Good evening folks and the Lord’s blessings to you.

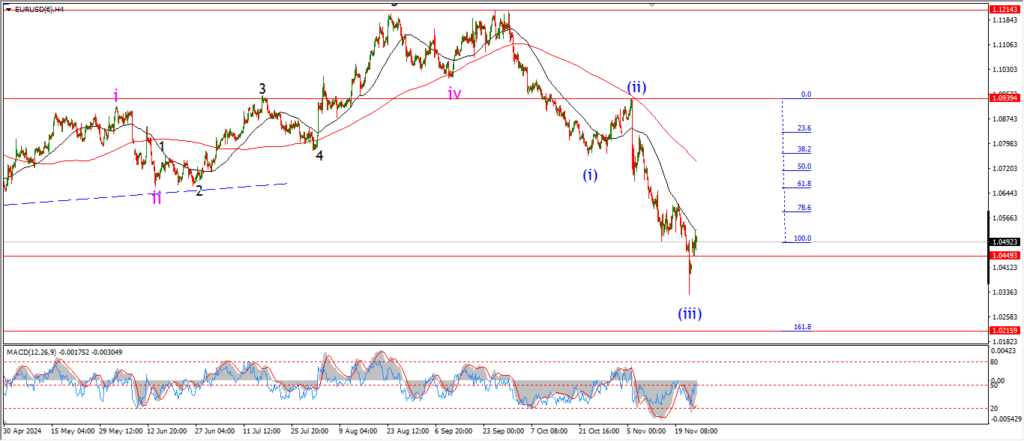

EURUSD.

EURUSD 1hr.

EURUSD has so far failed to rally into wave ‘c’ of (iv) as per the main wave count.

The higher low in wave ‘2’ is still holding though,

so I am willing to give this count another day or so to develop as expected.

If the price does not make a move into wave ‘3’ of ‘c’ of (iv) as shown by tomorrow evening then I will have to rethink this pattern.

Tomorrow;

Watch for the wave ‘b’ lows to hold at 1.0452.

wave ‘3’ of ‘c’ must move above 1.0550 tomorrow to stick with this interpretation.

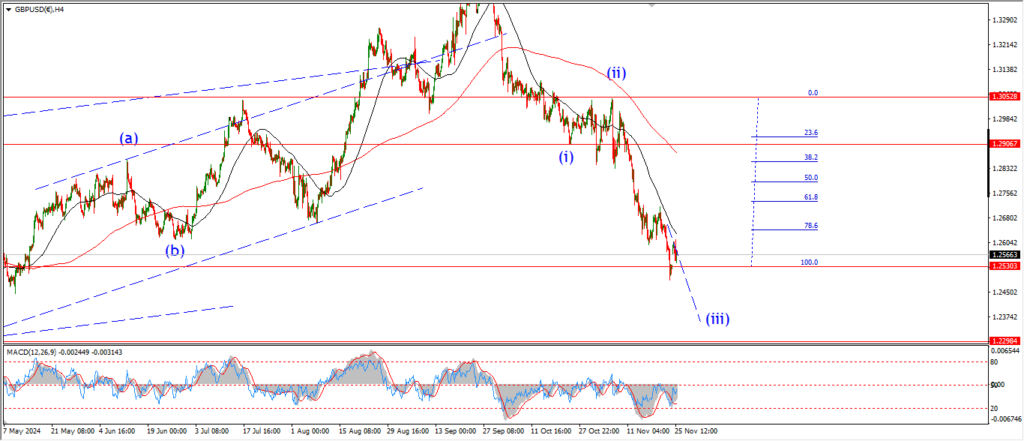

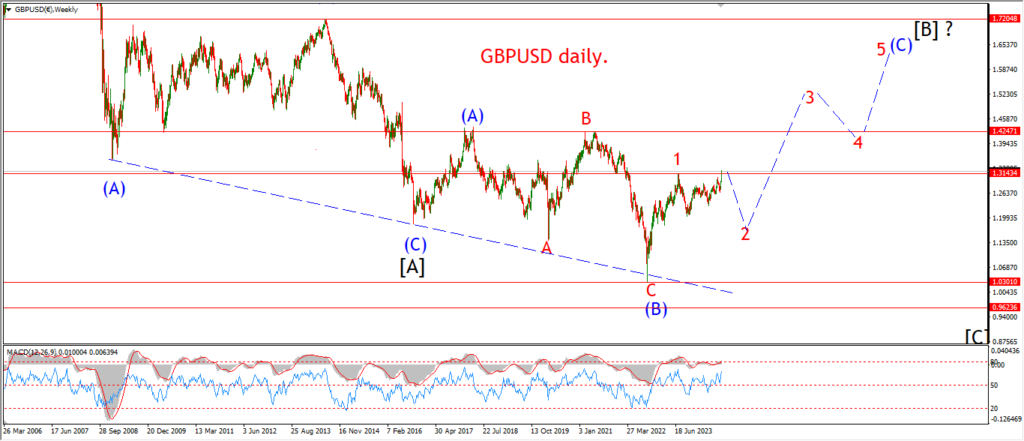

GBPUSD

GBPUSD 1hr.

I am switching to the alternate count tonight for wave (iv).

The price has broken above the internal lows of the recent decline,

and this move has invalidated last nights count for wave ‘i’ down.

The pattern now shows a rally in wave ‘c’ of (iv) underway.

Wave ‘c’ should trace out five waves up and break the recent high at 1.2810 to complete wave (iv).

Tomorrow;

Watch for wave ‘c’ to continue higher in five waves as shown.

The price must now hold above 1.2604 for this count to remain valid.

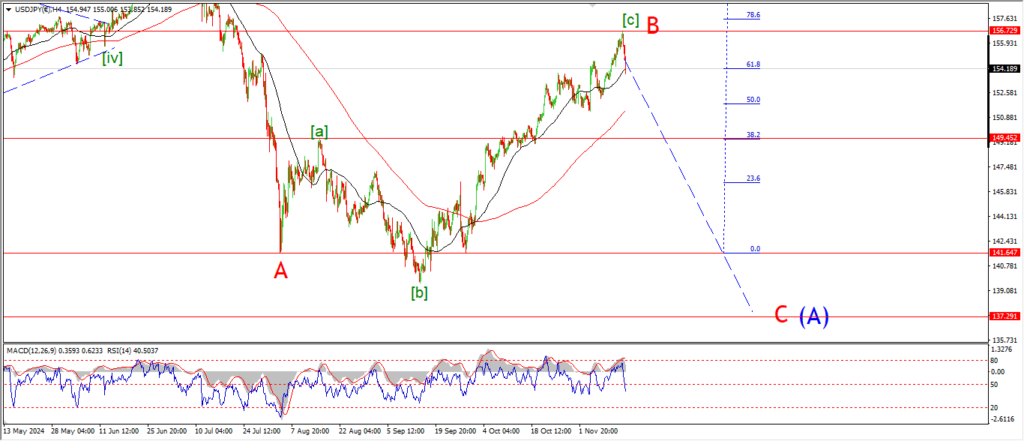

USDJPY.

USDJPY 1hr.

A small turn lower today off that possible wave [ii] high.

The decline is in line with the main count,

although I think we need to see a drop below 150.00 again to give this main count a boost.

The alternate idea will not be ruled out unless we see a break of 148.65 at the wave [i] low.

So the wave pattern here is still up for debate.

Tomorrow;

Watch for wave (i) of [iii] to trace out five waves down to hit the 150.00 handle again.

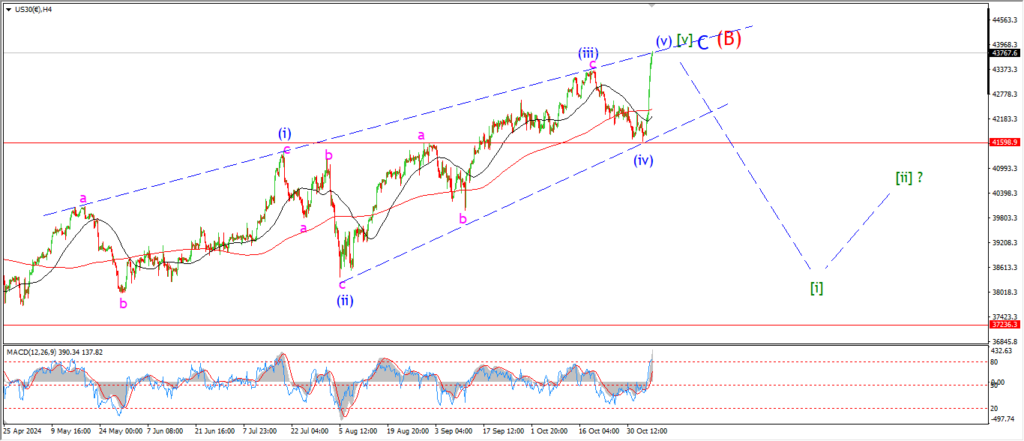

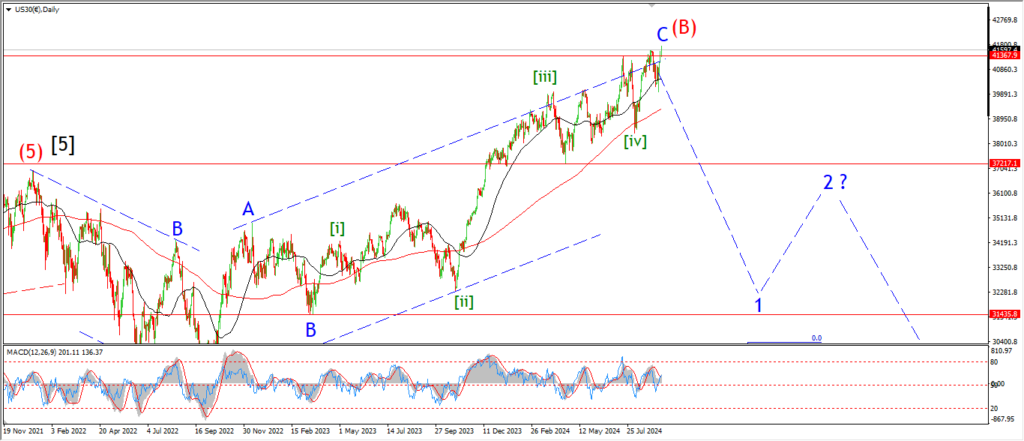

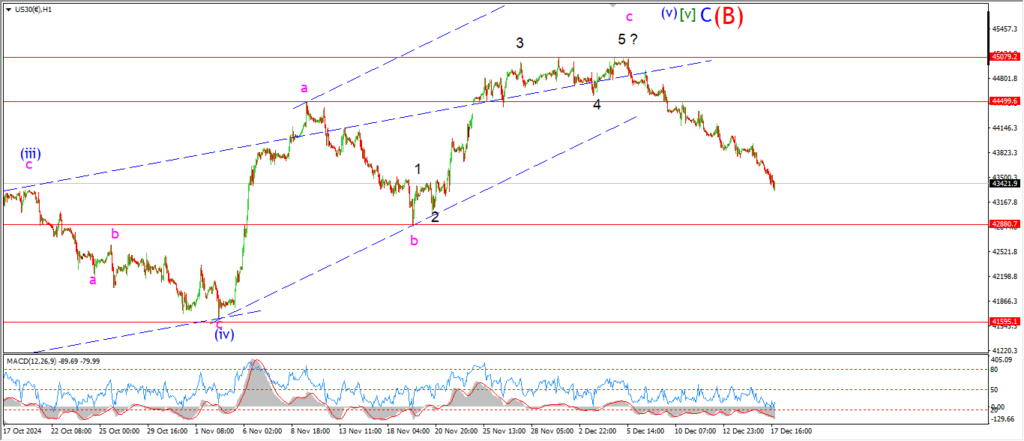

DOW JONES.

DOW 1hr.

Did you ever hear the saying, slowly-slowly catchy monkey!

the action today is reminiscent of that idea.

The market is moving lower even into the close tonight so there is still hope that we will see a break of support at wave ‘b’ this week.

I suspect the market will bounce off that level given that it is such an obvious support in the pattern.

The behavior of the market at that wave ‘b’ support at 42880 will tell us a whole lot about the possibilities for this decline.

If the market slices through there with ease,

that will give a boost to the reversal idea.

And if we get an impulsive bounce off support,

that will suggest there is more upside ahead I’m afraid.

Tomorrow;

Lets see if the market can make progress towards the support at 42880.

Watch for a break of support to give the main count a boost in probability.

Tomorrows trade will tell us a lot I think.

GOLD

GOLD 1hr.

Another small step lower into wave ‘c’ of ‘b’ today.

the price is really struggling to make progress lower in wave ‘c’,

so there is even a chance that wave ‘c’ will fail to break support at wave ‘a’ at 2604.

In that case wave ‘b’ pink will be classed as a running flat correction,

and we will see a turn higher into wave ‘c’ earlier than previously expected.

Tomorrow;

Watch for wave ‘c’ of ‘b’ to break 2604 to complete the standard expanded flat correction.

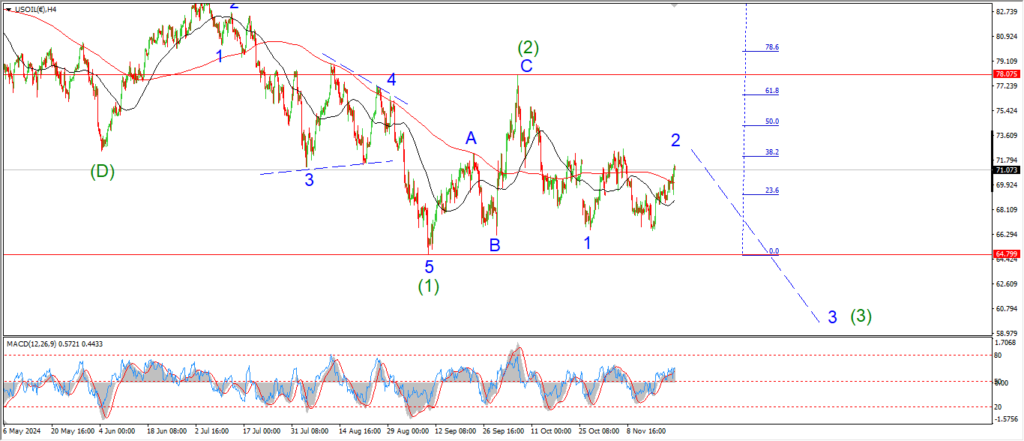

CRUDE OIL.

CRUDE OIL 1hr.

the pattern in crude this week has been a little perplexing,

but I still believe that the main count is the best fit pattern here.

The price dipped below 69.00 today,

and then a rebound this evening has retraced most all of that drop.

I have shown todays low as wave ‘iv’ of (c),

and now the price has bounced to begin wave ‘v’ of (c).

The larger pattern will be completed with a break of 71.46 again.

Tomorrow;

Watch for wave (c) of [ii] to complete at 71.46.

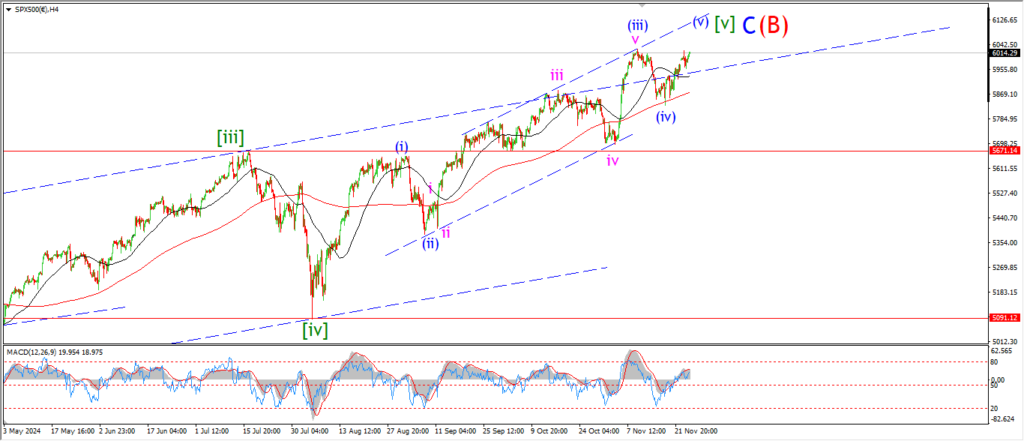

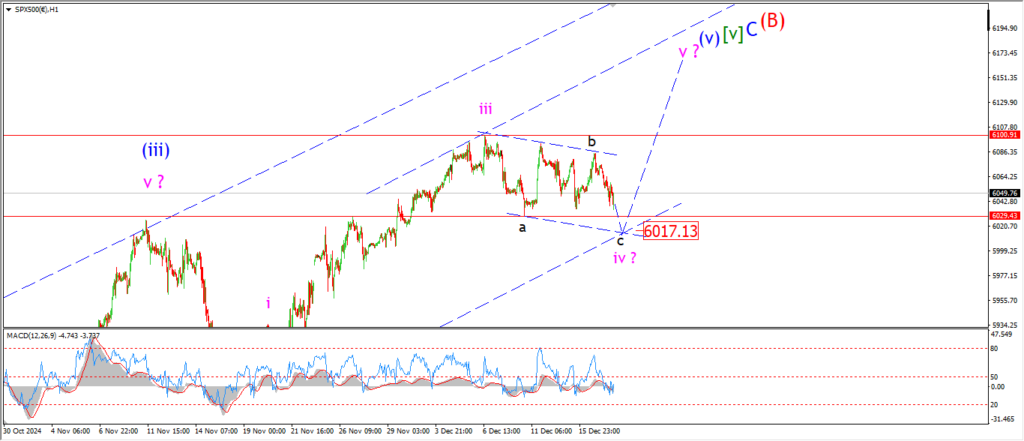

S&P 500.

S&P 500 1hr

The S&P will never do what I want it to do!

The price dropped today but somehow I don’t think the recent correction in wave ‘iv’ has been fulfilled yet.

The market is moving within a channel still,

and I can make out an overall three wave pattern in play here.

Todays drop is viewed as wave ‘c’ of ‘iv’.

And this will be followed by a rally into wave ‘v’ again as shown.

The price has a long way down to go to break support at 5830 at the previous wave (iv) low.

It is now impossible,

but it seems unlikely right now.

So I will stick with the main count unless a the market really falls through the floor to break that support level.

Then I might be convinced otherwise!

Tomorrow;

Watch for wave wave ‘iv’ to complete near 6017 again and then a rally will begin in wave ‘v’ from there.

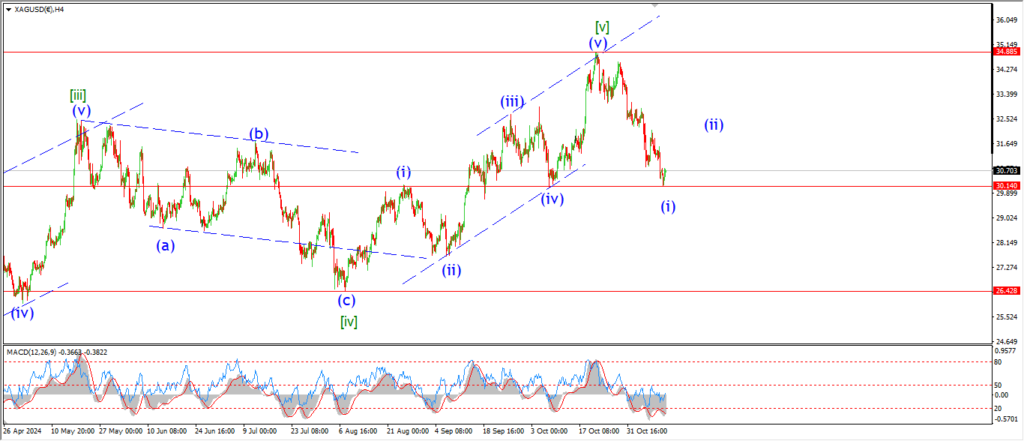

SILVER.

SILVER 1hr

It is possible that wave ‘i’ is complete at todays lows at 30.13 now.

I wanted to see a break of 29.65 to confirm the main pattern in wave (iii) down,

but that was a preference rather than a requirement for wave ‘i’.

If wave ‘ii’ is underway now,

then we should see a three wave correction into a high near 31.50 again.

At that point I will look for wave ‘iii’ of (iii) to accelerate lower.

It will take a few days for wave ‘ii’ to develop though,

so we will have to wait until next week for wave ‘iii’ of (iii) down I suspect.

Tomorrow;

Watch for wave ‘ii’ to trace out three waves up towards the 50% retracement level at 31.23.

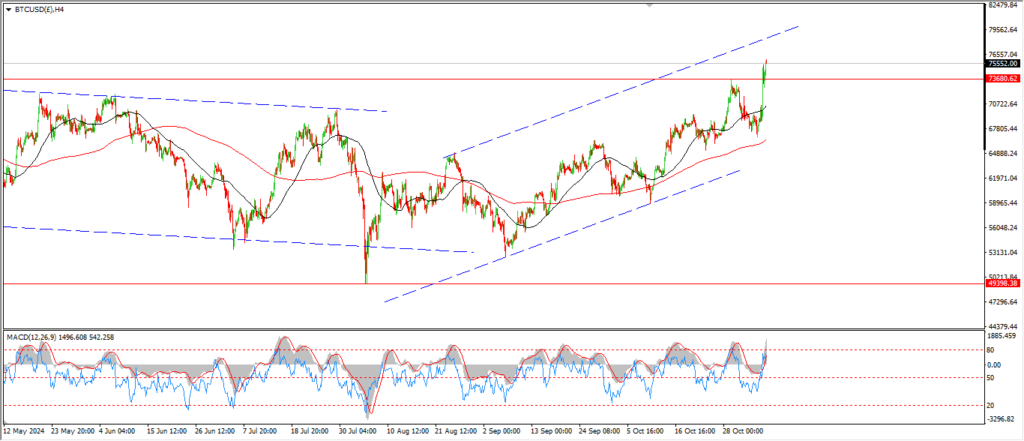

BITCOIN

BITCOIN 1hr.

….

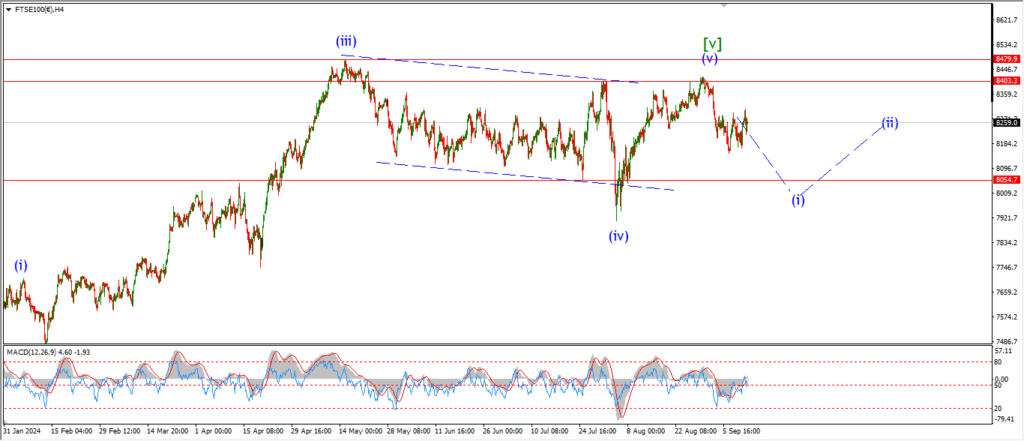

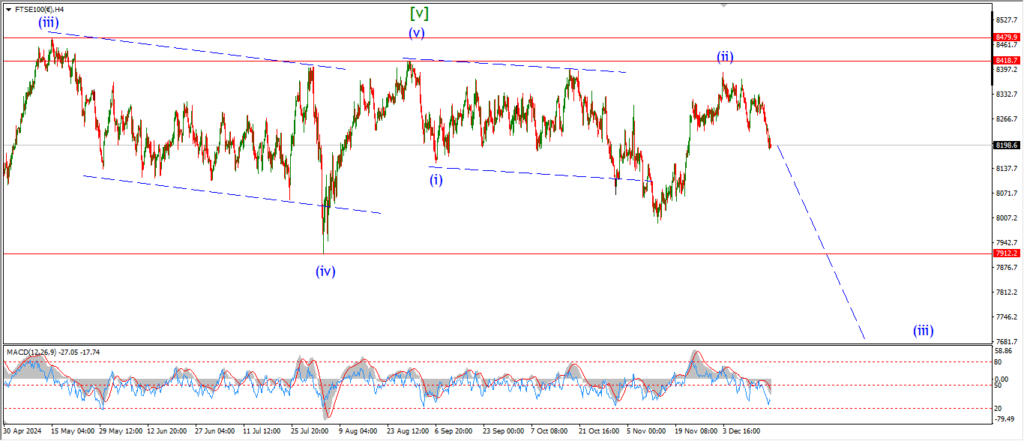

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

….

NASDAQ 100.

NASDAQ 1hr

….