Good evening folks, the Lord’s Blessings to you all.

https://twitter.com/bullwavesreal

EURUSD.

EURUSD 1hr.

The action over the last few sessions has not brought much clarity to the short term count.

The alternate count is still valid because the price never broke to a new high above 1.1017.

because of that fact,

I cant rule out the idea that Fridays low is actually the beginning of wave (iii) down.

We will see soon enough I suppose!

Tomorrow;

For the moment I can sit on the fence here until the action makes a defining move in either direction.

The main count can still allow for another pop to a new high in wave ‘v’ of (c) over the coming few days.

That will push out the eventual turn down into wave (i) of [c].

GBPUSD

GBPUSD 1hr.

The decline in cable today actually favors the idea that wave (v) of [c] of ‘2’ is now complete at the recent highs.

The price dropped below the previous wave ‘i’ high,

and that suggests a reversal is now underway into wave (i) blue.

Todays low takes the wave ‘i’ label.

And if this is correct we will see a five wave pattern develop to break 1.2499 over the coming days as shown.

Tomorrow;

the high at 1.2793 must hold at wave ‘2’.

Wave ‘i’ and ‘ii’ should form a lower high tomorrow,

and then wave (i) blue should trace out five waves down as suggested.

USDJPY.

USDJPY 1hr.

A three wave pattern higher into wave (ii) is pretty much done here.

The pattern has filled a channel now and the next step is to reverse this correction and fall back into wave (iii) down again as shown.

Wave (iii) will be confirmed with a break of 14093 again.

and the larger five wave pattern in wave [c] should fall back below 137.00.

Wave [a] and [c] will reach equality near 136.31 again.

Tomorrow;

Watch for wave (ii) to complete a lower high soon and fall back below the wave (i) low at 140.93.

Wave (iii) should fall in five waves and complete near 138.00 again.

DOW JONES.

DOW 1hr.

A small lower high is in place this evening which opens up the idea of a (i) (ii) decline off the top.

This count requires a sharp decline into wave (iii) tomorrow to confirm.

And if that decline does not occur,

then I will look again at a possible wave (v) extension to complete wave [v] green this week.

The euphoria from last weeks fed statement should now be fully done with here.

And the action does suggest at least a withdrawal from the excitement over the last few sessions.

We will see if the market has a moment of clarity this week to recognize how over extended and vulnerable these valuations are here.

The end of year Christmas season is now upon us,

and I did not think I would be dealing with a new all time high right now.

But I am pretty set on the idea that this is a large wave (B) top.

And wave (C) is going to be a scary ride down when it does come.

Tomorrow;

Watch for a drop below 37000 to see if wave (iii) can get a chance to begin here.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

We seem to have hit a point of indecision in the markets today.

Gold has not added much to the conversation here with the action today.

So far the decline off that wave (ii) top is in three waves.

The action today has corrected higher off Fridays low.

And this suggests a further decline will come tomorrow.

If the price does continue lower towards that wave ‘b’ low at 1972 again,

that will favor the main pattern idea in wave (iii) of [c].

A break of 1931 again will confirm the main pattern.

So,

this market is hanging in balance between to opposing wave counts now.

A rally back above 2047 again will favor the bullish count,

and a drop below 1972 will favor the main bearish count.

Tomorrow;

Watch for wave ‘i’ of (iii) to turn lower again and complete near the 2000 level.

A break of 1972 will give the main count a big probability boost.

CRUDE OIL.

CRUDE OIL 1hr.

CRUDE OIL 4hr.

CRUDE OIL daily.

I was looking at the possibility that wave (c) of [iv] was already underway earlier today.

and then the price reversed quite sharply this evening to rule out that idea.

The main pattern has taken a turn towards the more complicated at the moment.

But that is to be expected in a fourth wave.

The initial rally in wave (a) is now shown as a three wave pattern.

For wave (b) I favor a possible running flat correction,

and that pattern requires another drop back to about 71.00 again in wave ‘c’ of (b).

Wave (c) will wait until later in the week to turn higher again.

And the parget area for wave (c) of [iv] lies above 78.00 when complete.

Tomorrow;

Watch for wave ‘c’ of (b) to complete ear 71.00 and then turn higher into wave ‘i’ of (c).

S&P 500.

S&P 500 1hr

The market seems to have completed a triangle pattern early today in wave ‘4’ of ‘v’.

The price rallied out of the wave ‘4’ low to a new high for the pattern this afternoon.

and now a small reversal is in play here to raise the possibility of a completed pattern in wave ‘5’ of ‘v’ again.

I have nothing to back up the idea of a top here apart from the extreme nature of the current top which I have mentioned to the point of boredom now!

The completed internal pattern in wave ‘5’ of ‘v’ of (v) of [c] is still a speculation until that idea gets some confirming price action in the form of an impulsive drop off the top.

That remains to be seen.

Tomorrow;

The wave ‘2’ pattern remains intact this evening, and I hope it stays that way!

IF the market managed to retrace the gains that were made last week that would really help the matter immensely!

Lets see if the market can give us something to support this idea tomorrow.

SILVER.

SILVER 1hr

Silver continues to work between two patterns again today with neither pattern taking the place of a firm favorite.

I can see merits to the main count and the alternate count here.

And that will remain until the price actually moves in favor of one count decisively in the next few days.

The main count calls for a small higher low to build in wave ‘2’ of ‘iii’ near 23.40 very soon.

And a break below 22.50 again will trigger the alternate count with room for much more downside to come if that pattern is correct.

I will hold out for another few days until the price action confirms one count clearly.

Tomorrow;

Watch for wave ‘2’ to complete a higher low correction.

The price must hold above 22.50.

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

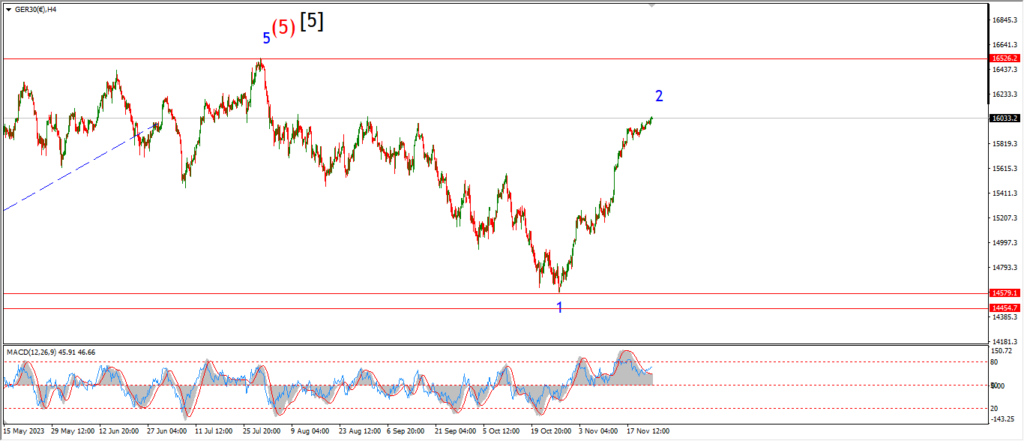

DAX.

DAX 1hr

….

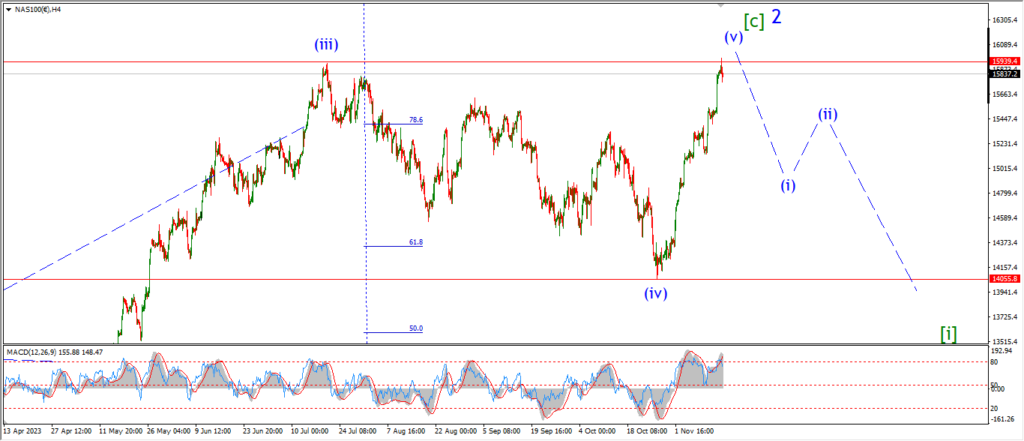

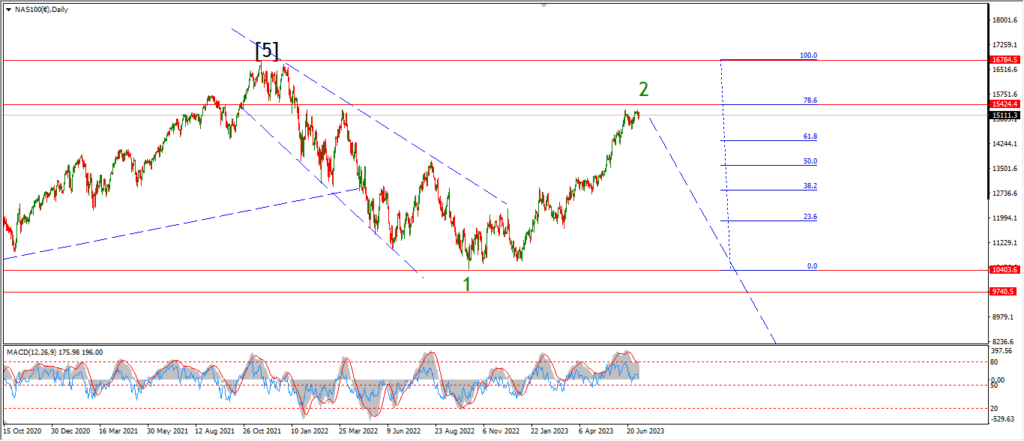

NASDAQ 100.

NASDAQ 1hr

….