Good evening folks, the Lord’s Blessings to you all.

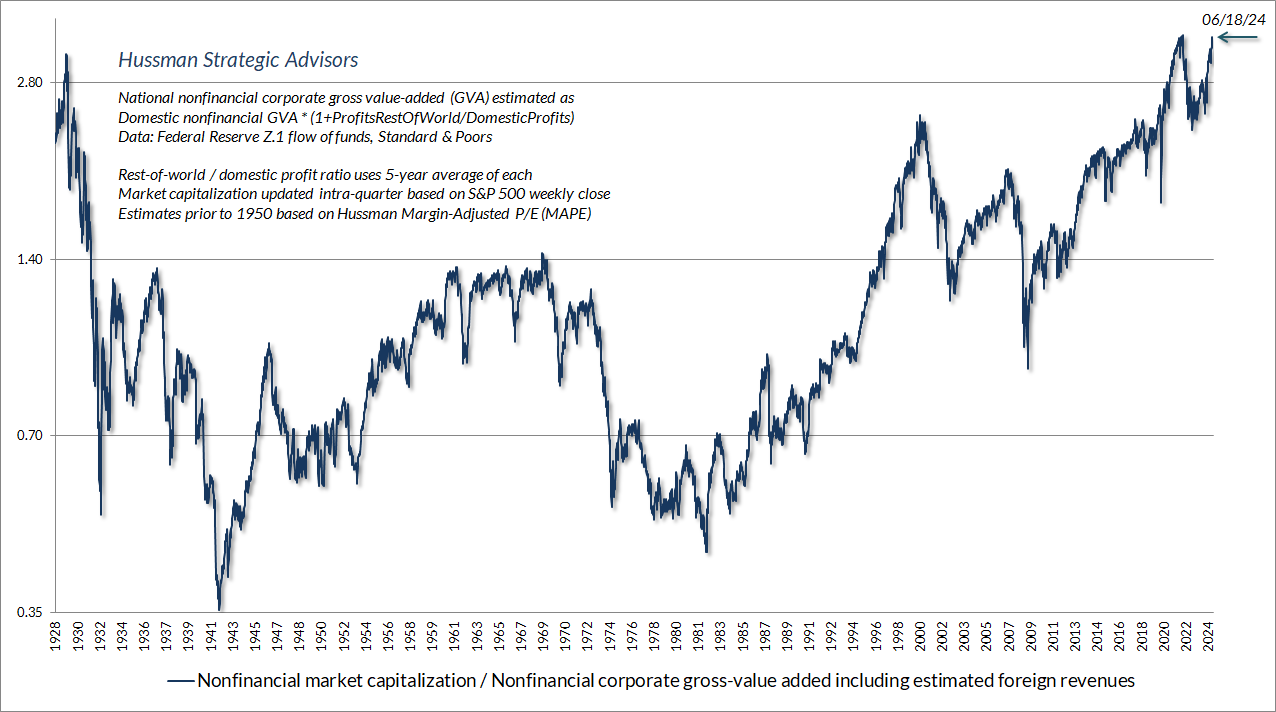

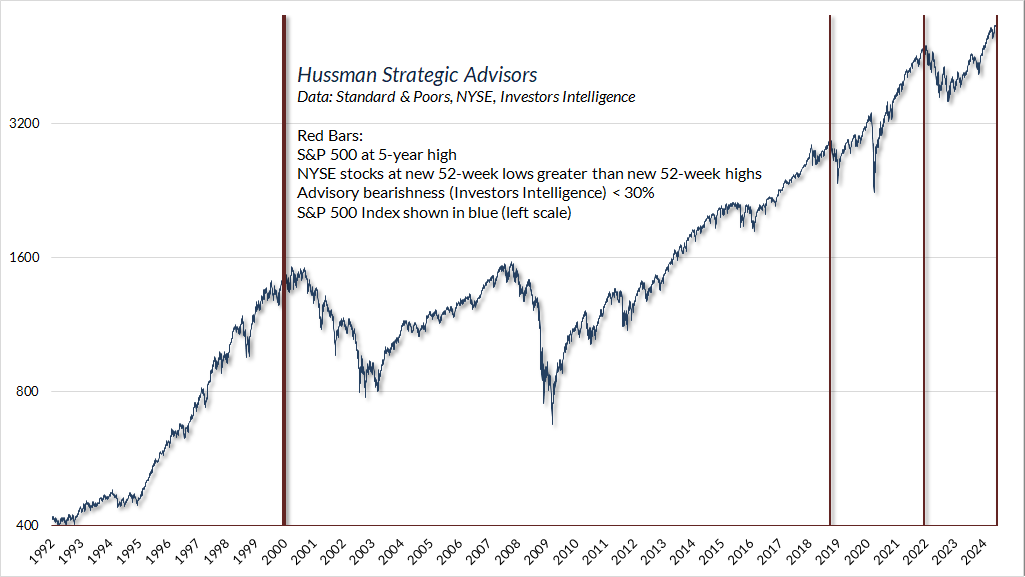

You Can Ring My Bell

I may as well just say it. Based on the present combination of extreme valuations, unfavorable and deteriorating market internals, and a rare preponderance of warning syndromes in weekly and now daily data, my impression is that the speculative market advance since 2009 ended last week. Barring a wholesale shift in the quality of market internals, which are quickly going the wrong way, any further highs from these levels are likely to be minimal. In contrast, current valuation extremes imply potential downside risk for the S&P 500 on the order of 50-70% over the completion of this cycle.

https://twitter.com/bullwavesreal

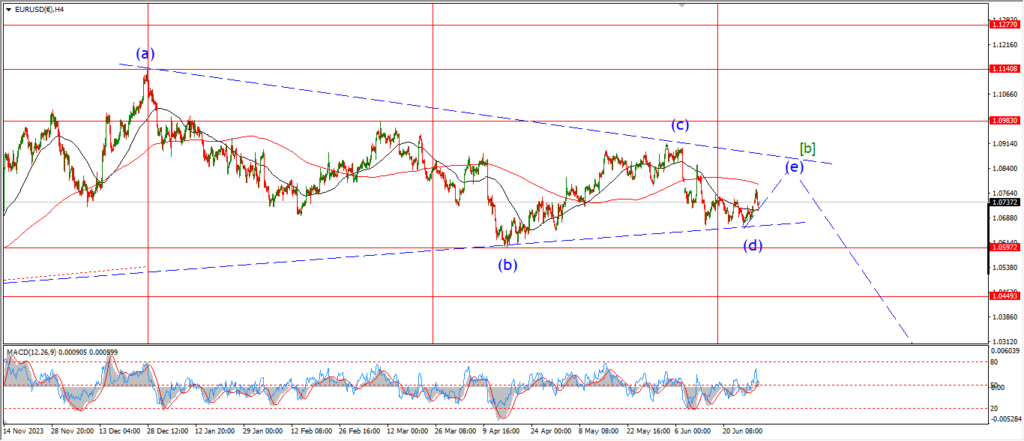

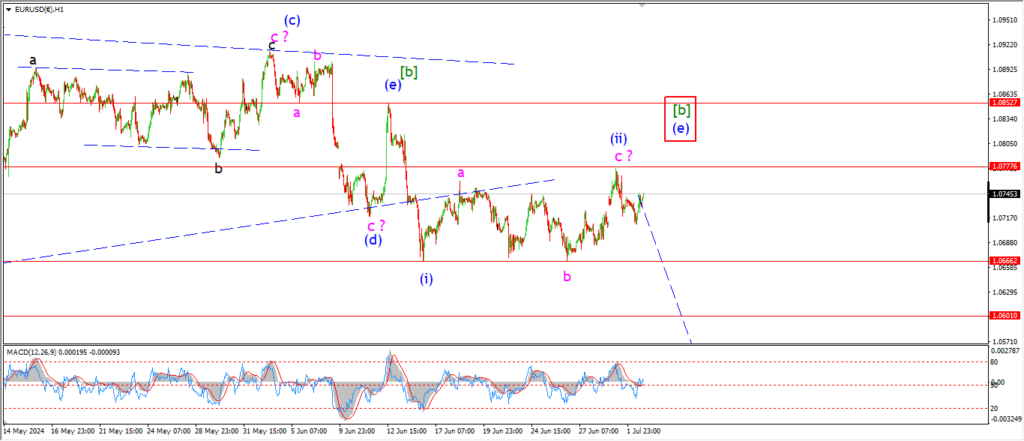

EURUSD.

EURUSD 1hr.

There was a small move lower today but I m not very impressed by it!

If we look at the 4hr chart there is also a possibility that the price is still moving in wave (e) of [b].

I have set that as a possible alternate this evening.

If we see a move above 1.0777 again that will trigger the alternate count.

Tomorrow;

Watch for a sharp move below 1.0666 to confirm wave ‘i’ of (iii).

1.0777 must hold.

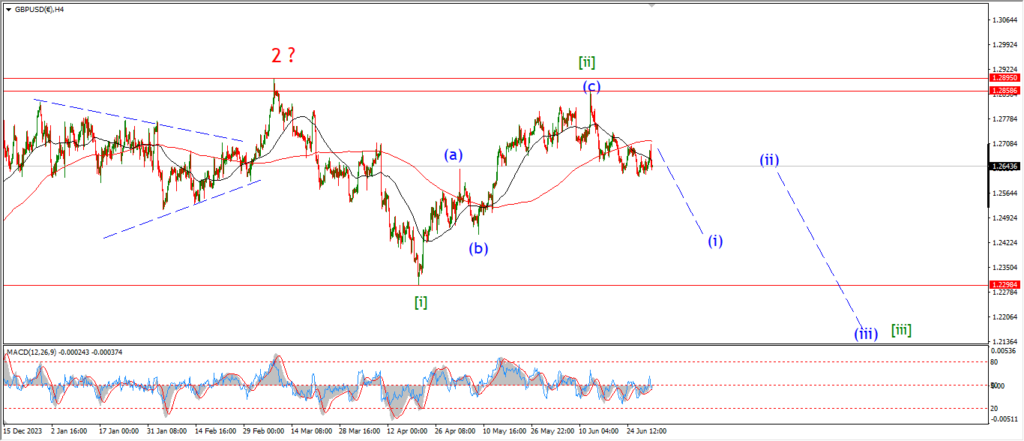

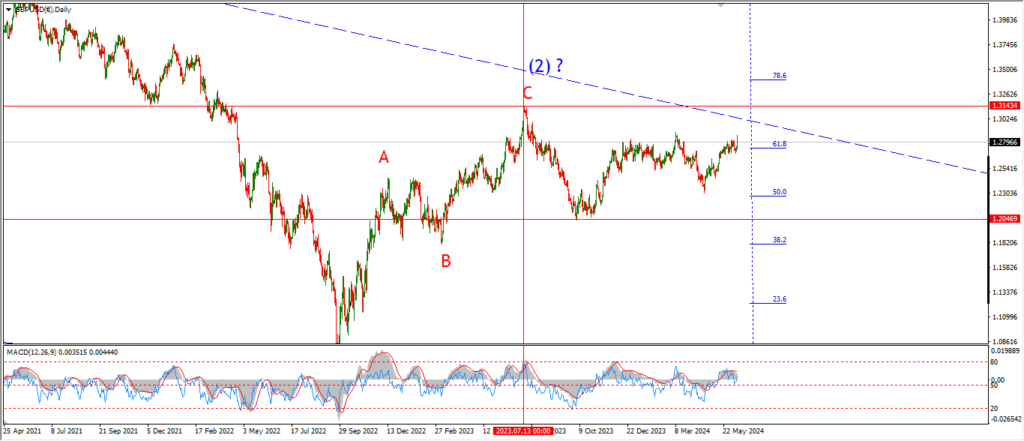

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

The bounce in cable today has not invalidated the main count for wave ‘ii’,

but it has definitely weakened that idea.

Wave ‘ii’ still holds at 1.2706 for the moment.

I want to see a move lower to break 1.2600 again tomorrow to confirm this count.

And then wave ‘iii’ should take over and carry the price down to break 1.2500.

Tomorrow;

Watch for wave ‘3’ of ‘iii’ to turn lower and confirm the main count with a break of 1.2600.

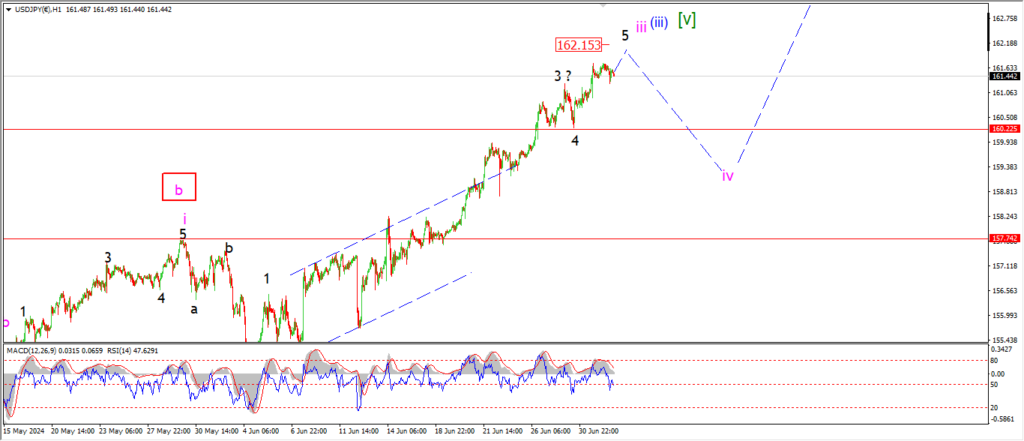

USDJPY.

USDJPY 1hr.

I am looking for one more pop above 162.00 to complete wave ‘5’ of ‘iii’ of (iii) tomorrow.

And then I will turn my attention lower again for a choppy correction into wave ‘iv’ of (iii) as shown.

Wave ‘iv’ should begin this week going with this scenario.

And that correction will likely take up most of next weeks trade.

For now,

its a case of waiting for wave ‘iii’ to top out and then turn into wave ‘iv’.

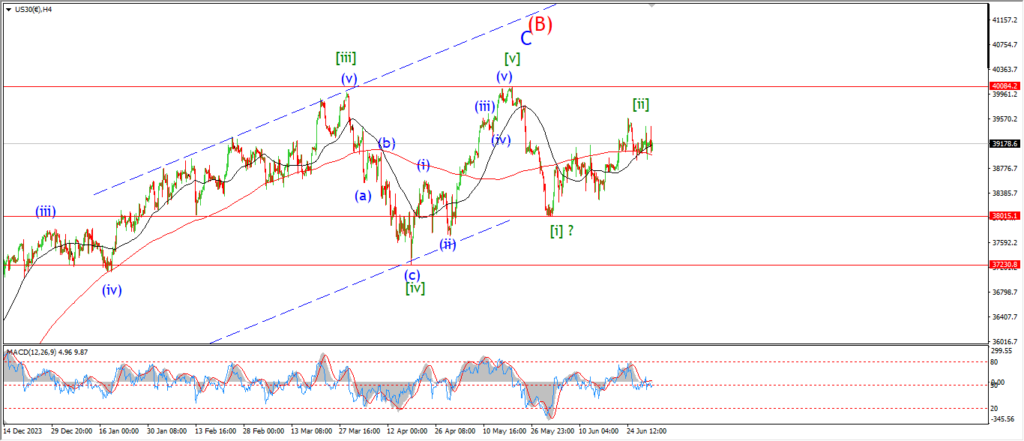

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

The DOW is not willing to move lower so far this week.

We have a possible lower high building off the wave ‘ii’ high.

But there is so little movement that it is hard to call this third wave in play yet.

There is a solid three wave pattern higher in place at the recent wave (ii) high.

So that idea still holds.

The next logical move here is a five wave decline into wave (iii).

I am looking for a decisive move into that next wave this week.

Tomorrow;

Watch for wave ‘ii’ to hold at Mondays high.

A break of 38900 again will signal wave ‘iii’ is underway.

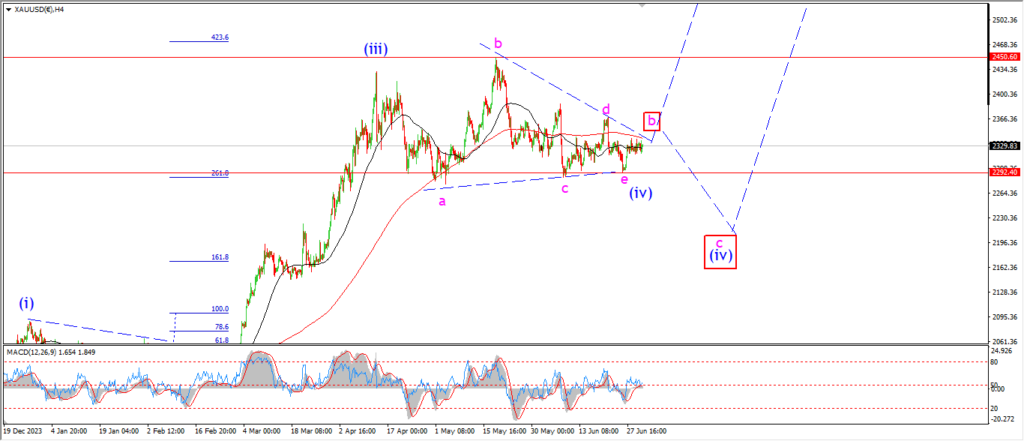

GOLD

GOLD 1hr.

Gold continues to hold above the wave (iv) low at 2293 today.

The action today looks corrective in nature.

and so I suspect we are building a higher low now in wave ‘2’ of ‘i’.

The first signal this count is correct will come with a break above 2368.

And from there we should see five waves up build in wave ‘i’ of (v).

I have shown an alternate count for wave (iv) on the 4hr chart.

This involves a complex correction in wave (iv) with an internal triangle wave ‘b’.

A break of 2293 again will trigger this count.

Tomorrow;

Watch for wave (iv) to continue to hold at 2293.

Wave ‘3’ of ‘i’ should turn higher and break the wave ‘b’ high at 2368.

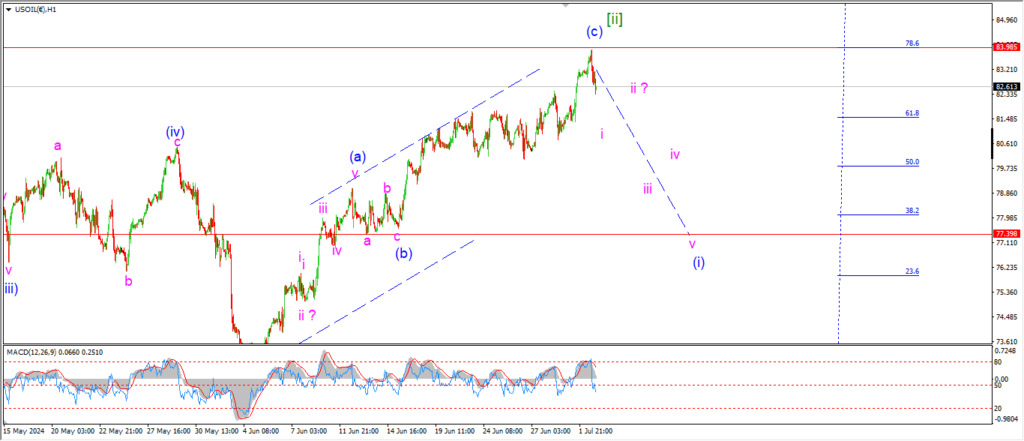

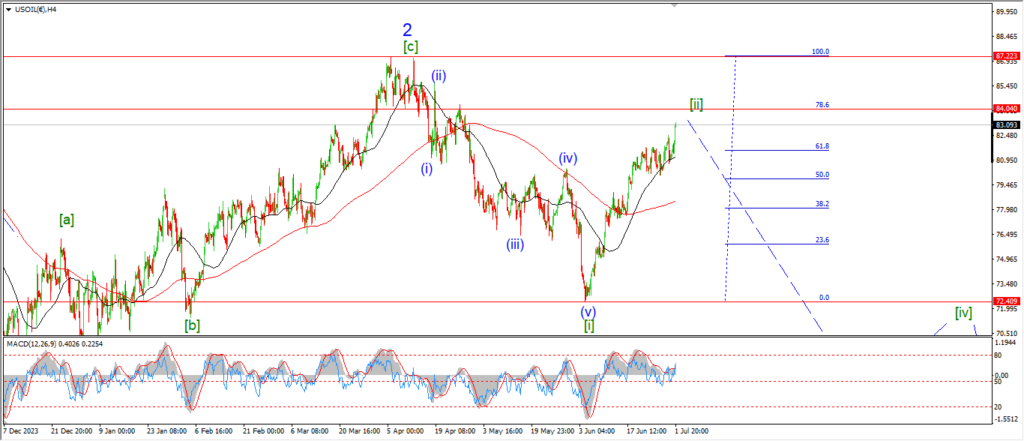

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Oil has turned lower off the top of wave [ii] today,

and at least now I can begin to look for a larger reversal into wave (i) of [iii].

A break below the 80.00 handle again will give a boost to this idea for wave (i) down.

So I wont get too excited until that happens.

And if this count is correct,

then wave (i) will dominate until the middle of next week most likely.

and we should see five waves down to break 77.00 again.

Tomorrow;

Watch for that wave [ii] high to hold and wave ‘i’ of (i) to fall towards 80.00 again.

S&P 500.

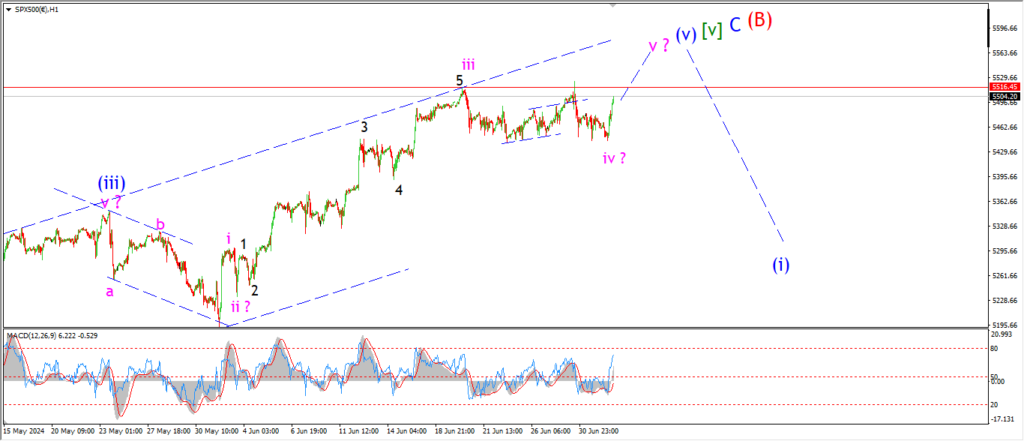

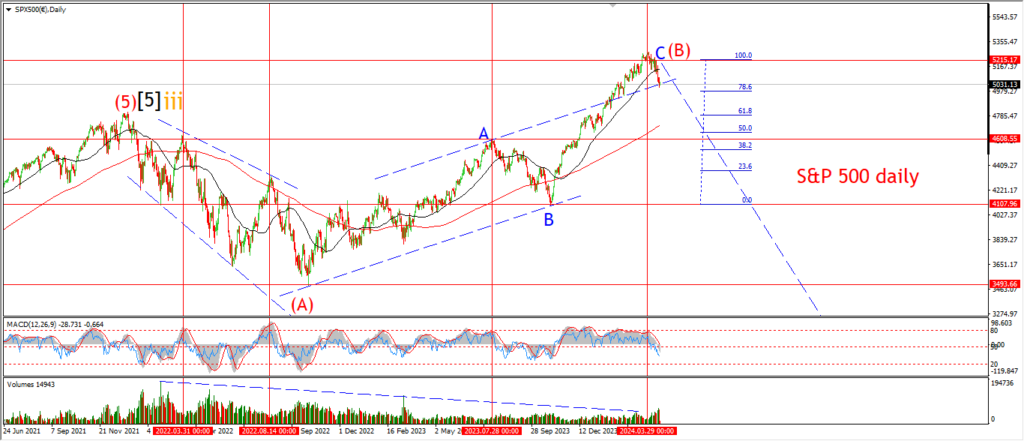

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

It looks like the S&P is reaching for another new high in wave (v) again after a rebound off the early lows.

The price will not make much progress over the previous high in wave ‘iii’ and I do think we will see a sizeable reversal soon.

the holiday week is buoying the mood a little,

and it seems the drift upwards is a symptom of that.

Wave ‘iv’ has taken most of the last week to unfold and that correction took the form of a triple combination I think.

The spike higher today has kicked off wave ‘v’ now.

We have an all but complete five wave pattern in wave [v] green.

but we are waiting for the last step of this internal pattern to complete before the trap door opens.

Tomorrow;

Watch for wave ‘v’ of (v) to close out over the coming days to top out the larger pattern.

SILVER.

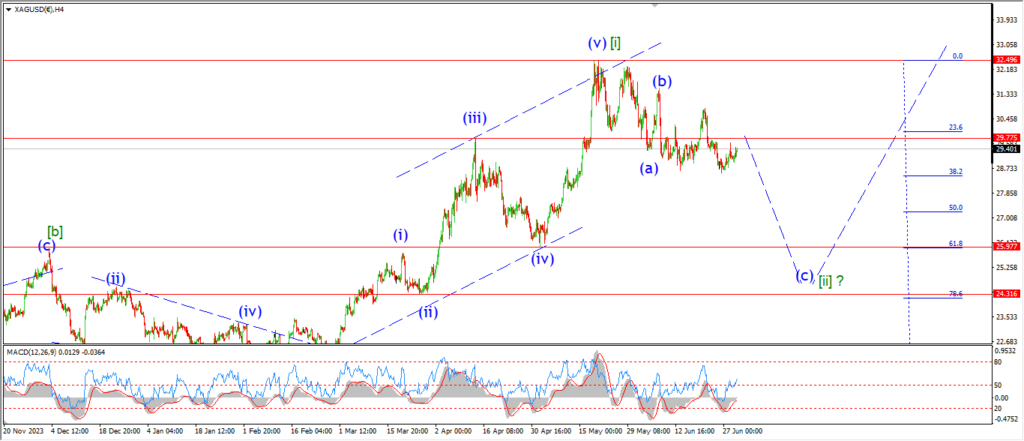

SILVER 1hr

SILVER 4hr.

SILVER daily.

The correction higher in wave ‘2’ extended again today.

The action remains in a channel to the upside and there is a chance that wave ‘2’ has topped out at the high again.

A drop below 28.55 is what I am looking for the signal wave ‘3’ of ‘iii’ of (c) has begun.

tomorrow;

This correction higher must complete pretty soon.

The price must hold below 30.83 for this count to remain valid.

Wave ‘3’ will be confirmed with a break of 28.55 again.

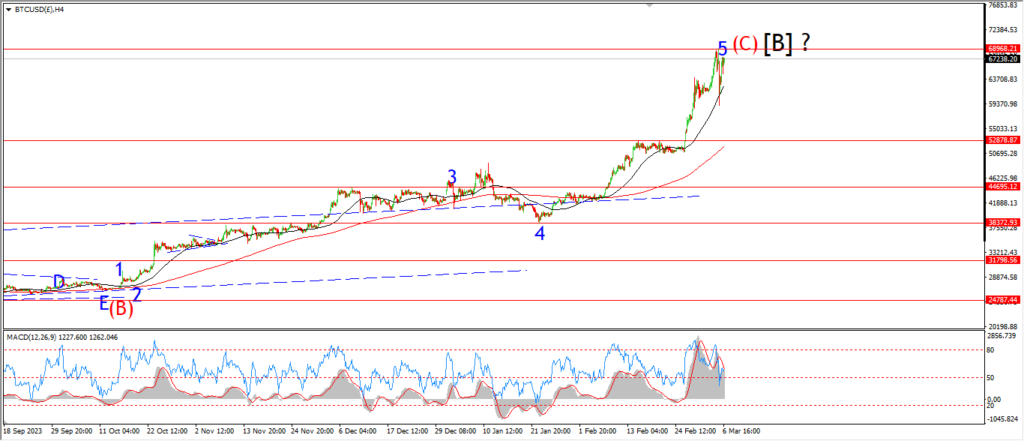

BITCOIN

BITCOIN 1hr.

….

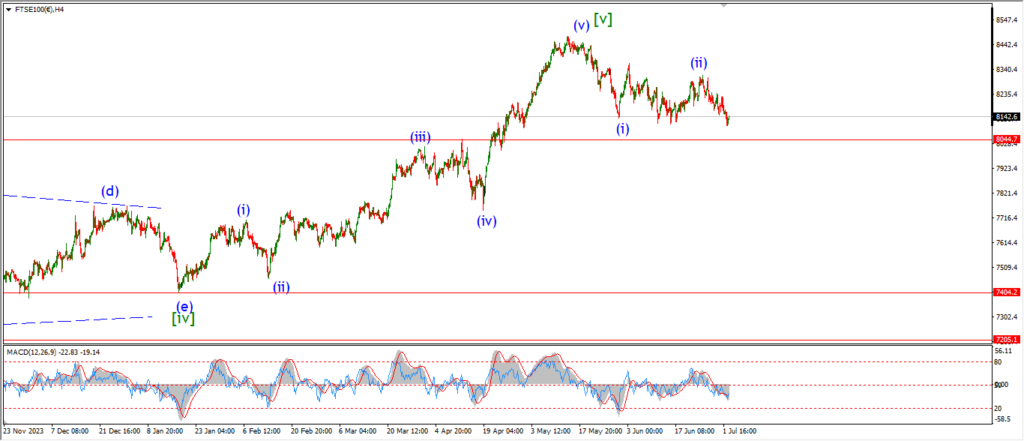

FTSE 100.

FTSE 100 1hr.

….

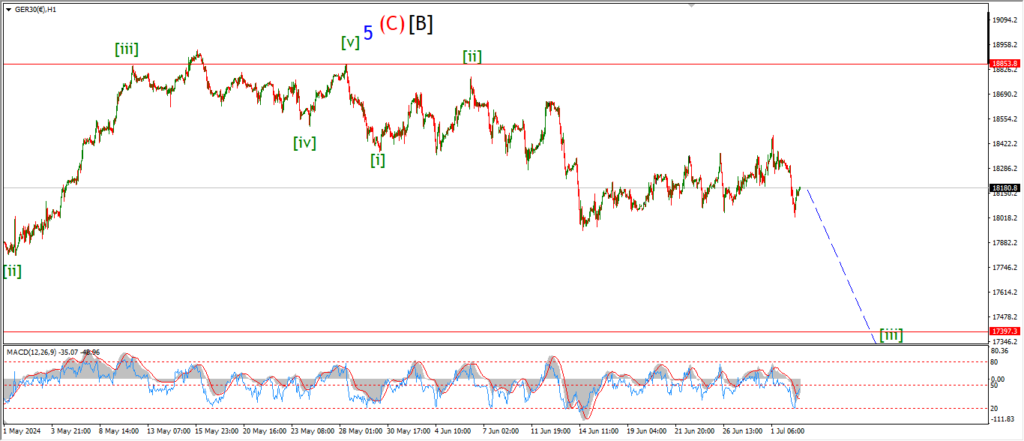

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

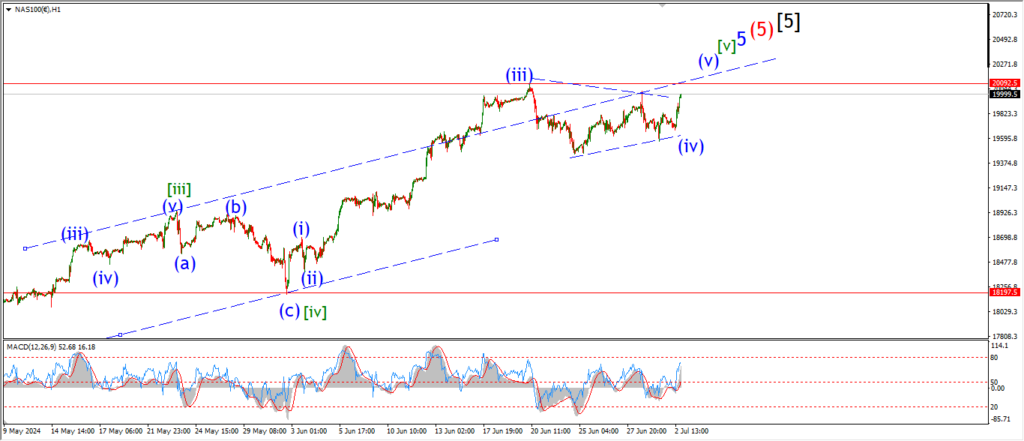

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….