Good evening folks and the Lord’s blessings to you.

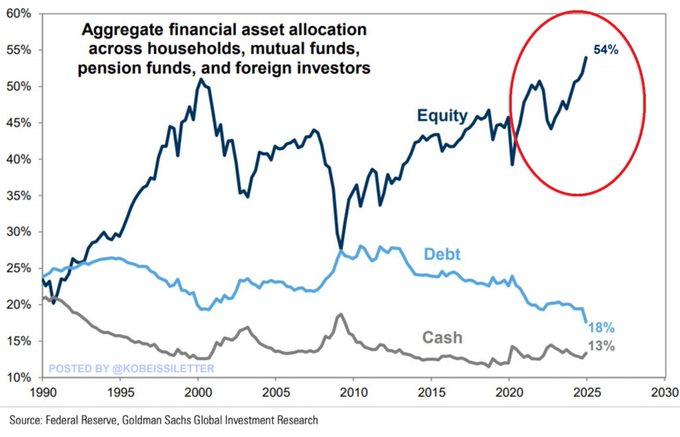

A turning point in bonds??

A wild market at the extremes of its overextension!

Looks like a struggling economy to me, recession already here.

EURUSD.

EURUSD 1hr.

EURUSD has definitely in a corrective move for the last few days.

the price is holding a higher low in wave ‘ii’,

and this action adds some weight to the reversal idea now.

I am not sure that wave ‘ii’ is complete yet as the internal pattern of wave ‘ii’ is not a clear three wave form.

so I am allowing for another drop into wave ‘c’ of ‘ii’ on Monday.

Monday;

watch for wave ‘ii’ to complete a higher low as shown.

And from there a break above 1.0354 to signal wave ‘iii’ has begun.

GBPUSD

GBPUSD 1hr.

The action in cable is still quite corrective looking today.

so I am looking at a contracting triangle for wave ‘4’ of ‘iii’ now.

This count still requires a further drop into wave ‘5’ of ‘iii’ next week.

So I will look for that on Monday to complete this leg and then a turn higher into wave ‘iv’ over the coming days.

Monday;

Watch for wave ‘iii’ to complete a five wave pattern as shown.

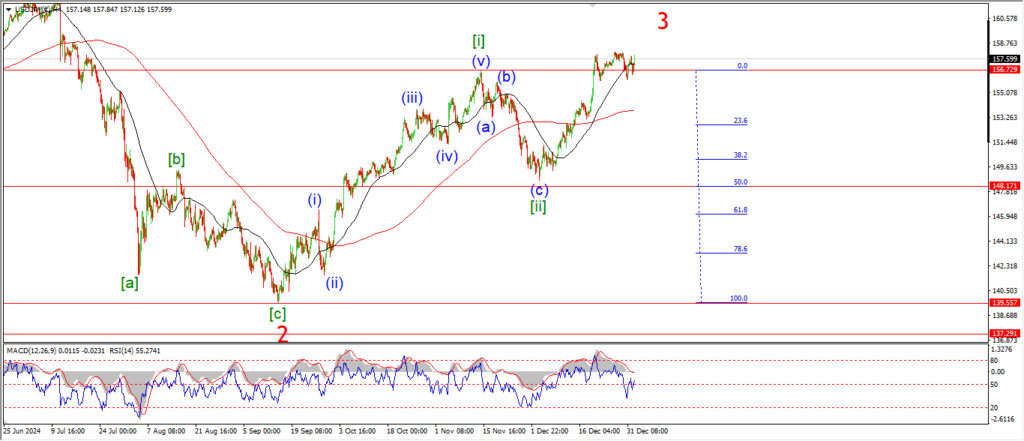

USDJPY.

USDJPY 1hr.

USDJPY has bounced today which indicates a possible end to the correction in wave (ii),

but we are not there yet!

Todays move is in the right direction but it’s just not enough to call wave ‘i’ of (iii) underway.

If we see a break back above the wave (i) high at 157.90 that will do the trick.

And from there I will look for wave ‘ii’ to build a bullish higher low.

Monday;

Watch for wave ‘i’ of (iii) to continue up to 157.90 and then from there wave ‘ii’ should start.

154.98 must hold at wave (ii) blue.

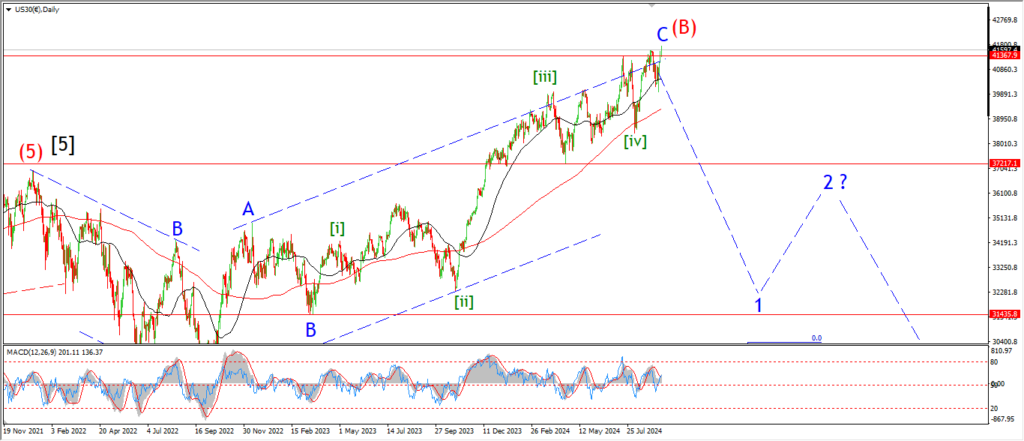

DOW JONES.

DOW 1hr.

After a solid rally this week we now have a five waves up in wave ‘c’ of (ii) completed at the highs.

the market has now completed the expanded flat correction in wave (ii) blue.

the high of the session hit the 50% retracement level of wave (i) also,

so that’s another vote in favor of this count.

From this point on the market must make a move lower to begin wave (iii) down.

and the further wee go into next week,

then more important that a sharp decline becomes to confirm the count.

Wave ‘i’ of (iii) should fall back towards the 42000 level again in this scenario.

That may look like a big ask,

but if this count is correct,

that will only be the beginning.

Monday;

Watch for wave ‘c’ to hold and wave ‘i’ of (iii) to move lower in five waves.

A drop below 43000 on Monday will start this pattern off quite well.

GOLD

GOLD 1hr.

We have a possible top in place for wave (c) of [b] at this weeks highs.

This idea has not been confirmed yet,

but I have marked the wave ‘iv’ low as an indication of the change of trend.

A break below that level will signal wave ‘i’ of (i) of [c] is underway,

That is the main focus for next week.

Tomorrow;

Watch for wave (c) of [b] to finally top out and reverse into wave ‘i’ of (i).

A break of 2656 will be a good sign that wave ‘i’ is in play.

CRUDE OIL.

CRUDE OIL 1hr.

Crude is beginning to come off the oil over the last two sessions after invalidating the previous count,

and triggering the alternate wave (2) count this week.

The price has touched the upper channel line and reversed by about 3% now.

Like much of the other markets I follow here,

this is a good start,

but not enough to confirm the turn into wave [i] green yet.

I want to see a drop below 73.00 in five waves in wave [i] green.

If that happens,

then we will get serious again about the turn into wave (3).

Monday;

Watch for a drop off this weeks top at wave [v] of ‘C’ in five waves so signal wave [i] is underway.

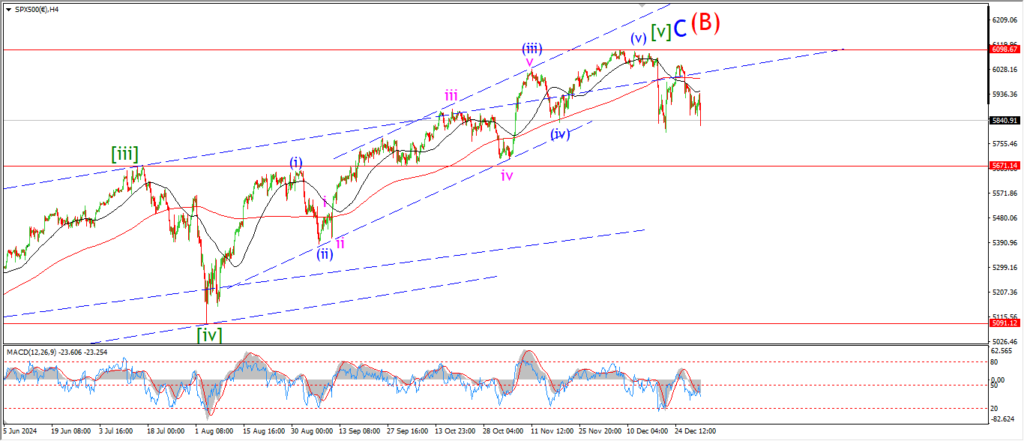

S&P 500.

S&P 500 1hr

The S&P will not give up that easily!

The market pushed higher today to create a double top at the previous high at 6016.

That has forced a rethink of the pattern here.

I am now switching to the same count as the DOW,

and the high today is labelled as wave ‘c’ of (ii).

We have a five wave pattern higher into wave ‘c’ of (ii) now.

And the price is still holding at a lower high below wave ‘a’.

It is possible that we have a running flat correction in play for wave (ii) here.

and in that case we will see a sharp turn down on Monday in line with wave ‘i’ of (iii).

Monday;

There is still a chance that wave (ii) will shift to an expanded flat correction.

But even then it will be a second wave lower high.

We will know soon enough how this plays out.

I can’t confirm wave (iii) down until we see a break below 5770 at the wave ‘b’ lows.

so lets see if that comes to confirm this new leg down.

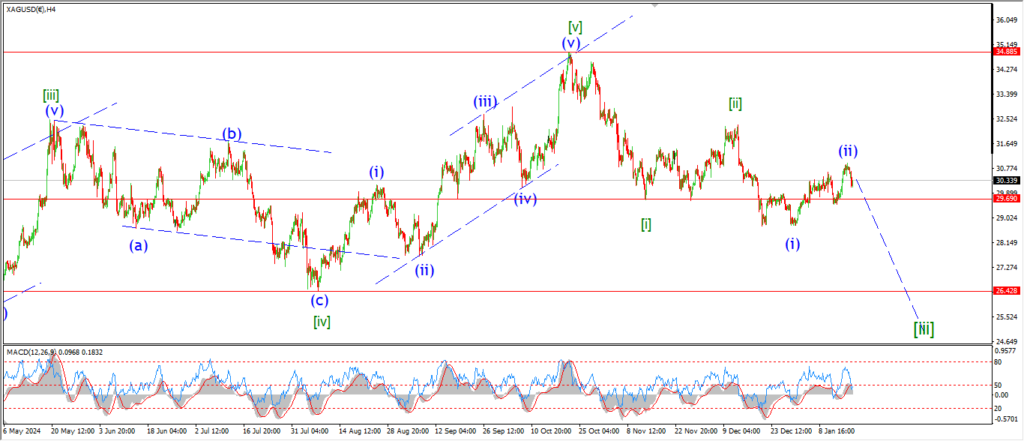

SILVER.

SILVER 1hr

Silver is still holding below the highs of the week at wave (ii) tonight.

The price has completed three waves up to hit the 62% Fib retracement level in wave (ii).

and now we have a possible drop into wave ‘i’ of (iii) in play here.

The price has not broken any support levels yet to give us more certainty of this count,

but the potential for a new five wave decline in wave (iii) is clear now.

And if we see a break below 29.00 again that will be a good sign that wave ‘i’ of (iii) is complete.

Monday;

Watch for wave ‘i’ down to break 29.49 at wave ‘b’ as a first indication of the pattern reversal.

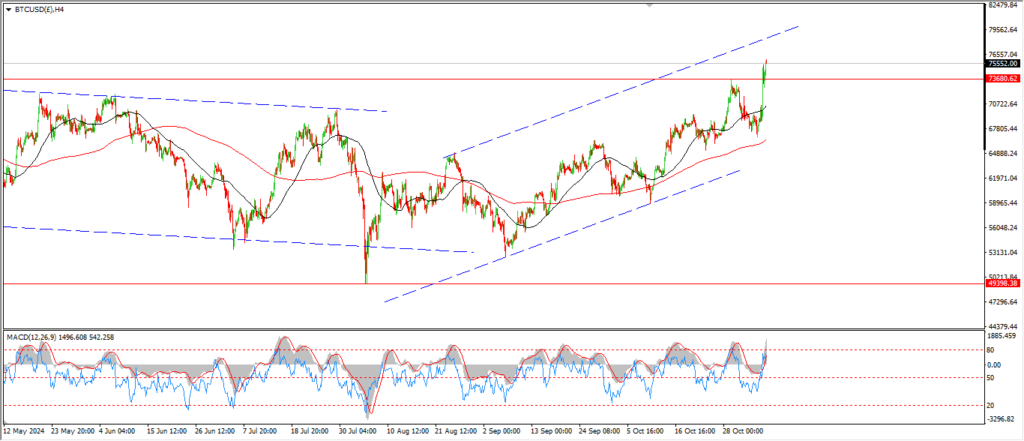

BITCOIN

BITCOIN 1hr.

….

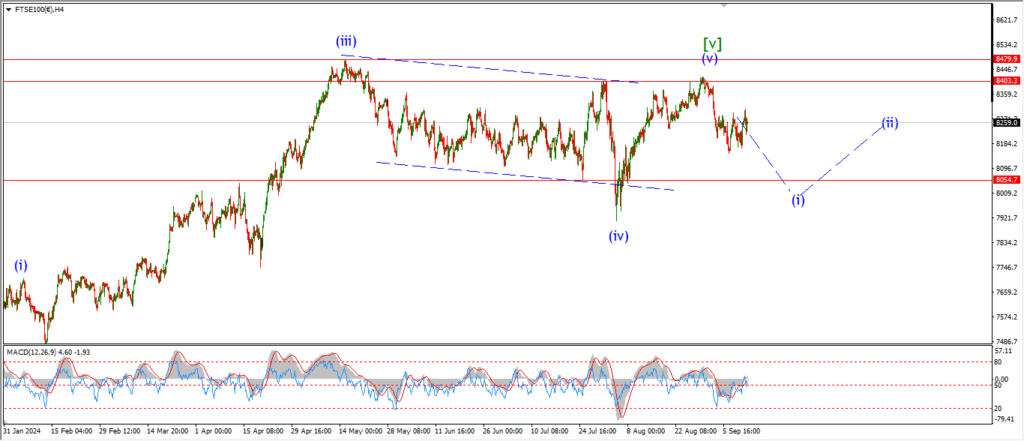

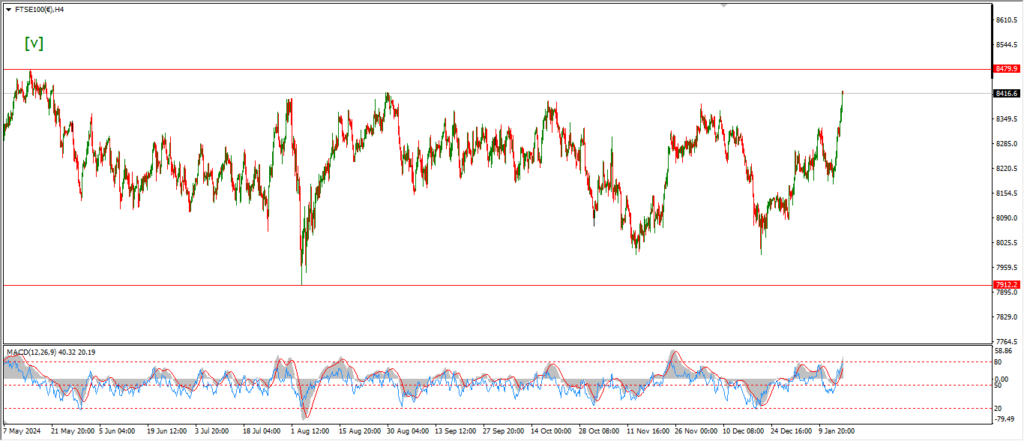

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

….

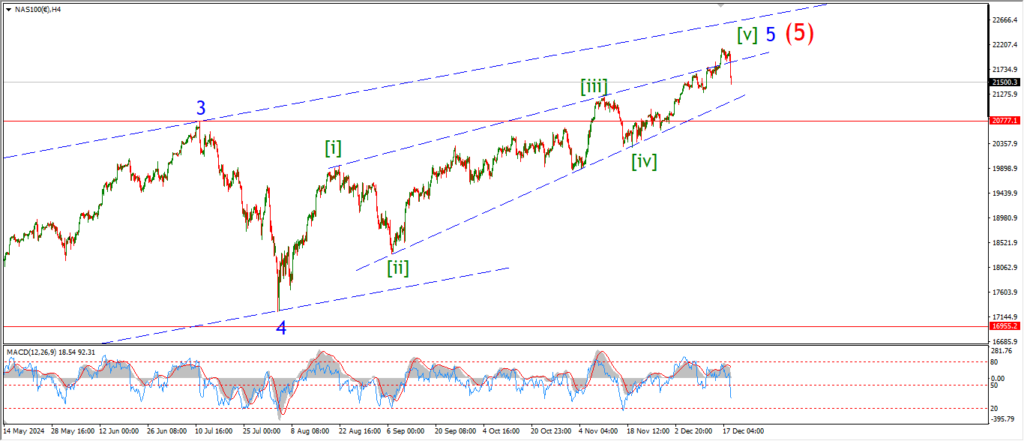

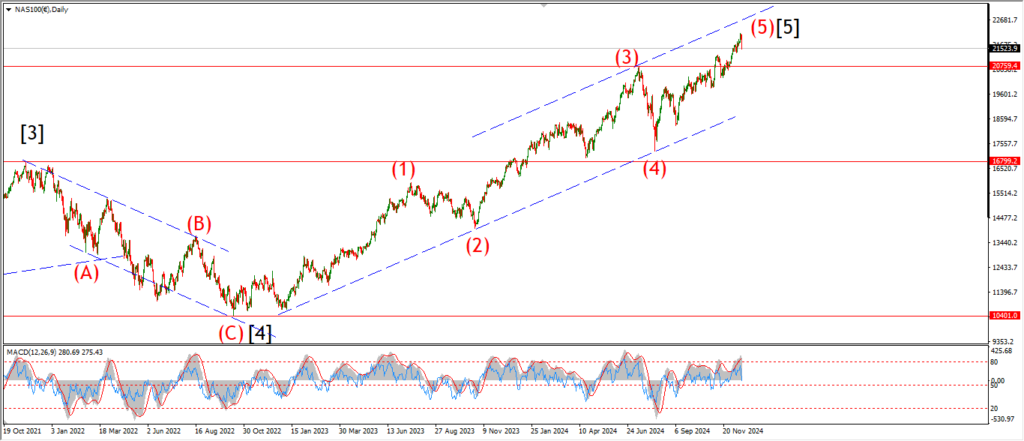

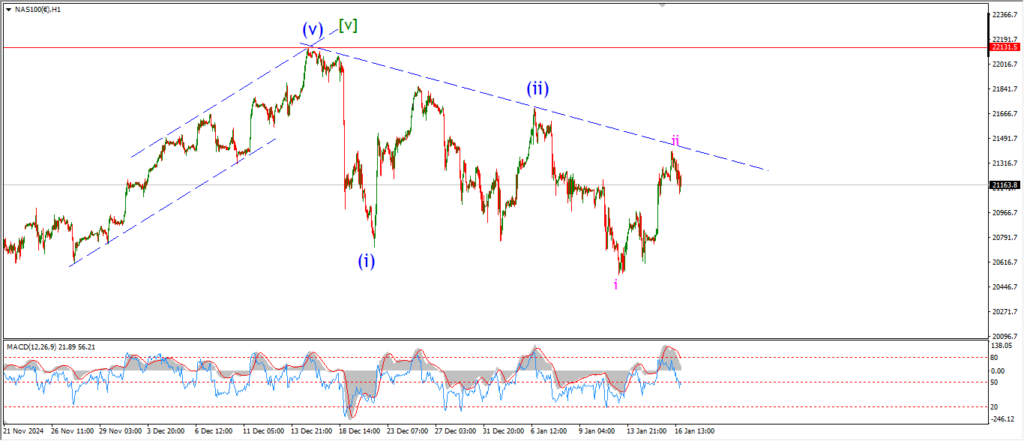

NASDAQ 100.

NASDAQ 1hr

….