Good evening folks, the Lord’s Blessings to you all.

Good evening all and welcome back.

I am camping away with the family and the place is quiet for a while so I thought I would do a quick chart review.

The market was closed today in the US so it is a good time to check out what has developed this week.

on with the show.

https://twitter.com/bullwavesreal

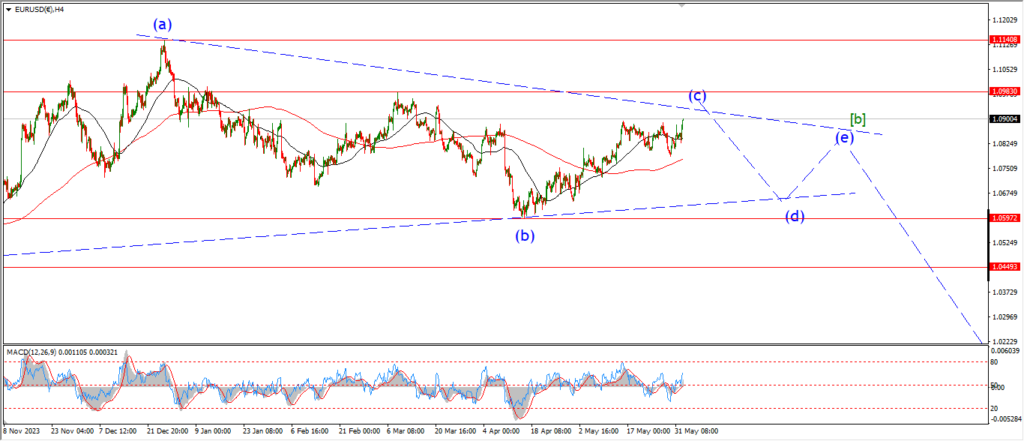

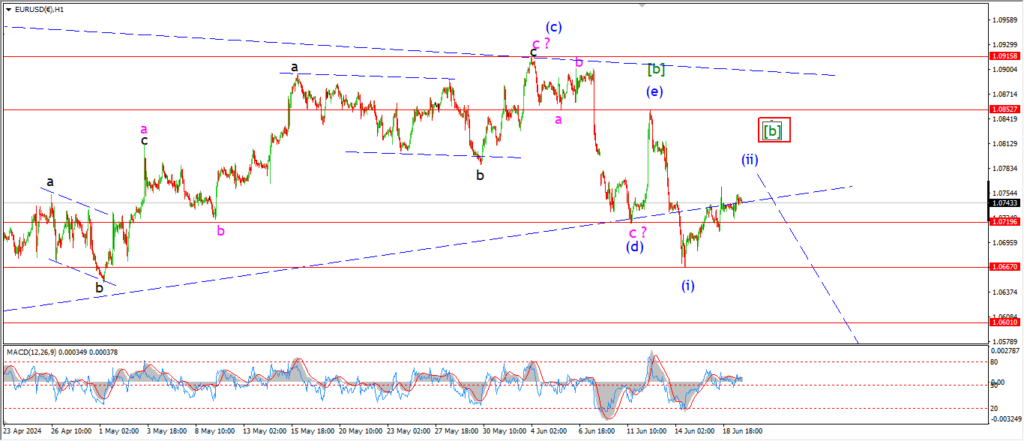

EURUSD.

EURUSD 1hr.

Last weeks high can be viewed as a complete wave [b] and the decline this week begins wave [c].

Wave (i) and (ii) in play now.

And wave (iii) should bring this price back towards 1.04 when complete.

The alternate idea suggests wave [b] is still to complete at a lower high this week.

Tomorrow;

Watch for wave (ii) to close out soon and then reverse lower again into wave (iii) of [c].

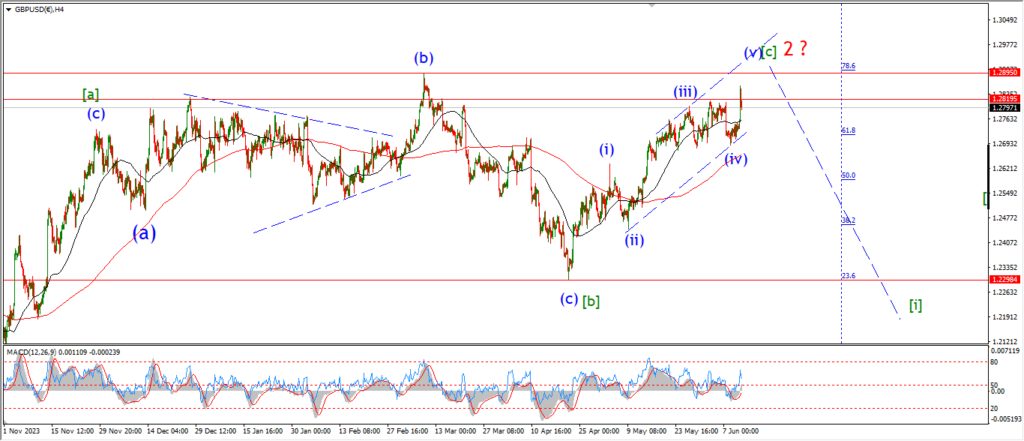

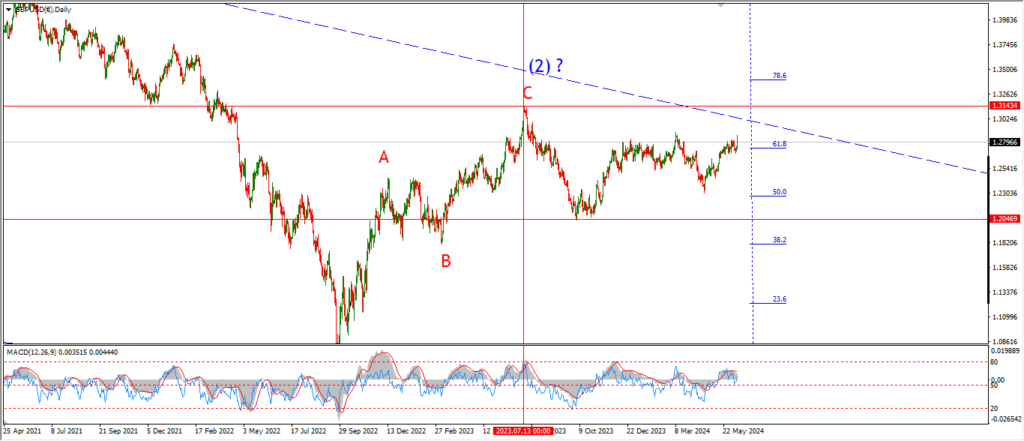

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

GBPUSD daily.

A similar idea here in cable.

The price has fallen impulsively off the top at wave [ii].

and wave [iii] is now set to carry this pair lower for an extended decline.

Wave ‘i’ and ‘ii’ should begin the larger wave (i) blue.

Wave (i) blue should break below 1.2500 when complete later next week.

Tomorrow;

Wave ‘ii’ of (i) has a target at 1.2757 at the 50% retracement level.

Wave ‘iii’ of (i) will be confirmed with a break of 1.2656.

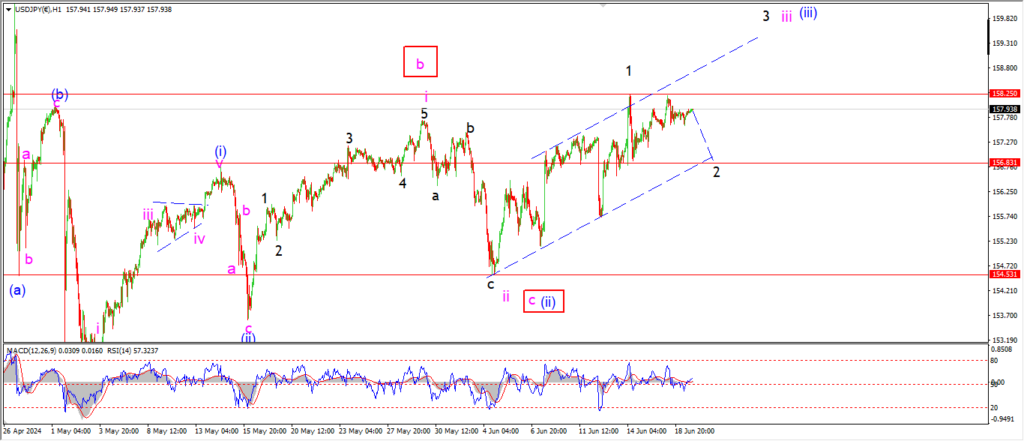

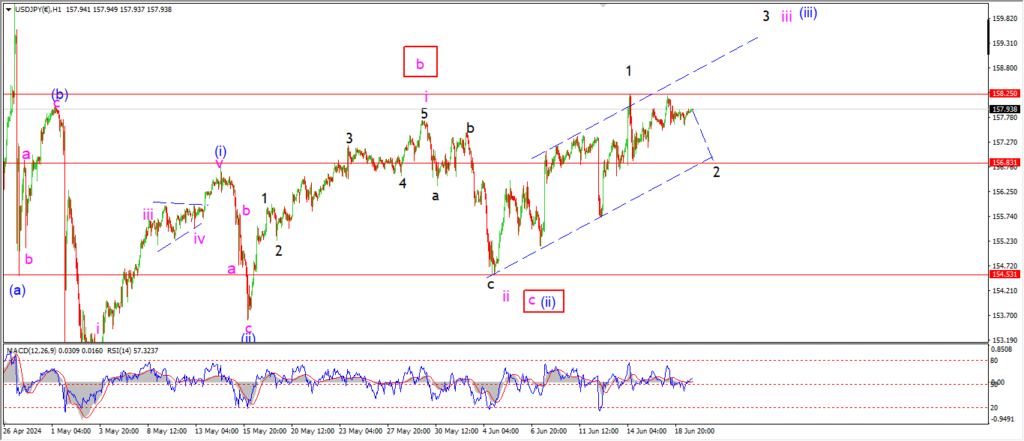

USDJPY.

USDJPY 1hr.

The price is holding above the wave ‘i’ high today and that does signal wave ‘iii’ is now in play here.

I am now suggesting that wave ‘1’ of ‘iii’ is a leading wedge pattern at last weeks high.

Wave ‘2’ will fall back to the lower channel line at 157.00.

And then wave ‘3’ of ‘iii’ will be set up to rally hard to confirm the larger pattern.

It really is crunch time for this count now.

tomorrow;

Watch for wave ‘2’ of ‘iii’ to complete at about 156.80.

Wave ‘3’ of ‘iii’ must then turn higher impulsively.

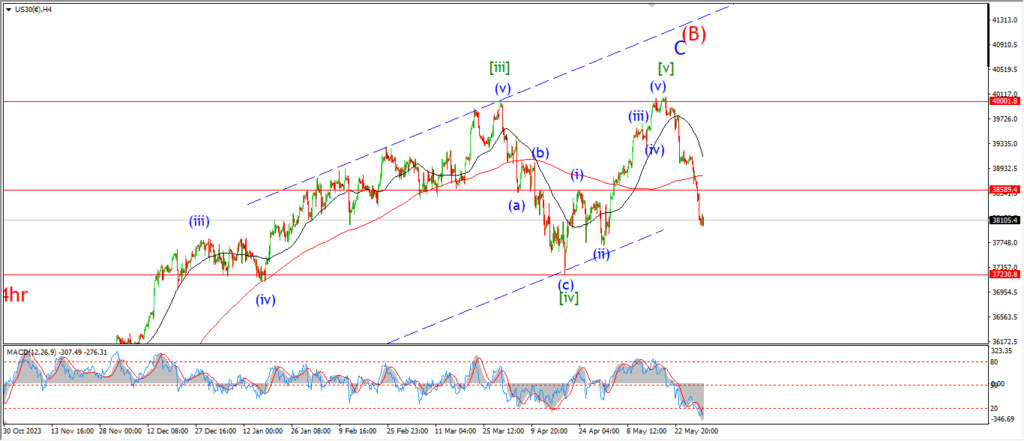

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

A rally this week has brought the market back to the 78.6% retracement of wave ‘i’ now.

The market must now fall hard from here to confirm the larger count and begin wave (iii) down.

Tomorrow;

Watch for wave (ii) to hold at 39150.

wave ‘iii’ of (iii) will be confirmed with a break of the wave ‘i’ low at 38280.

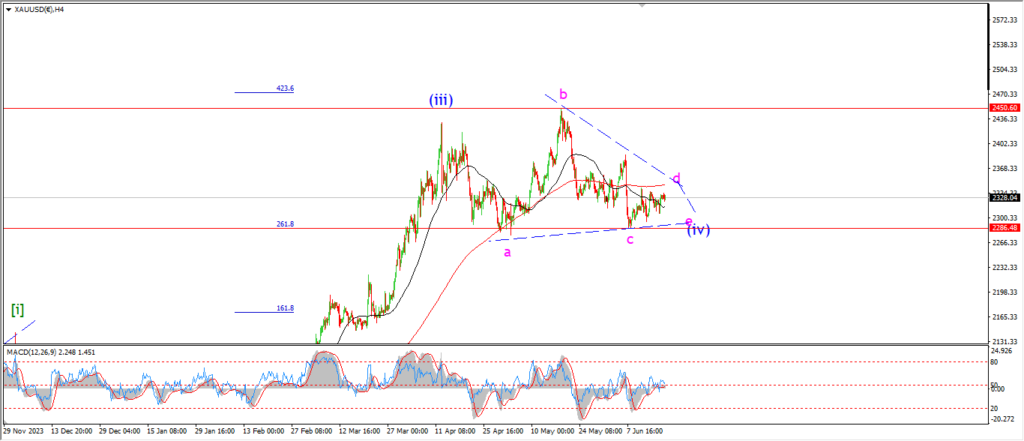

GOLD

GOLD 1hr.

I have switched to the alternate count for wave (iv) blue.

The pattern is shown as a possible triangle in wave (iv) now.

Wave ‘d’ of (iv) will complete near the recent high at 2387.

And then fall into wave ‘d’ to complete the pattern.

Wave (v) will then be set to rally out from there to confirm this pattern.

Tomorrow;

Watch for wave ‘d’ of (iv) to close out near 2387.

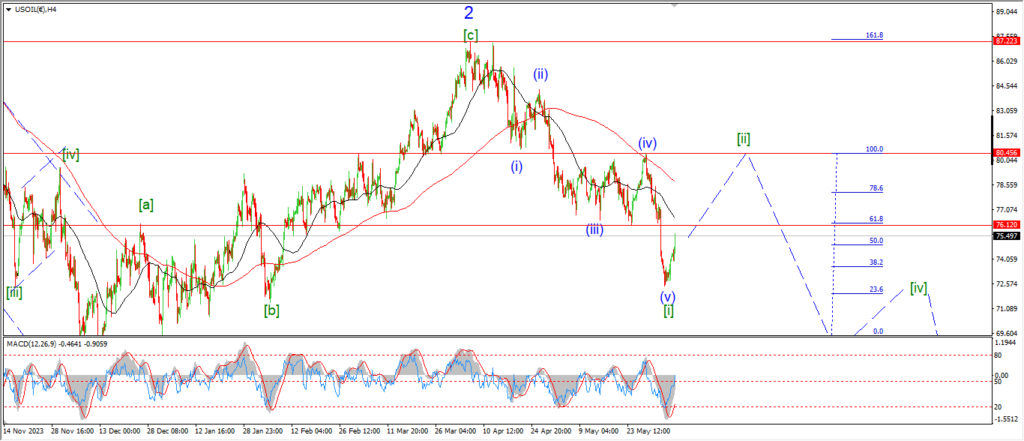

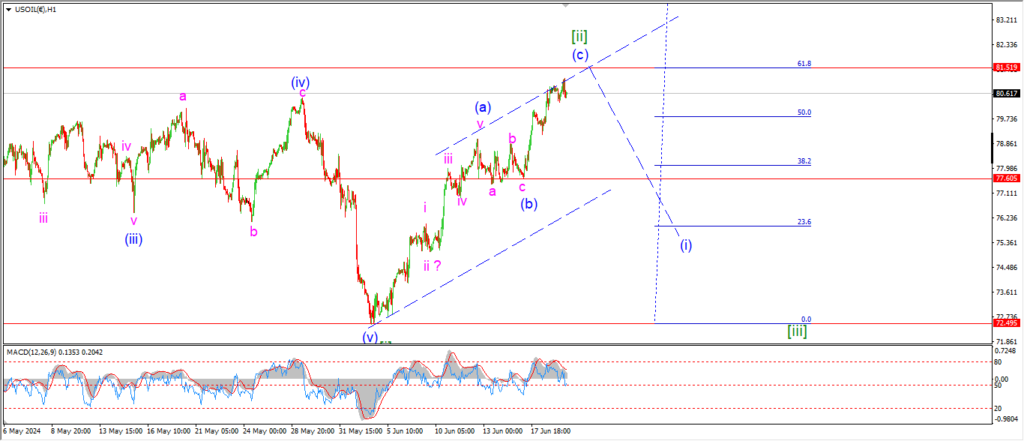

CRUDE OIL.

CRUDE OIL 1hr.

The rally into wave [ii] has reached the suggested target area at the 62% retracement level now.

but I am not quite sure of the internal pattern of wave (ii).

Maybe this will clear up over the next few days,

but I do have a question mark in my mind about this wave [ii] count now.

I will stick with the main count until proven wrong,

Tomorrow;

Watch for wave (c) of [ii] to top out near 81.50.

WAve (i) of [iii] should turn lower before the end of this week.

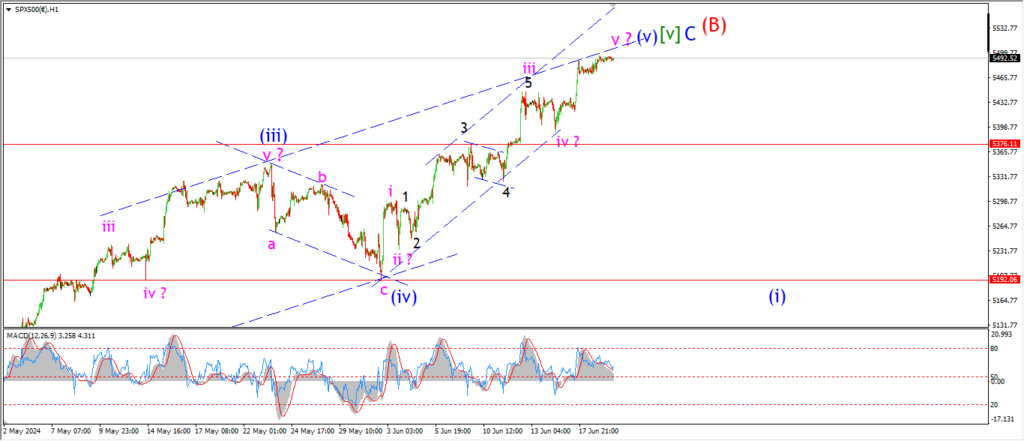

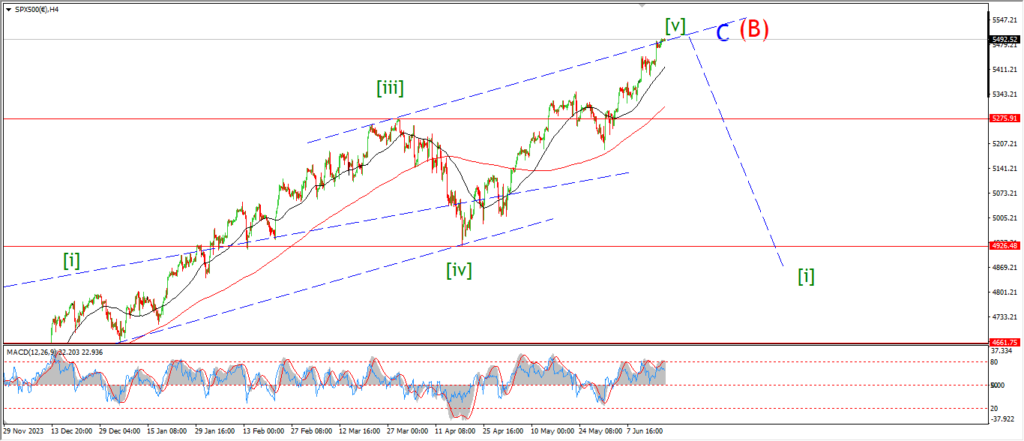

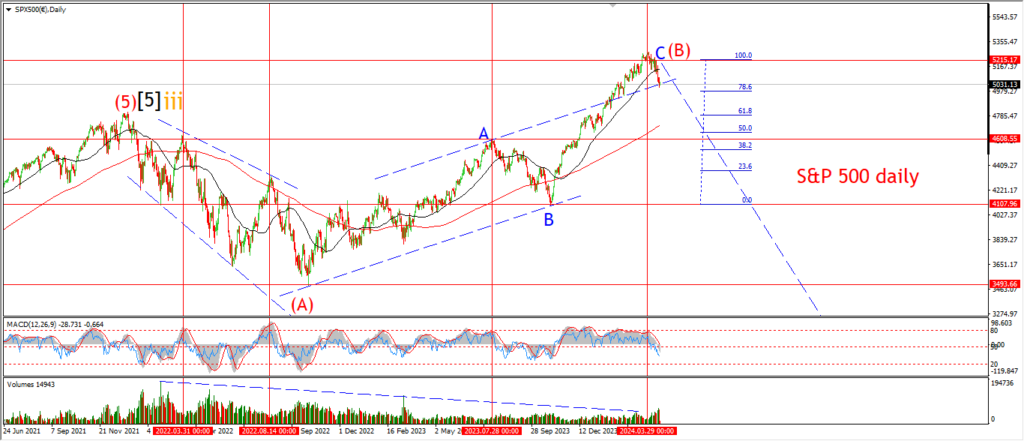

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

This is a full wave count now with the extra high this week extending wave (v).

the pattern has tagged the upper trend line of the larger channel in wave [v] this week.

And wave ‘v’ pink is close to filling out the smaller channel in wave (v) blue.

Also,

on the 4hr chart we can see that wave [v] green has filled the channel for wave ‘C’ of (B).

Its a clean count all the way down now.

and its time to look for an end point for this wave.

Tomorrow;

Let’s see if there is any more steam left to rally in wave ‘v’ of (v) to top this one out.

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

The price has failed to accelerate lower into wave ‘iii’ of (c) this week.

but the price is in a corrective move higher off last weeks lows.

This is viewed as wave ‘1’ and ‘2’ of ‘iii’ and we should see a renewed decline into wave ‘3’ of ‘iii’ over the coming days.

Tomorrow;

Watch for wave ‘3’ of ‘iii’ to turn lower and break 28.39 again.

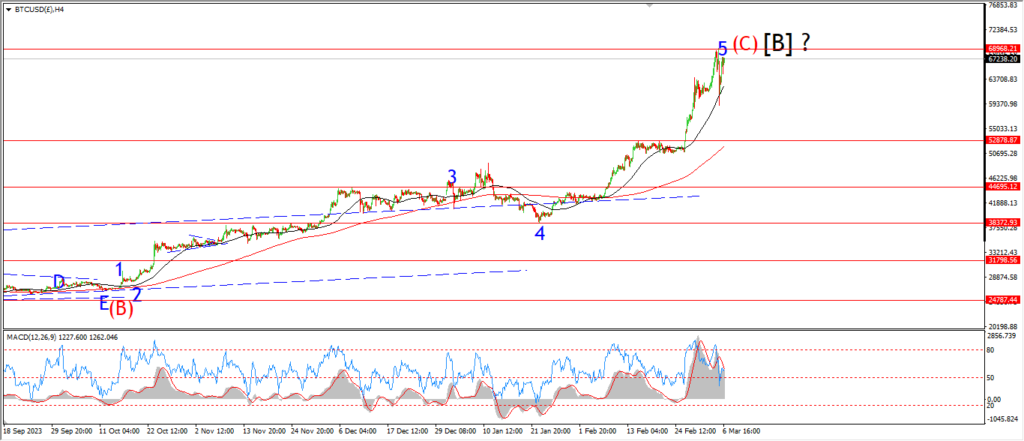

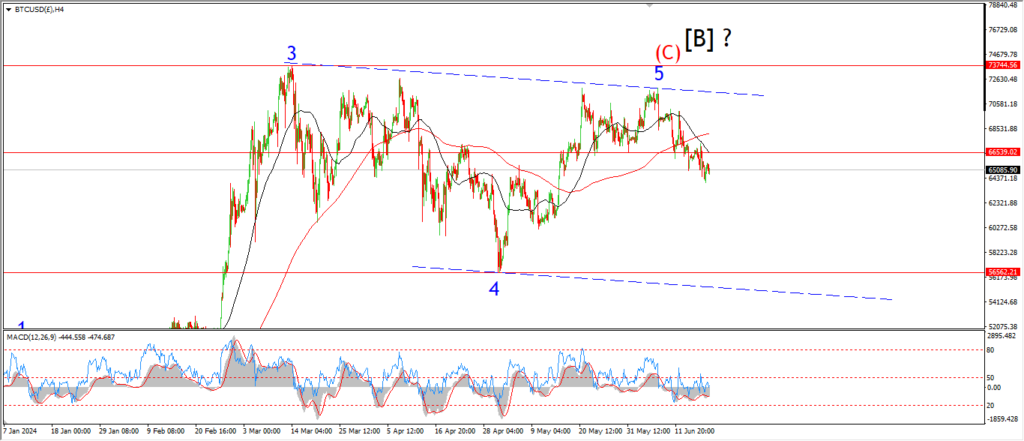

BITCOIN

BITCOIN 1hr.

….

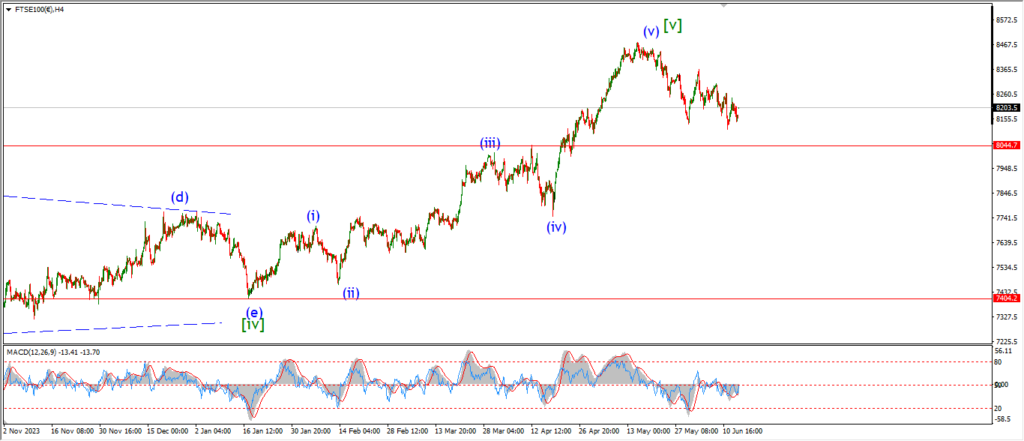

FTSE 100.

FTSE 100 1hr.

….

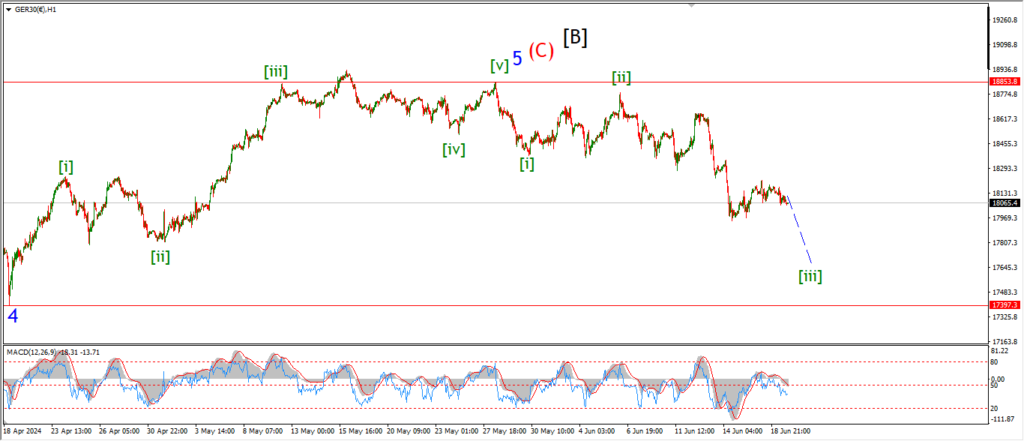

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

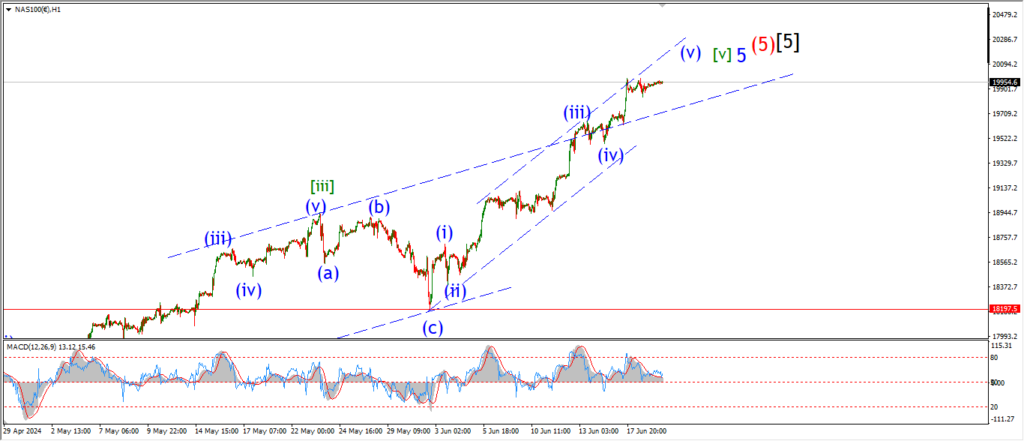

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….