Good evening folks, the Lord’s Blessings to you all.

While everyone is focused on how great earnings are for the Mag 7, & equating this to a strong US economy, for the 384/1946 companies who make up the Russell 2000 that have reported Q4 earnings, QoQ growth is down a jaw-dropping -53%. Maybe… things are about to get REALLY bad.

https://twitter.com/bullwavesreal

EURUSD.

EURUSD 1hr.

That was a pretty sharp move lower today which puts this wave count back on track for the moment at least.

Wave ‘iii’ down requires a larger move lower to confirm this pattern.

But I would suggest a low for wave ‘iii’ at about 1.06 to prove the larger pattern correct in wave (iii) of [c].

The larger wave [c] should break 1.0450 at a minimum,

So its good to remember that there is a larger pattern at play here in wave [c].

so the patter has work to do!

Tomorrow;

Watch for wave ‘iii’ of (iii) of [c] to continue lower over the coming days.

Wave ‘iii’ should complete five waves down near 1.06.

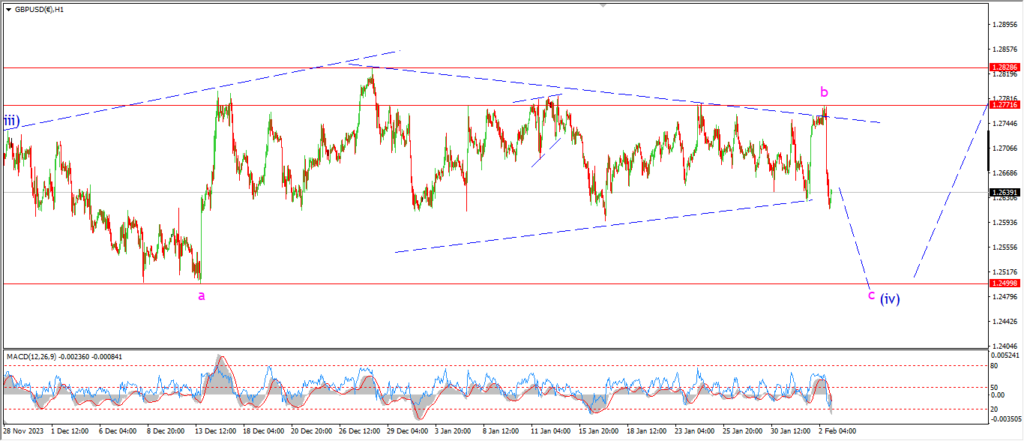

GBPUSD

GBPUSD 1hr.

Well the new pattern I showed for wave (iv) last night was invalidated today with that rapid decline off the high.

the price has now completely retraced the gains made this week.

And I must admit,

this action has complicated the pattern even further now!

I am going to continue with the idea with a fourth wave correction in wave (iv) blue.

The pattern is now labelled as a combination wave overall.

With wave ‘b’ of (iv) completing a triangle at todays high.

Wave ‘c’ of (iv) should break 1.2499 to complete the pattern early next week.

Then I will look for the beginning of wave (v) up.

Monday;

Watch for wave ‘c’ of (iv) to complete this large combination wave.

Wave (v) should begin off that new low in wave (iv).

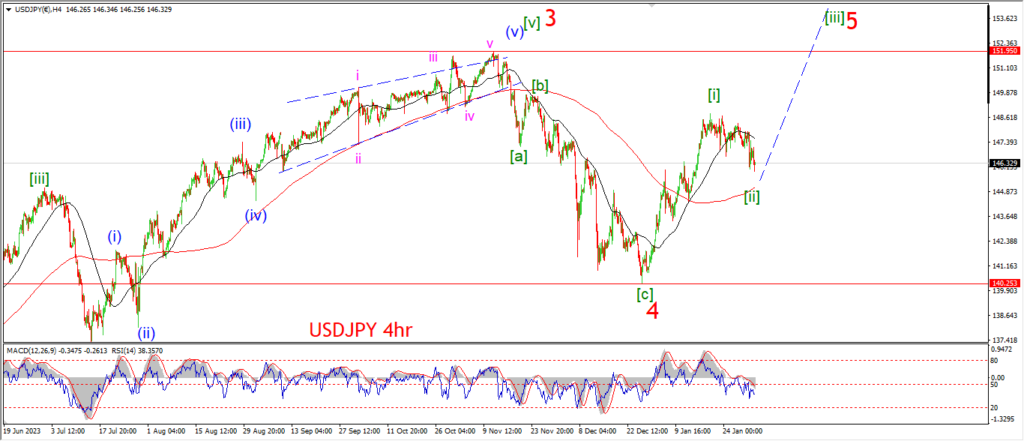

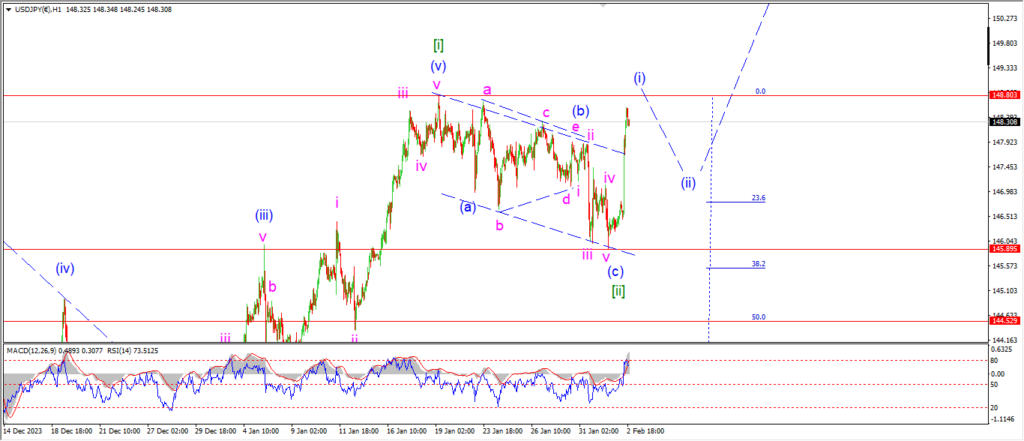

USDJPY.

USDJPY 1hr.

At least USDJPY is moving in line with the main pattern today!

The price rallied sharply off the wave [ii] lows today.

and now I have labelled this rally as wave (i) of [iii] of ‘5’.

This wave count will be confirmed with a breakof the wave [i] high at 148.80 next week.

Ideally wave (i) of [iii] will break to that high before correcting into wave [ii].

Monday;

Watch for wave[ii] to hold at 145.89.

Wave (i) and (ii) should complete a higher low above that level.

And the main progress in the overall pattern will be made in wave (iii) of [iii] of ‘5’ over the next few weeks.

DOW JONES.

DOW 1hr.

DOW 4hr

DOW daily.

We have been through several different iterations of the main count over the last few days.

The market decided to move to new all time high today in it’s wisdom!

And this is dealt with in terms of a fifth wave extension in wave (v) of [v] of ‘C’ of (B).

Remember,

this is a (B) wave top that is forming here.

And you can see this clearly on the daily chart.

The trend channel is almost filled now after this larger three wave rally in wave (B).

And the rally in wave ‘C’ has actually reached equality with wave ‘A’ this week.

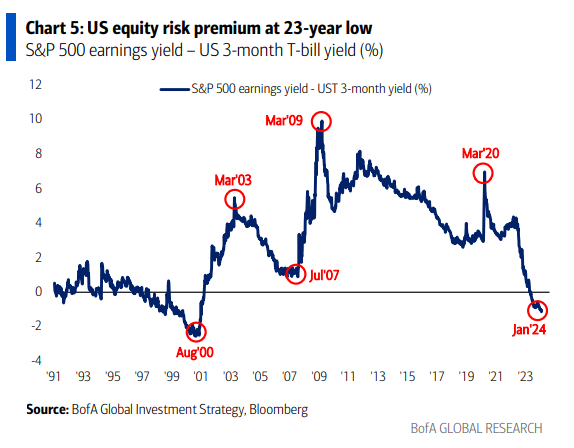

This new all time high is happening with a backdrop of diverged momentum and a developing banking crises.

Contracting credit,

contracting M2,

declining house prices,

oil signaling a recession,

record consumer debt,

contracting labor hours,

declining sales numbers,

contracting margins.

etc,

etc…….

Monday;

The focus remains on wave [v] of ‘C’.

The pattern has completed a new five wave structure into todays highs.

So we will see if this yields any results.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Gold gave us a hard reversal in the action today.

And now the price has retraced all the gains made in the last week.

The pattern now displays a clear throw-over and reversal around the upper trend channel line of wave ‘ii’.

the decline off that top looks impulsive at the moment.

And wave ‘iii’ down must now make progress lower to confirm the larger wave (iii) of [c] pattern.

Monday;

WAtch for wave ‘ii’ to hold at todays highs.

Wave ‘iii’ down is in line now to fall sharply over the next few days if this count is correct.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude oil is now firmly back in the range of the previous wave (b) correction again.

the price is actually closing below the wave (b) lows this evening after another step lower today.

I can see a five wave pattern now in place for wave ‘iii’ of (i),

so I am calling wave ‘iii’ down at todays lows.

And wave ‘iv’ and ‘v’ must now trace out another step lower as suggested

which will complete the larger wave (i) blue.

That will be the focus for the first few days next week.

Monday;

Watch for wave (i) to close out an impulsive five waves down as shown over the first half of next week.

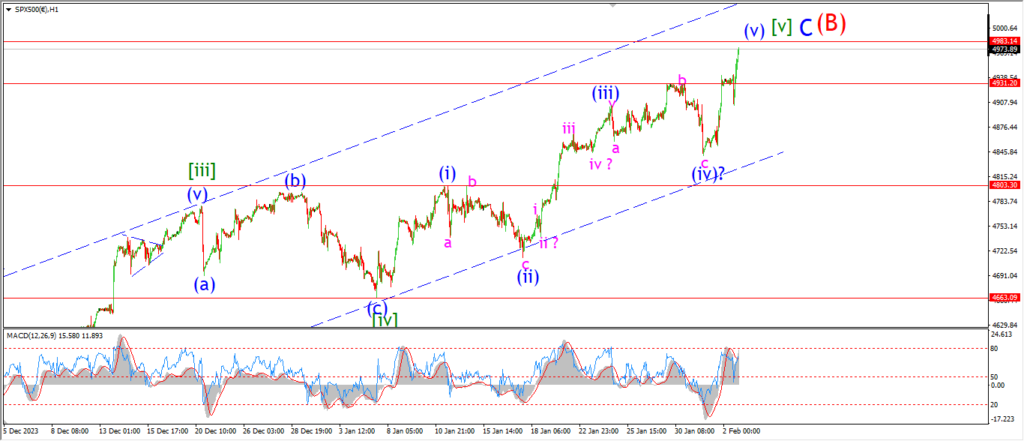

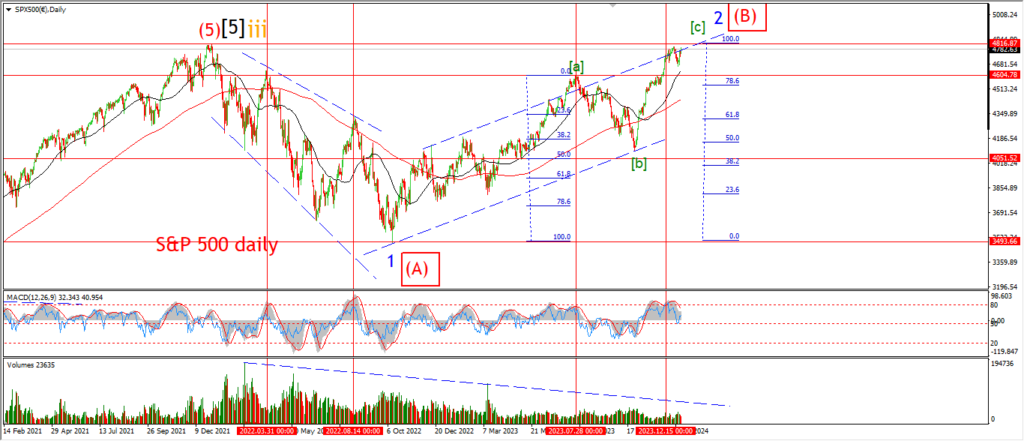

S&P 500.

S&P 500 1hr

S&P 500 4hr

S&P 500 daily.

If we take a look at the daily chart first tonight.

you can see that a major momentum divergence is now in place as the market hits a new high tonight.

This is a clear signal that wave (B) is now done all it can do.

and wave (C) down is to be expected soon.

I am showing a complete three wave pattern higher in wave (B) at the current highs.

And the trend channel for wave (B) is also full this week.

The rally in wave [v] of ‘C’ has actually created a throw over here also this week.

Again;

We have enough done here to consider the larger pattern done.

And as always.

The next step is for and initial five wave decline to come in.

Monday;

Wave (v) of [v] has traced out a five wave pattern higher at todays highs.

And now we have hit a point where a trap door can open below the price at any moment.

We don’t know what will be the catalyst,

but that moment is coming for sure.

SILVER.

SILVER 1hr

Wave (v) down seems to be underway now after that sharp drop back into the weekly lows.

The minimum target for wave (v) of [c] lies at 21.92.

But I favor wave [c] to drop below 20.68 at the wave [a] lows.

If the lower target will be met in wave [c],

then I suspect the pattern will revert back to a normal five wave decline,

rather than the wedge pattern that I am showing here.

I do think that next week will be enough time to complete the larger pattern in wave [c] of ‘2’.

So we could be in for a fresh wave lower next week to achieve that.

Monday;

Watch for wave (v) of [c] to hit the minimum target at 21.92.

With the lower target at 20.68 a real possibility .

At that point I will turn to a bull in the short term wave count!

BITCOIN

BITCOIN 1hr.

….

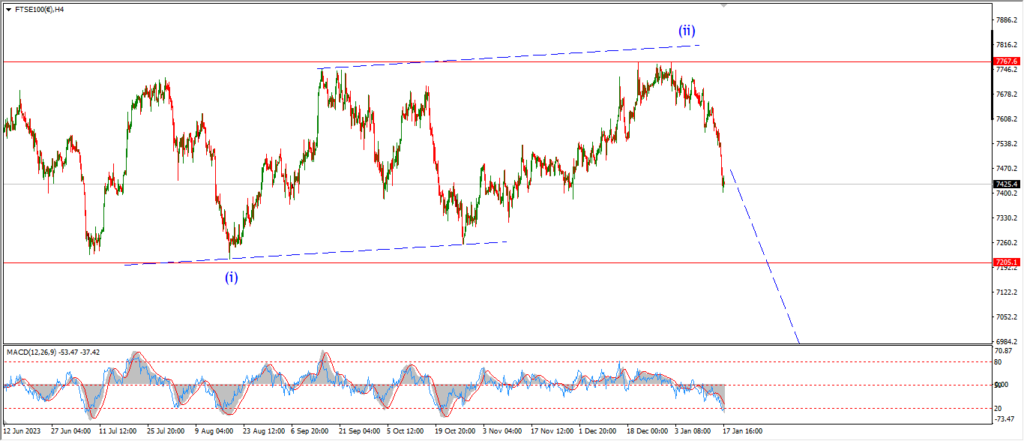

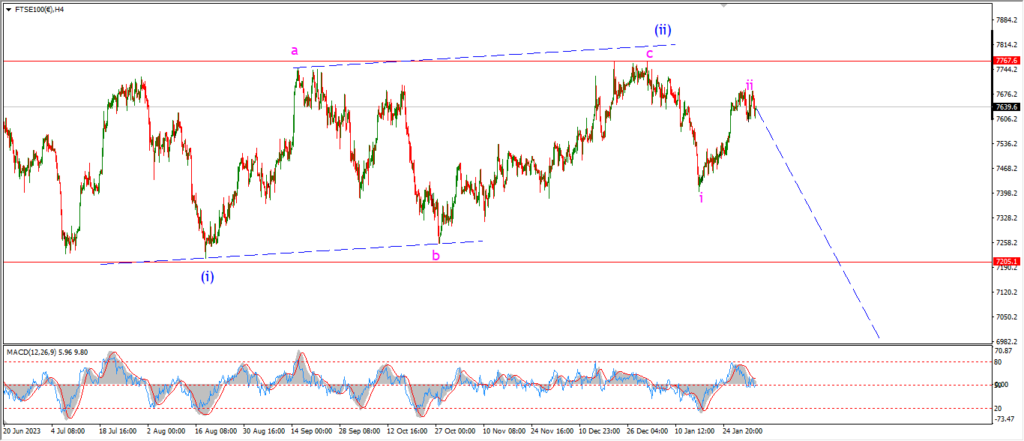

FTSE 100.

FTSE 100 1hr.

….

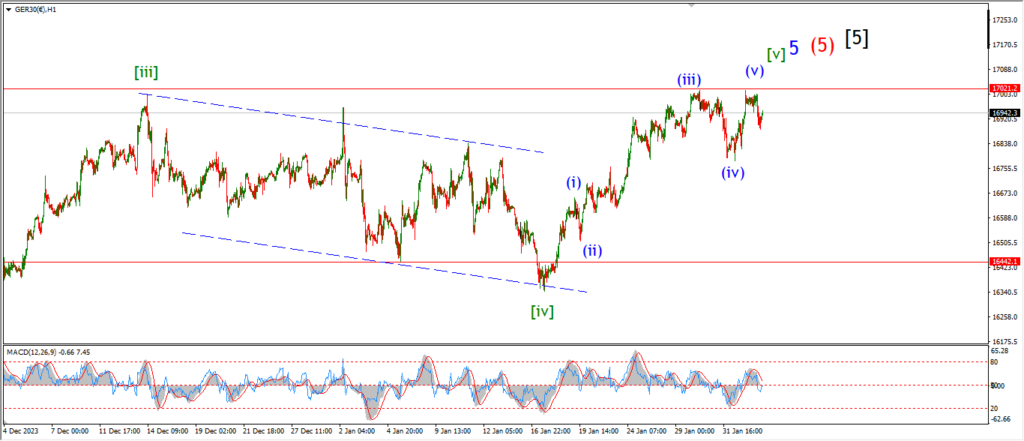

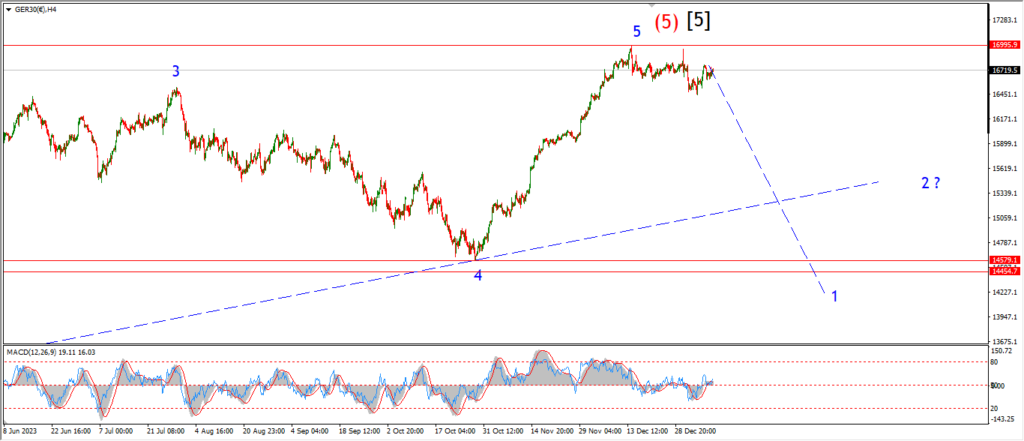

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

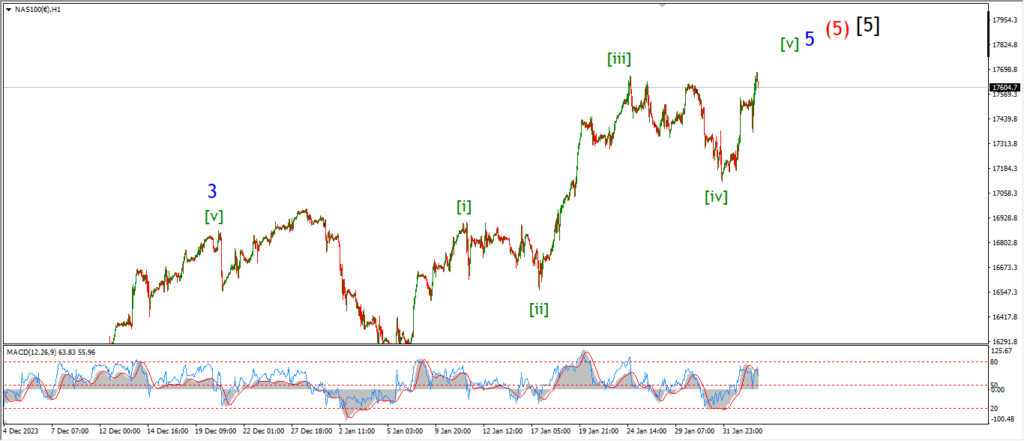

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….