Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

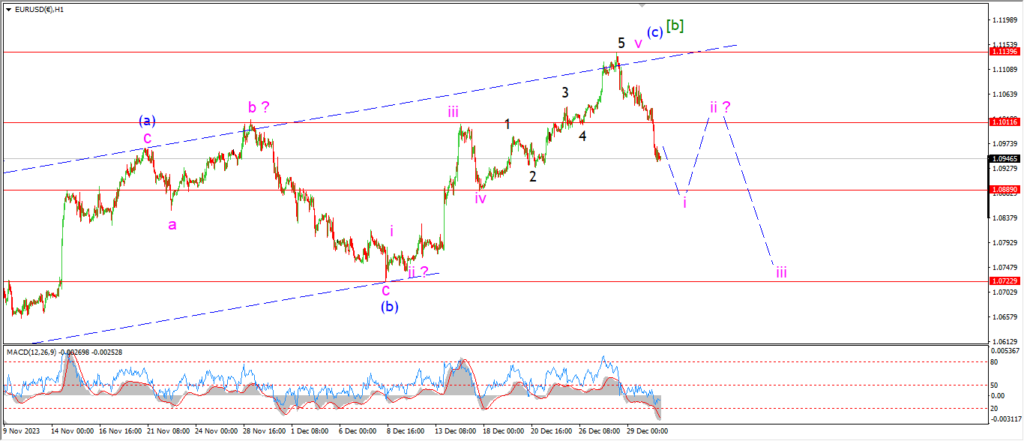

EURUSD.

EURUSD 1hr.

EURUSd has come down far enough now to consider wave ‘i’ now in play.

the price has not broken the support at wave ‘iv’ yet.

That level lies at 1.0890.

A break of that wave ‘iv’ will be a strong signal that wave [b] has indeed topped out and wave [c] is underway.

Tomorrow;

Watch for wave ‘i’ of (i) of [c] to complete five waves down to break 1.0890.

A lower high in wave ‘ii’ later this week will lead to a larger decline in wave ‘iii’ of (i) of [c].

GBPUSD

GBPUSD 1hr.

Cable came down pretty hard today and the price is sitting at support as I write.

I have labelled this decline as wave ‘iii’ of (i).

Wave (i) is expected to break the wave (iv) support at 1.2613 to confirm the wave count.

Tomorrow;

Watch for wave (i) to complete five waves down and break support at 1.2613.

And then a lower high in wave (ii) will come later this week.

USDJPY.

USDJPY 1hr.

USDJPY has traced out three waves up in wave (iv) so far.

The price has achieved the minimum for wave (iv) now,

but there is no sign of a top just yet.

there is potential for more upside as wave ‘c’ of (iv) completes.

The invalidation level for this pattern lies at the wave (ii) high at 144.93.

A break of that wave (ii) level will rule out the main count and it may even suggest the next leg up has begun.

Tomorrow;

Watch for wave ‘c’ of (iv) to complete a three wave rise into resistance at 142.85.

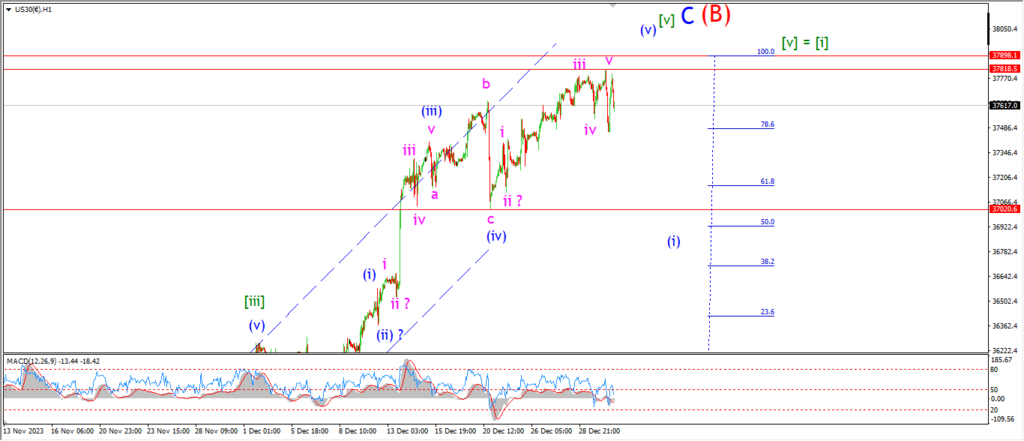

DOW JONES.

DOW 1hr.

Will reality bite the market in January like it did in 2022?

The probability is quite high in my book,

we have all the right conditions in place that go along with a top,

the new high in the DOW recently is hardly a bullish indicator!

January 5th marked the 22 high,

lets see if this week is a mirror of that top.

The market did hit a new high early this morning in the futures at least.

But that got reversed quickly once the main market opened.

The trade today has been quite choppy in general but the session in closing with a decline back off the lower high.

The rally in wave (v) blue now has another completed pattern in place at the session high.

So,

the question for this week remains the same.

Can we get an impulsive decline in the bag to get this next leg down underway.

Tomorrow;

Watch for a break of 37000 to indicate wave (i) is underway.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

Gold has held up today in a reasonable manner so its hard to say if wave ‘i’ of (iii) is underway yet.

I am looking at that wave ‘b’ low of 2015 as the confirmation level for wave (iii).

and wee should see wave ‘i’ of (iii) complete with a break of that level.

Wave ‘i’ and ‘ii’ must form a lower high this week,

and that should lead to the main progress for this pattern coming in wave ‘iii’ of (iii) early next week.

Tomorrow;

Watch for wave (ii) to hold at 2088.

Wave ‘i’ should trace out five waves down to 2015.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

The wave (b) low in crude is really taking its time in arriving!

The market took another sharp step lower today and the price broke below last weeks low again.

I have not changed the main count for crude oil yet even with that new decline today.

I still believe the overall three wave rally in wave [iv] has merit here.

So I will stick with this idea for the moment.

Tomorrow;

Watch for wave (b) to find a low very soon.

Wave ‘i’ of (c) should turn higher to break 73.70 again to signal the main pattern is back on track.

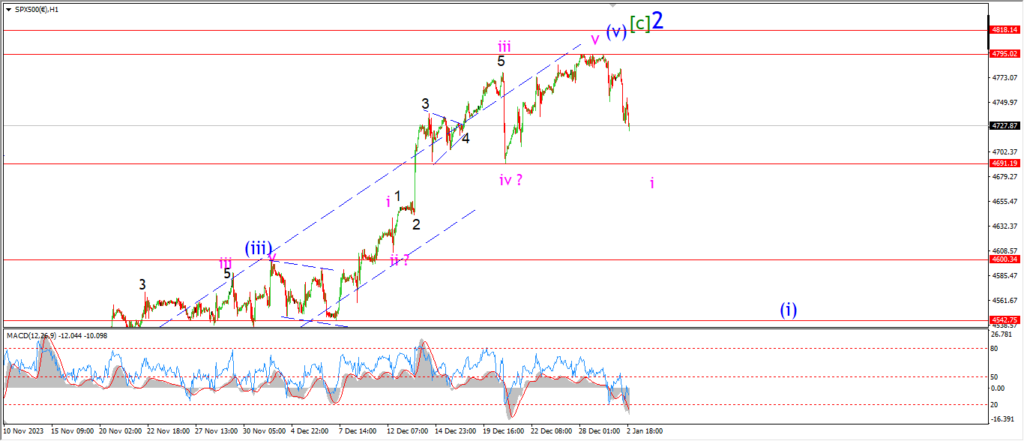

S&P 500.

S&P 500 1hr

The S&P has worked its way lower today to keep the main wave count for wave ‘2’ blue alive.

I want to see a break of the wave ‘iv’ low at 4691 again to signal wave ‘i’ of (i) is in play here

so I am going to remain reserved again this week without making any big proclamations for wave ‘3’ yet!

The market must turn lower to break 4691 at the very least to give the short term count a boost again.

And for the rest of this week I want to see a larger five wave decline begin to build in wave (i) blue.

If the wave ‘2’ count is actually correct,

then it is high time for this market to start moving lower impulsively again.

Tomorrow;

watch for wave ‘i’ of (i) to break the wave ‘iv’ low at 4691.

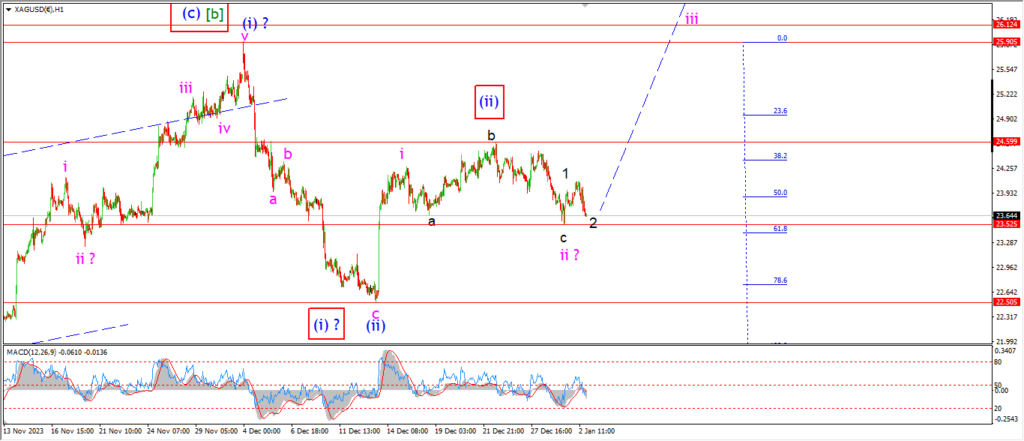

SILVER.

SILVER 1hr

Silver is beginning to move in favor of the alternate count today.

The price is threatening to break the wave ‘ii’ low at 23.52 this evening.

And right now there is very little sign of a third wave rally coming.

I cant invalidate the main count until we see a break of 22.50 again.

So that level is the one to watch this week.

a break of that level will favor the alternate idea again.

At the moment we are sitting on the edge of two wave counts.

And what happens this week will dictate the outcome for the next few months.

A break of 22.50 will favor a much larger decline in wave [c] of ‘2’.

While a break back above 25.90 again will favor the main count which calls for a rally in wave ‘iii’ of (iii) of [iii].

That’s a big difference in outcomes!

Tomorrow;

Watch for wave ‘ii’ to hold above 22.50.

Wave ‘iii’ must turn higher and break 24.60 to favor the main bullish wave count.

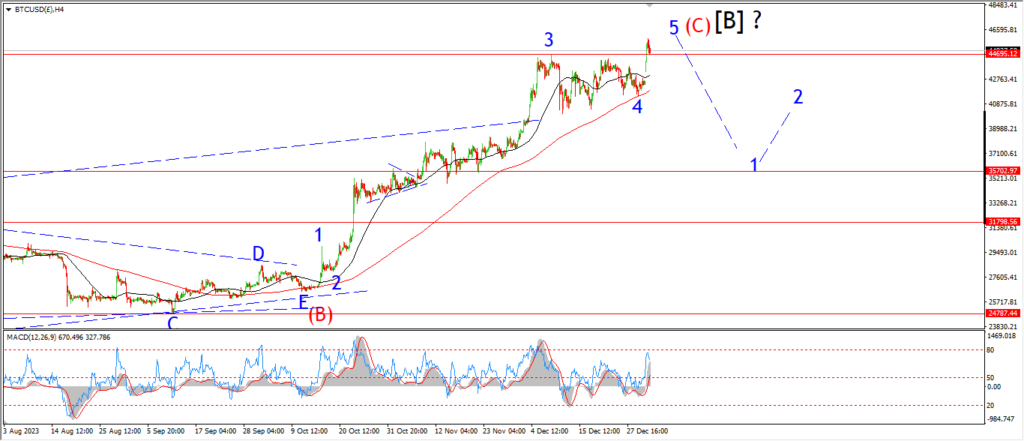

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

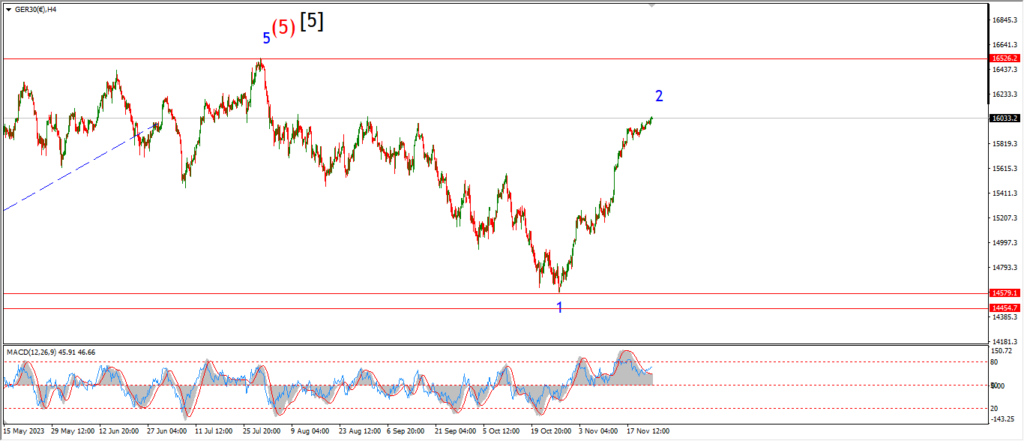

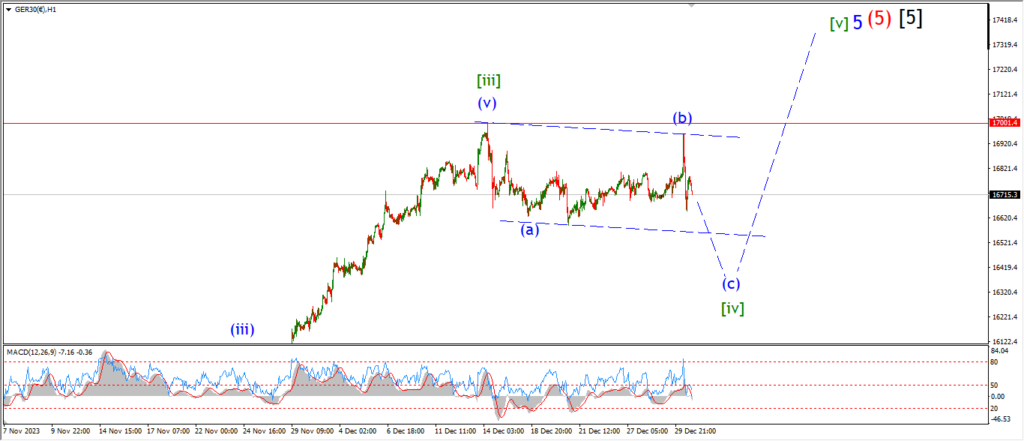

DAX.

DAX 1hr

….

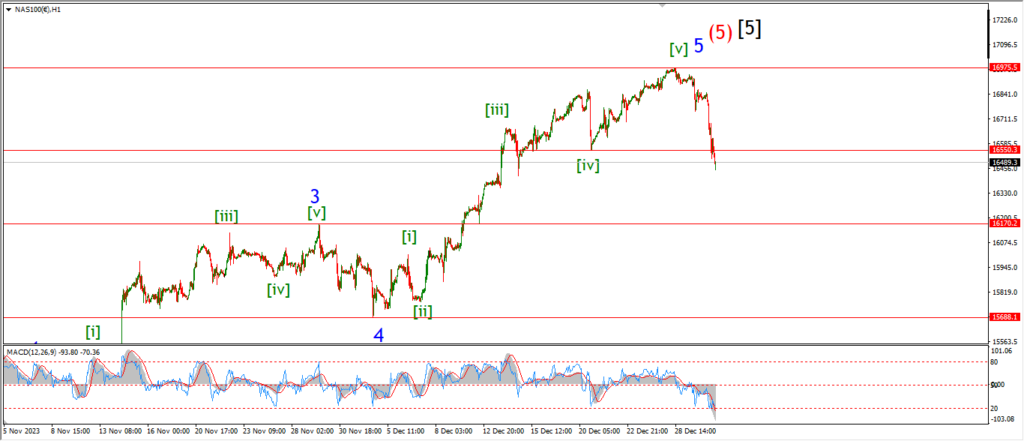

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….