[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Hi everyone.

Welcome back to me!

Thanks for your patience last night, it was much appreciated.

I will post the video tomorrow as its getting late on this side of the Atlantic now,

and I fear that I will fall asleep on the keyboard of I record a video tonight!

So without further adieu,

Down to business.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

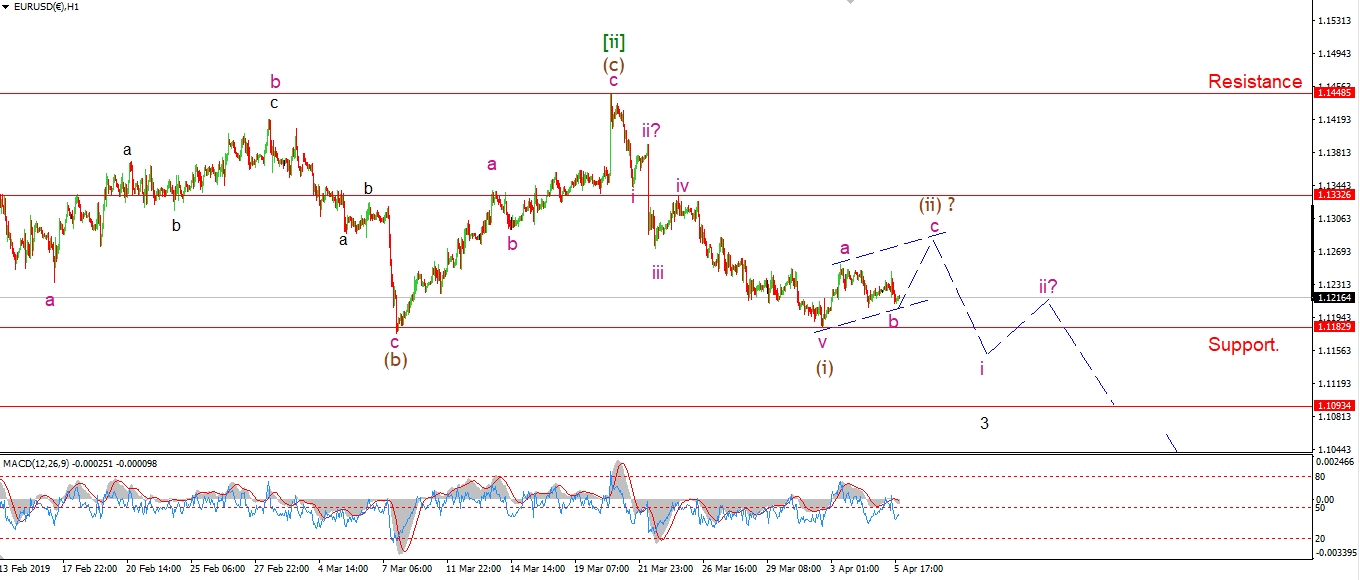

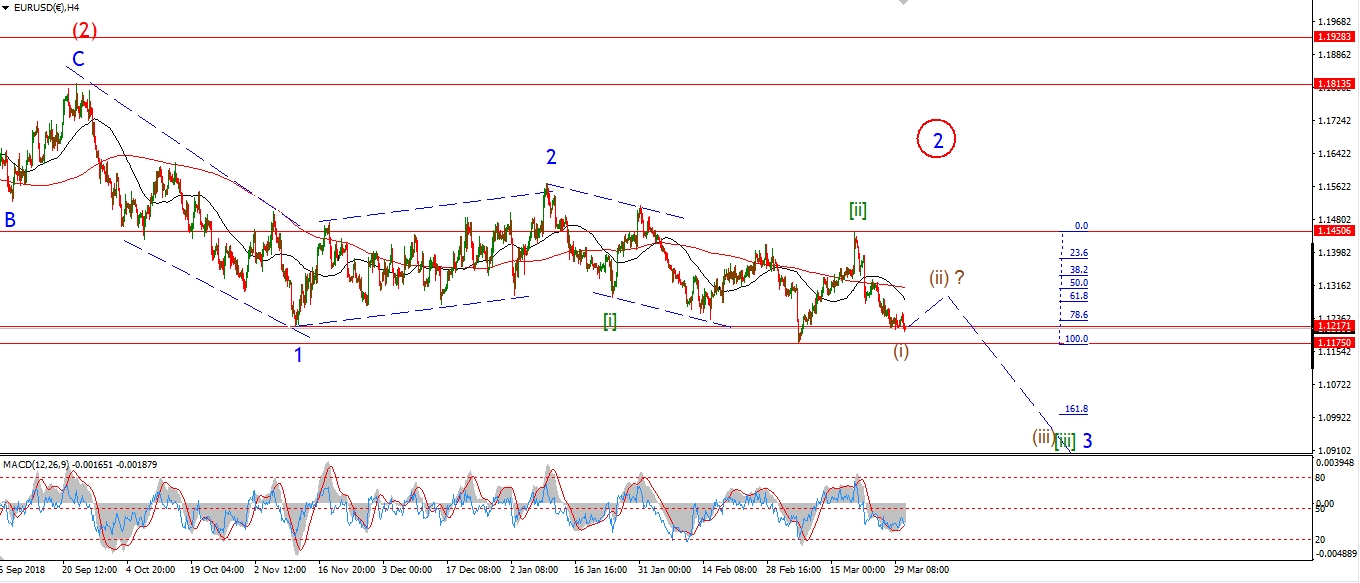

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The correction in wave (ii) is still in force today after a pretty uneventful week.

Wave (ii) should continue higher on Monday as wave ‘b’ and ‘c’ close out this three wave pattern.

Wave (ii) should complete below 1.1330

which marks the high of the previous fourth wave.

Monday;

Watch for wave ‘c’ to push back towards 1.1300 again to finish wave (ii).

Wave (iii) down is expected next week.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Cable has dropped in a pretty impulsive looking form today.

This raises the probability that the alternate count will be triggered early next week.

In fact we came quite close to that today,

with the low of the session holding above 1.2975 for now.

If that level breaks,

then we can switch to the alternate count and work on wave (iii) of [i] of ‘3’ to the downside.

Monday;

Either way I look at it,

This market is staring at a very large decline in wave ‘3’ down.

We should know by Monday evening if the top is in at the previous high,

or if we have to wait for one last high in wave ‘2’ to complete.

Watch for 1.2975 to hold as wave ‘c’ of (v) gets underway.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

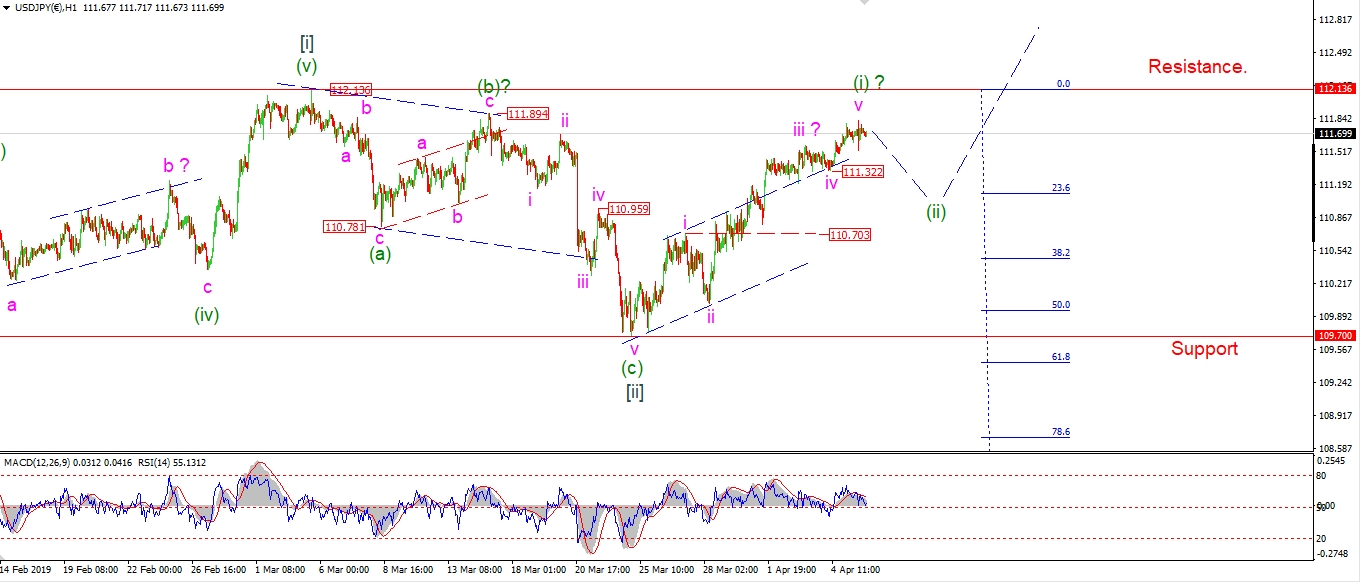

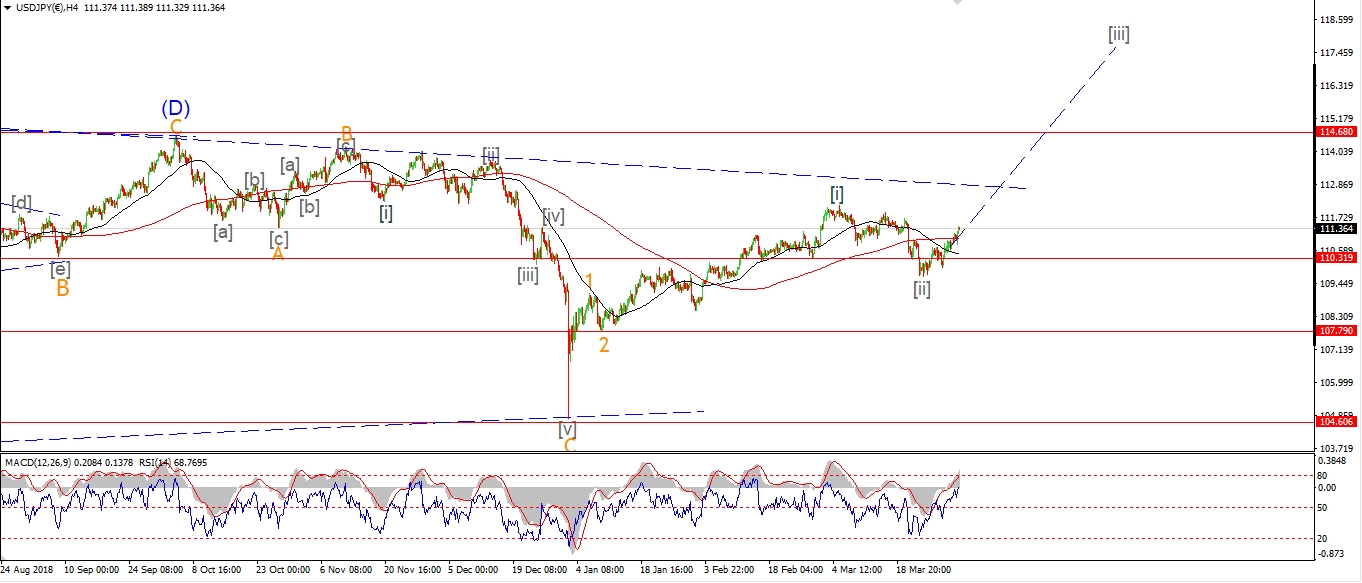

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY has rallied 200 points in wave (i) off the wave [ii] low.

This is a good start to wave [iii] up,

but I had expected a break of 112.13 to confirm the next leg up in wave [iii].

No luck on that front yet,

but we could see another rally in wave ‘v’ of (i) to form an extension.

in that case,

the wave ‘iv’ low at 111.32 must hold.

Monday;

If 111.32 breaks,

that will signal wave (ii) has begun and we can expect a decline in three waves.

Wave (ii) should find support at the 110.70 area.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Slowly but surely we are creeping up that ladder towards a new all time high!

But I hold form to the conviction that this is the final leg up to complete wave [5],

in a rolling top formation at the end of a 90 year bull market!

These all time highs are bringing with them a severe cost.

A cost that we will all have to burden over the coming years

in the form of a deflationary depression like none we have seen before.

The smiles will be wiped off our faces when this debt bubble pops

and brings down the major pillars of the economy with it.

Wave ‘5’ of (5) of [5] is now well into its journey.

And if the current wave count holds up,

then we will see a break to new all time highs in wave [iii] of ‘5’ by the end of this month.

Next week;

I can count five waves up now done at todays highs in wave [i] of ‘5’.

The market should fall in wave [ii] beginning next week.

And wave [ii] will not take long given the extreme in bullish sentiment at the moment.

So wave [iii] of ‘5’ may even get underway by the end of next week.

This is still a precarious moment in market history,

So we should remain vigilant,

as wave ‘5’ of (5) of [5] may complete quicker than suggested.

And the anticipated turn down off the highs will be spectacular I think,

and this time it will be unanswered.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

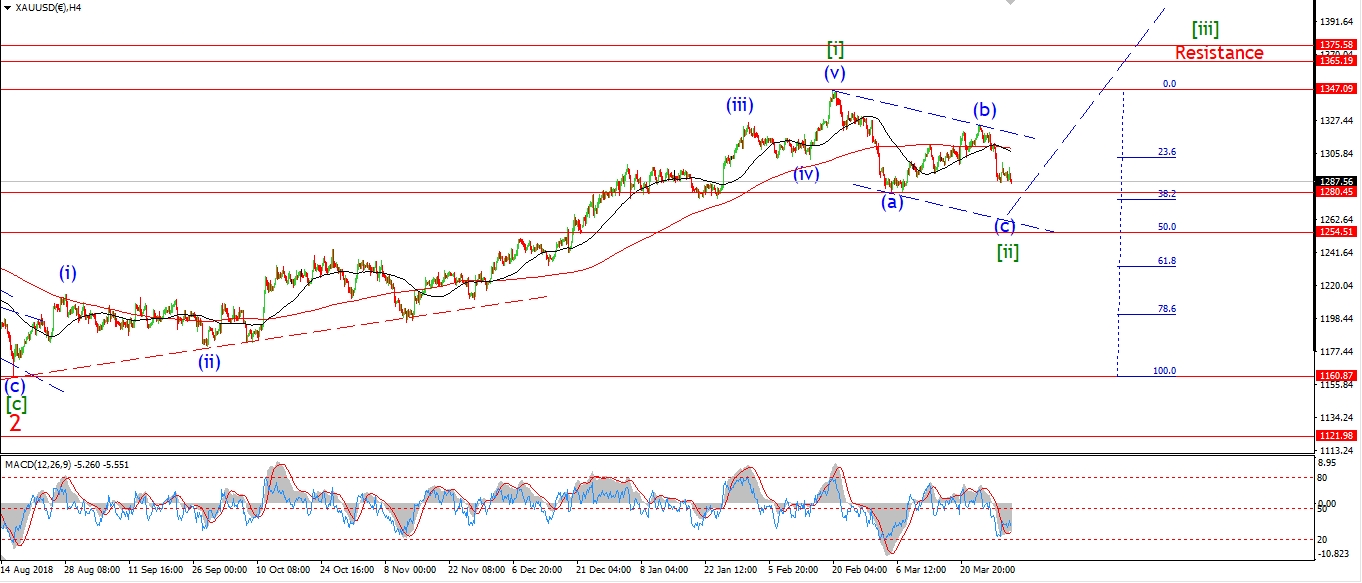

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

There is a reasonable chance that wave [ii] is now complete at Thursdays lows.

If so,

we can look forward to a nice rally ahead in GOLD over the coming months in wave [iii] of ‘3’.

The market hit the minimum target for wave (c) of [ii] on Thursday,

by breaking the lows of wave (a) at 1281.58.

The cash low on Thursday was 1281.07.

So as always, the job at hand is to identify five waves up to signal a turn back into trend again.

Monday;

Watch for 1281.07 to hold and a rally in five waves to occur over the coming week in wave ‘i’ of (i) of [iii].

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

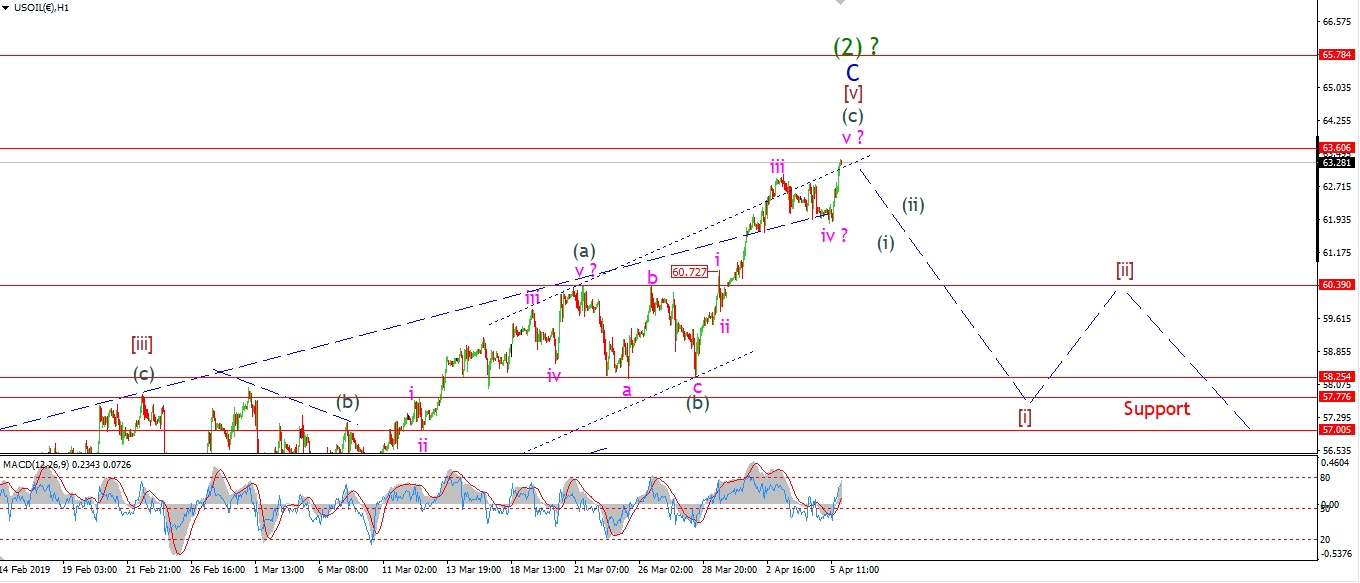

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Crude oil is marching to the beat of the bullish drum this week.

All is rosy in the economy and demand is going to push that price ever higher.

Forgive my skepticism,

but I don’t think so……

the short term count shows the price stretching out above the trend channel

to complete a fifth wave in wave (c) of [v].

The ending diagonal wave ‘C’ is still the best interpretation I can see at the moment for the larger three wave correction in wave (2).

And this structure is now done!

Wave (3) will come in soon I think.

And we may see crude oil lead the stock market down into a death spiral again.

Monday;

the 62% retracement level is just above the the price now at 63.60.

watch for this level to end this rally in wave ‘C’ next week.

We should see an impulse wave lower to begin wave (3) by the end of next week.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

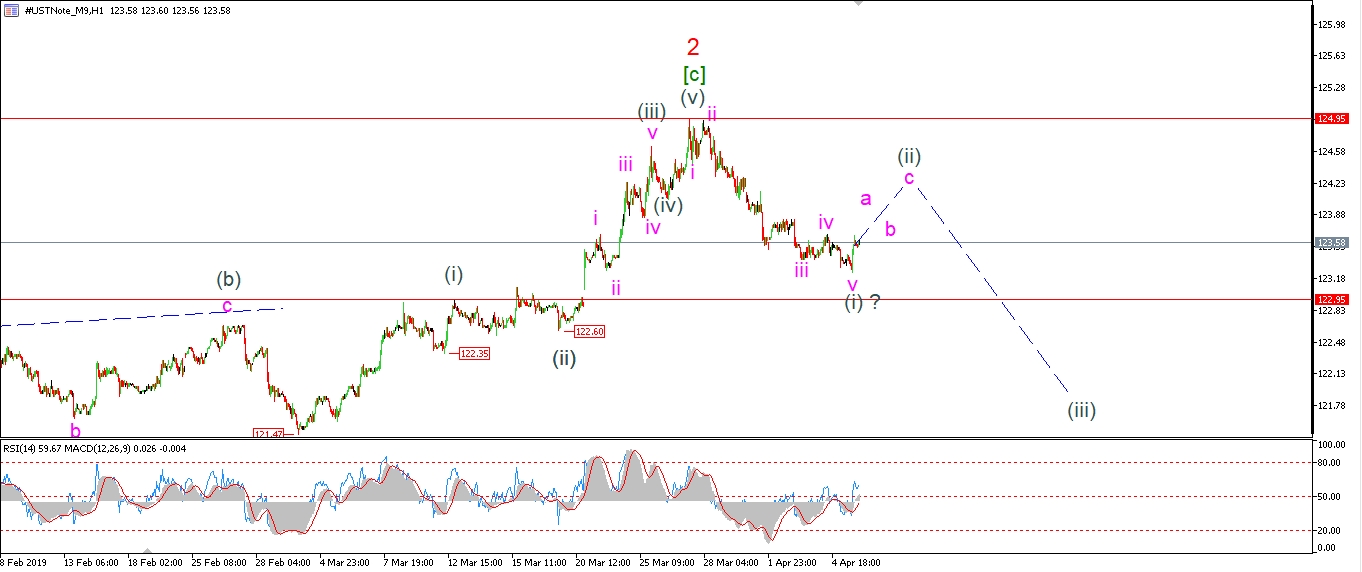

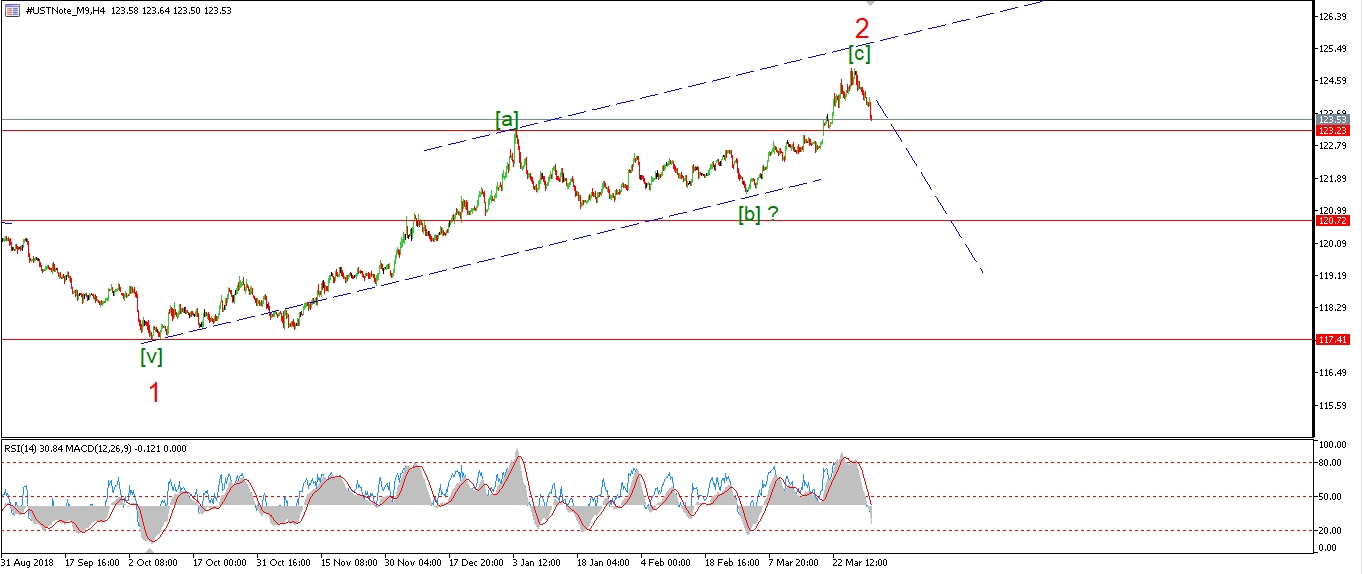

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

I have gone full neuclear on treasuries tonight!

The decline off the high at 124.95 is looking more like a five wave structure now.

And I have labelled it as such this evening.

The price hit a low at 123.24 today,

not quite breaking the previous wave (i) high but close enough to get serious about wave ‘3’ down.

A break of that previous wave (i) will be a heavy signal that we heve turned down.

Monday;

Watch for wave (ii) to begin a three wave correction higher which should hit 124.00 again.

If this action occurs,

then we are on, to turn down in a big way in wave ‘3’.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

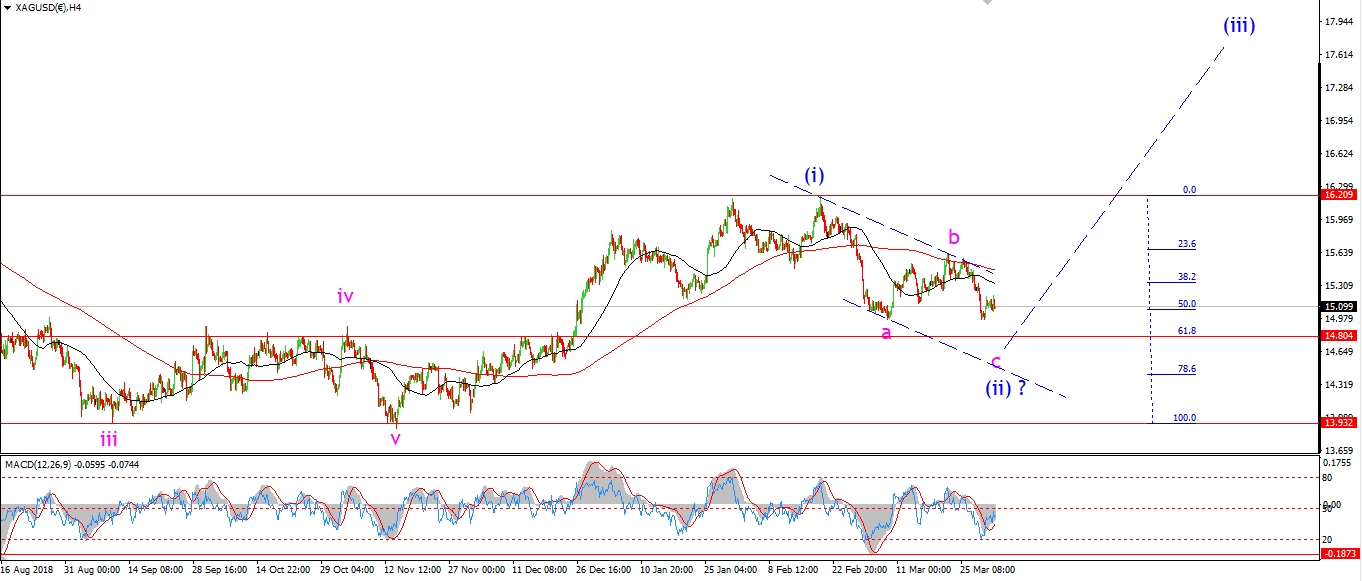

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The same spike lower on Thursday is labeled as the end of the correction in wave [ii].

The price immediately bounced back off that low in a nice impulsive fashion.

for the moment this is labelled as waves ‘1’ and ‘2’ higher to begin wave ‘i’ up.

the action is looking positive for a turn back up into wave (iii) next week.

First we need a five wave rally and break of the previous ‘b’ wave high at 15.62 to confirm the turn.

Monday.

Watch for the low to hold at 14.90 and wave ‘i’ up to continue.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P is crawling back to that all time high at 2941.

The market is like a wounded pet limping home to die by the fire!

At the moment we have daily and 4hr momentum divergence which does not auger well for the future.

We should get that new all time high in wave ‘5’ of (5),

but I don’t think it will last very long.

Going on the complete lack of interest and complacency in this lifeless price action.

It seems we are fast running out of marginal buyers now!

Today’s rise is labelled as the beginning of wave (v) of [iii].

Wave (v) should push above 2915,

as this is the level where waves [i] and [iii] reach equality.

Wave [iv] and [v] should then serve up a new all time high and a break of that psychological 3000 level.

Monday;

We should see an end of wave [iii] by the middle of next week.

Watch for wave (v) to hold above 2865 on Monday.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

That is it for the weekly updates.

Thanks for your patience this week.

I wish you all a great weekend.

God bless,

and see you Monday!

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]