[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Good evening Ladies and Gent’s.

Its the Thursday of Holy week.

Therefore,

there will be no trading on Good Friday because Jesus threw the traders out of the temple and since then traders all over the world have lived in fear of trading on Good Friday.

Well thats not exactly the story,

but the market is closed tomorrow and therefore so am I.

Although I will post the review video early tomorrow, so watch out for that.

And with that,

lets get down to business.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

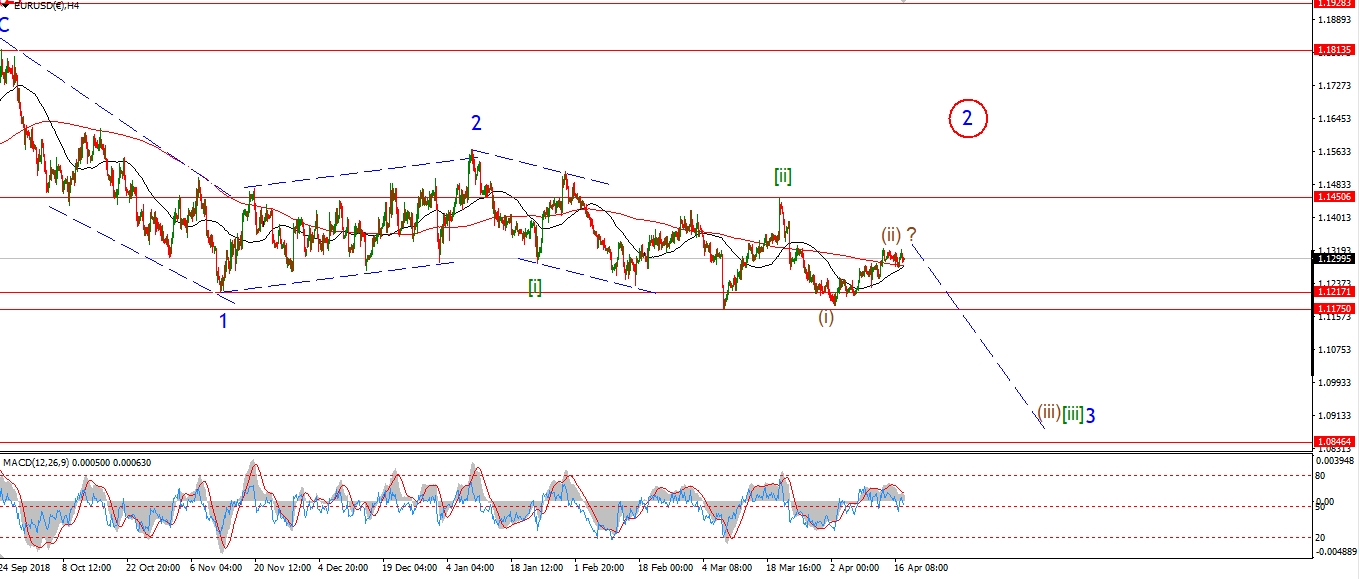

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The top seems to be in for wave (ii) at the recent high of 1.1324.

The price dropped in a more impulsive fashion today

when compared to the recent corrective grind higher.

This decline is labelled wave ‘i’ of (iii),

And wave ‘i’ should continue next week to create a clear five waves down.

A break of support at 1.1176 will confirm that wave (iii) is underway.

And we have the prospect of a decline in wave ‘iii’ of (iii) to come.

That should be fun!

Monday;

Watch for 1.1324 to hold at wave (ii) and for a five wave decline in wave ‘i’ of (iii) to complete.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Todays drift lower broke out of the triangle formation to the downside.

The break of 1.2986 ruled out the triangle,

and I have now switched to the more immediately bearish alternate count.

I will admit that I am not totally convinced with this short term count either,

But so long as the price tends to the downside,

then the possibility exists for wave (iii) down to pick up momentum in a third of a third.

So I am preparing for that idea now.

Monday;

the wave ‘ii’ high lies at 1.3133,

This high must not be broken for wave ‘iii’ to remain valid.

Watch for a break of 1.2959 to confirm wave ‘iii’ down.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY has dropped off the high at wave ‘i’ in three waves so far.

Wave ‘ii’ may be complete at the low of the session at 111.85,

but the rise off that low is in three waves,

So;

I am also open to this decline in wave ‘ii’ continuing into the lower trend channel line,

this would occur as part of a flat 3,3,5 correction.

Monday;

As a mirror image of EURUSD now,

USDJPY is on the verge of a rally in wave ‘iii’ of (iii) of [iii].

This should prive quite a strong move up.

Watch for a low in wave ‘ii’ to complete by Monday evening.

A rally off that low will signal wave ‘iii’ has begun.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

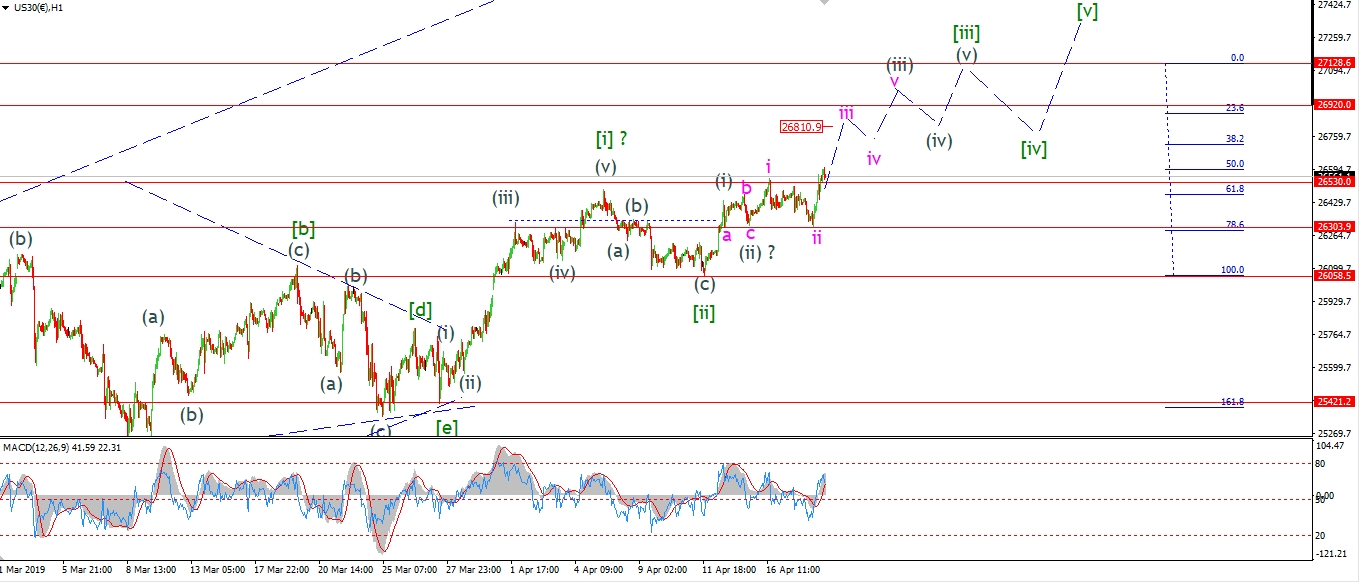

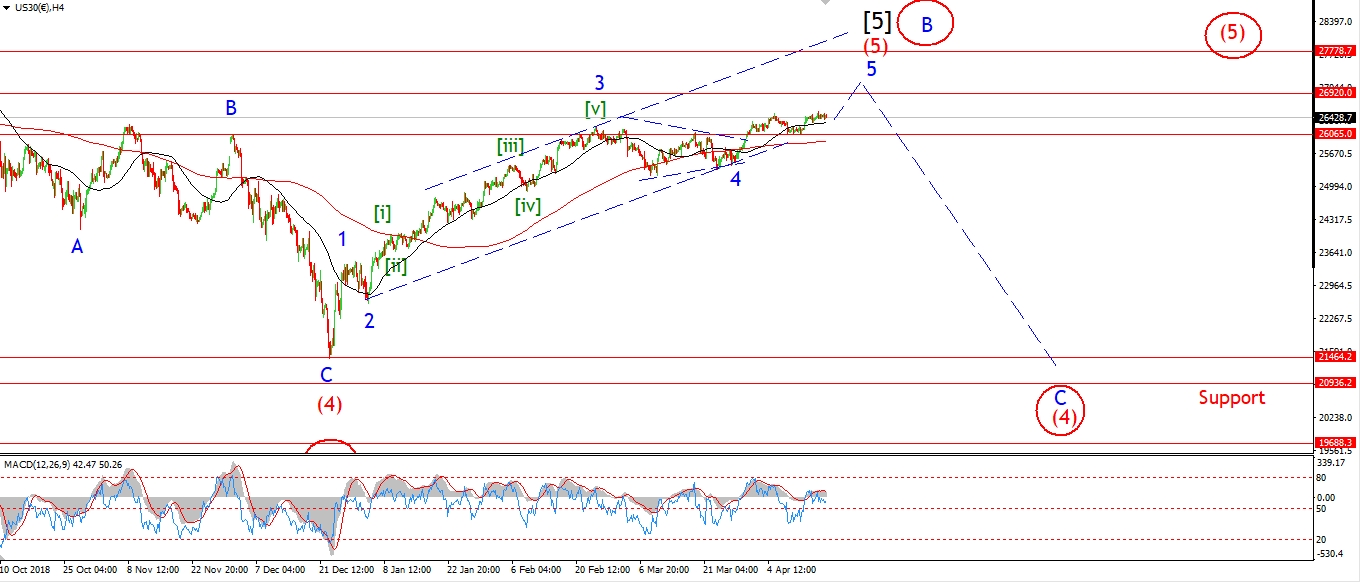

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The futures drifted lower early this morning

to create a larger three wave pattern in wave ‘ii’ of (iii).

but the cash market rallied straight out of the gate this morning to begin wave ‘iii’ of (iii) of [iii].

Wave ‘iii’ of (iii) should continue up to the 26800 area to complete.

we will be within a stones throw of a new all time high at that point,

and that accolade should prove irresistible to traders.

They will wear a new high it like a badge of honor,

in some cases, literally!

Although It will in reality,

be a millstone around our necks!

Monday;

Watch for a rise in wave ‘iii’ of (iii) to continue towards that all time high at 26920.

Next week will likely bring that new high,

and maybe even an end to the larger wave [iii] green.

With each step we are nearing the cliff edge again.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

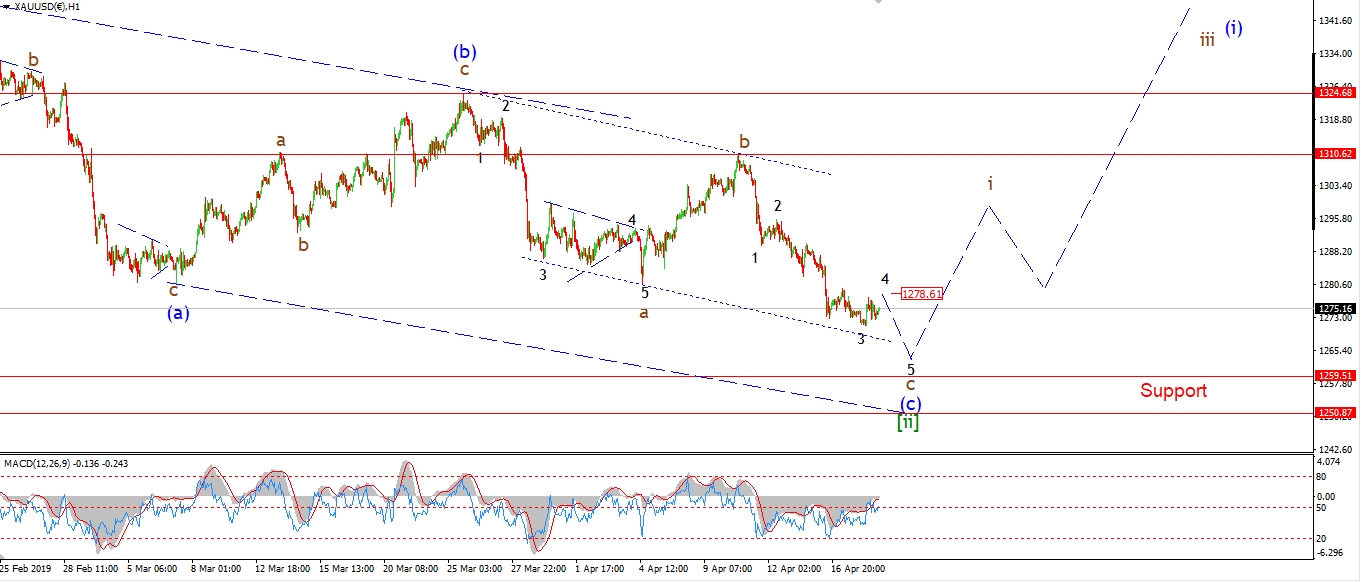

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

GOLD stabilized today in wave ‘4’ of ‘c’ of (c).

the market is likely to create another low between support at 1259.50 and the lower trend channel line at 1250.80.

And this should happen relatively quickly,

So we may well have the final low low in place for wave [ii] early next week.

Monday;

Wave ‘4’ of ‘c’ has not completed three waves just yet.

Watch for a short pop higher to about 1280 to finish wave ‘4’,

and then a drop into the lower target in wave ‘5’ of ‘c’ of (c).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Crude is nearing a complete three wave correction in wave ‘ii’ pink this evening.

Wave ‘ii’ must complete below 64.61 at the recent high.

If the price rallies above that level,

then the market is likely creating an extension in wave ‘v’ of (c).

However,

If the price drops again in a five wave form in wave ‘iii’,

that will add serious weight to the idea that a top is in place at wave (2).

If the short term count is correct,

then we should get confirmation of top by the end of next week with five waves down in wave (i).

Monday;

Watch for wave ‘ii’ to complete below 62.61 and then turn lower into wave ‘iii’.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The 10YR rose again today within wave ‘ii’ pink.

I don’t think the correction is complete yet though.

The rise so far is in three waves,

but this may just be wave ‘a’ of ‘ii’.

We will have to wait and see how the price reacts to the resistance next week.

If we see an immediate decline back below 122.63 then wave ‘iii’ of (iii) is on.

Monday;

Watch for wave ‘ii’ to complete with a break above 123.25 and then turn lower into wave ‘iii’ of (iii).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver seems to be creating a contracting triangle over the last few days trading.

The price has come to a complete standstill today,

this suggests the triangle is now complete and wave ‘5’ of ‘c’

will break lower early next week to complete the correction.

Monday;

The trend channel suggest a low for wave ‘5’ at 14.63,

while lower support comes in at 1454.

Watch for wave ‘5’ to find a low in that range

and then next week should bring a rally in wave ‘i’ of (iii).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

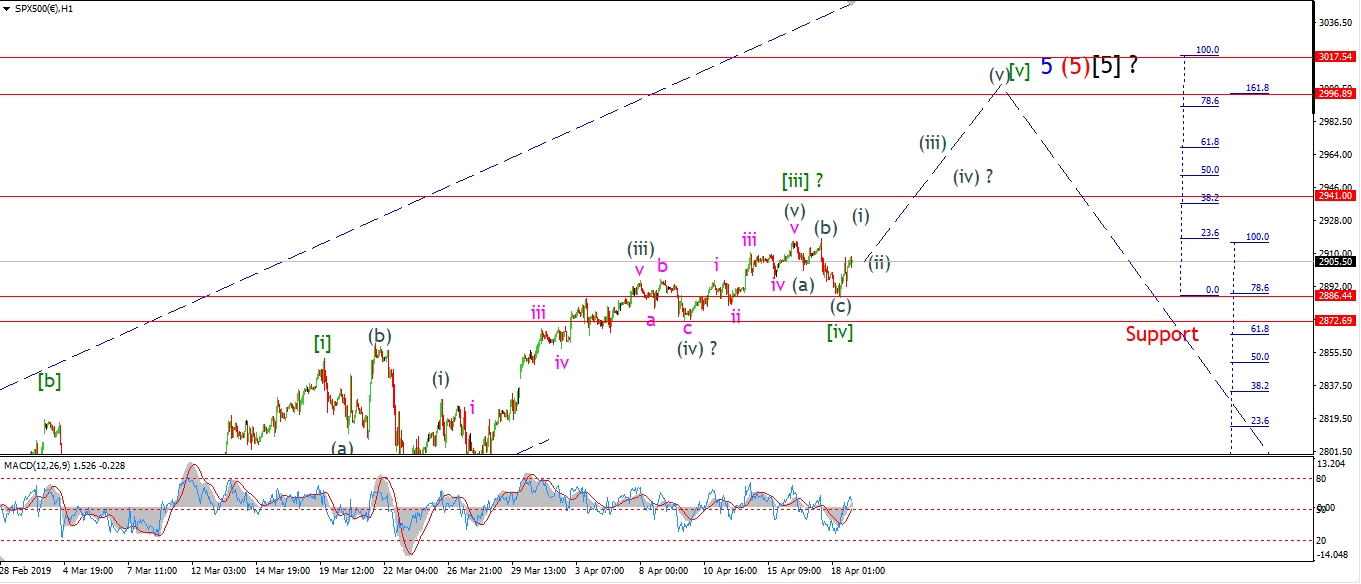

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P seems to be one step ahead of the DOW in the short term count.

The DOW is still rallying in wave [iii] of ‘5’.

While the S&P is now entering wave [v] of ‘5’.

Todays rally is viewed as the beginning of wave (i) of [v].

If this is correct,

then the low labelled wave [iv] at 2891 cash,

should hold for the remainder of the rally in wave [v].

The price is likely to rally for the next two weeks or so,

as the final leg up in wave [v] completes.

The short term target range for wave [v] lies between 2996 ans 3017.

2996 is where wave [v] hits the 162% extension of wave [i] off the wave [ii] low.

And,

3017 is where wave [v] equals wave [i].

I prefer the lower target for wave [v] at 2996.

The reason being,

wave [iii] must not be the shortest wave in the structure.

Monday;

Watch for wave (i) of [v] to continue higher towards that all time high of 2941.

Waves (i) and (ii) should complete next week.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

Until next week folks,

have a great Easter weekend.

See you Monday.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]