Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

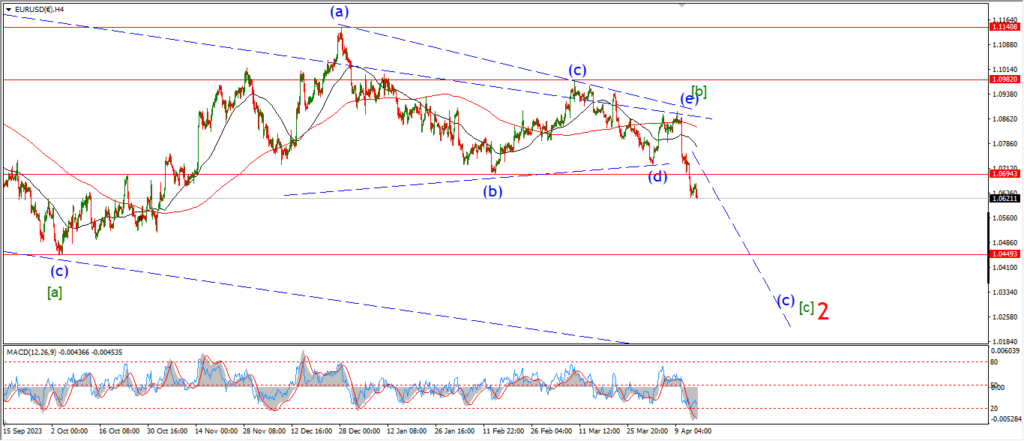

EURUSD.

EURUSD 1hr.

You know,

no matter how I look a the recent action off that wave (i) low,

I still come up with a correction to the upside.

The decline this week is not ideal for sure,

but I do believe that wave (iii) down is the next major move in EURUSD,

and so the main count remains the same tonight.

There is a chance that wave ‘c’ has one more high to come near the 78.6% retracement level to close out wave (ii).

That is the alternate count for the moment.

A break above 1.0811 will trigger that count.

Monday;

Watch for wave ‘i’ down to be confirmed with a drop below 1.0650.

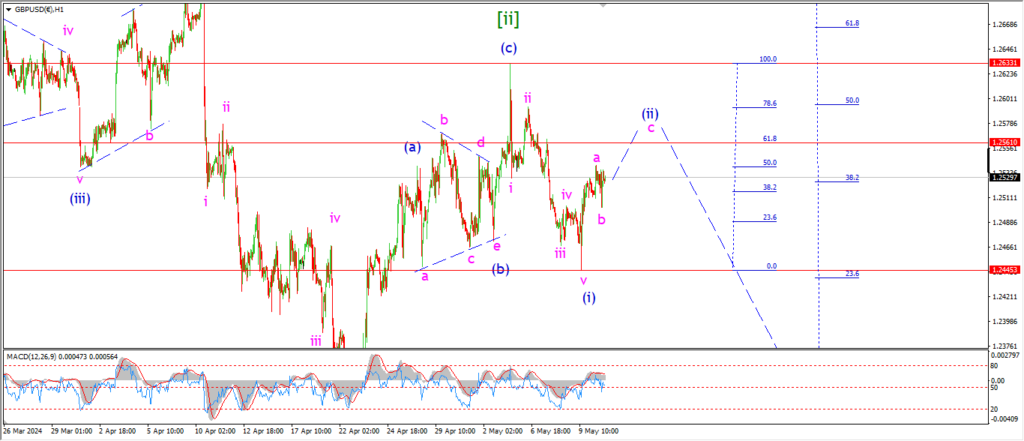

GBPUSD

GBPUSD 1hr.

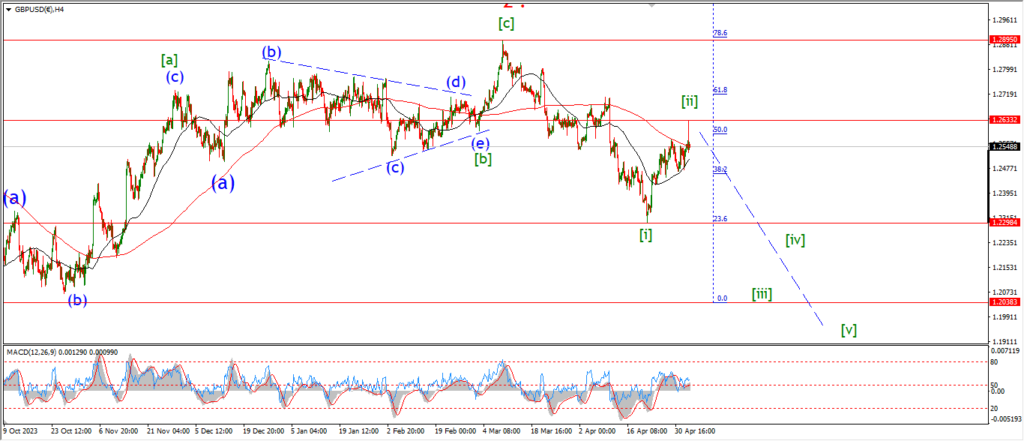

GBPUSD 4hr.

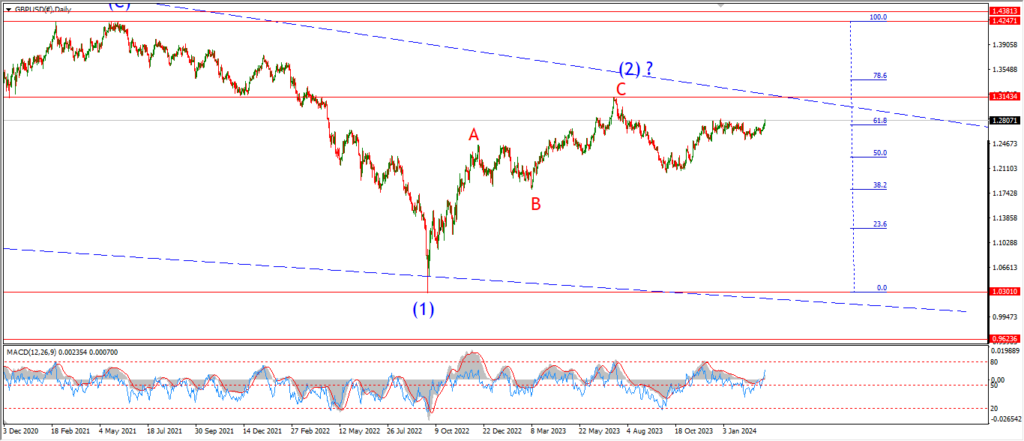

GBPUSD daily.

A small correction lower today may have completed wave ‘b’ of (ii),

it is a little smaller than expected,

but we have a higher low now in place,

and wave ‘c’ of (ii) should turn higher early on Monday towards that initial target at 1.2561.

Monday;

Watch for wave ‘c’ of (ii) to complete a three wave rally near 1.2560.

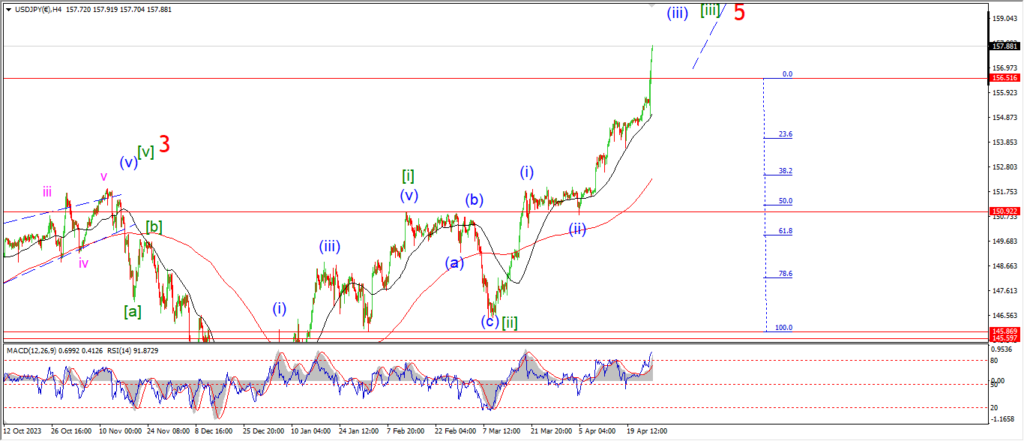

USDJPY.

USDJPY 1hr.

USDJPY gave us exactly what we needed in a wave (i) rally off the lows this week.

Now that we have a possible five wave pattern in place in wave (i),

it is time for wave (ii) to begin.

A break below 155.00 again will signal wave ‘a’ of (ii) is underway.

And I am looking at a 50% retracement into wave (ii) to complete near 153.90.

When that happens later next week,

then it will be time to look higher into wave (iii) of [v] again.

And that next leg higher should bring the price back above 160.00 when complete.

Monday;

Watch for wave ‘a’ and ‘b’ to create a lower high below 155.96 at the wave (i) high.

DOW JONES.

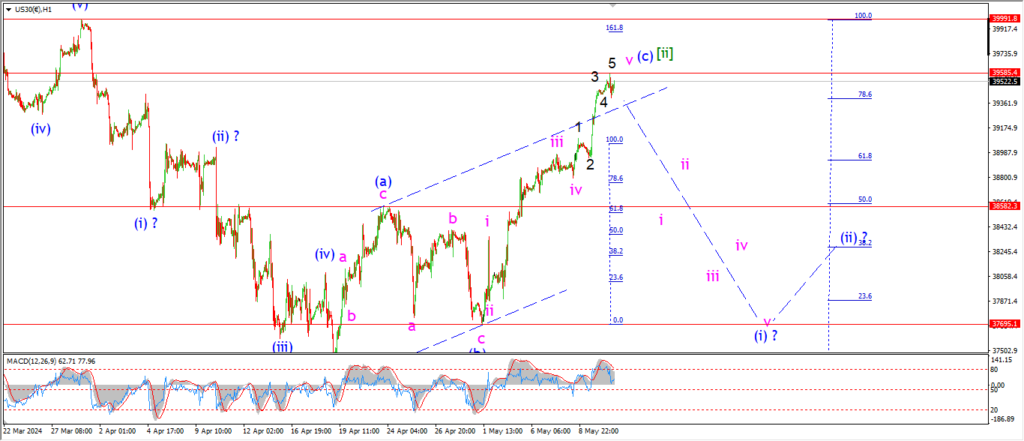

DOW 1hr.

DOW 4hr

DOW daily.

The wipe out that I was looking for did not come today.

the extension higher in wave ‘v’ of (c) is holding.

But despite a large rally in wave (c) of [ii],

The overall pattern still holds the essential characteristics of a correction higher at the moment.

Lets review what we have;

the market is stalling just above the 78.6% retracement level so far.

Wave [ii] has a clear three wave internal pattern.

The rally in wave ‘v’ of (c) created a throw over.

The retracement in wave [ii] was enough to wipe out all fears of a major reversal.

And at the moment,

no one expects a big drop into wave [iii].

Of course I might be wrong here because I cannot predict the future.

But the scene is set pretty well here as I see it.

Monday;

Wave [iii] down needs to take this market lower in a major way.

Wave (i) of [iii] should retrace most of that wave (c) rally.

so lets see if we get a five wave decline in wave (i) of [iii] early next week.

GOLD

GOLD 1hr.

Gold broke above the 62% retracement for a short while this morning,

and now we have a slight drop back below that Fib level this evening.

The rally into wave ‘b’ has done enough to consider this correction complete.

but we need a substantial move lower to confirm that wave ‘b’ is done.

So a sharp drop into support at 2281 is now required to call wave ‘c’ underway.

Monday;

Watch for wave ‘1’ of ‘c’ to fall back towards the wave ‘a’ low again at 2281.

A break of that level will confirm wave ‘c’ has begun.

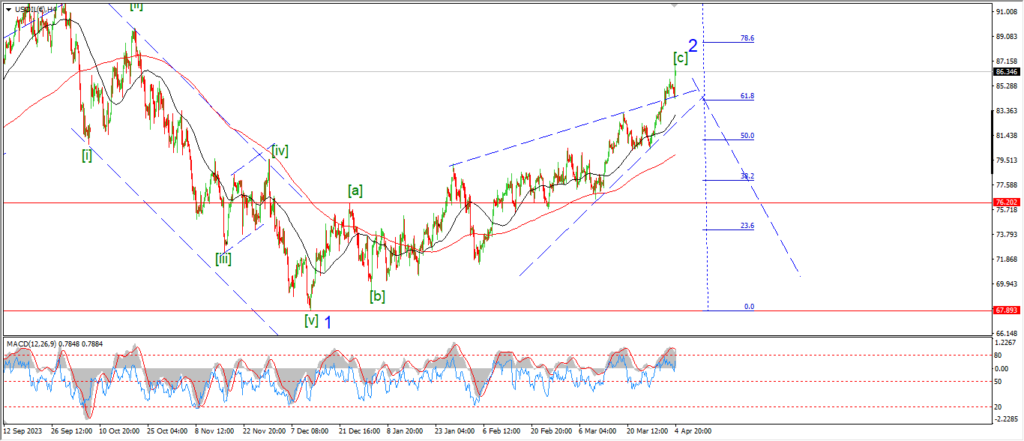

CRUDE OIL.

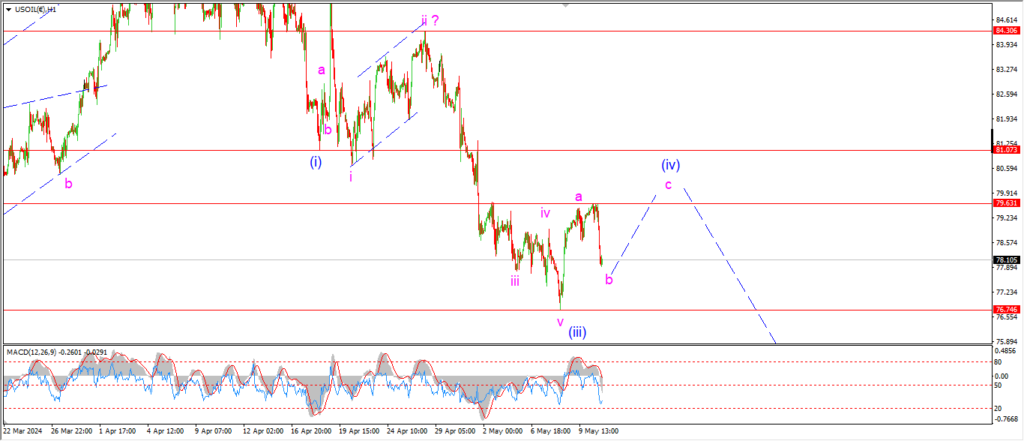

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

It seems that wave ‘b’ made the turn lower today and now the price is sitting at a higher low above wave (iii).

I have labelled wave ‘b’ as an expanded flat correction.

If this count in wave (iv) is correct,

then we should see a rally in wave ‘c’ of (iv) beginning on Monday,

and wave ‘c’ will break above 79.63 at todays high.

The wave (i) low at 81.07 marks the invalidation level for this count.

Si wave (iv) must hold below that level.

Monday;

Watch for wave ‘b’ of (iv) to hold above 76.74 at the wave (iii) low.

Wave ‘c’ should turn higher from here and complete three waves up below the wave (i) low.

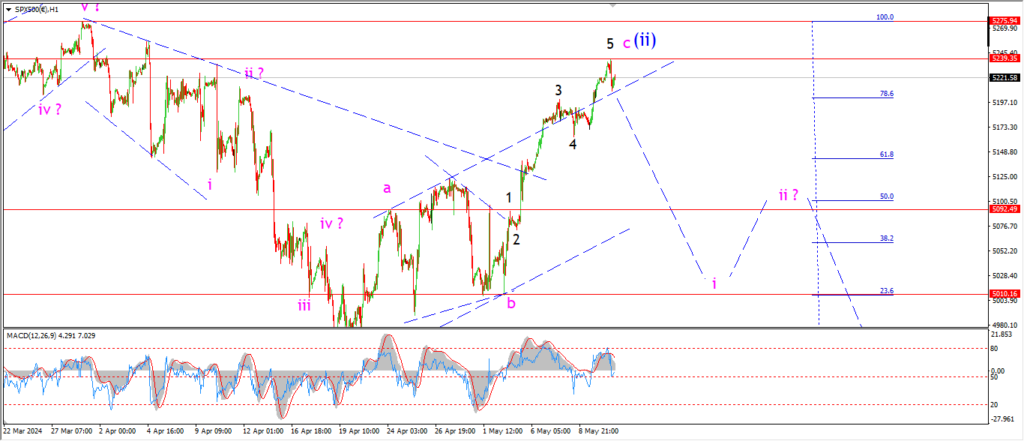

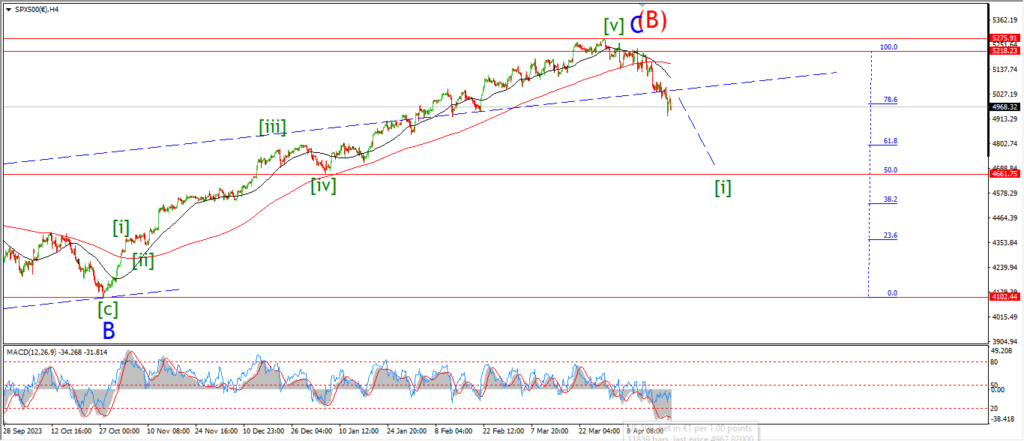

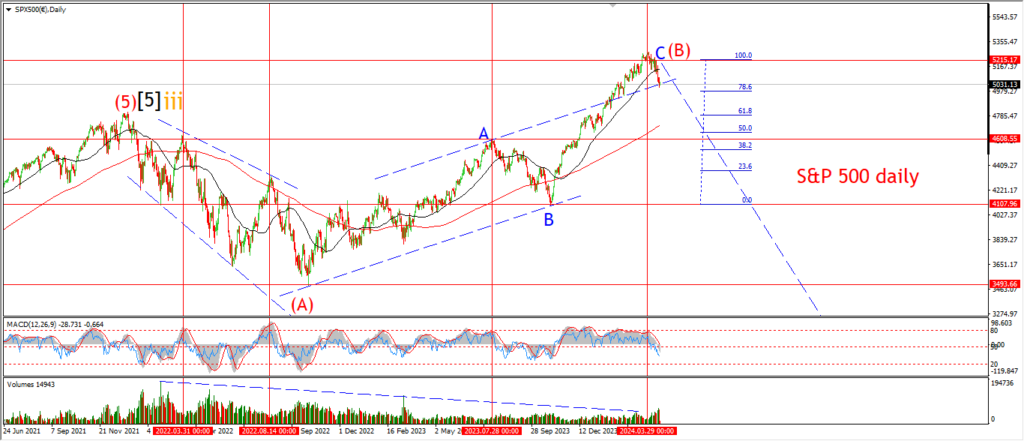

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P did threaten a run to a new high today,

but so far we have a small refusal.

The complete rejection of this rally has not happened today,

so I will expect that on Monday instead.

The wave ‘a’ high at 5090 is the first target for the decline in wave ‘i’.

And if the market manages to achieve that on Monday,

then we will be in a much better position to start thinking about the next move.

Until then,

its a close call but the bearish count stands for now.

Monday;

Watch for wave ‘i’ down to fall back below 5100 and trace out a five wave pattern lower.

The price must hold below the all time highs again.

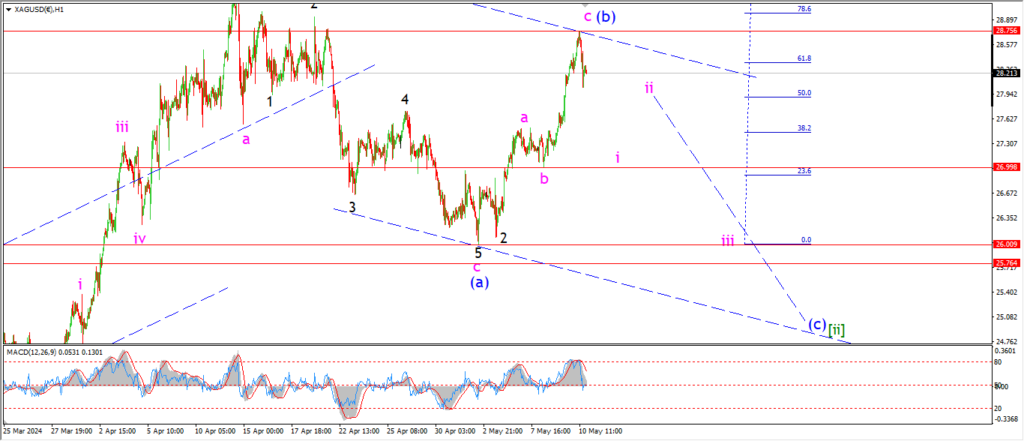

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

After a sharp rally this week I have been wondering about the overall pattern here.

The rally has gone far enough to call wave (b) complete at the highs today.

And I have changed the wave count to reflect that view tonight.

the price fell sharply off the highs today,

that should kick off wave ‘i’ of (c) if this count holds.

and I am looking for a drop in wave ‘i’ towards the 27.00 handle again.

Tomorrow;

Watch for wave (b) to hold at 28.75.

Wave ‘i’ of (c) must now continue lower as shown.

And wave (c) of [ii] should complete near 25.00 again when this pattern is finished.

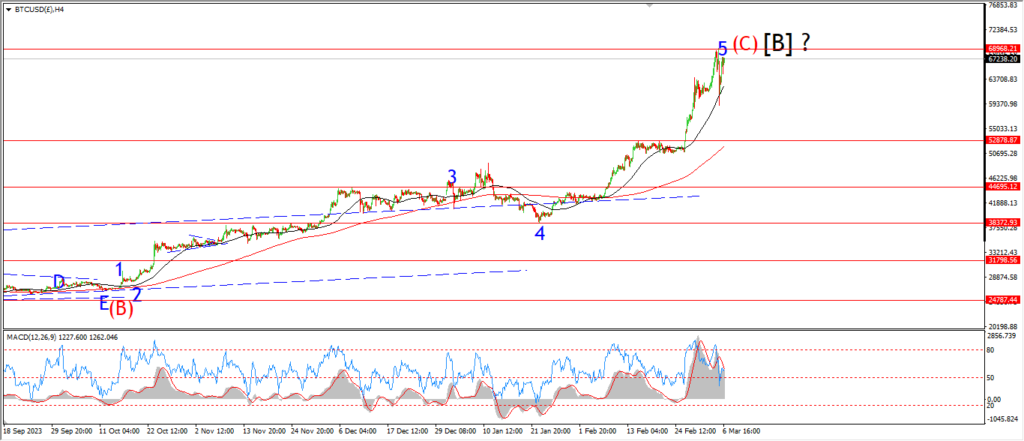

BITCOIN

BITCOIN 1hr.

….

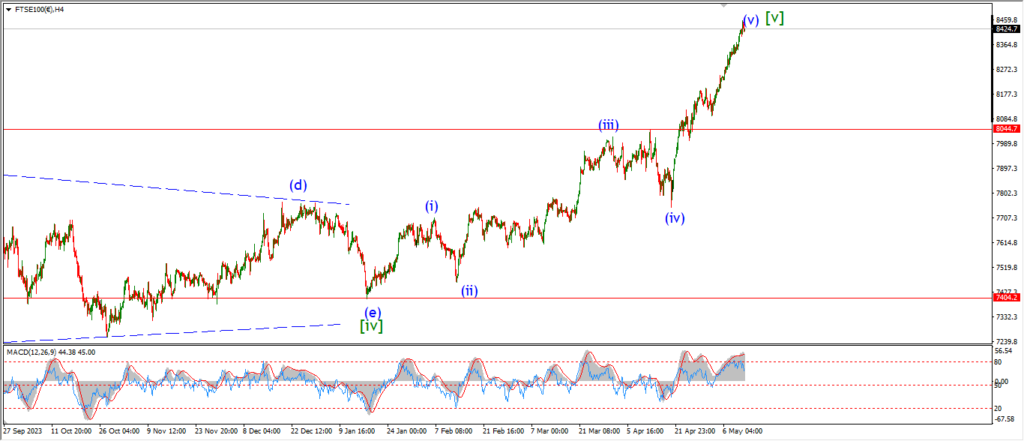

FTSE 100.

FTSE 100 1hr.

….

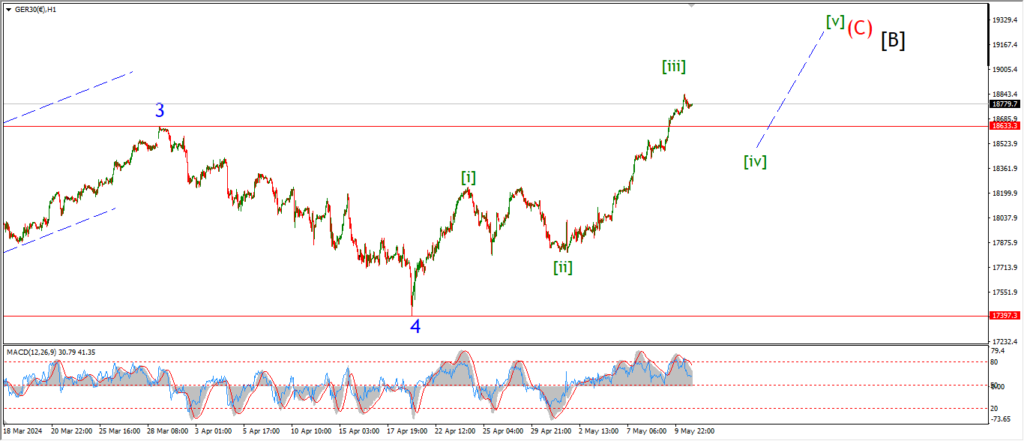

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

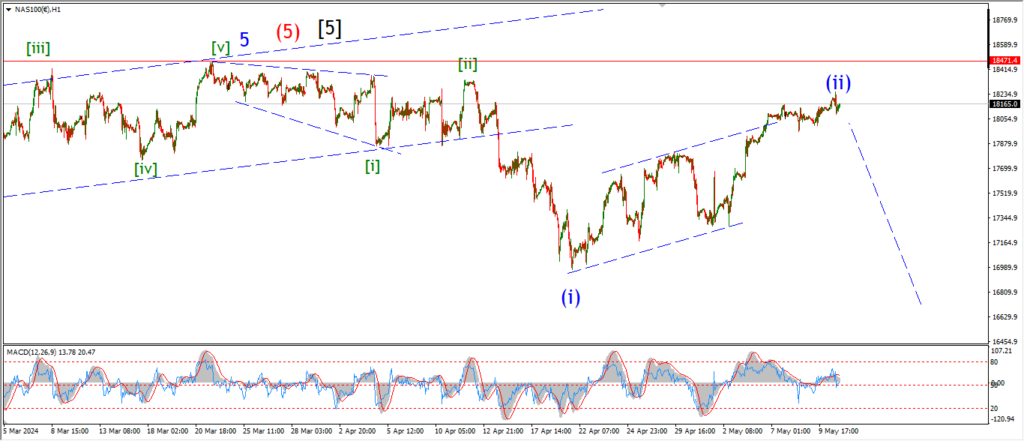

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….