Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

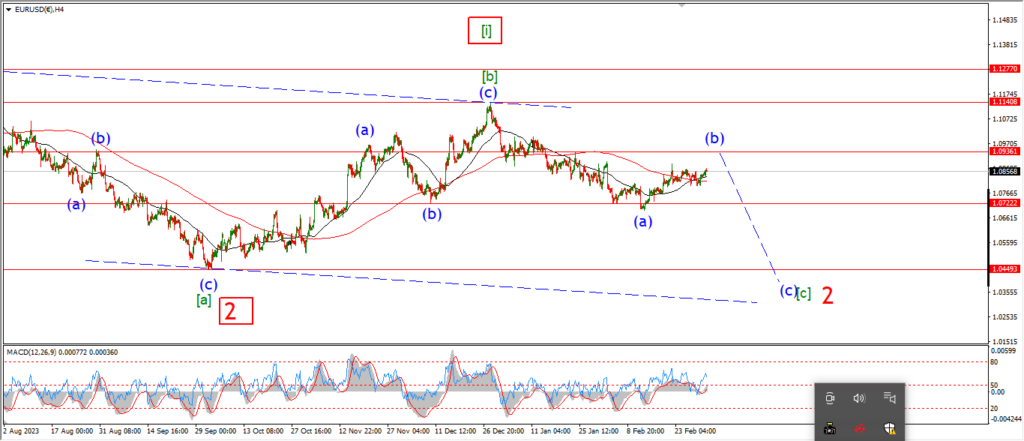

EURUSD.

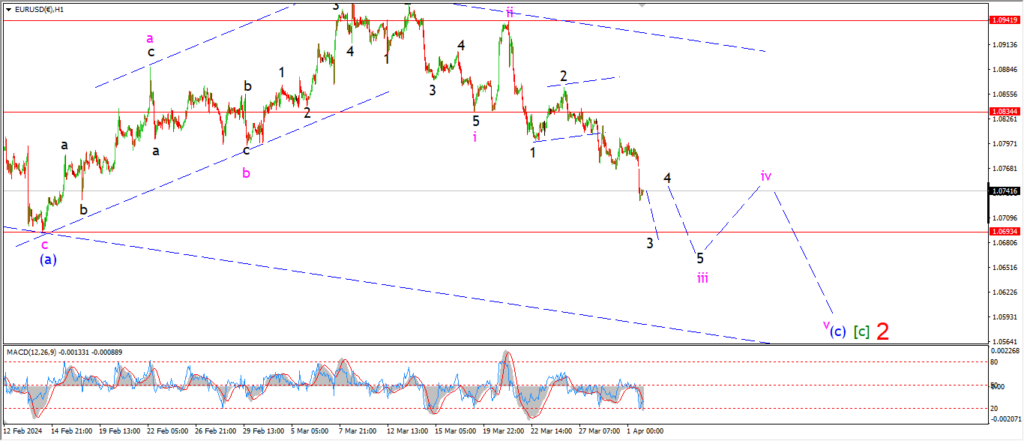

EURUSD 1hr.

The move lower today is in line with the wave ‘iii’ idea so far.

I am still a little unsure of the internal count for wave ‘iii’ of (c),

but even now the price is close to hitting the minimum target for the larger wave (c) in blue.

That target lies at 1.0693.

A break of that support may even cause an acceleration lower to the lower trend channel line near 1.0550.

In an ideal pattern wave [c] of ‘2’ will hit a low near that lower trend channel line.

Slowly but surely the price is making its way into wave [c] of ‘2’.

And if all goes well this week we should see a low in wave (c) of [c] of ‘2’ later this week.

Tomorrow;

Watch for wave ‘i’ to hold at 1.0834.

Wave ‘iii’ down should break support at 1.09693 and then I will look for a sideways correction in wave ‘iv’.

GBPUSD

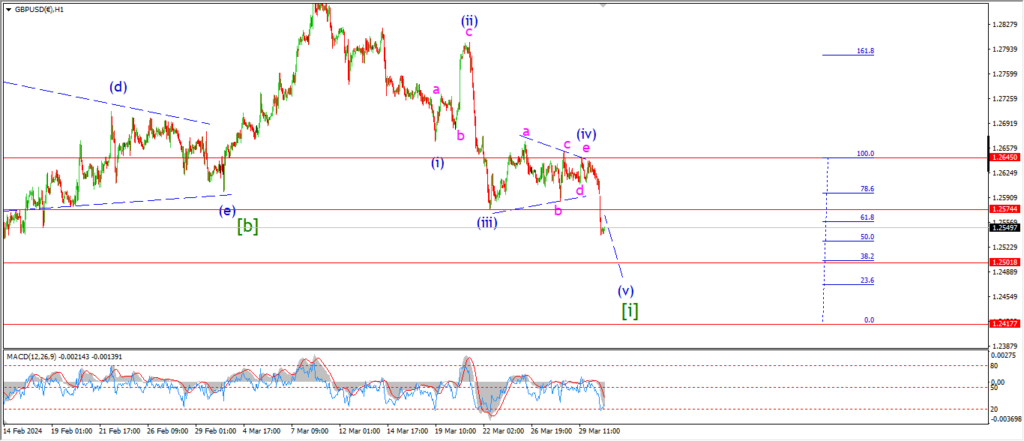

GBPUSD 1hr.

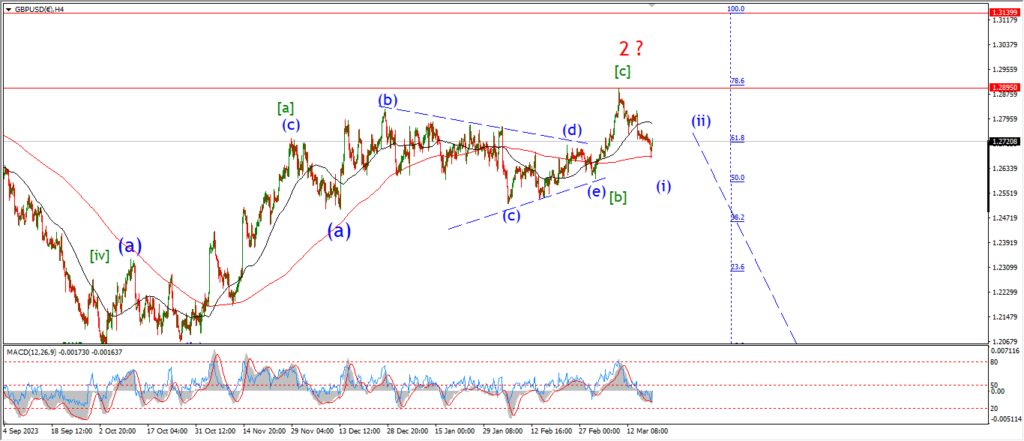

GBPUSD 4hr.

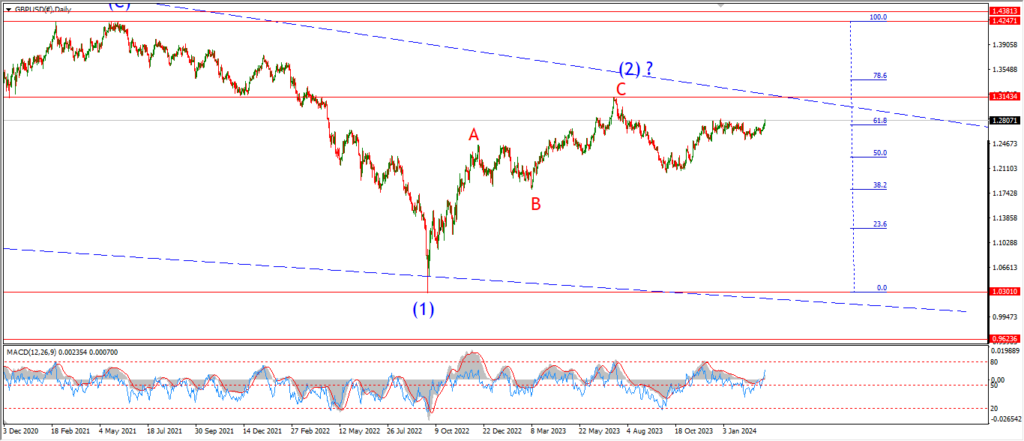

GBPUSD daily.

The triangle pattern in wave (iv) seems to have worked well today.

the price fell sharply out of 1.2645 to confirm this pattern.

The price even broke below the minimum target for wave (v) at the wave (iii) low at 1.2574.

So,

at this point we have a valid pattern for wave [i] now in place.

I would like to see further downside to really add weight to this impulse wave idea here,

but so far so good.

Tomorrow;

A break of 1.2500 again will be a good boost for this pattern.

Watch for wave (v) of [i] to trace out a five wave pattern itself.

Wave (v) of to reach equality with wave (i) at 1.2417.

USDJPY.

USDJPY 1hr.

On reflection today I realize the recent sideways action in USDJPY is very like a triangle correction.

I have relabeled the wave count to show that possibility this evening.

The triangle is viewed as wave ‘iv’ of (i),

with wave ‘v’ of (i) now underway off the session low.

Wave ‘v’ should complete out above 152.00 again and then we can look for another correction lower into wave (ii) starting later this week.

Tomorrow;

Watch for wave ‘v’ of (i) to continue higher in five waves to reach a high above 152.00 again.

The wave ‘iv’ low must hold at 151.16 for this count to remain valid.

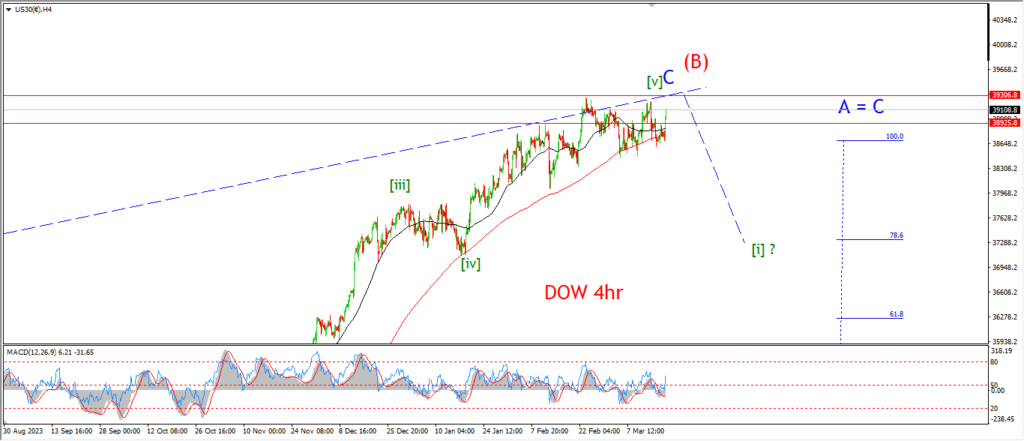

DOW JONES.

DOW 1hr.

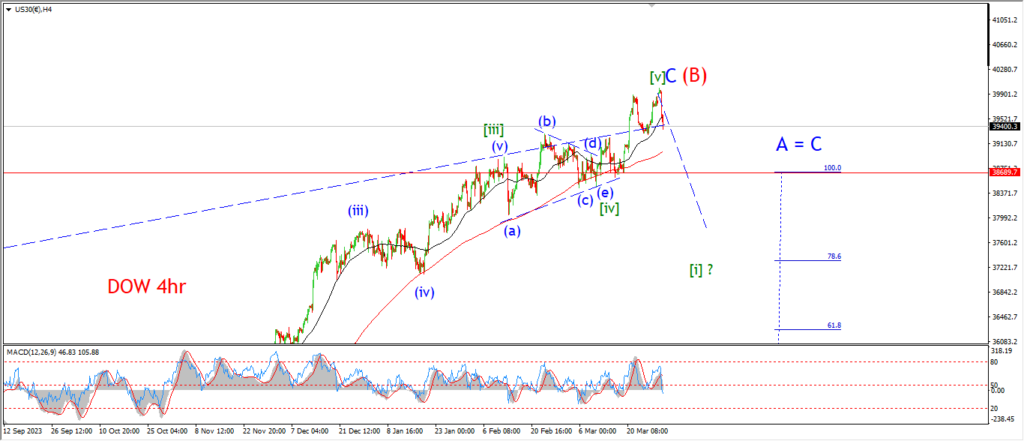

DOW 4hr

DOW daily.

It is a very tight head and shoulders pattern if wave [v] is now complete at Thursdays high!

But the pattern is the pattern,

and this one stands until proven wrong!

A nice sharp reversal off the top today has again opened up the possibility of wave (i) down beginning.

The main points in favor of this count are,

a clear five wave pattern into the wave [v] high last week.

A clear fourth wave correction as a triangle which was a nice setup for the rally in wave [v].

on the 4hr chart;

A full trend channel after a three wave rally in wave (B).

A throw-over pattern in place above the upper trend channel line in wave ‘C’ pf (B).

Wave ‘C’ blue has reached equality with wave ‘A’.

Each one of these is another box tick in favor of a top for wave (B) in play here.

And so the search continues this week.

Tomorrow;

We wont have to wait long to see if this reversal has any strength behind it or not.

So lets see if we get a follow through to the downside in five waves to signal wave (i) is underway.

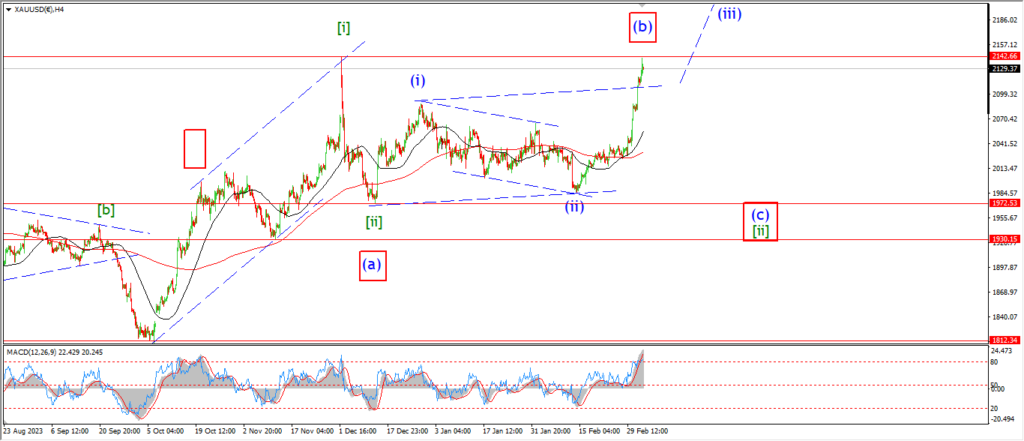

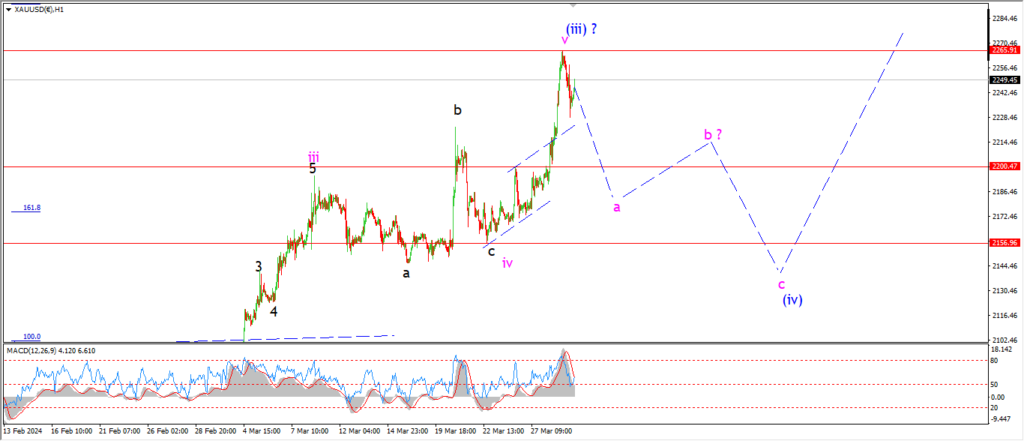

GOLD

GOLD 1hr.

The rally last week has opened up a possible new interpretation for wave (iii) of [iii] today.

The 4hr chart shows this pattern the best,

so I will start there.

If we view the recent choppy action as wave ‘iv’ of (iii),

Then wave (iii) has complete five waves up into last weeks top.

The price took a hit today which opens up the possibility of wave (iv) again.

and a correction lower into wave (iv) is where I will be looking this week.

IF wave (iv) is now underway,

then we should see a decline in wave ‘a’ of (iv) to break below 2200 again.

And I will be looking for a three wave decline in wave (iv) to retrace back below the the previous wave ‘iv’ low at 2156.

This overall correction should take a few weeks to play out if this pattern holds.

Tomorrow;

Watch for wave ‘a’ of (iv) to fall back to 2200 again in at least three waves to kick off the larger wave (iv) correction.

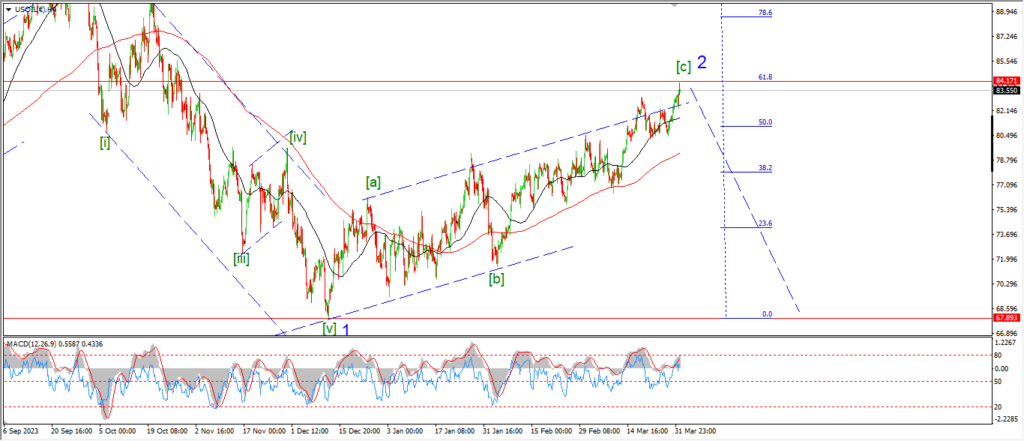

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Fridays pattern got invalidated today with a further rally in wave [c].

That forced me back to the drawing board tonight to see what is going on here in wave [c] of ‘2’.

The 4hr chart;

The overall pattern for wave ‘2’ is pretty solid I think.

Three waves up overall,

a break above the upper trend channel line,

and now a top at the 62% retracement level of wave ‘1’.

All in all I am confident that the overall rally into the current high is a correction and we should see a drop back into wave ‘3’ down beginning soon.

The internal pattern for wave [c] is another matter!

back on the hourly chart;

the rally in wave [c] of ‘2’ has been fraught with overlaps throughout and that does narrow down the options for a pattern.

An ending diagonal pattern for wave [c] is a reasonable option now.

I have shown a possible labelling for wave (iv) and (v) of [c] that calls this rally complete again at todays highs.

We will see if that pattern holds later this week.

But in general I have not changed my view of a top in wave ‘2’ coming soon.

Tomorrow;

A break of support here will be viewed as the beginning of wave ‘3’ down.

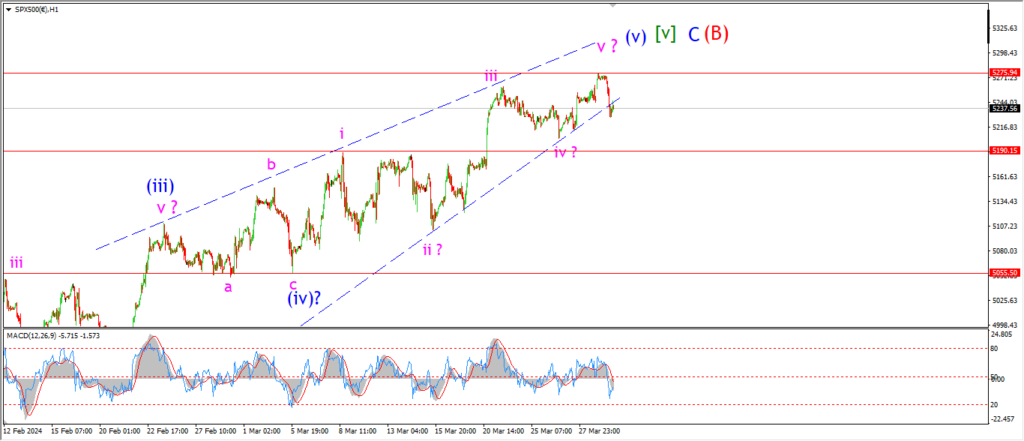

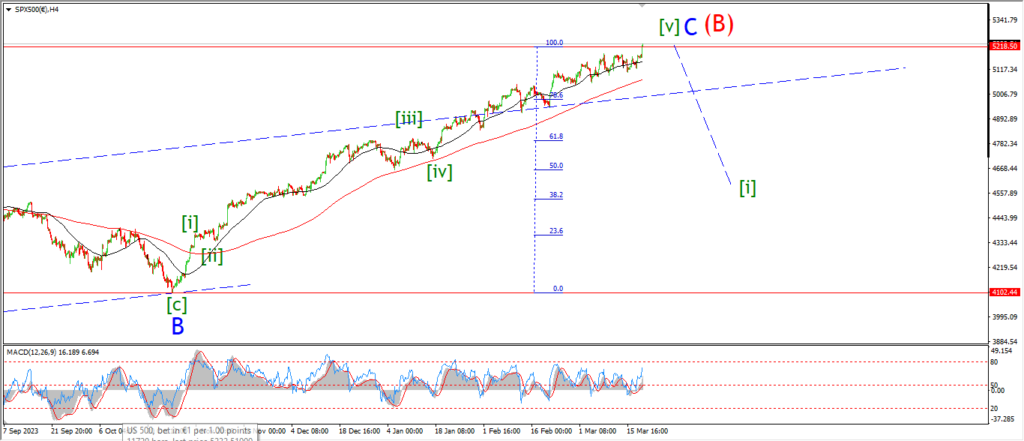

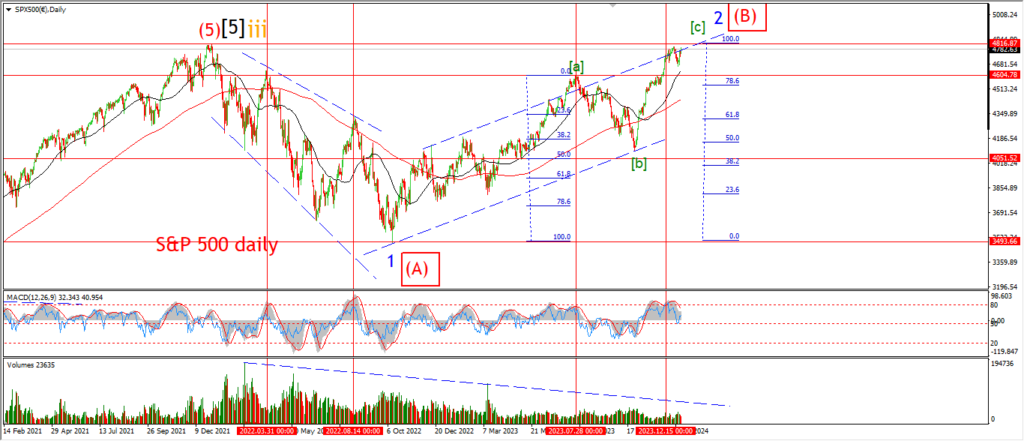

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

The drop off in the S&P is well below the range of previous declines over the last few months so I cant read much into it to be honest.

There is the possibility that wave (v) blue has completed a standard five wave rally into the highs,

so a reversal off that high is interesting in that scenario.

If the decline continues tomorrow,

that will raise the chance of a reversal building from here.

But we will just have to wait and see on that front.

Tomorrow;

The current pattern for wave (v) blue is complete at the highs.

If we see a sharp decline from here to break support again,

then the chances improve of finally turning that corner.

SILVER.

SILVER 1hr

WAve ‘b’ of (ii) turned higher again today only to reverse all gains again this evening.

I am suggesting that wave ‘b’ of (ii) is complete at todays highs,

and we should continue lower in wave ‘c’ of (ii) this week.

The target for wave (ii) remains at the 50% retracement level at 23.85.

And once the market gets down to those levels again then I will look higher into wave (iii).

Tomorrow;

Watch for the wave (i) high to hold at 25.77.

Wave ‘c’ of (ii) should continue lower as shown over the next few days.

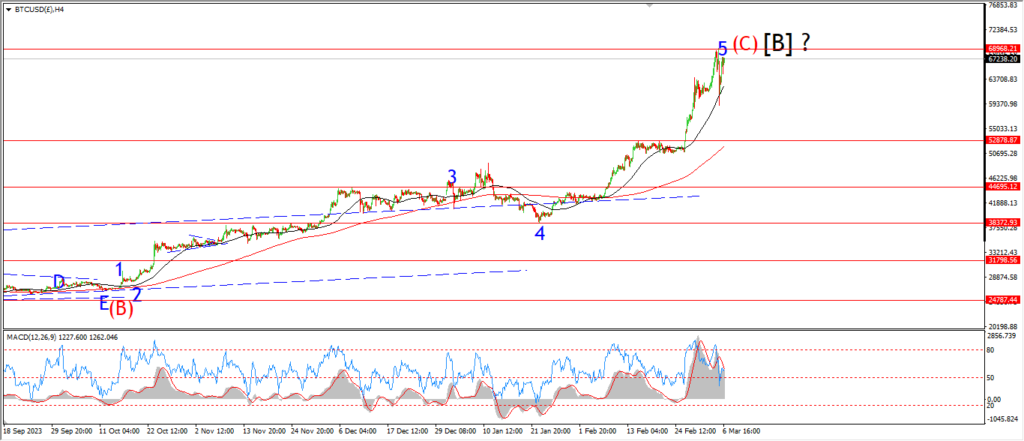

BITCOIN

BITCOIN 1hr.

….

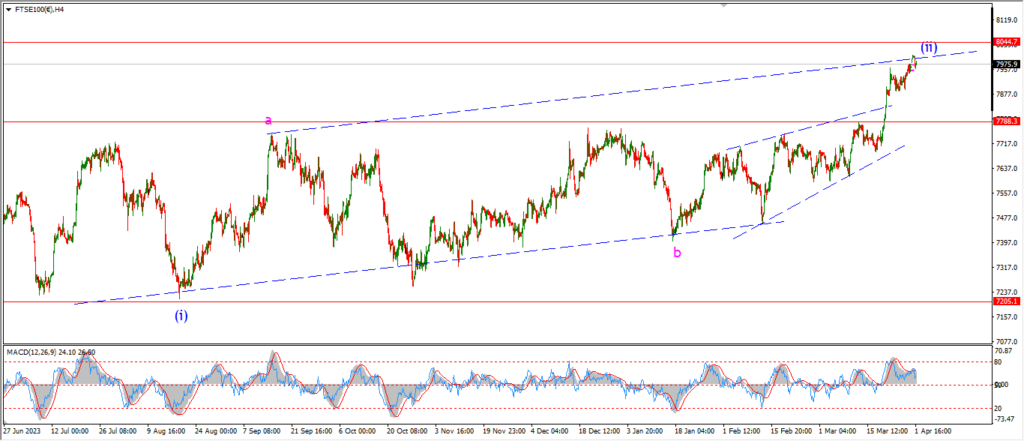

FTSE 100.

FTSE 100 1hr.

….

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

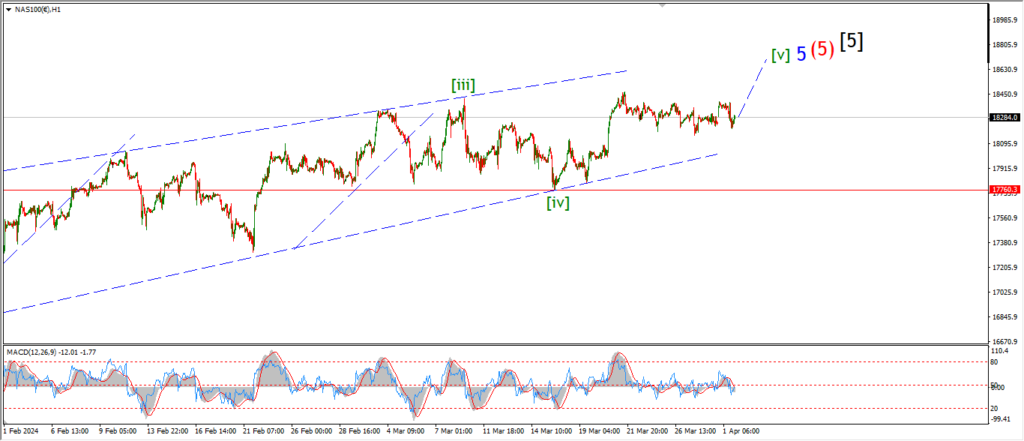

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….