Good evening folks, the Lord’s Blessings to you all.

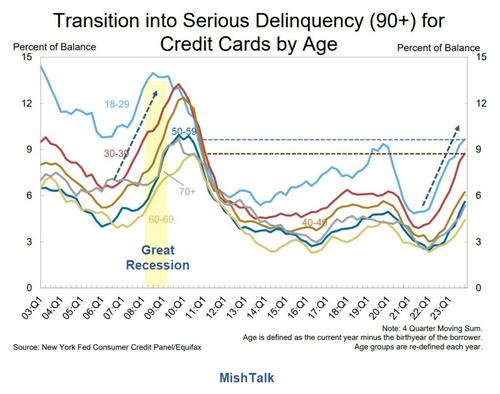

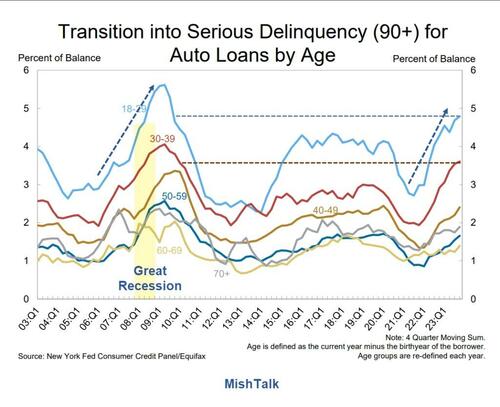

Hong Kong’s housing market tumbling as Country Garden slashes prices -30% in one massive step in its Kowloon development on the back of Evergrande’s liquidation. It’s a race to the bottom. HK’s family offices and banks are in trouble.

China’s largest developer headed into liquidation with ($333 billion in debt)…Evergrande’s $17 billion in USD bonds trading below a penny.:equity was halted at 16c. Total system wipeout as its CEO is also under police control. China’s so-called ‘miracle’ was just a mirage.

https://twitter.com/bullwavesreal

EURUSD.

EURUSD 1hr.

EURUSD is still stuck in this three wave correction today with very little in the way of progress in the pattern.

Wave ‘4’ is holding in the trend channel.

The price did manage a very slight new high for the week today.

But the internal pattern of wave ‘4’ is less than ideal.

I will give this pattern another day to see if get a top and reversal to indicate wave ‘4’ is done.

Monday;

Watch for wave ‘4’ of ‘iii’ to complete below 1.0812 and then drop back below 1.0722 again in wave ‘5’ of ‘iii’.

GBPUSD

GBPUSD 1hr.

A similar story in cable tonight I’m afraid.

the price is slightly higher today but that is not enough to confirm wave ‘c’ of ‘ii’ is in play yet.

It seems the price has traced out three waves up off that wave ‘b’ low.

so there is a good chance that we will see a further extension of wave ‘c’ on Monday.

I suspect wave ‘c’ will be complete by Monday evening.

Monday;

Watch for wave ‘c’ to continue higher towards a top near 1.2700.

After wave ‘i’ is done,

then wave ‘iii’ should turn lower and trace out five waves down by the end of next week if all goes to plan here.

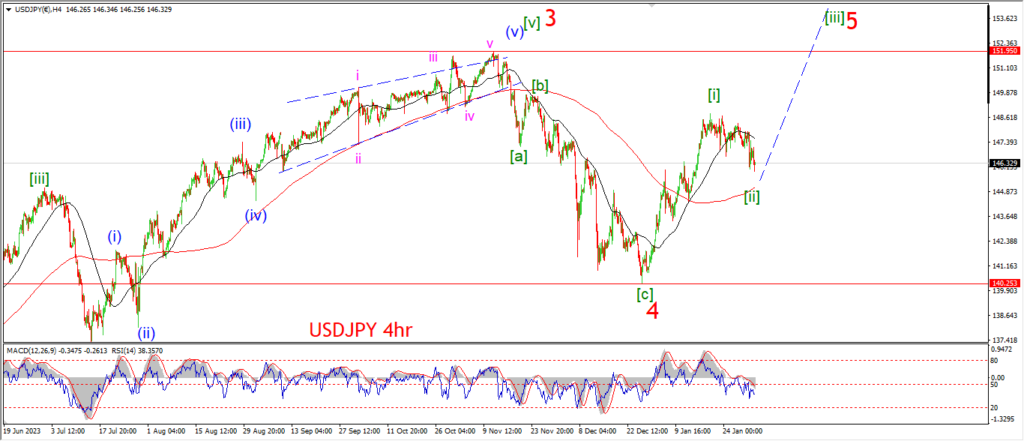

USDJPY.

USDJPY 1hr.

USDJPY has stalled at the top of wave (i) today.

The action has not turned lower into wave (ii) yet.

So that should begin next week.

Wave ‘a’ of (ii) should fall into the area of 148.50.

And the larger three waves down will take most of next week in this scenario.

That alternate idea for wave (i) and (ii) is still valid here.

And in that case,

wave (iii) is already underway.

The most recent rally is wave ‘i’ of (iii),

and wave ‘ii’ of (iii) will come early next week.

Monday;

Watch for wave (ii) to correct lower in three waves as shown.

DOW JONES.

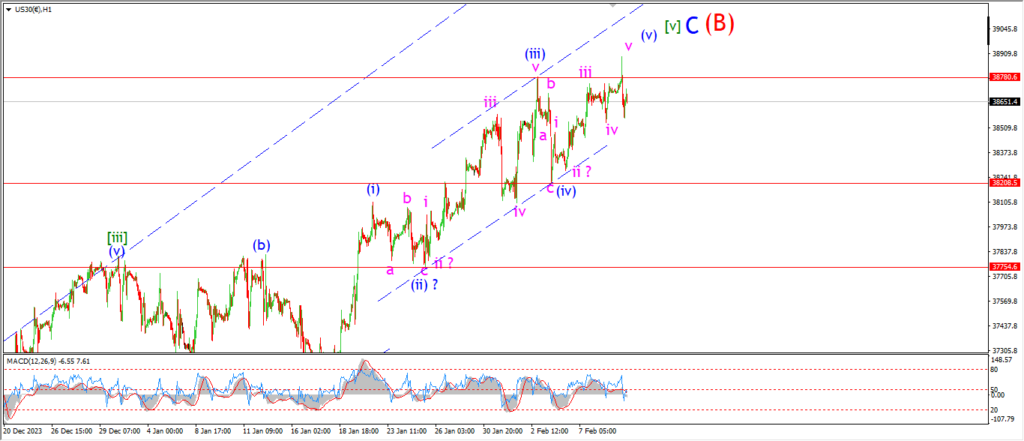

DOW 1hr.

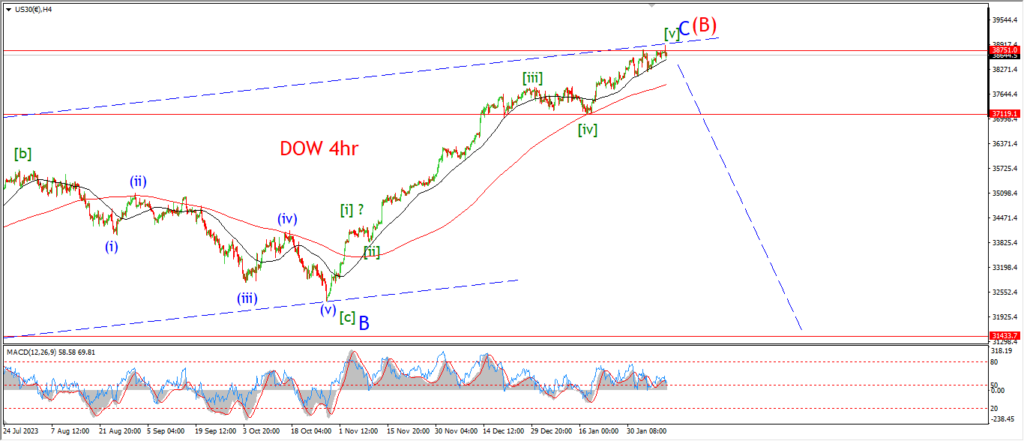

DOW 4hr

DOW daily.

An initial rally followed by a sharp reversal off the highs again.

This market is basically flat over the last week from the wave (iii) high.

These new highs did come as the pattern in wave [v] developed.

but they are pretty labored indeed even just looking at the action.

The DOW is actually slightly negative as we hit the close tonight even though the S&P is making a new high and closing above 5000.

If we take a look at the 4hr chart,

I find it interesting that wave ‘C’ of (B) is hugging the underside of the channel line for the last week.

And so far there is only momentum decline and pretty flat trade.

Monday;

The top of wave [v] of ‘C’ of (B) is within reach here,

if it is not already in place.

Its been a long period of repetition for me,

but I remain convinced that this is a sucker rally in wave (B).

And like I mentioned in the video tonight.

What follows from here will be quite the shock when wave (C) comes along.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Gold actually turned lower today against last nights count.

But I still think the pattern in wave ‘2’ has merit here.

Three waves down into todays low can be viewed as a correction within wave ‘2’.

And we should see this pattern in wave ‘2’ complete with another break of 2044 to complete next week.

Tomorrow;

Watch for a three wave correction in wave ‘2’ to close out the channel with a break above 2044.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude has ended the day flat after a small spike to the upside earlier on.

Wave (ii) is holding below the 78.6% Fib retracement level now.

this rally has done enough.

And I am now looking for the price to turn lower early next week to begin wave (iii) down.

Monday;

The wave [iv] high at 79.20 must hold.

watch for wave ‘i’ of (iii) to fall back below 74.00 to signal the pattern has turned again.

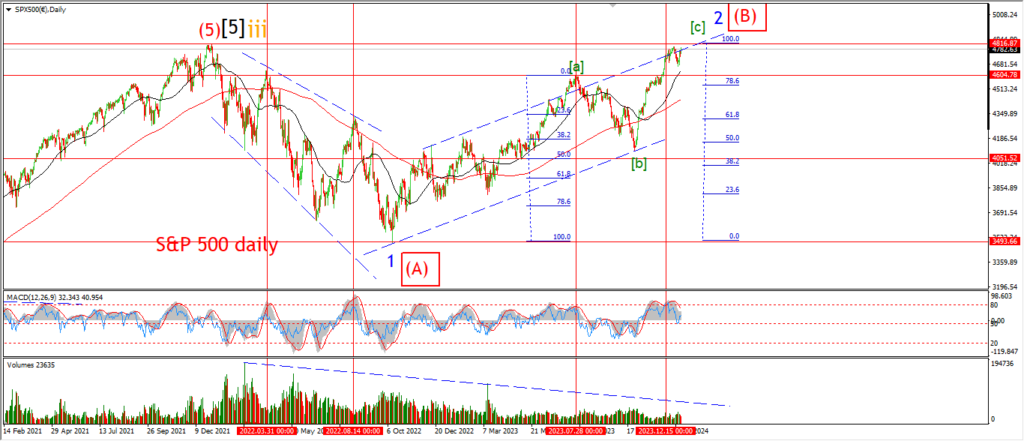

S&P 500.

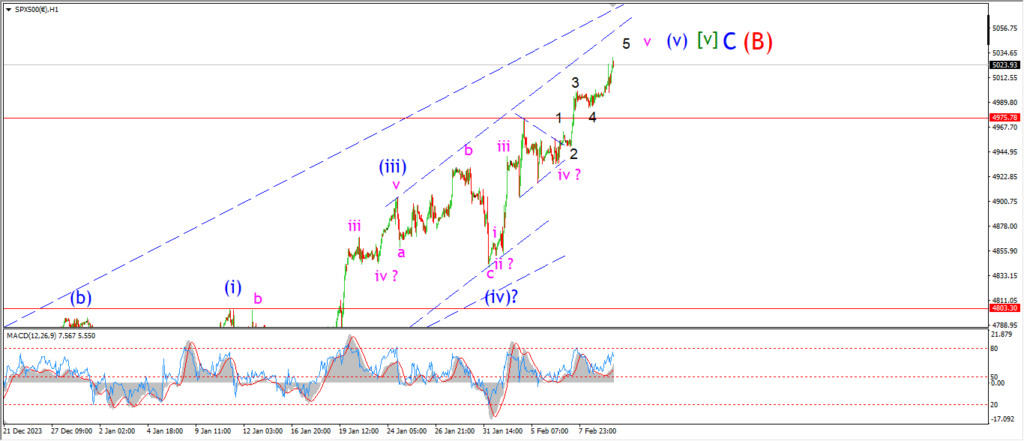

S&P 500 1hr

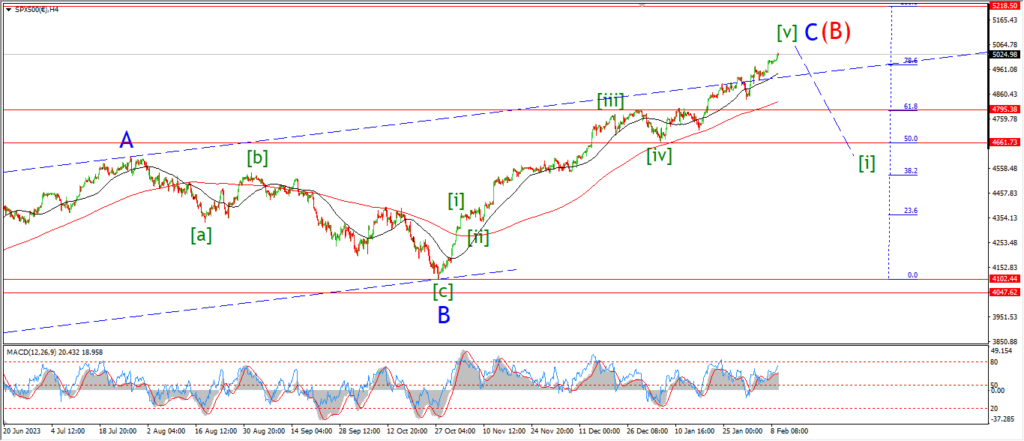

S&P 500 4hr

S&P 500 daily.

A new high to finish the week so all the pin-stripped suits can head off the pub with a smile on their faces when the bell rings in a few minutes.

Take a look at the 4hr chart.

The rally in wave [v] has now managed a clear throw over above the upper trend channel line this week.

That completes five waves up in wave ‘C’,

and three waves up in the larger wave (B).

These completed patterns may not have any bearing on the short term action over the next few days.

but I think it is worth keeping your eyes on this pattern at this late stage in its development.

Wave (C) down can begin with a bang as I demonstrated in the video earlier.

And so the market remains open to this outcome.

Monday;

Lets see how this pattern finalizes next week.

SILVER.

SILVER 1hr

The larger wav (iv) pattern is fitting the action again tonight after the price is building another higher low off wave ‘b’.

I am tracking five waves up in wave ‘c’ now.

and the action has already traced out wave’s ‘1’ and ‘2’ to begin that rally in wave ‘c’.

This pattern will complete with a break above 23.31 at the wave ‘a’ top.

and next week should be enough time for this correction higher to finish.

Monday;

watch for wave ‘3’ of ‘c’ to continue higher and complete with a break of 23.32.

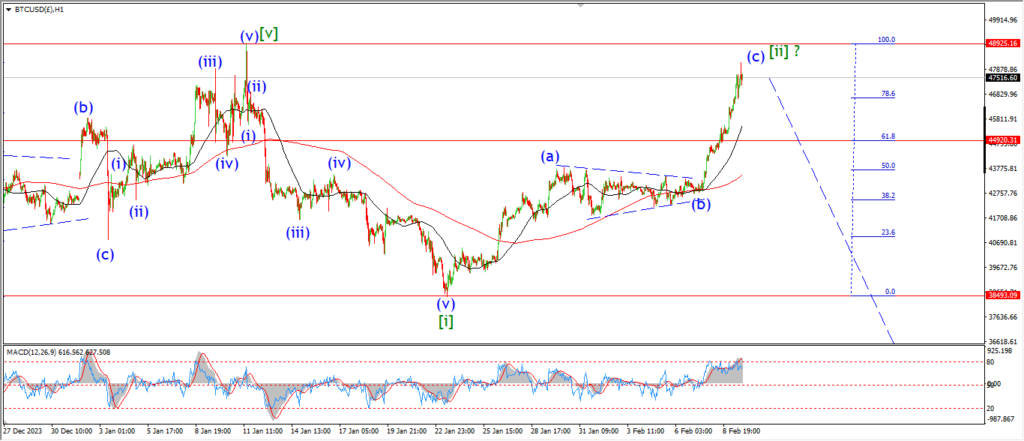

BITCOIN

BITCOIN 1hr.

….

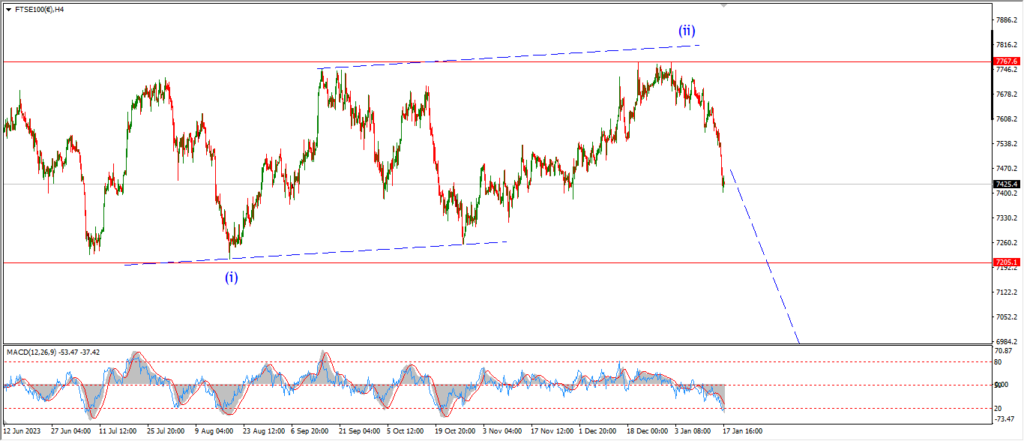

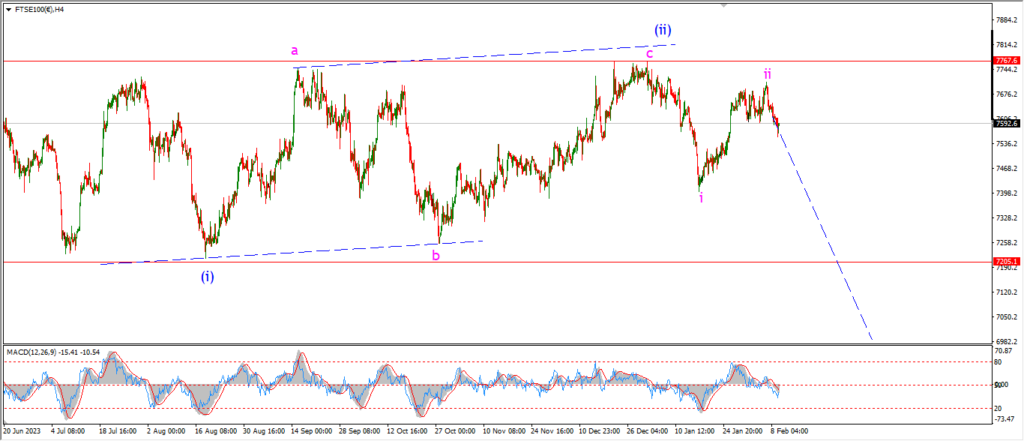

FTSE 100.

FTSE 100 1hr.

….

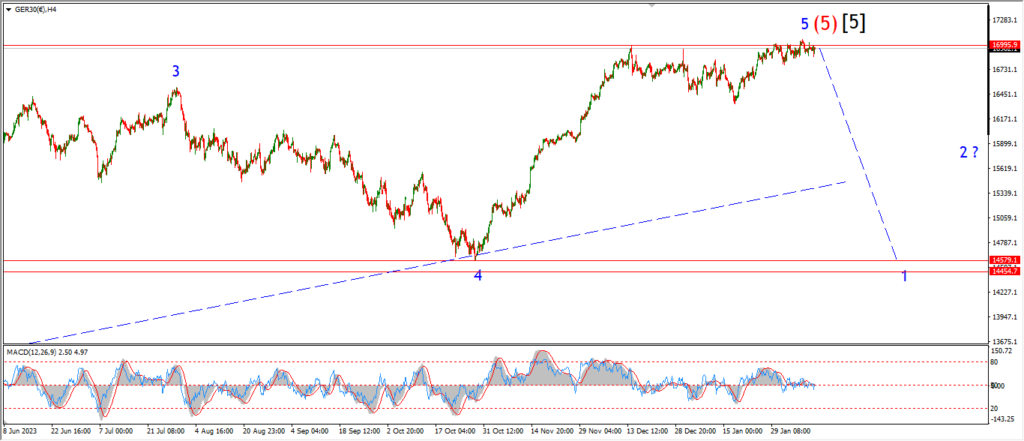

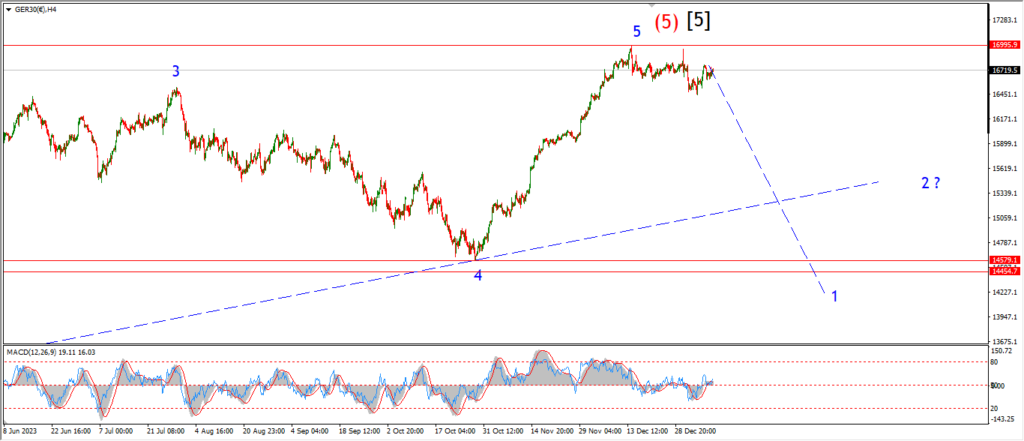

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

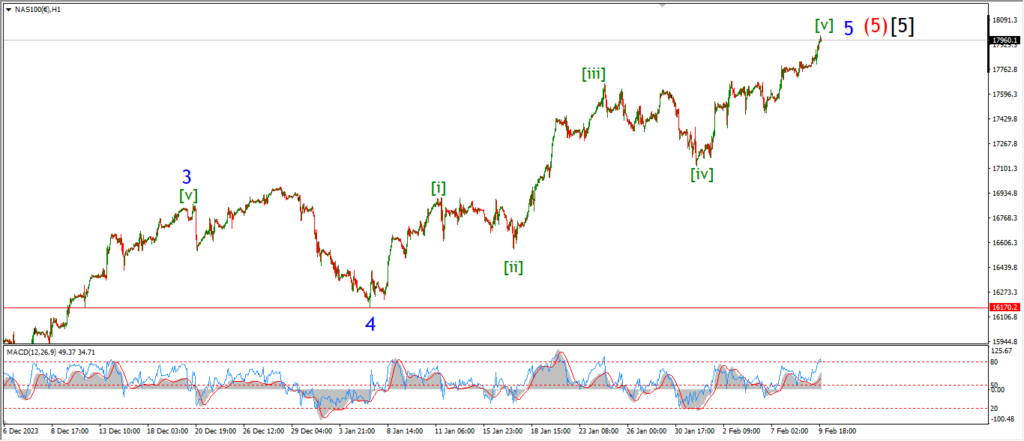

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….