Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

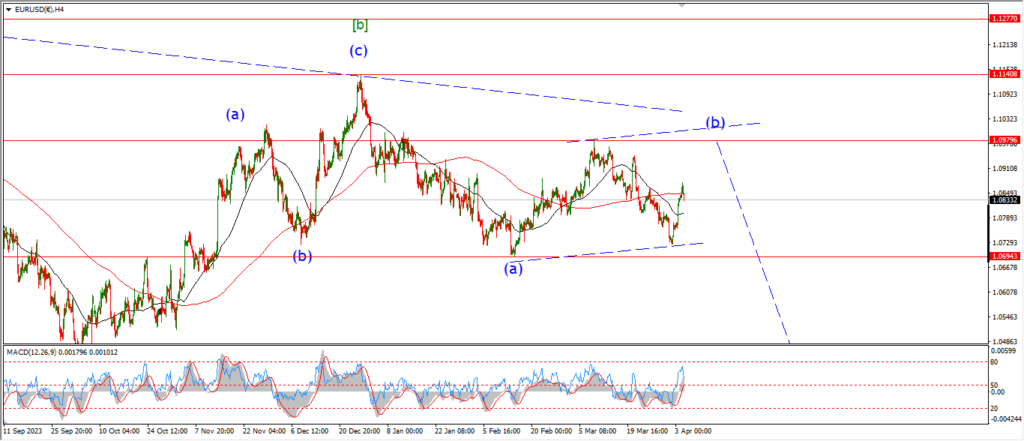

EURUSD.

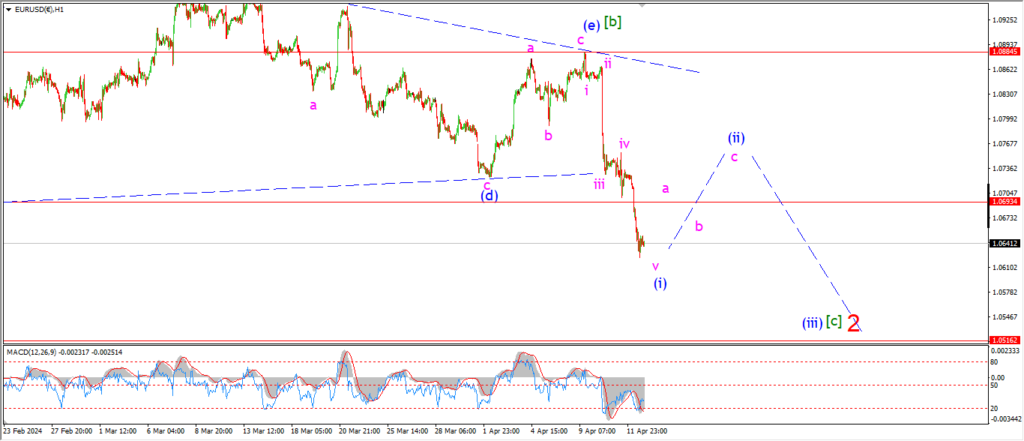

EURUSD 1hr.

another jump to the downside today and that has caused an extension in wave ‘v’ of (i) now.

The price has not firmly broken below the low end of the range of the triangle in wave [b].

At the very least,

this weeks action has confirmed the overall count in wave [c] of ‘2’.

And the idea of parity in wave ‘2’ is not out of the question here at all now.

Monday;

the price has not formed a big enough retracement in wave (ii) yet,

so I will be expecting a correction higher in wave (ii) early next week.

Watch for wave (i) to form a low and then reverse higher into wave ‘a’ of (ii) by Monday evening.

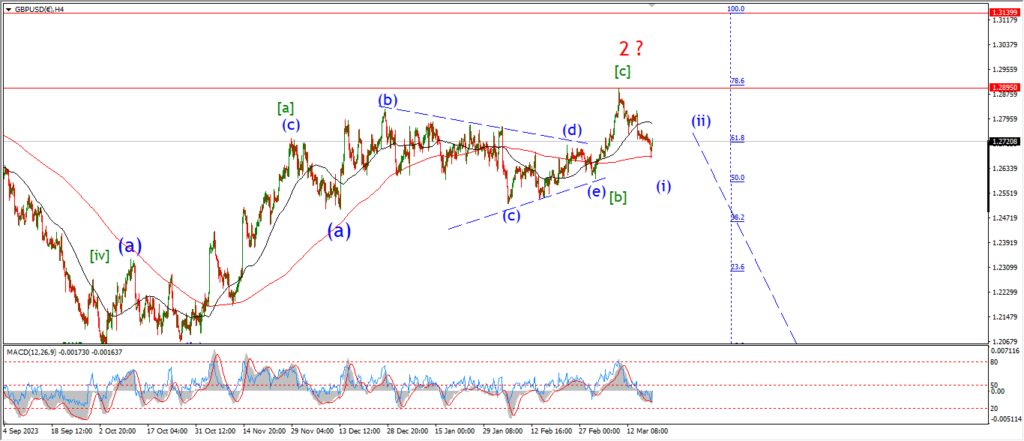

GBPUSD

GBPUSD 1hr.

GBPUSD 4hr.

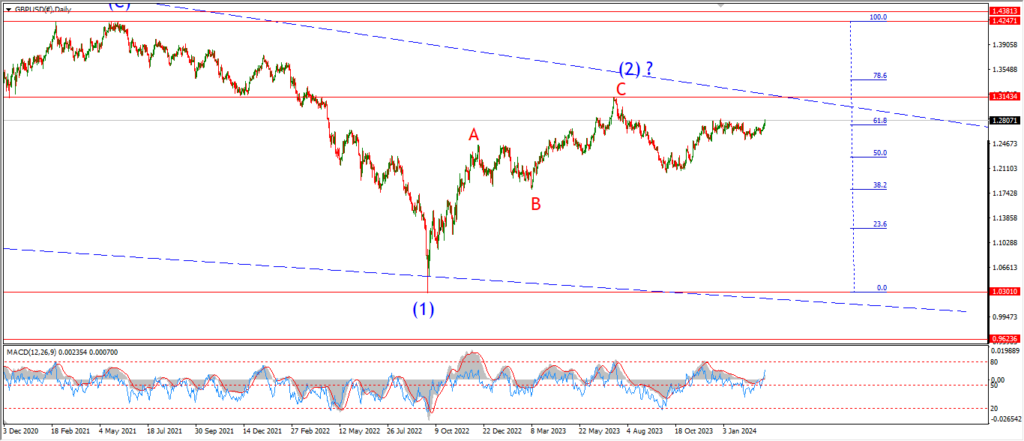

GBPUSD daily.

cable broke down below the range of the triangle also today

And now we are closing well below the 1.2500 level again.

This action gives a boost to the idea that wave ‘3’ has finally taken over here,

and Todays low is labelled wave (i) of [iii] of ‘3’.

If this count is correct,

then we are in for a major crash in cable over the coming months.

and in this case we can easily see a low near 1.04 for that final wave ‘3’ low.

I am getting ahead of myself here though

one step at a time.

Tomorrow;

Watch for wave (i) of [ii] to form a low on Monday and then wave (ii) should correct higher in three waves.

USDJPY.

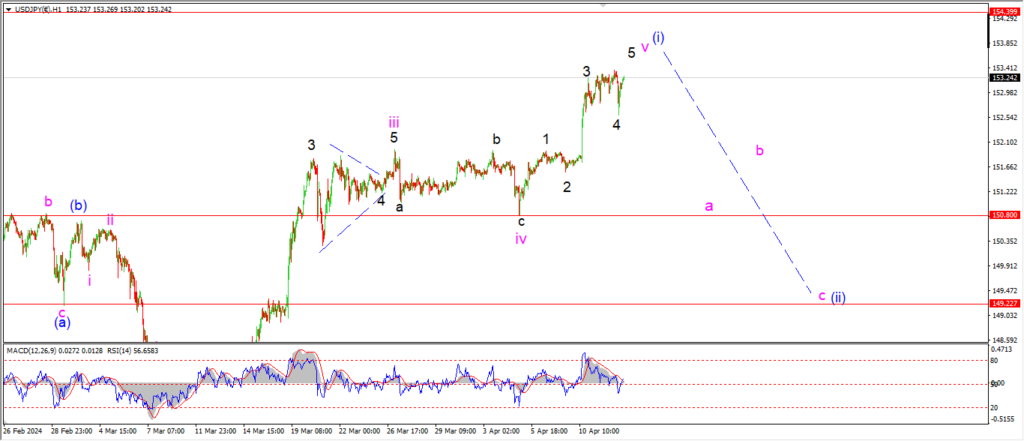

USDJPY 1hr.

The low today seems to have completed an expanded flat correction in wave ‘4’ of ‘v’ of (i).

The price has rallied out of the lows again now,

and we should see a five wave pattern complete in wave ‘v’ of (i) on Monday;

That will open up the possibility of a turn into wave (ii) early next week as shown.

And wave (ii) should fall back into support below 150.00 again at a minimum.

Monday;

The rally in wave ‘v’ is almost complete.

Watch for a drop back below 152.00 to confirm wave ‘a’ of (ii) has begun.

DOW JONES.

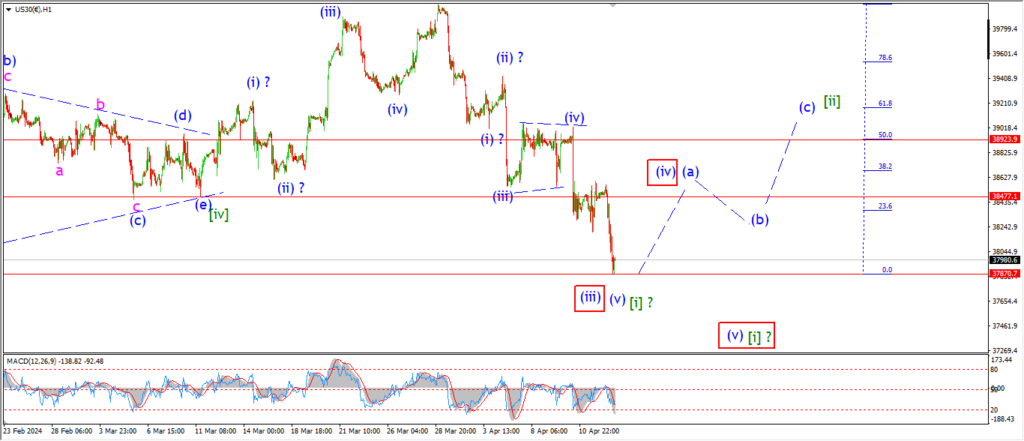

DOW 1hr.

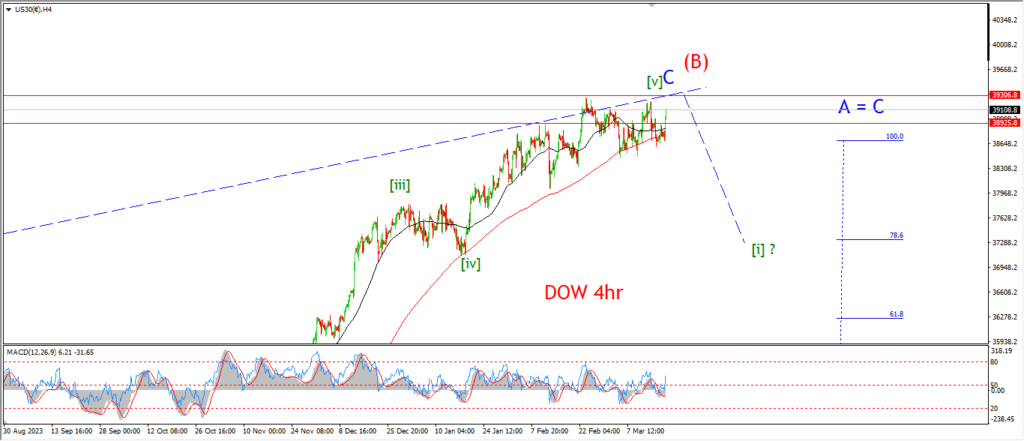

DOW 4hr

DOW daily.

You know,

It is almost like the people have forgotten what a declining market looks like!

The action this week brings the first meaningful decline in 6 months.

That is a lifetime in markets!

The decline this week gives me some hope that I am on the right track here with a false, fake, lying high in wave (B).

Three waves up completed at the upper trend channel line only last week,

and now we have a 5% decline off that high.

the action is impulsive looking to the downside finally!

And the internal pattern off the highs has a possible five wave count in place.

I have shown an alternate count for wave [i] which can allow for another step lower before complete the initial decline.

That alternate is shown marked in red boxes.

Monday;

Where do we go from here is the question.

I am pretty confident the market will make an attempt to form a lower high in wave [ii] green next week.

And it is reasonable to expect that wave [ii] will challenge the 39000 level again near the 50% retracement level.

That does depend on how low wave [i] actually reaches of course.

So;

Watch for a final low in wave [i] to form on Monday.

A break back above the 38477 level again will signal wave (a) is in play.

GOLD

GOLD 1hr.

I read at least 5 headlines today on how gold was about to launce to $3000 this year.

The ink hasn’t even dried on those articles,

and here we see a vertical drop of over $100 in a few hours!

this action has gone a long way to confirming the top of wave (iii) blue this week.

The price pushed out over the upper trend line yesterday,

and now we have a solid break down into the trend channel again.

The ideal target for wave (iv) blue is in the area of the previous wave ‘iv’ lows at 2170.

So lets see how the pattern develops over the comin days.

Monday;

WAtch for wave (iv) to trace out three waves down to the previous fourth wave lows.

Wave ‘a’ and ‘b’ should form a lower high by midweek.

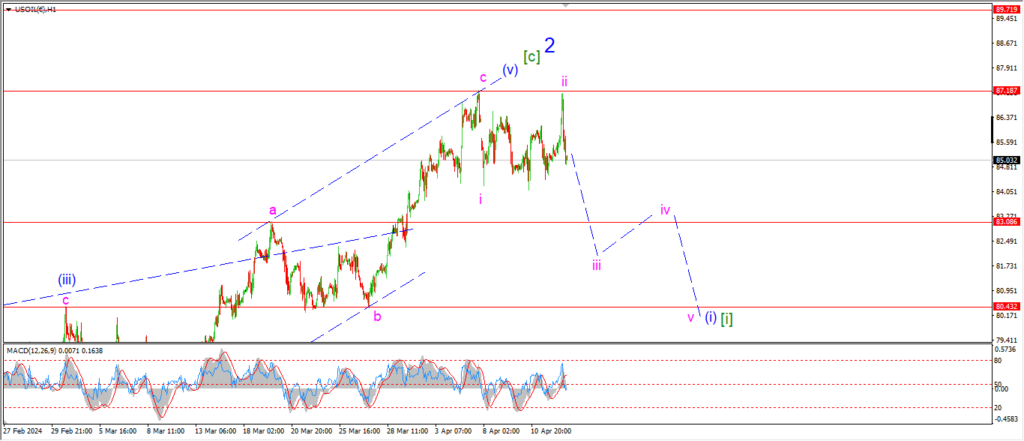

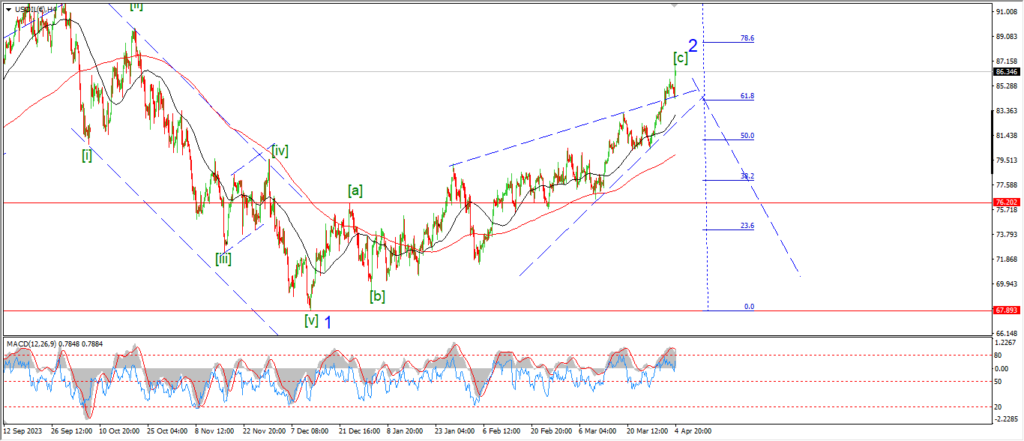

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude did threaten to rally back to a new high today but the price failed before doing it.

The price has dropped back again this evening to keep this wave count alive.

Wave ‘iii’ of (i) must now take this price lower to break the wave ‘a’ high at 83.00 again

to really give this bearish pattern a chance to build.

Monday;

wAtch for wave ‘iii’ down to continue lower and break support at 83.00.

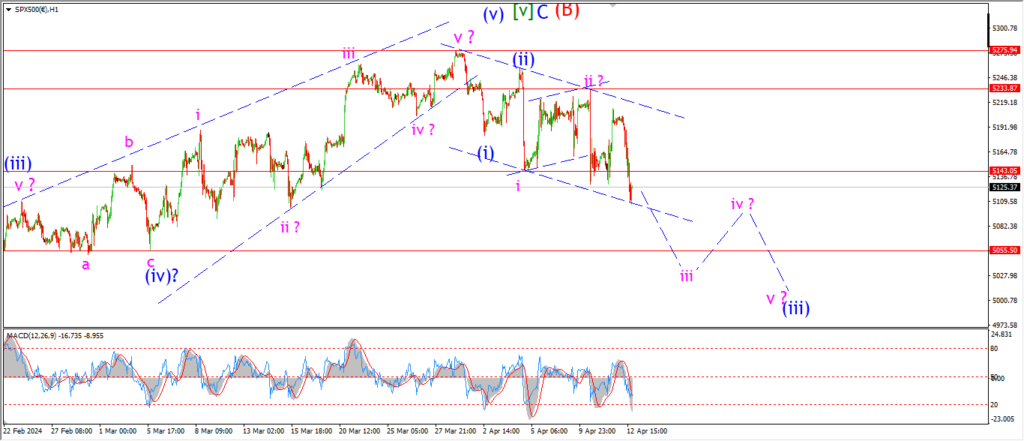

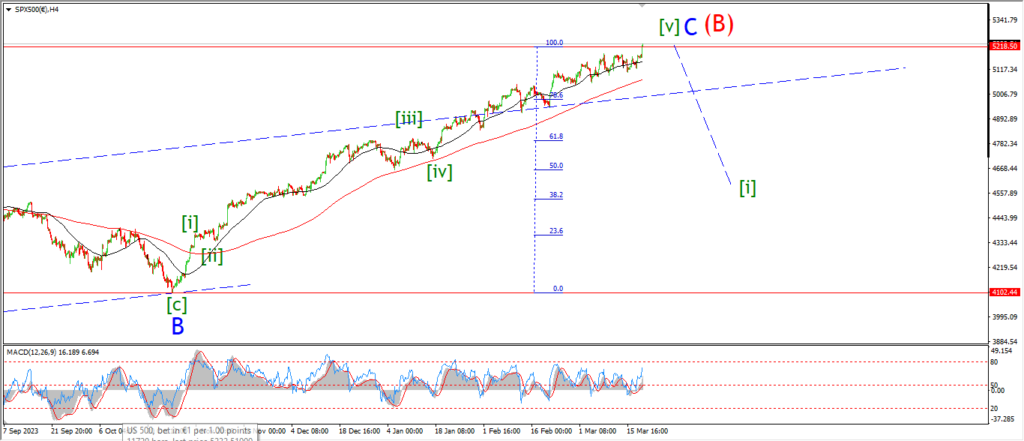

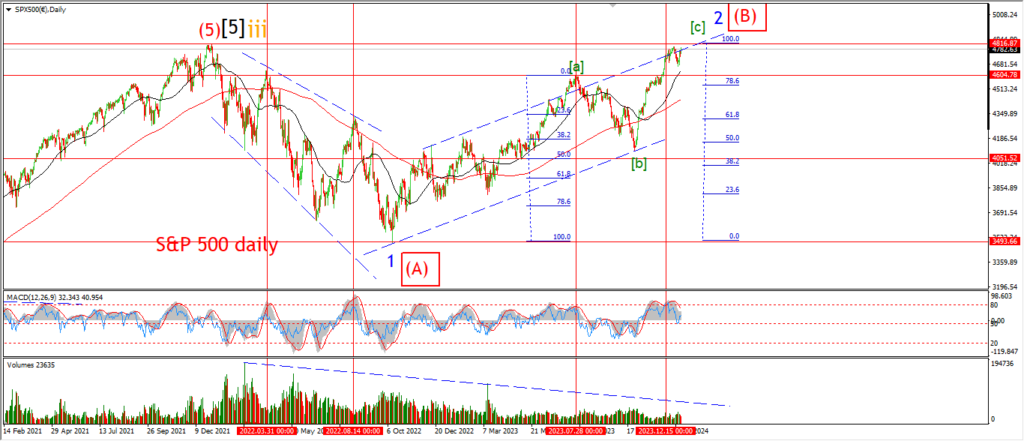

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The S&P is now moving lower in a trend channel,

so I will be thankful for small mercies as they say!

Unlike the Dow,

There is no clear five wave pattern in place to the downside yet.

And that is a point of concern to be honest.

But,

as long as this market continues to step lower,

then I think I will stick with the bearish wave count.

There is still a possibility that the pattern is going to extend lower into five waves.

And that is what I am allowing for in the hourly chart.

So,

lets give this a chance to prove itself by doing that next week.

Monday;

Watch for wave ‘iii’ of (iii) to complete a five wave pattern before correcting sideways again into wave ‘iv’.

The larger wave (iii) down will take a few more days to complete so time is on the side of this pattern.

IF we continue lower on Monday to break 5055,

that will give a nice probability boost to this idea.

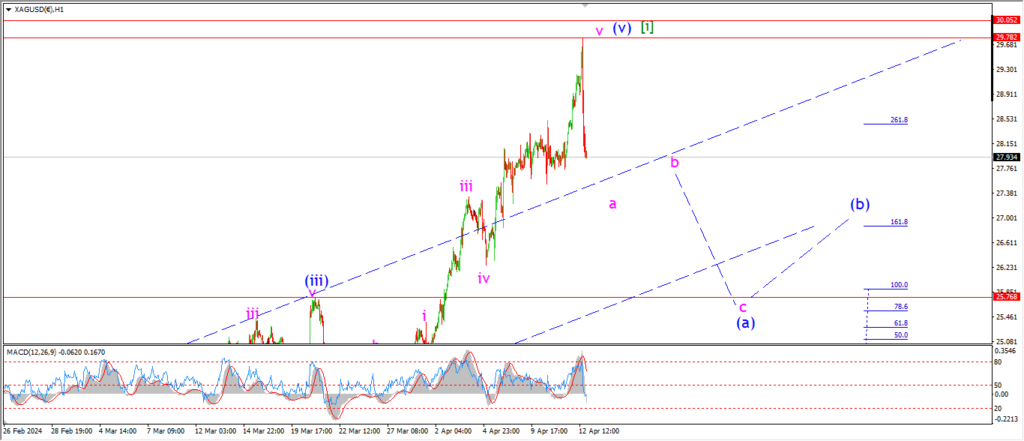

SILVER.

SILVER 1hr

SILVER 4hr.

SILVER daily.

Silver has just retraced that full spike higher that happened over the last few sessions.

This one trading session may have broken the endless bullish narrative that was entrenched in the media.

So,

what a difference a day makes eh!

The price has not broken back into the trend channel of the wave [i] rally yet.

But I do think wave (a) blue will do that and much more when complete.

Wave ‘a’ of (a) will find support at that upper trend line,

and then I will look for4 a lower high to build off that.

Monday;

Watch for wave ‘a’ and ‘b’ to form a lower high by the middle of next week.

And the larger wave (a) will take much of next week to complete.

If the price has finally turned into wave [ii],

then we should see a decline back below the 25.00 area to complete this pattern.

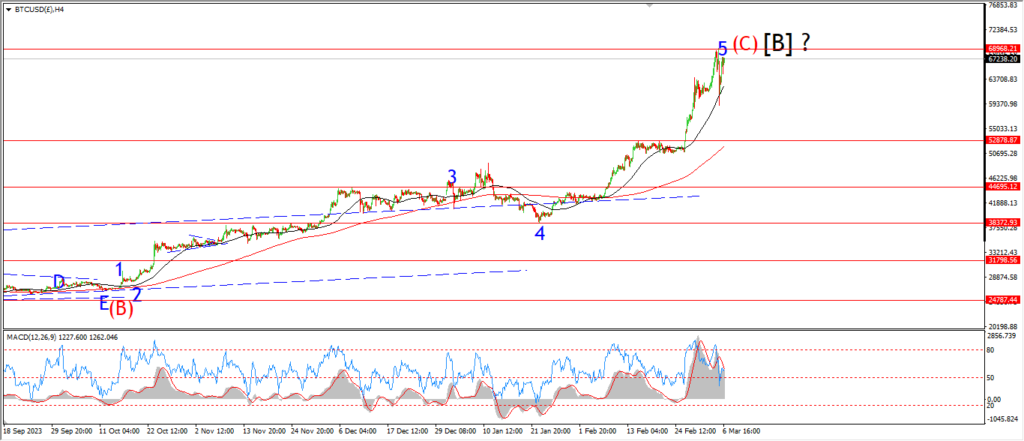

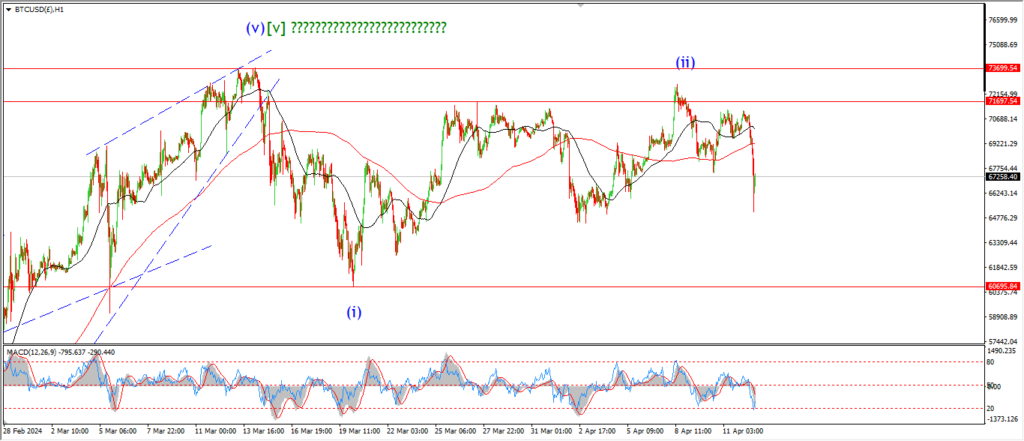

BITCOIN

BITCOIN 1hr.

….

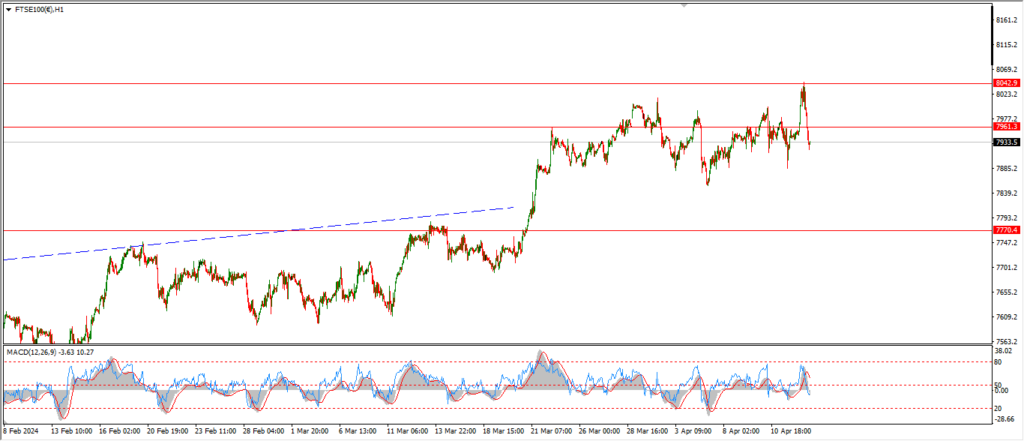

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

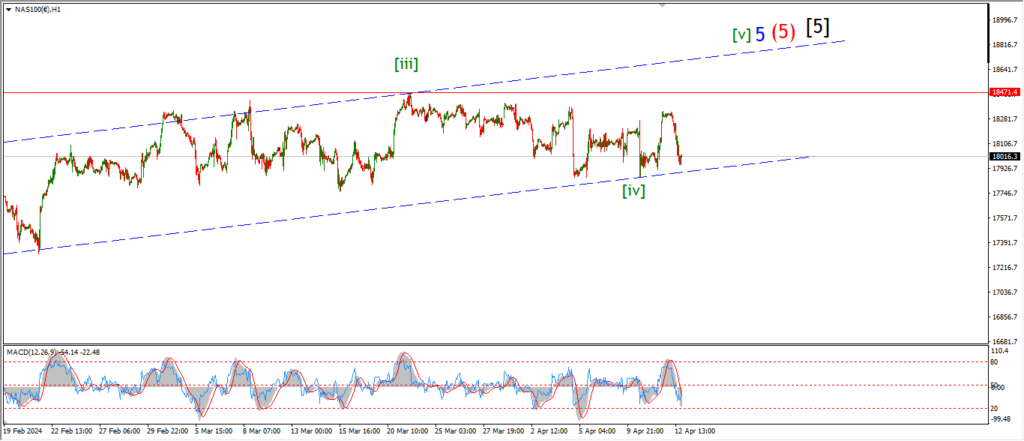

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….