Good evening folks and the Lord’s blessings to you.

Jobs Shock: October Payrolls Huge Miss As Private Jobs Go Negative For First Time Since 2020

EURUSD.

EURUSD 1hr.

EURUSD dropped off the highs today and I am suggesting wave ‘a’ is complete and wave ‘b’ is underway.

I am calling wave ‘b’ an expanded flat at the moment,

but this can change on Monday depending on the action.

A deeper retracement will favor some other pattern.

Wave ‘b’ must hold above 1.0763 either way.

Monday;

Watch for wave ‘b’ to complete early Monday

and then we should see a rally back towards 1.1000 again in wave ‘c’ of (ii).

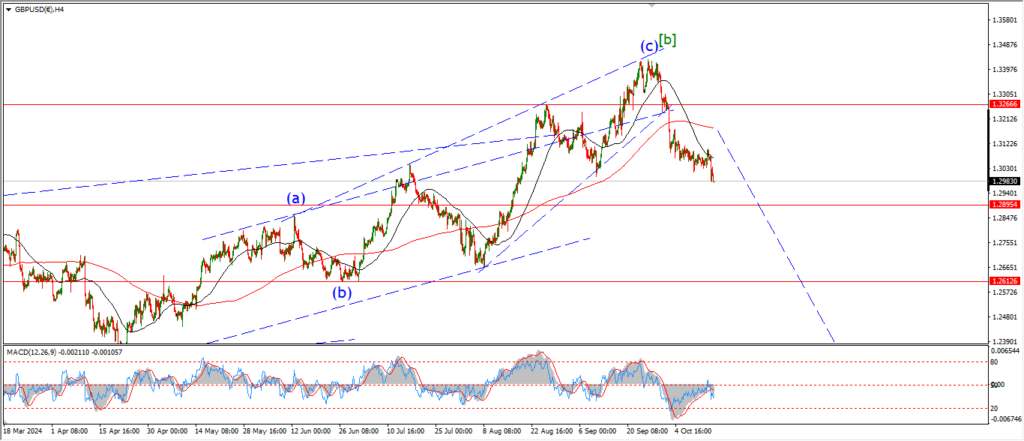

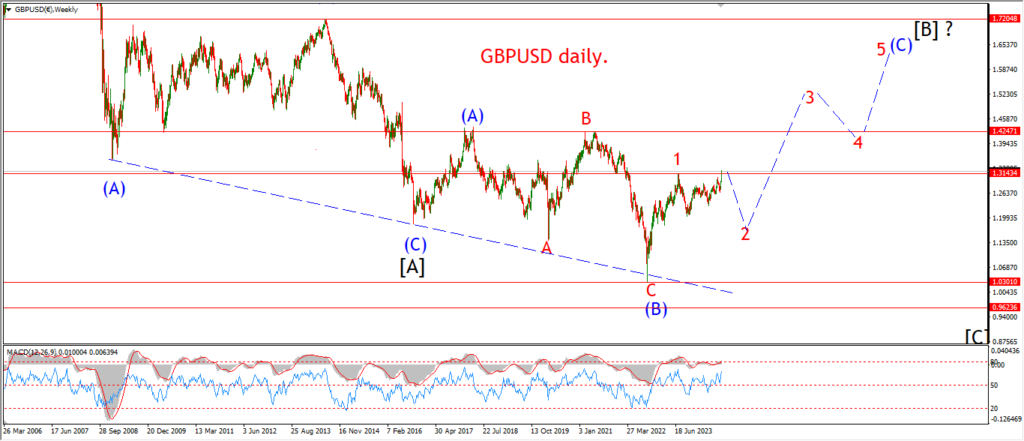

GBPUSD

GBPUSD 1hr.

the action in cable remains quite volatile

and the price retraced much higher than expected today.

The pattern into todays high is in three waves,

so I am calling this wave ‘2’ of ‘iii’.

and the price must now continue lower into wave ‘3’ of ‘iii’ of (i) next week.

Wave (i) will come close to complete by the end of next week if all goes to play here.

Tomorrow;

Watch for wave ‘3’ of (i) to continue lower in five waves towards 1.2700.

A break of 1.2843 will signal wave ‘3’ is underway.

USDJPY.

USDJPY 1hr.

USDJPY is about as clear as mud this week.

The price has basically traded flat over the last week.

So at the very least we can be sure that this action is corrective in nature.

I would like to see a drop off into wave ‘c’ as shown to complete a larger corrective pattern.

A drop back into the 150.00 area again will be sufficient I think.

Monday;

Lets see how the early action goes here,

a drop below 151.77 again will confirm wave ‘c’ is underway.

I want to see the wave (iii) high hold at 153.88.

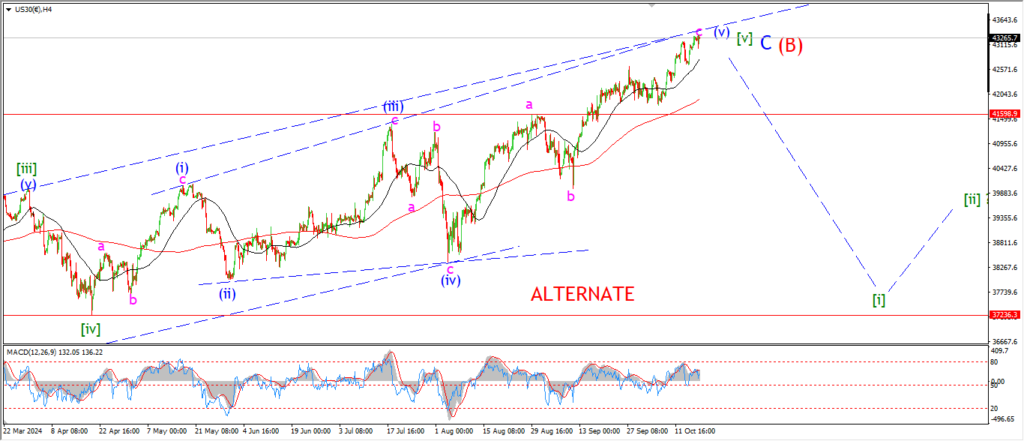

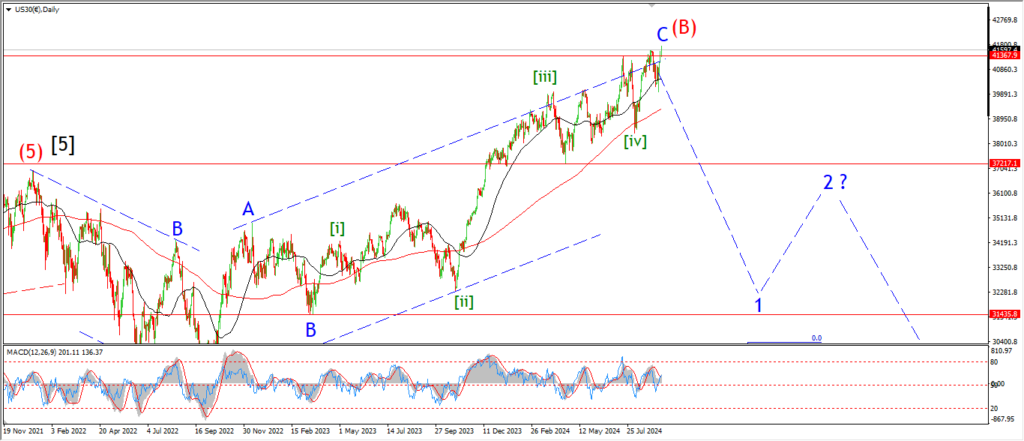

DOW JONES.

DOW 1hr.

A nice rebound off Thursdays low has been registered today and this is labelled wave ‘a’ of ‘ii’.

The market has already fallen back off the highs today,

and this is viewed as the beginning of wave ‘b’ .

Wave ‘c’ should begin on Monday with a rally back towards 42500 between the 50% and 62% retracement levels.

And at that point the test of this count will begin.

Wave ‘ii’ must give way to an acceleration lower in wave ‘iii’ of (i) next week if this count is correct.

Monday;

Watch for wave ‘ii’ to trace out three waves up as shown and to top out near 42500.

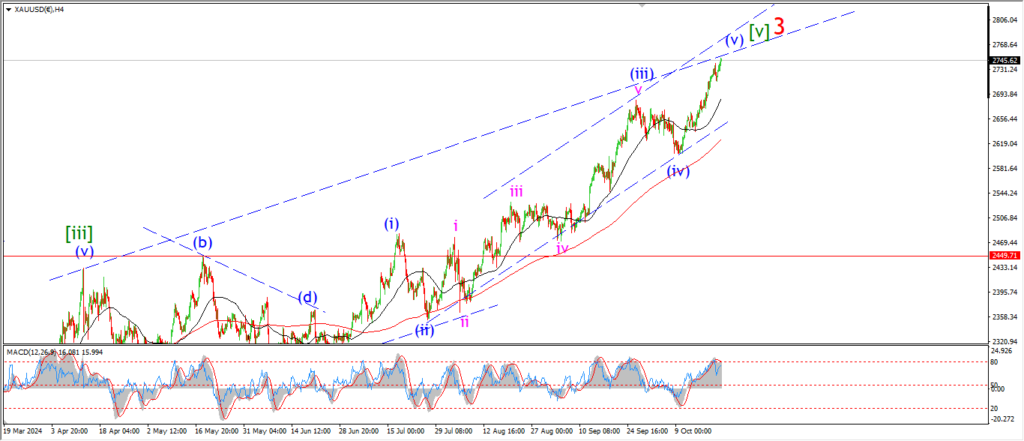

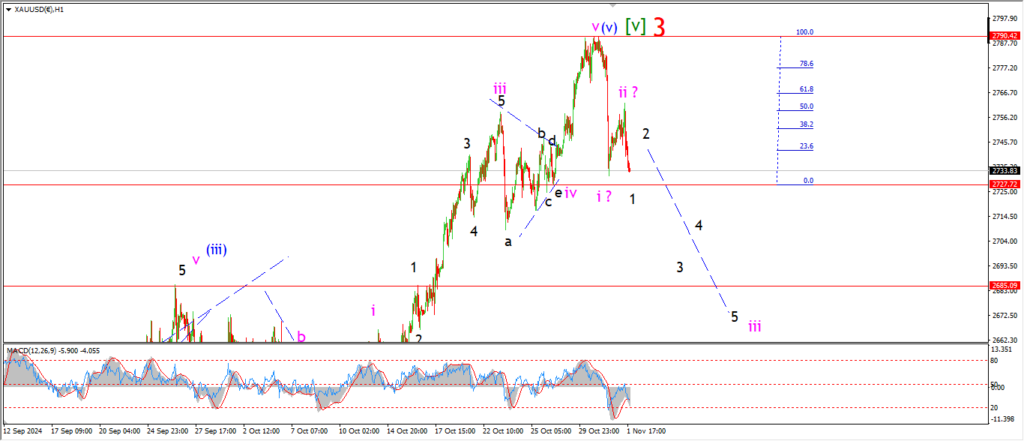

GOLD

GOLD 1hr.

Gold did form a lower high in a possible wave ‘ii’ today,

and the price turned lower again this evening.

the action suggests wave ‘iii’ pink is now in play here,

but the price has so far refused to break support of wave ‘iv’ at 2727.

WAve ‘iii’ down should slice through that level with ease once it gets going,

so that test will be left for Mondays trade it seems.

Monday;

Watch for wave ‘iii’ to trace out five waves down as shown.

A break of 2727 will signal wave ‘iii’ is underway.

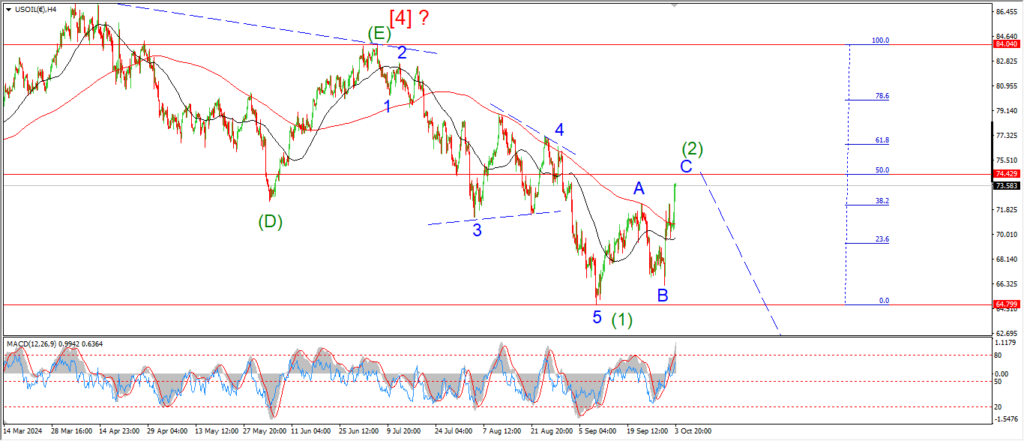

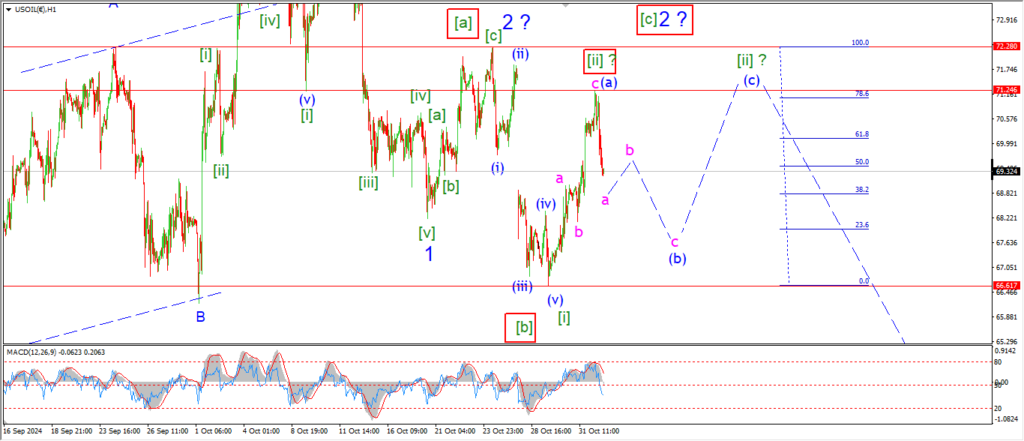

CRUDE OIL.

CRUDE OIL 1hr.

I am keeping an open mind on the pattern in crude oil tonight.

the price is back off the highs again as I write after breaking the 70.00 handle earlier in the session.

The rally has formed in three waves into that wave (a) high,

and now I am suggesting wave (b) is underway.

The lower wave (b) goes the better to be honest,

but I am looking for a break of 68.00 as a good target.

and then wave (c) can begin from there.

The first alternate count suggests wave [ii] is already done at todays highs,

this count is viable,

but we will soon know which count fits best by Tuesday evening.

Monday;

Watch for wave (b) to trace out three waves down to break 68.00 over the next few sessions.

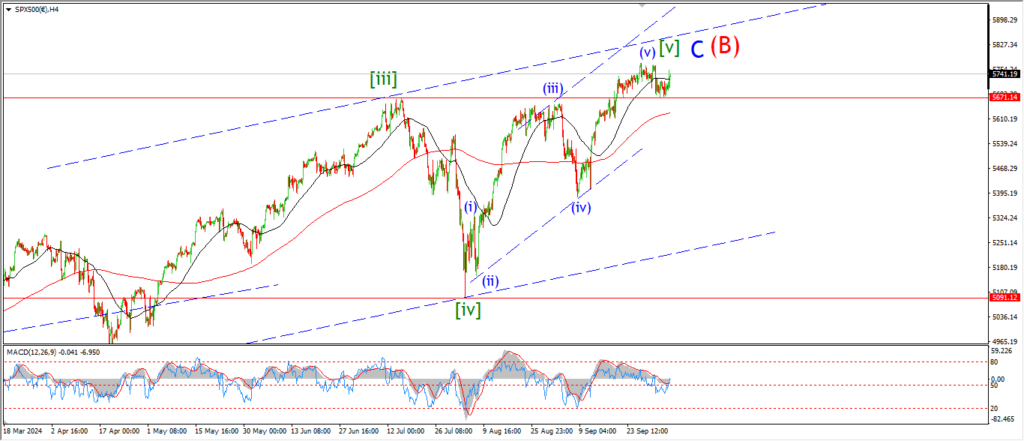

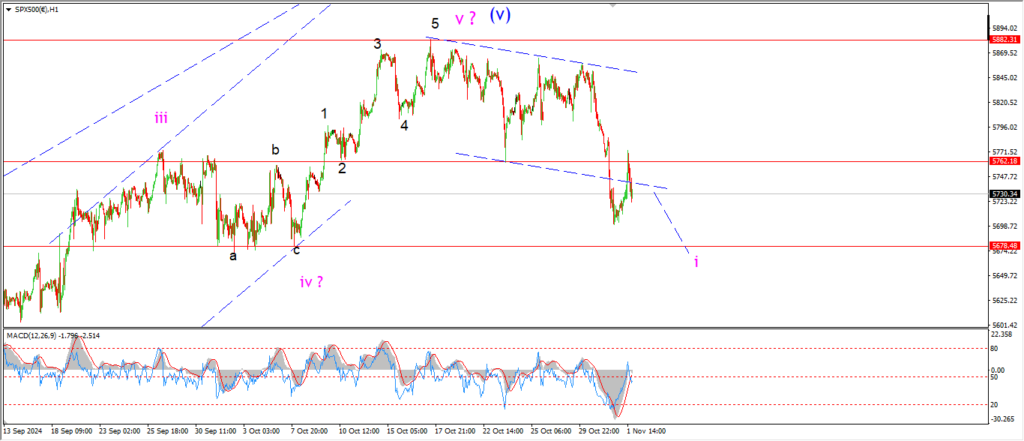

S&P 500.

S&P 500 1hr

I cannot rule out the correction idea here yet because the market has not broken support at wave ‘iv’ pink .

That level must go early next week in order to give the impulsive wave down a chance to build.

The rebound today has mostly been retraced now as we approach the closing bell.

but the key to the bearish pattern at the moment is a break of support at 5678.

I wait for Mondays trade to see if the mood swings.

Monday;

Watch for a possible break of support at 5678 to give this market a chance to build a possible bearish pattern.

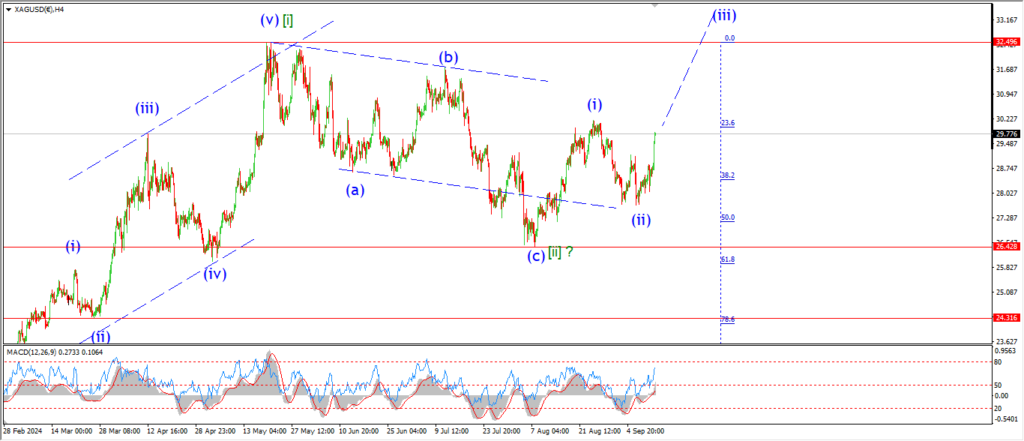

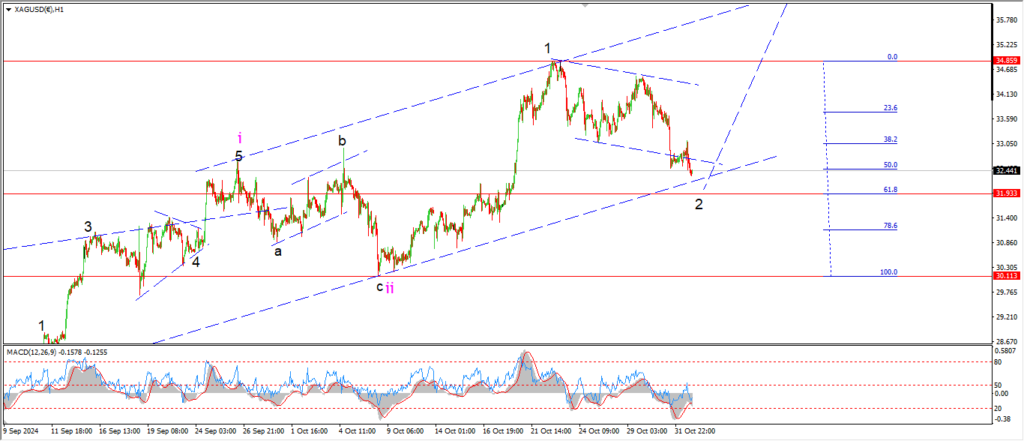

SILVER.

SILVER 1hr

I want to talk about the alternate count o the daily chart first of all.

The recent rally has completed five waves up in wave [v] of ‘C’ of (B).

Ironically this is the exact same count that I favor for the stock markets!

All the same bubble??

This week we have a turn lower off the top with some impulsive nature to it.

If this decline continues lower to break the wave [iv] low at 26.40 again,

I think that will be enough to trigger this alternate count.

I just think it is worth watching.

Monday;

The main count is in flux right now,

the decline off the recent top is in three waves and so it can be viewed as corrective for the moment.

I have labelled this as wave ‘2’ of ‘iii’.

And if this count is correct,

then we will see a hard rally into wave ‘3’ of ‘iii’ over the coming weeks.

A break below 30.11 will make this count very difficult to follow.

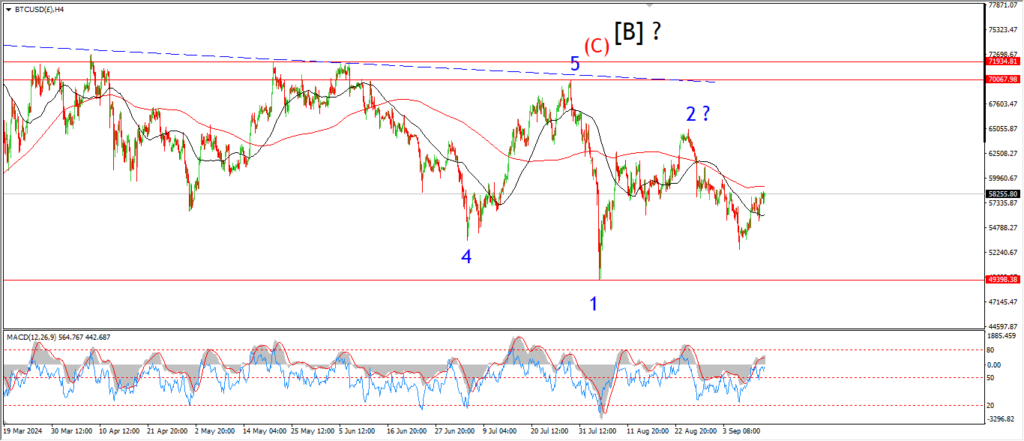

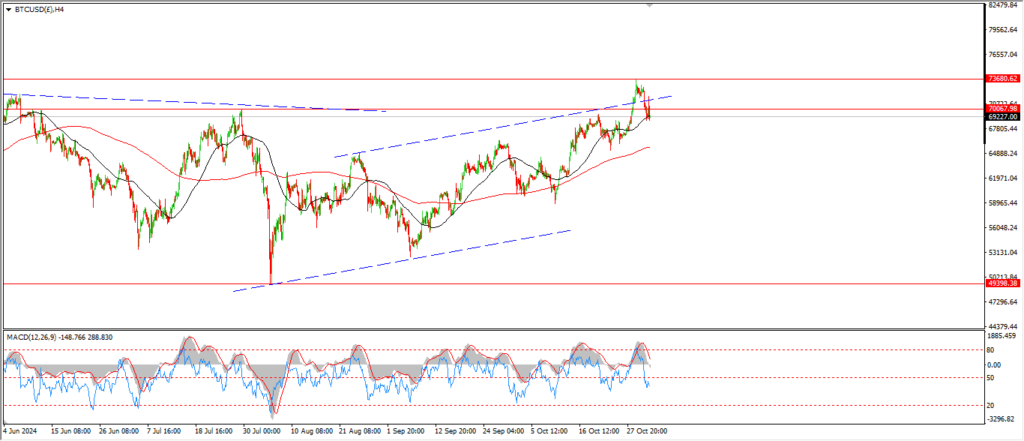

BITCOIN

BITCOIN 1hr.

….

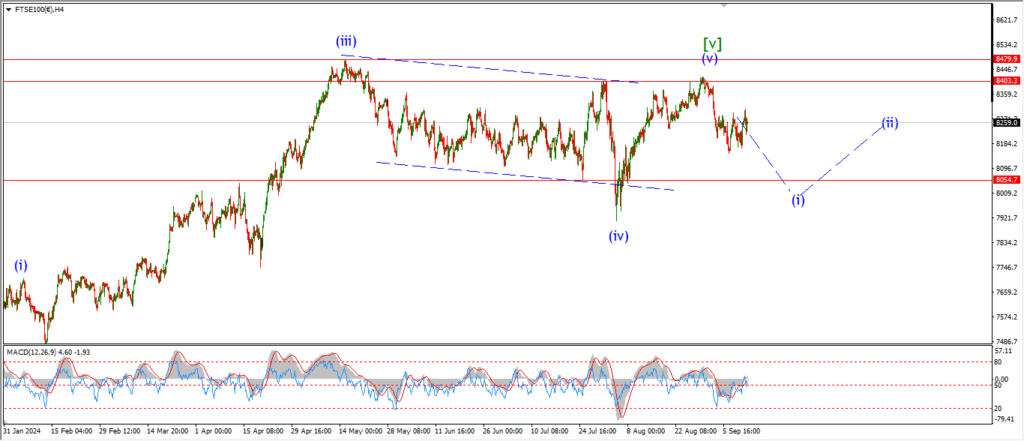

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

….

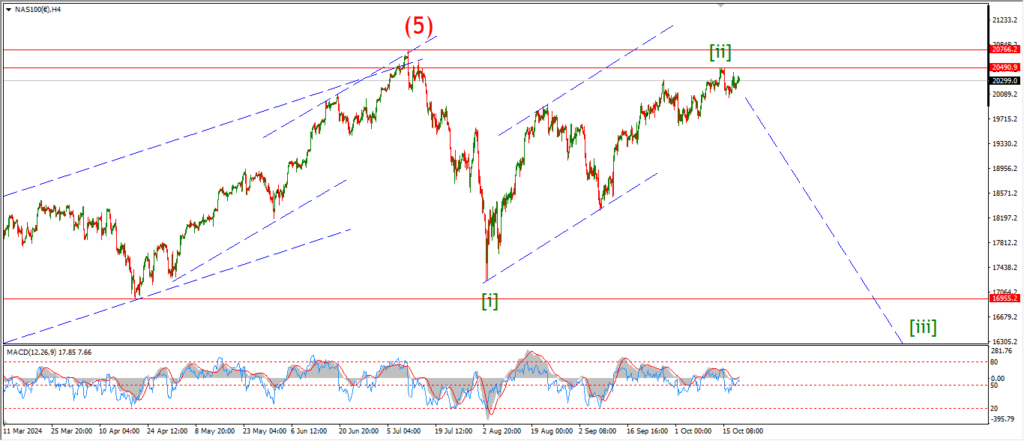

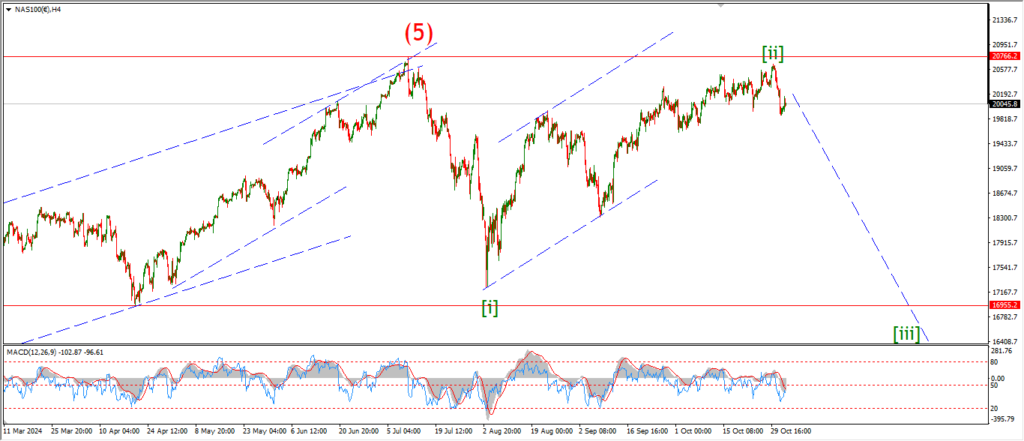

NASDAQ 100.

NASDAQ 1hr

….