Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

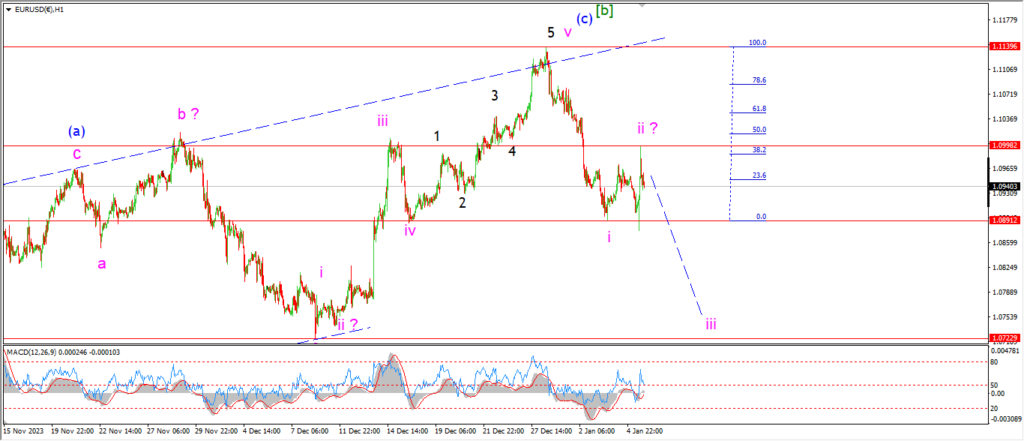

EURUSD.

EURUSD 1hr.

EURUSD managed a to rally off Thursdays low today in a possible wave ‘ii’ correction.

Wave ‘ii’ is an expanded flat correction in this scenario.

The price almost reached the 50% retracement level at the high,

and now we have a sharp drop off the high.

This may be the beginning of wave ‘iii’ of (i) now,

and the price must continue lower on Monday to confirm this pattern.

Monday;

Watch for wave ‘ii’ to hold at 1.0998.

Wave ‘iii’ down will be confirmed with a break of 1.0890 again.

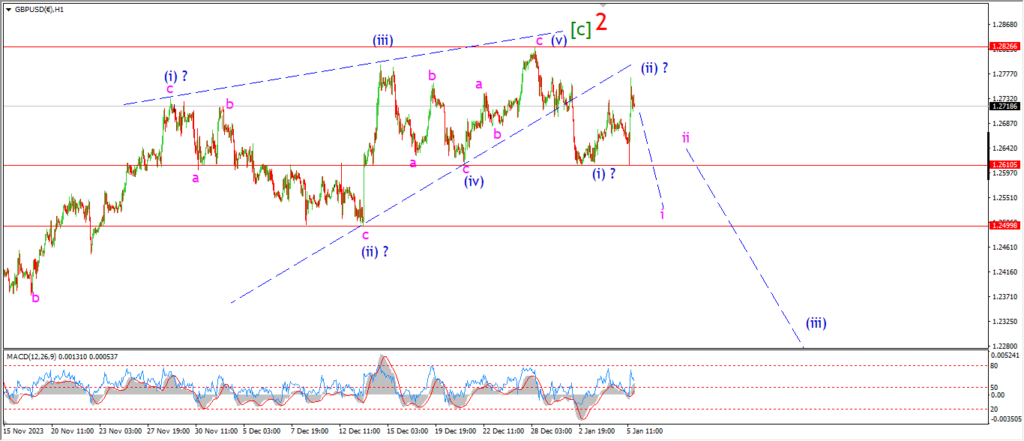

GBPUSD

GBPUSD 1hr.

I am not convinced by the hourly wave count here,

so I would proceed with caution as this pattern develops.

The high of the session is labelled as wave (ii).

The price must turn lower in a sharp and sustained decline for this count to hold.

And wave (iii) must break the support level at 1.2500 on Monday.

Wave ‘i’ of (iii) will break 1.2610 on Monday to confirm the pattern.

Monday;

Watch for that lower high of wave (ii) to hold and wave ‘i’ of (iii) to turn lower first thing Monday.

USDJPY.

USDJPY 1hr.

USDJPY topped out at 145.96 today and then took a nose dive off the high!

I am suggesting that wave (i) is complete at the high,

and wave (ii) began with todays drop.

Wave (ii) should trace out a three wave drop into the 50% retracement level at 143.10.

Waves ‘a’ and ‘b’ may already be complete off the highs,

and wave ‘c’ will complete the pattern by turning lower on Monday.

Monday;

Watch for wave (ii) to complete a higher low in the area of 143.10 as shown.

If this count is correct,

then next weeks trade will be dominated by a strong rally in the USD.

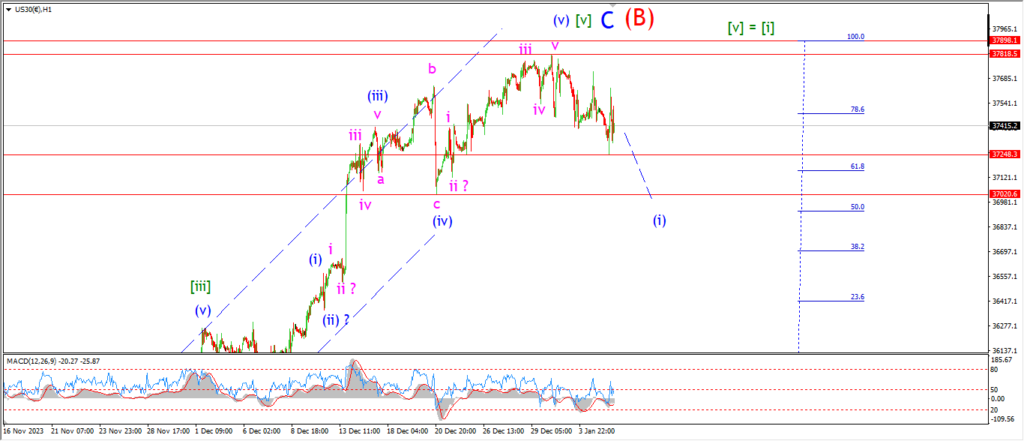

DOW JONES.

DOW 1hr.

Here is another market that I am unsure of at the moment.

the pattern up into that recent high is complete.

And the internal wave structure is solid.

But the action off that high is not impressive at all yet.

I will give the pattern a few more days to see if it develops into an impulsive structure.

But at the moment I am going to reserve judgement.

Monday;

Watch for a break of support at 37000 to give this pattern a chance.

As long as the price continues to form lower highs,

then there is a chance the market can form an impulsive wave lower.

We will see.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

I have shown a possible five wave decline off the top at wave (ii) complete at todays lows.

Wave ‘i’ is now done,

and wave ‘ii’ turned higher today.

I cant see a three wave pattern in wave ‘ii’ yet,

so there is potential to see a rally into the trend line again to complete three waves up.

The decline this week failed to break the support at the 2015 low,

and that is a mark agains the main count for sure.

so I want to see that level break as wave ‘iii’ of (iii) takes over early next week.

Monday;

Watch for wave ‘ii’ to complete a three wave correction higher and then turn lower into wave ‘iii’ by the end of Mondays session.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

Crude did break above the wave ‘i’ high today which suggests wave ‘iii’ is now in play.

But I must admit that the rally has cooled off substantially here.

And this is the opposite to what I was expecting for wave ‘iii’.

So this is a little concerning at the moment.

The main count still holds for now,

but I want to see wave ‘iii’ make solid gains on Monday to confirm this count.

Monday;

Watch for wave ‘ii’ to hold at 71.16.

Wave ‘iii’ up must continue as shown.

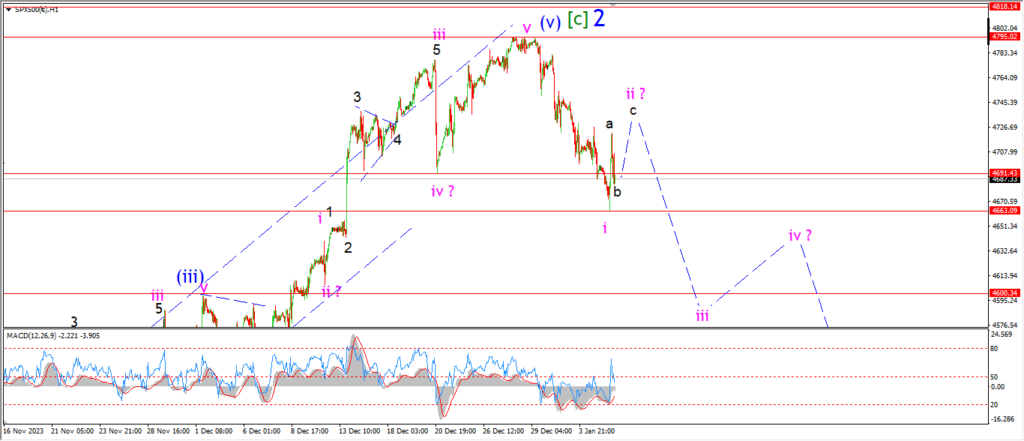

S&P 500.

S&P 500 1hr

The S&P is developing more favorably as a bearish reversal pattern when compared to the DOW.

The price has broken below the initial support at 4691 today,

That should complete wave ‘i’,

and now three waves up is underway in wave ‘ii’ today.

I have labelled todays action as wave ‘a’ and ‘b’ of ‘ii’.

With wave ‘c’ left to turn higher again on Monday to complete the corrective pattern.

The outlook is simple here.

the market must form a lower high next week in wave ‘ii’.

and then we reach the real test for this pattern.

An acceleration lower must take place in wave ‘iii’ of (i) to break 4600 again.

Monday;

watch for wave ‘ii’ to complete with a rise in wave ‘c’ as shown.

If wave ‘ii’ can complete on Monday then we know what to look for on Tuesday.

SILVER.

SILVER 1hr

Silver is now acting against the main count today.

The price has not broken the invalidation level at 22.50 yet so there is still time to turn higher into wave ‘iii’.

But,

todays action looks very like a three wave rise in a trend channel,

and that rally failed at the high fell back into the channel again this evening.

I have mentioned a few times that this pattern is sitting on the edge of two separate wave counts.

And I am still not able to pick a side here!

The market got very close to breaking support at 22.50 yesterday,

and even now I cant say that the price is out of danger.

Monday;

Watch for a break back above 23.53 to favor the main bullish count for wave ‘iii’ of (iii).

A break of 22.50 will trigger the alternate count for wave ‘iii’ of (iii)!

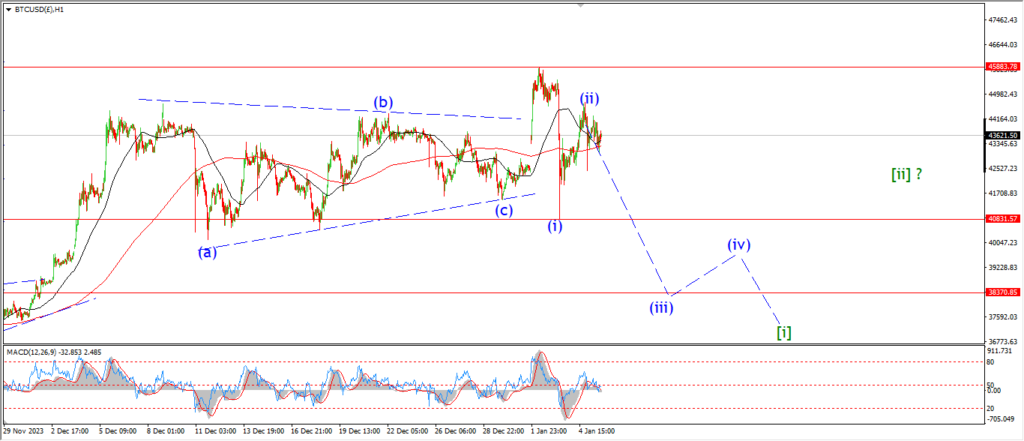

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

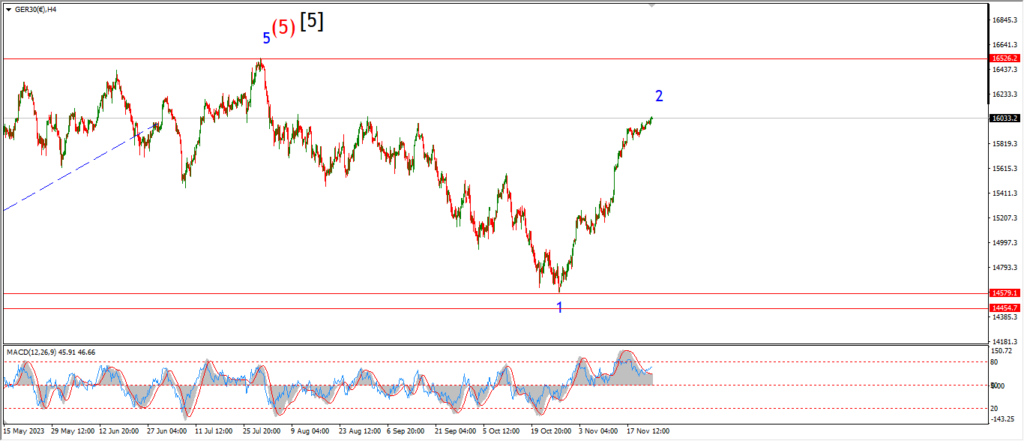

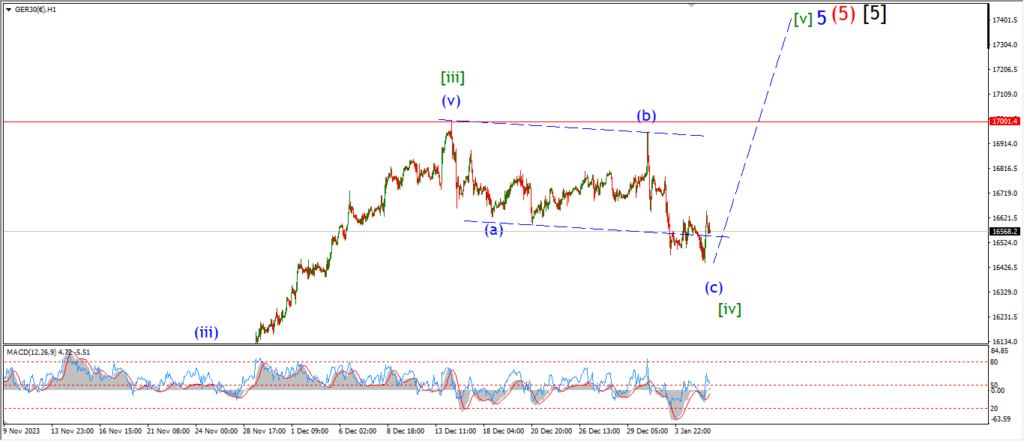

DAX.

DAX 1hr

….

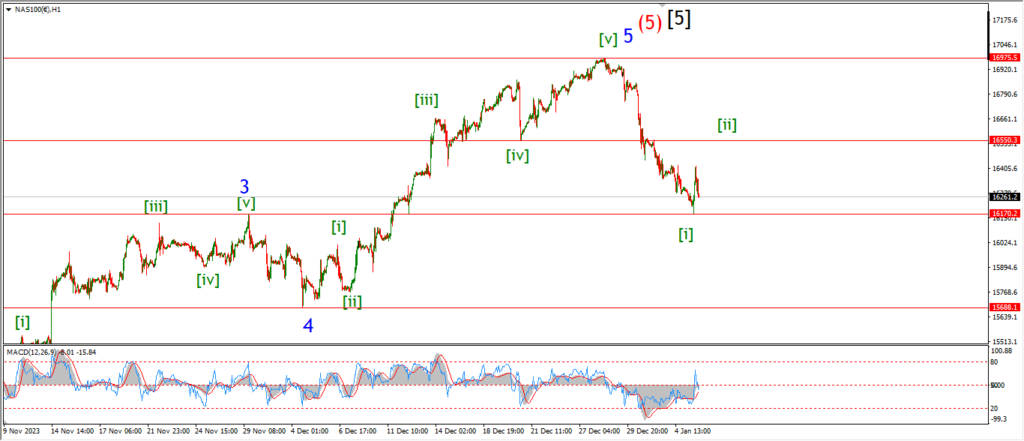

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….