[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Hi everyone.

The cover story in Barrons magazine this week has this headline:

This Bull Market Has No Expiration Date

Of course this headline is easy to write after ten year long stock market rally.

The excerpt of the article points to the gems inside:

“experts thinks the United States is only halfway through its period of economic expansion, due in part to the millennials set to boost spending and investing as they enter their prime earning years. And find out who believes that the notion of economic cycles may no longer be relevant, due in part to central bank interventions.”

the jist of the article is this;

shut up and buy,

stocks are set to boom forever because there is no such thing as an economic cycle anymore.

Sure, lets see what the market has to say about that!

Let’s get into it.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

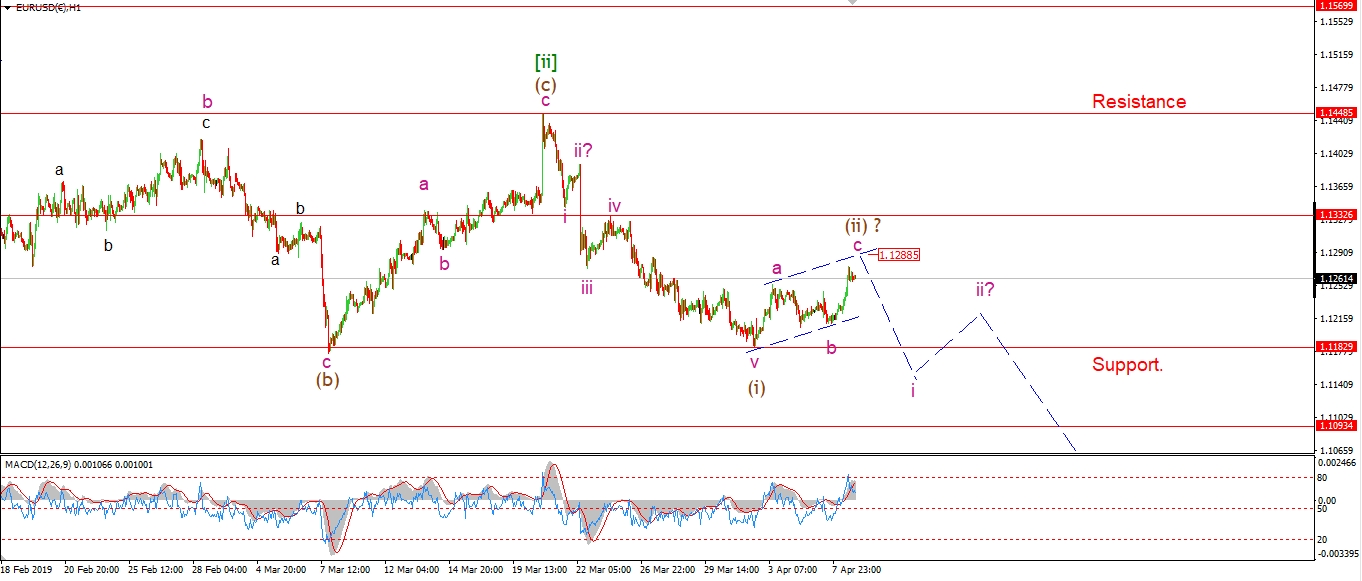

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD is on track to complete a three wave structure off he wave (i) low.

Wave ‘c’ of (ii) [pushed higher this afternoon,

and has met the minimum target by breaking the wave ‘a’ high.

Wave ‘c’ will meet the upper trendline at 1.1288,

and the previous fourth wave lies at 1.1330.

So That gives us a clear enough reversal zone for wave (iii) down to begin.

Tomorrow;

watch for wave ‘c’ to complete at about 1.1300 and then turn lower again into wave (iii).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The wave structure is very messy in cable at the moment.

The price is incredibly undecided in it’s action.

I suppose this reflects the political climate at the moment.

In terms of the wave count;

If we see a rally tomorrow that breaks to wave ‘a’ high at 1.3195,

That will confirm the idea of one more high in wave [c] of ‘2’ as shown.

And we will have to wait for another few weeks until wave ‘3’ down begins.

However;

If the price continues lower over the coming days and takes out 1.2772.

That will trigger the alternate count and signal that the larger wave ‘3’ has already begun.

Tomorrow;

Watch for support to hold at 1.2959.

A break of that level will favor the alternate count.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

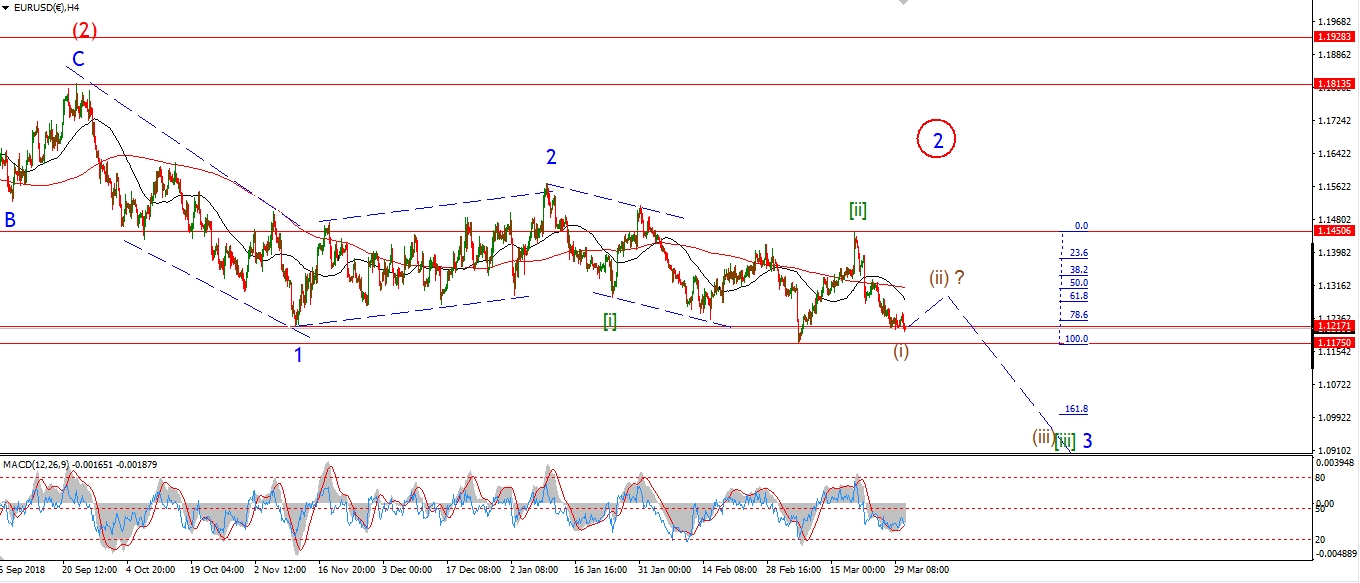

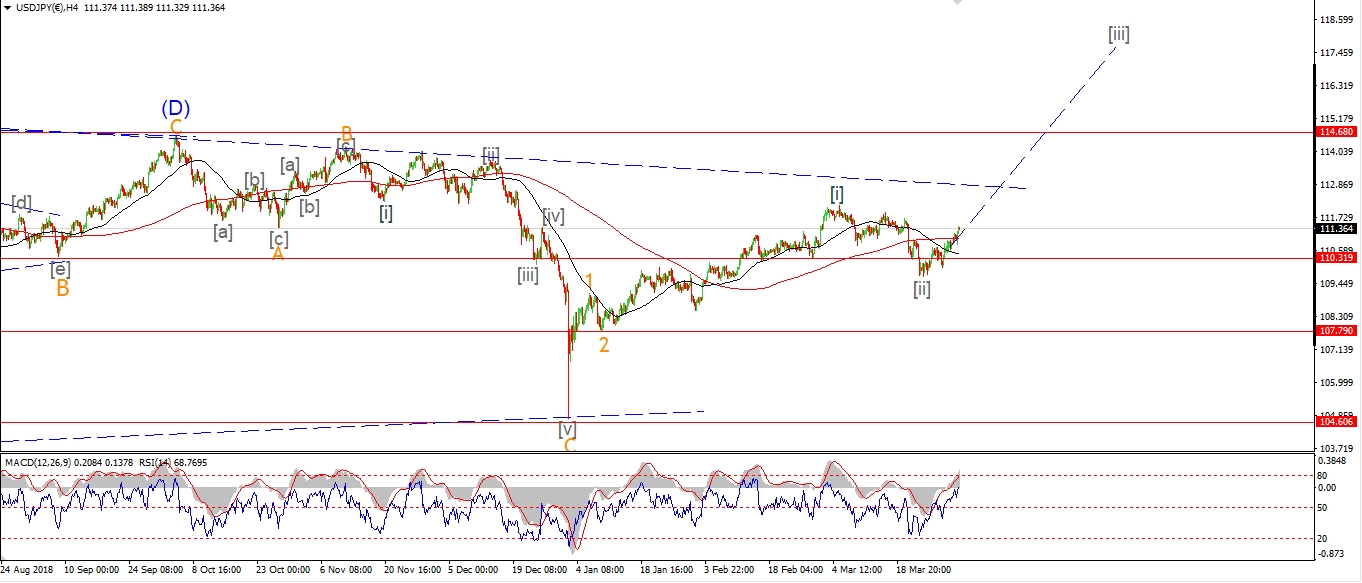

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY dropped off the highs and broke below the previous fourth wave at 111.30.

This suggests that wave (ii) is now underway.

The initial decine is labelled wave ‘a’ of (ii).

The overall correction should carry back to the trend channel line at about 110.90 to complete.

This will take a few more days to play out,

and then wave (iii) up should get underway.

Tomorrow;

Watch for wave ‘b’ of (ii) to complete below 111.82.

and then turn lower into wave ‘c’.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The price has dropped today off Fridays highs.

This initial drop is considered wave (a) of [ii].

Wave (b) should create a lower high tomorrow at about 26360.

Wave (c) should turn lower for the rest of the week

and complete a three wave correction in wave [ii].

Wave (c) and wave [ii] should find support at the previous wave (iv) low of 26100.

With the 50% retracement coming in at 25960.

Wave [iii] up is then set to break to a new all time high again next week.

And I maintain that this will not be a bullish new high.

All we are doing is filling out the final five waves of this 10 year long bull market.

And given that bullish cover on Barrons magazine this week,

We are closer to that end then most would like to think.

Tomorrow;

Watch for wave (b) to carry us to a lower high below 26490.

A break of 26100 will signal that wave (c) has already begun.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

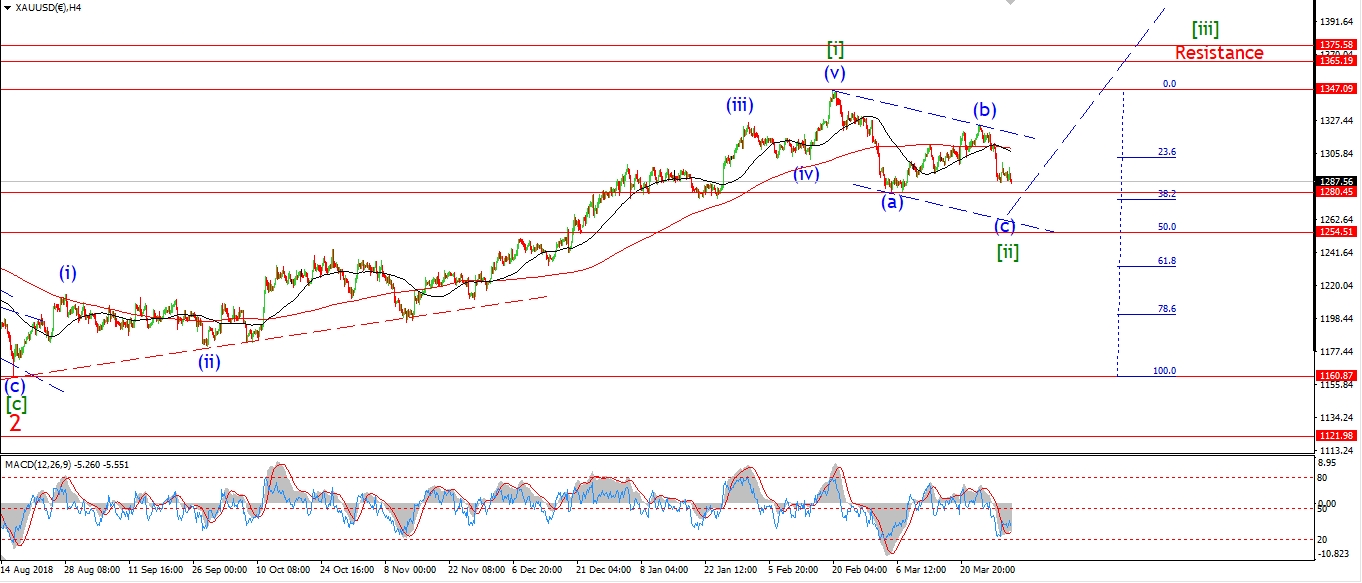

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

GOLD punched above 1300 again today

in what may well prove to be the beginning of wave [iii] up.

We have a way to go yet, but so far so good.

First we will have to see a clear five wave pattern higher

off the recent low at 1281.

And then a break of 1324 at wave (b) will heavily favor the bullish count.

That gives us a plan for the week ahead

in terms of what to expect to confirm the bullish outlook.

Tomorrow;

The lows at 1281 must hold as wave ‘i’ up develops.

Watch for price to continue back above 1300 again to complete five waves up.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

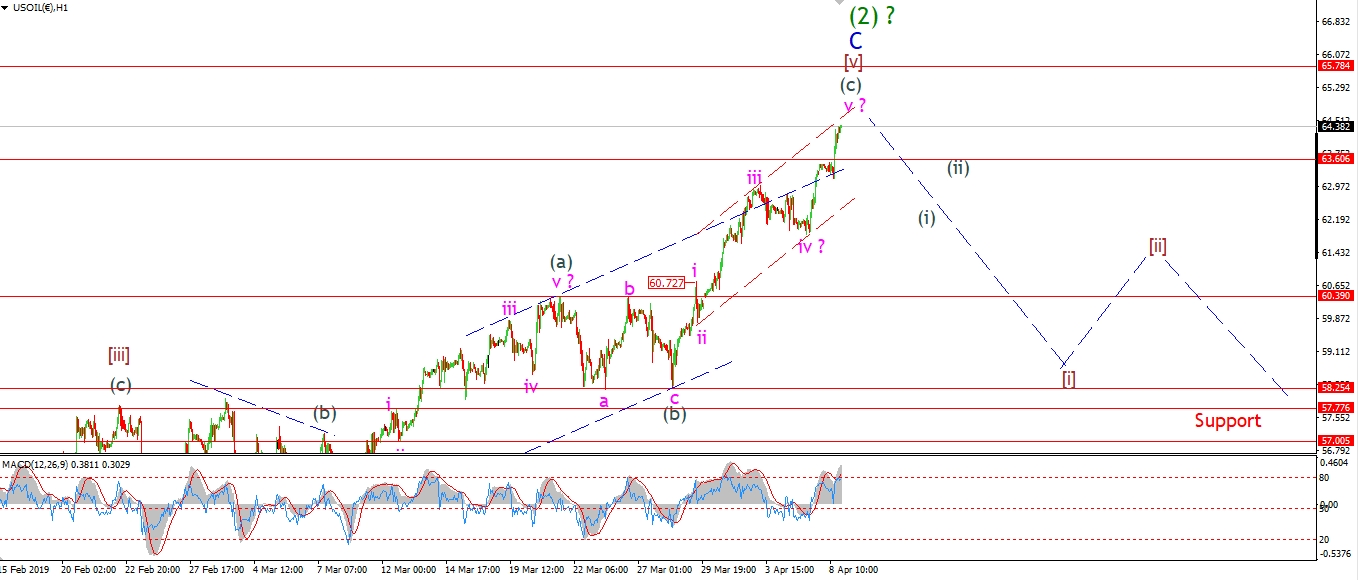

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The rally in wave [v] has now filled out a second trend channel at a lower degree,

and is fast reaching the turning point to begin a very large decline in wave (3).

Wave [v] of the ending diagonal has traced out a clear three wave pattern.

And wave (c) of [v] has now completed a five wave pattern.

Todays highs are within a few pips of the upper trend channel line now.

Also,

The larger wave ‘C’ in blue has just reached above equality with wave ‘A’.

So the dominoes are lining up in favor of a turn down in wave (3).

All going to plan,

we should see an impulsive drop beginning this week.

Tomorrow;

Watch for a sign that wave (c) has completed with a drop below 63.00 again.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

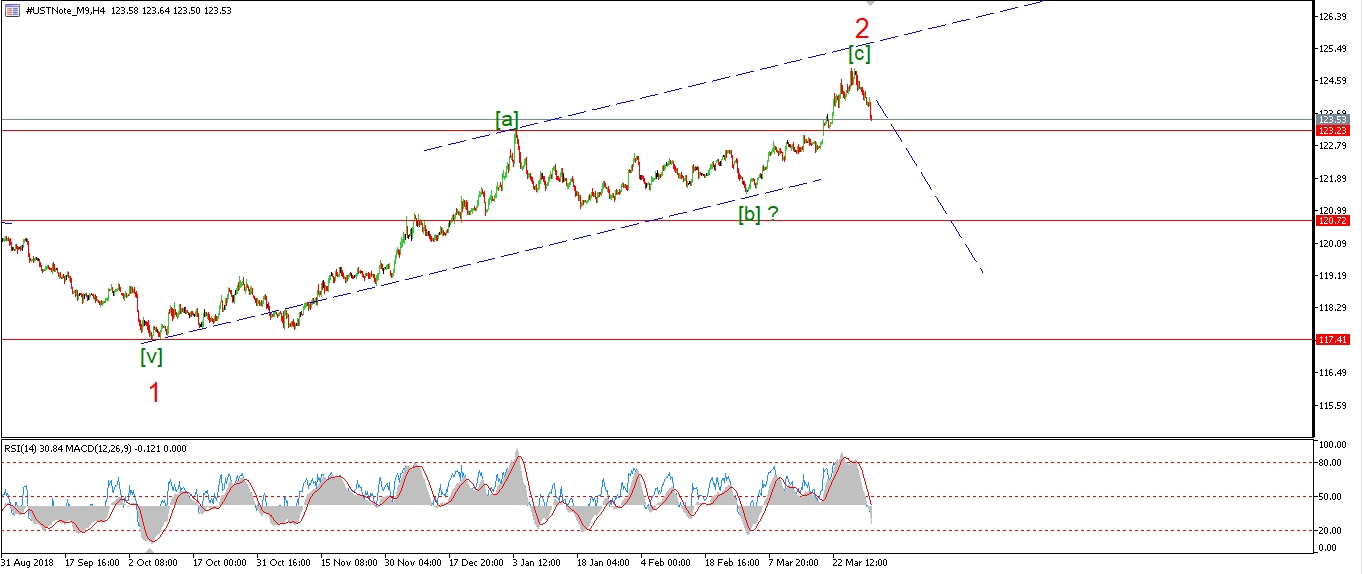

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The 10R is well on its way to creating a 5/3 bearish impulse wave,

and this price action should complete this week.

The price fell today in wave ‘b’ of (ii),

wave ‘b’ should hold above 1.2325 at the wave (i) low.

And wave ‘c’ up is expected to carry us back up to 124.00 again to complete a three wave correction.

The 50% retracement of wave (i) down lies at 124.10.

this level should offer resistance.

Tomorrow;

Watch for wave ‘b’ to complete and then prices should turn higher again in wave ‘c’ fo (ii).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

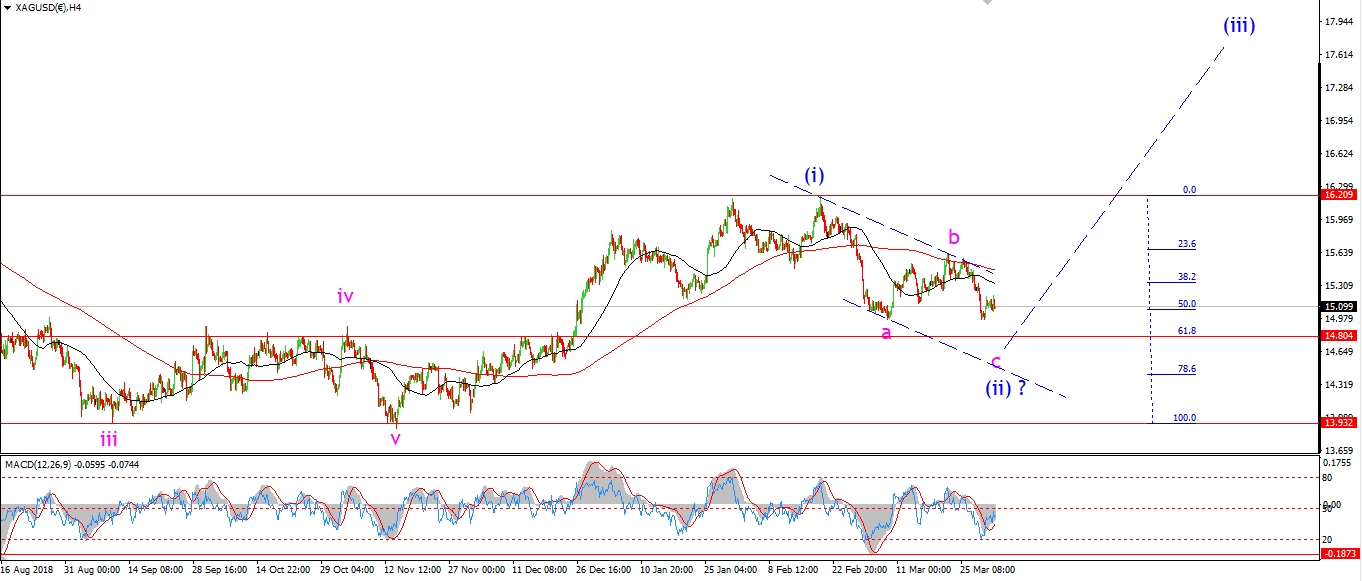

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver is up off Fridays lows also today,

although the rise is only in three waves so far.

The low of wave (ii) was set last Thursday at 14.90.

The price must hold above this level from now on to stay with the bullish short term count.

The main job this week is to identify five waves up off 14.90 in wave ‘i’ of (iii).

A break of 15.62 will add weight to the bullish count also.

Tomorrow;

Watch for wave ‘i’ to continue higher in five waves towards resistance.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

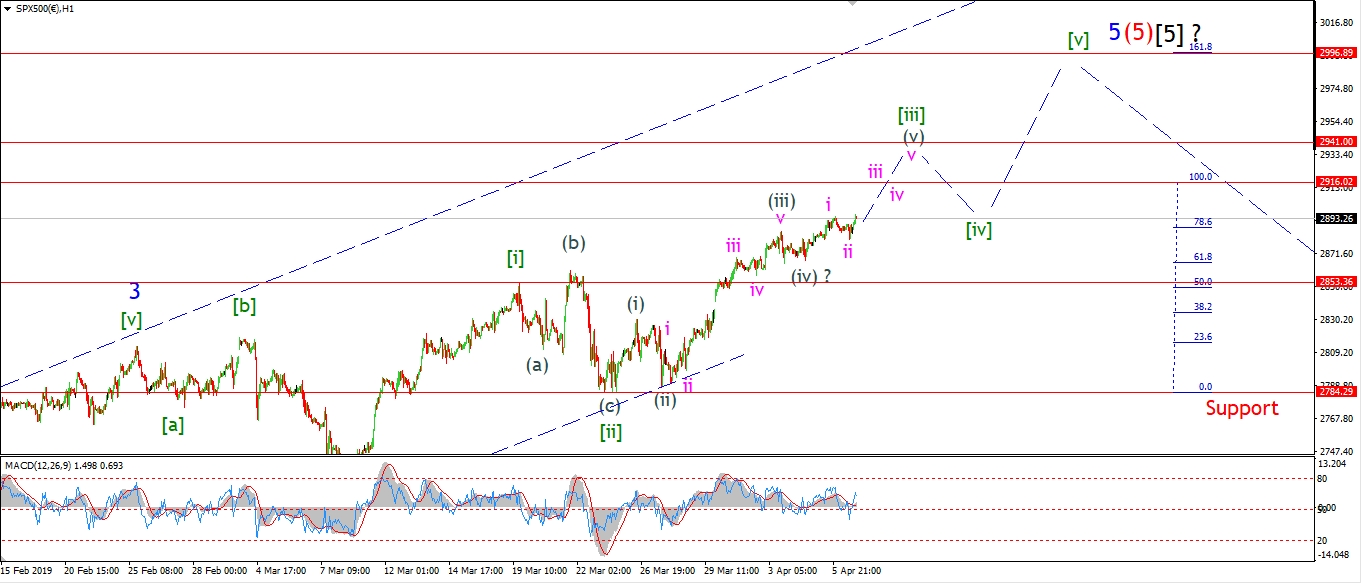

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P is moving higher this evening to begin wave ‘iii’ of (v) of [iii].

The initial drop this morning completed wave ‘ii’ of (v).

And the rally should continue tomorrow in wave ‘iii’ of (v).

A break of 2915 at a minimum is expected to complete wave [iii] up.

This level is where wave [iii] reaches equality with wave [i].

We should then see a correction in wave [iv] of ‘5’.

This will most likely begin before the end of this week.

The correction in wave [iv] should hold above 2853 at the wave [i] high.

Tomorrow;

Watch for wave ‘iii’ of (v) to push higher and break 2915.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]