How to trade forex successfully ( for beginners! )

When I first got into forex trading,

I had no clue How to trade forex!

And,

I had a thousand questions about trading that I simply could not get a straight answer for!

No matter where I went to find Information, nobody could give me simple starter advice on how to trade forex, for beginners that is!

There was just one talking head after another, trying to get me to fund an account on their platform!

I just wanted some simple answers to simple questions, free from spin and manipulation,

was that too much to ask!

Questions like;

Was forex trading for beginners like me?

How to trade forex, PROFITABLY?

How difficult is it to learn how to trade forex?

How much money do I need to start trading successfully?

What are the RISKS involved?

Well, today is your lucky day!

Stick around, and I will give you, what I never got!

that is:

Some straight answers on how to trade forex, From the very beginning.

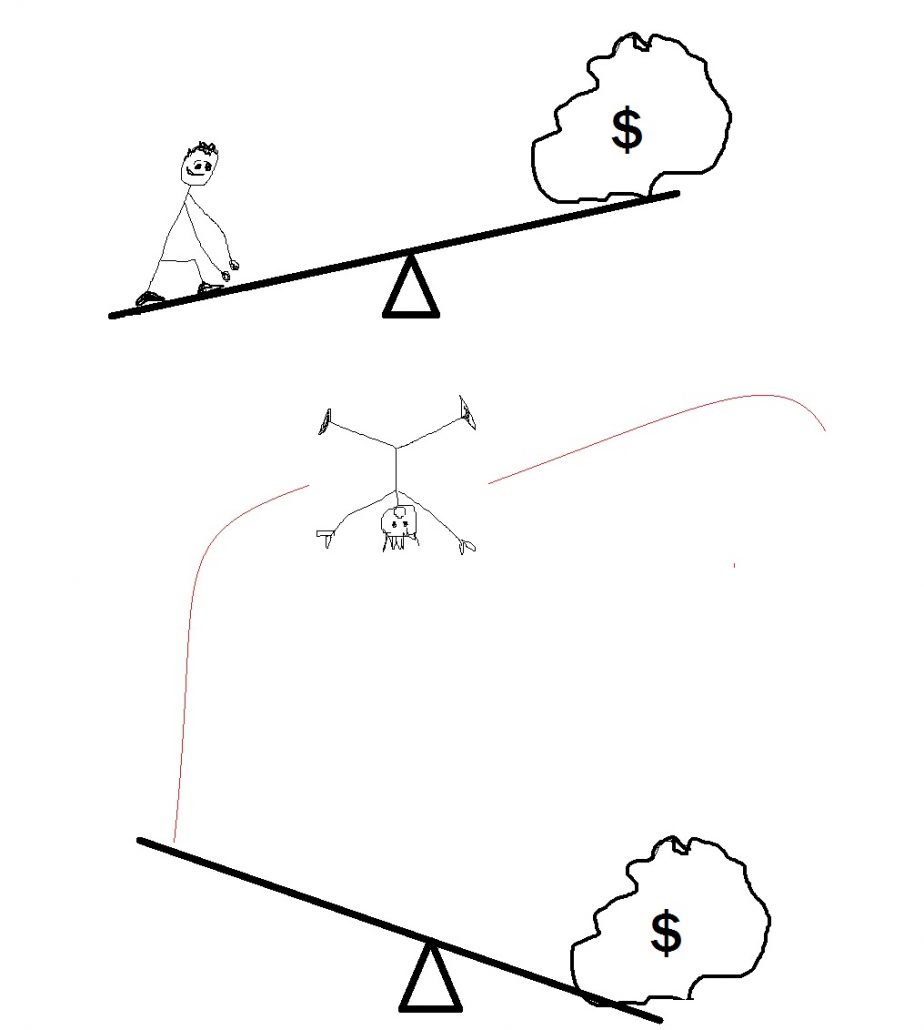

The realities vs the image:

We have all seen those movie clips, Yes?

Some high octane trader, shouting across the floor at another trader.

Hailing at the top of their lungs BUY, BUY, BUY!

Or,

We read the typical Cinderella story online;

A guy puts $1000 dollars into a brokerage account, knowing ZIPPITY DO DA, about how to trade forex, or without even reading the most basic forex training course.

He clicks BUY,

He Stirs the cauldron

Says the magic words,

and hey presto.

Ten day's later his account balance reads a cool million!

Like it or not, these are the stories that attract our attention to the whole idea of trading forex.

We all get into trading forex, wanting to be that guy who beats the market into submission with our own bare hands, and comes out smiling from ear to ear with a huge account balance!

The guy who drives a Ferrari while only having to work for 30minutes a day!

That one in a million success story!

sadly, It is not that easy to trade forex for a living.

While the fantasy is not exactly impossible per se!!!!!!!!!!

It is however, highly unlikely! In reality we are FOOLING ourselves with these stories.

So what are you to do then? Curl up and do nothing with your life?

Hell no!

This is where the reality bites, and the rubber meets the road!

You have to get up, teach yourself some forex trading strategies. And get to it!

You can start trading only knowing some forex trading basics, believe it or not, my best trades have been based on implementing these basic strategies.

It is obviously better to give yourself the a chance, by first learning to trade properly through a forex trading course!

While it is the next to impossible to press a button and wake up the next morning a freshly minted millionaire, the realities of trading are much different!

It is possible however: to start with a modest account balance, say $1000.

and then graft,

and graft,

and study,

and save,

and fall,

and learn,

and fail,

and learn again,

and win modestly,

and loose small amounts quite often,

and be consistent,

and trade sparingly,

and trade conservatively,

and score one decent trade maybe once a year,

And finally;

over an extended period of maybe 10 years,

eventually you can turn that original starting capital into a good retirement fund.

And that, my friends, is a realistic goal for a trader to have at the beginning.

Why learn how to trade forex?

The foreign exchange market, ( forex or FX, ) is the most exciting, accessible market to be had for the every day man or woman.

Markets in general and especially forex trading in the currency market, used to be the domain of financial institutions and corporations, hedge funds and the extremely wealthy.

BUT:

The rise of the internet, and the democratisation of markets has changed all of this,

It is now possible for the average Joe blogs like you and I to engage in forex trading from home, easily with the click of a mouse through our online brokerage accounts, or desktop platforms like metatrader 4.

While this article is a primer on how to trade forex for beginners, it is not an education! It is always advisable to get yourself onto a forex trading course and learn forex trading from a professional.

They will teach you things that you wont read online!

Some general info about the forex market

The Forex market is the largest financial market on Earth. It has a short history, but has grown exponentially!

Its average daily trading volume is more than $3.2 trillion.

As compared to the NYSE The New York Stock Exchange, which only has an average daily trading volume of about $52 billion.

To put that in context,

The total traded dollar value of ALL of the world's equity and futures markets together, would only equal on quarter of the Forex market!

Is size important??????

Well, in a word, YES!

The bigger the market,

the more participants there are, then the more liquid it is, and the less likely it is that a catastophic price event will happen.

Simply put, the more buyers and sellers there are, then the closer the market will be to the true value of the instrument.

Here are some benefits to trading forex.

- Most firms don't charge a commission, you pay only the bid/ask spreads.

- Around the clock access to trading, you dictate when to trade.Leverage!

- Great when the trade is going your way, and terrible when it goes against you.

- Forex is accessible to the mass market, you don’t need a whole pot of money to get started.

Here are Some of the RISKS!

The enormous leverage ratios can increase the value of potential movements in a currency pair.

BUT!

That very same leverage can wipe out your account in a couple of minutes if you are not careful. There was a nice piece in the WSJ on those pesky risks by Stephen Bernard.

Take the example of a beginner trader, without knowing, how to trade forex correctly, with a starting account balance of $500.

She places a trade, forgetting to set a stop loss on a that trade.

An unforgivable move! But it happens all the time!

She buys EURUSD at the market price of 11400, that means €1 euro is worth $1.14

Lets say her trade is worth $2 per pip.

The market is jolted by some dumb central banker shooting off his mouth to a reporter over cocktail's!

And the price drops 150 points to 11250 in a couple of minutes.

That 150 point drop, just cost her account $300, now she is almost out of the game!

Top TIP: Any investment in forex should involve only risk capital. Never, ever ever, ever trade with money that you cannot afford to lose.

Leverage

Trading operates on a per pip (percentage in point) basis, the trader basically bets an amount of capital per point that the market moves.

So a small movement in the instrument price can have an outsized effect on the account equity, say hello to leverage!

There is one simple rule here.

the higher the leverage,

the higher the risk.

Leverage is the key to big gains and losses in the forex market, this is a key point to learn in understanding how to trade forex. The amount of leverage on an account differs depending instrument and the broker.

With this kind of leverage, there is the real possibility that you can lose more than you invested - although most firms have protective stops preventing an account from going negative.

It is vital that you remember this when opening an account and when you determine your desired leverage you understand the risks involved.

Picking a broker:

The broker is your very own middleman!

All brokers differ so much on the type of accounts they offer, so it is important to open a few different accounts before making a commitment. You can check out this guide to choosing a broker by Joshua Kennon, although the guide is focused on traing stocks, the principles of finding the right broker are the same.

Each broker will offer different levels of services and instruments available to you along with fees charged.

So when opening an account, make sure to find out the pip spread they offer on the FX pairs you are looking to trade.

So before choosing;

- open a few demo accounts,

- see what suits your style,

- and then fund the account you like.

Remember: they all want your money, so let them fight for it!

Forex trading - the basics:

Lets run through a few terminologies and jargon that you are bound to run into, Understanding the terminology will easy the path to learning how to trade forex successfully.

A Pip:

Not the hero of the Charles Dickens novel Great Expectations!

It is the "Percentage In Point" (PIP), also known as a "Point".

This is the minimum price change of a Forex trading rate. The most common Pip is 0.0001.

usually a 1 cent change in a pair equalls 100 pips.

Ask price:

This is the price you can buy a currency pair at.

Or the price at which the market is willing to sell the currency to you, more to the point!

Bid price:

The bid price is the price you can sell a currency pair at.

The market is willing to pay you this price for this particular currency.

Spreads:

Spread are the difference between bid price and ask price.

This is where most brokers make their money!

The wider the spread, the more you pay to trade.

The most traded currency pairs have the narrowest bid ask spread.

Currency rate:

This is the price that a pair trades at market right now.

Types of Orders you can place.

If you are looking to open a new position it will likely be either one of two types;

- a market order

- or a limit order.

A market order:

This type of order is basically buying or selling the market price as is currently being traded in the market, noquestions asked, no answers given!

A limit order:

On the other hand, allows you to specify the trade entry price.

So if you are looking to sell off an established resistance point, you can enter the trade with that information in mind, and if that trigger price is hit, then your broker will automatically place the trade as specified.

Setting a stop loss:

If you learn anything about how to trade forex at all before you start trading, it should be this.

No one ever went broke setting a stoploss!

Every time you place a trade, you should have a stopp loss set on it.

Its that simple!

When you buy or sell a currency pair, you should calculate the maximum amount you are willing to loose on that trade.

Then set a stop with that loss amount in mind!

How the currency pair works.

Most currency trading is done via trading the currency pair, be that EURUSD, GBPUSD etc.

In the case of the currency pair,

you are buying and selling based on the prospect of the first currency in that pair.

So;

If you think the euro will strengthen against the dollar, you will buy the eurusd, because a strenghtening EURO will cause the price of that pair to rise.

You profit on the difference between the price you bought at, and the upward distance the price moves.

The converse is true also,

Selling Eurusd means you expect the price of that pair to drop.

In this case you profit on the difference between the price you sold at, and the downward distance the price moves.

You can also use derivative products, such as options and futures, to profit from changes in the value of currencies.

Check out our article on Binary options for more information.

Starting forex trading: your first trade!

Before you get this far you should learn how to trade forex with a demo account, before you invest real capital.

This way you get a feel for the system your broker uses, the trading process and you learn the basics of the operation of the market without loosing your shirt.

When you are trading consistently on a demo account, then you can move on to a real forex account.

First you gotta make your mind up as to what path the future price is likely to take.

How do you do that?

This is where analysis comes in!

There are several different methods:

Technical analysis:

This involves studying charts and historical data to try to predict how the currency will move based on certain technical characteristics.

Your brokers platform will have inbuilt charting software, or you can use a platform like Metatrader 4.

Fundamental analysis:

This method involves analysing a country's economic and political fundamentals, trade statistics and growth projections and then using this information to predict the future value of that countries currency. It also encompasses news trading, for example if a story breaks which changes your beliefs on the currency fundamentals.

When the analysis is done and you have your decision made, its time to trade!

Now you are ready to place your order, here are some pointers.

- Never risk more that 3% of your account balance on any single trade.

For example,

If your capital invested is $1000,

Keep your risk on any particular trade to less than $30. This way you will live to fight another day.

- Always stick to your initial trading idea.

This means that if the trade is going against you,

and the price is coming close to your stoploss position,

Do not move the stoploss to acommodate more losses!

This is a cardinal sin, and your account balance will not forgive you!

And last but not least.

- Do not over trade!

Believe it or not,

The bulk of the profits that a professional trader makes in a year, come from 2 or 3 good trades!

Thats it!

The rest of the time is filled with analysis and thought!

One great trade will make a year for any trader,

so be patient and let the market come to you.

As a beginner, you should start with a very light footprint! don not spend your days staring at the screen. If you overindulge at the beginning, and you have a string of bad trades, you will likely loose confidence and give up quickly.

Now get in there and try it out, If you follow these guidelines you can build a sizeable nest egg over time.