Good evening folks, the Lord’s Blessings to you all.

Well,

Its been a turnaround week this week!

And of course the action has invalidated some counts that I was working with.

All is not lost though,

and I do believe we are dealing with corrective rallies in the currencies and the stock markets.

So lets get into it to see where we stand.

https://twitter.com/bullwavesreal

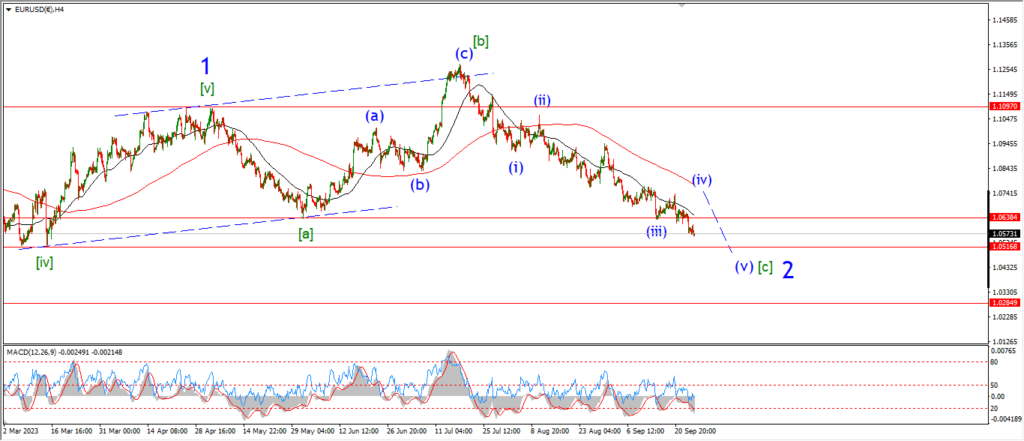

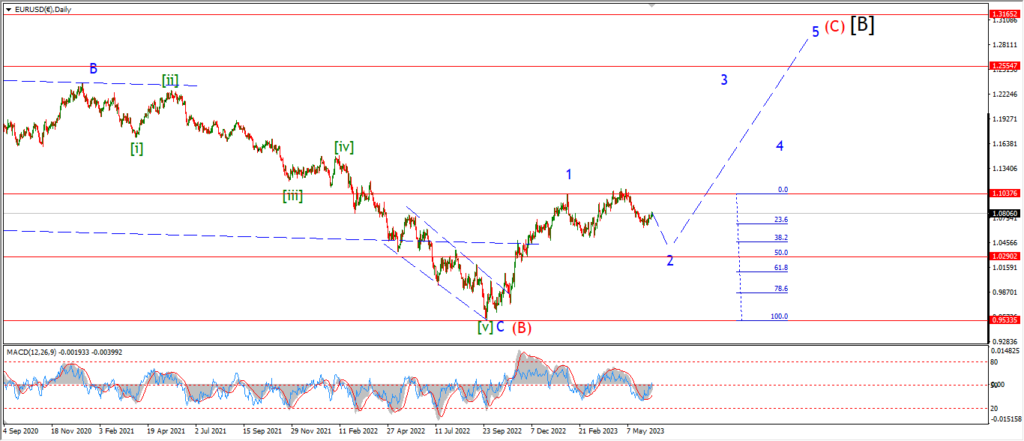

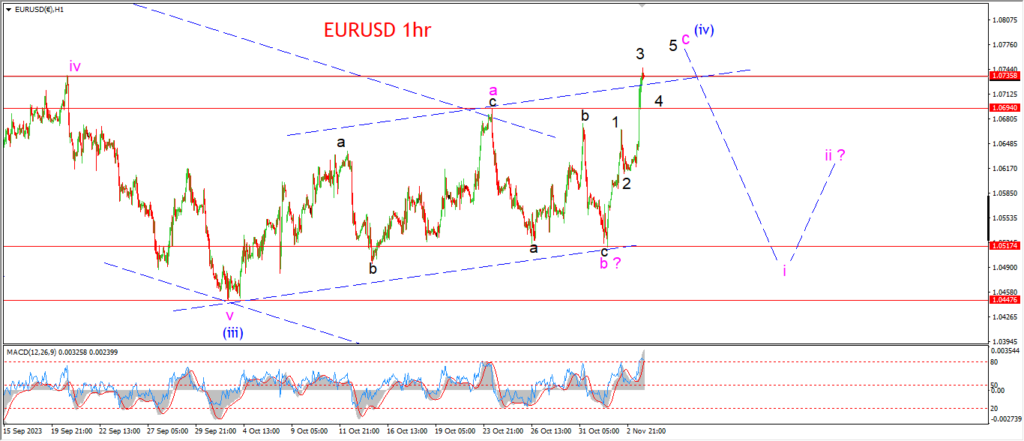

EURUSD.

EURUSD 1hr.

EURUSD has whipsawed all over the place this week and the rally today has ruled out the previous short term count for wave (iv).

Like I said above,

I still think we are dealing with a fourth wave correction higher.

And the rally this week is now shown as wave ‘c’ of (iv).

Wave (iv) is shown as a flat correction with a 3,3,5 internal structure.

This correction should complete early next week and then I will look for a turn lower again into wave (v) later next week.

Monday;

Watch for wave ‘c’ to top out and after a five wave rally completes.

The price has already hit the previous fourth wave high,

and we have a break of the upper trend channel line.

Wave ‘i’ down should begin with a break of 1.0650 again.

GBPUSD

GBPUSD 1hr.

We have a similar setup in cable tonight also.

The rally today has invalidated last nights pattern.

the overall pattern in wave [iv] is shown as a combination wave with a 3,3,3 internal pattern.

Todays rally is shown as wave ‘3’ of ‘c’ of (c) of [iv].

Wave (c) is a flat correction with a 3,3,5 internal pattern itself

I know thats a mouthful!

But the pattern is quite full even now.

The rally in wave (c) has filled the trend channel this evening which brings this pattern close to an end.

We will see soon enough next week if this pattern holds up.

Monday;

watch for wave ‘c’ of (c) to complete five waves up and then turn down into wave (i) of [v].

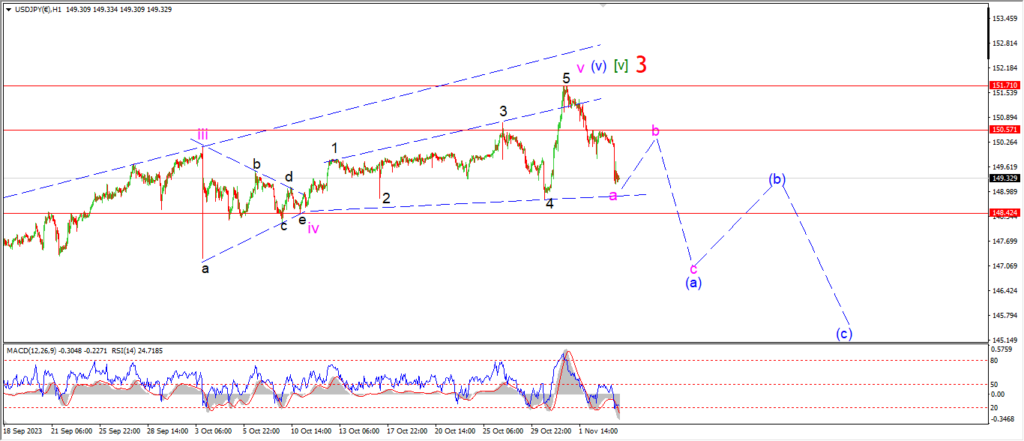

USDJPY.

USDJPY 1hr.

I am looking at a three wave decline in wave (a) tonight instead of the five wave pattern shown last night.

WAve ‘a’ of (a) has now fallen back into the low end of the range of the wave ‘iv’.

And I think wave ‘a’ has a three wave internal pattern also.

It looks like wave (a) blue will trace out a flat correction lower with an internal 3,3,5 pattern.

Monday;

This pattern suggests wave ‘b’ will turn higher in three waves on Monday.

Wave ‘b’ should top out near 150.50.

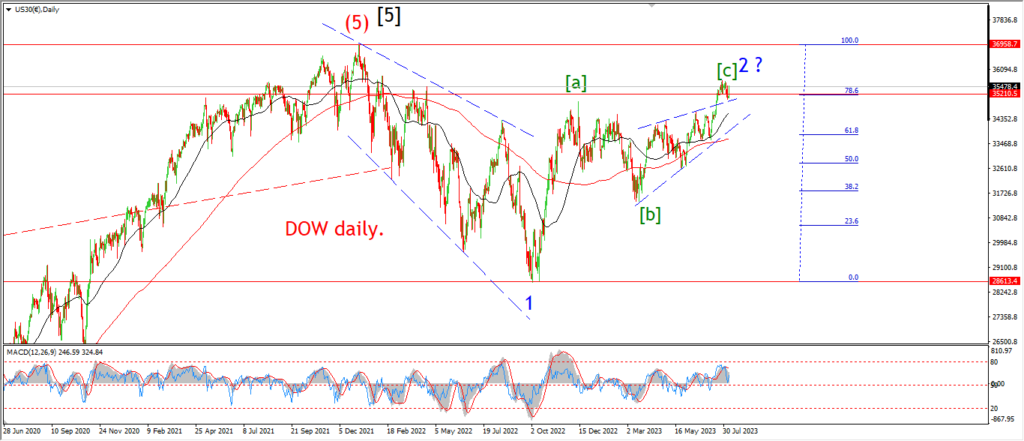

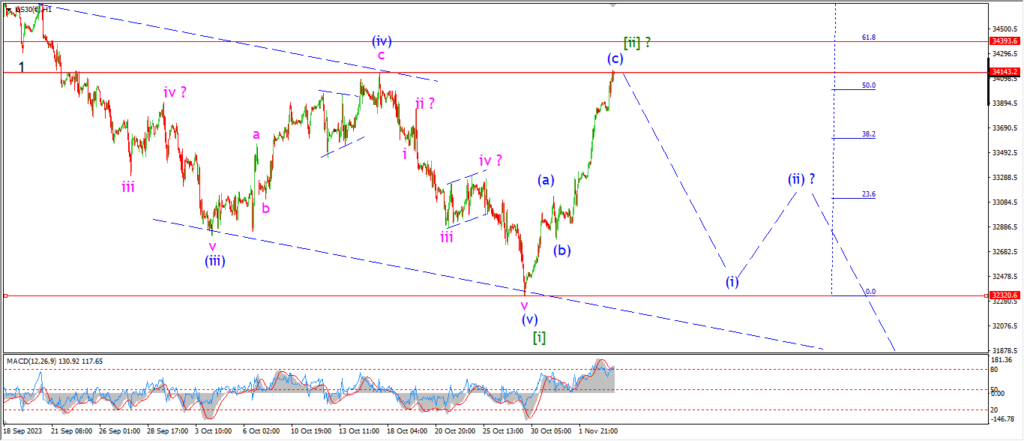

DOW JONES.

DOW 1hr.

The Dow was expected to rally this week,

but I did not see us hitting that high so quickly!

the rally this week has actually retraced above the 50% level of the whole decline off wave ‘2’!

So I have to rethink the pattern here because of that big retracement into todays highs.

I have labelled the whole decline into the recent lows as wave [i] complete now.

And because the rally has hit the 50% retracement level already,

I do think the high today is a possible wave [ii] candidate.

I realize that the pattern in wave [ii] is very compact.

We will see next week if the next decline is more corrective than impulsive.

That will suggest wave [ii] is ongoing and will complete a larger pattern over the coming week.

The main wave count is still solid though.

We have either finished a major lower high at wave [ii] now,

or the market will trace out a larger wave [ii] pattern over the coming week.

In both scenarios,

the next leg down into wave [iii] of ‘3’ is one step lower now.

Monday;

Watch for wave [ii] to top out and reverse early next week.

If that happens,

then this sharp and compact wave [ii] pattern will be favored.

Wave [iii] of ‘3’ down has the potential to begin next week,

so keep that in mind here as we look for the initial move lower into that wave.

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

We have another lower high this evening as the price again holds below the wave [i] top.

the rally into todays high is in three waves,

that pattern suggests wave ‘b’ is complete.

and the price has fallen off that level this evening to signal a turn into wave ‘c’ is underway.

Wave ‘c’ should fall back below the wave ‘a’ low at 1969 again to complete wave (a) down.

Monday;

three waves down in wave (a) will complete next week if this pattern is correct.

Watch for wave ‘c’ to drop back below 1969 at a minimum.

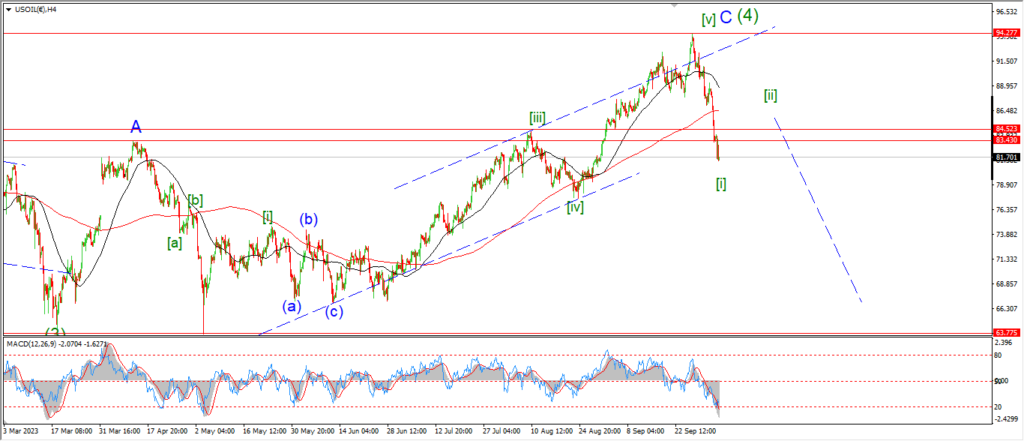

CRUDE OIL.

CRUDE OIL 1hr.

Even though the action is quite choppy this week overall,

the main pattern holds again for wave (iii) down.

If this short term count is correct,

then wave ‘iii’ of (iii) is now underway.

Wave ‘iii’ pink should fall into that Fib target level at 77.86 where wave (iii) blue will reach equality with wave (i) blue.

that is the minimum target for wave (iii) overall.

Monday;

Watch for wave ‘ii’ to hold at 83.39.

Wave ‘iii’ of (iii) is expected to fall below 78.00 as suggested.

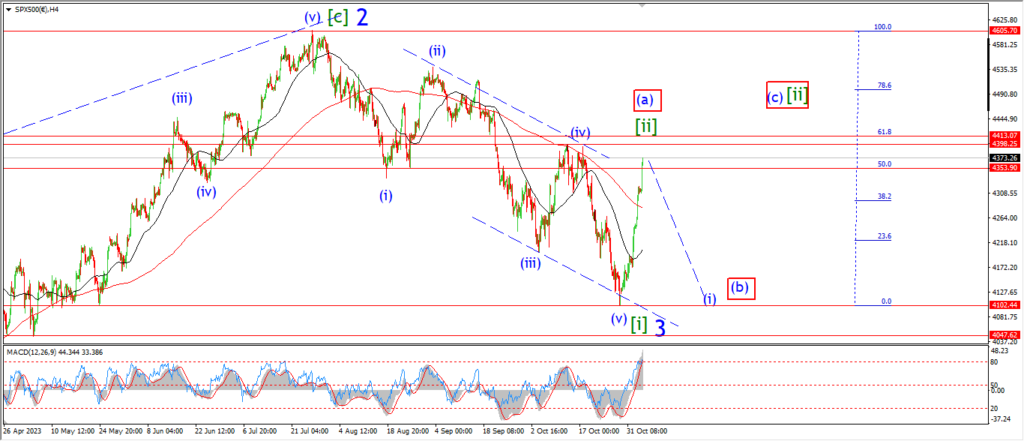

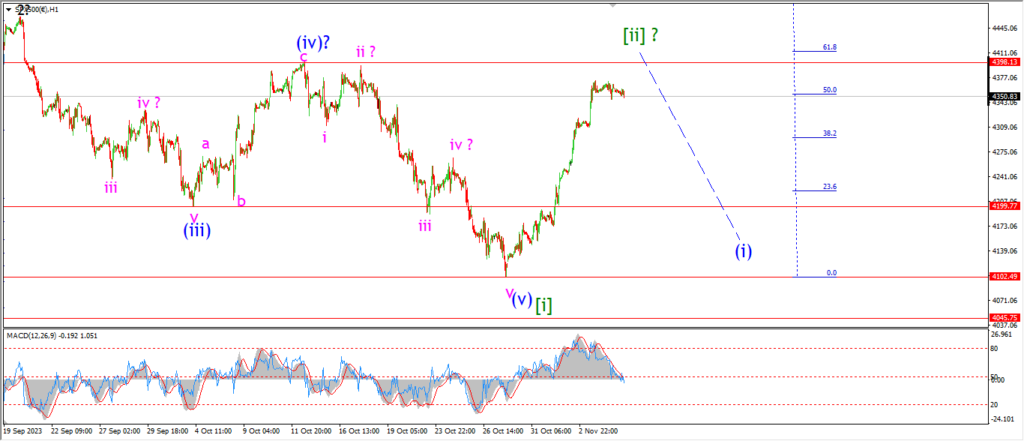

S&P 500.

S&P 500 1hr

We have hit a similar point of no return in the S&P tonight after that extended rally off the recent lows.

The highs today have broken above the 50% retracement level of the whole decline off wave ‘2’.

and because of that fact alone we can consider this rally as a possible wave [ii] now in place.

the previous wave (iv) high is a typical target level for a corrective rally also,

and that high comes in at 4398.

I do suspect wave [ii] will hit resistance at that level and then turn lower again.

The big question is this,

will the next decline be the beginning of wave [iii] of ‘3’.

Or,

will this be part of a more complex wave [ii] pattern.

We should know by midweek next week as we see the internal pattern of the next move develop.

Monday;

Watch for the market to turn down off this weeks rally to begin the next leg down into wave [iii] of ‘3’.

Wave (i) of [iii] should retrace most of this weeks rally,

and if that happens,

that should be a strong enough signal that wave [iii] of ‘3’ is taking over again.

SILVER.

SILVER 1hr

I am looking at a possible triangle wave ‘b’ this evening after the sideways action over the last few days continued today.

Wave ‘c’ of ‘b’ has completed at todays high,

and now we should see a further contraction in the price rage as wave ‘d’ and ‘e’ continue.

Wave ‘b’ will achieve very little from here,

so I expect wave ‘b’ to complete near the 23.00 level again.

At that point I will look lower into wave ‘c’ towards the end of next week.

Monday;

Watch for wave ‘d’ and ‘e’ to complete a triangle near 23.00.

Wave ‘c’ should then take over and fall back below 22.42 at a minimum.

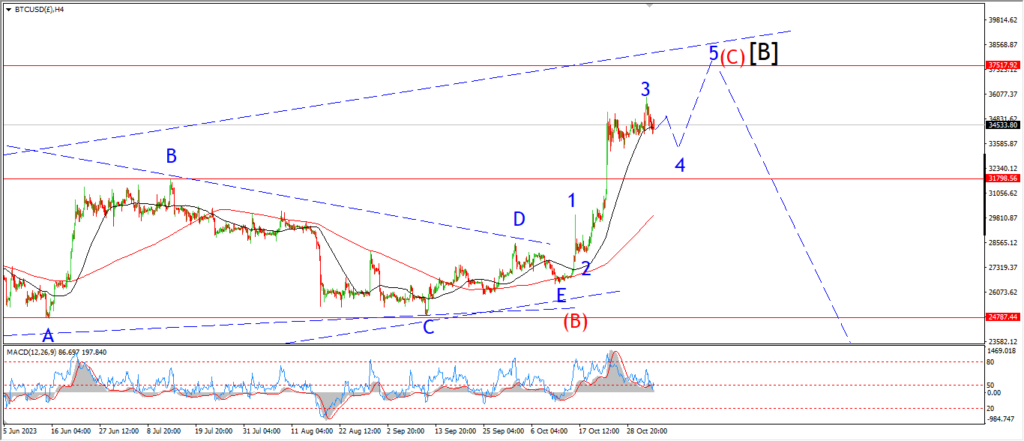

BITCOIN

BITCOIN 1hr.

….

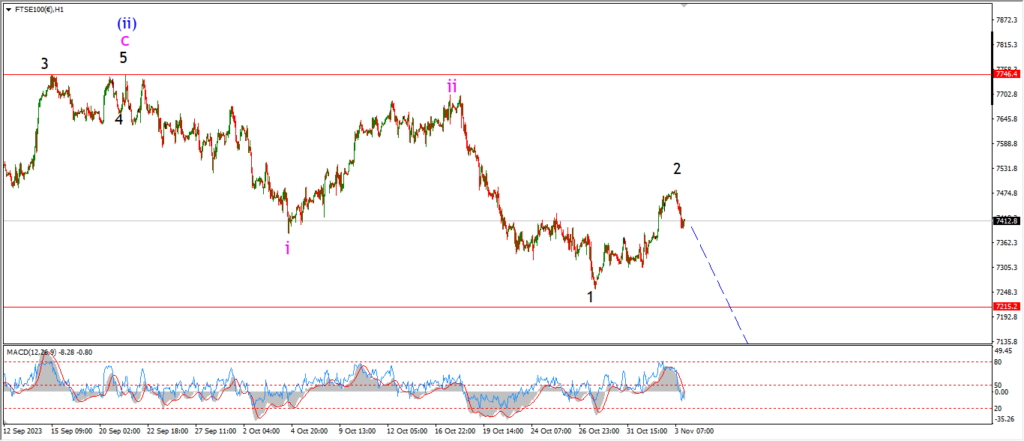

FTSE 100.

FTSE 100 1hr.

….

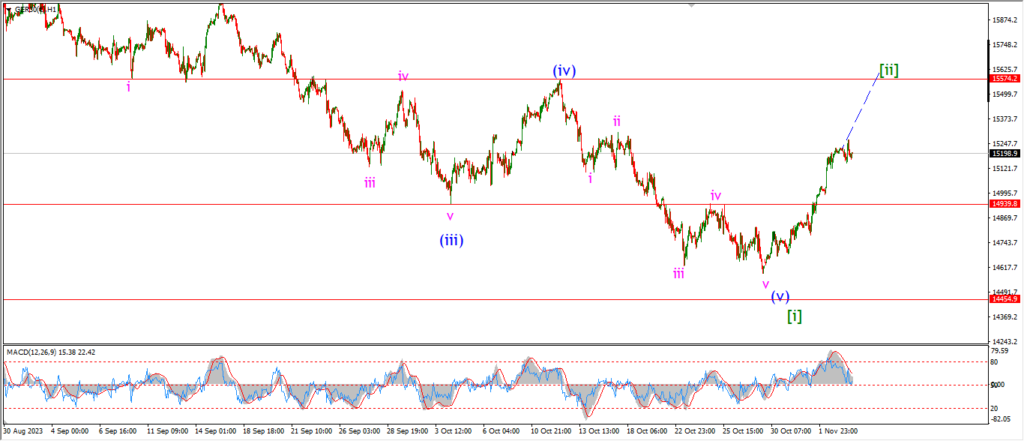

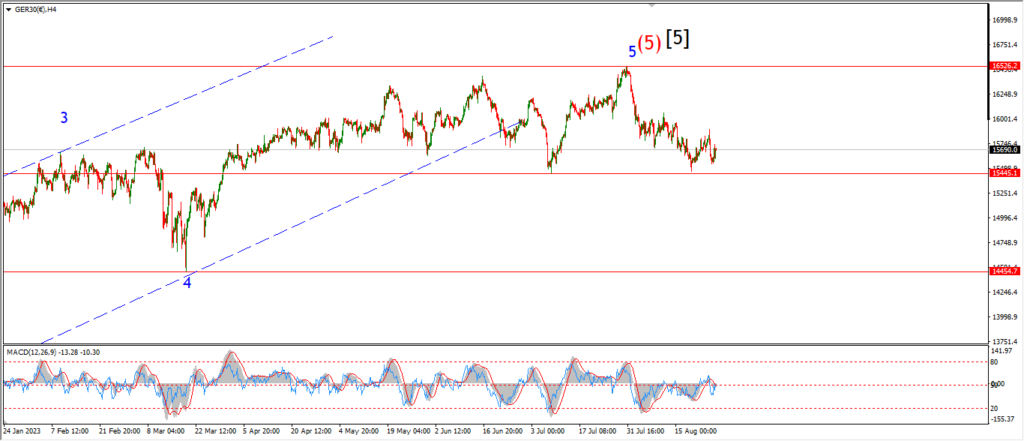

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

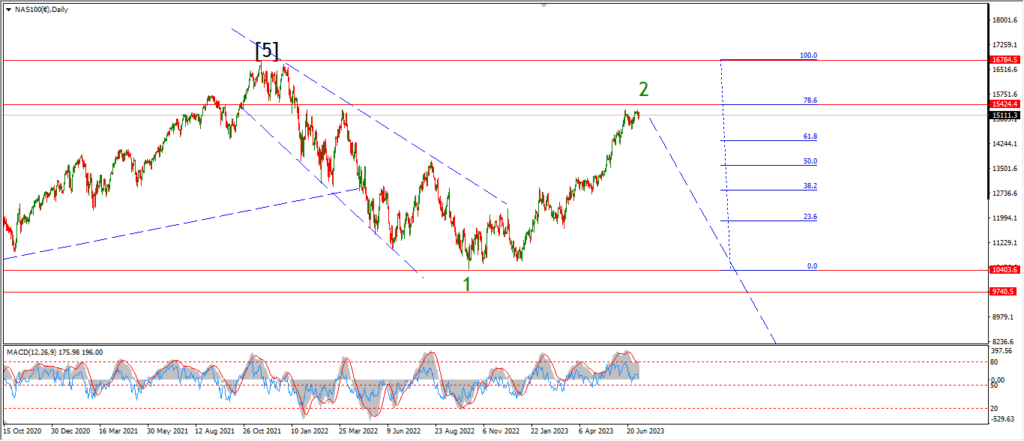

NASDAQ 100.

NASDAQ 1hr

….