Good evening folks, the Lord’s Blessings to you all.

The 6-mo trend in the core deflator is now below target at +1.9% SAAR; last there in Sept 2020. It was ‘transitory’ after all! A round trip! As “Dandy Don” would said on Monday Night Football back in the 70s, “turn out the lights, the party’s over…”. David Rosenberg.

https://twitter.com/bullwavesreal

EURUSD.

EURUSD 1hr.

The price had an interesting reaction off that upper line of the channel today.

that is a small hint in favor of the idea of a topping pattern in wave (c) of [b].

The action is not enough to prove the theory yet,

but we can now look for some confirming price action to the downside again.

Tomorrow;

I have marked the wave (a) and wave ‘iv’ levels at 1.0965 and 1.0890 as initial support levels to watch.

A sharp decline to break below that support band will signal wave [b] has topped out and wave [c] may be about to begin.

GBPUSD

GBPUSD 1hr.

Another day,

another pattern for cable!

Cable is the first of a few markets that are showing possible ending diagonal patterns now.

I have labelled this wave [c] rally as a possible ending diagonal now after a pretty sharp drop off the session high today.

The overall rally in wave [c] can be broken into a series of three wave patterns.

and todays high tops out wave (v) of [c].

Wave (iv) and wave (ii) mark the support levels for this pattern.

WAve (iv) at 1.2613 is the first level to watch.

Tomorrow;

Watch for wave (v) of [c] to hold at 1.2826.

A break of 1.2613 will signal wave (i) is underway.

USDJPY.

USDJPY 1hr.

You are going to get tired of ending diagonal patterns when Im finished with you tonight!

USDJPY is the next candidate.

This makes sense in a way because USDJPY does often move in a mirror fashion to the Atlantic pairs.

So we have a possible ending diagonal wave [c] of ‘4’ in USDJPY tonight.

The pattern requires a correction higher in wave (iv) and another drop into wave (v) of [c] to complete here,

so there is a good chance that we will see another low next week in wave (v).

For the moment I can look for a three wave pattern higher in wave (iv) blue to complete a correction near 143.00.

It is interesting how the calls for a USD crash are now coming in thick and fast here,

just as we reach the end of a correction in wave ‘4’.

Some things never change!

Tomorrow;

Wave (iv) of [c] should trace out three waves up to complete near 143.00.

DOW JONES.

DOW 1hr.

Ok,

here comes the next one!

I am looking at a possible ending diagonal pattern for wave (v) of [v] tonight.

After last weeks sharp drop off the top to complete wave (iv),

we have a very choppy and overlapping rise back off that low.

Each new rally in wave (v) was met with a decline that overlapped the previous top.

So this pattern in wave (v) never really made the impact that a normal impulse wave would.

And of course the momentum readings have reflected that action.

Tomorrow;

I will give this idea a few days to see if the action holds within that rising wedge pattern in wave (v).

A drop back out of the wedge will suggest an end to this short term pattern.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

At this point both wave counts can be viewed as correct.

the crunch time comes for the alternate count if the price gets close to 2015 again at the wave ‘b’ low.

A break of that level will strongly favor the main count.

So I will continue to follow both counts until we cross that line.

The action today brought a small decline off the highs labelled wave (ii).

If this is wave ‘i’ of (iii) now beginning,

then we should see a drop back into that 2015 level pretty quickly over the coming days.

Tomorrow;

Watch for wave (ii) to hold at 2088.

wave ‘i’ of (iii) must make progress towards that wave ‘b’ support at 2015 to confirm the main count.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

The decline into wave ‘c’ reached the target level at 72.48 today and that should be enough to complete an expanded flat correction wave (b).

The price does not look like it has bottomed out in wave (b) yet,

but that should happen tomorrow.

I would like to see wave (b) hold above the previous wave ‘ii’ low at 70.58.

And it looks like we will have to wait until next week for wave (c) to begin.

Tomorrow;

Watch for wave ‘c’ of (b) to find a low soon and then turn higher into wave ‘i’ of (c) next week.

S&P 500.

S&P 500 1hr

At this point it is quite likely that a new all time high will be made here give that the market is being drawn to that level by a gravitational pull.

If that happens,

then we will switch to a similar pattern as the DOW,

with a new high counted as part of a very large wave (B).

We will deal with that when it happens.

Tomorrow;

I have said all that can be said about the pattern for wave ‘2’ now,

so it just remains to be seen if the pattern will be invalidated or not.

Lets see if we can manage somehow to turn the tide before the end of this weeks trade.

SILVER.

SILVER 1hr

Silver has turned lower again today and that gives a boost to the idea that wave ‘ii’ is still in play here.

The price should fall to 23.64 in this scenario to complete wave ‘ii’.

and then wave ‘iii’ up will be free to begin next week.

Tomorrow;

watch for a three wave decline to drop into 23.60 and complete this wave ‘ii’ pattern as a complex flat correction.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

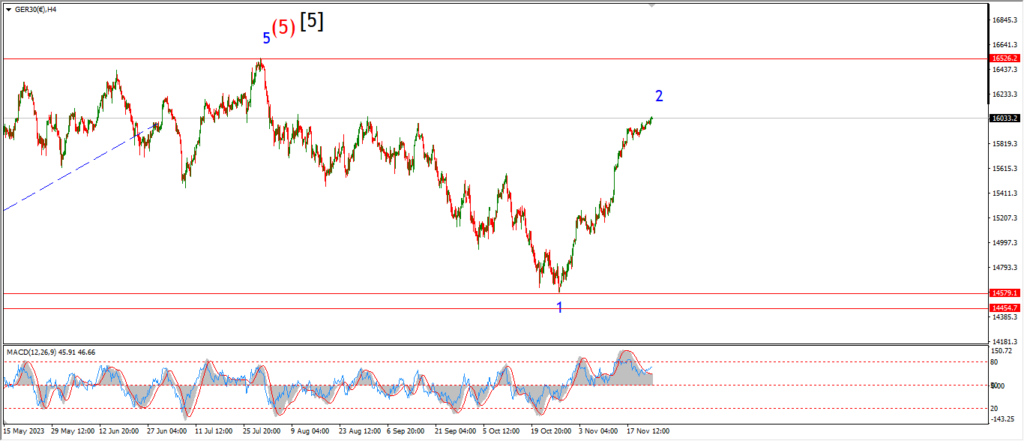

DAX.

DAX 1hr

….

NASDAQ 100.

NASDAQ 1hr

NASDAQ 4hr.

NASDAQ daily.

….