Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

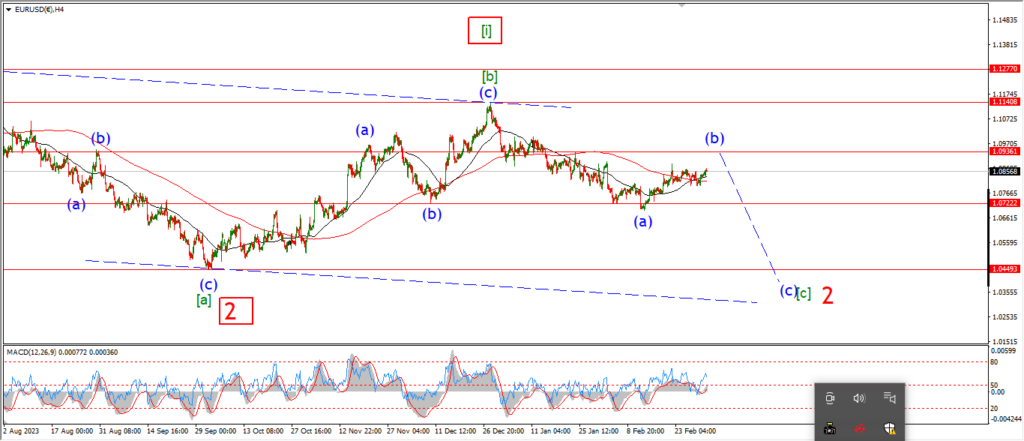

EURUSD.

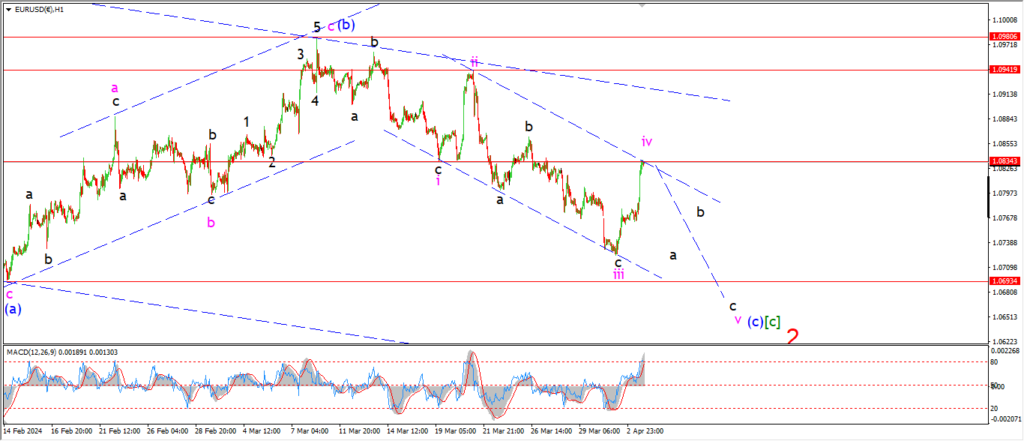

EURUSD 1hr.

The action today is enough to take pause and rethink what is happening in wave (c) blue.

If we start on the 4hr chart,

We have a three wave pattern higher in wave (b) that completed at 1.0979.

And off that level it is reasonable to assume that wave (c) is underway.

So for this moment I am going to stick with the wave (c) decline idea.

the hourly chart shows a new interpretation for the action off the wave (b) high.

I am using the ending diagonal pattern a lot these days,

and now we have a possible wave (c) ending diagonal in EURUSD.

the internal pattern of each wave down can be split into three waves so that fits.

So now we have one more decline in wave ‘v’ to contend with to complete wave (c).

Tomorrow;

WAve ‘iv’ has already overlapped the wave ‘i’ low so that wave should now complete.

Watch for wave ‘v’ of (c) to turn lower again and complete with a break of the support at 1.0693.

GBPUSD

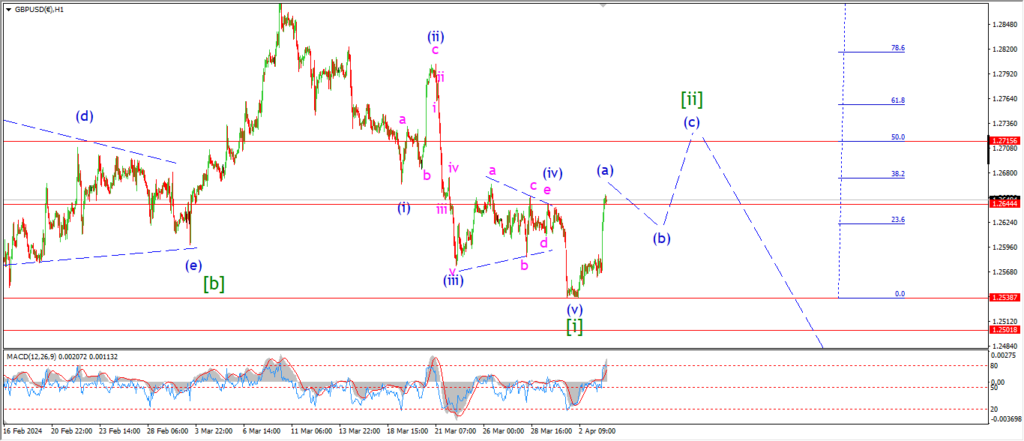

GBPUSD 1hr.

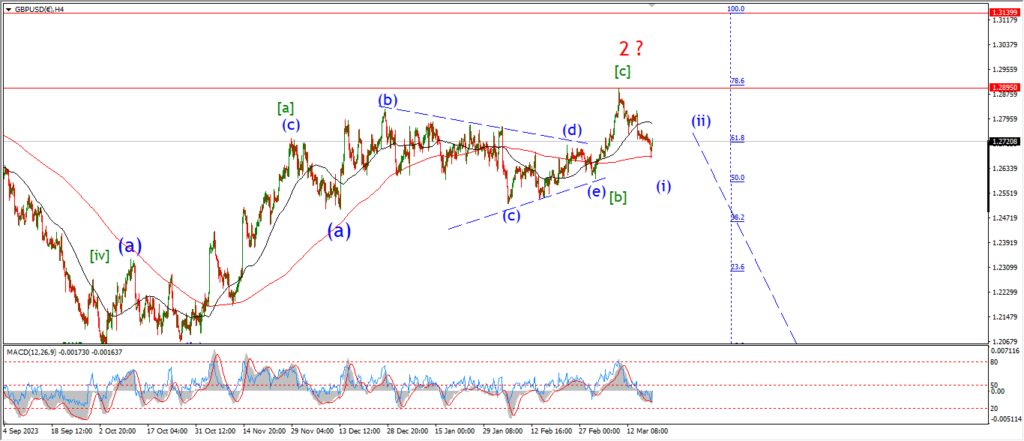

GBPUSD 4hr.

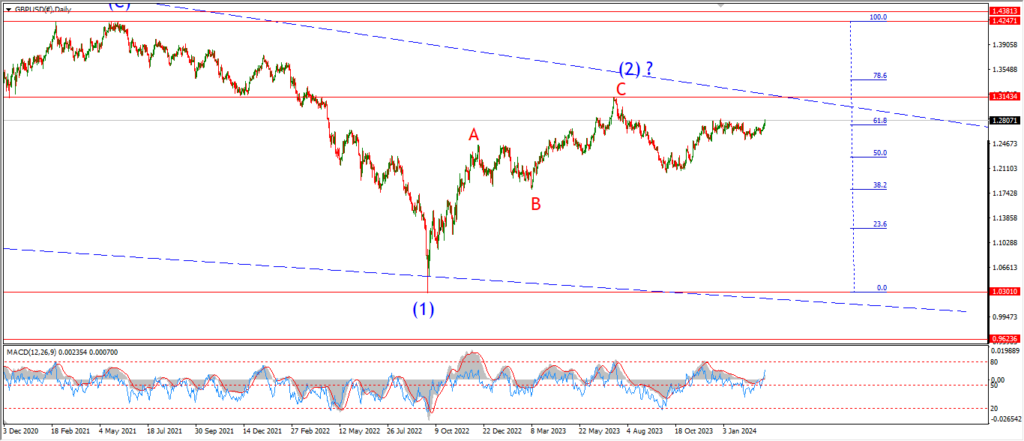

GBPUSD daily.

The rally in cable has ruled put a stop to the wave [i] pattern now.

The decline in wave (v) of [i] did reach the minimum target by creating a new low for the decline.

But we never got below the 1.2500 level as I hoped.

The rally today is now labelled as wave (a) of [ii].

And wave (a) has already hit the previous wave (iv) high which forms initial resistance in the pattern.

That should be enough for wave (A) to complete,

Wave (b) can now correct sideways for a few days as shown,

and then next week we should see a rally above the 50% retracement level to complete the whole correction near 1.2750.

Tomorrow;

Wave (a) should close out and then consolidate into wave (b) to form a higher low at about 1.2600 over the next few sessions.

USDJPY.

USDJPY 1hr.

Wave ‘v’ has just about completed a double top for the pattern at the high today.

I would like to see a break to a new high in wave ‘v’ as shown,

with a top near 153.00.

Wave (i) will give way into wave (ii) next week I expect,

but as long as the wave ‘iv’ low holds at 151.16 then I can look for an extension in wave ‘v’.

A break of wave ‘iv’ will signal wave (ii) has already begun.

Tomorrow;

Watch for wave ‘iv’ to hold at 151.16.

Wave ‘v’ should continue in five waves towards the 153.00 level.

DOW JONES.

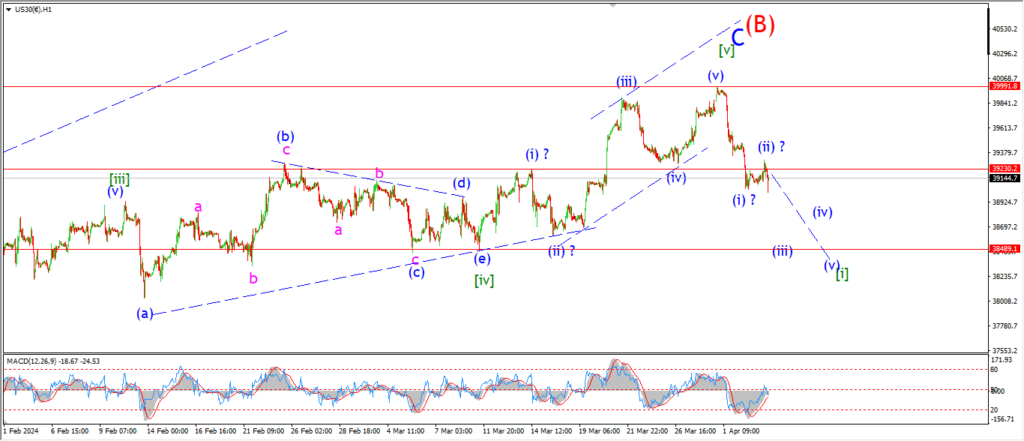

DOW 1hr.

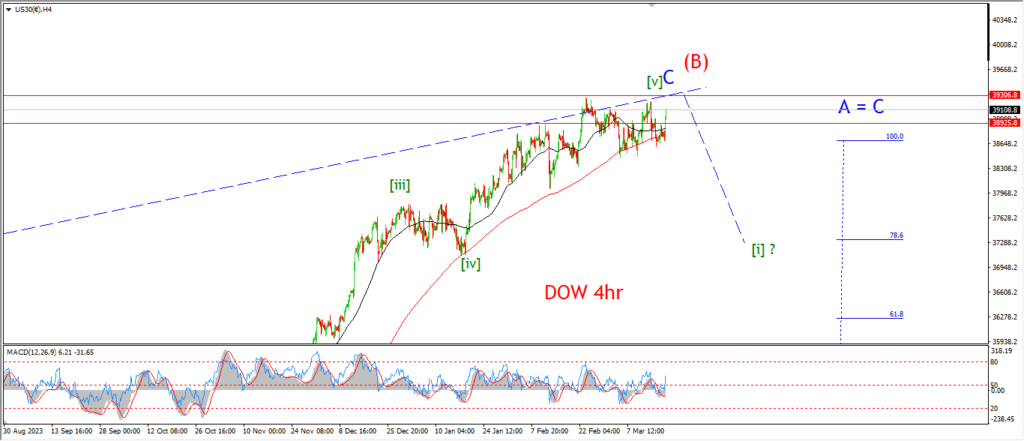

DOW 4hr

DOW daily.

The market is closing lower this evening after a pretty flat session early in the day.

The lower we go,

the better I feel about the idea of a top forming in wave [v] of ‘C’ of (B).

So its pretty simple now.

Lets see if the market will retrace the full rally in wave [v] by breaking below 38490 at wave [iv] in the next few days.

If that happens,

then I can start to build a pattern for a bearish impulsive wave down.

I have shown a possible wave (i) and (ii) complete at todays highs,

this is a very speculative count but if the market accelerates lower towards support over the coming days,

then we can be a bit more confident.

Tomorrow;

Lets see if the market will trace out five waves down to break support by the end of the week.

GOLD

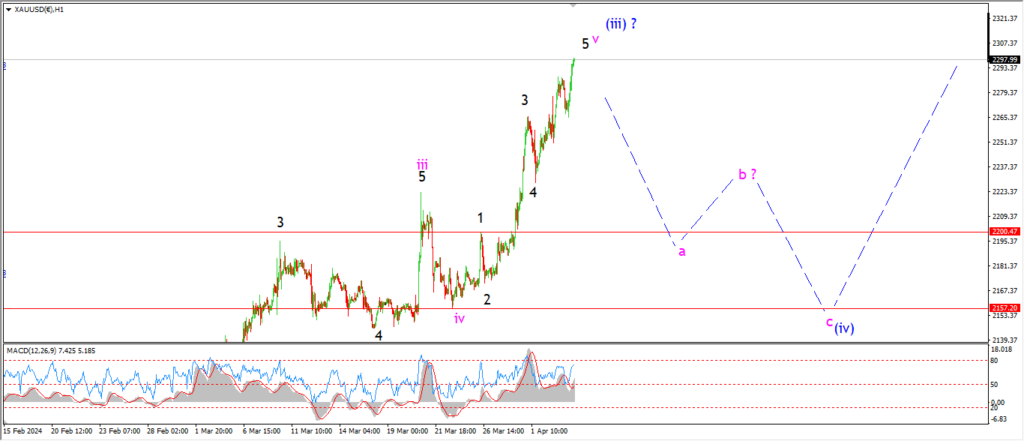

GOLD 1hr.

I am fishing for a top here in wave ‘v’ of (iii) these days and that might look foolish to the world,

as it seems there is no reason in the world for the gold price to fall now!

But that’s where we stand at the moment.

The fed statements today have driven people to buy the rally at the top of a pattern,

so I will take that as a signal that the market is all in here at the top of wave (iii).

And the opposite statement will be true at the bottom of wave (iv),

there will be no reason in the world to buy gold after the correction is over.

And that is exactly the time to load up!

Tomorrow;

The rally in wave (iii) has now reached to the 262% Fib extension of wave (i) with a $300 rally in about 6 weeks!

I do think we will see a large reversal into wave (iv) over the coming week.

It will take some patience to wait for that reversal to start.

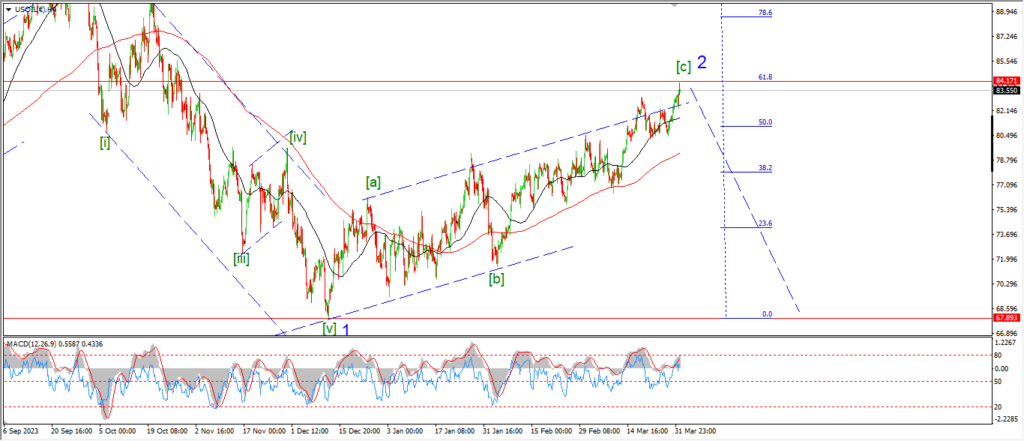

CRUDE OIL.

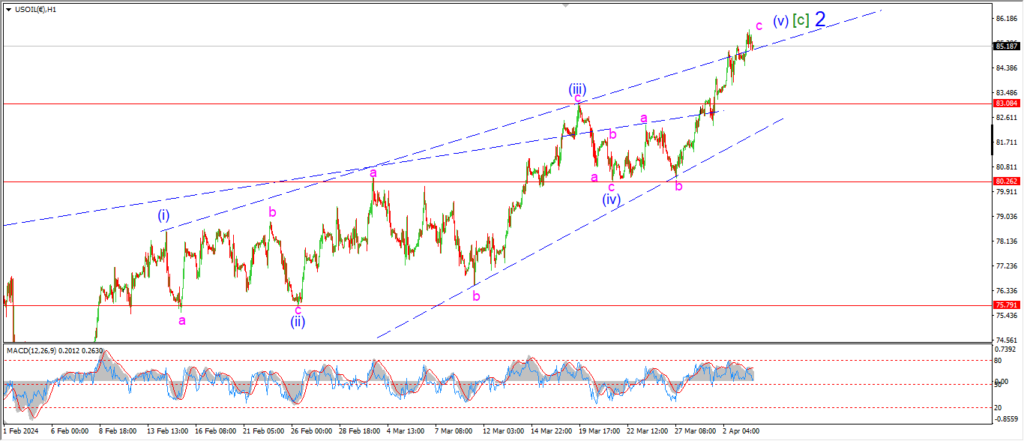

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

The price continues to hug the upper trend line of this wedge pattern.

this week.

With pretty weak price action over the last few sessions.

If the main pattern is correct for wave [c],

then we are witnessing the last few breaths of wave (v) here.

and wave ‘c’ of (v) already looks over extended.

The price action has managed to create a small throw-over above the top line now also,

so the boxes are all being ticked here to indicate the end of a pattern is at hand.

Tomorrow;

Watch for a drop back below the wave (iii) high at 83.08 to signal a top is in for wave (v) of [c].

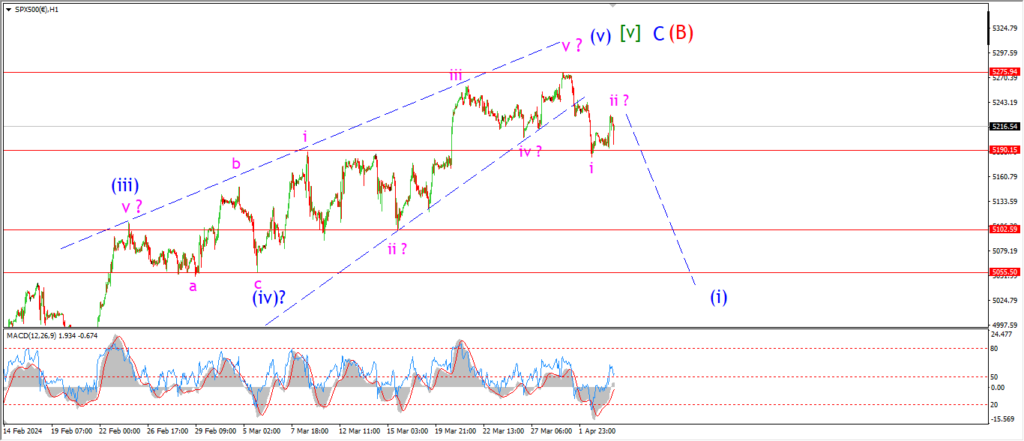

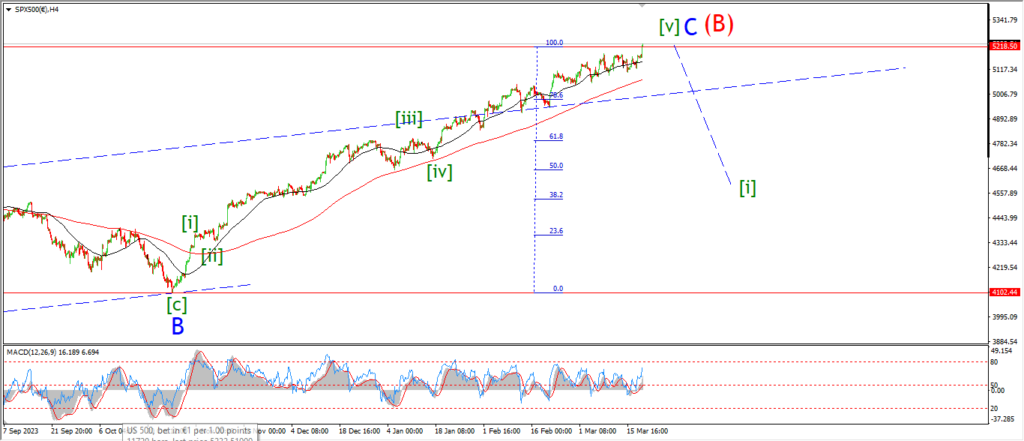

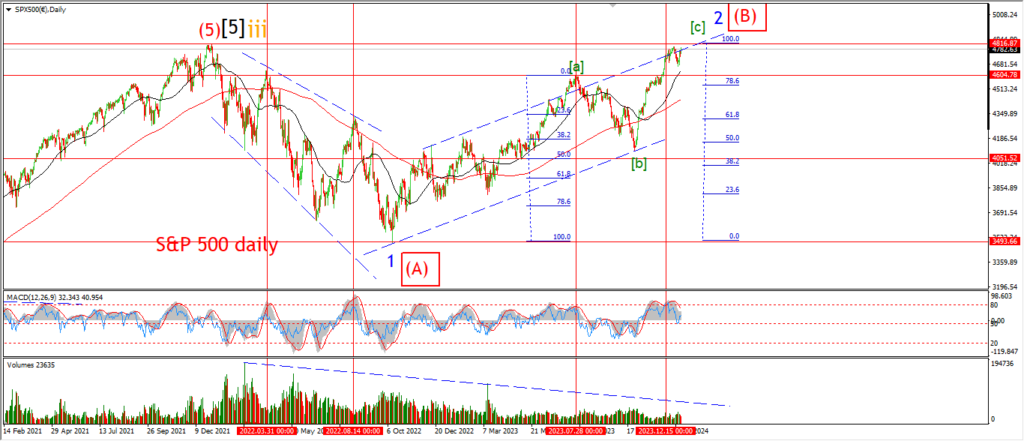

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

After a three wave rise into the session high this afternoon,

the market reversed with a spike to end the session effectively flat.

So,

what can we make of that action?

Three waves up suggests a corrective upside rally,

and I have labelled this wave ‘ii’ of (i).

I know it is early in the pattern here,

but I must make some effort to chart the action this week!

I do have my eyes on the larger wave (iv) lows at 5055 to call this rally done here.

I know that level seems a long way down from here,

but a real impulsive decline should make that distance quite quickly to be honest.

WAve (i) will be confirmed with a break of support at wave (iv) and then we can look at the bigger picture from there.

At the moment it is a matter of charting the baby steps.

Tomorrow;

Watch for another step down into wave (i) as a signal of the growing reality of a top in wave (B).

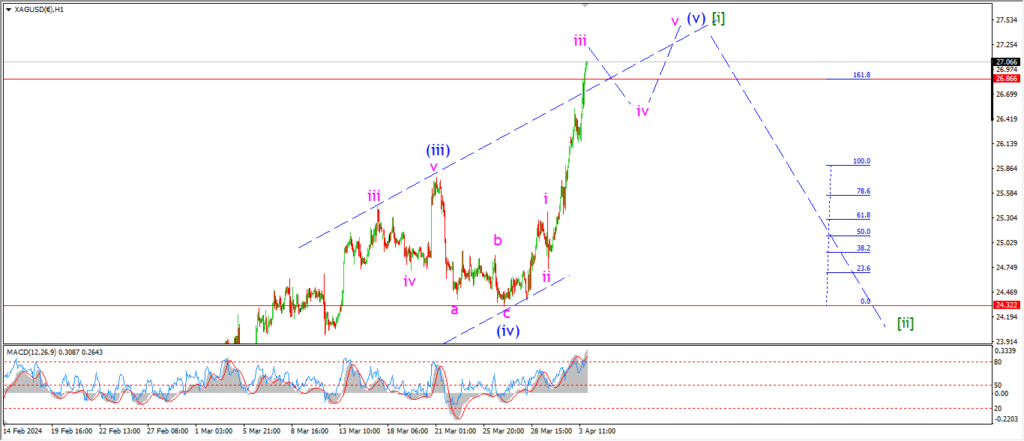

SILVER.

SILVER 1hr

Todays rally has filled the Elliott channel for wave [i] up.

That should be enough to call wave (v) of [i] complete after a rapid rise in the last week.

but I am going to allow a little more upside to complete the internal pattern of wave (v) now.

Wave ‘iv’ and ‘v’ may even create a throw over scenario next week to close out wave [i] and then I will begin to look for a drop into wave [ii].

Of course the decline in wave [ii] will not be expected at all.

and that is exactly when it should happen!

Tomorrow;

there seems to be a five wave pattern complete in wave ‘iii’ of (v) here.

and now wave ‘iv’ should begin off that complete wave.

Lets see if the price will turn lower in a corrective decline in wave ‘iv’ before the end of this week.

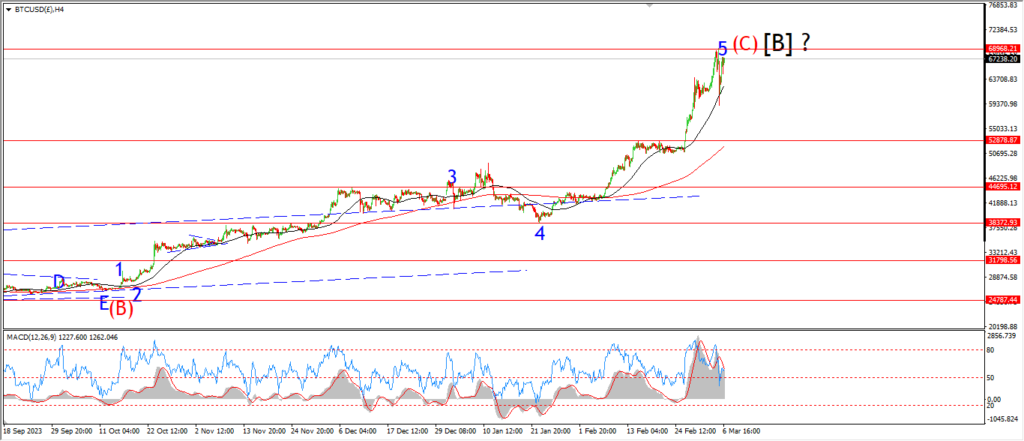

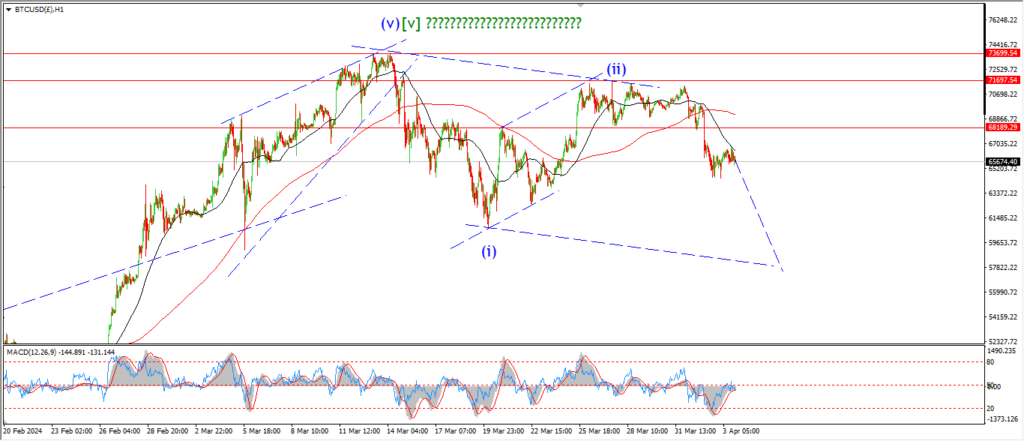

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

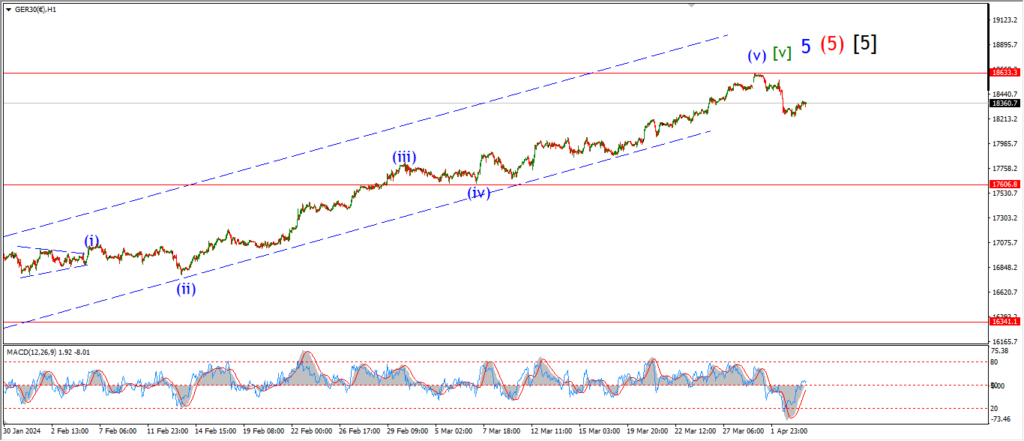

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

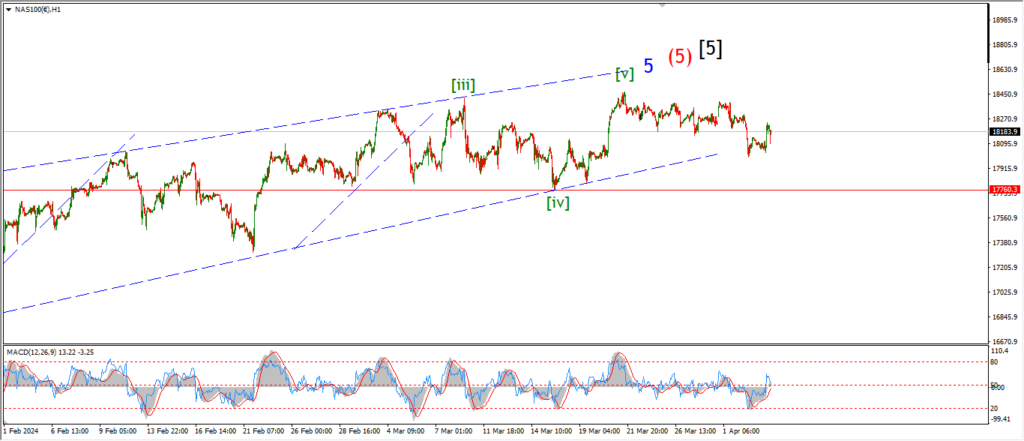

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….