Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

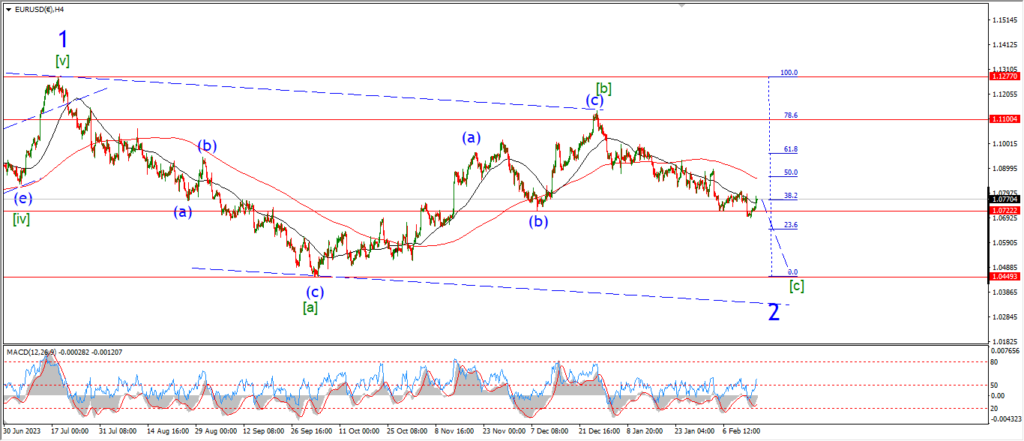

EURUSD.

EURUSD 1hr.

Todays was the day of the bounce for many markets and with that we have a reset on some of the short term counts.

The main wave count for wave (iii) blue is still in force here,

but the internal pattern of wave (iii) has moved on a little.

The rally today suggests has ruled out last nights count,

and now suggests wave ‘iii’ is complete,

and ‘iv’ of (iii) is now underway.

Wave ‘iv’ should trace out three waves up as shown,

and the previous fourth wave high at 1.0805 is the initial target.

Once that correction completes we should see a drop back to a new low in wave ‘v’ of (iii) next week.

Tomorrow;

Watch for wave ‘iv’ pink to complete a three wave correction higher over the coming days.

Wave ‘iv’ must hold below the wave ‘i’ low at 1.0846.

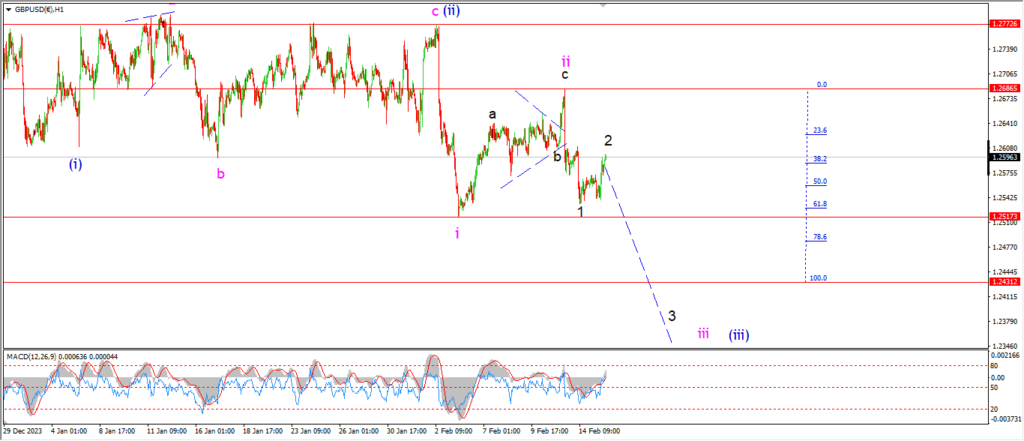

GBPUSD

GBPUSD 1hr.

Cable turned higher also today but the pattern remains the same from last night.

this rise is viewed as wave ‘2’ of ‘iii’ of (iii).

and if this count is correct here,

then wave ‘3’ of ‘iii’ should turn lower again by tomorrow evening.

A break below the 1.2500 level again will signal wave ‘iii’ is underway.

And I am looking at a minimum target for wave ‘iii’ at 1.2431.

that level marks the point where wave ‘iii’ reaches equality with wave ‘i’.

Tomorrow;

Watch for wave ‘3’ of ‘iii’ to fall into 1.2430.

The wave ‘ii’ high at 1.2686 should hold.

USDJPY.

USDJPY 1hr.

USDJPY dropped back below last Fridays highs at 149.58 today and that ruled out last nights count for wave (iii) blue,

I have relabeled the hourly chart tonight to show the next most likely count for wave [iii] green.

If this count proves correct,

then we should see a continued rally over the coming days into wave (v) of [iii] as shown.

The minimum target for wave (v) lies at 150.88 at the wave (iii) high.

But I would like to see an extended pattern in wave (v) to hit 152.36,

where wave (v) reaches the Fibonacci extension of wave (i).

The wave (i) high at 148.81 must hold for this pattern to remain valid.

Tomorrow;

Watch for wave (v) of [iii] to continue higher and break above 150.88 at a minimum.

DOW JONES.

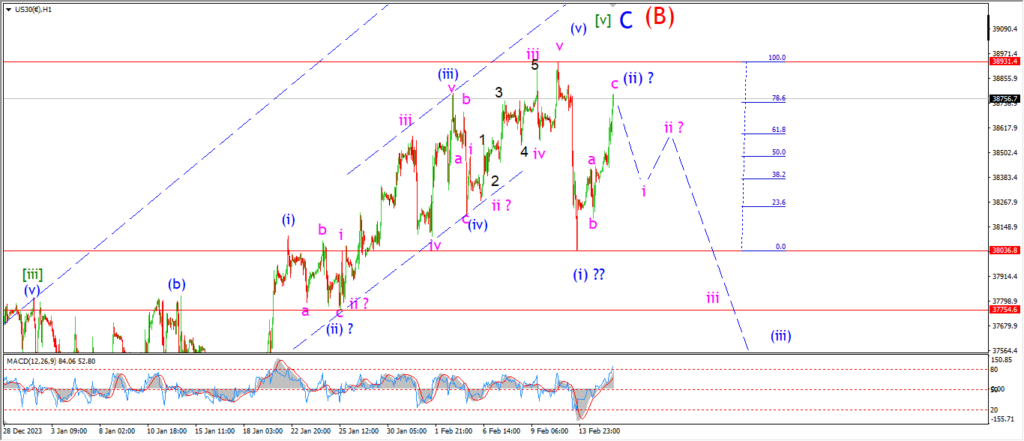

DOW 1hr.

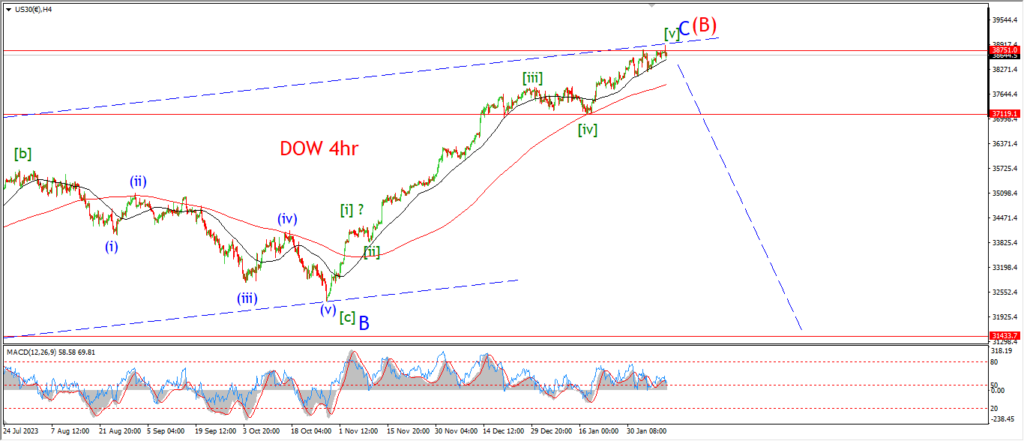

DOW 4hr

DOW daily.

Nice try, as they say!

This weeks sharp decline has been retraced to the 78.% Fib at the highs this evening.

Technically,

the pattern still holds as a possible (i) (ii) bearish lower high.

But the rapid rally today is putting severe pressure on the highs as we hit the close tonight.

The wave count stands for the moment.

And if this rally fades tomorrow in an impulsive fashion,

then we can look towards wave (iii) down next week.

The outlook in general does not change even if the market manages to reach out to a new high again.

The very same weakness exists in the underlying.

So we can expect another ‘air pocket’ to develop over the coming week.

Tomorrow;

Lets see if the high holds at wave (B).

Watch for wave ‘i’ of (iii) to return lower again.

Wave ‘i’ of (iii) will retrace the rally that happened today if this count is correct.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Gold is holding up today without turning down into wave ‘3’ of ‘iii’ yet.

This obviously puts pressure on the count,

but I am willing to allow this idea another day to see if the resistance at wave ‘1’ can hold at 2014.

If the price holds below that level and then turns down again towards 1972,

that will put this wave count back on track.

so far the rise off this weeks lows is only viewed as corrective within wave ‘3’ of ‘iii’.

So I want the price to turn lower again tomorrow.

Tomorrow;

Watch for wave ‘1’ to hold at 2014.

Wave ‘3’ of ‘iii’ must resume to the downside and hit the 1972 area to confirm this count.

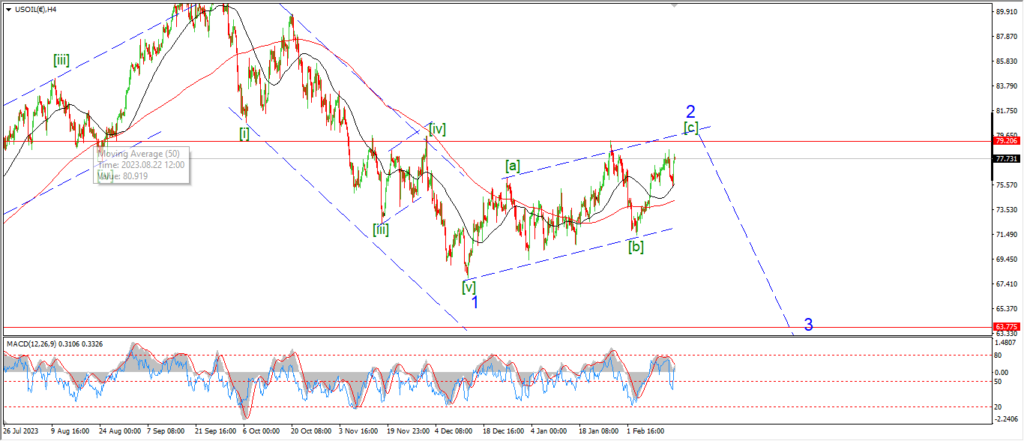

CRUDE OIL.

CRUDE OIL 1hr.

I have switched to the alternate count tonight,

so lets start at with a big picture view first.

The daily chart has been updated to show the pattern in wave (5) of [3] now underway.

The recent decline and correction higher is labelled as waves ‘1’ and ‘2’ of (5).

With a top in wave ‘2’ still up for debate at the moment.

Once wave ‘2’ is complete,

then we will see further downside in wave ‘3’ of (5).

The 4hr chart shows a new count tonight for the recent correction higher.

The previous count labelled this correction as wave [iv] of wave ‘1’.

Now you can see that wave ‘1’ is complete at the previous lows,

and now wave ‘2’ is in play here.

The question now is this;

has wave ‘2’ already topped out at the late January high.

Or is wave ‘2’ only now finishing.

Both ideas call for a sharp reversal lower over the coming weeks.

We will see soon enough on that front.

The hourly chart shows the new wave count for this wave ‘2’ correction.

I have shown the alternate count in red at the recent highs.

The rally into this weeks highs has come farther than expected.

Although the price has not broken out above the January top at 79.22,

the rally has come far enough to look at this alternate count.

Tomorrow;

Watch for wave [c] of ‘2’ to complete a the upper trend channel line with a break above 79.22 over the coming few days.

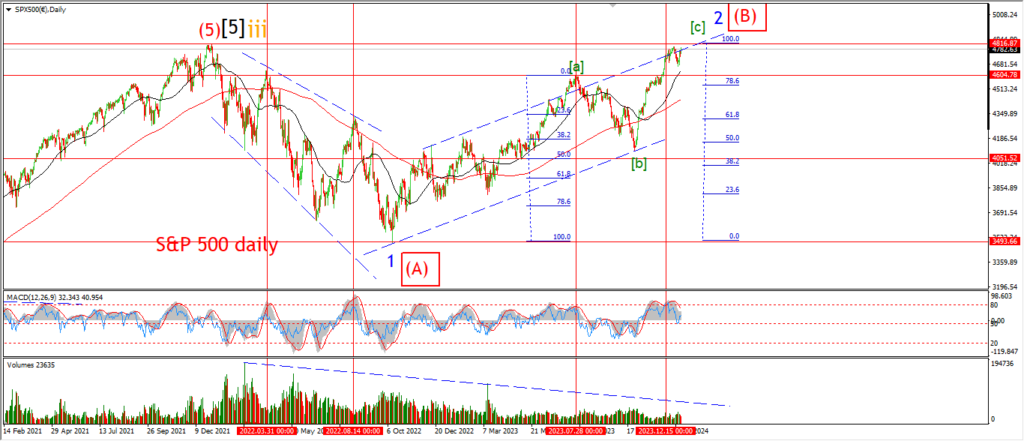

S&P 500.

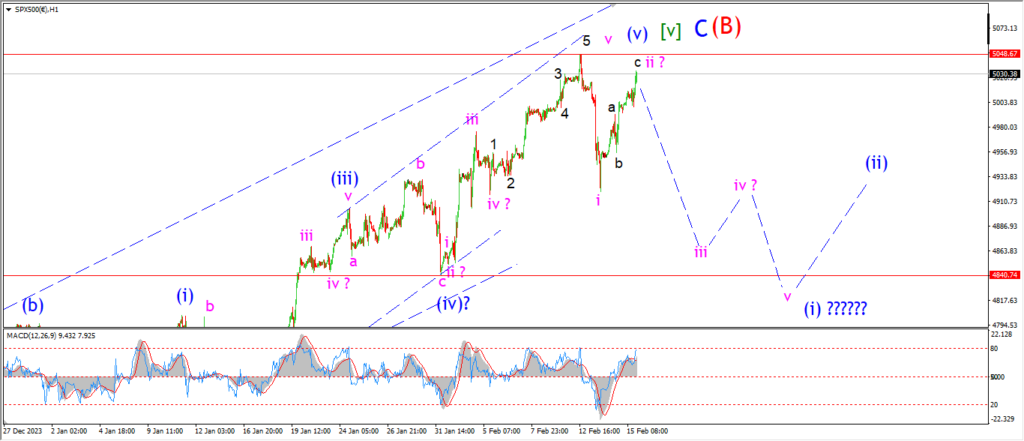

S&P 500 1hr

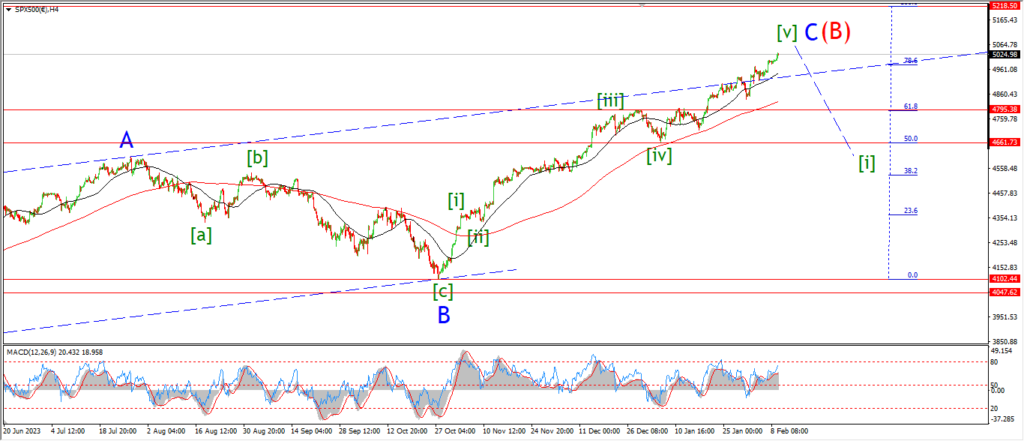

S&P 500 4hr

S&P 500 daily.

This weeks sharp decline off the highs was the first real break in the narrative we have seen for a good long time.

For a moment people got shaken by the lofty position of the market.

There was a very faint smell of fear in the air!

Now,

this decline can be retraced tomorrow no doubt,

but I will mark this move lower is a sign of things to come no matter what.

The retracement rally has now come close to reaching back to the highs again.

And I have labelled the rally as wave ‘ii’ of (i).

the bearish count is speculative for sure give how close we are to the highs again.

But the shoe fits tonight.

We will see if tomorrows session gives up on the rally or continues to a new high.

the decision is clear here.

Either this position is justified or not!

The market will choose.

Tomorrow;

Lets see if the high can hold at wave (B) also.

A third wave decline will fall back pretty quickly towards support at 4840.

SILVER.

SILVER 1hr

The rally today has done enough damage to consider a new count for wave (iv) again.

I am looking at an expanded flat correction for wave (iv) now as shown.

This weeks rally is labelled as wave ‘c’ of (iv).

And wave ‘c’ should hit the wave ‘a’ high again at 23.33.

That will complete a three wave correction higher,

and we can then look lower into wave (v) for next week.

Tomorrow;

watch for wave ‘c’ of (iv) to complete with a run up above 23.33.

BITCOIN

BITCOIN 1hr.

….

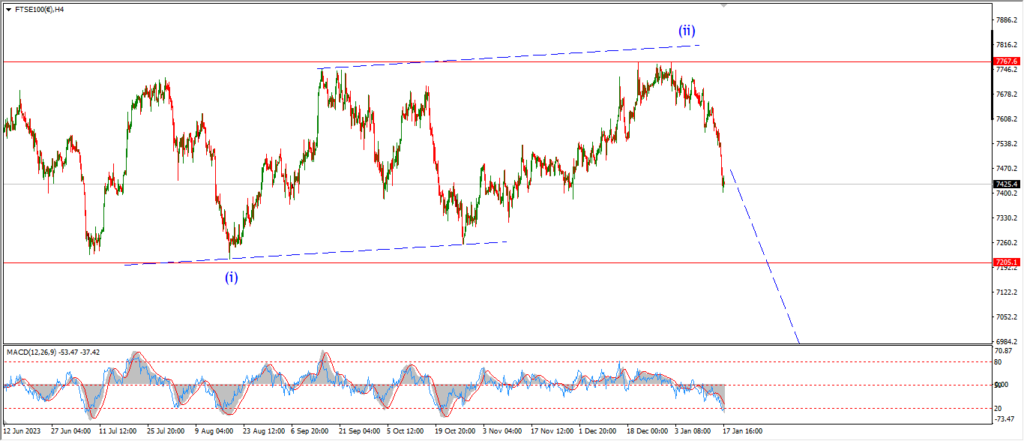

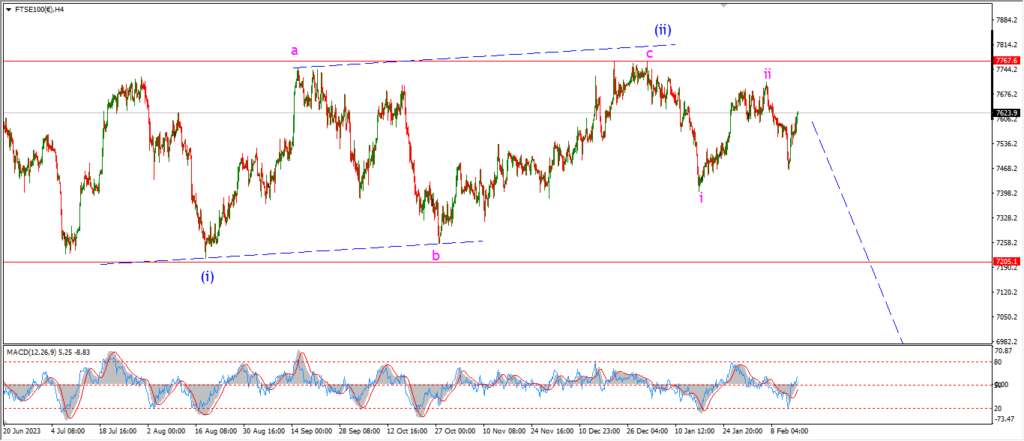

FTSE 100.

FTSE 100 1hr.

….

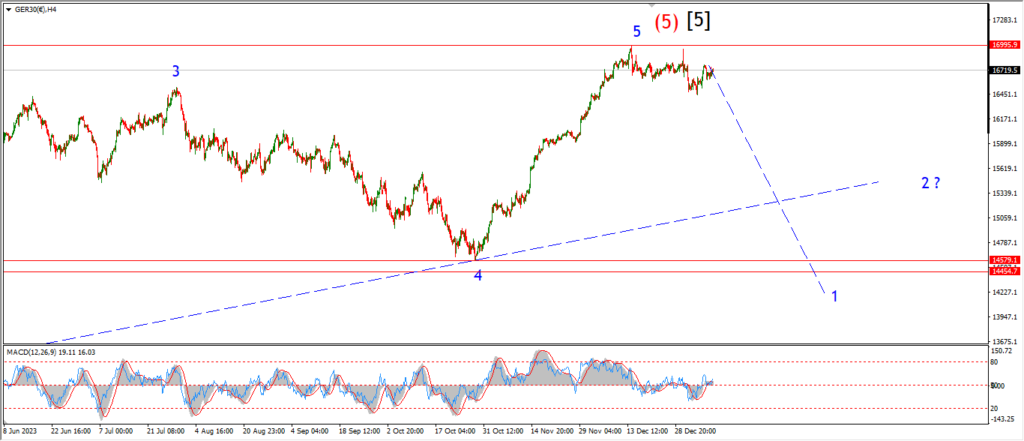

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….