5 Best Interest Rate Divergence Trades

And The Results

When one central bank is pushing rates UP, and another is pushing them DOWN.

We have to ask, what affect does US interest rate divergence have?

[vc_column][vc_custom_heading text="TOP ARTICLES!" font_container="tag:h2|text_align:center|color:%23dd3333" use_theme_fonts="yes"][vc_separator border_width="2"][vc_basic_grid post_type="post" max_items="8" element_width="2" gap="5" item="basicGrid_NoAnimation" grid_id="vc_gid:1489406338111-30fa07c6-e54a-7" taxonomies="19"][/vc_column]

This article is the third in our series examining the conventional view of what affects the value of a currency or the price of a currency pair, the first called the trade deficit and the dollar. and the second the FED's interest rate policy and the Dollar

Now we are going to look at the affect (if any) of central bank interest rate divergence on a currency pair.

And more importantly, can we trade it?

The central banks in question are the FED and the ECB, the currency pair is the EURUSD.

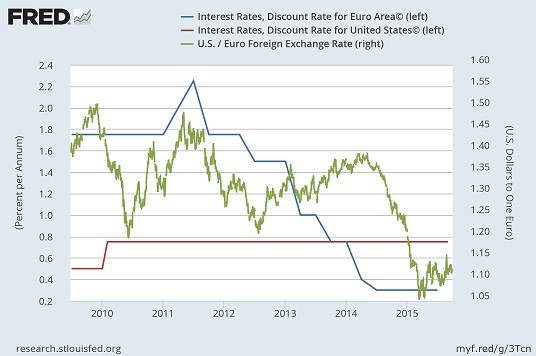

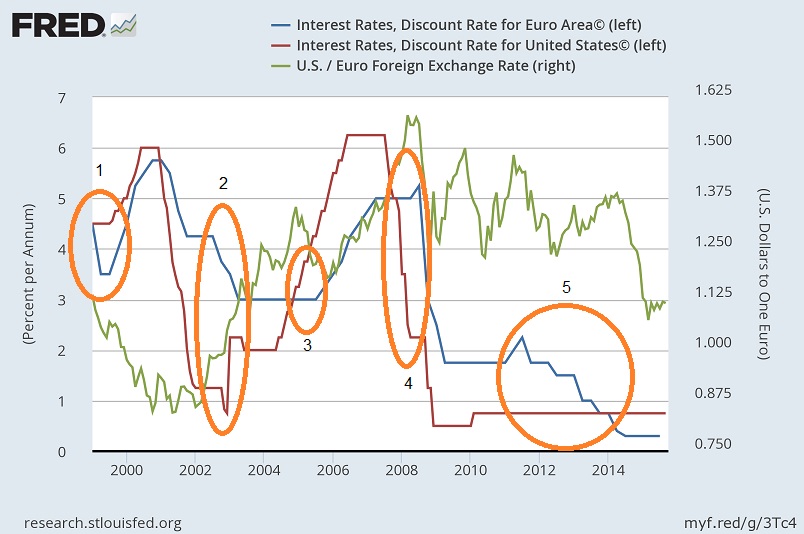

The chart below shows the last 15 years of both central bank discount rates and the price of the EURUSD pair.

Lets take an over view first and the dive into the points of US interest rate divergence.

On the whole it has been a case of the FED moving first and the ECB turning up late to the party. The ECB never moved as high as the FED or never dived as low as the FED, that is, not until january 2014.

I have identified 5 major points of US interest rate divergence( circled in the chart above ) In some cases, for very short peroids of time, the EURUSD did exactly what the Theory would have suggested.

And then in other cases, the pair did the exact opposite!

So, what affect does US interest rate divergence and convergence have or does it even matter?

And.

Can we position our trading to take advantage of these policy changes?

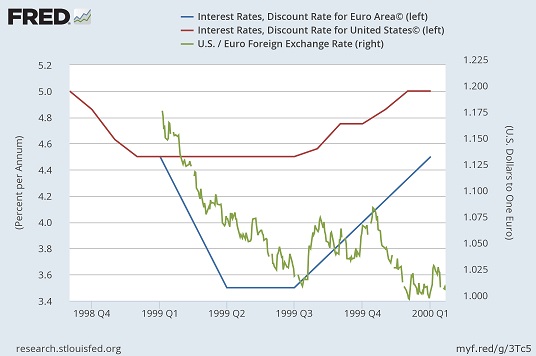

1999 Q1 – 1999 Q2

1999 Q1 – 1999 Q2

In 1999 the ECB entered the arena at 4.5% and in Feburary dropped to 3.5% and held it there until the fourth quarter. This 100 basis point move down for the ECB happened while the FED maintained rates steady at 4.5%.

This US interest rate divergence coincided with a large move down in the EURUSD, approximately 1200 points in this case.

The conventional wisdom suggests this would have happened, as the ECB cheapened credit it cheapens the currency so the cross rate drops.

A trade based on the theory would net you 1200 points.

That is one up for the theory.

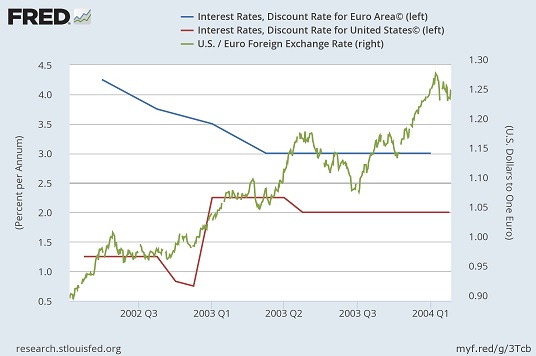

2002 Q4 – 2003 Q2

At this point in time both central banks were moving rates actively in opposite directions.

The FED rose rates from 0.75% up to 2.25%, a massive 150 point rise in 3 months. All the while the ECB was steadily moving lower from 3.75% down to 3% in may 2003, a 75 point move.

With the ECB dropping rates and the FED raising rates you might have thought this would favor the Dollar substantially.

Well, you would be wrong. The EUSUSD continued rising and over the period of policy divergence, it rallied 1300 points.

Which is the exact opposite of what you would expect in that circumstance.

A theory based US interest rate divergence trade would cost you 1300 points in this case.

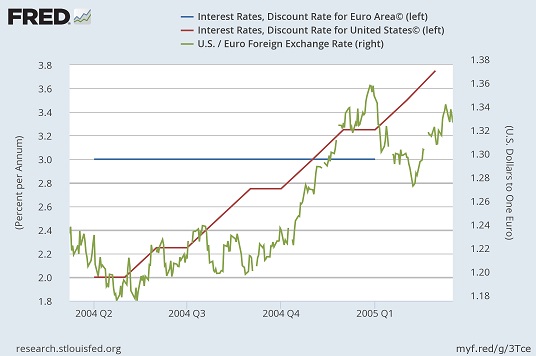

2004 Q2 – 2005 Q1.

The next big US interest rate divergence began in Q2 2004, beginning at 2% the FED went on a rate rising spree for that nine month period up to 3.25%, a 125 basis point move. The ECB on the other hand, stayed flat at 3% until 2005 when it joined the rate rising trend.

And what did the EURUSD do?

It rose from 1.18 up to 1.36. 1800 basis points in that same nine months.

Im starting to question conventional thinking again, arent you?

The theory suggests that the FED's tightening should push the Dollar value higher. NOT SO in reality!

It was the Euro that made all the gains.

So, a theory based trade would cost you 1800 points in this case.

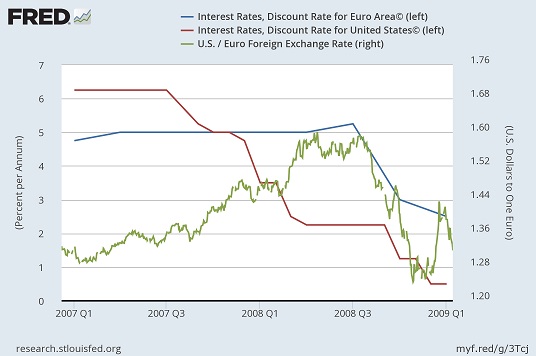

2007 Q3 – 2008 Q3.

Next up, the twelve months at the begining of the great recession.

In october 2007 the US interest rate divergence began aggressively, with the FED cutting rates starting at 6.25% all the way down to 2.25%. 400 basis points in a year! Thats a hell of a move.

In the same period, the ECB did not budge! Staying stuck at 5%.

This example is quite interesting, given that the FED actually started above and ended below the ECB's 5% line. Weakening the dollar even more, relatively speaking.

The EURUSD heeded the call of conventional wisdom this time, and rose from 1.36 to 1.60 (the all time high).

This 2400 point move ended abruptly, when the ECB began a run of cutting rates, which has continued to this day.

Again the theory based trade would net some 2400 points in this case.

2011 Q3 – 2014 Q3.

In sept 2011 the ECB began another rate cutting spree. Starting at 2.25% and ending at 1.075% in 2014. The FED was fast asleep at this point not budging from 1.175%.

And what did the cross rate do?

First the Euro fell 3000 points, then it rose 2000 points, and then it fell again another 3500 points.

Overall falling 4500 points, on a policy divergence of 117.5 points!

Now thats what we call a leveraged effect!

The theory proved correct this time, as predictable as a coin toss.

And the theory based trade would netted a very tidy 4500 points.

Results

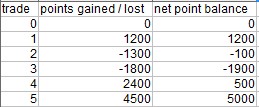

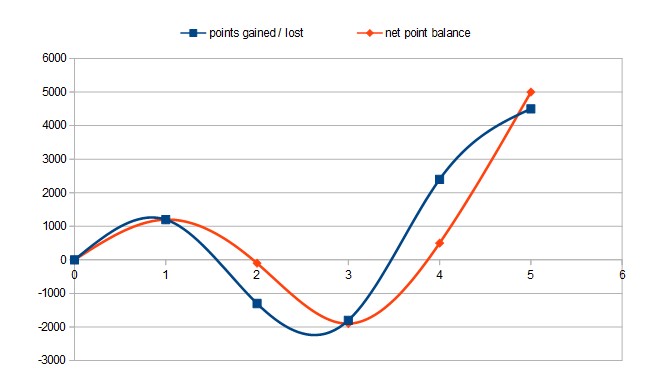

How does trading based on the theory fair over these five trades?

The theory of US interest rate divergence affecting the value of the cross rate in a positively correlated fashion proved correct 3/5 or 60% of time in the above examples.

The chart shows the trade gain or loss and the points balance.

All in all, for a trend trader, it may prove to be a useful bolt on indicator in your trading toolbox. While I would not let it be the defining factor in a trade choice.

The net gain in the end is a healthy 5000 points, but this does include 2 large losers in the middle!

In the end, Handle with care, is the advice I would give.