[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Good evening to one and all.

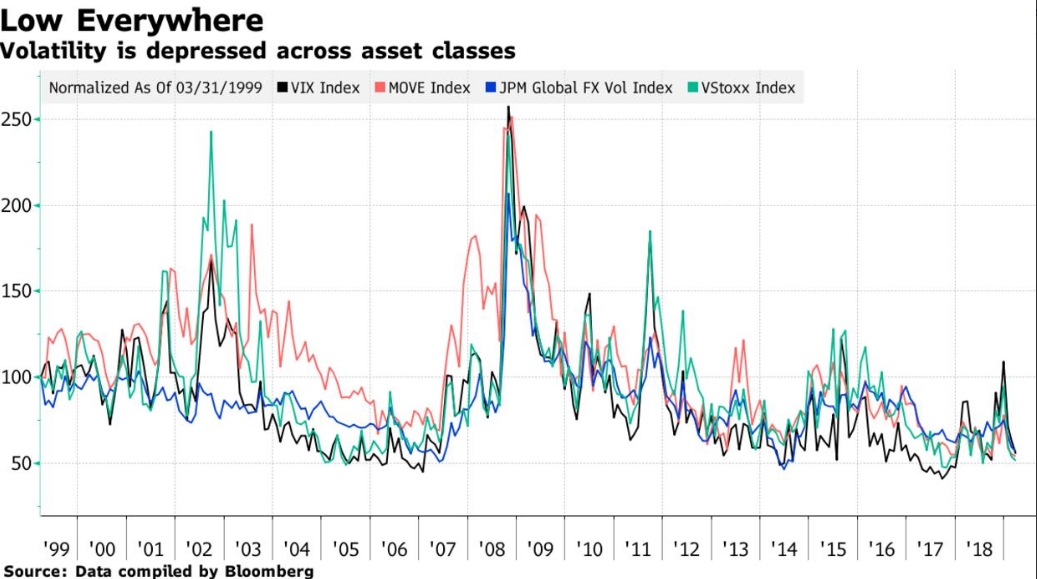

On the theme of a risk-less financial world which the FED seems eager to promote,

Heres an interesting visualization of the numb march higher across the asset classes over the last two and a half months.

Not a cloud in the sky,

never mind those rich valuations or the evaporating VOL.

This is the best economy in the history of………………………….

Here we go!

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

It is hard to pull a positive for EURUSD from todays action.

The price hit a slight new high in wave ‘c’ by 2 pips over Mondays high.

Wave ‘ii’ has drawn close enough to the resistance line now,

and wave ‘iii’ down is over due,

so I expect tomorrow should begin with a drop to begin wave ‘1’ of ‘iii’.

The alternate count can be interpreted a little differently also after the recent action.

A running flat wave (ii) would also complete now,

where wave ‘c’ of (ii) would finish below wave ‘a’ of (ii).

Both counts call for a drop immediately.

Tomorrow;

Watch for the first spike lower in wave ‘1’ of ‘iii’.

A lower high created in wave ‘2’ of ‘iii’ would offer a nice low risk opportunity.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

If the high of todays session holds at 1.3309,

and the price turns lower tomorrow in an impulsive fashion,

then we can say that wave (i) of ‘3’ has finally begun.

Todays high may have completed a running flat wave ‘ii’ at 1.3309.

If so,

then wave ‘iii’ down is now underway.

Tomorrow;

Wave ‘ii’ must not break 1.3380,

and wave ‘iii’ must push lower tomorrow if this bearish setup is to remain valid.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

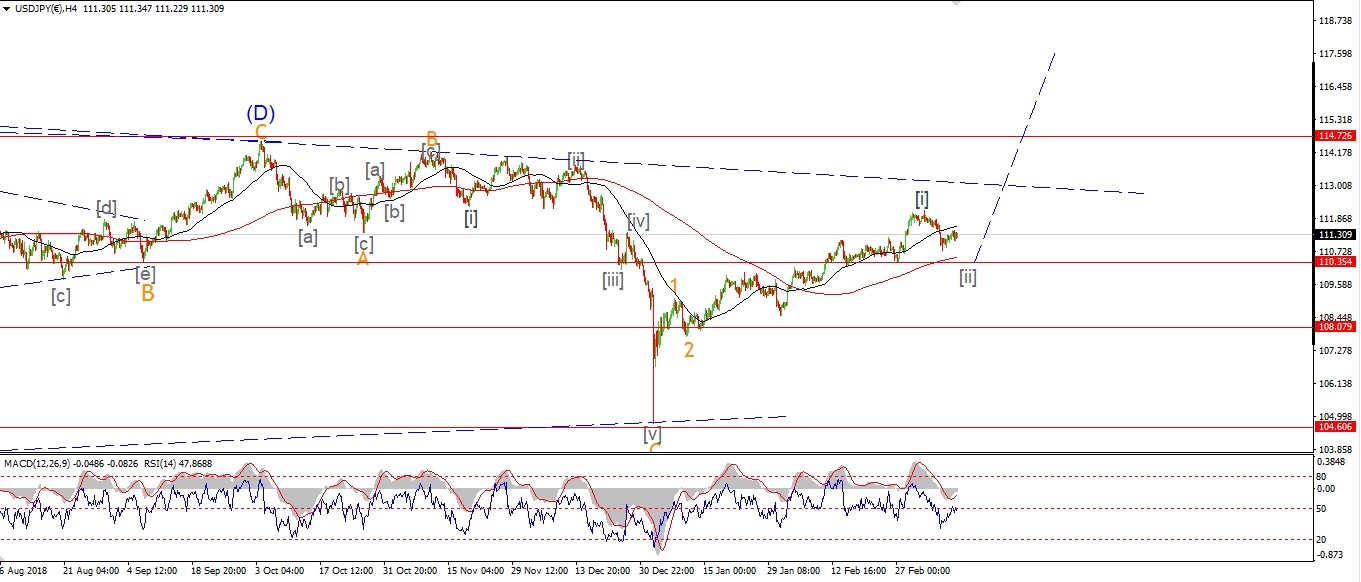

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY seems to be tracing out a double combination pattern in wave [ii] grey.

The price is not creating a five wave move lower off wave (b).

Instead wave (c) is best viewed as a three wave decline.

Wave ‘a’ and ‘b’ of (c) are most likely complete,

And now wave ‘c’ of (c) should drop into the lower trend channel line to finish the larger pattern.

Tomorrow;

The high at wave (b) lies at 111.89.

This level must hold and wave ‘c’ of (c) should continue to drop into the target area at 110.56.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The DOW did push higher in the futures early this morning

and then gaped higher on the open

and broke through that upper trend channel line again

this created a small throw over to complete wave ‘c’ of (ii).

And since that high at 26109,

the market dropped sharply in a possible five wave form.

If wave (ii) is now complete at that high,

then wave (iii) should dominate for the rest of the week.

Wave ‘i’ of (iii) will be confirmed with a break of 25460,

so we have a bit of work to do before getting a solid indication that the top is in.

Tomorrow;

Watch for 26109 to hold at wave (ii).

Wave ‘i’ of (iii) should continue lower tomorrow.

This market could get very exciting from here.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

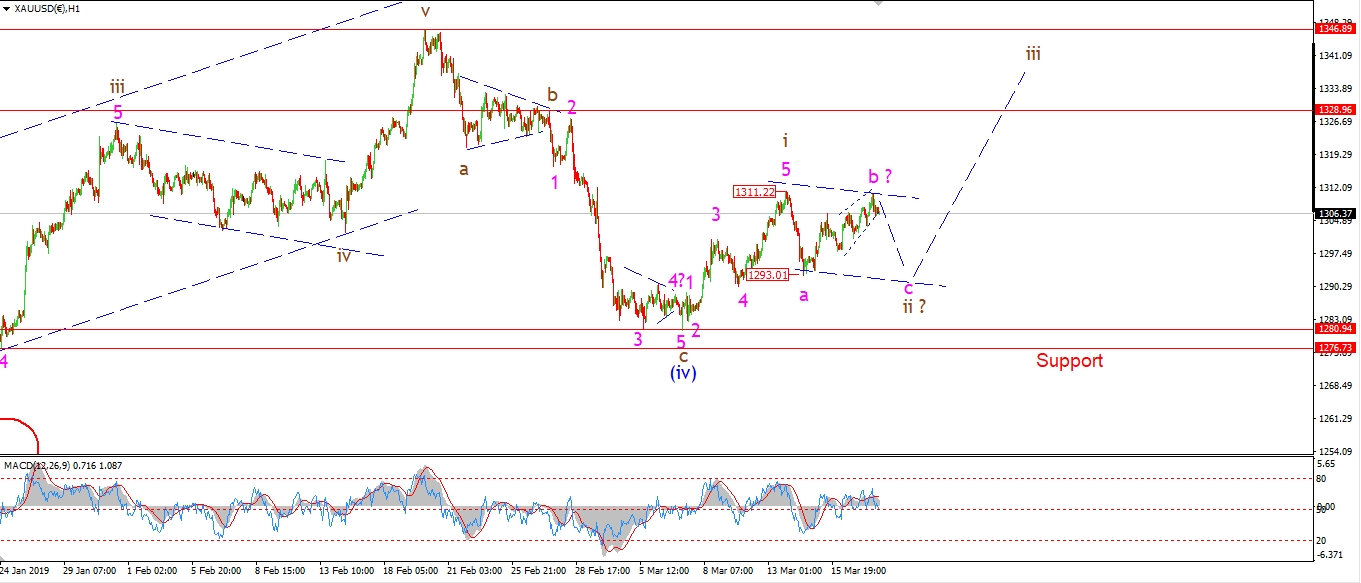

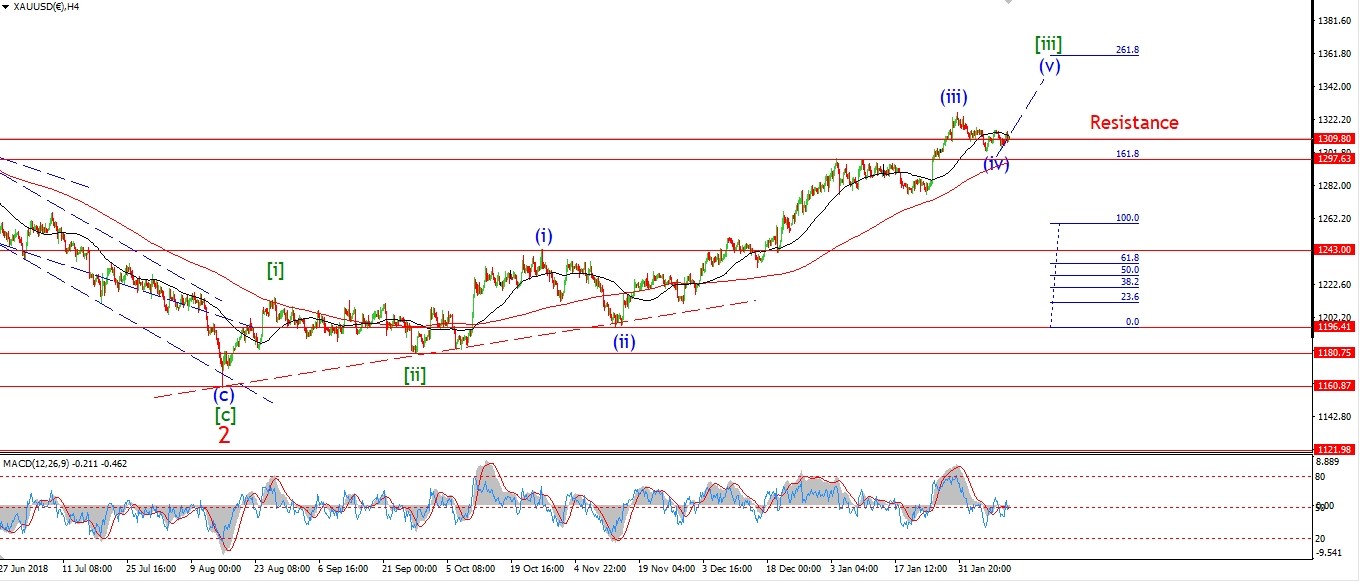

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

I have shown todays rise as an ending diagonal wave ‘c’ of ‘b’.

The wave ‘b’ idea still holds as the rise off 1293 is in three waves so far.

A drop in wave ‘c’ is expected tomorrow to break 1293 again and complete wave ‘ii’.

A sharp rise back towards 1328 will rule out the larger wave ‘ii’ and signal that wave ‘iii’ has begun.

Tomorrow;

watch for a possible drop in wave ‘c’ to finish wave ‘ii’.

Wave ‘ii’ must hold above 1280.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

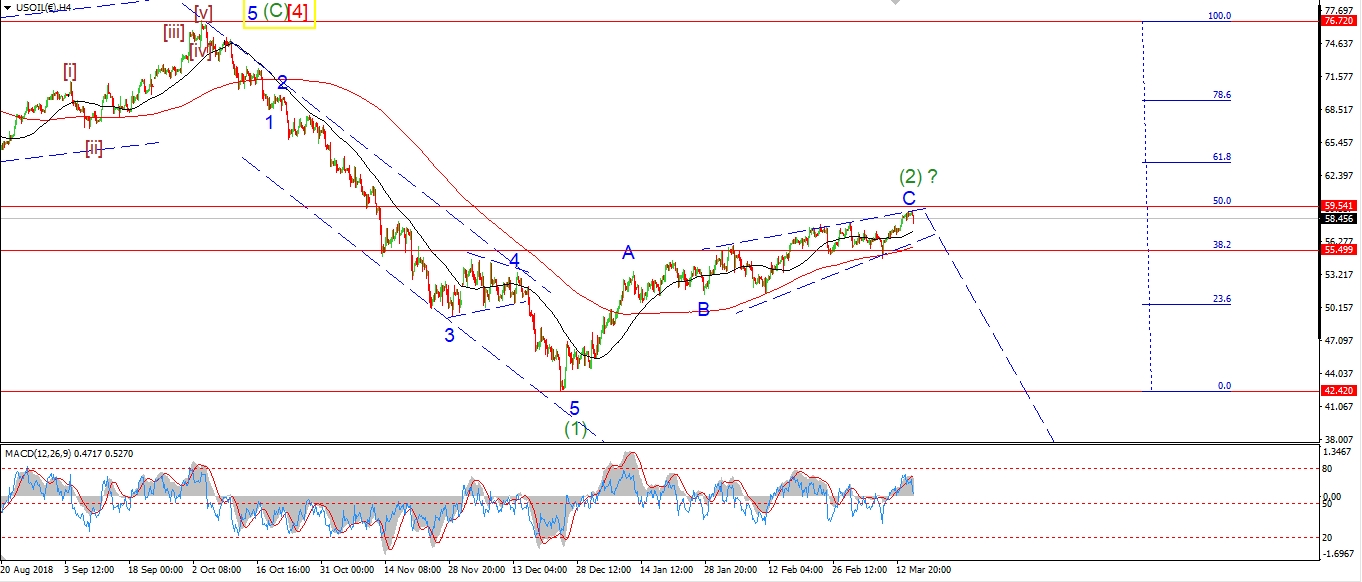

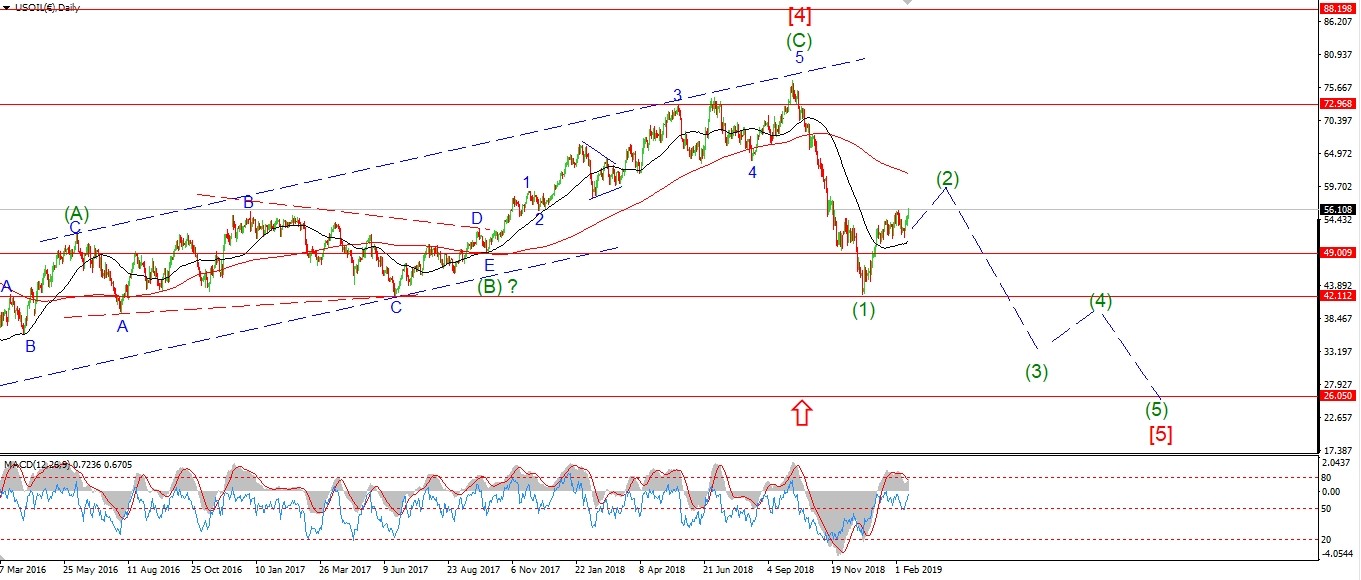

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Crude reached a high at 59.57 cash today.

not quite the magic 60 handle I thought we might see!

But still close enough to the 50% retracement level of wave (1) down to call wave (2) done.

Crude sold off along with stocks this evening.

Which is interesting given that I am expecting a third wave down in crude.

And the main count in the stock market shows only a ‘C’ wave decline on the cards.

The alternate count calls for a wave (3) decline though.

Maybe the synchronicity will continue for both markets?

Tomorrow;

The drop off the high must develop further to call the top in place.

A break of the wave (b) low at 57.00 will be the first sign that wave [i] down has begun.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

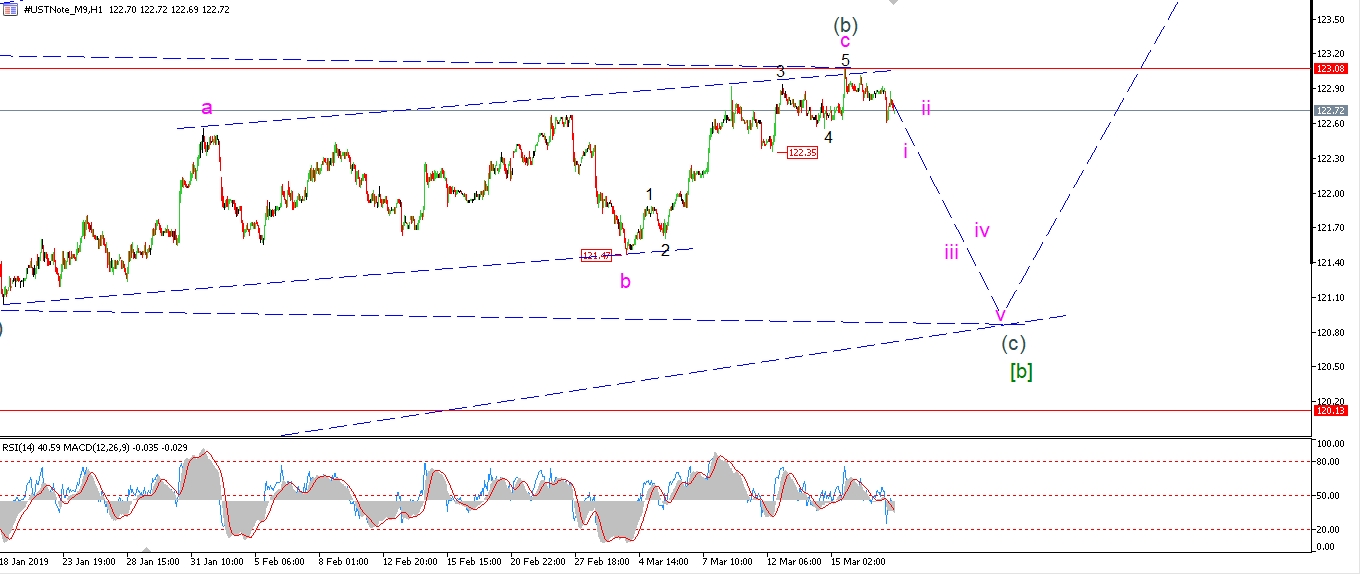

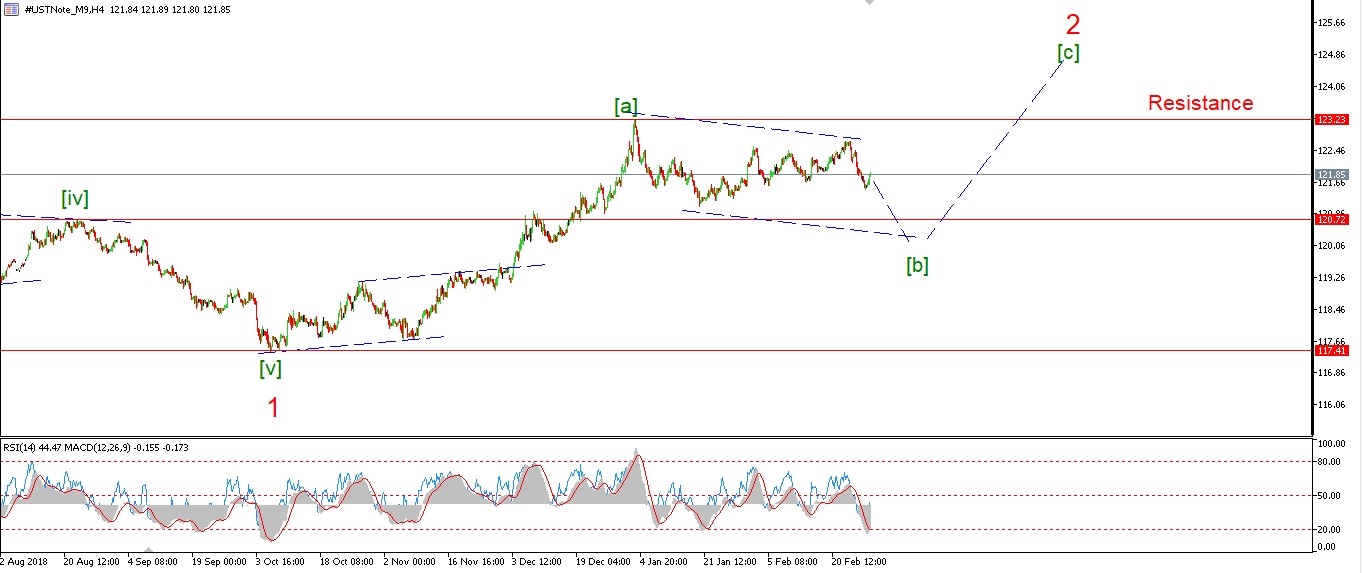

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The 10YR is finally dropping off the wave (b) highs today.

The action has not developed in five waves yet,

but the drop could be a series of smaller 1,2 waves

that will unfold into a larger five wave move.

This implies that we will get a sharp drop in a third of a third wave

to carry most of the wave down in wave (c) over the coming days.

Tomorrow;

All of this hinges on wave (b) holding at 123.08.

Watch for wave (c) to continue lower with a break of 122.35 tomorrow.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Although the price remains levitated today,

the action is less than I would expect to begin wave ‘3’ of ‘i’.

For this reason I have shown the possibility of a larger wave ‘2’ underway

within a trend channel.

The price would drop once more in this scenario,

but wave ‘2’ must hold above 14.97 and then return higher

to break 15.53 again in short order to confirm wave ‘i’.

Tomorrow;

watch for wave ‘2’ to complete above 14.97.

An impulsive break of 15.53 again tomorrow will signal that wave ‘3’ has already started.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The high of the session today hit 2852.42.

This brought the price right up to the upper trend channel line

to complete a possible wave ‘v’ of (v).

The nice sharp selloff for the rest of the session hints at a larger turn down in play now.

If wave ‘B’ is complete at todays highs,

then we should see a reasonable decline for the rest of the week in wave (i) as shown.

A break of that previous wave ‘iv’ low at 2722 after a five wave decline,

will be a good sign that the top is in for wave ‘B’.

And at that point we can expect a nice 700 point drop in wave ‘C’ to start with.

As for the alternate counts shown circled in red,

I simply cannot discard them!

And if the market does experience a significant selloff from here,

the probability of these alternate counts will only grow.

So I’m afraid the outright bearish view

will be sticking around for the long haul it seems!

Tomorrow;

Watch for this initial selloff to continue in wave (i).

2852 must hold.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]