Good evening folks and the Lord’s blessings to you.

This pattern in bonds is looking more and more like an expanded flat correction to form a higher low.

The market is now poised for a third wave up to break back above 103.00 with ease.

If this is a reversal pattern to turn the market higher again, then we have the potential for a much larger run higher for a much longer time.

This is one I can’t stop looking at these days!

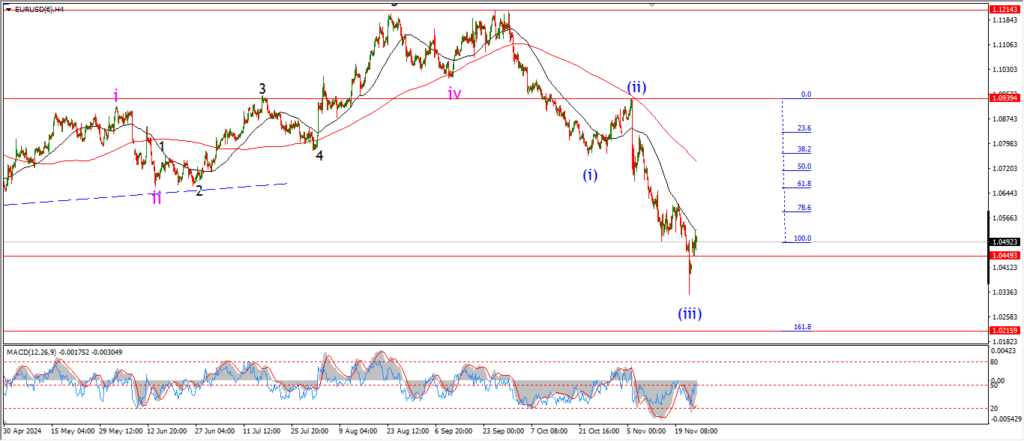

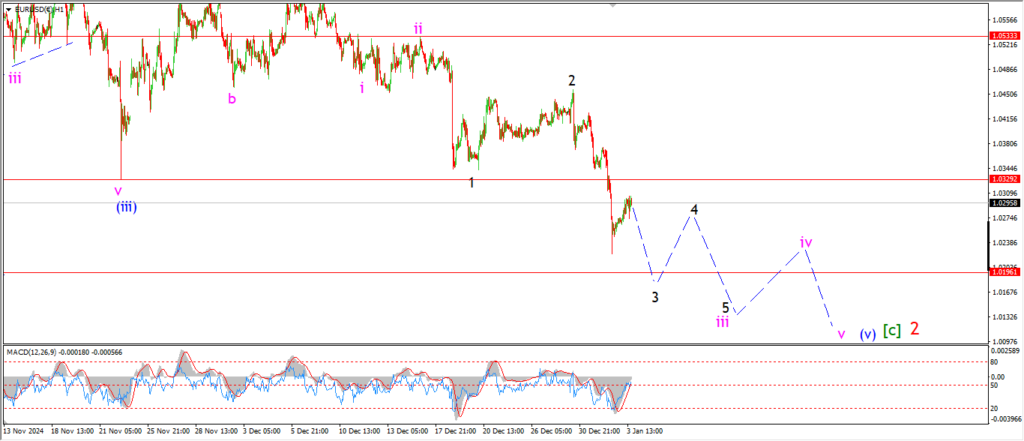

EURUSD.

EURUSD 1hr.

A small turn higher today is viewed as a correction higher within wave ‘iii’ pink so far.

the larger pattern requires more downside to fill out the pattern correctly so I will continue to look lower for Monday.

If the price breks above the wave (iii) low at 1.0329 then I will rethink the internal pattern for wave ‘iii’ and wave (v).

Monday;

Watch for wave ‘iii’ down to complete five waves with a drop below 1.0200 again.

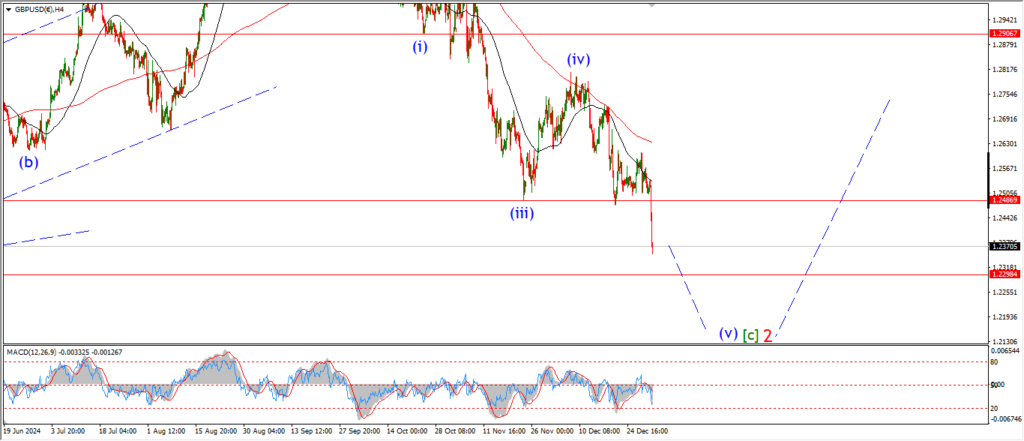

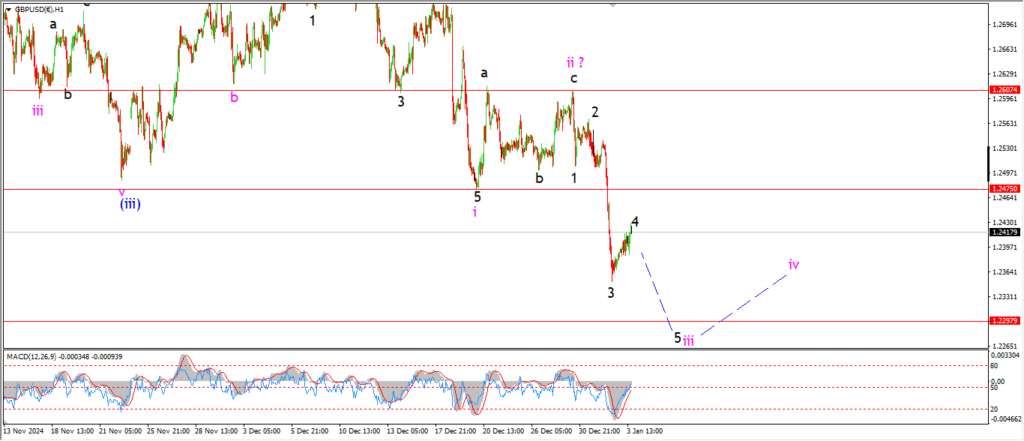

GBPUSD

GBPUSD 1hr.

I have labelled today rise in cable as wave ‘4’ of ‘iii’ of (v).

The pattern has not completed within wave ‘iii’ yet.

In fact it requires another step lower to break 1.2300 again.

And even from there I want to see further moves lower into wave ‘v’.

so I have not even begun to think of upside here yet,

and if this pattern is correct,

then next week will be more bad news for cable.

Monday;

Watch for wave ‘5’ of ‘iii’ to drop back below 1.2300 to complete.

Then we should see a sideways move into wave ‘iv’ as shown.

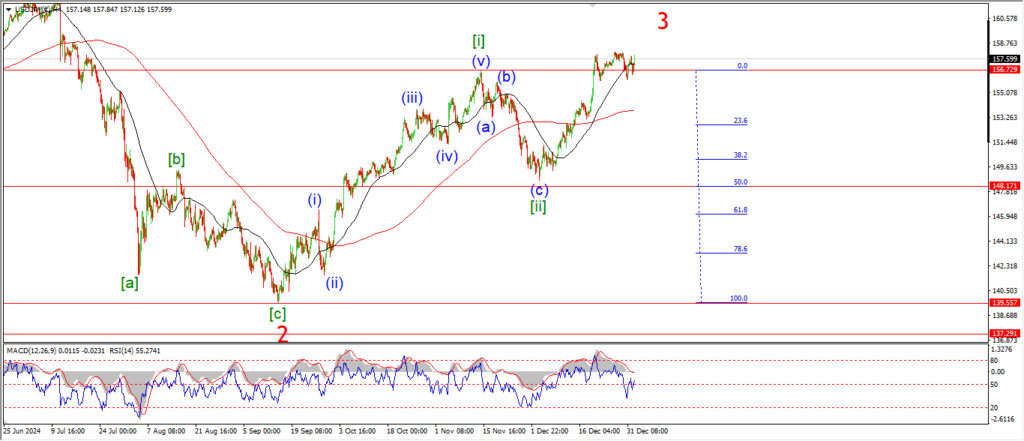

USDJPY.

USDJPY 1hr.

USDJPY has basically gone sideways for 10 days now and there is no end in sight yet!

The pattern I am working with here for wave (iii) up is still valid today.

But I ant to see some progress early next week to confirm the wave (iii) idea.

So wave ‘i’ of (iii) must push back towards 160.00 again to set up for the next leg up in wave (iii) blue.

Monday;

watch for wave (ii) to hold at 155.95.

A break of 158.00 will signal wave ‘i’ of (iii) is underway.

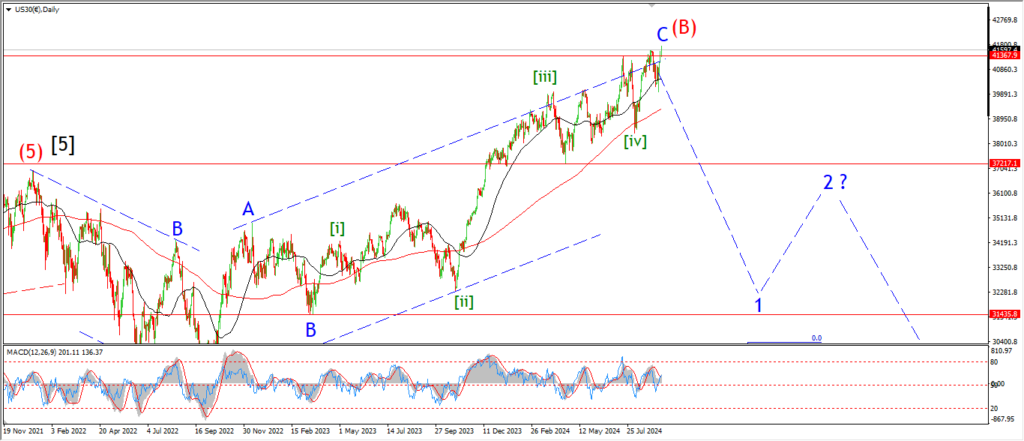

DOW JONES.

DOW 1hr.

A pretty uneventful day in the stock market today has not offered any insight into the pattern yet.

The market came back up off the weekly low in a corrective manner today,

and at the moment we have another lower high in play here.

So,

until we see a decisive move in either direction I can’t add anymore clarity here.

Monday;

Watch for the wave ‘ii’ lower high to hold and a sharp drop to begin into wave ‘iii’ of (iii).

that will confirm the main count here.

However,

a break above 42900 again will trigger the alternate count for wave (ii).

GOLD

GOLD 1hr.

Gold has failed again to run higher into wave ‘c’ of (b) today.

This fact has not invalidated the main count yet.

But,

it sure does make that wave ‘ii’ idea look good in comparison to the failing wave ‘c’ rally.

If the price does not make progress in wave ‘c’ of (b) on Monday,

then I will have to take that alternate count more seriously.

Monday;

Watch for wave ‘c’ of (b) to pick up pace and break above 2666 to confirm this pattern.

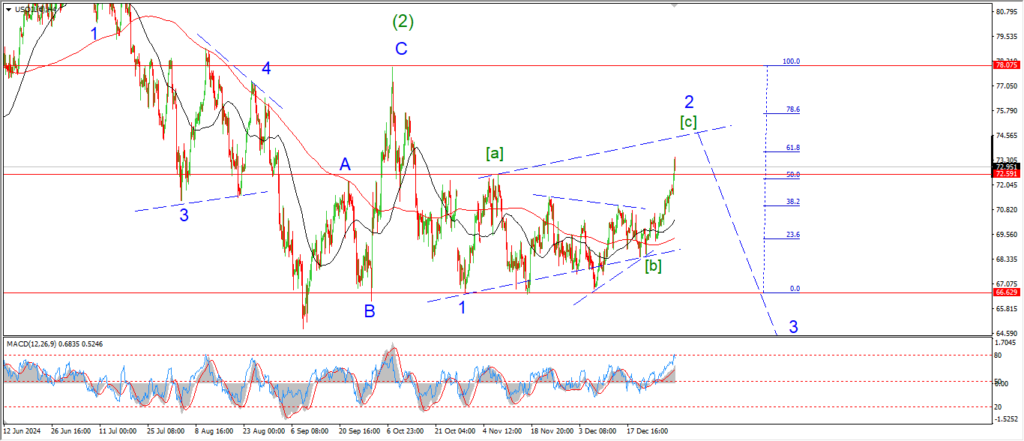

CRUDE OIL.

CRUDE OIL 1hr.

Crude completed three waves down at todays lows in wave (iv) of [c].

And then a rebound into wave (v) came in this afternoon which has brought us very close to hitting that upper trend line again.

That will complete the pattern in wave [c] of ‘2’ early next week.

and from there I will begin to look for a reversal into wave [i] down again.

Monday watch for wave [c] to complete near 75.00 again which will complete the larger pattern.

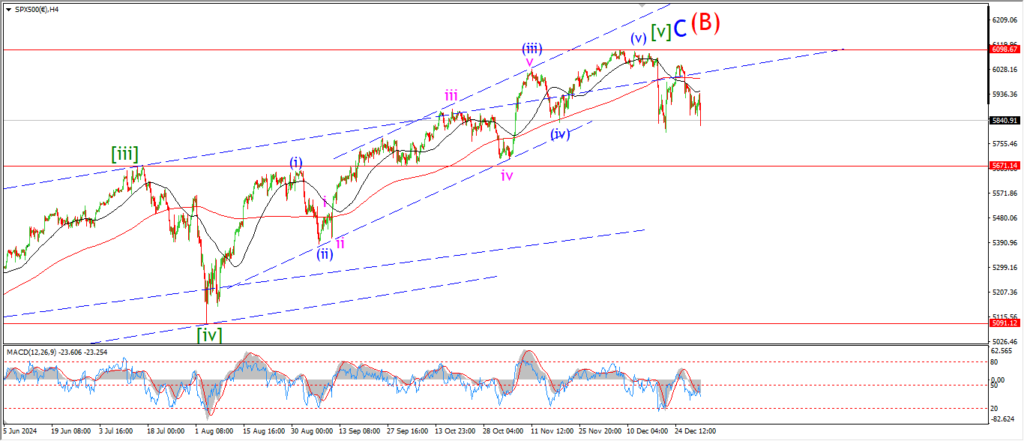

S&P 500.

S&P 500 1hr

The S&P has bounced back into resistance at 5940 again this evening and that rules out last nights count.

I am sticking with the idea of wave ‘ii’ of (iii) here,

and if this is correct,

then we should see a sharp turn down into wave ‘iii’ of (iii) as shown over the coming week.

The market must now hold at the wave (ii) lower high at 6043 for this count to remain valid.

Monday;

Next week should be exciting in this scenario,

a third of a third decline should fall into 5600 again.

So lets see if we get a drop in wave ‘1’ of ‘iii’ to start it off on Monday.

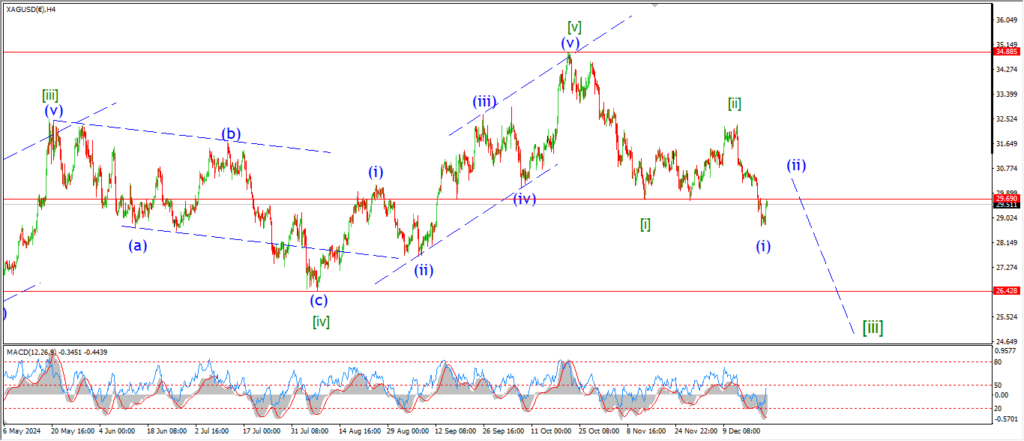

SILVER.

SILVER 1hr

A very slow day in silver with very little to speak about.

The price may have topped out in wave ‘a’ of (ii) with the small drop off this evening.

Wave ‘b’ will fall in three waves to form a higher low on Monday if this is correct.

And then wave ‘c’ will complete wave (ii) by midweek if all goes well.

Wave (iii) of [c] to the downside should come in before the end of the week.

Monday;

Watch for wave (ii) to trace out three waves up to complete a correction at about 30.50.

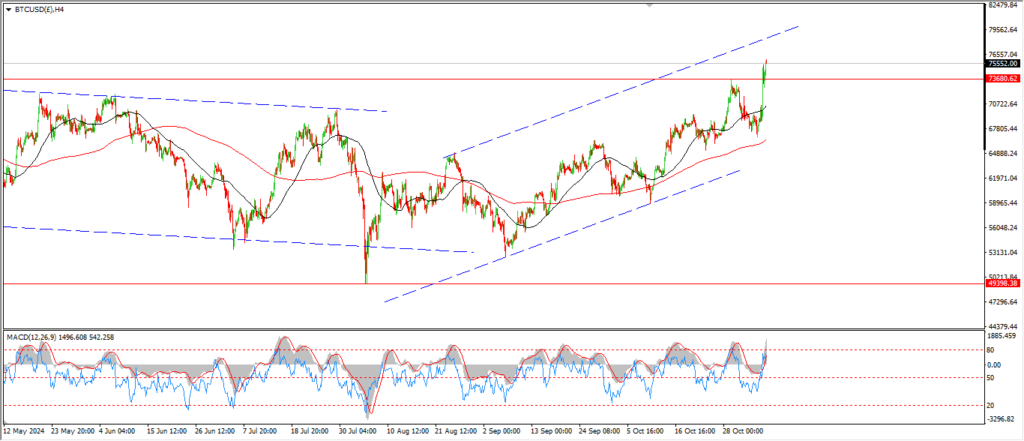

BITCOIN

BITCOIN 1hr.

….

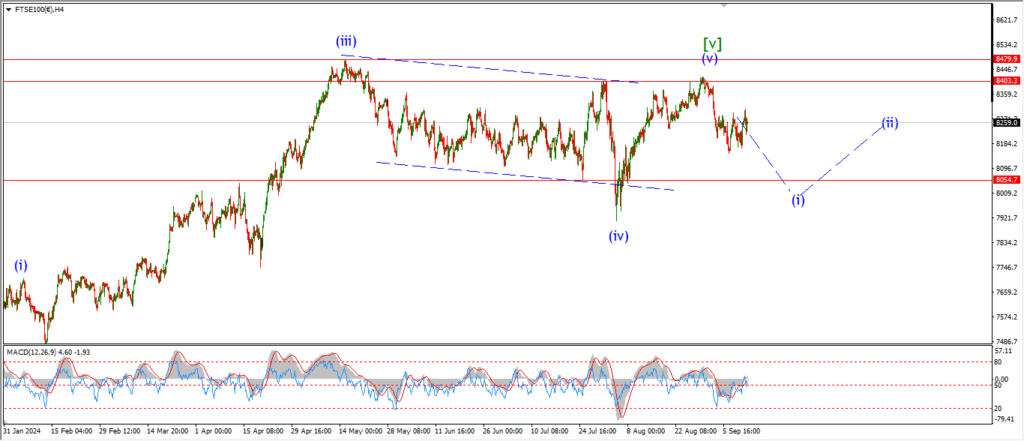

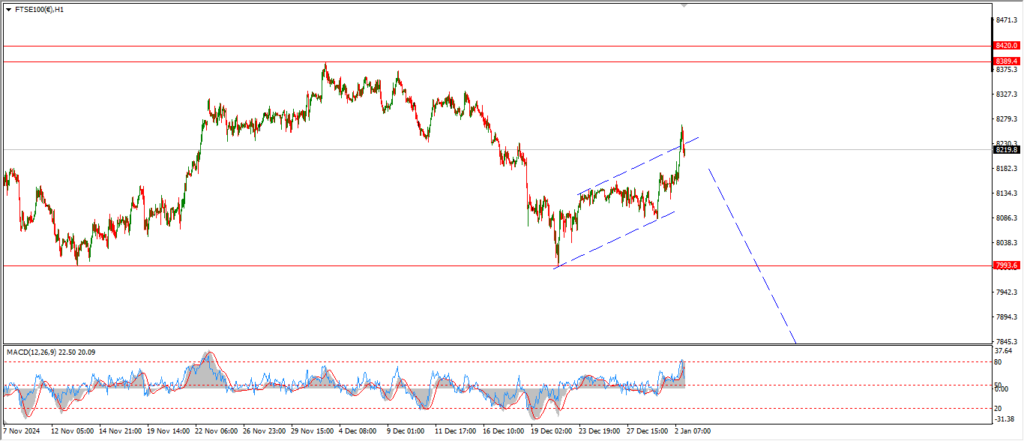

FTSE 100.

FTSE 100 1hr.

….

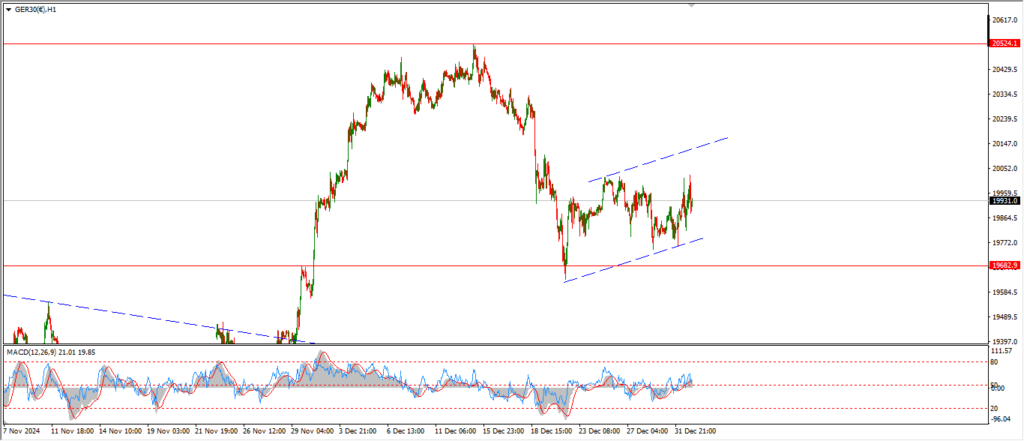

DAX.

DAX 1hr

….

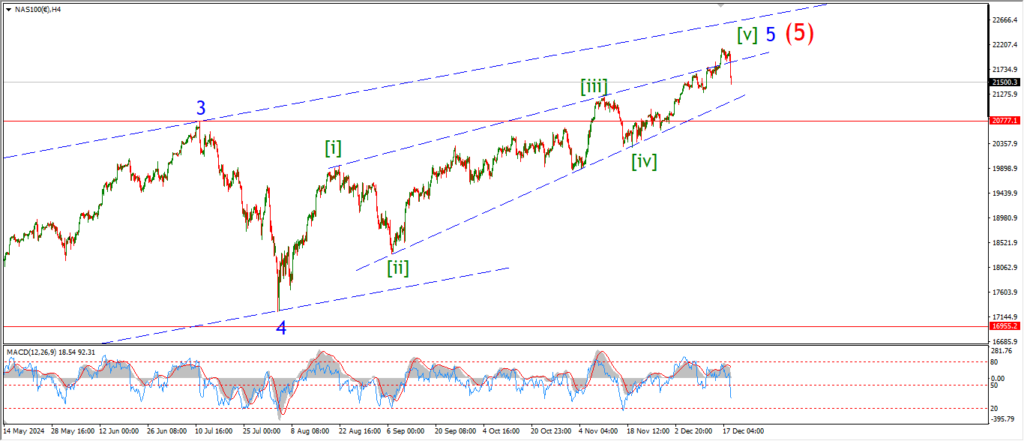

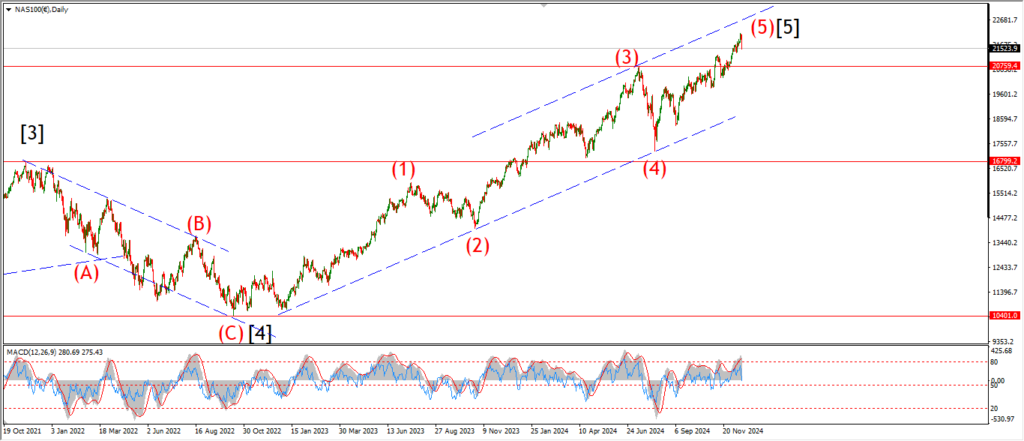

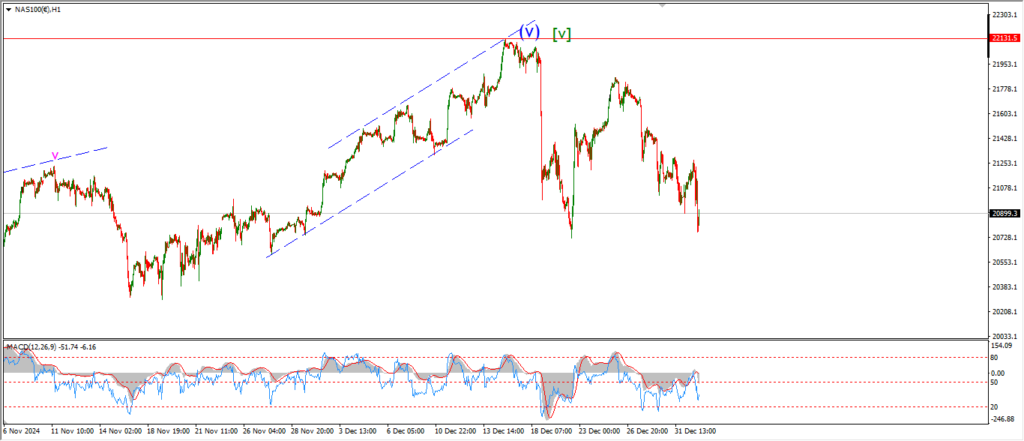

NASDAQ 100.

NASDAQ 1hr

….