[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Welcome back all.

I mentioned the insider selling early last week,

well here’s an article from Bloomberg on that topic which is very interesting indeed.

The rats are most definitely jumping ship now, after the most rapid appreciation in stock valuations in years.

It would be very interesting to find out if they are selling stock granted as part of year end compensation for 2018.

It’s a nice scam to run in a public company;

Institute a big stock buyback program to massage the EPS figures,- increasing shareholder value don’t you know!

Borrow heavily on the back of company to fund said program.

Next step, grant yourself a nice bonus using the stock you bought back.

And finally;

sell the stock back into the market again and reap the rewards.

In the end, the company is loaded up with debt and the shareholders are left to cover the losses.

This is outright fraud in my book!

And this is bubble behavior at its best! Enron? Countrywide? Bear sterns?

Down to business.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

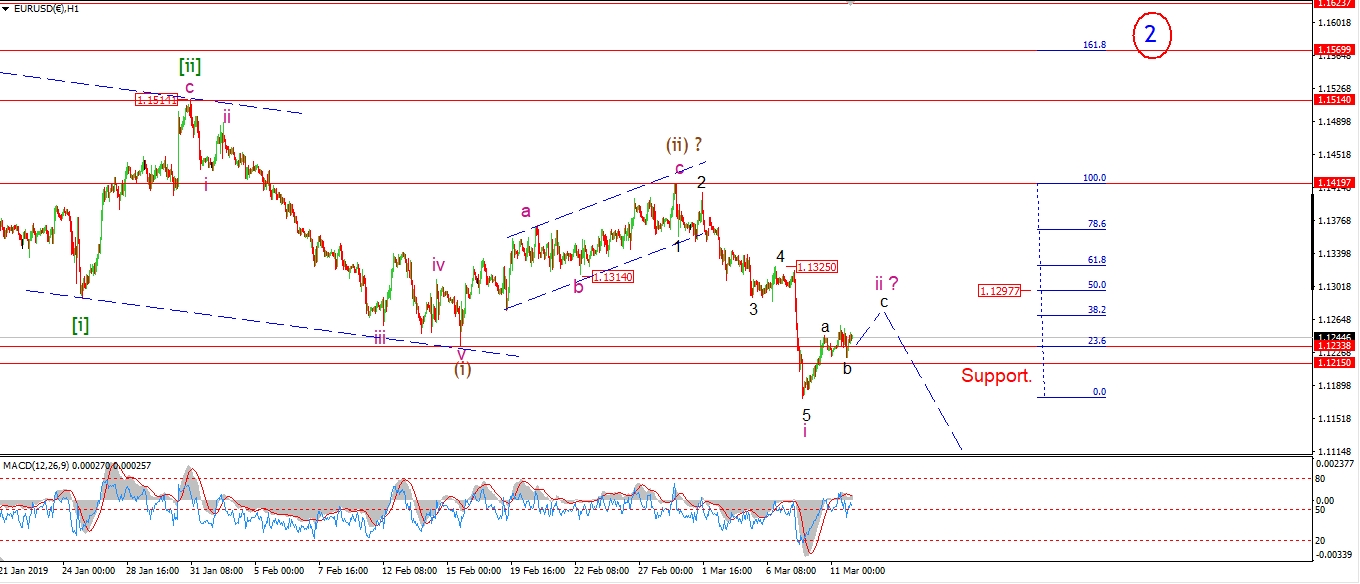

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

We seem to have a three wave correction off Fridays rally in place today.

This is labelled wave ‘b’ of ‘ii’.

With a further rally in wave ‘c’ needed to complete wave ‘ii’ over the coming days.

A 50% retracement of wave ‘i’ down will carry up to 1.1297.

So that is the target for wave ‘ii’ to complete.

I am keenly aware now of the high degree of bearish sentiment on the Euro.

For that reason I have not completely dismissed the alternate count shown circled in red.

A rally above 1.1420 will trigger that count.

Tomorrow;

Watch for wave ‘c’ to hit 1.1297 and again turn lower into wave ‘iii’ of (iii).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The sharp rise today suggests that wave ‘ii’ is now underway.

The price found support at the internal wave ‘b’ at 1.2966 and rallied from there.

I have shown this rise as wave ‘a’ of ‘ii’.

Wave ‘b’ and ‘c’ must hold below 1.3349 to complete wave ‘ii’.

A zigzag 5,3,5 correction would fit the form the rally today,

So I expect to see a three wave correction off todays highs in tomorrows session.

Tomorrow;

Watch for wave ‘ii’ to carry on until the middle of the week in a net sideways form.

1.3349 must hold.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The rise off the low labelled wave ‘ii’ has been quite subdued so far.

Price rose into the 111.20 highs of wave ‘b’in a very overlapping form.

This could be a wedge pattern off the lows to begin wave ‘iii’,

but I have my doubts.

I will reserve judgement until after tomorrows action on wave ‘iii’.

If we see a further rally which breaks 111.85,

that will be a positive signal.

And a break of 112.13 will confirm wave ‘iii’ underway.

Tomorrow;

watch for the low of wave ‘ii’ to hold at 110.78 and continued upside to begin wave ‘iii’.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

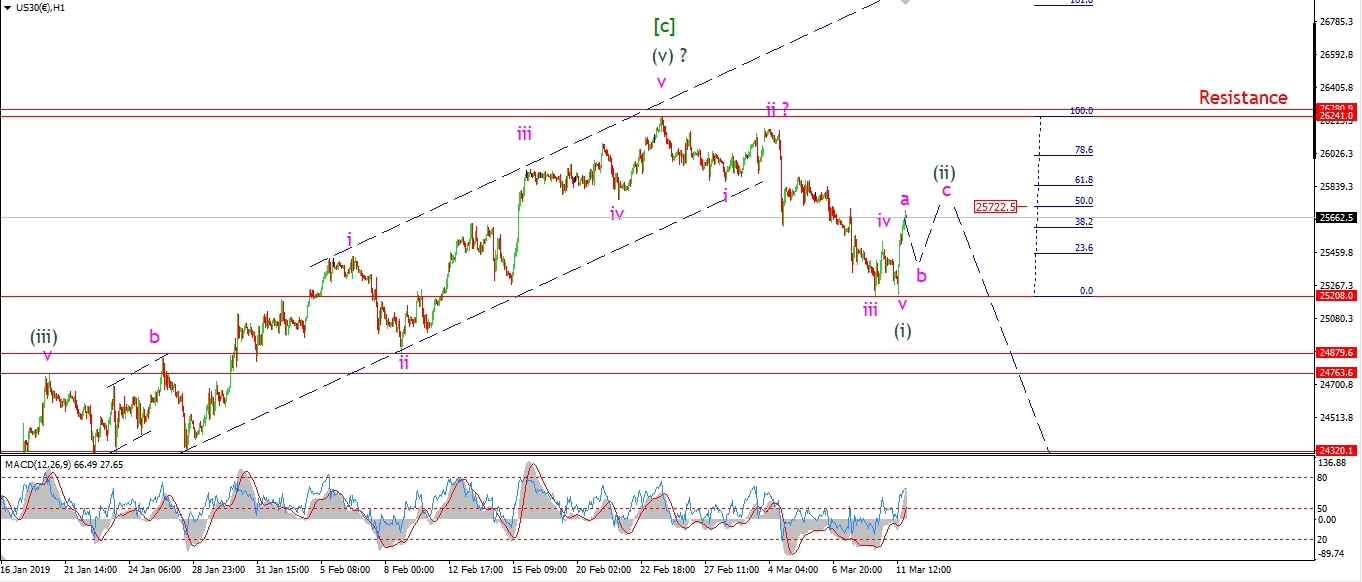

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Futures were lower early this morning,

the market then gaped lower by about 250 points at the open.

and then, almost immediately,

the market reversed higher to begin wave (ii) grey.

The price is now closing about 450 points higher off the lows of the session.

Just another normal day in an extreme financial bubble!

I have labelled this rise as wave ‘a’ of a three wave correction higher in wave (ii).

The price will reach a 50% retracement in wave (ii) at 25772.

So we could already be nearing the highs of a second wave right now.

If we see another sharp drop below 25208 tomorrow,

that will signal wave (ii) is complete and wave (iii) down is beginning.

Tomorrow;

Watch for a possible three wave correction

to create a lower high in wave (ii) by wednesday evening.

Price should drop in wave ‘b’ of (ii) tomorrow.

A sharp drop will signal that wave (ii) is already complete and wave (iii) is beginning.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

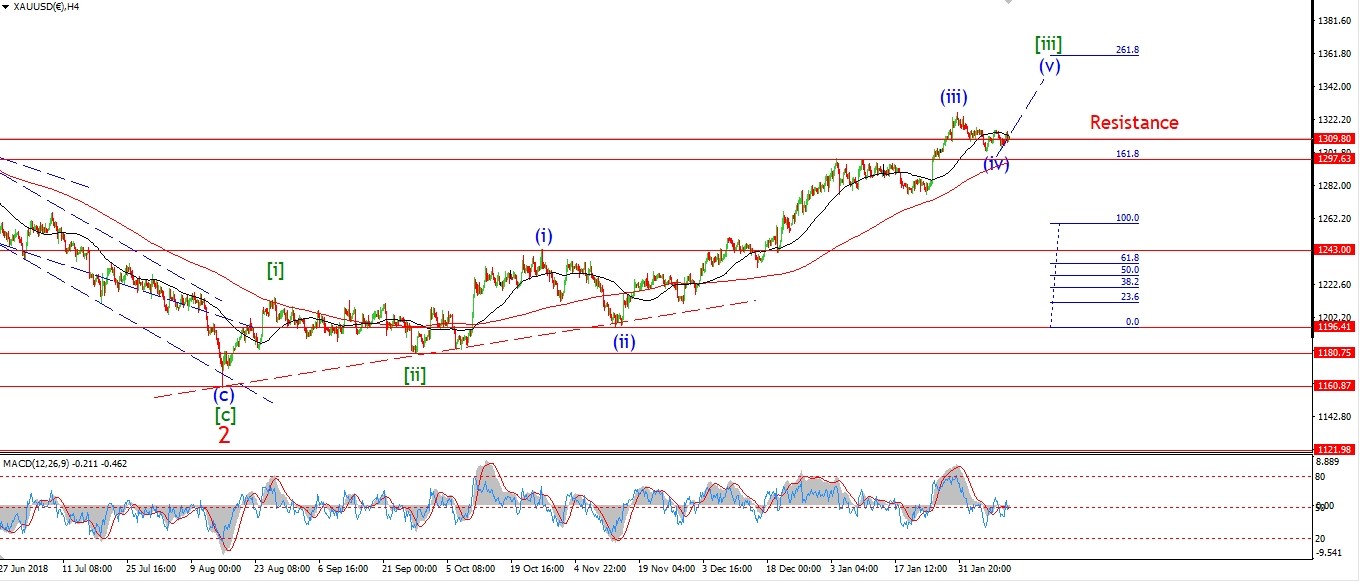

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Gold has dropped correctively off Fridays highs as expected.

This drop is labelled wave ‘2’ of ‘i’,

but it is hard to know if wave ‘2’ will develop into a larger three wave form tomorrow.

Even so,

wave ‘2’ must complete above Fridays lows at 1281.

And then wave ‘3’ of ‘i’ should rally back towards 1320 by the end of this week.

Tomorrow;

Watch for wave ‘i’ to continue higher this week.

Wave ‘2’ of ‘i’ must now hold above 1280.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

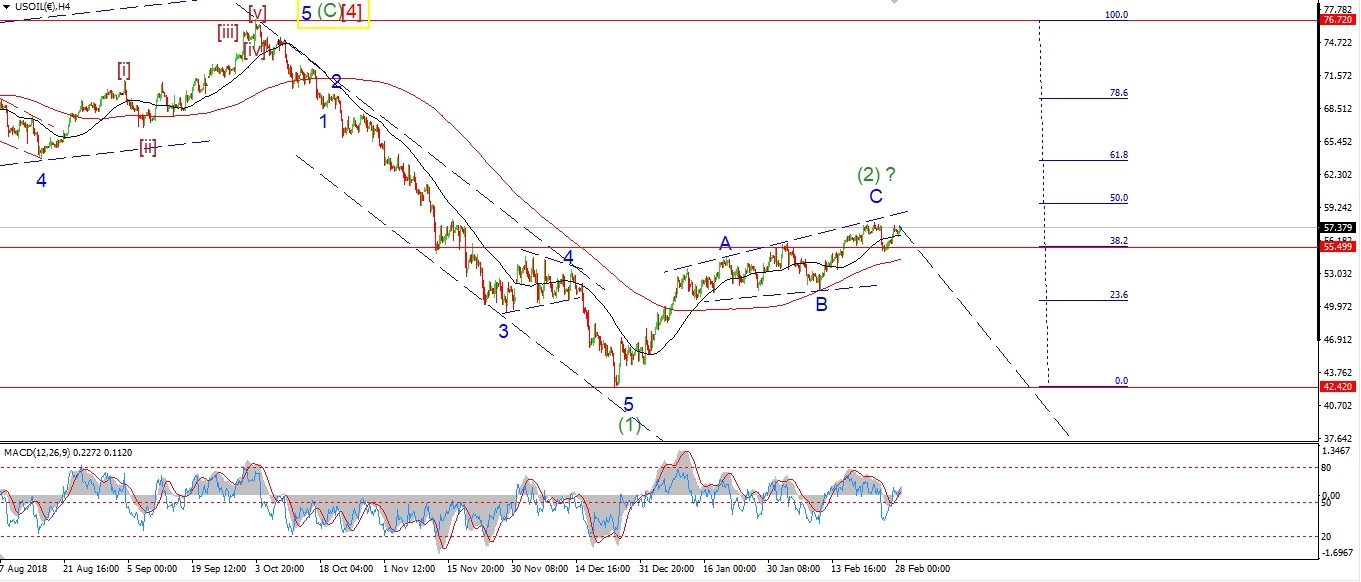

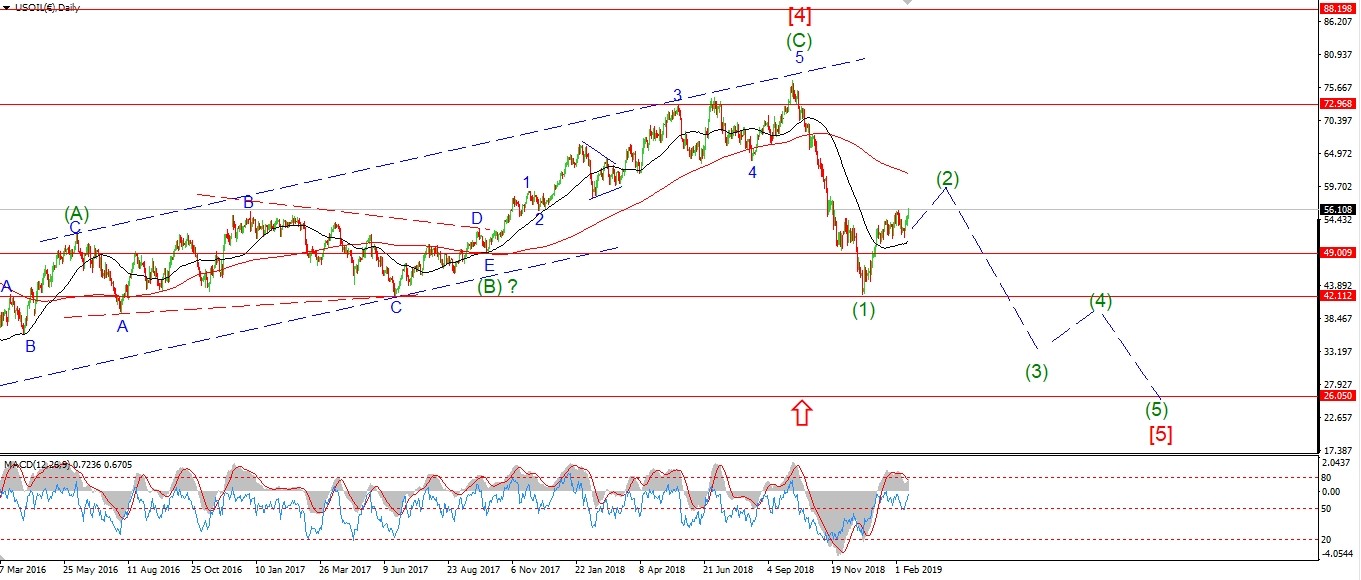

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

It’s been a wild ride over the last few sessions in Crude!

Todays rally has ruled out the immediately bearish interpretation.

The price has rallied in an impulsive fashion off the lows

and broken the previous interim high at 56.99 ruling out the ‘i’ ‘ii’ pattern lower.

This evening I have switched to the next best interpretation.

This involves an ongoing wave ‘C’ in five waves off the wave ‘B’ lows.

Wave ‘C’ is shown as an ending diagonal

with one last push higher into the upper trendline left to complete a five wave rally.

A 50% retracement of wave (1) down will be hit at 59.63.

and I have marked this on the short term chart.

Tomorrow;

Watch for a small correction in wave (ii) followed by a continuation higher in wave (iii).

Slowly but surely we are reaching the end of this correction in wave (2).

The market is simply cycling through the ending waves right now.

Once complete,

The longer term downtrend will resume in wave (3).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

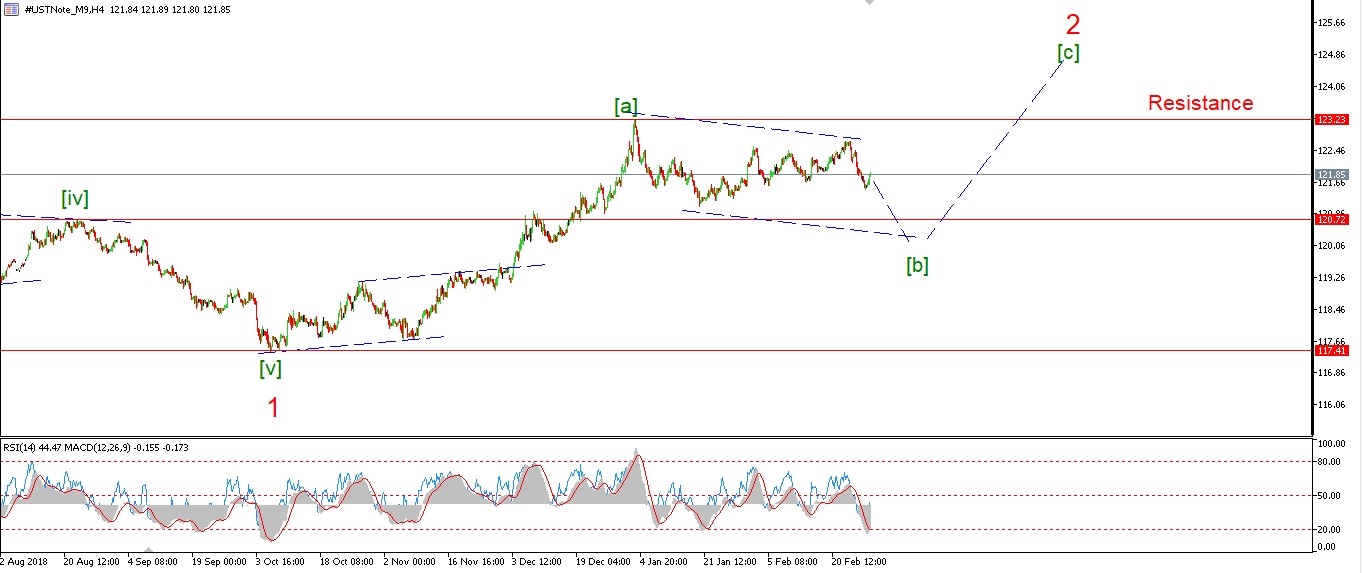

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

It has been a flat day in the bond market!

which gives us nothing of substance to work with this evening.

I am looking for wave (c) to come into force this week

and carry the price lower to fill the trend channel

and complete a large three wave structure in wave [b].

The price will hit the trendline at 120.70.

Then we will be clear for a terminal rally in wave [c] of ‘2’.

Tomorrow;

watch for the price to begin to fall in wave ‘i’ of (c).

A break of 121.42 will confirm the current count.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

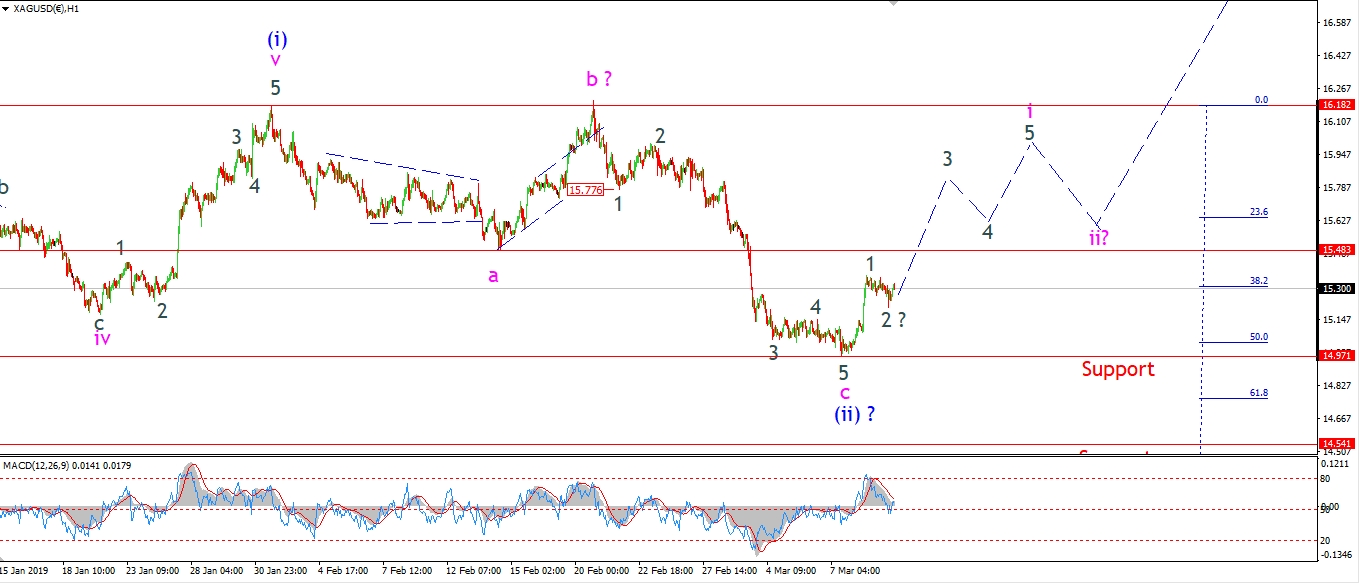

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver corrected slightly off Fridays highs today,

and we even managed a bounce towards the end of the session.

It is likely that wave ‘2’ is now complete at the lows.

A rally tomorrow which pushes above 15.50 again

will signal that wave ‘3’ of ‘i’ is underway.

This week I am looking for a clear five wave rally off the wave (ii) low

to confirm that the corrective phase is complete.

At that point I think we can look significantly higher in wave (iii).

Tomorrow;

Watch for price to hold above 15.00 again as wave ‘3’ gets underway.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

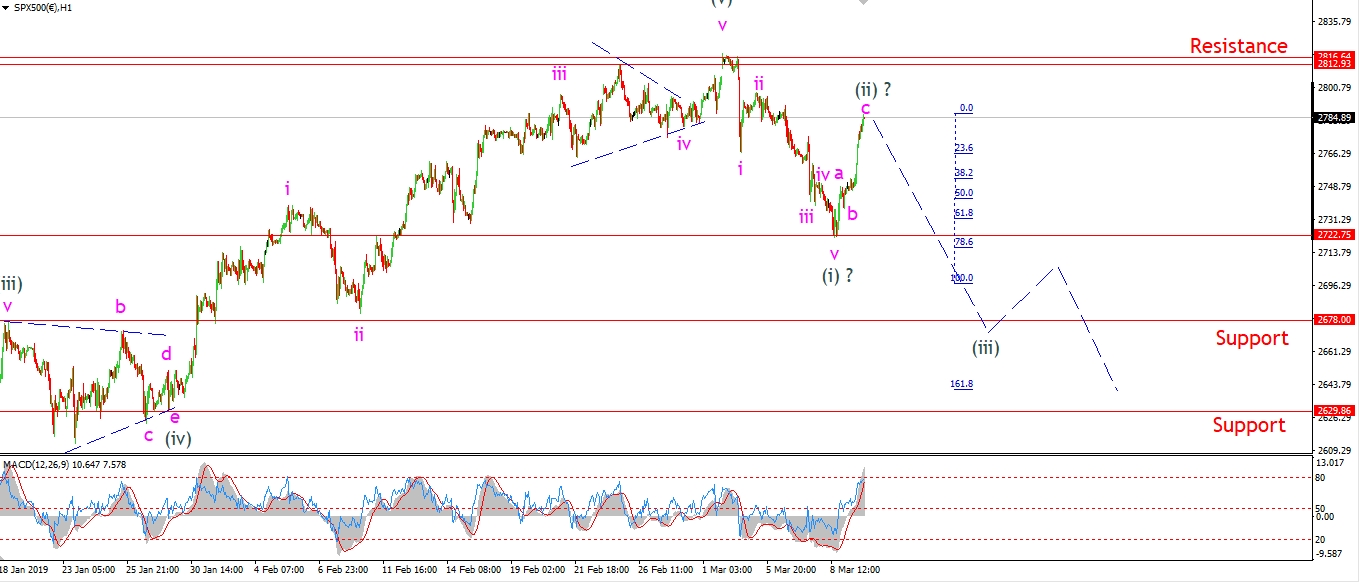

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The S&P blasted higher by 40 points today,

without any of the whipsaw action we saw in the DOW this morning.

And now the price is closing at the highs back within touching distance

of that long-term resistance at 2800.

Another failure at 2800 in wave (ii),

followed by an acceleration lower in wave (iii) will be serious shot accross the bow for the broad market.

Tomorrow;

But first of all we need to see an end to this wave (ii) rally.

The recent highs at 2816 must hold.

We need to see a return lower tomorrow to begin wave (iii).

The wave (i) low lies at 2722,

A break of that low will signal that wave (iii) has begun.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]