Good evening folks, the Lord’s Blessings to you all.

“More Like A Train Wreck Than A Soft Landing” – Dallas Fed Services Sector Survey Slumps In October

https://twitter.com/bullwavesreal

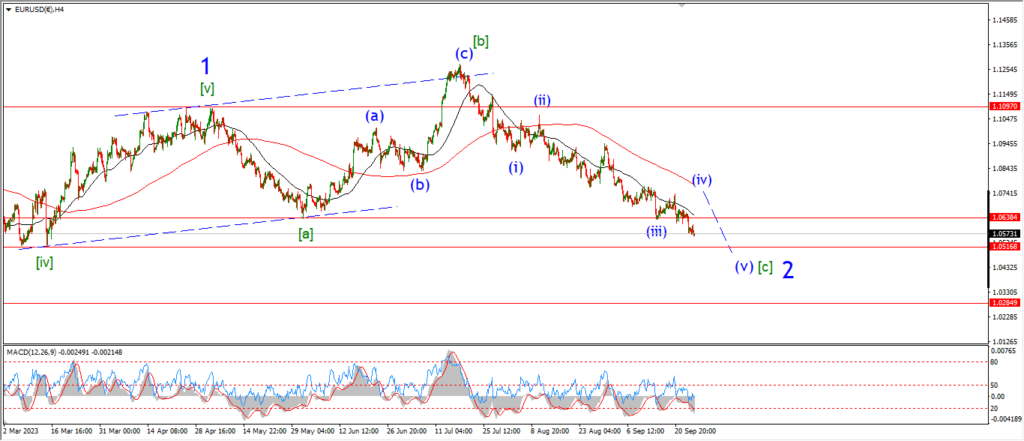

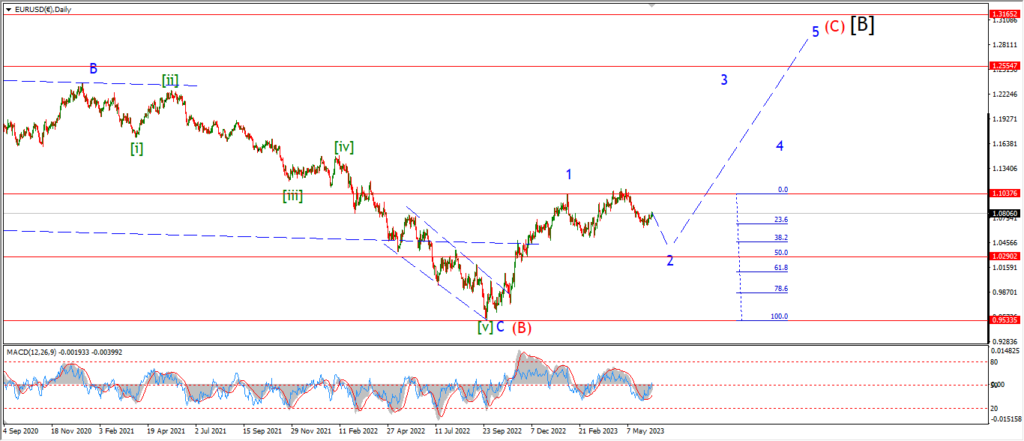

EURUSD.

EURUSD 1hr.

The price had an early spike rally today and the high of the session almost broke the invalidation line at the wave (iv) high.

But the rally stopped below the wave (iv) high,

and the action quickly reversed in a very impulsive manner.

I have labelled the low as wave ‘1’ of ‘iii’.

Wave ‘2’ should form a lower high tomorrow.

and then the main thrust lower should happen in wave ‘3’ of ‘iii’ of (v).

Wave ‘iii’ pink should break 1.0447 at the previous wave (iii) low.

Tomorrow;

Watch for that lower high to form in wave ‘2’.

Wave ‘3’ of ‘iii’ should turn lower again and break 1.0521 at wave ‘i’ to confirm this pattern.

Wave (iv) must hold at 1.0694.

GBPUSD

GBPUSD 1hr.

A small new high in wave ‘ii’ topped out earlier today and the price then fell back into the corrective range again.

The pattern stands here for wave ‘ii’.

and wave ‘iii’ down is still expected to continue lower in five waves over the coming days.

I am looking for a break of 1.2036 again to confirm wave ‘iii’ of (iii) has begun.

Tomorrow;

Watch for wave (ii) to hold at 1.2289.

Wave ‘iii’ down should continue lower as shown.

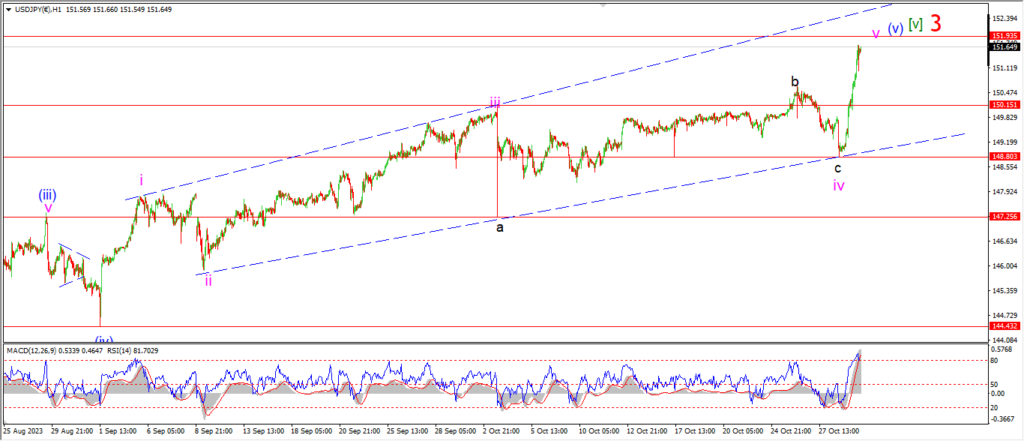

USDJPY.

USDJPY 1hr.

The rally in USDJPY has completely invalidated the recent wave count.

And it is time to go back to the drawing board again for the overall pattern.

On the 4hr chart I have shown a possible interpretation for the rally in wave [v] of ‘3’.

This rally has lasted longer than I expected.

And even the recent corrective action has has been retraced higher by todays rally.

The only way to view this action now is as part of the larger wave [v] rally.

Wave (v) of [v] has become a complex pattern to figure out.

I can only suggest now that wave (v) blue is an expanding wedge.

And wave ‘iv’ of that wedge completed at the recent low,

and now wave ‘v’ of (v) is underway.

the upper trend line is in sight now.

So I will just have to wait and see if this rally will hit the upper trend line

and then reverse off that level to begin the turn down into wave ‘4’.

Tomorrow;

Lets see if this wedge pattern picks up that wave ‘v’ high at the upper trend line to complete wave (v) of [v] of ‘3’ again.

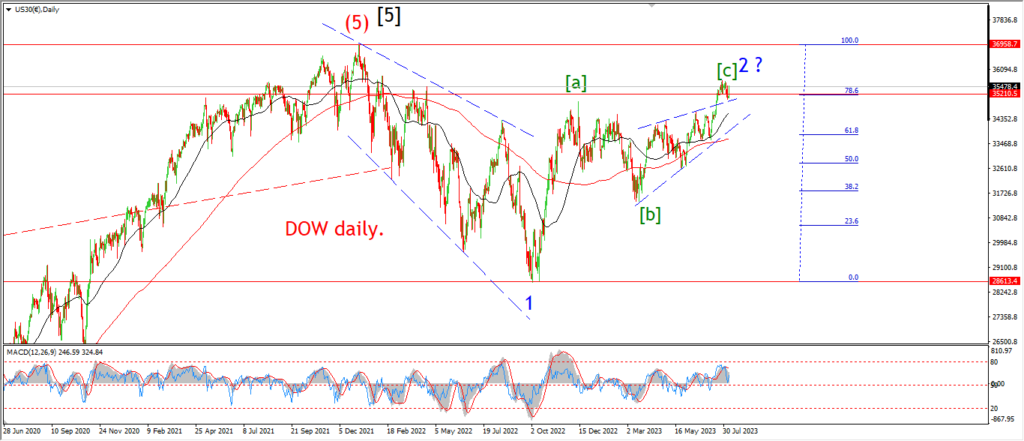

DOW JONES.

DOW 1hr.

The top in wave ‘a’ seems to be complete at the early morning high.

And now the price is basically flat off that level.

I am suggesting that wave ‘b’ of (iv) is underway here,

but I can’t confirm that idea yet.

There is a possible three wave correction in wave ‘b’ underway here.

And if I am correct,

wave ‘c’ of ‘b’ will fall again towards 32700 to complete the pattern tomorrow.

Once we have a clear three wave correction to a higher low at wave ‘b’.

Then I will look for wave ‘c’ of (iv) to turn higher again as shown.

We might have to wait until Thursday for that rally to come in again.

Tomorrow;

As always,

a corrective pattern takes time to reveal itself,

and this correction in wave (iv) is no different.

Watch for a three wave decline to complete a higher low above 32320.

Once we have that in place we can work on the next leg up.

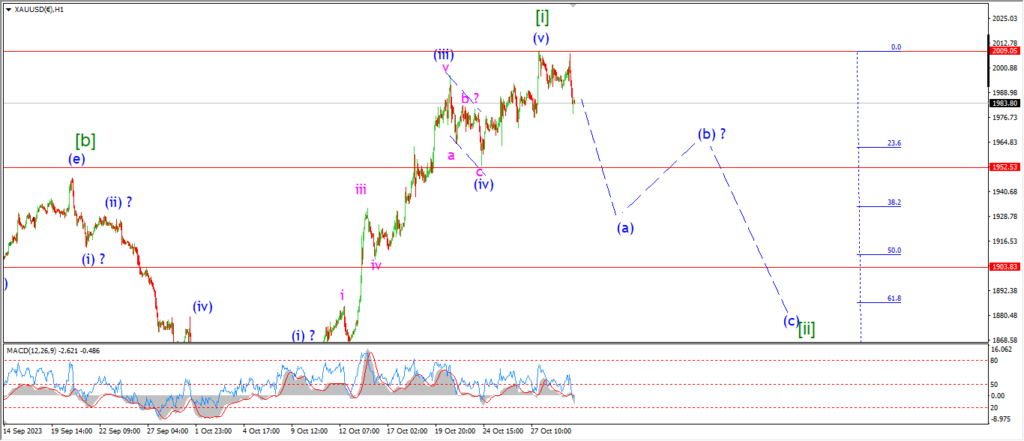

GOLD

GOLD 1hr.

GOLD 4hr.

GOLD daily.

The price has turned lower again today and now we are back within the corrective range of that previous decline pattern.

Wave [ii] now has another chance to begin the larger corrective turn down.

Wave (a) of [ii] should break that previous wave (iv) low at 1952.

And then wave (b) should turn higher again to form the lower high as shown.

I cant confirm the start of wave [ii] until wave (a) breaks that initial support at 1952.

So I’m afraid it’s a waiting game here too!

Tomorrow;

Watch for wave (a) of [ii] to fall and break 1952 again to confirm the correction has begun.

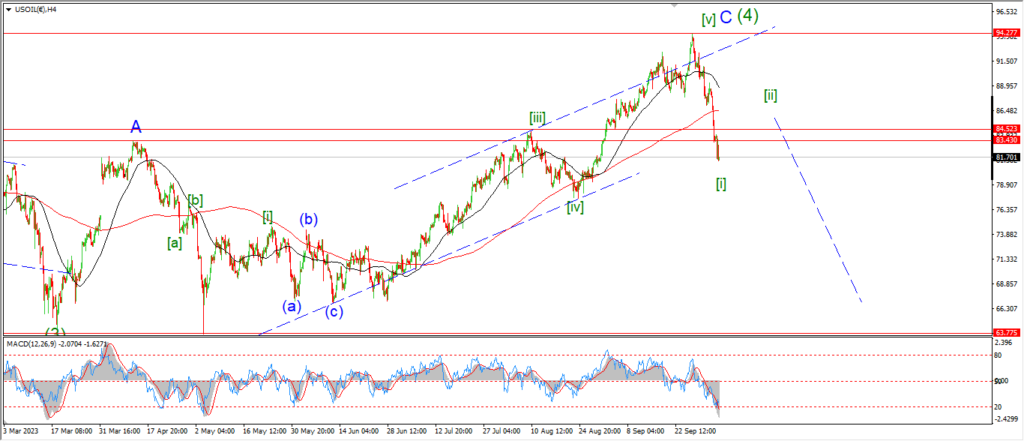

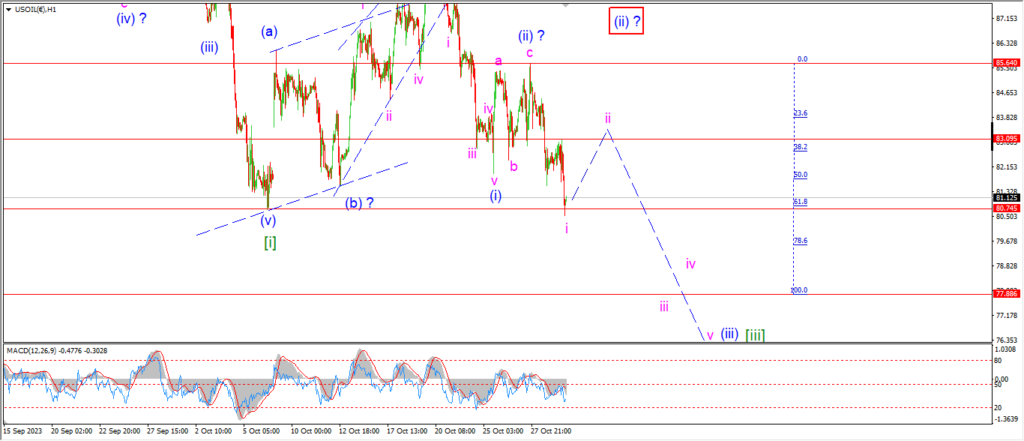

CRUDE OIL.

CRUDE OIL 1hr.

Crude oil dropped back into the 80.00 handle again today,

with at tag of the previous low at wave [i] green again.

I think the main count is getting a boost today,

as the decline off the wave (ii) high has now completed five waves down.

So the alternate count for wave (ii) is becoming unlikely now.

Todays low is labelled wave ‘i’ of (iii).

Wave ‘ii’ should correct higher in three waves over the coming days as shown.

And then wave ‘iii’ of (iii) has the potential to fall into the 78.00 area.

I have marked the minimum target level for wave (iii) blue at 77.88.

That is where wave (i) and (iii) reach equality in length.

So that is the first area of interest as this decline develops in wave (iii).

Tomorrow;

Wave (ii) must hold at 85.60.

watch for wave ‘ii’ to complete a correction higher into the 83.00 area by tomorrow evening.

A further acceleration lower to break the 80.00 level again will signal wave ‘iii’ of (iii) has already begun.

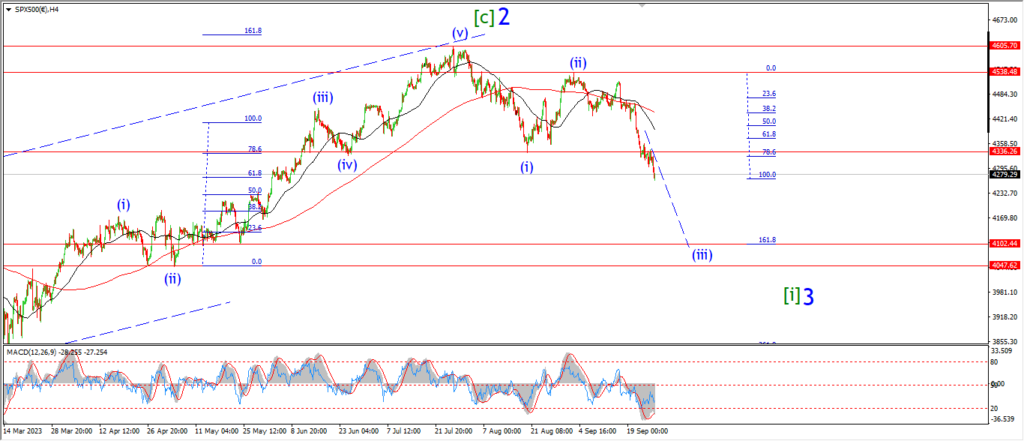

S&P 500.

S&P 500 1hr

the correction higher in wave ‘a’ of (iv) is developing quite well so far.

The action is still quite choppy into todays high,

which is expected in a corrective move.

The high of the session is holding below the 4200 level so far.

That level marks the previous wave ‘iii’ low and it seems like a reasonable target for this initial move higher.

We will have to see if wave ‘a’ can break that level to complete three waves up by tomorrow evening.

And then we should expect a decline into wave ‘b’ over rest of the week.

Tomorrow;

Watch for wave ‘a’ to complete three waves up with a break of that 4200 level again.

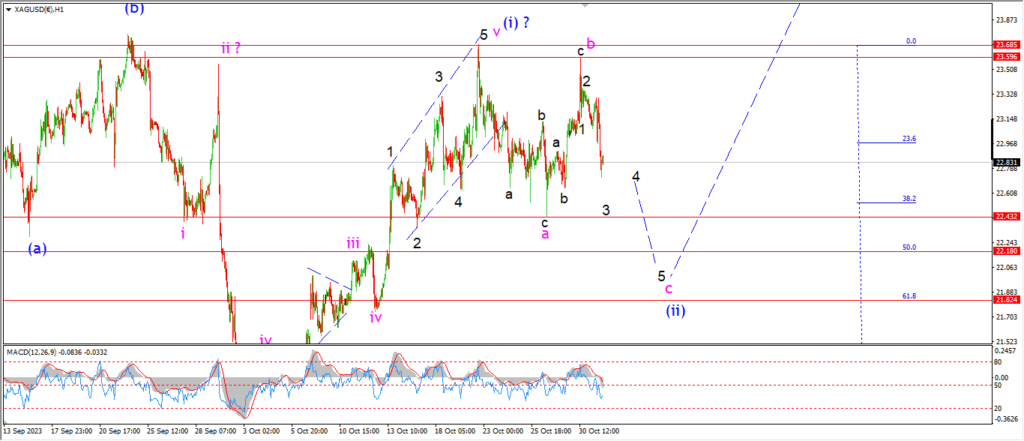

SILVER.

SILVER 1hr

The decline again today does favor the main count.

But the action has not gone far enough to confirm the pattern in wave ‘c’ of (ii) yet.

I am looking for five waves down to hit the 22.18 area to complete wave ‘c’ of (ii).

And if this count is correct,

then wave ‘3’ of ‘c’ should hit 22.43 at the wave ‘a’ low.

Anove that level breaks,

that will confirm the pattern.

Tomorrow;

Watch for wave ‘c’ to continue lower in five waves as shown.

The minimum target lies at 22.43.

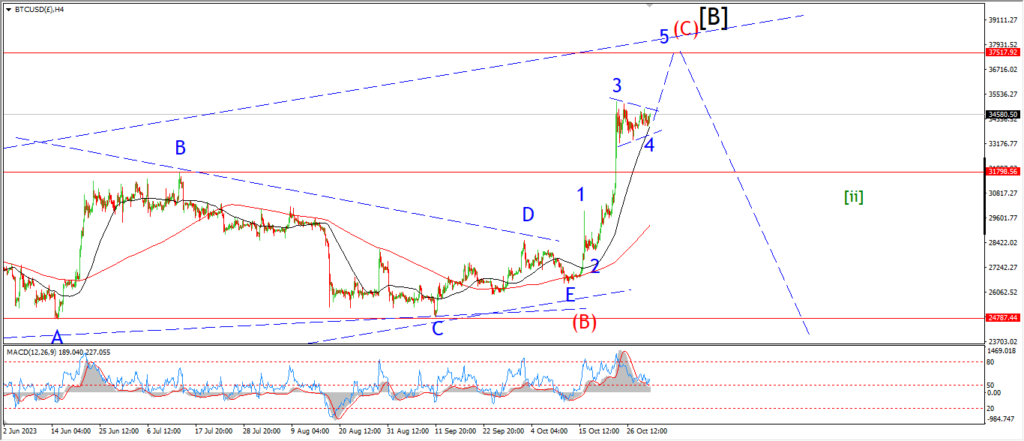

BITCOIN

BITCOIN 1hr.

….

FTSE 100.

FTSE 100 1hr.

….

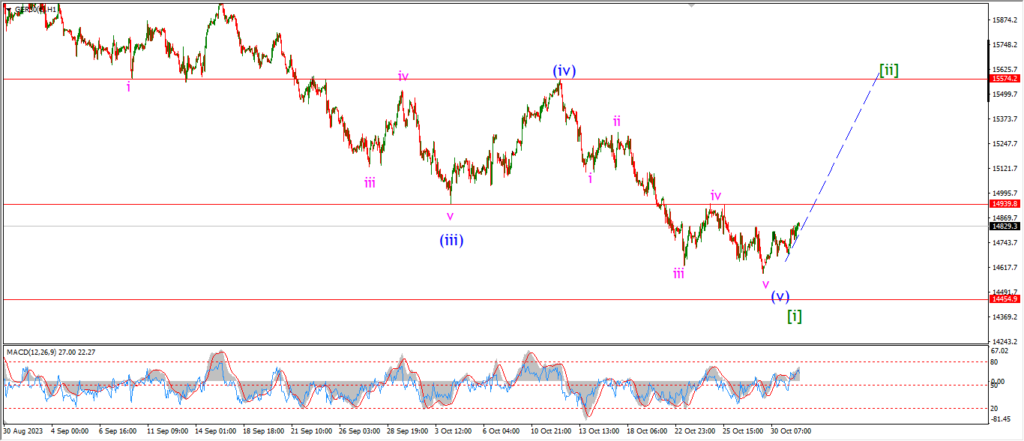

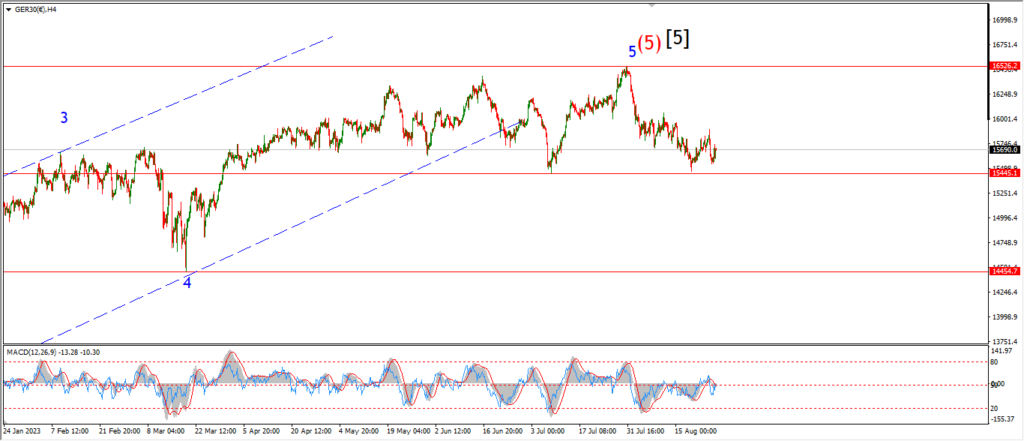

DAX.

DAX 1hr

DAX 4hr

DAX daily.

….

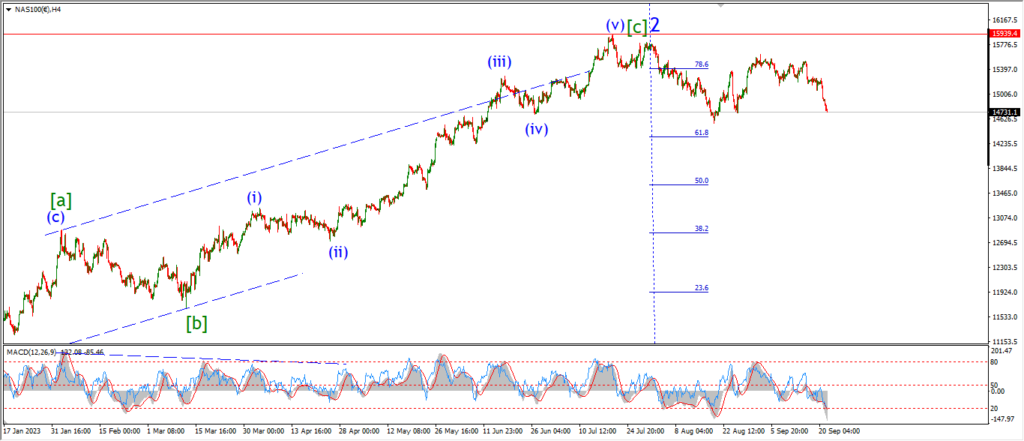

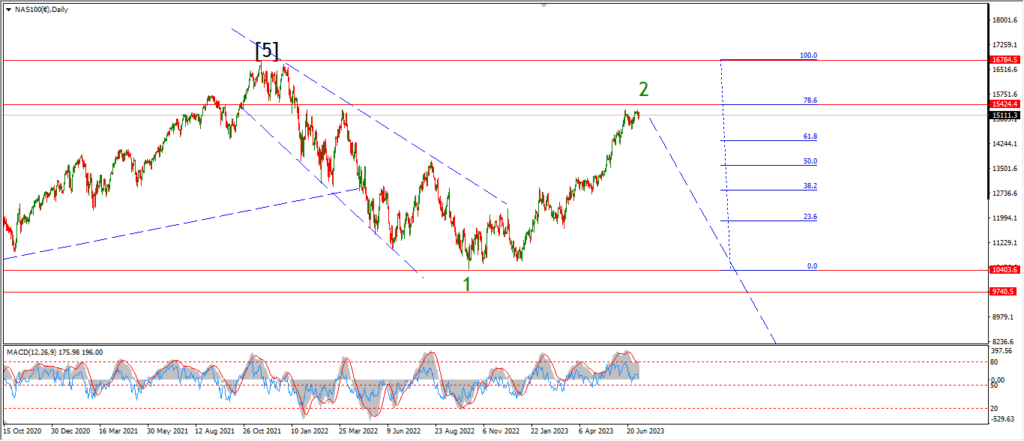

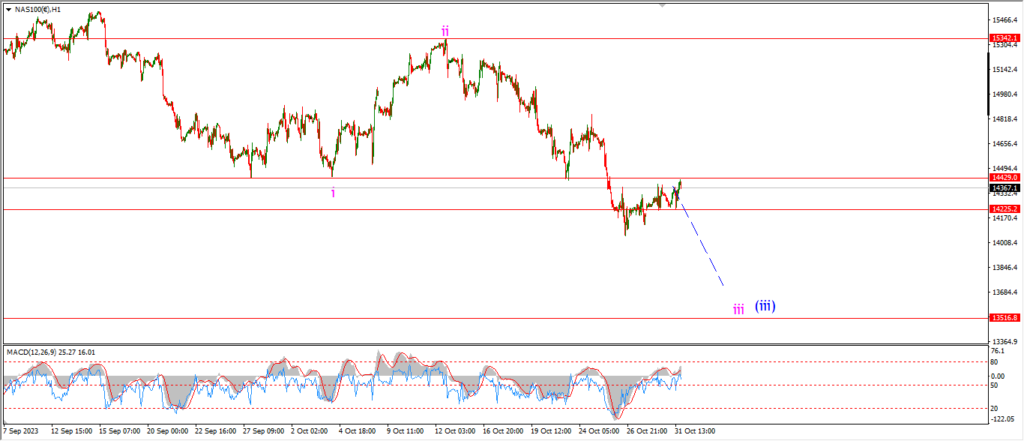

NASDAQ 100.

NASDAQ 1hr

….