[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Hi there everyone.

A couple of things to ponder this evening!

Here the first.

Karl Denninger at the market ticker does the best jobs numbers analysis that I can find.

I was very suspicious about that release last week,

and then I read his take on it.

In short,

the report is a whole load of crap,

based on statistical models which overestimate and distort on a routine basis.

I simply cannot believe the headline figures that comes out of that office!

Second:

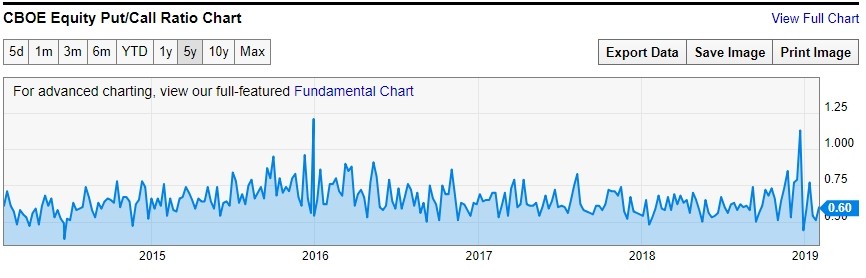

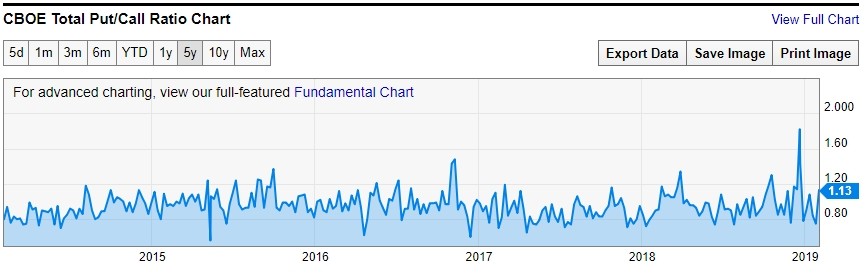

the latest put/call date from the CBOE is very telling indeed!

The Bulls slammed the ratio to the floor over the last few weeks!

Bulls are in party mode again.

Ok down to business.

[/vc_column_text][/vc_column][/vc_row]

[_s2If current_user_can(access_s2member_ccap_eurusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

EURUSD

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The drop in EURUSD today is less impulsive than expected.

It could be that wave ‘3’ down is getting ready to extend and accelerate,

or,

the correction in wave wave ‘2’ is still unfolding.

the price has yet to break that 1.1404 low at wave ‘b’ pink to confirm the turn down into wave ‘i’.

So we are still on the hunt for a clear five wave move to the downside in wave ‘i’.

Tomorrow;

watch for wave ‘3’ of ‘i’ to continue lower back towards the 1.1300 level again in five waves.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gbpusd)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GBPUSD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Cable has only drifted lower in a very corrective fashion off last Thursdays wave ‘a’ high.

This suggest the decline is only wave ‘b’ of ‘ii’.

and wave ‘c’ is left to complete at the 1.3160 level again.

once wave ‘ii’ completes we should see a drop below 1.2926 again in wave ‘iii’ of (i).

The short term alternate allows for a run up to the 1.3300 level again

in a larger wave (c) of [c] as shown on the 4hr chart.

If the price breaks 1.3220,

this count will be triggered.

Tomorrow;

watch for wave ‘c’ of ‘ii’ to complete at 1.3160.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_usdjpy)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

USDJPY

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

USDJPY has hit the target at 110.00 today,

reaching a high of 110.16 before dropping this evening.

The USD is showing early strength against the yen,

and this strength should transfer to the other cross rates soon enough.

The rally off wave (ii) at 108.49 is a nice clear five wave pattern labelled wave ‘i’.

Wave ‘ii’ should now correct in three waves off the high of wave ‘i’.

And at that point we will have a bullish impulse wave in place

to lead the way into a rally in wave ‘iii’ of (iii).

with an initial target at 112.12.

Tomorrow;

Watch for wave ‘ii’ to get underway off the highs of wave ‘i’.

the 50% retracement level of wave ‘i’ lies at 109.32.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_dow_jones)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

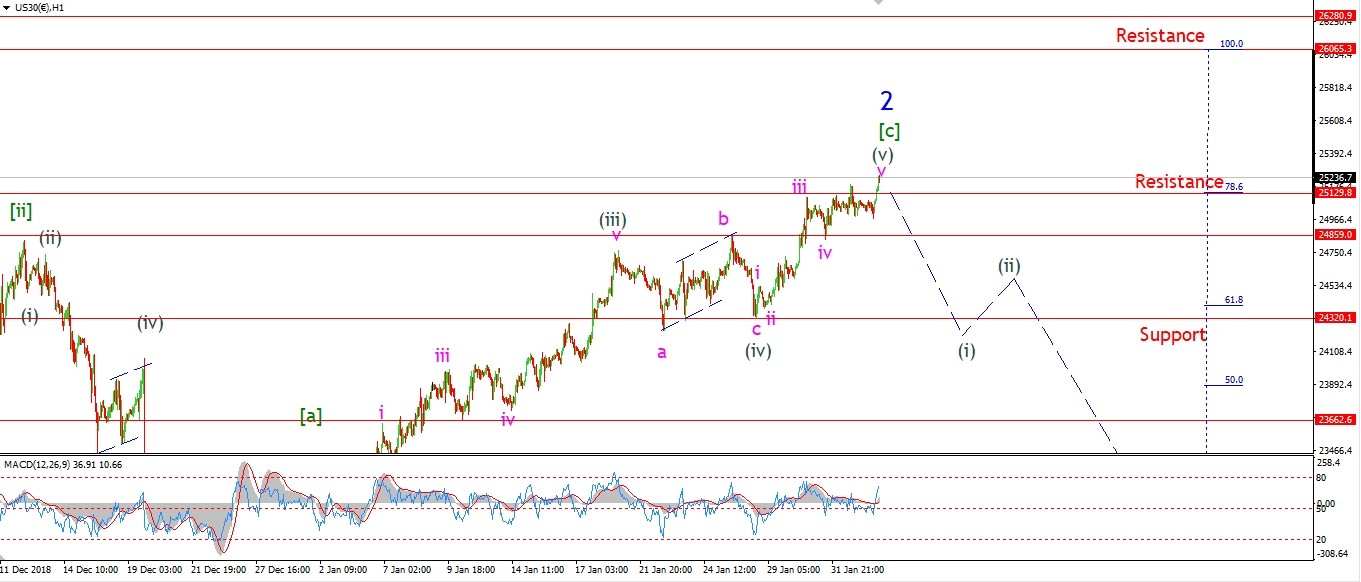

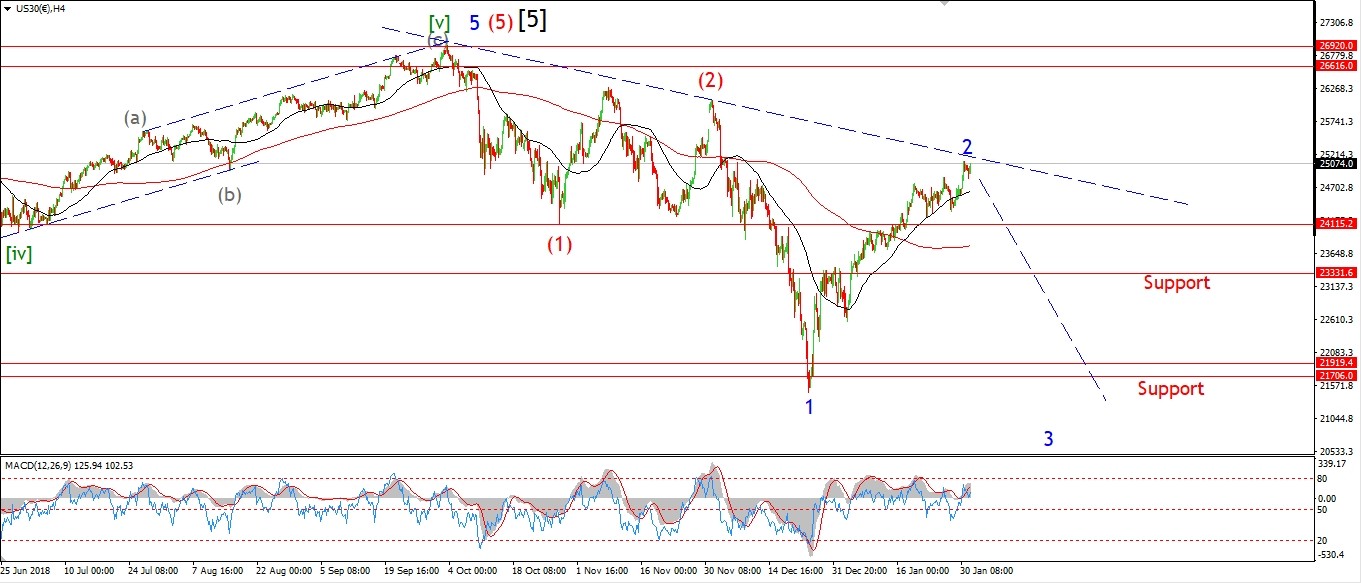

DOW JONES INDUSTRIALS

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The DOW rally in wave (v) is petering out this evening,

The price is close to the highs of Friday evening,

but so far has failed to break that level.

I do expect wave (i) down to begin this week as the wave structure in the rally off the lows looks complete,

and the general state of euphoria in the market is back at extremes.

This market is so over extended to the upside now

that I think the initial move off the high in wave (i) will be like a Hangman’s trapdoor opening beneath.

The market could get violent quickly from here.

Tomorrow;

A move back below 25000 again should get wave (i) underway.

Watch for a break of that previous wave ‘iv’ of (v) in wave ‘i’ of (i).

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_gold)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

GOLD

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The price has moved off the high at wave (iii) in three waves so far.

I have labelled this as wave ‘a’ of (iv).

wave ‘b’ may even be underway now off todays lows at 1308.

That wave should complete by midweek,

and then wave ‘c’ of (iv) will likely continue lower for the remainder if the week.

Initial support at 1276 is the target for the low of wave (iv).

I mentioned in the video this weekend

the possibility that the rally just complete is only wave ‘iii’ of (iii).

If so,

the price will not get that low in this correction.

If we get an impulsive rebound off the 1300 level that will signal that wave (iii) is more upside left to run.

Tomorrow;

Watch for wave ‘b’ of (iv) to correct higher briefly,

wave ‘c’ down should commence soon.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_crude)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

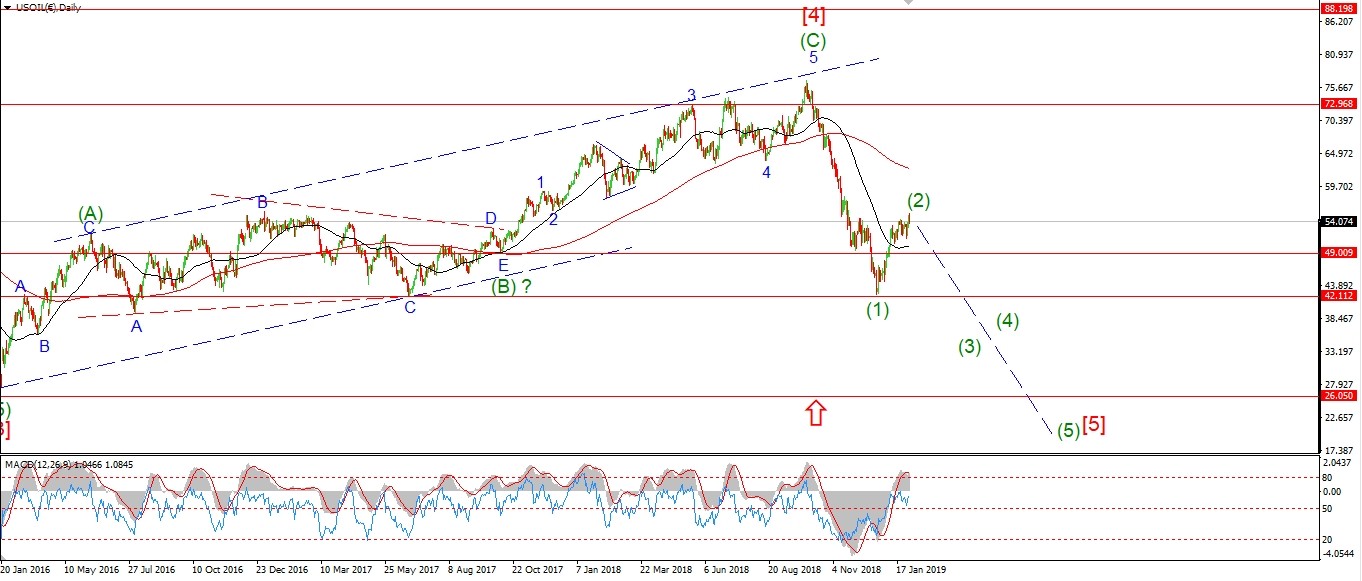

U.S CRUDE OIL

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The drop off the high today is viewed as wave (i) of [i],

this decline should continue and create at least a large three wave decline

off the high as per the alternate count.

The favored wave count views the next decline as wave (3) down,

And that could go on for a significant duration.

First things first though,

Wave [i] down must be confirmed as a five wave structure lower,

and break through support at 50.60 again.

And the wave [ii] should complete the impulse wave and bearish signal.

If the high is in,

Then wave [i] should take the most of the week ahead to complete.

Tomorrow;

watch for 55.75 to hold,

and a drop in wave (iii) below support.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_us10yr)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

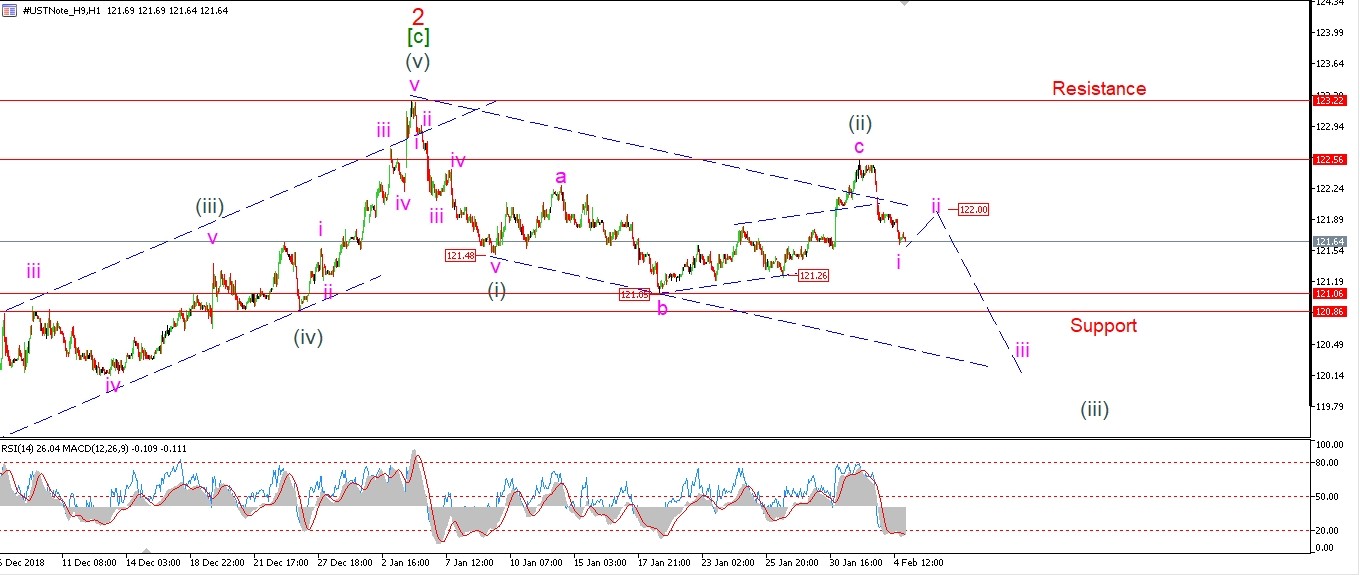

US 10 yr Treasuries.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

The drop off the wave (ii) high at 122.56,

has traced out a five wave structure lower.

this high must hold at 122.56 for the current count to remain valid.

I have labeled this decline as wave ‘i’ down.

Wave ‘ii’ should now correct higher to about 122.00 again and complete a bearish impulse wave lower off the highs.

Wave ‘iii’ of (iii) down should reassert the downtrend again by breaking the 120.00 handle.

Tomorrow;

watch for wave ‘ii’ to begin tomorrow with a slight three wave rally into 122.00 again.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_silver)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

SILVER

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Silver dropped into the low at 15.67 this afternoon,

this completed a three wave decline in wave ‘a’ of (ii).

Wave ‘b’ reacted strongly off the lows this evening,

and should trace out a three wave rise to a lower high.

the correction in wave (ii) is unfolding fast and may even complete before the end of the week.

The low at 15.17 is the lower end target for wave (ii).

Tomorrow;

Watch for wave ‘b’ to complete at a lower high in the region of 16.00 again.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[_s2If current_user_can(access_s2member_ccap_sp500)]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

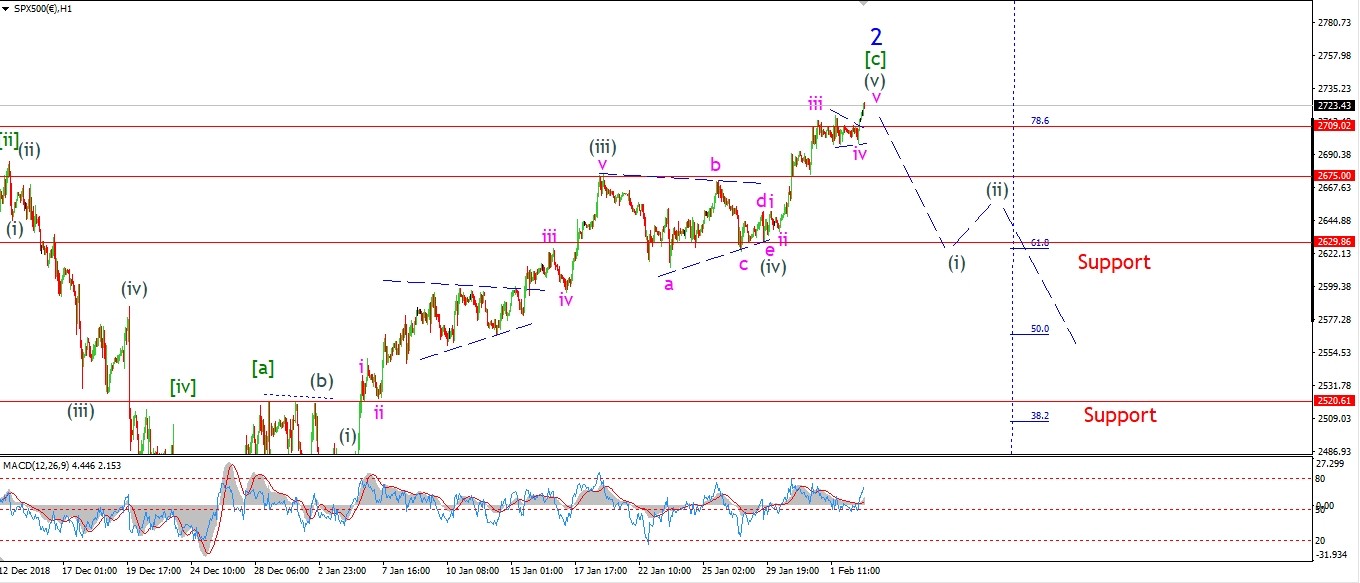

S&P 500.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row][vc_row][vc_column width=”2/3″][vc_custom_heading text=”1 hr” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][/vc_column][vc_column width=”1/3″][vc_custom_heading text=”4 Hours” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Daily” use_theme_fonts=”yes”][vc_column_text] [/vc_column_text][/vc_column][/vc_row]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]

Wave ‘v’ of (v) broke out to a new high today.

The end is in sight for the larger structure,

but these subwaves are just filling out the end of wave (v) now.

The sideways action of Friday completed as a triangle wave ‘iv’.

A triangle is the penultimate move in a structure.

Now we have two triangles in a row at ever decreasing degrees of trend.

The upside is very limited at this point.

Tomorrow;

Wave (i) down is coming,

The setup is perfect for the decline to begin this week

given the level of optimism and pure bullish abandon in the market.

Watch for that initial spike lower to begin either tomorrow or wednesday.

[/vc_column_text][/vc_column][/vc_row]

[/_s2If]

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_separator border_width=”5″][/vc_column][/vc_row]