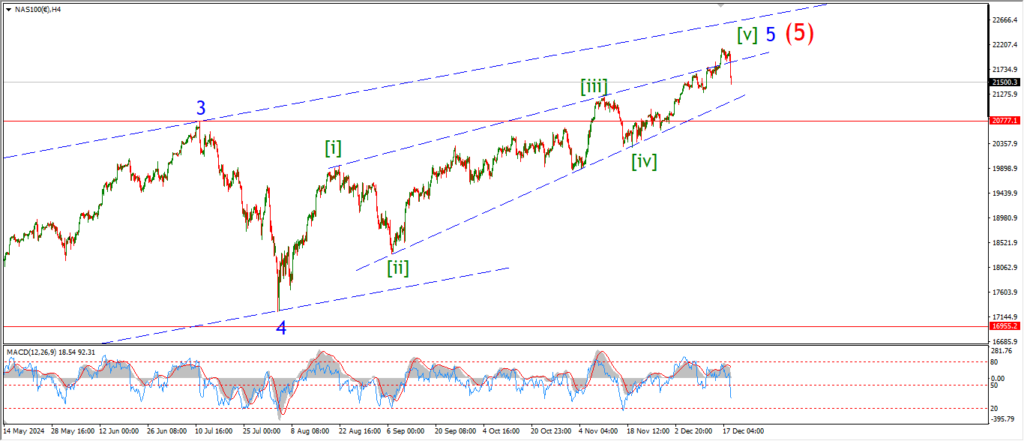

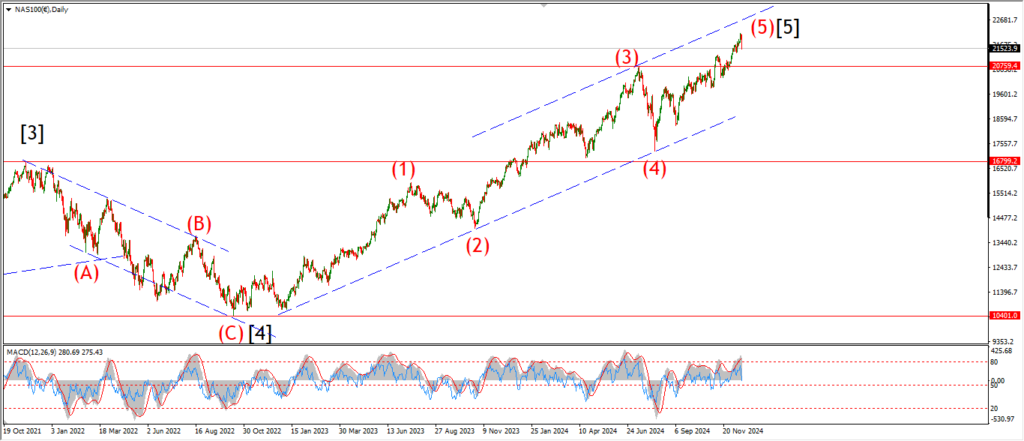

NASDAQ 100.

NASDAQ 1hr

….