Good evening folks and the Lord’s blessings to you.

EURUSD.

EURUSD 1hr.

EURUSD is hanging at the lows of the recent decline this evening,

and because of this I am suggesting that wave ‘5’ has probably got more to go here.

We will see a drop below 1.0950 to complete wave ‘5’ of ‘i’ in this case,

and after that I will look for a turn higher into wave ‘ii’.

Tomorrow;

Watch for wave ‘5’ of ‘ii’ to complete the pattern with a break of 1.0950.

Wave ‘ii’ will have to wait until the middle of the week in this scenario.

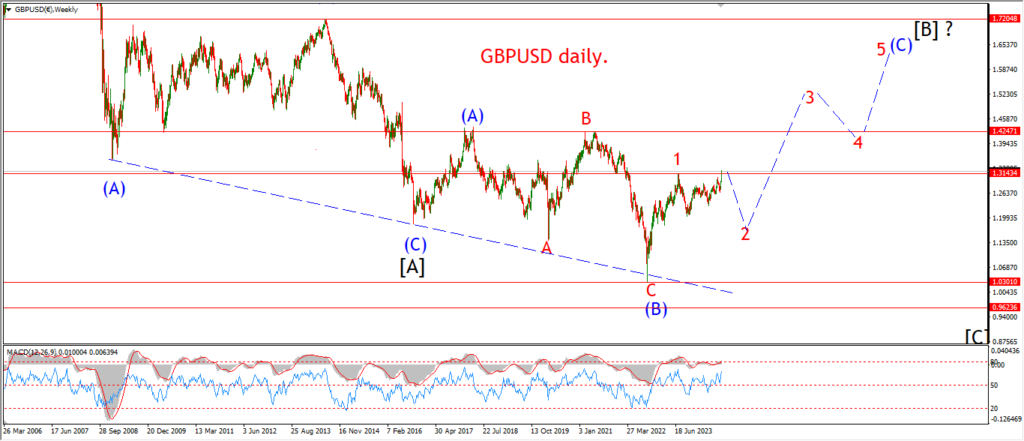

GBPUSD

GBPUSD 1hr.

The action today suggests that wave ‘i’ pink is not complete yet.

We may even get a break below the support at wave ‘iv’ to finish wave ‘i’ now.

If wave ‘iv’ is broken at 13000,

I will be much happier about the potential for the larger reversal getting underway here.

Tomorrow;

Watch for wave ‘5’ of ‘i’ to break below that support at 1.3000 to complete the impulse wave off the top.

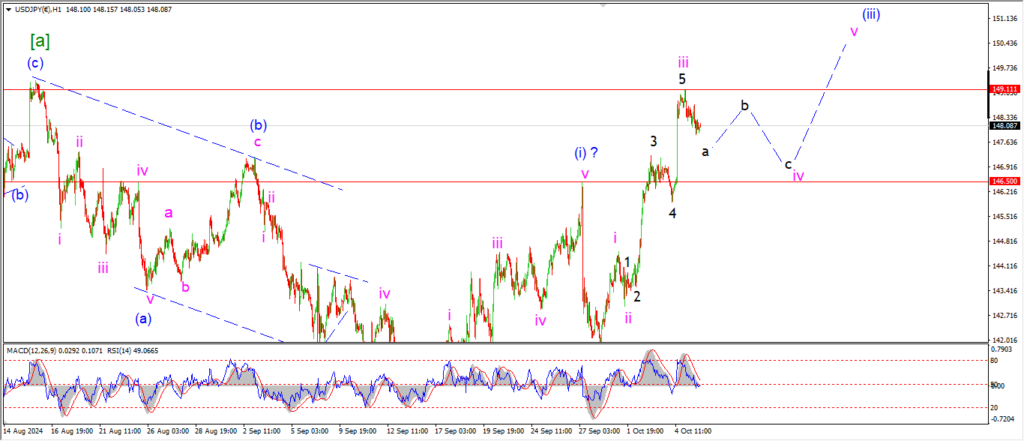

USDJPY.

USDJPY 1hr.

USDJPY is correcting off the top today and I am calling this move the beginning of wave ‘iv’ now.

Wave ‘a’ of ‘iv’ has a three wave form in place off the top.

And now I suspect wave ‘b’ will create a lower high starting tomorrow.

The larger three wave decline in wave ‘iv’ should find support at the wave (i) high at 146.50.

And from there wave ‘v’ should begin later this week.

tomorrow;

Watch for wave ‘iv’ to continue for the next few days as shown.

Wave ‘b’ will form a lower high below 149.11 ideally.

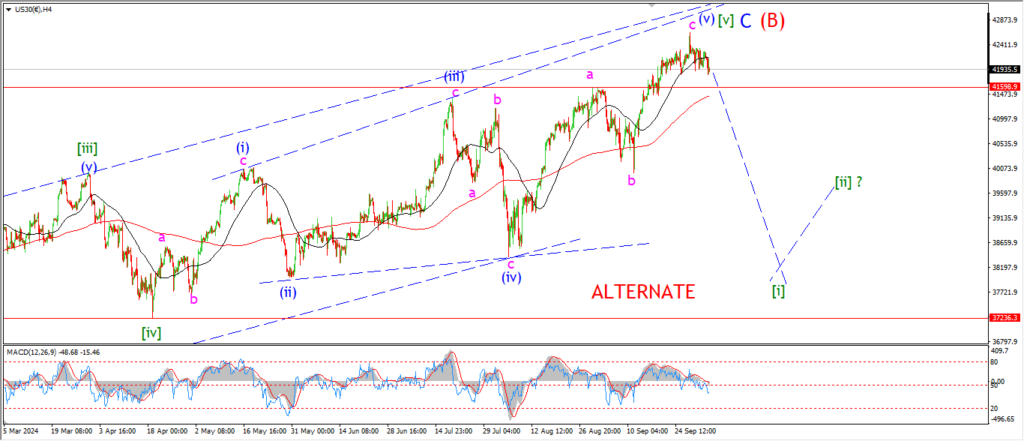

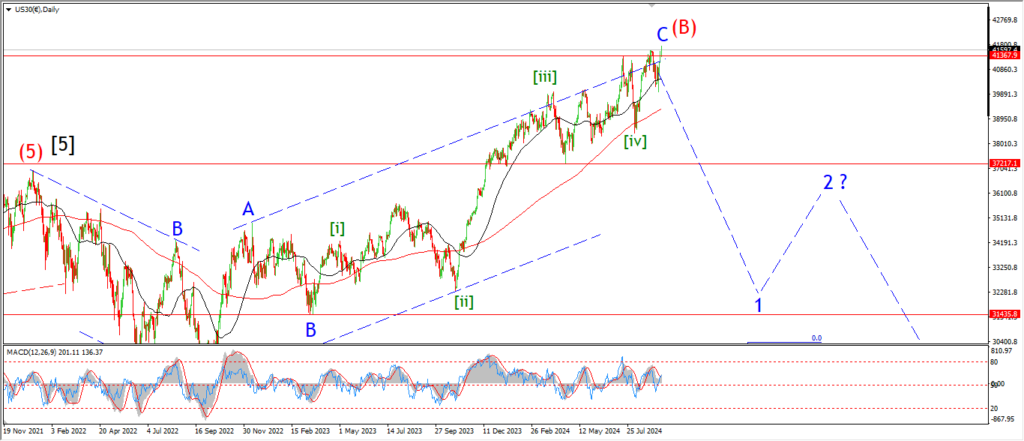

DOW JONES.

DOW 1hr.

I am looking at a corrective channel off the top now,

and the drop off in the market this evening is close to filling that channel again.

I am refraining from labelling the pattern in any way simply because I want the market to give a que here first.

It seems to be doing that right now,

but wave (i) down requires a larger acceleration lower to break 40000 again.

If that happens,

I will be quite happy to start hunting for that major top and reversal again.

for the moment,

I am on the fence!

tomorrow;

If this decline does turn out to be a correction,

then I will revert back to that weave [v] of ‘C’ rally again.

I am hoping the follow through will just kick off now and get the ball rolling,

but the market does not care what I think.

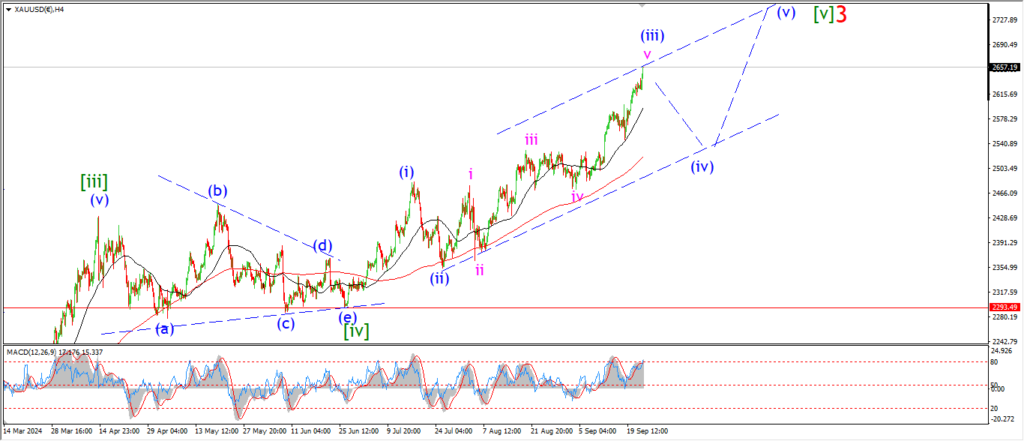

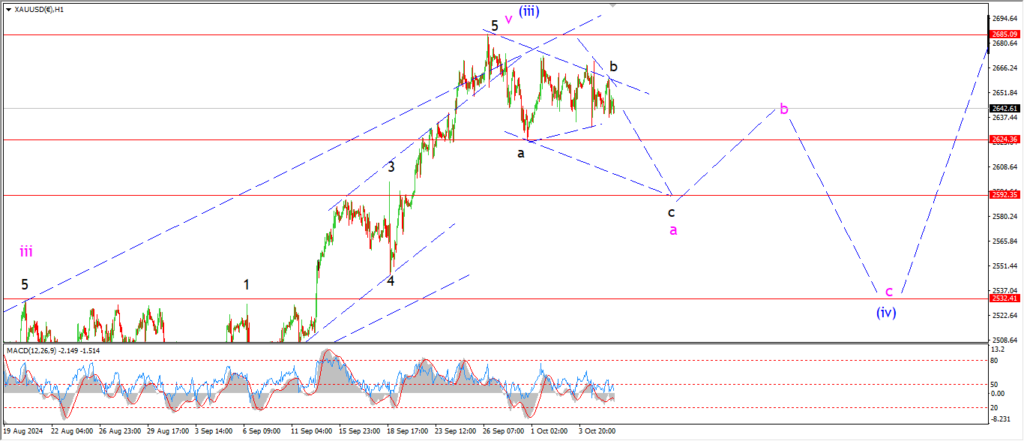

GOLD

GOLD 1hr.

I am tracking a possible triangle in wave ‘b’ of ‘a’ now as the market has gone sideways again today.

The price should now turn lower into wave ‘c’ in this scenario.

A low in wave ‘c’ should come in at about 2590,

That is where wave ‘c’ will close the channel again.

Once that happens,

then we can look for a turn higher into wave ‘b’ over the following days.

Tomorrow;

Watch for wave ‘c’ to break the wave ‘a’ low at a minimum.

that gives a target range between 2620 and 2590 for wave ‘a’ to complete.

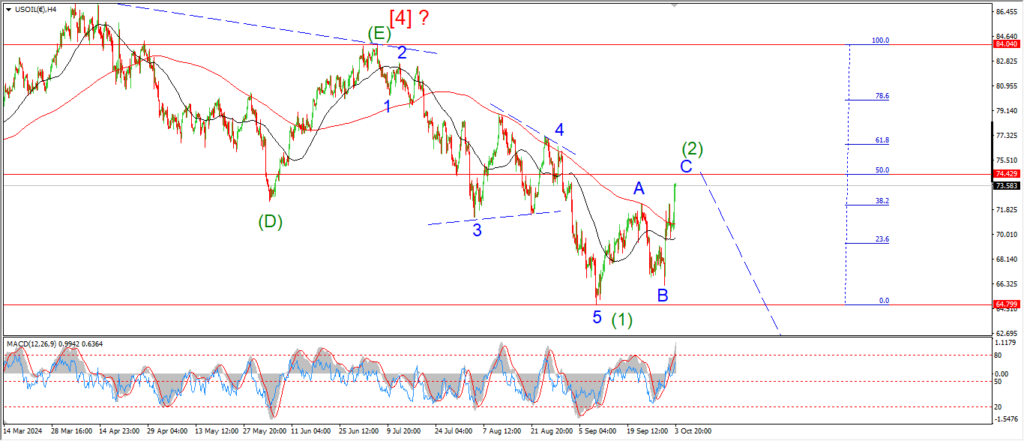

CRUDE OIL.

CRUDE OIL 1hr.

Wave (2) has now broken the 62% retracement level after another spike higher today.

the pattern still shows a three wave pattern off the lows.

and wave ‘C’ now has a five wave internal pattern in place.

All the signs are pointing to a correction completing in wave (2) here,

so I remain convinced that crude will turn down again into wave (3) once wave (2) is over.

Tomorrow;

I suspect wave ‘C’ of (2) will complete this week,

and then I will look for a reversal pattern to build into wave (3) down.

For the moment,

I will just track the final sub waves of wave [v] of ‘C’.

A break below 72.00 again will be a good signal that wave (2) is done.

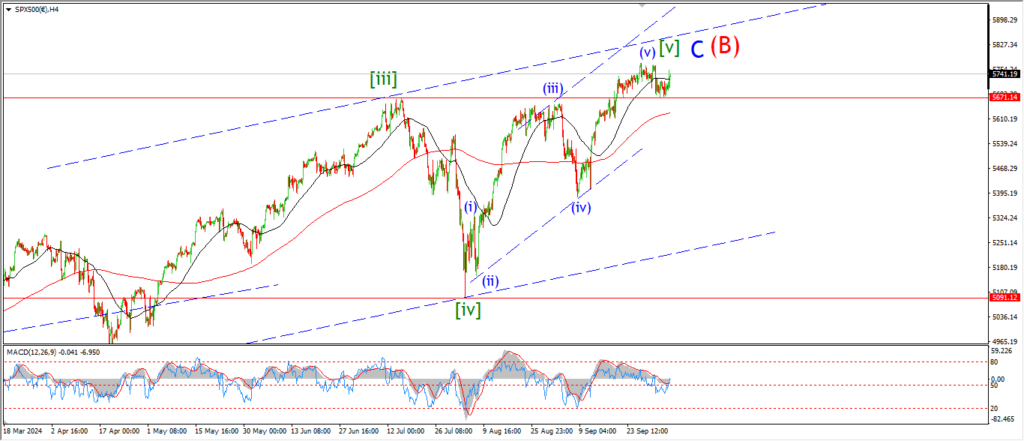

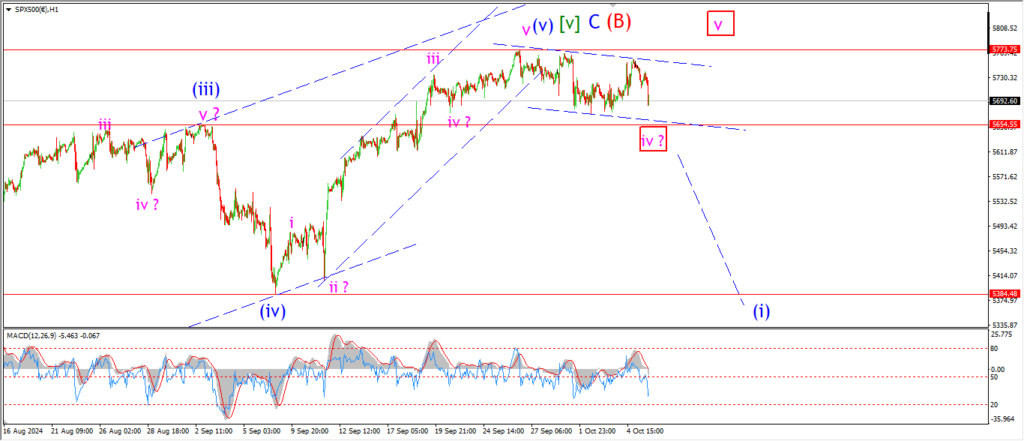

S&P 500.

S&P 500 1hr

The S&P is moving sideways in a channel over the last week,

and that does suggest a possible correction here.

I have shown an alternate count for wave ‘iv’ and ‘v’ to complete wave (v) as the next possible count here.

the market ahs a long way down to go in order to prove the main idea for wave (i) blue.

that wave will be confirmed with a break of 5380.

So I admit that the path of least resistance is to a new high in that alternate wave ‘v’.

Tomorrow;

The market will chose between these options very soon.

The close we get to 5500 again

the more I will favor the wave (i) idea.

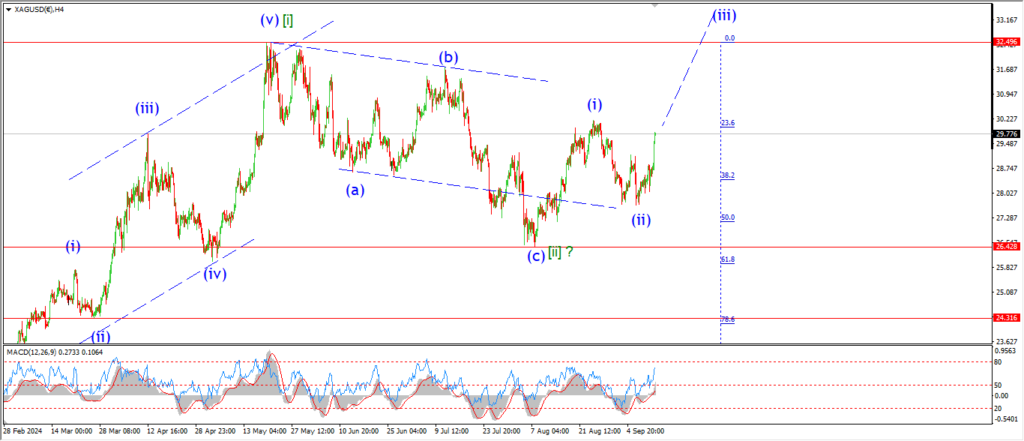

SILVER.

SILVER 1hr

Silver is still moving in the range of the previous wave ‘a’ decline today.

the count requires a decline back below 30.86 at a minimum for wave ‘ii’ to close out.

so I will stick with that idea for wave ‘ii’ unless the price action indicates that the rally is about to resume again.

Tomorrow;

Watch for wave ‘c’ of ‘ii’ to fall into the target at 30.86.

the expanded flat pattern that I am working with for wave ‘ii’ suggests that wave ‘c’ will fall back into the 30.00 level again.

but we will take each day as it comes.

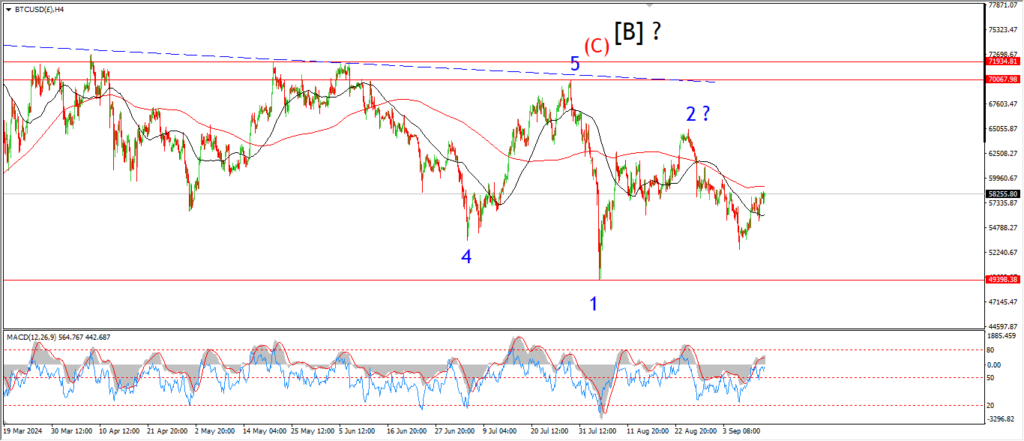

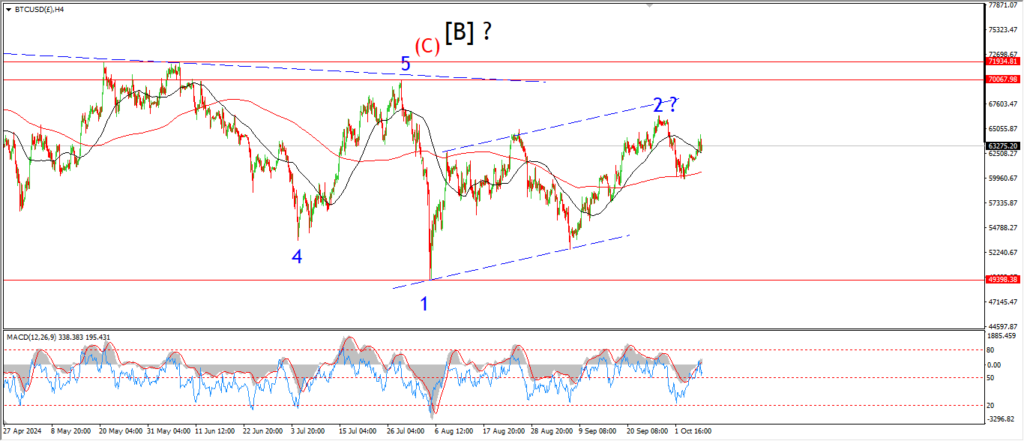

BITCOIN

BITCOIN 1hr.

….

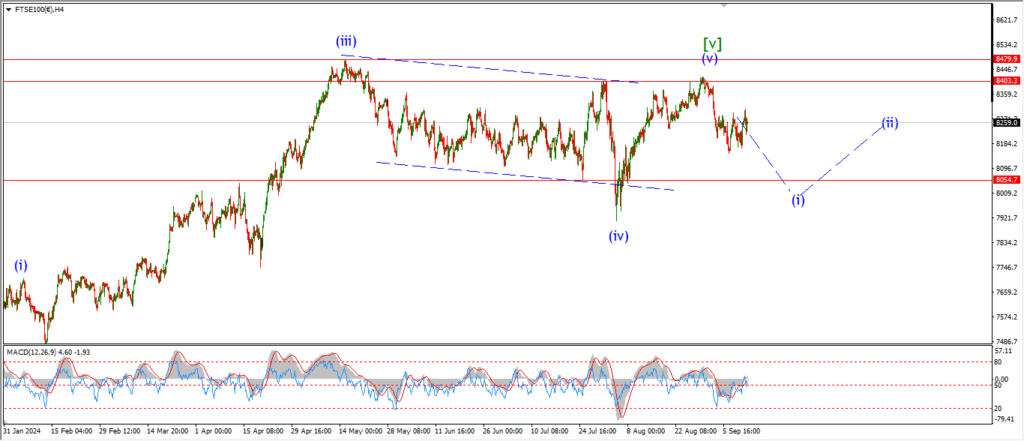

FTSE 100.

FTSE 100 1hr.

….

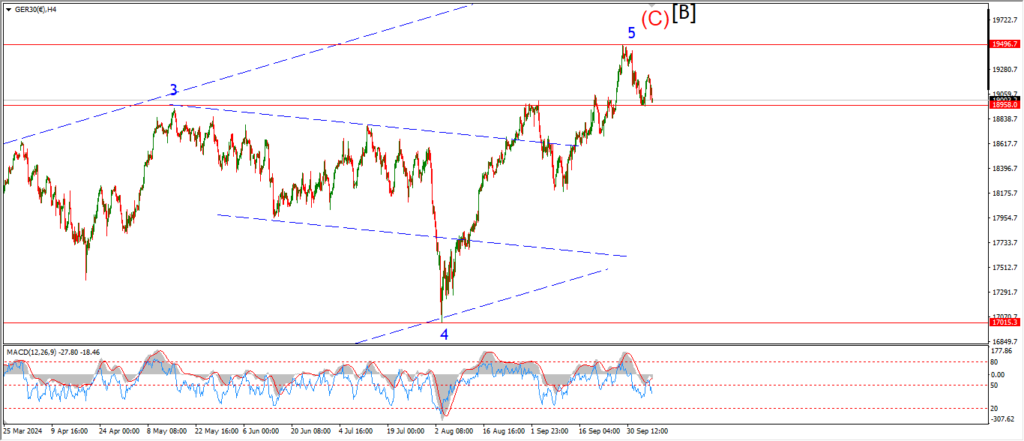

DAX.

DAX 1hr

….

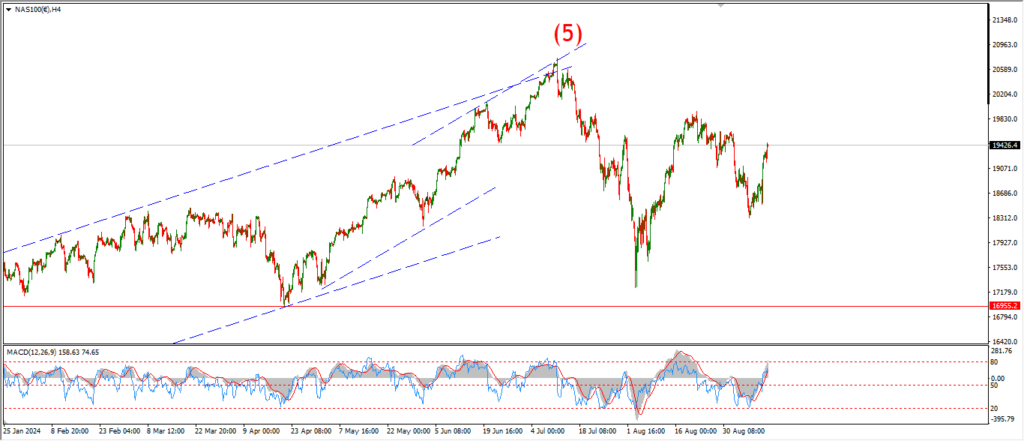

NASDAQ 100.

NASDAQ 1hr

….